Dear Global Intelligence Letter subscriber,

Late afternoon. Ypres, Belgium. April 22, 1915.

As the sun approached its evening rest in the Western sky, Germany’s 4th Army opened the spigots on 5,730 cylinders of liquid chlorine. It quickly formed into chlorine gas.

French, Moroccan, and Algerian troops in their trenches rose to see an odd and unexpected greenish-yellow haze wafting across the flat, Flemish countryside. Moments later, those soldiers were “haggard, their overcoats thrown off or opened wide, their scarves pulled off, running like madmen, directionless, shouting for water, spitting blood, some even rolling on the ground making desperate efforts to breathe.”

That’s how French Col. Henri Mordacq described the horrific agony of the world’s first chemical attack at the Battle of Gravenstafel Ridge during World War I.

On the opposite side of the front stood a 50-year-old scientist, a captain in the Germany army and head of the Chemistry Section in the Ministry of War. He had traveled to the Western Front to oversee Germany’s first attempt at weaponizing a chemical for use in war.

His name: Fritz Haber, a bald, bespectacled man now considered the “father of chemical warfare.”

On May 5, just two weeks after Haber unleashed the first chemical weapon on the world, his wife, Clara, committed suicide. She shot herself through the heart with Haber’s own pistol, distraught at the realization that her husband, through his immoral creation, had killed, injured, and maimed an estimated 67,000 people.

Then, three years later, Fritz Haber won the Nobel Prize in Chemistry.

But that’s not the oddest part of the story.

This is: Haber is the man responsible for the cornucopia every time you walk into a supermarket.

The story of Fritz Haber is one of history’s great Jekyll and Hyde tales: A German scientist who gave the world the means to kill indiscriminately and with immense, terror-invoking pain…yet who also did so much to make the world a better place.

Because of Haber, we have something known as the Haber-Bosch Process. This Nobel Prize-winning invention fundamentally changed agriculture by radically improving crop yields, which has helped global farmers produce greater and greater quantities of food from an ever-shrinking base of farmland.

Now, as we approach a pivotal change in our economy—an era of higher inflation—I want to tell you the story of the Haber-Bosch Process, its relationship to nitrogen, and how we are going to benefit financially today from Fritz Haber’s Jekyll and Hyde life.

Before we jump into this month’s issue, I want to let you know that this is part of the new direction I’m taking with the Global Intelligence Letter. While I continue to focus on living and earning an income abroad and pursuing a richer life overseas—here and in my daily Field Notes dispatches—I am expanding my umbrella to include global investment opportunities.

It’s all part of the same wheelhouse of international opportunities. Sometimes those are new residence visas that let you pursue a lower-tax retirement somewhere outside America…sometimes they’re ways to build your wealth and your annual income stream through an easy-to-access investment you’re not going to hear about in the U.S. financial press.

It’s part of the same mission.

Now, onto the opportunity in nitrogen…

Somewhere in the recesses of your brain, you likely remember from a high school chemistry class that nitrogen is the most abundant element in the atmosphere. With every breath you take, 78% of the air you draw in is nitrogen.

Alas, atmospheric nitrogen is the Arnold Schwarzenegger of air. It’s strong. So strong, in fact, that plants, which are massive consumers of nitrogen, can’t break down airborne nitrogen. Instead, all plants, everything from trees to herbs, must rely on nitrogen in the soil.

Nitrogen makes its way into the ground through a variety of slow, natural processes. Lightning strikes create nitrogen that plants can absorb, for instance, while bacteria in the soil and fungi turn animal waste and decomposing organic matter into a consumable form of nitrogen that plants gobble up.

Why is that important to our story?

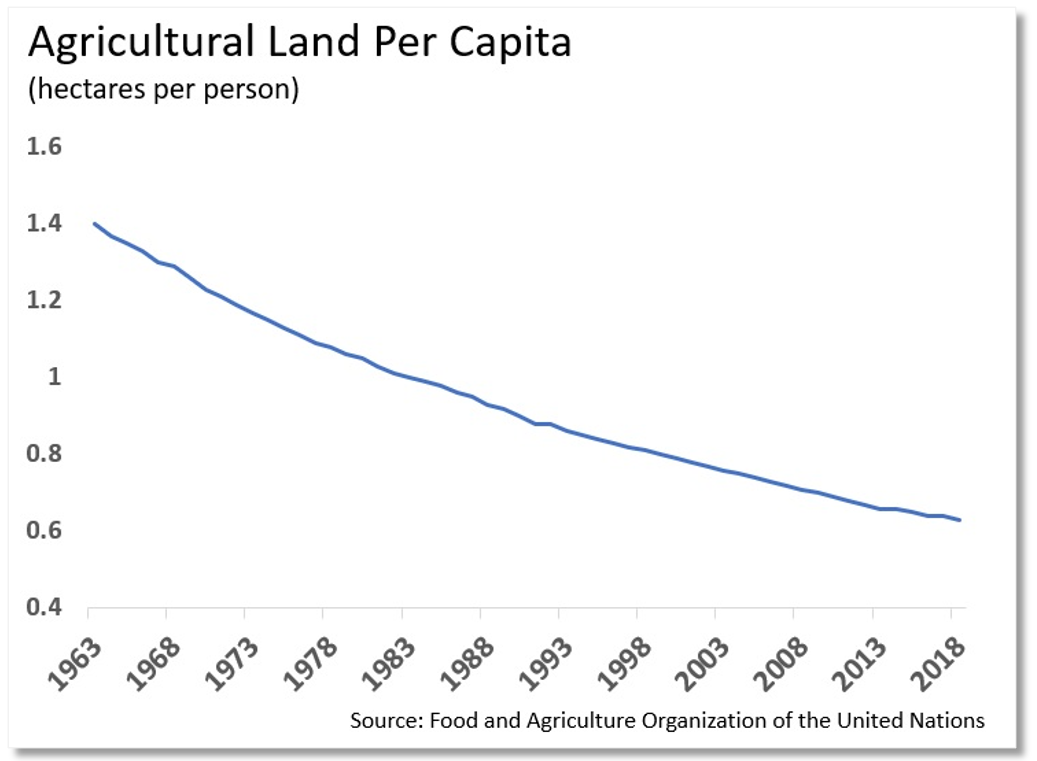

Well, nitrogen is the most important member of the NPK trio—nitrogen, phosphorous, and potassium. And that trio, in turn, is the most important collection of nutrients that plants demand. Which means those three are critical to the modern, global food chain that must feed 7-plus billion people on the planet, even as the amount of agricultural land per person has fallen sharply over the last six decades.

You can see the unfavorable trend…

Basically, that means each acre of land must produce ever-more food for an ever-expanding population of hungry stomachs around the world.

That Herculean task demands nitrogen. Yet, it’s made all the more challenging because the naturally occurring nitrogen cycle is quite the slow process, relying as it does on bacteria, fungi, and lightning to do the work over time.

And then along came Fritz Haber…

While teaching at Germany’s University of Karlsruhe in the first decade of the 20th century, Haber worked with Carl Bosch, a chemist at German chemical giant BASF, to invent a process that pulled ammonia from hydrogen and atmospheric nitrogen using high pressure and high temperature. From ammonia, chemical factories can easily fashion nitrogen that plants can access through their roots.

Thus was born the modern fertilizer industry—a revolution in feeding humans.

Farmers, of course, have used fertilizers for millennia. Babylonians, Romans, and Egyptians relied on manure to improve the health and yield of their crops. So, too, the early Germanic tribes.

Still, for much of the history of agriculture, crop yields didn’t grow substantially until Haber and Bosch unlocked the secrets of mining ammonia from air.

That proved incredibly important to humanity’s ability to feed itself.

