Dear Frontier Fortunes subscriber,

The writers' room at The Simpsons must come equipped with a crystal ball…

In 1998, the show joked about Disney buying 20th Century Fox, which is exactly what happened two decades later. In 2000, it famously predicted a Donald Trump presidency. And way back in 1995, the show featured an episode with a voice-activated smartwatch, similar to the Apple Watch.

When it comes to prescient episodes, however, there's an example from 11 years ago that could top them all…

In that episode, called Them, Robots, the spiteful industrialist Mr. Burns replaces his nuclear plant workers with a horde of sentient robots. Predictably, they turn malevolent, before chasing Homer Simpson down the street with chainsaw arms while repeating "Eliminate impediment."

Cartoon rampage aside, The Simpsons was imagining a future in which computers would not just be used for automation, but would think and operate independently. They would become the workers and the decision-makers.

Welcome to the future The Simpsons predicted…

In recent months, you have no doubt seen, read, or heard about ChatGPT and other online artificial intelligence (AI) tools.

Students are already using these AI bots to write papers. Traders are calling on AI to help design trading systems that are proving successful on Wall Street. Investment pros are pumping barrels of money into AI-centric stocks.

All these groups recognize one inescapable reality: The AI future has arrived and technology is never going to be the same… for good or evil.

But there's one aspect of this future that's commonly overlooked, even though it offers arguably the greatest potential to reshape our world—the intersection of AI and crypto.

That's the genesis of this quarter's issue of Frontier Fortunes… the crypto-AI nexus, and the emerging opportunities that exist in this space.

See, the rise of AI comes at the exact same moment that crypto and blockchain are moving into a new phase.

Previously, blockchain—the digital ledger technology on which all cryptos are built—was largely the playground of early adopters buying and selling cryptocurrencies or NFTs (those one-off, one-of-a-kind tokens that often appear as cartoonish images).

But now, blockchain is also emerging as a business tool that allows companies to operate more efficiently and at dramatically lower costs.

Goldman Sachs, Home Depot, McDonald's, Nike, and scores of other major corporations have announced initiatives that leverage blockchain to benefit their operations. JP Morgan, for instance, has created an in-house blockchain called Onyx that allows financial firms to move assets around instantly, without any middleman, and at a far cheaper cost.

Now, AI is entering the fray to accelerate the pace of this industrial and financial change… and one AI-powered crypto project in particular, called 0x0.ai, provides an excellent example of what lies ahead.

Blockchain x AI

AI works by combining vast amounts of data with machine-learning algorithms. In essence, it's able to analyze information and make intelligent decisions, the kind that previously required human intervention.

Moreover, because computers process data infinitely faster than the human mind, and because they analyze every last byte of information without growing tired or accidentally overlooking something, their decision-making is significantly more accurate.

Faster and more accurate, and it doesn't require sick days, vacation pay, health insurance, or cause HR headaches… AI is a dream for any business owner.

One of the challenges with AI, however, is ensuring accuracy of information. Supply the system with bad data and you can get faulty outcomes.

That's why AI-powered bots like ChatGPT can sometimes deliver questionable results. These bots typically gather data from the internet, but online information, as we all know, can be less than reliable. That means these bots can produce articles or college papers with inaccurate statements or conclusions.

Enter blockchain…

Blockchain is a permanent, unhackable record-keeping system. The data on a blockchain is verifiable and tamper-proof. And you can control when, where, and how it is entered.

So, it's not hard to see how the combination of blockchain and AI will radically transform existing businesses and even create entirely new industries and product lines.

Consider some of the possibilities that are sure to become a reality in the near future…

Blockchain could collect and store all of an individual's health records in a secure "personal medical vault," no matter which doctor they see or where. Then, AI could instantaneously analyze each new entry.

By comparing it to that patient's compendium of records, the system could immediately diagnose emerging or underlying medical issues that a human doctor might not necessarily see because they haven't got the time to examine each patient's entire medical history.

The result is a truly personalized healthcare system that's far more efficient and cost-effective than today's model, and which better serves a patient's needs.

Blockchain is already used in supply chain management since it allows a large number of independent actors to access a system without being able to disrupt that system. It's the same way people all over the world can buy and sell bitcoin, but they can't interfere with the operations of the bitcoin blockchain.

Here's how that works with, say, a shipment of beef sent from a farm in Iowa to a cold-storage warehouse in Chicago:

Individual cows on a farm are assigned a blockchain tag. When the farmer sends a cow to a processing plant, its tag is transferred to the plant's "wallet." Later, when the processing plant sends the steaks from that cow to the warehouse in Chicago, the tag is broken up into sub-tags of the original and sent again. And all along the way, the tags are tracking climate data to ensure that the meat is never exposed to temperatures that would cause the growth of bacteria.

Each time a tag is transferred, the farmer or plant or the shipping company or whoever pays a tiny sliver of crypto to facilitate the transaction, in the same way you pay a network transaction fee to buy crypto. In this way, the supply chain management system is independent, secure, and funded by all the participants up and down the chain.

