The Bond Market Forces the President’s Hand…

The problem with history is us humans.

One: We’re largely incapable of remembering history beyond our own because we didn’t live it.

Two: We’re largely incapable of learning from history because we believe “this time is different” and we assume humanity has advanced to such a degree that the past no longer applies. We’re smarter now. Those boobs from yesteryear have nothing on us modern bipeds.

But for those of us who read history for the lessons it teaches, the past is very often a nod to our future.

The past we care about in today’s dispatch comes to us from July 26, 1956. Egyptian President Gamal Abdel Nasser seized and nationalized the Suez Canal, which to that point the British and the French had jointly run.

The Brits and Frogs were none too pleased by this.

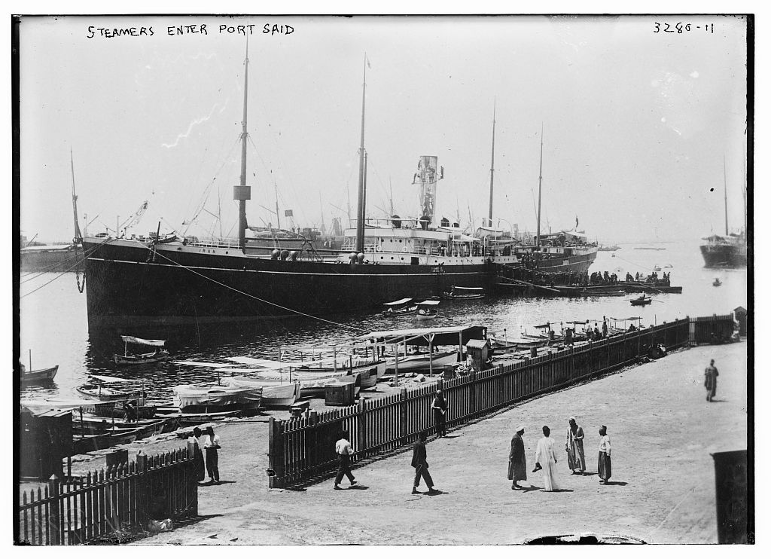

So, jump ahead to November 5, 1956, and British/French troops are invading Egypt by way of Port Said, northeast of Cairo, where the Suez spills into the Mediterranean.

Now, I’m gonna stop there because I have no interest in wading through the minutiae of the so-called Suez Crisis. I only mean to make a single point: That moment in history was the death knell for the British pound as a world reserve currency.

And there’s quite the good chance that Trump’s Tariff Crisis will prove to be America’s version of the Suez Crisis. Or phrased another way, Trump’s Tariff Crisis could very well be the straw that broke the camel’s wallet.

For many a year now, I’ve been telling tales of the power of the bond market—an entity with far greater muscle than any government or any president. Not everyone buys into that truth because they think government can do anything to anyone at any time to effectuate any result that government wants.

Alas, Trump’s Tariff fiasco has proven my point.

After ratcheting tariffs to the moon and beyond on every country under the sun, Trump hastily beat a retreat almost as quickly as he imposed the tariffs.

Why?

Well, Wall Street was tanking—racking up monumental losses including some of the largest single-day declines in history.

But that didn’t scare Team Red.

In fact, that’s what Team Red wanted—a crisis of confidence in the stock market… which would drive investors out of stocks and into the market for Treasury bonds… which would drive down Treasury bond yields… ultimately forcing the Fed to cut rates.

But someone on Team Red forgot to tell the bond market about the role it was supposed to play. Because the bond market clearly refused to go along with the plan. Instead of bond yields falling, as Trump wanted… bond yield ROSE.

Sharply.

And Trump freaked out.

He immediately backed down and called for a 90-day pause on tariffs last week to—ostensibly—deal with all the foreign leaders who have—theoretically—been calling and asking him “Sir, can we make a deal?”

I’m not convinced that’s true because Trump has a “tell.” Whenever he uses anecdotes that have average people, military leaders, and world leaders calling him “sir,” it means Trump has almost assuredly wandered well way from the path of truth.

So, he backed down because the bond market was taking him, metaphorically, out behind the woodshed for a beatdown.

