Dear Global Intelligence Letter Subscriber,

To quote Kenny Rogers (sort of)…

You’ve got to know when to hold ’em, know when to fold ’em, know when to walk away, and know when to… double down.

This month, my poker face is trained on Jerome Powell.

Because Jerome Powell and the Federal Reserve are playing a losing hand.

They keep teasing interest rate cuts… A cut in interest rates would spur on the stock market and the crypto market… However, the Fed hasn’t cut rates yet, because higher rates are its only tool to fight an inflation problem that just won’t go away.

In this issue, I’m doubling down on a bet I’ve been making for months…

The Federal Reserve is going to cut interest rates. Period. It really has no other choice (as I’ll explain in a moment).

And when the rate cuts come, we’ll be poised for even bigger gains… because I’m also doubling down on two Global Intel positions that are best-placed to benefit from cuts.

They’re both interest-rate sensitive stocks that will see their share price pop the moment the Fed announces a rate cut.

My expectation is that both stocks can double—or more—from their current price.

So, we want to increase our positions in these particular stocks… And that’s what we’re doing this month.

I call it, “doubling down for double the profits.”

Why do I say that the Fed has no choice but to cut rates?

The Fed throughout history—which we’ll get into in a moment—has been epically late with its interest rate moves.

Right now, it’s short-sighted in its near-singular focus on inflation…

The knock-on effects of that wrongness are visible in economic data that is not the inflation report. That data indicates that the underlying US economy is struggling, and that if the Fed continues on its current path, it’s going to be epically late once more in cutting rates.

The impacts of that are going to crush the American consumer, regional banks, Wall Street companies, and even Uncle Sam himself.

Jerome Powell does not want to end up there.

Which is why the Fed will not persist with its current path.

See, the Fed has worked itself into a cul-de-sac. There’s only one way out at this point and that’s to turn and head back toward where this journey began—lower interest rates.

Granted, lower interest rates are bad news longer term. But this is the situation that various Congresses and presidents have wrought through decades of relying on debt to both grow the economy and bail out the country after various crises created by decades of hairbrained policy decisions.

That’s not the focus of this month’s issue.

This month, we’re not preparing for the inevitable crisis which America will undoubtedly face (probably later this decade). We’re focused on the prospect of rate cuts happening soon—and the bump our stocks will get…

In my view, the Fed is already late in taking the interest rate action it needs to… but the Fed acting late is nothing new.

Let’s look at history…

The sands of time have not been kind to Federal Reserve. Not just this iteration of the Fed, but various Fed iterations over the years.

We can go back to the Great Inflation of the 1970s to see that the Fed is consistently late (or just flat out wrong) in making policy decisions, and that those lagging decisions usually have hugely negative consequences on the US economy and American families.

That inflationary cycle ran from the mid-60s to about 1982. By the early 70s, President Nixon wanted cheap money to promote growth going into the 1972 presidential election. The Fed, helmed by Arthur Burns, acquiesced and began flooding the country with cheap money by way interest rate cuts that took rates to 3.3% in 1972 from 9% in 1969.

The result was the Great Inflation of the late-70s that forced the Fed under Paul Volcker to push rates to nearly 20%—a move that ultimately bankrupted businesses, destroyed the housing market, and gored Wall Street.

Lots of cheerleading economists will disagree with the assertion that the Fed caused America’s Great Inflation. They will (wrongly) insist that it was fueled by the Arab Oil Embargo. But as the Wall Street Journal correctly noted in 1986: “OPEC got all the credit for what the U.S. had mainly done to itself.”

Jump ahead to the Fed of Alan Greenspan, who Wall Street saw at the time as a mythical figure who could do no wrong—largely because he pretty much guaranteed he would always bail out the Street if implosions happened on his watch.

In fact, that’s where Greenspan’s Fed was wrong. His Fed embarked on a five-year string of rate cuts that, in plain view, were fueling asset bubbles in housing, stocks, and elsewhere. That resulted in a derivatives meltdown in the mid-90s. Bankruptcies ensued.