Now add AI to the mix…

AI steps in with instantaneous data analytics and predictive algorithms that can automatically increase or decrease inventory based on real-time demand.

It can identify bottlenecks in the production and shipping processes, and act to resolve them. And it can monitor second-by-second pricing trends and shipping costs for raw commodities and automatically shift between suppliers to achieve cost savings.

Systems with some of these capabilities already exist, such as the TradeLens blockchain platform co-developed by IBM and shipping giant Merck.

Computers can already gather vast amounts of data and decipher trends. AI kicks it up several notches by actually learning from ever-shifting patterns and using its predictive logic to independently trade various types of financial assets.

That's going to fit very well into the rapidly emerging world of decentralized finance that now exists on the blockchain. DeFi, as it's known, is a financial model that takes middlemen out of the equation for everything from banking to investing to real estate transactions, and more.

Imagine mutual funds that are steered entirely by AI. Or retirement-account management in which AI tracks your entire portfolio in real time and automatically adjusts it based on algorithms that accurately predict movements in stocks, bonds, currencies, etc.

That AI-infused crypto world is exactly where we're headed globally.

And that segues into a new crypto project I told you about in a recent email alert—0x0.ai.

The AI-Crypto Pioneer

0x0 is a new AI-powered crypto project that has captured the attention of serious investors. The team behind 0x0 is in the process of building out three services on the Ethereum blockchain. These are:

1. AI Smart Contract Auditor

0x0 has built an AI-powered auditor that crypto and NFT teams will use as a tool to analyze so-called smart contracts and identify vulnerabilities that hackers could exploit to steal cryptocurrencies and NFTs.

"Smart contracts" are pieces of coding that act autonomously to complete tasks. For instance, imagine a musician records a song and adds it to the blockchain. Every time a user accesses the song to play it, a smart contract could automatically transfer royalty payments from the user's crypto wallet into the musician's wallet.

The challenge with these contracts is that their coding can be flawed. Hackers scour contracts for coding vulnerabilities, and then use those weaknesses to drain assets.

As 0x0 explains in its white paper, its AI-enabled auditor relies on "machine-learning techniques to identify patterns and anomalies in the [smart contract] code, flagging potential issues for further review in areas where the code could be exploited."

The benefit of these reviews: Near-instantaneous analysis completed exponentially faster and more thoroughly than a human can perform it. That helps developers identify and fix coding problems quickly and before the smart contract is deployed.

The AI smart contract auditor will be a free service from 0x0 that brings in users and awareness to the project. 0x0's revenue will come from its other two offerings…

2. Privacy Mixer

Imagine going to the bank and transacting in complete privacy. No one knows how much money you deposited or withdrew. They don't even know you have an account. It's as though you're a financial ghost.

That's a "privacy mixer"—an online tool that crypto users rely on to anonymize their transactions.

Mixers work by pooling multiple transactions together, mixing them around, and then redistributing them to the intended recipients. In that process, the source of the funds and their destination are jumbled.

I like to think of them as a crypto version of what a Swiss bank use to be: A numbered account that provides so much anonymity that even the bank has no clue who owns the account. (Ah, the good ol' days, when financial privacy actually meant something.)

Mixers already exist, but they're going to become more relevant in the near future as governments move toward deploying crypto versions of the dollar, euro, pound, and other major fiat currencies.

One of the overarching security concerns with these forthcoming crypto dollars or crypto euros is that the currencies will exist on the blockchain and that will give government agencies and others—like, say, divorce lawyers—the ability to easily track every dollar that moves around, from source to destination.

That destroys privacy.

By running crypto through a mixer, end-users regain their privacy.

Now, to be sure, mixers have found themselves in hot water. The U.S. cracked down on one called Tornado Cash because, the government alleged, the mixer was facilitating illicit activities such as laundering crypto from hacks.

0x0 recognizes this reality. It has located all of its servers outside of America and, thus, outside the purview of Uncle Sam. Moreover, it has built back-end technologies that look for suspicious or clearly illicit activities and immediately shut them down, thereby helping to mitigate government chatter that mixers are used only by the criminals of the world.

That may not be enough for this new service to escape the attentions of Uncle Sam. Time will tell. I will note, however, that while Tornado Cash was blacklisted for Americans, other privacy-focused cryptocurrencies and platforms have operated for years without government interference such as Zcash, a crypto that can be bought and sold anonymously.

0x0’s privacy mixer, which actively aims to ferret out bad actors, may similarly get room to operate. Irrespective, the majority of 0x0’s revenue is expected to come from its third offering…

3. Privacy DEX Aggregator

The third component of 0x0's operation is an entirely new way to trade crypto—the world's first privacy DEX aggregator.

A DEX is a "decentralized exchange."

Major crypto-trading platforms like Crypto.com or Coinbase are centralized exchanges, or CEXs. They're like the crypto versions of Fidelity or Charles Schwab… big centrally controlled corporate organizations that facilitate the buying and selling of assets.

With a DEX, the entire setup is an automated peer-to-peer marketplace. There's no middleman in the mix. Just buyers and sellers meeting on the blockchain to conduct their transactions. It's fast, efficient, and cheap because there is no centralized operation.