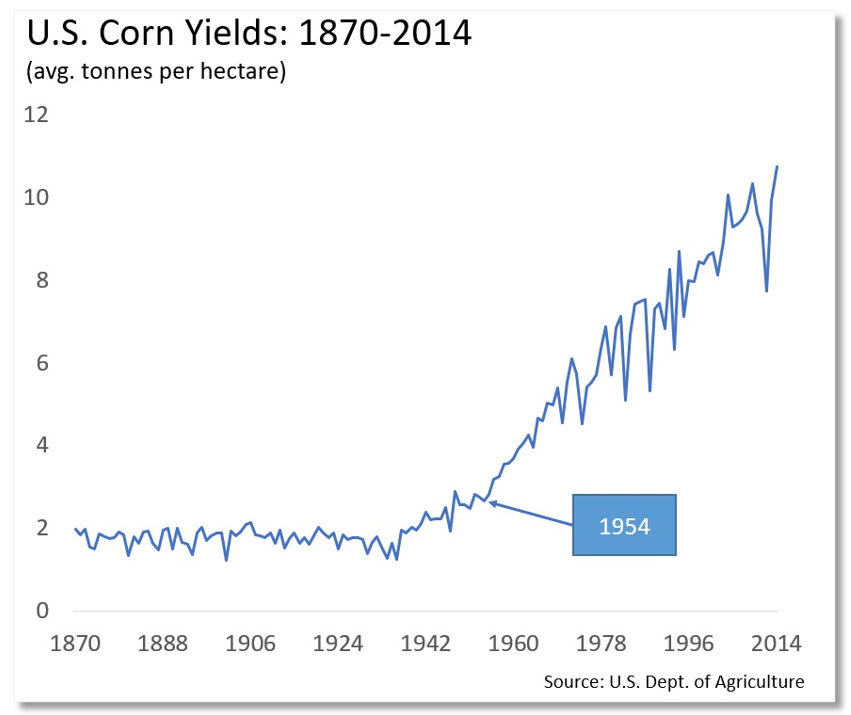

In fertilizer form, nitrogen is easily accessible to plant roots. And plants just gobble it up. It’s like a turbo boost to crop production. The chart below shows what that turbo boost looks like…

Until the mid-1950s, corn yields in the U.S. were fairly stagnant—about 1,800 pounds of corn per acre. Then, suddenly, they shifted into a speedier gear. The reason: agricultural mechanization and what was then the entirely new practice of mixing large quantities of nitrogen fertilizer into the soil.

Farmers, thus, came to realize that, outside of weather, nitrogen is the most critical variable in expanding crop yields. It is to the world’s corn, wheat, rice, and soy (four of the most important food crops) what sugar is to yeast—a source of fuel.

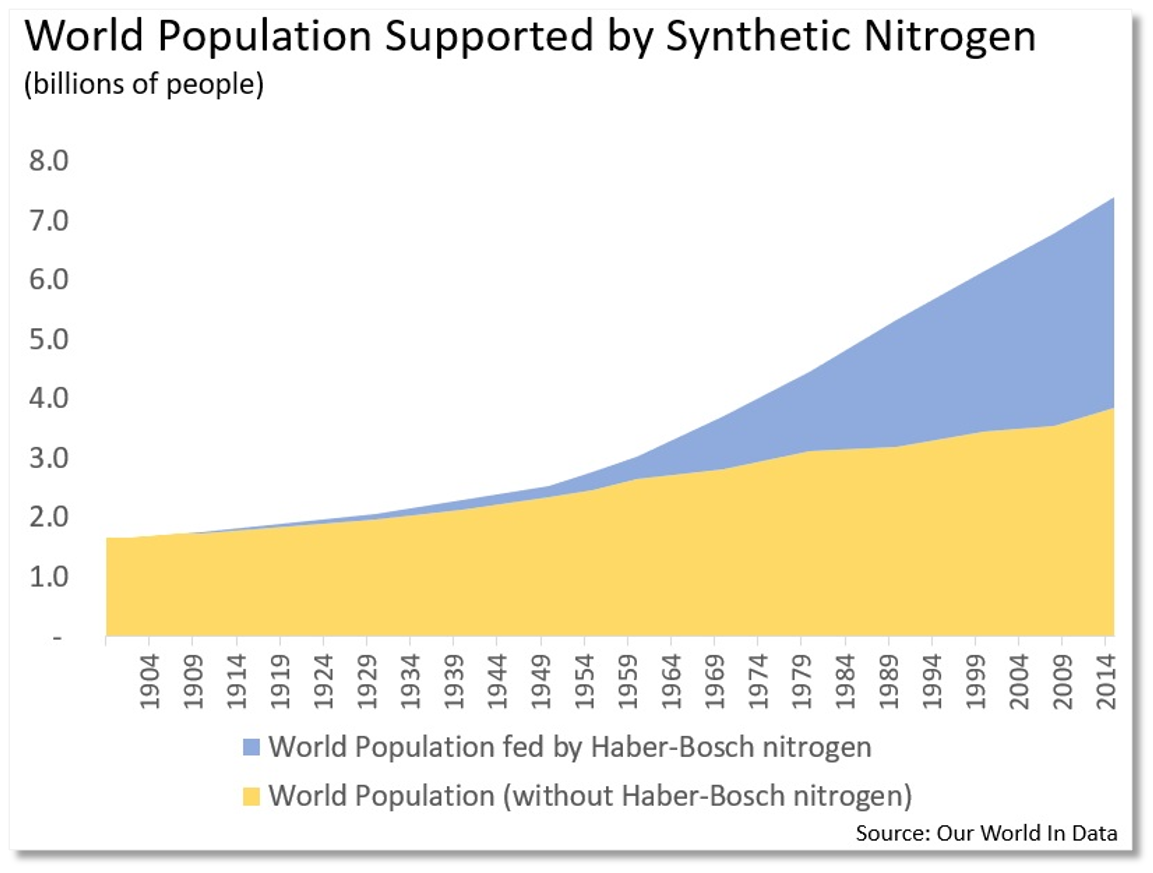

Again, I want to show you visually just what that has meant to our ability to feed ourselves:

Without synthesizing nitrogen, nature’s processes can support the food needs of just under 4 billion people (as of 2015 data). With human-made nitrogen, we can feed nearly double that.

I tell you all of this about nitrogen because we are going into an inflationary economy in America. And I know that’s a seemingly strange segue, but inflation and nitrogen are inextricably linked.

Inflation to nitrogen in four steps.

I mentioned inflation in the March issue of the Global Intelligence Letter about my expectations for a weakening dollar over the next several years.

As I write this, the U.S. has just distributed another round of COVID-relief checks and other pandemic spending measures. In all, the country has spent something in the neighborhood of $6 trillion on COVID aid over the last year. That’s nearly 29% of the entire U.S. economic output in 2020—truly a boatload of bucks.

In the 2007 housing/banking crisis, almost all of the trillions that government threw at the problem remained on bank balance sheets as a way to stabilize financial institutions teetering on the edge of failure; that money never saw the light of day.

This time around, almost all of the $6 trillion has gone directly into the economy by way of consumer and business spending.

That’s a radical increase in the money supply—the amount of money flowing through the economy.

All those dollars are a combustible fuel that will lead to what is known as “demand-pull inflation.” Consumers and businesses, flush with money, will bid up prices for goods and services because they have the cash to do so. Basically, too many dollars will chase the same amount of existing goods.

That’s where we are headed now that we have so many extra dollars coursing through the economy. I’ll stick to my previous expectation that we will see inflation run up to between 4% and 5%, what’s called “walking inflation,” this year.

However, I will not rule out what’s known as “galloping inflation,” or inflation of 10% or greater. That’s a nasty, destructive form of inflation that would have all kinds of unsettling consequences for consumers and the economy.

Consider this example from the high-inflation era of the 1970s: Food prices in 1973 rose by 20% and then by another 12% in 1974. Let’s overlay that onto today. The U.S. Department of Agriculture estimates that the average family of four in America spends about $239 a week on food, or just under $1,000 a month.

Imagine, then, that monthly food costs are $1,200 this time next year, and nearly $1,350 by 2023. There are millions of American families that cannot take on an extra $350 in food costs without seriously crimping their monthly spending on other necessities. That will ripple through the economy.

Now, the Federal Reserve tells us not to worry. No meaningful inflation lurks on the horizon, the Fed asserts, and that even if a wee bit of inflation does pop up, it will be temporary and all but painless.

Then again, the Fed also told us in 2007 that the U.S. mortgage crisis was contained and would not spill over. Then, the uncontained mortgage crisis spilled over into the Great Recession.

And, perhaps worst of all, in the 1920s the Federal Reserve wildly botched and worsened the Great Depression by idiotically raising interest rates as the economy plunged into crisis. The Fed at the time insisted (wrongly) that speculation on Wall Street was the culprit and that making investing more expensive would salve the economic ills, which only served to exacerbate the crisis.

All proving that the Fed’s analysis of economic risks and reality is pretty much on par with a Bourbon Street palm reader. They’ll both say anything to fit the message they’re trying to sell.

The point is, we need to prepare for inflation. It’s coming.

