Dear Frontier Fortunes subscriber,

It’s often said: “That which is free is worth the same.” But these days, crypto is stepping up to say, “Mmmm, maybe not.”

That’s what this quarterly issue of Frontier Fortunes is all about: The ways in which the cryptosphere is allowing people to redefine income. Some of that income is “earned,” though it’s not “earning” the way you and I might. Some of it is, indeed, free.

But that just raises the question: If a dollar of income is free, is it worth less?

I would say, “Of course not.”

And lots of others agree, based on the growing number of crypto investors looking for and investing in projects that generate income with minimal or no effort at all. In one particular case—a game I will tell you about in a moment—players are earning hundreds, thousands, even tens of thousands of dollars per month.

Before we get into that, though, I want to step back for a moment and address the bigger picture taking shape in crypto today. This moment has been a long time coming, but it was always coming. What I’m talking about here is the new bull market in crypto.

In the last several weeks, crypto prices have soared notably.

Bitcoin, the progenitor of all crypto, is up roughly 50% since mid-September. Solana, a major crypto and one we own in the Frontier Fortunes portfolio, is up more than 200% in the same period.

The moves underscore a message I have reiterated time and time again: Be patient because when crypto moves, it moves at lightning speed.

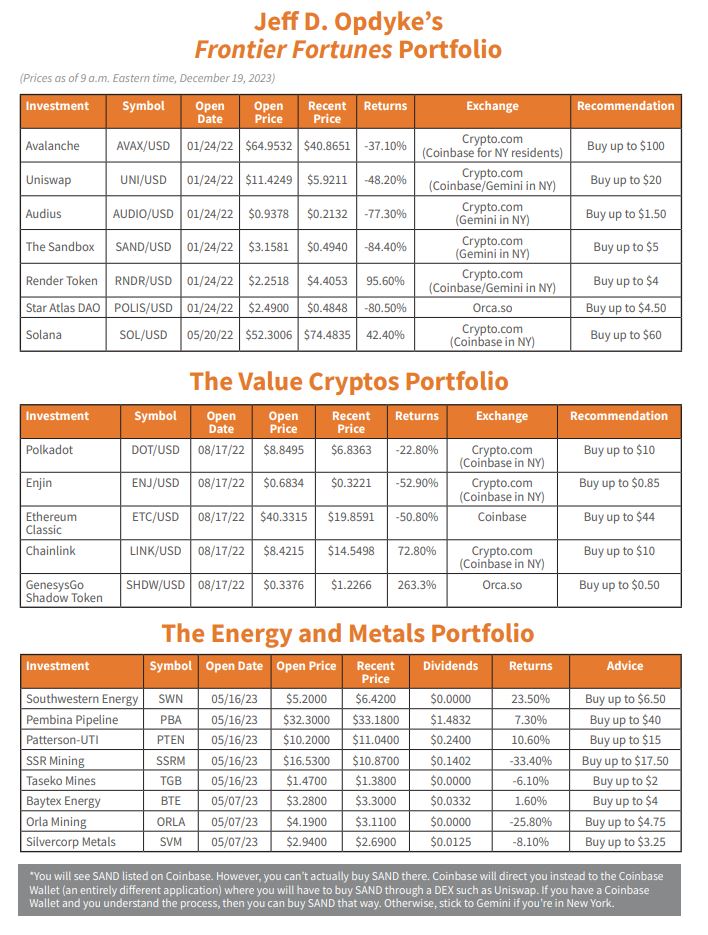

As a result of what’s going on, our long-beleaguered crypto portfolio is reviving.

From being down sharply in Solana, we’re now up about 12%.

GenesysGo Shadow Token, which powers data-storage services on the block chain, was down more than 91% for us at one point. Since late-October, it has gained nearly 600%. As such, we’re now up 18% on that position. Chainlink, underwater by more than 40% at one point, is now up 80% in our portfolio.