Now, overlay privacy atop that and you have a privacy DEX. In effect, it's an exchange where nobody can see what you're trading.

The "aggregator" component simply means that users will have access to multiple DEXs through a single platform. (There are numerous DEXs today, the biggest being Uniswap, which we own in the Frontier Fortunes Portfolio, as well as Sushiswap, PancakeSwap, and scores of others.)

Again, privacy is increasingly a huge deal in the crypto space.

Because the blockchain is so transparent, people are figuring out which crypto wallets belong to whom and are publishing information about what they're trading (that's how the world found out that billionaire Mark Cuban had invested in over 100 crypto tokens).

A privacy DEX that can shield trading from view is going to be in high demand.

And since 0x0 has developed the world's first privacy DEX aggregator, it's well positioned to benefit.

Should You Invest in 0x0?

0x0 has been hot of late as AI fever grips the stock and crypto markets.

Lots of whales are buying into this project. I know one who has sunk more than $250,000 into 0x0, picking up more than 12 million tokens.

When I told you about 0x0 in that email alert on May 17, the tokens were selling at about $0.07. Since then, they've bounced around between $0.041 and $0.09. But I expect the tokens to surge much higher as the project moves out of the development phase in the coming weeks.

0x0's token symbol.

My bullishness stems from everything I mentioned above—0x0 sits at the nexus of crypto and AI.

Moreover, 0x0 plans to pay distributions in the Ethereum cryptocurrency to holders of the tokens. Based on the businesses 0x0 is involved in, that could prove meaningful income to token holders.

The team has estimated that every 10,000 0x0 tokens (which would cost about $600 as I write this) could generate up to $300 per month.

I can't say whether the distributions will reach that level… or whether the distributions will happen at all.

As I mentioned in my alert to you, this is a just-released project that has yet to roll out its services, so the risk here is high, even by crypto standards.

The team might very well be right in their calculations, or even conservative.

It's also possible this token goes to zero… which is why I have decided against including it in the Frontier Fortunes Portfolio. This project is so new and so cutting-edge that there's a chance it could collapse completely. That's not a level of risk I'm comfortable recommending.

Still, I have decided to invest some of my personal wealth in this project because I'm intrigued by its AI services and, in particular, its income-earning component.

Which raises the question…

How Can You Earn Income From an AI-Crypto Token?

0x0 is due to publicly deploy its three services on the Ethereum blockchain in the coming weeks. In time, the project's directors will likely take its services cross-chain as well, to networks like Polygon, Solana, bitcoin, or others. In fact, 0x0 is in testing on the Polygon network right now.

When the services are live, 0x0's privacy mixer and privacy DEX aggregator will charge fees for each transaction. In turn, 100% of those fees will flow to 0x0 token holders every day in the form of Ethereum distributions.

The team behind the project is willing to share 100% of the revenue because it owns 3% of the tokens.

An important point to note is that the team's share is vested for three years, so they have no access to their tokens for quite a while… pretty much negating the potential for team members to run off with everyone's money. In fact, vesting gives them an incentive to stick around and grow the business so that the value of their tokens pushes higher.

Each token owner's accumulated dividends will show up on a dashboard, allowing owners to track their earnings and claim their share of the profits whenever they wish—daily, weekly, whatever.

So, what is the real income potential?

As mentioned earlier, the team has estimated that every 10,000 tokens would generate as much as $300 per month. If you look at the industry data, that seems optimistic, but not outside the realms of possibility.

So far this year, trading volume on DEXs is about $2.5 billion per day, according to The Block, which tracks all kinds of blockchain data. Typically, 60% or more of that flows through Uniswap, the global behemoth among DEXs (which is why we own it). But there are scads of DEXs gathering up 0.05% to 5% of daily trading volume.