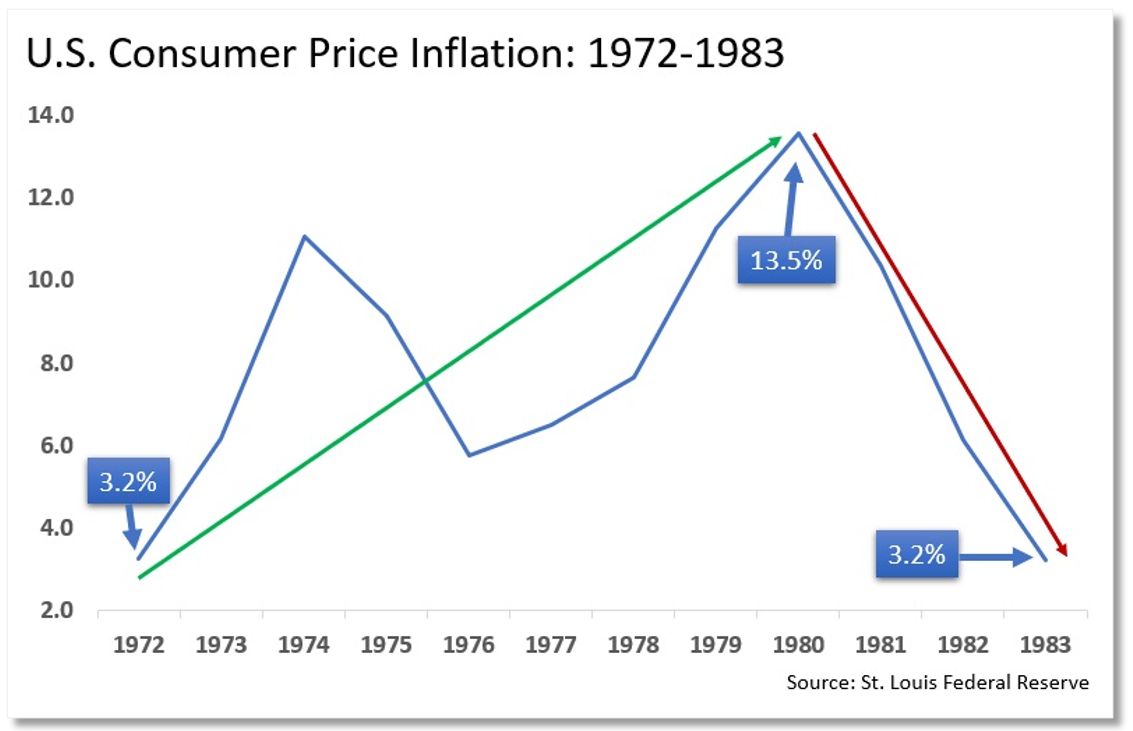

From the 1950s until the early 1970s, commodity prices in general, and agricultural raw materials in particular, bounced around within a fairly narrow band. And then, boom!—the mid-’70s arrived and prices launched like a rocket. That coincided with U.S. inflation that rose from 3.2% in 1972, to 11.1% in 1974…to 13.6% by 1980.

As a result, prices for agricultural raw materials—bushels of wheat and corn and whatnot—absolutely exploded higher. Agricultural prices were up between 20% and more than 70% on an annual basis across most of the 1970s.

Now, let’s bring nitrogen to the party…

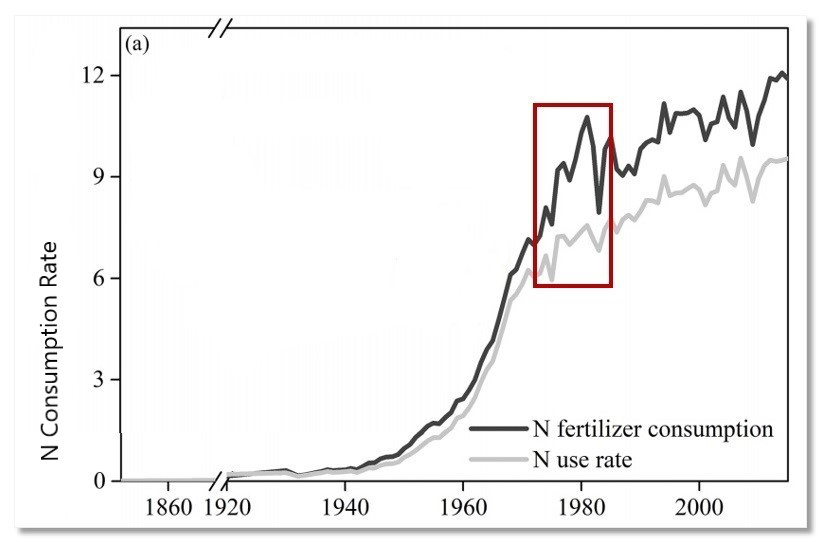

This edited chart is from a 2018 Iowa State University research paper on “Historical nitrogen fertilizer use in agricultural ecosystems…” The title is actually much longer, but you get the point.

“N” on the chart refers to nitrogen. Look at the red box I’ve drawn. Nitrogen consumption among farmers was already ramping higher from the 1950s (which further underscores my earlier point). But starting in the 1970s it spikes. And it tops out in 1980, then crashes.

How neatly that coincides with inflation: It races higher across the 1970s, then falls off a cliff in 1980.

You can see that in this chart from the St. Louis Federal Reserve bank:

Again, more proof that inflation does, in fact, roll through the nitrogen market.

Which is why I went in search of an opportunity for us to profit from the economic environment already taking shape. And I found it in a company that traces its roots to the very origins of nitrogen fertilizer. A company that actually marketed and sold the world’s first shipment of nitrogen fertilizer.

So, let me introduce you to Yara International…

Yara is a Norwegian company that’s been around for more than a century, and today is one of the five largest players in the global nitrogen fertilizer market.

In fact, Yara’s founders—Sam Eyde and Kristian Birkeland—had devised a process for creating nitrogen six years before Fritz Haber. But their process—the Birkeland-Eyde process—was not very energy-efficient, and it ultimately fell away.

Still, Yara sold the world’s first shipment of nitrogen fertilizer in 1913…to China. So, the company has a storied history in this business.

Today, Yara is a $12 billion company. It operates in 60 countries, giving it the widest reach of any fertilizer firm. Right now, wherever a farmer on the planet is laying down a blanket of fertilizer over a field of crops, there’s a 20% chance Yara made that fertilizer.

The company is also involved in various other sectors, such as civil explosives for the mining industry, chemical supplements for the animal-feed industry, bio-nutrients for wastewater treatment, and other such chemical needs.

But crop nutrition—nitrogen fertilizer—that’s Yara’s primary reason for existing.

Obviously, nitrogen is not rare like, say, various rare earth metals that industry relies on for all sorts of consumer products. But we’re not looking to own nitrogen on some sort of rarity play. We want to own it precisely because of its ubiquity—its ongoing, unceasing, ever-increasing global demand.