And then we have Ben Bernanke, who famously told Congress in the spring of 2007 that America’s unfolding sub-prime mortgage crisis was “contained.” By that December, it was clear that “contained” had been a decidedly wrong word choice as the sub-prime crisis metastasized across the globe, bringing down banks and causing vast numbers of homeowners to simply walk away from properties that were financially underwater.

Which brings us to Jerome Powell, the current Fed chairman.

You will no doubt remember that, in the wake of the US and countries around the world dumping trillions of dollars into local economies to fight COVID shutdowns, Powell famously said that whatever inflation might emerge would be “transitory.”

If you’re a long-term Global Intel and Field Notes reader, you might also remember that in early 2021, I wrote that inflation was far from transitory and would soon severely pinch the US economy. I predicted that inflation would approach 10% from what was then still sub-2%. We exceeded 9% in the summer of 2022.

Powell’s Fed was late to the fight.

Inflation was always going to be an issue because of the vast amounts of money dumped into the economy. The US alone poured roughly $6 trillion into an economy that was about $20 trillion in size, meaning COVID spending equaled nearly one-third the size of the entire US economy—a huge injection of money.

The Fed has spent the last couple of years aggressively fighting the “transitory” inflation that has proved to be a bit more permanent.

But the Fed has become very myopic in that fight. As I’ve written elsewhere, it’s like Powell’s Fed is channeling the ghost of Paul Volcker’s Great Inflation-fighting Fed of the late-1970s.

Alas, that’s like a defensive lineman for a football team trying to compete in the Winter Olympics as a speedskater. Both sports require athleticism, but that’s where the similarities begin and end.

America in the 2020s is nothing like America of the 1970s.

The household debt-to-income ratio in 1975 was 0.57, meaning households had $57 in debt for every $100 in income. Today, the average household has $130 in debt for every $100 in income. As such, families today have a far more challenging time affording higher debt-service payments than did American families 50 years ago.

The US government is even worse off.

Half a century ago, America’s government debt relative to the size of the US economy stood at 32%.

Today, it’s 123%. At current spending rates, and given the need for America to sell increasingly more debt just to afford its existing debt payments, debt will exceed 150% of GDP by 2028, just four years from now.

That’s banana republic levels of indebtedness. But even stopping at 150% would prove to be a quaint hope. America keeps running up larger and larger budget deficits, which add to the overall debt. So the amount of debt over which interest rates are applied is growing ever-bigger.

Thus, the Fed’s dilemma: Keep rates high, or elevate them more to (try to) attack inflation, and Uncle Sam’s debt-servicing costs spiral higher and higher, potentially spiraling out of control.

For fiscal year 2025, which begins October 1, debt-servicing costs, per White House projections, will equate to 15% of the federal budget—an usually large number. Back in 2001, before America’s reliance on debt really exploded, debt-servicing costs were about 10% of the budget.

Starting next year, according to the non-partisan Congressional Budget Office, “net interest costs are greater in relation to GDP than at any point since at least 1940.”

The US rolls over its debt every year. When one Treasury bill, note, or bond comes due, it just sells another one to repay the one that has matured. In family household terms, it’s like applying for a new credit card every time the bill arrives on your old card—you’re just moving the debt around without ever repaying it. Instead, you just make interest payments on the debt you owe and continue to accumulate.

For the US, many of its maturing bonds were issued at ridiculously low rates of 1% or 2%—sometimes even less than 1%. When those bonds mature, however, the replacement bonds carry rates of 4% or 5% or higher.

Thus, you can see how Uncle Sam’s debt costs are rising.

Even if the Fed allows interest rates to remain where they are in the 5.5% range, that just means that all of Uncle Sam’s cheap, expiring debt will take on those higher rates that then play through the federal budget as higher interest payments… which then forces the Treasury Department to sell even more higher-rate bonds to afford the higher rates on the replacement debt.

You can see how this ugly spiral plays out: A fiscal crisis for America that spins into a monetary crisis as investors flee the US dollar.

This is one of the reasons (the fiscal reason) I say that the Fed really has only one choice…

The Fed will cut rates.