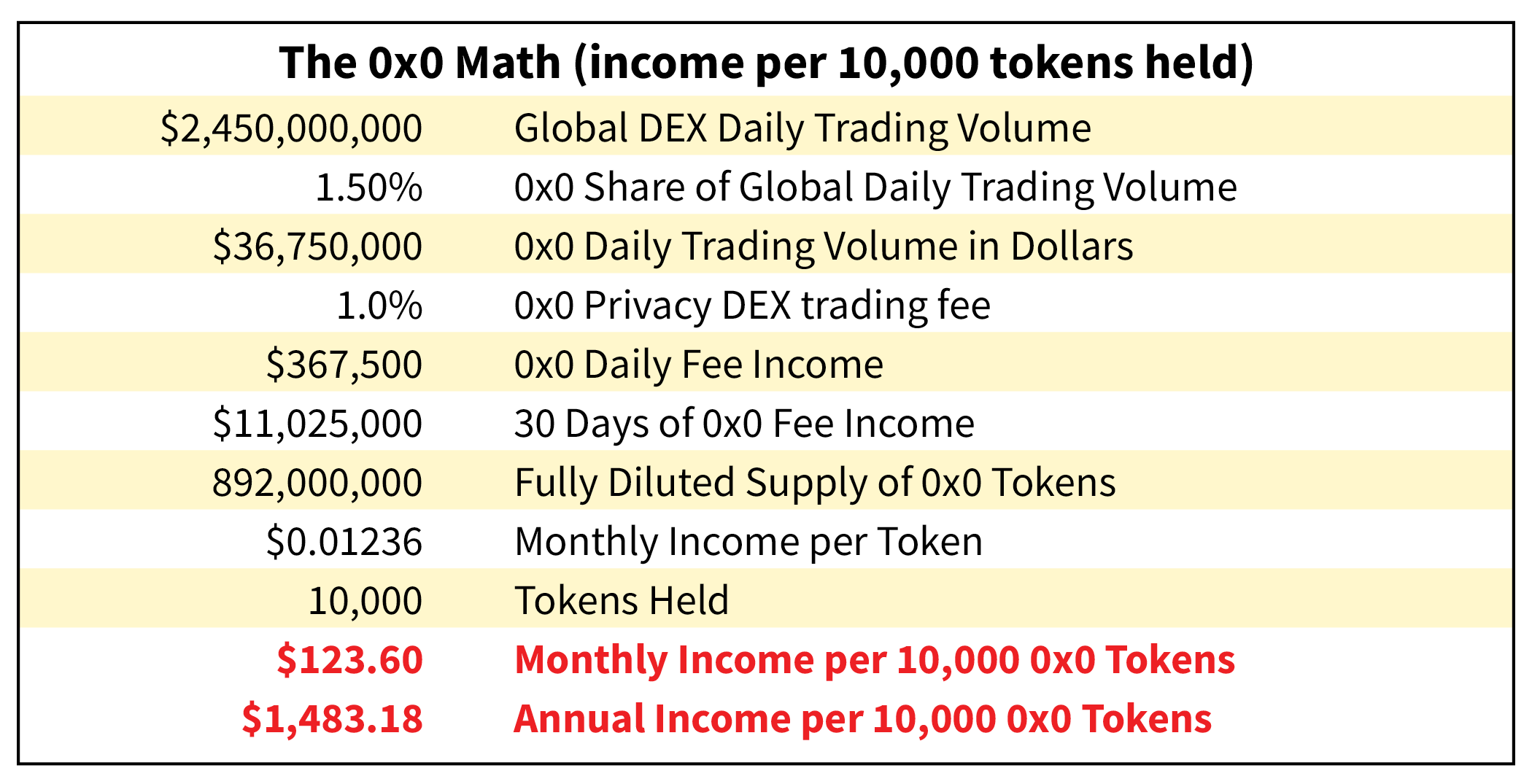

Let's say 0x0 collects 1.5% of daily trading volume, which I don't think is a stretch, given that I anticipate ramping demand for privacy. I've put together this chart to show how the revenue would flow in that scenario, and how much income that could potentially generate for 0x0 holders:

A couple of notes on these calculations:

As I write this, 0x0 is trading at about $0.06 per token, meaning 10,000 tokens is about $600.

Consider that on a return basis… You spend $600 to potentially collect $123 per month (based on the assumptions above). Once the project is running full bore a few months from now, and is kicking out distributions, you recoup your entire investment in less than five months.

That's why I've grabbed more than 75,000 0x0 tokens for my personal crypto portfolio.

Again, I offer this not as a recommendation. This is a high-risk play, even for the crypto space.

Rather, I share this to let you know what I'm doing with my own money. I have been a buyer between $0.02 and $0.09, and I will be adding more on any weakness that manifests.

Where Does 0x0 Trade?

0x0 operates on the Ethereum blockchain and trades only on Uniswap and a centralized trading platform called LBank. You will not be able to buy 0x0 on any of the major centralized exchanges such as Coinbase or Crypto.com

Moreover, to benefit from the payouts you need to hold your 0x0 tokens in your own wallet, not on an exchange such as LBank.

I recommend a MetaMask browser wallet because it's the most convenient to use since it sits on your web browser for quick and easy access. This wallet operates very similarly to the Phantom browser wallet that we use as part of our portfolio.

My original alert on 0x0 contains more on MetaMask and how to trade on Uniswap, including some instructions with screenshots.

As a final point, I will add here that trading on the Ethereum network is not always cheap. Transaction fees-called "gas" in the crypto space—can still be high when the network is busy. Trades can cost $50 to $80 in many cases, though if you wait for off-hours—usually the wee hours of the morning or weekends—you can regularly find transaction costs under $20.

The Crypto-AI Nexus

AI promises to fundamentally reshape great swaths of society, entertainment, and industry. Heck, it's already starting.

Just look at the way AI is infiltrating real life. Pictures and videos are now showing up on social media that are totally fake, but are so perfectly rendered that viewers are mistaking them as real.

Or look at Hollywood, where writers are on strike in part because they want to ensure that entertainment studios do not begin to rely on AI to write blockbuster movies and TV scripts.

But these are only early indications of the vast changes to come. The true power of AI will only be unleashed when it's married with crypto.