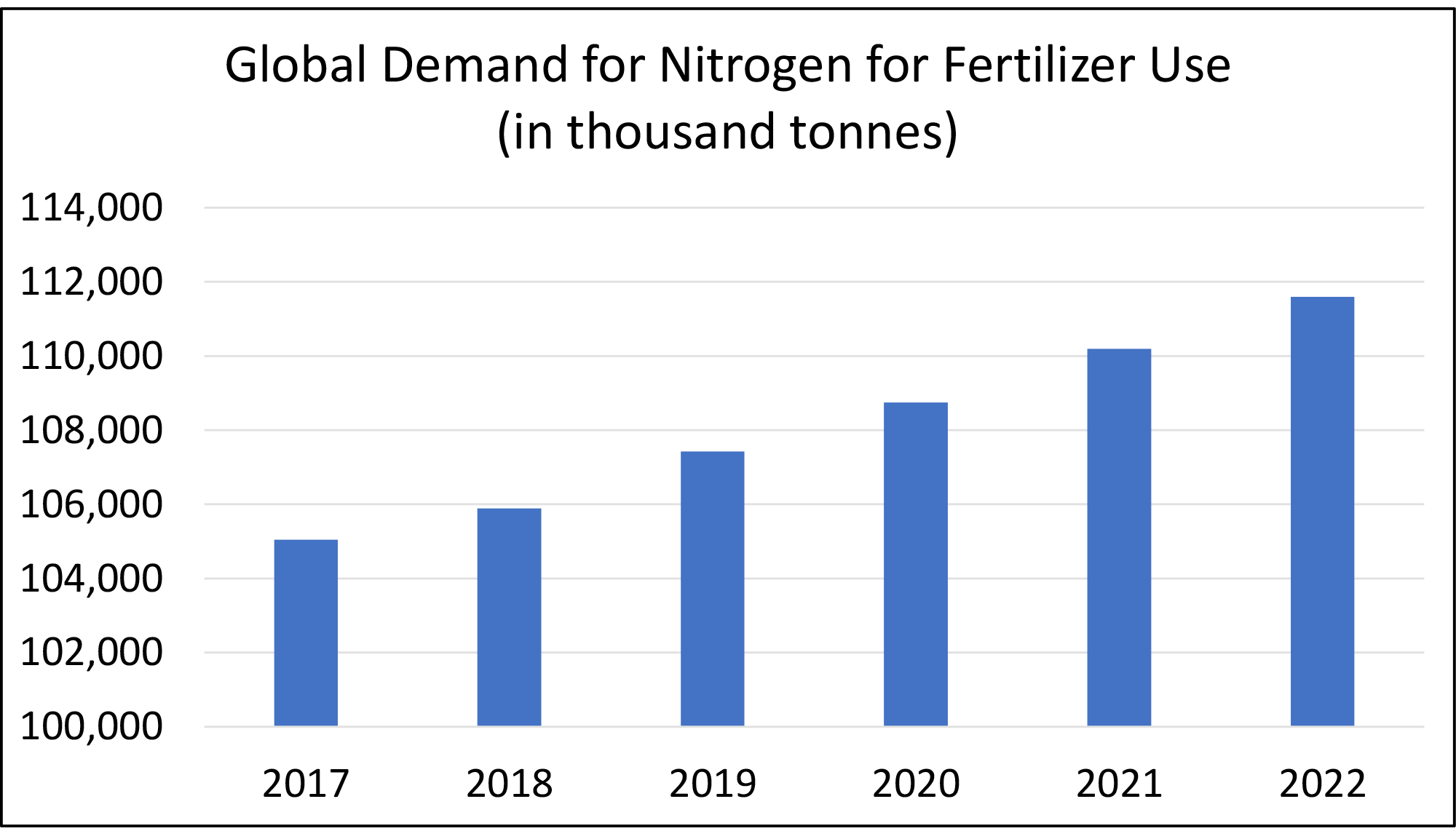

The increase in that demand growth certainly isn’t speedy; at this point in the history of agriculture and fertilizer, growth is measured and slow. But it is consistent and unflinching in its march ever higher.

The chart above shows global demand for nitrogen through 2022, as forecast in a report released last year by the U.N. Food and Agriculture Organization.

There’s not a lot of growth. Then again, we are talking about a mature industry.

But that’s exactly what we want at this point as we prepare our nest egg for an inflationary cycle: consistent, unflinching demand.

Just recently, global fund managers told a Bank of America survey that the biggest risk to their portfolios going forward is no longer the pandemic but rather, inflation.

They see exactly what I’ve been writing about for a while now, particularly in my daily Field Notes dispatches. Namely: Inflation is popping up globally, the result of governments pouring oceans of money into local economies to keep them afloat in the wake of the COVID pandemic that shut down pretty much everything.

Emerging economies—India, Brazil, China, etc.—have already begun battling inflation. That’s common. Those economies are typically canaries in the coalmine.

Retail-price inflation in India is running at more than 5% annually, with some products, like cotton, up 24%.

Brazil, meanwhile, recently hit its highest inflation rate since 2019. That prompted the Brazilian central bank to raise interest rates in March for the first time in six years in an effort to slow the overheating economy.

Turkey, Nigeria, and others are also now experiencing new inflationary pressures, particularly at the food level.

All of that matters to us. Say, for instance, the price of production starts rising in China—the world’s primary factory floor. Then prices are very likely to start rising elsewhere, since Chinese manufacturers pass along those added costs. And, indeed, Chinese production prices were stronger than expected recently, demonstrating that commodity inflation is soon to hit.

During inflationary periods, we want to own companies backed by unending demand for their products, and which have some capacity to raise prices. Commodities that bill well—particularly food-related commodities.

When inflation begins to hit home, people will stop taking cruises. They will skip the trip to Disneyland. They will put off buying a new car. But they won’t stop eating.

Moreover, as I noted earlier, because inflation pushes commodity prices higher, farmers will plant more of a particular crop and will manage their fields for maximum yields so that they can harvest as much profit as possible during moments when food prices are elevated.

They will demand more and more nitrogen for that turbo boost it provides plants.

Yara is a winner in that world.

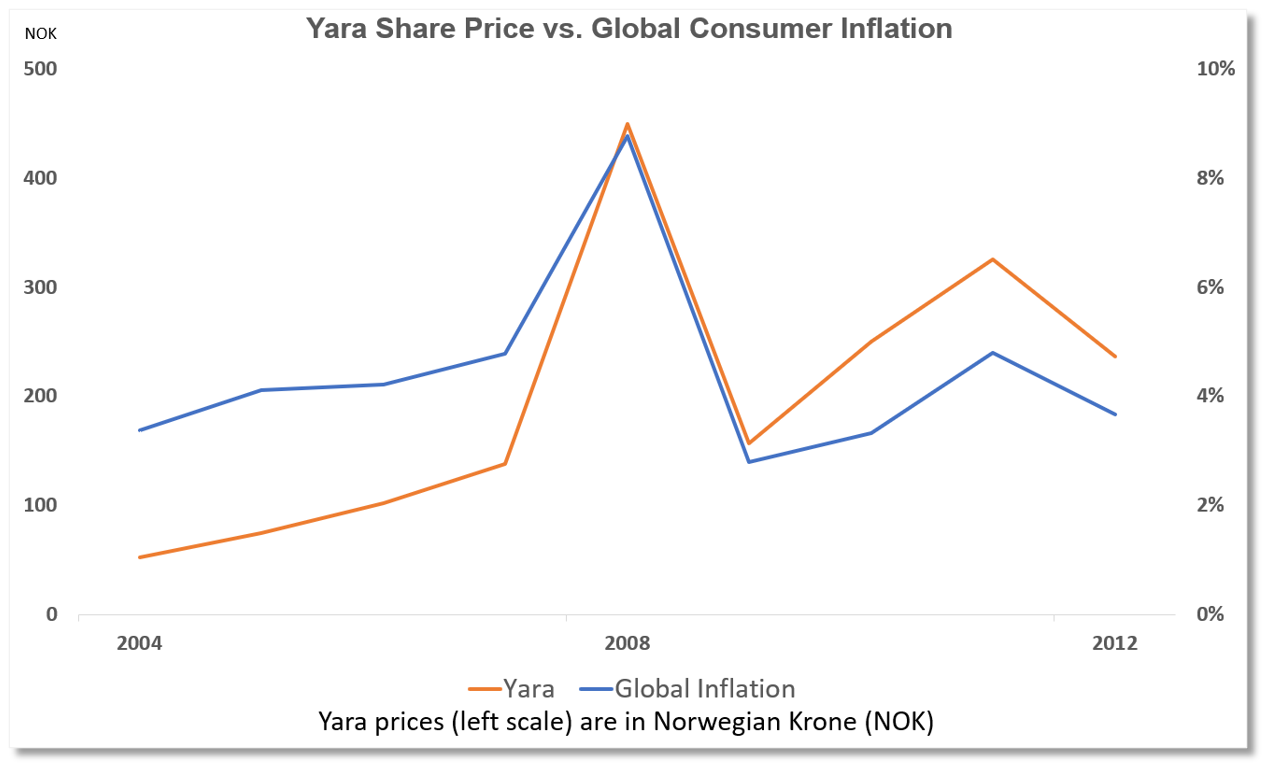

Frankly, this one chart is all you really need to see to understand why I make that claim…

The last time the world saw anything that resembled inflation was the mid-2000s. At that time, consumer inflation on a global scale rose to nearly 9% in 2008 from about 3.4% in 2004, according to the World Bank.

Yara’s share price literally tracked every step higher…and, then every step lower.

It is, in practical terms, a stock market stand-in for investing in global inflation.

Inflation going higher: Own Yara before inflation takes off.

Inflation going lower: Get out of Yara.

It might be one of the simpler decisions in the investment universe.

And right now, with those inflation expectations cranking up, that simple, yes/no decision tree tells us that now’s the time to own Yara. Demand for nitrogen is going to rise as prices for corn, wheat, soy, and other major world crops rise…and, as a direct result of that, Yara’s share price is going to rise, too.

But why Yara?

Why not one of the large, U.S. fertilizer players?

Because we face a particular set of circumstances that will turbocharge our profits.

That turbo boost is currency.