But there’s an economic reason, too.

Lots of economists and economic commentators keep telling us that we’re blind and/or ignorant if we can’t see that the Biden economy is a rockstar.

Perhaps the New Yorks Times’ perennially out-of-touch econ columnist Paul Krugman best summed it up when he wrote in early April that, “The truth is that the U.S. economy is a remarkable success story. Don’t let anyone tell you that it isn’t.”

OK. I won’t tell you it isn’t.

I will let the facts say what they will.

Facts:

I’ll stop there because those plot points adequately demonstrate that the US economy is not a “remarkable success story” right now.

The “success” was the post-COVID rebound and all the free money that consumers and businesses received from the government. That has pretty much worked its way through the economy, and now we’re returning to a more normal financial environment.

And in that environment, the economy is a “catfish.” It dolled itself up all nice and pretty for a while, but the makeup’s coming off now and what’s underneath isn’t as pretty as one might have hoped.

Which leads me to the nub of this month’s issue…

The stocks in our portfolio that I’m doubling down on are First Horizon Bank and KIMCO Realty Corp.

Let’s start with First Horizon, a 160-year-old Tennessee-based, super-regional bank serving the Southeast.

These shares have performed well so far. We moved into the stock last August, and since then it’s up a bit more than 28% as I write this. Not a bad return in less than a year and slightly outpacing the S&P 500 index.

First Horizon, widely regarded as one of the best-run super-regional banks in the country, recently reported its results for Q1 and they beat analysts’ estimates.

In their most recent conference call with analysts and investors, First Horizon management reported that the “First quarter was a great start to 2024 and… this is the beginning to a strong year for First Horizon. We've updated our 2024 outlook slightly to reflect better-than-expected performance.”

Though higher interest caught a lot of banks off guard, First Horizon, as I noted in the original recommendation, opted not to chase yield when interest rates fell, but to park a bunch of cash in short-term Treasury paper. That slowed earnings growth, but didn’t expose the bank to investment volatility.

Susan Springfield, the bank’s Chief Credit Officer, noted as well in the recent conference call that, “The good news about not having any [Fed rate hikes yet is that] you're seeing a lot of borrowers who have adapted to this new interest-rate environment, whether it's able to pass along costs in their businesses or just learning how to do things differently, being more efficient, learning how to operate in a higher interest rate environment.”

The bank has also announced a $650 million stock-repurchase plan, of which $150 million, or roughly 11 million shares, was completed in Q1. When companies buy back their stock, that reduces the number of shares over which earnings are spread… which means a higher earnings-per-share figure… which means a lower price-to-earnings ratio. And since stocks are valued based on their earnings, buybacks typically mean a higher share price over time. So this is good news for our shares.

When the Fed does begin cutting rates, the rates First Horizon charges for mortgages and home equity lines of credit and other forms of lending will come down, but so too will the bank’s cost-of-capital—the interest it pays on savings and CDs and such. So the net-interest spread (the profit a bank earns) should remain roughly similar.

More important, the number of mortgage and loan requests will very likely ramp higher since there’s a great deal of pent-up demand for house buying. Those applications carry fees unrelated to interest rates, so that should fatten earnings, and lead to increased quarterly dividend payments.

Right now, the shares yield just under 4%—a relatively nice yield as we wait for the pump that will come when the Fed finally announces its first rate cut.

The story is very similar with KIMCO, a real estate investment trust (REIT) that operates America’s largest number of open-air shopping malls. (You can see my original, full write-up in your January issue.)

The only real difference is that KIMCO’s shares are down about 12% since joining the portfolio last December—a decline that is entirely the result of Wall Street disappointment that the Fed has not lived up to its promise to cut interest rates yet this year.

Indeed, KIMCO’s Q1 earnings topped Wall Street estimates and the company told investors to expect full-year profits for 2024 that will come in larger than originally expected. It also announced a quarterly dividend of $0.24 per share, meaning at current prices the stock represents a dividend yield of just over 5%.

Frankly, I don’t know what more to say about KIMCO at this point.