A number of our positions certainly remain in the red. But they are moving up. And again I will underscore the word “patience.” This new crypto bull is just waking up and stretching. When it starts running at a full gallop, we’re going to see large gains across the board.

At the root of this bullishness are three events occurring simultaneously:

This will be a mutual-fund-like investment product that tracks bitcoin’s spot-price, the price you see when you Google “What’s bitcoin’s price today.”

Institutional and individual investors have been clamoring for such a product because it means the ability to own direct exposure to bitcoin without having to buy bitcoin through a crypto-exchange account and deal with digital wallets.

The SEC has refused to allow such a fund for years (and for reasons that are irrational, but which I won’t bore you with). Now, however, the pressure on the SEC is mounting from inside government, inside the legal system, and from some of America’s largest financial institutions, including Fidelity and BlackRock.

When a spot-price ETF is approved, trillions of dollars are going to flow into bitcoin ETFs, driving bitcoin’s price higher.

The Fed’s move to a hawkish stance on interest rates back in late 2021, when inflation was torrid, launched what came to be known as “crypto winter.” As interest rates raced higher and consumers were forced to pump more money into debt repayments, cash drained from stocks and crypto. Prices for both tanked, through crypto fell substantially farther.

Sentiment crashed too because the Fed’s aggressive attack on inflation meant that the free-money gravy train of near-0% rates was coming to an end. Nothing fuels investment speculation like free money.

Now, however, expectations are that the Fed has overreached in battling inflation, and has engineered (purposefully or not) an upcoming recession. Higher rates have slammed consumers, businesses, and government, and the Fed is taking the blame for that.

With inflation having retreated (temporarily), with the jobs market slowing, and with the economy ramping down now, the Fed is widely seen to be cutting rates across 2024. That will spur a “risk-on” mentality in the markets that sees crypto—the most speculative asset—race higher.

I won’t dive into the technological minutiae of halvings. I will only say that these are seminal events for bitcoin that occur roughly every four years. They’re designed to thwart bitcoin inflation by making the creation of new bitcoin twice as hard. These halvings will occur through 2060.

All you really need to know is that the three previous halvings have seen bitcoin’s price rise between 688% and more than 9,900% in the months leading up to and following the halving. Each time, bitcoin set a new all-time high.

The last halving was in 2020, which launched bitcoin to its last all-time high approaching $70,000 per coin.

The fourth halving will happen sometime in late April, based on my math. And this time around, the widely held expectations are that bitcoin will cross $100,000 for the first time ever. My personal expectation is that bitcoin flirts with $185,000 before the next crypto bear market growls itself awake.

Those three events—the halving, Fed rate cuts, SEC approval of a bitcoin ETF—are coming together in the same moment, and they have given life to this new crypto bull market.

Again, I will urge patience. We’re going to see much bigger moves as this bull market takes over.

Now, let’s move on to the real subject of this quarter’s issue: Income.

NFTs: Smart, Easy Way to Earn Income Online

I’ve long written to you here and in my daily Field Notes e-letter about the various ways I earn income through my crypto holdings.

Throughout all off 2023, I’ve been collecting income from an assortment of NFTs—non-fungible tokens—that I own. To date, I’ve collected more than 200 Solana, which is the equivalent of more $12,000, based on current Solana prices. Not too bad when you consider this income flows from a bunch of digital pictures like this one:

That’s a rare, one-of-one NFT from Banx by Frakt, an NFT lending platform on the Solana network. It’s done up in the style of famous street artist Banksy. I’ve collected about 25 Solana ($1,500) from that project alone, starting in July, and I’ve done nothing to “earn” that income other than simply hold five Banx NFTs in my digital wallet.

That income highlights the radical new era we’re moving into.

We are on the cusp of a massive job-extinction event that’s going to spotlight the need for new sources of income.

Technology, robotics, and artificial intelligence promise to destroy jobs on a mass scale. Burger flippers will go away. Engineers will shrivel in number. Paralegals will vanish. Graphic artists and advertising copywriters are toast. Police will be replaced by robots that never tire, are packed with laser-guided weaponry, and will have heat sensors, among other technology.