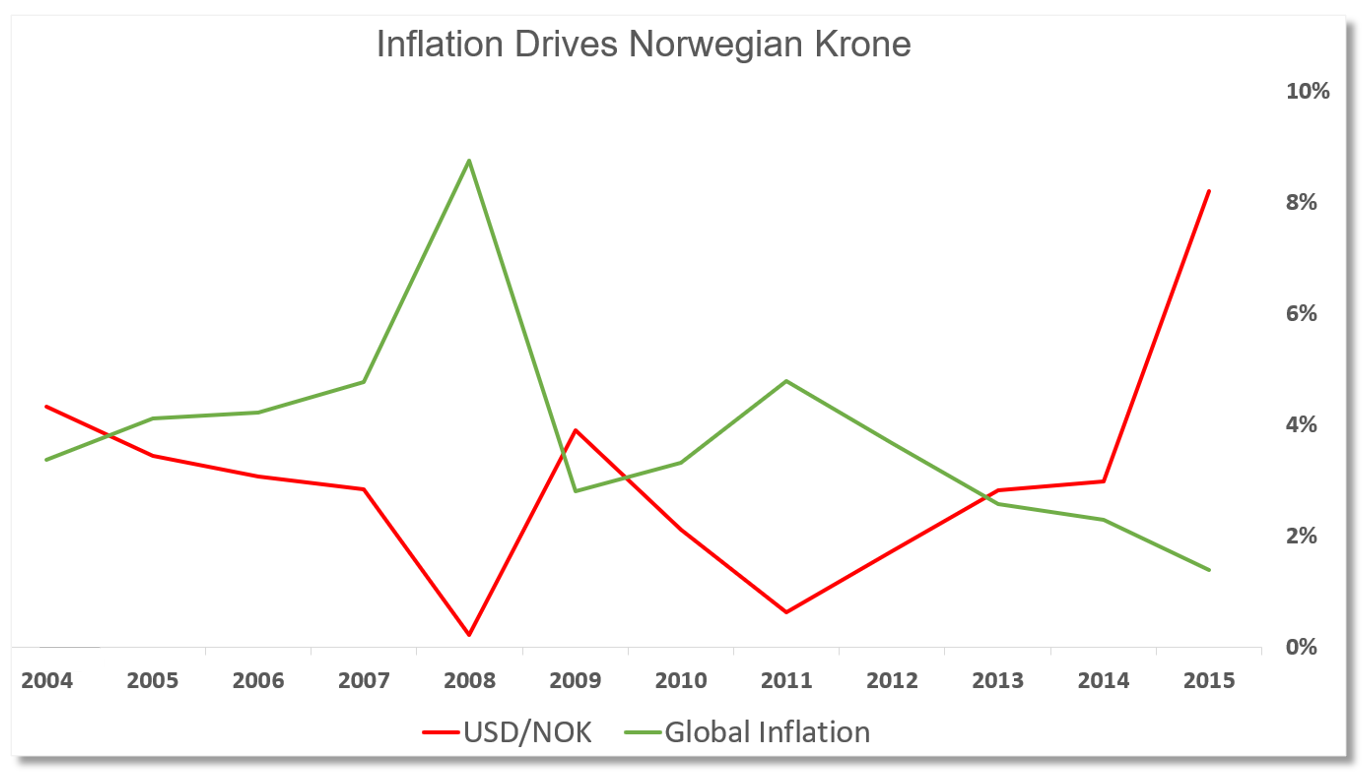

Besides giving us exposure to nitrogen fertilizer at an opportune moment in the inflation cycle, Yara also gives us exposure to the Norwegian krone, a currency we want to own right now.

You might recall from the March issue of Global Intelligence Letter that I referred to the krone as an “oily currency.” Basically, when the price of oil goes up, so does the value of Norway’s currency.

That’s because Norway is a major producer of oil from its offshore, North Sea oil fields. Oil, obviously, is a commodity. And just as inflation pushes prices higher for wheat and gold, it pushes oil prices higher, too.

That flows directly through the krone relative to the U.S. dollar. Here’s a visual to show you what I mean…

That chart looks a bit confusing at first, but here’s how to consider it: The red line is the U.S. dollar vs. the Norwegian krone. When it’s going down, it means the dollar is weakening and the krone is strengthening.

So, the fact that these two lines move in near symmetrical opposition means that the krone rises in value against the dollar as inflation rises. Basically, the krone and inflation are brothers in arms.

That serves two important functions relative to our expected profits:

Question is: To what degree will the krone strengthen?

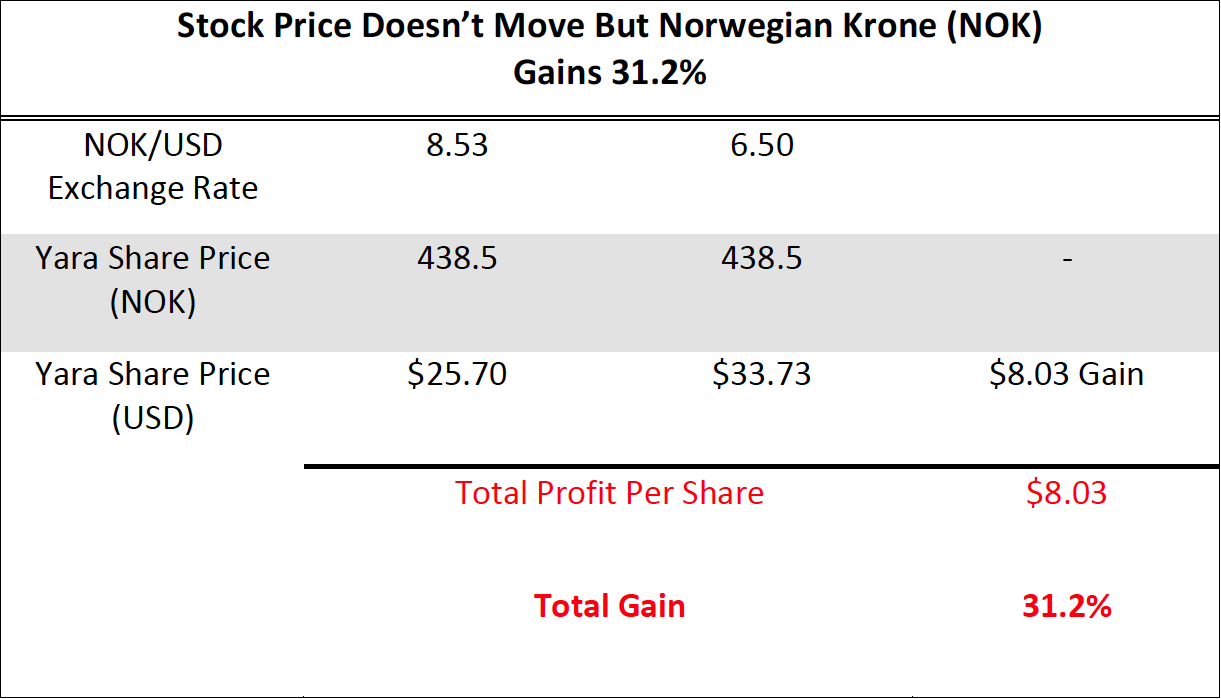

My prediction: The krone, now at 8.53 to the dollar, will see 6.5. That looks like a decline, but this is the currency world, where assets move in pairs as though they’re on a seesaw. One goes up, the other must go down by definition.

So, when one U.S. dollar buys 6.5 krone instead of 8.53, that means the dollar has lost 23.8% relative to the krone—it buys less krone than before.

Which means that on the opposite side of the seesaw, the krone has risen. It has gained 31.2%.

Here’s what that looks like if Yara’s shares were to remain unchanged, but the krone goes to 6.5, as I expect:

Yara’s share price does not move in terms of its home currency. It remains at 438.5 krone.

But because the krone has gained 31.2% on the dollar, Yara’s share price in dollar terms rises 31.2%. We benefit just because the krone strengthens. (By the way, your mental math skills might immediately recognize that 438.5 krone at an 8.53 exchange rate is $51.40 per share, not $25.70. I’ll explain that quirk in a moment when I give you my full recommendation.)

This same situation plays out with Yara’s dividend.

The company most recently distributed an annual dividend payment of 15 krone (about $1.76 per share), a yield of 3.42%. That’s not an insignificant yield. But if the krone gains 31%, then that same 15-krone dividend payment rises to $2.31 per share, a yield of nearly 4.5%.

Better yet, the inflationary period that’s approaching will very likely see Yara’s profits accelerate, which will allow the company to hand us even larger dividend payments over time.

Those payments will be all the more important when inflation is hot and heavy. They will help us maintain spending power in dollar terms. We will be collecting more dollars simply because the krone we earn buys more dollars in the future.

That is one of the primary reasons I look to own blue-chip, international stocks: non-dollar dividends.

Dividends have become a bit of a rarity on Wall Street over the past three decades for all manner of reasons. Yet, overseas they are far more common.

Moreover, the payouts abroad tend to be larger. I know this fact personally because I opened my first brokerage account overseas—in New Zealand—in 1994. At various points over the intervening years, I’ve traded from more than a dozen accounts on five continents. I can tell you there is a cultural phenomenon at play.