The company is executing quite well. The fundamentals remain strong. Yes, consumers aren’t in the greatest mood, but KIMCO’s shopping centers are anchored by what I’ll call “basic retailers” such as TJX department stores, Albertson’s, Ulta Beauty, Hobby Lobby, Kroger, Ross Dress For Less, and others like that. Everyday retailers serving basic needs—my favorite kind of retailers. These are the kinds of stores that will continue to do well even when consumers are cutting back.

As with First Horizon, a Fed rate cut is going to jumpstart KIMCO’s stock-price run.

REITs are heavily reliant on debt to run their operations and to grow by way of buying or building more properties. When interest rates are high or rising, REITs feel the financial pressure on their income statement.

But when rates are low or failing, it’s manna from heaven for the industry.

Thus, the minute the Fed says “we’re cutting rates” the REIT market is going to sprint higher quickly, and KIMCO is going to be a leader in that because it’s such a high-quality company with a long history of growth.

Risk: First Horizon, medium. KIMCO, higher. (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Both of these stocks are available through any brokerage firm you use.

I cannot say exactly when the Fed will cut, only that it will.

My guess—and it’s just that, a guess—is a June cut. But this is the Fed, and guessing at what the Fed will do is definitely Quixotic, given how late the Fed always seems to be with its decisions.

But, to me, it’s a no-brainer that a cut will happen.

The tea leaves are telling a troubling story for the US economy, and the heavily indebted consumer and government.

Lower rates are the only logical answer.

Logic will prevail… even if the Fed acts, as usual, late.

And when logic prevails, First Horizon and KIMCO shares will have the moon in their sights.