And that’s just the start of the job destruction on the way.

This mass replacement of human workers with technology won’t happen overnight. It will take time (by the end of this decade, we will definitely feel the impacts). But it raises a troubling and fundamental question for society: How will people afford to live when they have no access to traditional jobs?

Crypto has an answer for that: “Earning” and income online by playing games or by owning crypto that offers for a fee services that people want or need, and which in turn shares that income with those who hold that projects crypto tokens.

I know that sounds ridiculous, particularly earning an income playing games. For those of us in the Gen X and Boomer cohorts, we grew up playing the earliest versions of video games, and never thought about earning any money from it. At best, playing Pitfall and Space Invaders was just a time vampire.

But hear me out, because income from crypto-based gaming and other crypto services is already a thing, and it’s only going to grow in significance from here.

Crypto-Based Gaming: Pay for Play

Let’s start with 0x0.ai.

I told you about this project back in June. It runs what’s known as a “privacy DEX aggregator.”

DEX is crypto-speak for a “decentralized exchange.” Think: Charles Schwab or Fidelity, but without centralized locations. Instead, traders buying and selling crypto on a DEX are interacting with one another directly through “smart contracts,” or blockchain-based contracts that execute only when all agreed-upon parameters are met.

As for the aggregator component, imagine going to a website to buy shares of Apple, and the site rapidly scans every brokerage firm in the world to find the best price for that trade. That’s what a DEX aggregator does—scans the world of DEXs to find the best trade for a buyer or seller at that moment.

The privacy component, however, is what’s novel here. Scores and scores of DEXes exist across numerous blockchains. But none are privacy focused. 0x0, by technologically shielding buy and sell transactions, provides users a way to trade assets without prying eyes knowing what’s going on.

0x0 charges fees for that service. It then turns around and distributes 100% of those fees to 0x0 token holders.

At the time I first wrote to you about 0x0, it had not yet started distributions. Those have now started. At the moment, the yield is small—just 4.5%.

But the privacy component underlying the project has massive, global potential. Fees will ramp substantially higher in time, and those who hold 0x0 in their digital wallet will be earning a passive income for doing nothing other than holding the tokens.

The crypto market always saw the potential here, but now that we’re moving back into a bull market, 0x0’s tokens are moving.

From a low of $0.025 in August, the tokens are now at $0.12 as I write this—a 380% gain in four months. My estimation is that during the bull market, 0x0 will cross the $1 threshold.

And as the mainstream masses move into crypto over the next few years, demand for privacy is going to surge.

That’s because the blockchain is a glass house. Everyone can peer inside and see every transaction that occurs. If someone—or, more importantly, some government agency—can attach you to a particular digital wallet address, then they can monitor everything you do on the blockchain: where you earn money, where you send money, where your spend money, etc.

That promises to be a monumental issue with human rights and financial privacy as the world’s governments replace physical cash with blockchain-based “central bank digital currencies.” These are crypto version of the U.S. dollar, euro, pound, yuan, yen, etc. More than 80% of the world’s central banks are exploring CBDCs, and by “exploring” they mean looking for the soonest possible date to switch over to this digital technology.

The upside is that governments will save billions on printing, minting, and dealing with physical dollar, coins, and government checks. They will save hundreds of millions or more in the cost of moving money around through the existing banking system.

The downside is that all transactions will be visible on the blockchain. Government will have the ability to know where you spend money, even down to the specific expense. In a truly dystopian world, that level of knowledge means that government could mandate than people only have two soft-drinks per month, for instance. Try to buy a third and your digital wallet refuses to allow the transaction.

You will have lost your personal and financial freedoms to some government minions who have decide what is best (in their opinion) for society.

Clearly, a privacy DEX has huge opportunities in that world.

0x0 is creating operational blindness to help users cloak their actions and the assets they own, and those of us who own the 0x0 token are getting paid for that.