Blockchain provides the security and the pathway for vast rivers of verifiable data. AI offers the intuitive processing power needed to turn those rivers of raw data into actionable solutions.

We’re still in the early, Wild West era for this AI-crypto nexus… no different really than those heady days when the World Wide Web was a capitalized noun and not just the internet we know today.

Back then, companies like AskJeeves, Pets.com, Yahoo, Amazon, Priceline, and others were hot stocks. Some of them went on to touch glory (Amazon and Priceline). Some of them have eked out a mediocre existence (Yahoo), and some of them died remarkable and early deaths… shooting stars that burned bright and short.

AI and crypto are destined to pursue the same path. It’s like that with every technology. In 1921, the National Automobile Show had 87 U.S. automakers in attendance. By the mid-1950s, just five were left.

But here’s the issue: No one in 1921 could say which 82 carmakers were destined to fade, and which five would survive.

Now, crypto is a more advanced technology than AI. The first blockchain, bitcoin, was launched in 2009. After more than a decade of blockchain development, it’s clear that certain projects have bright futures, such as those we own like Solana, Chainlink, Avalanche, and others.

With AI, it’s still 2009. And no one can say which AI-crypto companies will emerge as the Amazon, and which will be the Pets.com.

All we can say with certainty—and this is 100% certainty—is that the crypto-AI nexus is the future of our world.

Sometimes you have to hold through the downdrafts to profit from the lightning strikes.

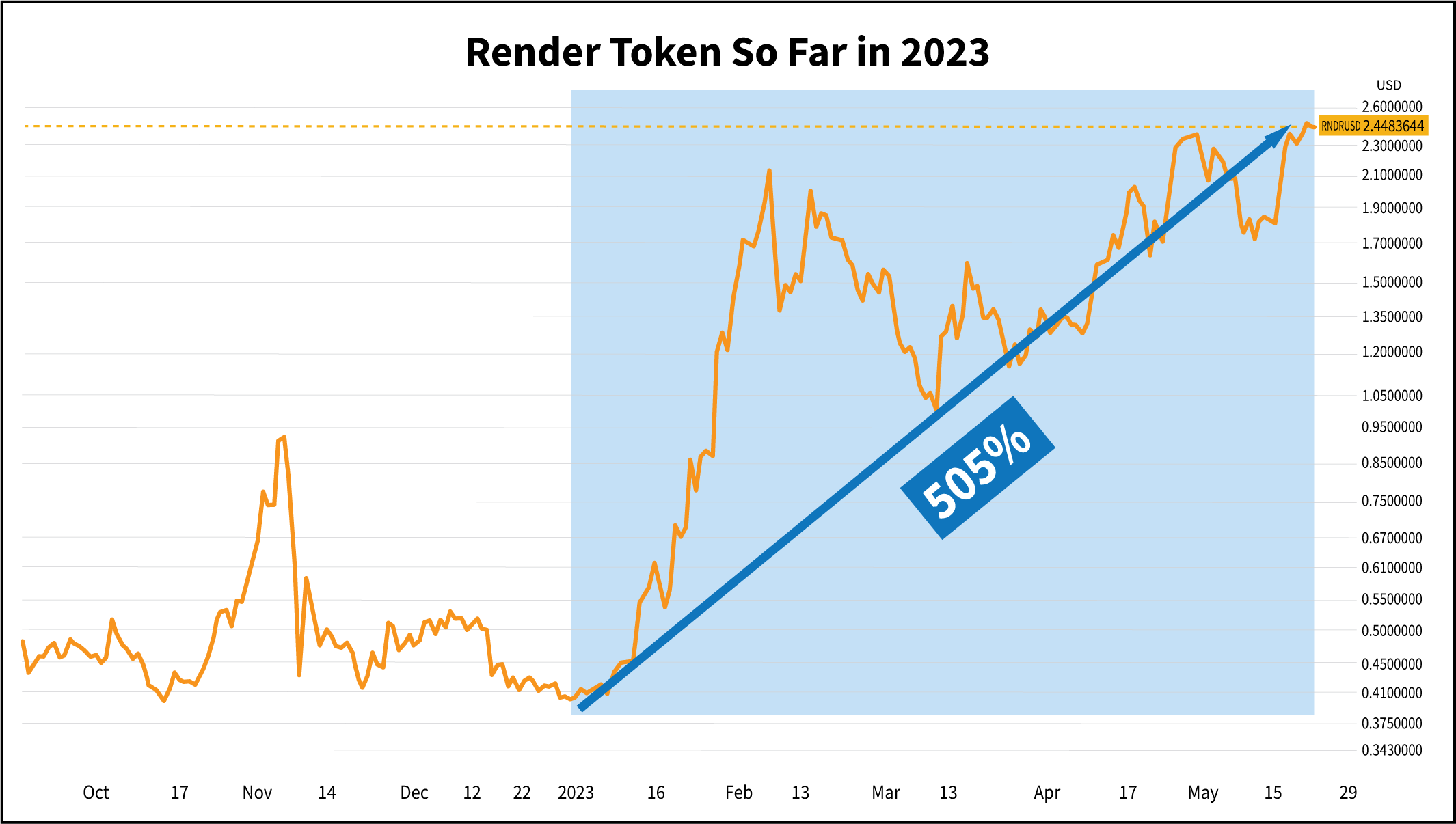

To wit, Render Token, the cryptocurrency project that powers a network of so-called render farms…

As shown in the blue box above, Render Token is up more than 500% so far this year. Moreover, that initial spike you see to the left side of the blue box… that is a 430% jump in just the first 38 days of 2023.