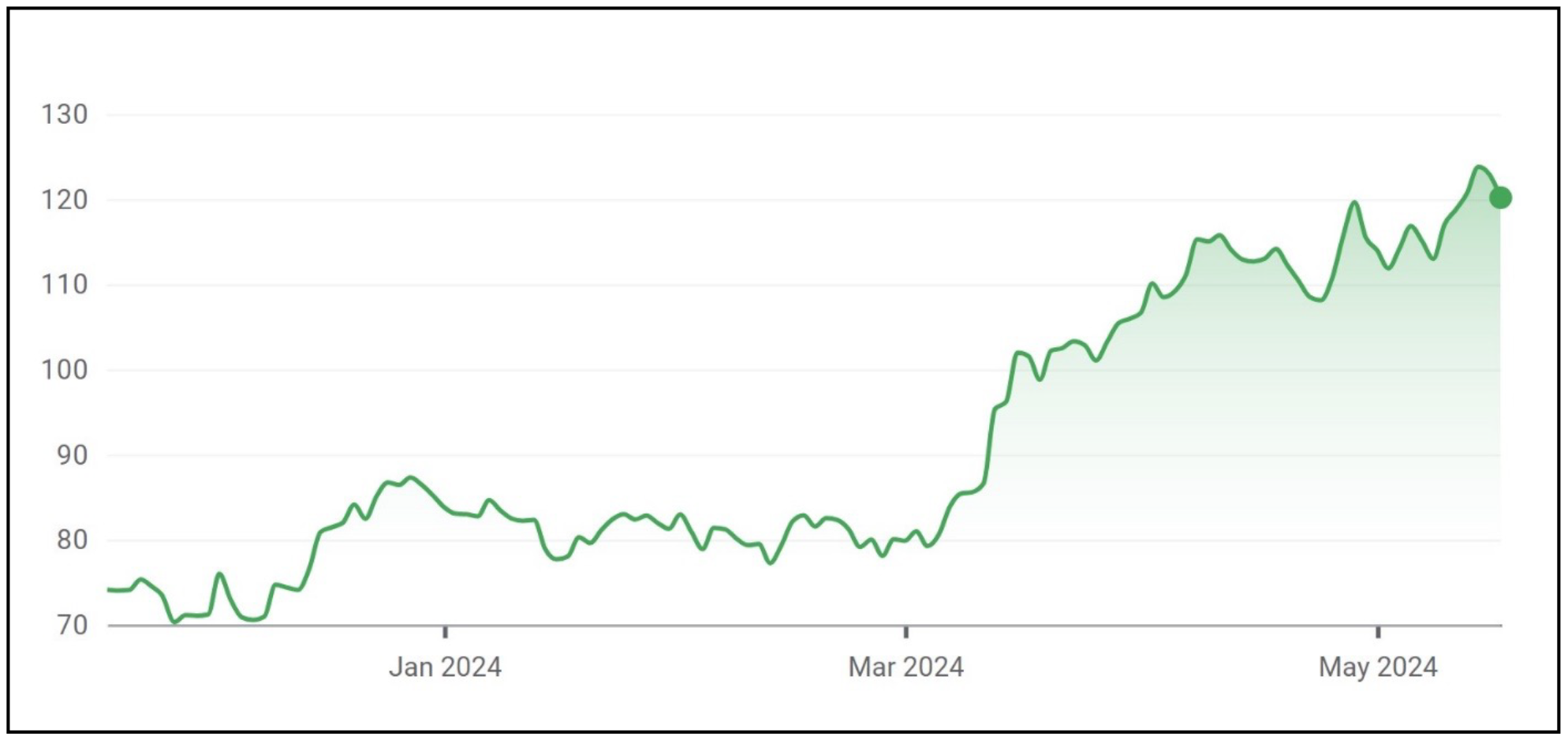

We picked a good moment to move into copper when we added Southern Copper to our portfolio in March last year.

Southern Copper is up more than 84% since then. That’s nearly triple the S&P 500’s gain over the same period.

Just this year, Southern Copper’s price has risen from around $83 to over $120.