Distributions are made weekly. 0x0 holders log into a website, connect their wallet, and collect their share of the fees in Ethereum. Or they can allow the ETH to accumulate and claim it later. Or they can convert the ETH into more 0x0 tokens, a method of compounding their investment.

Question is, What is income potential?

Jockeying for Winning Positions

As I noted, the yield right now is relatively small at just 4.5%.

But the DEX only launched a few months ago and is still gaining traction. But as mainstream masses move onto the blockchain—willingly or forcibly because the rise of CBDCs—demand for privacy services will rise sharply.

Right now, about two-thirds of global, crypto trading volume that flows through DEXes flows through Uniswap, the world’s largest DEX and a component of our portfolio. Assuming 0x0 can capture just 1.5% of global volume—a tiny number—then the 1% fee that 0x0 charges would amount to $90 per month for every 10,000 tokens held. (That’s very rough math based on ever-changing daily DEX volume, but it gives you a sense of scale as 0x0’s operations ramp up and as global DEX volume ramps.)

If you want to own 0x0, it’s an Ethereum blockchain token that you can easily access through Uniswap. I recommend a MetaMask browser wallet because it’s the most convenient to use since it sits on your web browser for quick and easy access. My original alert on 0x0 contains more on MetaMask and how to trade on Uniswap, including some instructions with screenshots.

As a final point, I will add here that trading on the Ethereum network is not always cheap. Transaction fees—called “gas” in the crypto space—can still be high when the network is busy. Trades can cost $50 to $80 in many cases, though if you wait for off-hours—usually the wee hours of the morning or weekends—you can regularly find transaction costs under $20.

Next, I want to tell you about meaningful income flowing through a crypto-based horse-racing game…

You might have seen in my Field Notes dispatches in recent months that I’ve been playing an online game called Photo Finish Live. It’s an addictive game doing big business. The game launched back in April and by mid-November it had racked up:

Moreover, the game has a 91% stickiness rate, meaning nine out 10 newcomers to the game are still around 60 days later.

If those newcomers are anything like me, by the time they’re just a few weeks into the game, they’re already running multiple horses and are spending untold hours researching those horses, individual races, and other horses they might want to buy. And they’re probably planning on building a stable to breed female horses for added income.

At its core, Photo Finish Live is based on owning one or more digital racehorses, and then racing them in online races. If your horse comes in first, second, or third (sometimes fourth or fifth, depending on the race), you win money.

That’s it –at least the simplest level.

On a more advanced level, this is a deeply strategic game in which players build stables of horses that they’re either racing, or using to breed new digital racehorses that they then sell on the marketplace. They’re also investing in racetracks.

As such, players can approach Photo Finish Live from three income angles:

The game is built to mimic an entire horse-racing ecosystem as well as the life cycle of a horse… including death. In this game, horses die after about 25 seasons, which in real-world time is about two years, given that a one-year season in Photo Finish Live lasts for four weeks in the real world. This is unique in the gaming world, where digital assets live forever. It adds to the strategy of the game, and means that the game will always be ever-changing and old horses move to the Great Pasture in the Digiverse, leaving new horses to redefine the game.

To play, players buy horses to race.

At the moment, the cheapest horses eligible for racing cost about $475—and the price can go well into the thousands.

Many players (and I am one) are investing in multiple horses so that they have a horse available for different track surfaces and conditions.

Others are focused intently on breeding horses, looking for the best possible traits to marry together in an offspring that will either bolster a stable’s racing results or sell for big dollars on the marketplace.

To succeed at this game, players must research horses to find the best one they can afford, and then research races to find the best possible race for the horse(s) they own. They need to thoughtfully plan out their stables so that they have a complementary collection of horses for the various race conditions that exist. And they need to smartly plan their breeding operations—if they want to pursue that—so that they’re creating new horses that buyers in the marketplace will want.