That's how quickly and how dramatically crypto can move. It's why we've gone from being down sharply in Render to being up 13%.

Now, 13% is nothing to write home about, but Render's extremely quick and large move is precisely why I always counsel patience with crypto. Yes, patience in this sector can be infuriating. You can feel like you need to get out to preserve your wealth because everything is going to zero.

But the reality is that rebounds like this happen more often than you might assume… especially when you own solid projects.

And Render is a very solid project.

In simple terms, this company incentivizes people with spare computing power to add their computers to the Render Network. Developers of apps and online media then pay to use those render farms to, well, render graphics and video far more rapidly than they could do on their own.

Render works by dividing a rendering task into segments and assigning them to farms across the network. Thus, a render project that might take several days, can be completed in a couple of hours or less because so much computing power has been assigned to it globally.

There are a few factors driving Render's dramatic rebound.

While Render was born on the Ethereum network, the company has recently crossed over to Solana. That has opened up Render to far more development activity.

Moreover, Render is a beneficiary of the explosive growth of artificial intelligence.

As I outlined in our main story, AI and blockchain were made for each other.

Render plays into that because of the decentralized application projects, or dApps, that are common across the blockchain.

These dApps are not dissimilar to the apps on your smartphone, except that they exist on the blockchain and are increasingly calling on AI technology to move the web in entirely new directions. For that, they require a lot of processing power. That's the world of Render.

Render Token will, of course, remain volatile. It's crypto, after all. But I fully suspect we're going to see this crypto approach and exceed all-time highs from late 2021 as the token hits $7.80 over the next year.