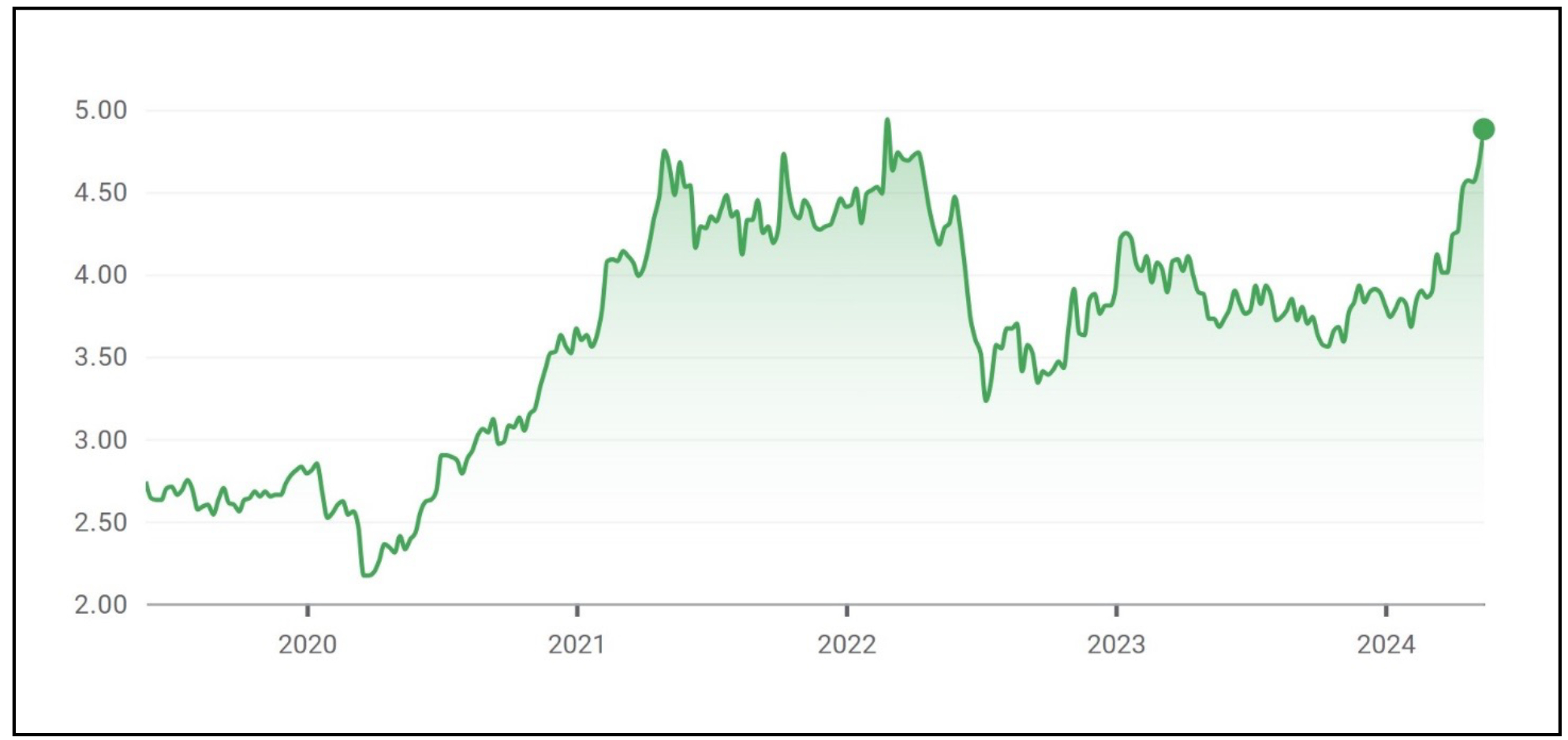

So far in 2024, the price for copper itself has jumped more than 30% to nearly $5 per pound from about $3.75 at the beginning of the year.

What’s interesting about this moment is that the global economy is slowing a bit, and that has historically seen copper prices weaken.

But, so far, not this time.

The reason: Inflation is persistent globally, and commodities prices fare well during periods of inflation. Moreover, there’s now talk of a new commodities super-cycle, which is precisely what I’ve been saying was on the horizon.