All of that might seem like child’s play, but the financial realities of Photo Finish Live are shocking.

One stable owner earned $35,000 in a single week in selling breeding access to one of his high-quality stallions, and earned well over $150,000 in a single month from breeding operations across his entire stable of horses.

Another stable owner earned more than $12,000 in a month just from sharing proportionally in the race-entry fees that the in-game tracks collect for hosting every race.

And a third stable owner has, over the last seven months, collected more than $900,000 in an in-game cryptocurrency Photo Finish Live is handing out to every horse in every race through the end of April 2024.

Granted, those are much larger stables running dozens or more than 100 horses. But even smaller stables are collecting not-insignificant income.

In the six weeks that I’ve been playing the game to this point, I’ve netted right at $2,000. I’m not mad at that.

Two grand in a month and a half for racing six digital horses?

Yes, please.

At the rate I’m currently collecting the in-house crypto the game is giving away with every race, I’ll have collected more than $10,000 worth of crypto by the time April ends and the team stops the handouts.

By then, I will also be breeding my own horses and selling those into the marketplace to feed the growing demand for horses as Photo Finish Live continues attracting new players looking for high-quality horses to race.

Three Ways to Win at This Game

The game provides three primary ways to earn an income:

Players can choose to focus on all of those opportunities, or just one or two. The most-successful stables have a hand in all of those pots.

Let me address each one separately so you can see how the income flows.

Exactly what it sounds—racing digital horses.

Races are currently held at six different virtual race tracks that populate the game, including a track owned by Churchill Downs, the parent company of the Kentucky Derby. Churchill Downs has partnered with Photo Finish Live and runs a series of qualifying races that culminates in a digital Kentucky Derby once every season.

Races go off every couple of minutes of every day. Each is different in some way. Some are run on dirt surfaces, others are turf. Some require that horses make righthand turns as they navigate the tracks, while other tracks turn to the left. And weather conditions are ever-changing so that some tracks are firm, while others are wet and sloppy; in between are several gradients ranging from good to soft.

All those factors are relevant to the race because every horse has a set of preferences that shape how it’s likely to fare in that race. Those preferences—track direction, track surface, track condition—are denoted by 0 to 3 stars, and are a function of six hidden attributes that define a horse and which are determined but the digital DNA a horse’s parents have passed along. (The hidden attributes are revealed when a horse retires, so players can examine a racer’s bloodline to get a sense of what the hidden attributes might be.)

Players pay an entry fee to register a horse for a race. That fee can from as little as $6 for a low-grade race with a small purse, to nearly $95 for a high-grade race with a big prize pool. Their winnings can be as small as a few dollars to more than $1,400 for the recent Kentucky Derby, which ran in November, at the end of last season. (The winning horse, a 3-year-old named Commodus, has been racing for just two months—two seasons—and has earned just under $2,500 in that time. He’s also won more than $2,200 worth of crypto the team is giving away with each race. So, more than $4,700 of income in two months from a digital racehorse.)

I’m averaging about $54 in winnings for each of the races in which my horses land on the podium, or in fourth or fifth place.

(Note: The in-house currency Photo Finish Live uses for race-entry fees, paying race winnings, and buying/selling horses is called $DERBY and it is permanently set at 80 $DERBY per $1. So there is no risk the crypto you own will dive in value.)

Male horses can breed 35 times per season, while females can give birth once per season.

Not every retired male horse will get a chance to breed. Some simply don’t have the preference stats or the attributes that will attract a mate. Others, however, will attract lots of attention from owners of fillies and broodmares because they do have substantial statistics that, in theory, should lead to a high-quality offspring. That’s not always the case, however, which adds to the challenges of this game.

Females will always get to breed—because their stable owners are paying for the right to breed. The result is that even the lowest-grade female can pay to breed with the highest quality male (assuming the stable owner is willing to pay the price). The offspring of such a union would very likely be a horse of higher quality than the female, giving that stable owner a better horse to race, to use for breeding as the stable grows, or to sell into the marketplace.