The stock market quickly rebounded when Trump announced the pause, and then fell again.

But bond yields have continued their ascent.

As I write this, the 10-year Treasury is yielding 4.5%. It closed at 4.39% a day earlier.

Before Trump’s tariff debacle, it stood at 3.86%.

For the record, that’s a huge move higher in Treasury yields in such a short span.

And that’s not good news for America or the dollar.

Per former Treasury Secretary Larry Summers:

Long-term interest rates are gapping up, even as the stock market moves sharply downwards. This highly unusual pattern suggests a generalized aversion to US assets in global financial markets. We are being treated by global financial markets like a problematic emerging market. This could set off all kinds of vicious spirals, given government debts and deficits and dependence on foreign purchasers.

The bond market—always the smartest guys in any room—is sending a pointed message: The US administration is on the wrong path and it’s waging a war it will not win.

Some people will be mad at me for writing that. They will see it as Trump-bashing or that I’m not being patriotic. But I’m just the lowly messenger interpreting the message of the market for those who don’t speak “Wall Streetese.”

The bigger problem comes in connecting the dots from here to tomorrow.

Let’s assume for a moment that Trump gets his way and he imposes all these tariffs. What’s the end result of that?

It will not end with America collecting a ton of income from foreign countries. Tariffs don’t work that way. Whatever income the US collects from tariffs will have come directly out of the pockets of Main Street Americans who are the ones who have to pay the cost of the tariff. (Put simply: Companies exporting or importing to the US—whether foreign or domestic—pay the tariffs. They get the money to pay them by raising the cost of their products for US consumers.)

But there’s more!

As a bonus, you not only get higher prices on American consumers and businesses, you get less trade overall.

We’re already seeing that at Amazon.com, which announced it has cut off orders from China… which hurts US vendors and small businesses that rely on China as their factory floor for ship-on-demand/print-on-demand services at Etsy and other outlets where millions of Americans earn all or some of their income.

Let’s extend that a beat further…

What happens when there is less demand for trade into the US?

Foreign suppliers have no need to own dollars.

So demand for dollars declines.

As demand for dollars declines, the value of the dollar falls relative to other currencies because, well, there are far fewer businesses buying dollars for transactional needs.

As the dollar’s value falls, two events take shape:

- Inflation slaps American families.

Like it or not, America imports a lot of daily-use consumer goods—from clothes to shoes to food to all kinds of chemicals that go into all kinds of products from toothpaste to shampoo to makeup.

All of those items and more are, overnight, more expensive, which drains wealth from American families and puts further strain on already stretched middle-class paychecks.

- Countries begin rejiggering their internal currency reserves.

If I, as a country, am now making fewer trades in the dollar, then I don’t need to hold many dollars. So, I sell off the dollars I have and I buy euro and other currencies I am trading in more frequently now.

The problem there is that trade tends to be sticky and inelastic.

Basically, trade is lazy.

Merchants and suppliers find each other, and they don’t easily part ways… unless they’re forced to do so because of some exogenous event, like, say, the imposition of an illogical tariff structure.

Moreover, countries have long memories.

If Country A treats Country B unfairly and demonizes Country B, then when Country A’s leadership reverts back to what is historically more normal, well, Country B will rightly worry that Country A is going to lose its mind yet again.

So, when Country A approaches Country B with an apology, a bouquet of roses, and a box of See’s Candies, Country B will likely and rightly say, “Hey, thanks! Glad you’re back to your old self… but, um, I’m good. I’ve been seeing someone else and, well, no.”

And thus, we come to America’s Suez Crisis.

Trump’s tariffs are forcing countries to reconsider their reliance on the US and, particularly, on the US dollar.

China and the European Union are suddenly cozying up and are talking about replacing tariffs with “minimum pricing.” The EU is the world’s largest base of consumers. China is #3. Anyone who thinks those two economic giants are going to willingly use US dollars to trade between themselves is delusional. They will ultimately move toward trade denominated directly in euro/yuan.

And the dollar loses.

At that point, reserve currency status is hanging by a thread.

Which is hugely problematic for America…

And exactly what some in the Trump orbit want.

More on that tomorrow…