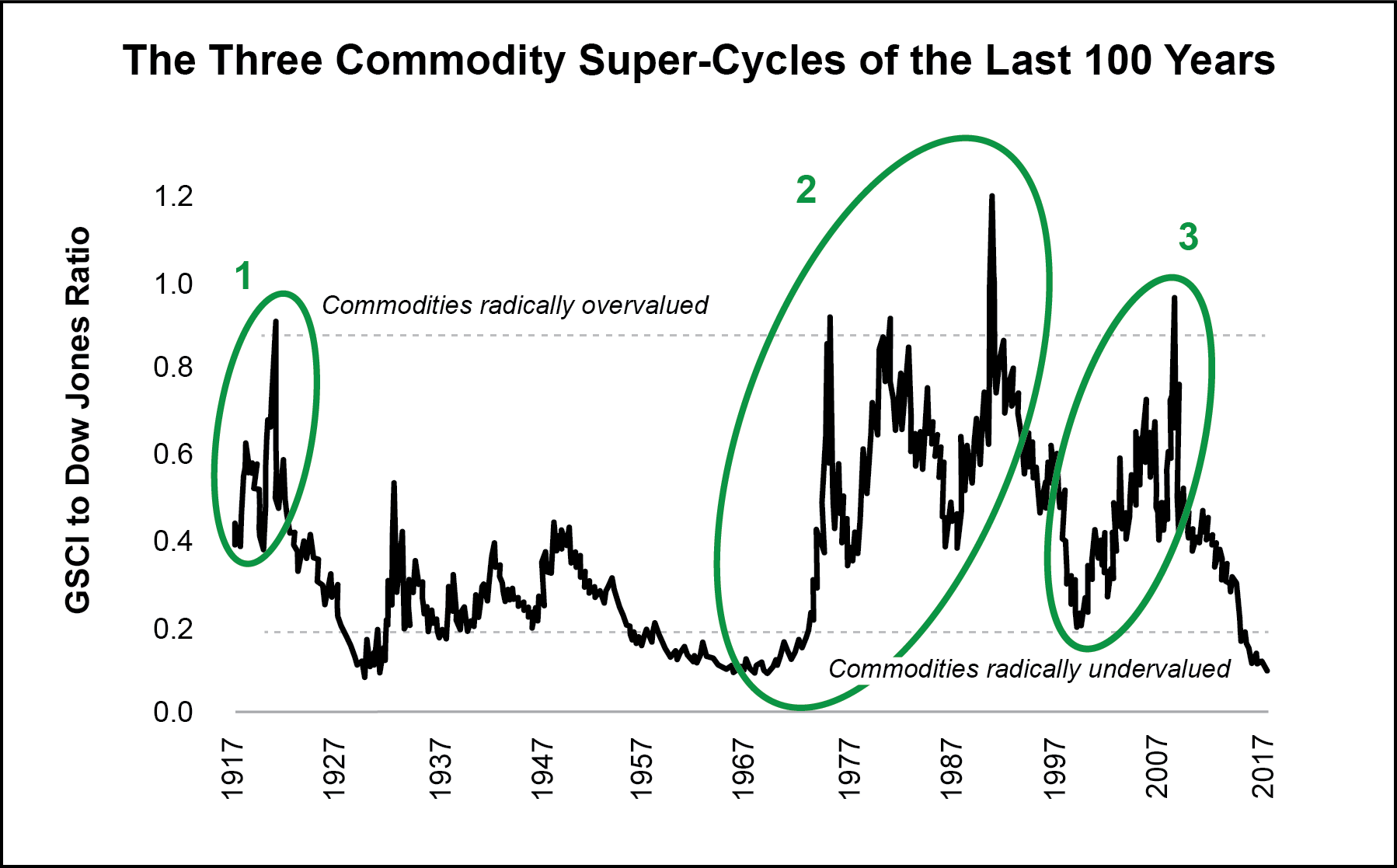

These super-cycles are rare. As I wrote in your May 2021 cover story, only three have occurred in the last 125 years.

The last one began in 2000 and lasted until about 2011. Even accounting for the Great Recession, which occurred in 2008/09, copper prices during that period rose more than 665%.

In my view, we’re already a few years into the current super-cycle, which began when copper and other commodities bottomed in the early months of the COVID pandemic in 2020. Since then, copper is up about 150%.

Copper’s rise since 2020…

So you and I caught more than half that move off the bottom.

And we have much more room to run.

Now, the analysts and the metals community are suddenly talking about a commodity super-cycle—and that says we’re likely to see lots of money pouring into the sector, everything from minerals to agricultural products to industrial metals.

Sandeep Daga, a director at metals-analysis company Metal Intelligence Centre, recently told the Reuters news agency that "Index funds, exchange-traded funds, etc., are attracting retail money into metals."

When retail investors start moving into any investment en masse, we’re potentially at the beginning of something big and profitable.

The retail crowd is moving into commodities because it now sees what I’ve been going on about for many a month: that inflation is far from under control and is becoming a near-permanent fixture of this economic landscape because of all the free money Western governments have pumped into their economies over the last 15 to 20 years.

All the money is creating inflation. It’s textbook.

Copper is the king of industrial metals because it goes into so many building applications including electrical wiring and plumbing.

But we also have a new copper consumer—green energy.

Rewiring the world’s power plants to run on renewable energy, and replacing the world’s auto fleet with electric cars, demands more copper over the next decade or two than humans have consumed in our industrialized history up to this point.

It’s simply a gargantuan amount of copper.

That demand is running headlong into constrained supply, since the mining industry has under-invested in new mines over the years. There’s not enough new copper being produced to meet the expanding demand.

And it’s not like industry can just gin up a new mine tomorrow. There are years of tests and permitting and designing environmental mitigation measures and building the actual mine before the first ounce of copper arrives.

So it is, then, that copper prices should continue to run higher.

Which means Southern Copper should continue to run higher.

Once we’re past a 100% gain, I will likely send you an alert to sell half your position so that we recoup our original investment, then let the rest ride as our free investment in a metal the world can’t live without if it wants to go green.

Be ready for that alert.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke

Editor, Global Intelligence Letter

© Copyright 2024. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.