In the U.S., corporate executives believe they know how to better spend shareholder money than do we, the shareholders.

So, they go nuts with share buy-back programs (which have questionable value and were once considered illegal by the Securities and Exchange Commission). Companies do this instead of increasing dividend payments because they believe shrinking the number of shares enhances the share price.

I’ll make the argument—as the SEC once did—that it is stock-price manipulation primarily for the benefit of the executive-level management of the company.

By reducing share count, a company artificially boosts its per-share earnings, which artificially boosts a stock’s price. That, in turn, allows corporate executives to exercise their stock options and pocket millions of dollars in profits, even when a company’s financial fundamentals are stagnant or weak.

Another highly questionable strategy popular among U.S. executives and boards of directors is to run off and buy another company in a process that, too often, is what famed mutual fund manager Peter Lynch has labeled “di-worsificiation.” In doing so, they actually erode shareholder value.

Overseas, shareholder culture demands actually sharing in corporate profits. So, dividends are more common and generally larger.

As an investor, I like that. Yes, I absolutely want to see my shares rise in value over time, but I also want to get paid regularly for holding those shares because I know the inside secret to building wealth in the stock market: dividends.

Study after study has shown undeniably that dividends are a critical component to Wall Street’s overall return.

Standard & Poor’s data show that over a rolling 10-year period, dividend payments account for about 48% of the S&P 500’s total return. Stretch that out over 20 years, and dividends account for 60% of the total return.

By owning Yara, then, we own a stock that benefits from inflation, and which will pay us a nice dividend in a currency that itself is a beneficiary of inflation.

It’s a win-win all around.

Which is why I am recommending Yara. As inflation takes over:

Though Yara’s home market is the Oslo Stock Exchange in Norway, the shares are available in the U.S. as American depositary receipts traded under the symbol YARIY.

ADRs, as they’re called, are foreign stocks that trade on the New York Stock Exchange, Nasdaq, and Over-The-Counter Market (known as the OTC).

Many of the world’s biggest companies trade as ADRs—AstraZeneca, Toyota, Sony, Nestlé. Even beer juggernaut Anheuser-Busch is an ADR. In all, a few thousand foreign companies are available as ADRs through a U.S.-based online brokerage account.

Note, however, that not all online brokers offer access to all ADRs. The big kahunas—Fidelity, E*Trade, and Schwab—provide broad access to ADRs, so you will have no problem trading Yara through those. Robinhood, WeBull, and some of the newer, app-based brokers do not, and, thus, you will not have access to Yara on those platforms.

ADRs can have a few quirks that you need to be familiar with. Mainly, each ADR does not always represent one share of a company’s stock back in its home market. The most common reason is that share-price conventions are not universal. In some overseas markets, a single share regularly trades for the equivalent of hundreds or thousands of dollars. While in other markets, a single share equates to just pennies or even fractions of a penny.

So, to meet American investment norms, an ADR can sometimes represent 10 or even 100 underlying shares from the home country, or maybe just one-tenth of an underlying share.

Yara is a good example of this. As I mentioned above, Yara trades at 438.50 krone per share in Norway. At 8.53 krone per dollar, that implies a dollar price of $51.40. Yet, Yara trades in the U.S. at $25.70—exactly one half the Norwegian price.

The difference is that each Yara ADR represents one-half of a Yara share in Oslo. That doesn’t change anything about the investment, and I only point it out so that you recognize how ADRs work.

Now that you’ve read this month’s issue, you will be more attuned to the inflation chatter that is really heating up in the financial media. The mainstream media—the nightly news, weekly and monthly news magazines—haven’t really picked up on this yet.

They will. By the time they do, Wall Street’s inflationary plays will have already begun their ascent. That’s why we want to get in early.

Better to build your position now, knowing you’ve cushioned your nest egg from what will likely be the worst bout of inflation America has seen in 40 years.

As part of our launch of the Global Intelligence Letter, we’ve developed a new Portfolio Tracker, which you can view online here.

This feature enables you to see in one place how our portfolio is faring, and what my current recommendation is regarding each position. New positions, such as Yara, will be added to the tracker as soon as the new issue is published. If there are any changes to a recommendation, you will be able to see this on the tracker and you will also receive an email alert from me about any change.

Currently, we have four positions (including Yara). Two are open-ended, meaning there is no buy-up-to recommendation. Those are Invesco CurrencyShares Swiss Franc Trust (FXF) and the Norwegian krone.

The krone collected the most interesting news of the month. Nordea Markets, Goldman Sachs, and HSBC all said in March they are bullish on the krone. Goldman, in particular, is looking for the krone to hit 7.73 to the dollar heading toward 2022. I’m more bullish with my 6.5 target longer term. As such, my recommendation on the krone remains a buy.

As for the Swiss franc…in March, the Swiss central bank spent 110 billion francs (about $118 billion) trying to keep the franc from appreciating. When central banks intervene like that, they’re trying to drive down the price of their currency against others. In this case, the Swiss want a weaker franc relative to the dollar and the euro, Switzerland’s key trading partners. A weaker franc makes Swiss exports more affordable, thereby helping the local economy.

These are temporary patches, at best. The franc remains the world’s truest safe-haven currency, and the franc will continue to appreciate against the dollar over time, regardless of interventions. So, the franc remains a buy through my recommended Invesco CurrencyShares Swiss Franc Trust (FXF).

Finally, our third position—iShares MSCI Global Gold Miners ETF (RING)—remains a buy up to $32. It’s an exchange-traded fund that is a leveraged play on gold prices rising as the dollar weakens. Gold prices have come off slightly in the last month, down to $1,740 from $1,800. But the U.S. just dumped $1.9 trillion into the economy, and talk of inflation is heating up, which is driving investors into gold companies in preparation for what’s coming. So my recommendation stands.

By Zoltan Istvan

Expert Insights

Zoltan Istvan is one of the world’s best-known futurists. An entrepreneur with many international properties, he has visited over 100 countries and written for National Geographic, The New York Times, and other major publications.

I learned my lesson the hard way…

It was the turn of the century. I was in my 20s, a philosophy student at Columbia University in New York City.

Back then, the stock market was booming. Internet startup companies were all the rage. Ordinary people with zero background in finance were quitting their day jobs to trade full time. It seemed like everyone around me was investing and getting rich. And I wanted my share.

So, I took some of my student loan money and I started playing the market. How could I go wrong, I thought? Every stock was going up.

You know how this story ends.

Before long, the dot-com bubble burst. Over the course of a year, I lost nearly all my money. I was devastated and depressed, and I wasn’t alone. An entire generation of newbie stock traders in their 20s and 30s were wiped out, left penniless facing into their first big recession.

For me, it was a brutal lesson. But it proved to be a worthwhile one.

It made me realize that investors should look for valuable assets rather than quick-fire gains. It also taught me when the market seems too good to be true, it probably is.

That was certainly the case 20 years ago, when investors were getting rich off worthless tech startups.

And it’s the case right now, as stocks boom again amid a global pandemic.

History, as we know, likes to repeat itself. As I write this, public excitement about stock trading is off the charts. This has helped drive the markets to all-time highs.

Yet, when I look at the economic realities, I find little evidence to support this enthusiasm.

That’s why my advice to anyone who’s done well on stocks in this boom market is to take your earnings and invest in the same asset I’ve used to build my wealth over the past 20 years: real estate.

But I don’t mean just any real estate.

I mean using the strategy that’s taken me from essentially zero net worth at the end of the dot-com crash to owning an expansive portfolio of properties at home and abroad today…the strategy that’s perfectly suited for this emerging work-from-home age.

If my name is familiar to you, it’s undoubtedly as a futurist. I’ve written stories on this topic for The New York Times, Newsweek, National Geographic, and other major media outlets. I appear frequently on TV and at international conferences talking about crazy new tech like brain implants, exoskeleton suits, and flying taxis.

But despite my advocacy of futuristic tech, I have a far more traditional outlook on wealth. Namely that there are few better investments than good old-fashioned real estate. This perspective has served me well.

I first started investing in property while working for National Geographic in my 20s. Nat Geo hired me to cover stories for a news show called National Geographic Today on its newly launched TV channel. This allowed me to travel the world, gaining insights into different cultures, countries, and economies.

Although living on the road was rewarding, it also made me long for a sense of permanency. I think that’s why everywhere I went, I started looking at homes for sale. So began my love affair with real estate.

Back then, I was getting paid quarterly by Nat Geo, basically every time I finished a story. Because I was living and traveling in countries with significantly lower costs of living, these checks—totaling about $12,000 every three months—were sometimes enough to put a down payment on a condo or house.

