Why America Doesn’t Need the Federal Reserve.

Great minds think alike.

To wit, this question that landed in the “Ask El Jefe” inbox:

Why not abolish the Fed and let the market determine all rates? Thanks for your insights! – S.

Dear S.—I was quite literally thinking about this exact same question just a couple weeks ago. The upcoming issue of Global Intelligence is tied in large part to the Federal Reserve, where it came from, and the challenges it faces today with stagflation, the dollar, etc.

As part of writing that, I started to wonder about this question. The version in my head was: Why do we even need a Fed when the market takes care of interest rates outside the Fed’s purview?

Frankly, I don’t have a good answer other than “tradition” and probably “political influence from Wall Street and the banking industry.”

As far as I’m concerned, the Fed is pointless.

The Fed began because Wall Street and the banking community disliked a rigid currency and they felt that it was the cause of all the sundry financial panics and recessions and depressions that afflicted the American economy across the 18th and, particularly, 19th centuries.

They wanted “currency elasticity,” which is the ability to expand and shrink the supply of money to address economic expansion and contraction. Thing is, elastic money is predicated on the ability to conjure up cash out of thin air… a fiat currency, one backed by nothing but the full faith and credit of the US government… which is worth about as much as pre-chewed bubble gum you find stuck to the underside of a movie theater seat.

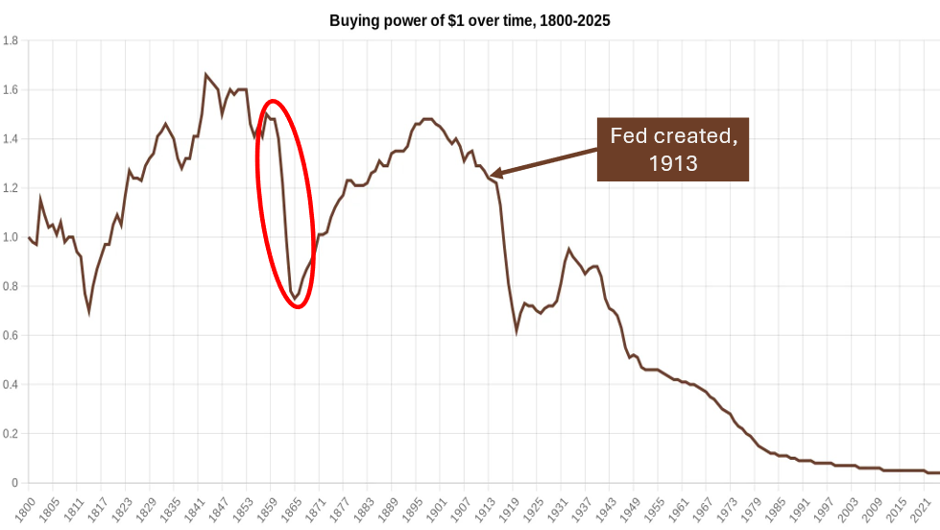

In the 112 years prior to the Fed’s creation, the US dollar certainly bounced around, sometimes up, sometimes down, but a dollar from 1800 was worth about $1.20 in 1912, the year before the Fed arrived. You can see it in this chart:

That red ellipse was the Civil War, when the federal government temporarily abandoned the gold standard and printed money to afford the war.

But look at the dollar since the Fed joined the party: A buck from 1913 is today worth just over 3 cents.

So the Fed has overseen the destruction of nearly 97% of the dollar’s wealth. I would not call that good stewardship of the US currency.

The big winner, not surprisingly, has been the banking industry. State-sponsored inflation, which is the Fed’s goal (the 2% annual inflation rate it seeks to maintain), creates nominal GDP growth, which stimulates borrowing demand, which generates interest payments and banking fees.

Moreover, the creation of the Fed gave us “fractional banking” which allows a bank to take in $1 in deposits and loan out, say, $10. In short, the bank needs to keep just $1 in reserves for every $10 it has loaned out. That is literally the process of creating money out of thin air. (Since 2020, the reserve requirement is 0, meaning banks do not need to keep any money in reserve; not a safe system by any stretch of the imagination.)

So, given the destruction of the dollar over time, and given that the Fed’s actions have allowed asset bubbles to blow up and burst, do we really need a Federal Reserve?

I am not convinced we do.

The market is fully capable of managing itself, just as it did prior to 1913.

Though the Fed sets the so-called Fed Funds rate that influences certain other interest rates in the economy, the market is the real player here.

The market determines the interest rates that Uncle Sam pays on his debt. That’s accomplished through regular Treasury paper auctions the Treasury Department holds. Bond buyers bid on what they’re willing to pay to own US debt of various maturities. The average price determines the rate.

That’s not a direct function of the Fed.

It’s a direct function of how the market views the US economy, the US political situation, the US debt situation, etc.

These days, the market is none-to-pleased with America. Foreign buyers in particular have been skipping some US Treasury auctions, and as a result the market has been demanding higher rates on the US debt it buys.

And those rates, especially for the 10-year Treasury note, set rates on mortgages, credit cards, auto loans, etc.

The market, thus, is more important than the Fed.

Without the Fed, that system would remain and it would determine interest rates in America.

We’d still have booms and busts, but it’s not like the Fed eliminated those. See: inflation of the 1960s, stagflation of the ’70s, the dot-com boom-bust and the housing boom-bust that were both built on easy credit.

And pay particular attention to the dollar’s never-ending erosion. That is 100% the function of Fed actions and policies over the last century.

Some economic observers will argue that absent the Fed, the government would not be able to adequately respond to financial crisis and we’d return to pre-Fed panics.

I disagree.

This is not the 19th century.

We have beaucoup technology and decades of fiat-currency experience. Artificial intelligence, digital infrastructure, and blockchain tech that could easily replace the Fed and help manage any kind of crisis that emerges—and it would do so unemotionally and without undue influence from loudmouth politicians who understand the economy as well as a geranium understands the process of making smores.

A free-market/decentralized banking system would do a far, far better job of managing the economy and a fiat currency. Sounds crazy, but the US could “gamify” the economy, meaning that in a financial crisis, blockchain-tech, managed by AI, could create incentives and disincentives for saving, investing, spending—all designed to stabilize the system, whether the economy is in an inflationary or deflationary crisis, or whatever.

Will we ever reach that point?

I don’t know.

But AI, blockchain, and the rapid digitization/tokenization of real world assets like stocks, bonds, currency, and real estate leads me to believe that we’re not far away from this vision.