Male horses—colts and stallions—are earning $50 to more than $1,800 per breeding session. Assuming a horse was chosen to breed its full complement of times in a given month, then even at the low end that’s $1,750 of income. With higher-priced horses, the income possibility ratchets up substantially.

For females—fillies and broodmares—the income opportunity is selling new foals into the marketplace. As I write this, a new season of foals has just arrived, and the lowest priced one fetches the equivalent of $250. But that’s a lower-grade horses. The cheapest horse in the highest grade is priced at $500.

As such, breeding is where the real money is at, and it’s why so many stable owners concentrate on buying a high-quality filly that they can then mate with high quality colt or stallion. That’s a pricier way into the game, since high-grade, high-quality fillies generally cost about $1,000, minimum, as I write this. But if they’re generating foals that start at $500 and quickly escalate from there, then a female can recoup her cost within two or three months, possibly less, depending on the foal she produces.

As I mentioned, six tracks populate the game. Five of them—excluding Churchill Downs—allow players to invest in the track each season.

Investing in this case means “staking” an in-house token called $CROWN. (This is the token the team is giving away with each race). In the world of crypto, “staking” is a term that essentially means “depositing.”

So, you deposit $CROWN with one or more tracks, and you become a proportional owner in that track.

The entries fees that players pay to register their horse for a race goes to the track. About 80% of that money comprises the prize pool for that race. Much of the remaining 20% stays with the track as its fee for hosting the race. At the end of each season, those fees are distributed proportionally to all the track owners—all the players who have invested in that track.

As such, you don’t even need to race or breed a single horse to make money at this game. Buy $CROWN on a crypto exchange like Jup.ag, stake it at one or more tracks, and reap your rewards once every month based on the entry fees the tracks collect during each season.

Profit From This Model for Crypto-Based Gaming

The beauty of the Photo Finish Live system is that it’s self-sustaining. It’s not reliant on the development team to fund the game through advertising or merchandise sales or whatever, which a lot of projects do rely on.

Players in Photo Finish Live are paying race-entry fees that are funding the prize pools as well as the staking returns. So as long as players want to race, the game sustains itself. And given that players are earning real dollars, the game sustaining itself seems probable.

The question to address is: “What happens when the team stops distributing $CROWN in April?”

Right now, lots of players (including me) are running horses in less-than-ideal races because they want the $CROWN. They’re expectation is that the value of $CROWN rises over time because as the game expands, it will create more tracks with more demand for races, which leads to more and more race-entry fees that, in turn, flow back to $CROWN owners who have invested in the tracks. Demand for passive income derived from those track-entry fees will drive demand for $CROWN and, thus, the token’s price.

In many cases today, the value of the $CROWN earned in a race exceeds the cost of the entry fee, so racing for $CROWN, even with a losing horse, still makes a lot of sense financially.

Once the $CROWN distributions end, strategy will change.

Stable owners will more likely choose to race their horses only in the races that make the most sense for that horse and its preferences. Thus, the game will still sustain itself, and the races will likely grow even more competitive when the field is packed with horse that are built for those exact conditions.

To me, Photo Finish Live is the first crypto-based game to emerge that has the formula right, which is why I expect it will grow increasingly popular as word-of-mouth spreads the gospel of this game.

As such, Photo Finish Live will very likely become a model of other forms of crypto-based gaming that provides a meaningful income component. Sure, there are lots of crypto-based gambling games, but cards and dice and slots are purely games of chance. Buying and racing horses is all about the ability to research a horse, dial in its strengths, and then chose the best possible race for that horse.

As I said at the start, it’s an addictive process and the races spark an adrenaline rush no different than I’ve experienced at real-world horse tracks.

This is the future of online gaming and the future of crypto-based income opportunities.

If you want to research Photo Finish Live yourself, head over to photofinish.live. But be warned, owning a horse—even a digital—quickly becomes an addiction.

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2023. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.