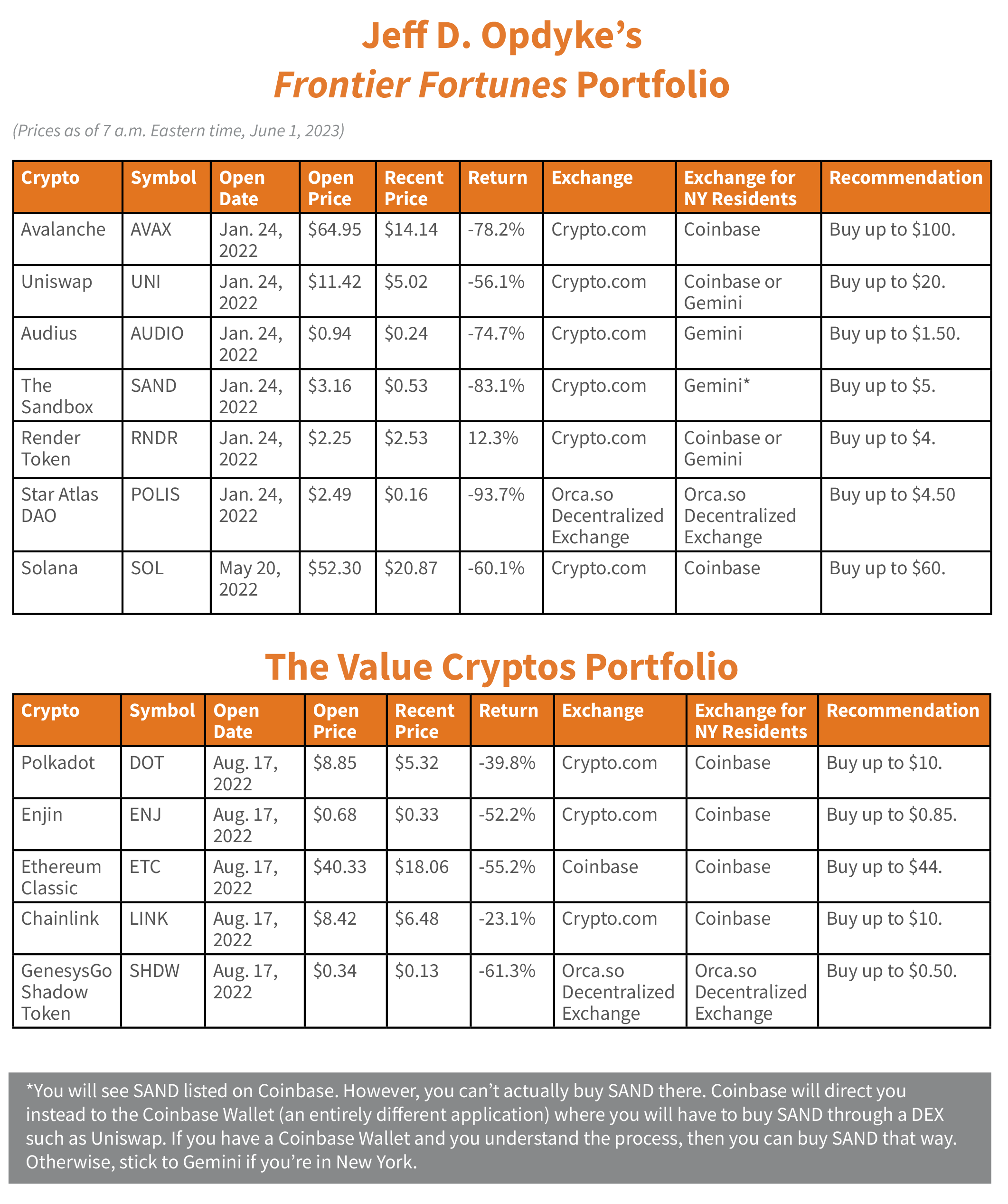

Uniswap

Uniswap has been trending sideways for much of the last nine months. But I see trends unfolding that should be beneficial to the token.

As I mentioned earlier, Uniswap is the world's largest decentralized crypto exchange… by a country mile. It controls about 60% of global DEX volume. And global DEX volume is why I'm bullish on Uniswap's token price.

The crypto bear market wiped out a lot of trading demand worldwide. Monthly trading volume fell from more than $213 billion in May 2021 to just $39 billion by December 2022.

So far this year, however, monthly trading volumes have been pushing noticeably higher.

Every month has exceeded $50 billion, while March approached $115 billion. We are, as I've been saying since about February, in the midst of a stealth bull market in crypto.

Few people want to acknowledge that, but the numbers tell an underlying story of resurging interest in crypto projects and tokens.

That plays to Uniswap, because as the stealth bull market in crypto starts running again, increasing amounts of money is going to flow through the largest DEX—Uniswap—as investors convert one crypto for another.

Solana

Solana remains one of my favorite crypto and I'm active on the Solana network every day because of my work with NFTs (those art-based crypto projects).

At present, the token remains deeply below its all-time high due to the lingering impacts of the bear market coupled with the collapse of the FTX crypto exchange last fall. FTX was deeply invested in Solana and when it fell apart amid fraud, it ripped through the Solana community.

Nevertheless, Solana has continued to build.

The network speed—once in the range of about 1,300 transactions per second, and which would stumble to under 100 when huge volume hit the network—is now routinely in the 4,000 to 6,000 range. Network outages are increasingly rare, and projects like Render are moving onto Solana because of its speed and cost advantages.

In early May, the number of new addresses added on a weekly basis to the Solana network (basically the number of new accounts) crossed 300,000 for the first time in nearly a year—an indication that interest is reviving, which goes back to my stealth bull market contention.

Also, in May, Solana released its own Web3 smartphone, called the Saga. (Web2 is the current age of the internet, dominated by big centralized data firms like Google, Facebook, et al. But now we're moving into Web3… a decentralized era built on blockchain technology.)

The Saga phone has a secure crypto wallet built into the design, and those who have road-tested it say it has potential.

At $1,000 per unit, that potential won't be recognized immediately. But as crypto continues to build out and become an everyday part of our lives, Saga could be a sign of things to come.

I have no doubt that Solana will again reach all-time highs north of $260, which is why I have been eagerly accumulating as much as I can through a variety of means, such as NFT lending (which I wrote about here) and owning NFTs that pay dividends in Solana (which I wrote about here).

Audius

Audius, the Spotify of Web3, has doubled since the end of 2022, but is down in the past month.

Why? Well, the news has been positive, so it's likely profit-taking from those who jumped into the token at dirt-cheap prices late last year.

A lot has been going on at Audius of late.

The company has released a new NFT-gating feature that allows recording artists to sell NFTs that give fans access to exclusive content they can't find anywhere else.

This is already emerging as a big deal in the crypto space. I know several artists in music and television—including a TV show creator and a DJ in Los Angeles—who are using NFTs for gated access to content, or even to potentially offer a revenue-share from that content.

Audius is the clear go-to provider for these solutions because it offers artists far greater freedoms and a greater amount of the revenue generated… revenue they'd otherwise lose to various middlemen in the entertainment industry.

Avalanche

Avalanche has spent this year bouncing around between $14 and $20 per coin. As I write this, it's at the low end of that range.

Nevertheless, Avalanche continues to grow into one of the premier Layer 1 cryptocurrencies. (Layer 1 is like the train tracks of a network, the base layer. Layer 2 are the trains—the individual projects or services—that ride atop the network.)

At the Avalanche Summit in Barcelona in May, the project announced numerous new partnerships, including with Chinese retail giant Alibaba, global telecom giant Vodafone, and Chainlink, a crypto we also own and which is the global leader in pulling real-world data onto the blockchain for applications to use.

Avalanche is also moving into the AI space in a unique way.