My first project was a fixer-upper home in Oregon that I bought for $99,000. It needed a lot of work—new carpets, windows, and siding—and there were some old cars I had to remove from the backyard. But the three-bedroom house had good bones, and once newly painted and remodeled, I was able to sell it for double my purchase price.

In the decades since, I’ve owned more than 20 properties. About 95% of my net worth today is from real estate investing.

That’s not to say I don’t invest in the market and other assets. I have holdings in crypto, gold, and art, as part of a typical diversification strategy. But I study the market carefully before investing in stocks, and right now my financial brain is flashing warning signals.

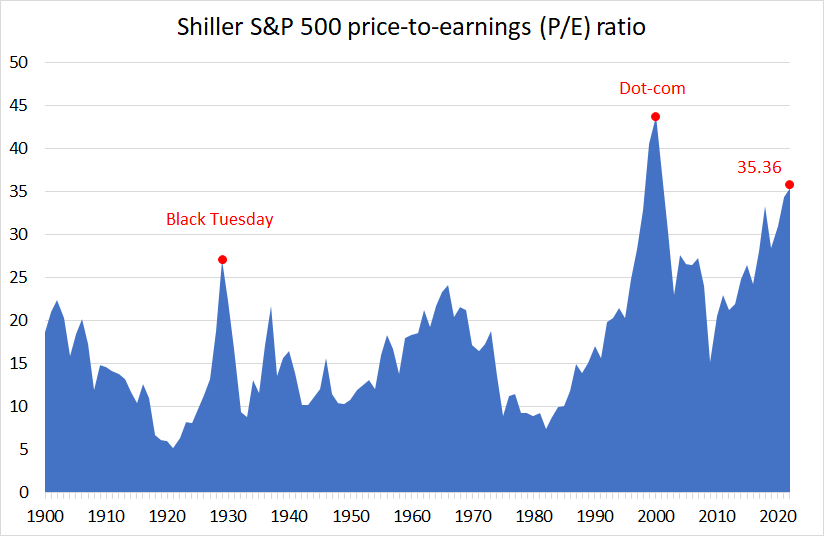

One metric I like to keep an eye on is something called the Shiller S&P 500 price-to-earnings (P/E) ratio.

That’s the price of stocks relative to inflation-adjusted earnings from the previous decade. Basically, the lower the ratio, the better the value in the market.

The average Shiller P/E over the last century and a half is 16.80. As of March 23, it’s 35.36, more than double the historic average. The only time it was higher than this was during the dot-com bubble.

Just as in 2000, this overvaluation is being driven by rampant speculation. Evidence of this is everywhere. Consider the news stories of ordinary investors pouring their COVID stimulus checks into their online trading accounts.

Or the emergence of WallStreetBets, a community on social media-style news website Reddit that’s using group purchasing power to manipulate higher the stocks of failing companies like GameStop. This group is not just out to make a profit but to attack Wall Street short-sellers, investors who bet that a company’s stock will fall.

Then there’s the rise of SPACs, or special purpose acquisition companies. These are shell companies with zero assets or business operations that are set up by prominent investors or organizations to raise money to buy another company.

But here’s the thing about SPACs: The investors buying into them do not know what the acquisition target is. They’re blindly trusting the individual or organization that launched the SPAC, which is why these vehicles are called “blank check companies.” And yet, investing in them has become one of the hottest trends on Wall Street.

All of this unhinged speculation is happening despite the fact that many countries are still in COVID lockdowns and millions have recently lost their jobs.

I have seen this kind of fervor before. I know how it ends. That’s why I’m encouraging all my friends, acquaintances, and followers to put their stock market earnings in real estate.

In a time of fast money and irritational markets, property is a safe haven—a reliable long-term investment. In addition, real estate has been booming during the pandemic, a result of low mortgage rates and younger professionals wanting their own space as offices move fully online.

U.S. housing gained approximately $2.5 trillion in value in 2020, the most in any year since 2005, according to online real estate marketplace Zillow. This run is expected to continue, with the company forecasting even stronger growth in 2021 for home sales, rents, and property values.

But while the real estate market is surprisingly robust, it is also changing…particularly in terms of the kind of properties people are interested in. This is why I believe my investment strategy is perfectly suited for today.

The best thing I’ve done as a real estate investor is to focus not on investment properties with tenants and maintenance headaches, but on personal properties I actually want to visit. Which brings me to rule No. 1 of my real estate strategy: Buy something you love.

Industry orthodoxy advises new real estate investors to focus on dreary condos and apartments in densely populated urban or suburban areas. A loveless marriage, little different than trading the stock of some company whose name you’d struggle to remember. That advice, if it was ever sound, is ludicrous today.

With the greater freedom offered by the work-from-home revolution, people are focusing on where and how they want to live, not where they have to stay for work.

That’s why I’d advise anyone investing in real estate now to focus on properties with unique appeal. That should include looking overseas. I’ve done very well by buying real estate abroad.

When it comes to buying property overseas, the exchange rate makes a big difference, and as a result, this often determines where I’m looking. For example, when the dollar was on par with the euro, I looked for opportunities in Europe. Now, with the greenback remaining relatively strong against the Canadian dollar, I’m looking north of the border.

Still, my first rule always holds. You shouldn’t let the exchange rate stop you from buying an asset you’re truly passionate about.

In Argentina, I acquired a small vineyard with 70-year-old Malbec planted on it. In the U.S., I bought a 92-foot wooden yacht called Lion’s Whelp from 1929 with a storied lineage. As an avid surfer, I bought an oceanfront lot in the Bahamas. In Tahoe, I purchased a fixer condo on the slopes, where snowboarding is just steps out the front door.

I bought each of these assets because I was captivated by them. I’d constantly dream of how I’d fix them or build on them. Buying something you love is the difference between seeing property ownership as a laborious job and experiencing it as a passion. Plus, if you love a property, odds are someone else will, too.

At my vineyard in Argentina…

To make money in real estate, you need to find value. This requires identifying assets that you can work on and improve. That’s why rule No. 2 of my real estate strategy is: Focus on fixers and do the work yourself.

Many of the properties I have bought and sold were single-family fixer homes and condos. Even in my 20s, I realized a person with a $200 tool set could make twice or three times the amount of money fixing properties that a journalist could make writing for a major publication.

So as a young man, I took time to learn all the basic building trades, including wiring, framing, roofing, and plumbing. Because of the internet and YouTube, you can easily watch dozens of hours of instructional videos on almost anything involving construction for free.

Watching videos, of course, isn’t the same as learning something or becoming good at it, but slowly I was able to practice most methods of construction until my skills were solid. Eventually, I even built an entire house solo, a home I still own on the southern Oregon coastline.

My wife is a physician, an OB-GYN, and she’s always amazed that I know my way around an array of power tools. But what amazes me is her amazement. Fixing up a home is nowhere near as complex as delivering a baby during an emergency C-section.

The point is that we overestimate the complexity of building work. Most people can easily fix most anything in a house with just a little careful research.

Once you become a little confident with your skills, you can move on to rule No. 3: Improve the internal space.

Fixers tend to be older, which means they come from a time when houses were designed for larger families. So, one way to modernize a house—and thus make it more valuable—is by removing unnecessary walls.

I have made significant profits on a number of occasions by finding a fixer and redoing the space in the house, making rooms bigger. These seem like big jobs, but more often than people think, walls aren’t supporting the roof, and so they can be removed fairly easily.

Another classic move is turning large closets into offices. That way the office can technically be called a bedroom. A two-by-three-foot closet can take as little as 10 hours to transform, but create an extra $5,000 in value in a $250,000 house.

Even if construction is not your thing, you can do a lot with just elbow grease, which leads me to rule No. 4: Think about the aesthetics.

One of the very first things I do when buying a property is improve the curb appeal. It’s amazing how a small apple tree and an empty half wine barrel can change the first impression of a house. The value of a house can be increased by 2% just by having the right door, welcome mat, and planter by it.

I’ve made a profit simply by turning homes that needed painting and landscaping. Properties can often be increased in value by 10% just by slapping on a new coat of paint and doing basic gardening.

My final rule for real estate investing is simply this: Get started.

Many of my stock trading friends are younger than me by 10 or 20 years, and don’t have the money to buy a house or condo in California where they live. I tell them: Forget the location. Just buy real estate you can afford, wherever you can afford it.

If it’s just a mountain cabin in the middle of America 1,000 miles from where you live, it’s still a worthwhile asset. If it’s just land in a far-off country, it’s still yours (just ensure the deed and government are trustworthy).

Humans are gamblers. We love to buy a stock and watch it double in a week. But there’s real risk involved in pursuing fast gains, particularly in this market.