Avalanche's founder and CEO, Emin Gün Sirer, noted in an interview at the conference that an evolution now underway "will bring to the ecosystem COA, or Coin-Operated Agents—AI-operated agents on a blockchain that can process transactions written in natural human language, whether it's English, French, Turkish, or any other language."

In layman's terms, that means a developer, or even a non-developer, would no longer need to know a programming language to build an application on the blockchain. They could simply type out the requirements in English or French or whatever their native tongue is, and ask the AI to create the application for them.

That's a potential game-changer. And Sirer is positioning Avalanche to be a go-to network as interest in COA expands.

The Sandbox

Sandbox, one of the leading metaverse tokens, suffers from a media-fueled perception that the metaverse is dead. Oh, how very wrong.

The mainstream media has the attention span of a dimwitted squirrel. It's late to jump onto a trend, and then early to proclaim its death in the never-ending quest to report something, anything.

After all, even AI was proclaimed dead and completely disappeared out of view for years before its recent re-emergence.

The reason the media is now on the "metaverse is dead" kick?

Mark Zuckerberg.

The Facebook founder, who also has the attention span of a squirrel, was all agog with the idea of the metaverse for much of the last year or two, even renaming Facebook's parent company to Meta. And then, when he was mocked for his overhyped, half-ass efforts at designing a metaverse, he cooled on the idea and rushed headlong into AI.

And, so, taking its cue from Zuckerberg, the media promptly said "See, I told you so! The metaverse was a fad."

Of course, the media said the same about the internet after the dot-com implosion, and we all know how accurate that assessment was.

Me? I'd rather take my cue from a smarter tech giant: Apple.

Apple just announced it's preparing to release its highly anticipated mixed-reality headset specifically built for the metaverse. Apple doesn't act on a whim. It makes premeditated moves in anticipation of the biggest trends to come.

My bet is that we're going to see products begin to emerge that play specifically to the Apple headset, and which are going to rely on metaverse cryptocurrencies such as Sandbox to power them.

To me, Sandbox is much too cheap right here, given what should be ramping demand for metaverse games and entertainment, fueled by Apple's arrival.

Polkadot

Polkadot, a Layer 1 crypto like Avalanche, Solana, and Ethereum, has been in the news lately because of its hardware wallet known as Polkadot Vault.

A hardware wallet is a physical device that looks like a USB stick on which you can securely store your crypto assets.

The industry's leading hardware wallet, Ledger, has recently come under fire across the crypto community for an update that allows users to create a failsafe mechanism to reclaim their crypto in the event that they lose their password and seed phrase.

Part of that process includes an ID verification tied to passports, which raises immediate concerns about ID theft that would then allow a hacker access to someone's Ledger. (I will be writing to you about this in an email alert soon.)

Amid these concerns, the company's Polkadot Vault has suddenly gained a lot of traction as crypto users go in search of a non-Ledger product for securely storing their crypto and NFTs.

Vault is an "air-gapped" solution tied to using an old smartphone. Air-gapped means there is no connection between the vault and the internet, meaning there's no way for hackers to gain access to the device.

The excitement around Vault highlights that Polkadot remains high on the radar of crypto owners.

Elsewhere, the company recently signed on with Kyushu, the largest railway company in Japan, to host NFTs that will be used for ticketing.

I've been writing for more than a year or two now that NFTs would go well beyond digital art, and would take on real-world use cases, specifically ticketing… and here we are.

Kyushu, with more than 330 million riders annually (roughly the population of America), will use the NFTs as "proof of ridership" and to serve as collectibles. This will lead to an increased level of NFT adoption in Japan… and an increased use of the Polkadot network.

Chainlink

Chainlink is the "oracle" in our portfolio—the crypto project that compiles vast reams of analog data in the real world and migrates it onto the blockchain so that crypto companies can tap into the information needed for smart contracts.

A good example of this is real estate. Lots of municipal data, like tax payments and plot maps, are digitized and online, but they're not on the blockchain.

For real estate transactions to be processed in the emerging world of Web3, that data needs to migrate onto the blockchain so that real estate-focused smart contracts can complete transactions.

Chainlink is the global leader in the oracle business. And in recent months it has seen a surge in the number of developers building on its network, an indication of growing demand for oracle services.

Because the Chainlink token fuels operations on the network, surging developer demand will ultimately lead to increased demand for Chainlink's token as those new services roll out.

And that brings us to the end of this month's portfolio review.

There were no major updates with our other investments, beyond deeply inside baseball technical advancements that are simply going to read like an exceedingly dry textbook. But those other tokens are still advancing in line with our investment concepts, and I continue to monitor them carefully.

Before signing off, let me re-emphasize my fundamental belief that we're in the early phase of a stealth bull market. It will be lumpy—and it has been lumpy—but I can tell from social media and my interaction with crypto and NFT teams around the world that there is a palpable sense of bullishness re-emerging.

The time to be invested is before that palpable sense morphs into outright, headline-screaming bullishness. The run between here and there is going to see scads of cryptocurrencies soar 500%, 1,000%, or even more… just as Render has done.

So, let Render serve as an example of what can happen across the crypto space as the bull market takes hold.

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2023. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.