Real estate, however, has intrinsic value. There’s value simply in the fact that land is limited, that house lumber has to be harvested, cut, and transported, that copper has to be melted and processed before it carries electricity, that nails have to be hammered in with human labor to make walls stand upright.

Creating a portfolio of real estate properties—much of which I still own—took me decades. And houses, unlike stocks, generally take years to appreciate. But in an age when everyone else is fixated on short-term gains, the best strategy is to play the long game.

■As predicted, bitcoin had a rocky ride in March. Here’s what comes next…

You may recall that in our last issue, I noted March has historically been a turbulent month for bitcoin. Well, the world’s No. 1 crypto started the month well, rising from about $45,000 per coin to a record high of more than $60,000. Then, in the second half of the month, it fell into the low $50,000 range before climbing again.

As I outlined last month, this was to be expected. March is when a lot of people start thinking about the taxes they owe Uncle Sam, so profit-taking in all kinds of investments is common.

Still, I’ve heard from a lot of newcomers to crypto who are worried about bitcoin’s recent turbulence. Here’s what I’d advise them and you: Hold fast.

Bitcoin, like all other cryptos, is a highly volatile asset. Moreover, it’s been on a breathtaking bull run since last year, so periods of consolidation and profit-taking are entirely normal. Long term, everything still points to bitcoin soaring above its current $50,000 to $60,000 range.

Among the positive signs just this month, a massive investor pulled some $800 million in bitcoin off the Coinbase crypto exchange so they could park it. That means a “whale” is storing bitcoin—that’s bullish. And after announcing last month that it planned to accept payment in bitcoin, electric car maker Tesla said in March that it would be storing any coins it receives as bitcoin, rather than converting them back into dollars. That, too, demonstrates a very bullish sentiment (and a negative sentiment about the dollar).

All of which is why I continue to add to my bitcoin holdings and why I fully expect to see a six-figure price for bitcoin this year.

■Speaking of paying Uncle Sam, here’s a few ways to file your return for free.

Filing taxes is an excruciating, yet unavoidable part of life. But while filing your taxes is painful, it doesn’t have to cost you money.

If you make less than $72,000 a year, you can use the Free File Program from the IRS. This is a public-private partnership initiative under which various tax preparation software companies provide complimentary access to their programs. It’s a great way to save on the cost of hiring a tax professional.

Those who make over $72,000 a year can also file their taxes for free using the IRS Free File Fillable Forms. However, this option does not include access to software, so you need to know how to prepare your own tax return.

Some of the tax software industry’s leading players also offer their own free filing options, though eligibility requirements vary from company to company. Two of the best are from H&R Block and TurboTax.

Since the IRS postponed the tax filing deadline from April 15 to May 17, you have some extra time to avail of these options. You can delay payment of any money you owe until May 17. And if you still need more time to complete your return, you can request an extension until Oct. 15 by filing Form 4868.

■Earn free miles with American Airlines simply for parking some cash with this bank.

With the national average interest rate on savings accounts currently a meager 0.04%, I’m constantly on the lookout for innovative ways we can get value from our hard-earned savings. That’s why I was intrigued to learn about the Bask Bank Savings Account.

Bask, an online-only savings bank launched by Texas Capital Bank in 1999, is currently offering one American Airlines AAdvantage mile for every dollar you save in one of these accounts. So, say you parked $5,000 in your account, you’d earn 5,000 airlines to use next year. And these miles will never expire, as long as you maintain the account with Bask.

Plus, you can earn additional miles for making monthly deposits. This means if you were to make an initial deposit of $20,000 and then make a recurring monthly deposit of $2,000, you’d earn about 31,000 miles a year.

According to a recent search I did on the miles rewards map on the American Airlines website, that would be enough to cover an early 2022 trip to a host of desirable European destinations, including cities in Greece, Spain, Belgium, Denmark, and Germany.

One note with this: Miles are accrued daily, so the totals may not be as round as the figures above. Still, if like me, you’re itching to get back in the air, this seems like an excellent way to cover one of the biggest expenses of a dream vacation. It’s certainly more rewarding than a 0.04% APY.

■Get a COVID vaccine while you vacation in the sun.

Across the U.S., most adults are still waiting to get summoned for their vaccine shots. But if you book a vacation to the U.S. Virgin Islands, you may be able to get one during your getaway.

In St. Croix, St. John, and St. Thomas, the three largest of the U.S. Virgin Islands, vaccines are available to tourists. At a recent briefing, the region’s governor, Albert Bryan Jr., stated that as many as 1,000 vaccines had gone to visitors thus far.

One reason that the U.S. Virgin Islands has decided to offer the injections to travelers is that vaccine hesitancy is high among the local population. By making the jabs fully available to visitors, officials hope to encourage locals to embrace the vaccines.

The U.S. Virgin Islands is relatively easy to visit as a tourist at present. To travel to the territory without having to quarantine, you simply need to submit a negative COVID test taken within five days of departure, or a positive antibody test taken within the previous four months. In comparison, other Caribbean destinations such as Barbados require all visitors to quarantine.

■Can you work remotely? Then you may soon be able to do it from a beach in Bali.

Bali, Indonesia has long been touted as one of the world’s foremost digital nomad destinations, thanks to its solid infrastructure, breathtaking beaches and scenery, incredible food culture, and affordable cost of living. Now, the Southeast Asian country is looking to tap into that reputation to bolster its flagging tourism sector.

The Indonesian government recently announced its intention to roll out a five-year visa that will allow foreigners to live and work in the country without a work permit. The plans are still in development, but the length of the proposed visa would set Indonesia apart from other nations with digital nomad programs. Typically, such visas limit stays to just one or two years. I’ll keep you posted on this as the story develops.

■Here’s some tips for getting past the robot gatekeepers if you’re looking to get back into employment.

The economic crisis unleashed by the pandemic has been particularly unkind to older workers. In 2020, the average monthly unemployment rate for workers aged 55 and older reached 7.5%, the highest figure on record.

One of the reasons for this worrying trend is that applying for positions as an older worker can be difficult. Whether Corporate America wants to admit it or not, it has an ageism problem. Even getting to the interview stage can be tough for older workers because they have to make it past the hiring robots, or applicant-tracking systems (ATS).

These systems are increasingly used by corporations to sort and rank applicants, before a human so much as looks at a resume. To make it past their robotic gaze, you have to know how these systems work. Here’s a few brief pointers, some of which will likely surprise you.

First, you’ve probably been told to always send in resumes as PDFs, to ensure the formatting is the same as when you completed it at home. Forget that. Often, these systems can’t read PDFs. Unless the ad specifically says PDFs are accepted, stick to Word or Pages documents.

Also out are charts and graphs. Delete any from your resume. A human would likely be impressed by that pie chart detailing the consistent annual growth in your sales figures at your last job, but again, the robots can’t read it, so stick to plain text.

What these systems do like, however, is keywords. That means when you’re writing your resume, you need to carefully study any repeated or emphasized words in the job posting and make sure to fit them into your application where relevant. Often, a good place to put them is in the summary at the top of your resume.

■If you’re trying to lose some weight, here’s a way to make some money while you do it.

At the website HealthyWage, you can make a wager that you’ll reach a certain weight-loss goal. Simply go to the site and place your bet, specifying how much weight you plan to lose and over how much time. The site will then offer you a cash prize of up to $10,000.

According to the platform, the amount of your cash prize is based on a proprietary algorithm that takes several factors into account, such as your BMI and the time of year you make your bet. So, the prizes can vary, though once you make the wager, you’re informed of the amount and it’s locked in. To ensure there’s no cheating, participants take part in a verified weigh in and weigh out. This can be done over video through the site’s app.

I tried out the site’s Prize Calculator and was told if I wagered $50 a month that I could lose 40 pounds in six months, my prize might be as much as $814. Not bad if you’re committed to shedding the pounds anyway.

■Can you get COVID after being vaccinated?

You may have seen some stories pop up recently in the mainstream media about vaccinated people catching coronavirus. This scenario, though unlikely, does happen. It’s called a “breakthrough” infection.

The reality is that no vaccination can fully protect you against COVID. However, the chances of infection after vaccination are extremely small.

For instance, one recently published report found that just seven out of 14,990 vaccinated healthcare workers in California tested positive two weeks or more after receiving their second dose of the Moderna or Pfizer-BioNTech vaccines. In addition, the workers who experienced breakthrough infections seemed to have milder symptoms than usual, or no symptoms at all.

The point being, the vaccines work extremely well, but that doesn’t mean you can completely drop your guard after you get one. Let’s stay vigilant. And in the meantime, ignore these breakthrough infection stories in the media.

Thanks for reading and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2021 by International Living Publishing Ltd. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of International Living, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.