Dear Frontier Fortunes subscriber,

Back at the turn of the century, Jeff Bezos, then a little-known entrepreneur, was watching his life’s work fall to pieces.

Bezos had quit his job on Wall Street to build an online bookseller, Amazon.com. His idea had been widely ridiculed. “Why would anyone wait days for a book to be delivered?” was the common criticism.

Still, Bezos had attracted large sums from investors who could see his vision for the future, and he’d managed to build the company into a credible venture.

Then, the dotcom bubble burst…

Internet companies were collapsing left and right. To many, it seemed as though the internet age would come to an abrupt, premature end. Bezos, however, was calm. Looking back on this period later, he explained why:

“The stock is not the company. And the company is not the stock. And so, as I watched the stock fall from $113 to $6, I was also watching all of our internal business metrics—number of customers, profit per unit…every single thing about the business was getting better. And so, while the stock price was going the wrong way, everything inside the company was going the right way.”

I’ve been thinking a lot about that sentiment lately amid the current crypto market shock.

This last quarter has been one helluva turbulent period in crypto, and it arrived as a true surprise. After a year of turmoil in the wider economy, the crypto market had started to stabilize and was actually nudging higher. And then, boom! A black swan—a rare, highly impactful event that was difficult to predict—crash-landed on the landscape in the form of the FTX debacle.

In this quarterly issue of Frontier Fortunes, we’re going to dig into everything that’s been happening—the collapse of the FTX crypto exchange…the impact this has had on the market and our investments…and a step I recommend you take to protect your assets.

I’m also going to explain why I remain as bullish as ever on the future of crypto.

And I want to start there because in the midst of a serious downturn, it can be easy to lose sight of the bigger, brighter future that is assured.

The dotcom bubble back in the early 2000s was so similar to this moment in crypto. Investors fled good internet companies as well as bad. As Bezos noted, Amazon saw its stock price completely collapse (it actually fell far below $6, briefly touching $0.30). Yet, by July 2021, a single share of Amazon was worth over $185. And there are many other examples like this. Booking Holdings, known as Priceline.com back in the day, was down 99% in the midst of the dot-com collapse…and then rose more than 33,000% off the floor.

The point here is that when the technology is sound, and when teams are continuing to build groundbreaking projects and services, the surrounding economic environment is not what matters. What matters is the future that’s taking shape.

So, in this issue, I want to dive more deeply into what that future looks like, and to show you one specific area where it’s already unfolding.

That area is social media, where a potential replacement for Twitter based on crypto tech was just released…

The Web3 World

Right now, we all operate in what’s known as Web 2.0, a version of the internet we’ve been utilizing for the last 20-plus years.

This is the internet of Google and Facebook and Twitter—gargantuan, centralized companies that manage content, control our personal data, and set the rules by which we play. Step out of line (as defined arbitrarily by the company) and you’re done.

It’s as though companies like Twitter and Facebook have become nation-states with the power to revoke citizenship for even the most innocuous transgression.

Thankfully, that world is crumbling, and it’s being replaced by Web3.

This emerging version of the internet is being built atop the blockchain, the technology behind all cryptocurrencies. The premise of the blockchain is simple: It’s an unhackable technology that keeps a permanent, unchangeable record of all transactions.

I tell people to think about it in terms of a giant whiteboard in the sky, on which everyone can write anything, but no one can erase anything. This whiteboard keeps track of every transaction that happens. Everyone can see those transactions, but no one can alter them.

Key to this is that a blockchain is spread out across a vast network of computers around the world. So unlike traditional computer networks, which are centralized, blockchains are decentralized and controlled by no one individual.

This puts power in the hands of the users and takes power away from the big corporate organizations like Twitter, Facebook, and the others.

And it’s bringing us closer to the moment when the entire world realizes that social media, as we know it, is a dinosaur looking up at a bright asteroid in the sky and wondering what it is…

The Next Twitter?

Twitter is a highly centralized space, now controlled by one of the biggest egos on the planet: Elon Musk, who too often lords over the platform like a petulant chimp. The man who swore to bring freedom back to Twitter ironically bans users for comically imitating him on the platform. So much for free speech.

I am quite active on Twitter and I can see the platform’s days are numbered. Across the cryptoconomy, a new generation of tech companies is plotting its demise.

One of these crypto services just went live: Diamond.

Diamond is the very first social media app on the blockchain, and it looks and acts and functions a lot like Twitter. Users post what are effectively tweets. Others can follow those users to keep up with their latest musings.

Because Diamond is on the blockchain, however, the entire service is decentralized—meaning no one company, person, or government controls the platform.

Content creators—those who post verbal content, art, photos, whatever—are in total control of their accounts. There is no centralized overlord who, suddenly angered by a poke, can arbitrarily retaliate by banning the user.

Signing up is easy: head to Diamondapp.com and click on the “Create Account” link in the upper right-hand side. From there, it’s just inputting a bunch of basic information. Or, as I did, you can simply connect with your crypto wallet, in this case a MetaMask wallet that operates on various blockchains, most notably Ethereum.

What’s most interesting is that Diamond users are free to monetize their content in any way they can imagine. They could, for instance, launch “social tokens” (think: a personalized cryptocurrency) that other users would buy in order to follow a particular account or to access high levels of information tied to that account.

Diamond looks a lot like Twitter, but with a less-polished, crypto-themed interface.

Diamond still looks basic. After all, it’s a just-launched, first-of-its-kind platform. But as the next few years play out, we’re going to see a vast assortment of Web3 services like this appear. And eventually, some of them will catch fire with mainstream internet users, spelling the end of the major social media services we know today.

Maybe Diamond will be one of those. Likely not. As in war, the first ones through the wall are usually clearing the path for those behind to follow.

What’s not in doubt is that, in time, crypto services will overtake the services of today.

We’re going to see companies like Walmart roll out shopping websites that will be built on blockchain technology.

We’ll see banks like JPMorgan introduce cryptocurrency wallets that will tie in directly to your personal bank account (JPMorgan, in fact, has already received a patent for the wallet it’s creating).

We will see real-world exchanges begin to offer crypto trading, which Nasdaq is already working on.

In short, Web3 is on the precipice of replacing Web2, an event that will unleash enormous wealth-creation opportunities.

When Web2 took over from Web1 (the original read-only version of the internet), it did so just as the internet was collapsing amid the dotcom bust. The media widely reported on the death of the internet and the idea that companies like Amazon.com were basically pointless because no one was ever going to order items online and await delivery when they can just drive to the store and buy it immediately.

That analysis was a total failure and it hurt investors who paid attention to it. That’s where we are now. Many mainstream media outlets are predicting the end of crypto, a technology they in no way understand, even as Web3 is taking over from Web2.

Yes, crypto is in a tough moment, but from the ashes will arise the Amazons, Twitters, Googles, and Facebooks of tomorrow.

Which is exactly why we want to own high-quality crypto underpinning this new version of the internet.

Our Value Cryptos Portfolio

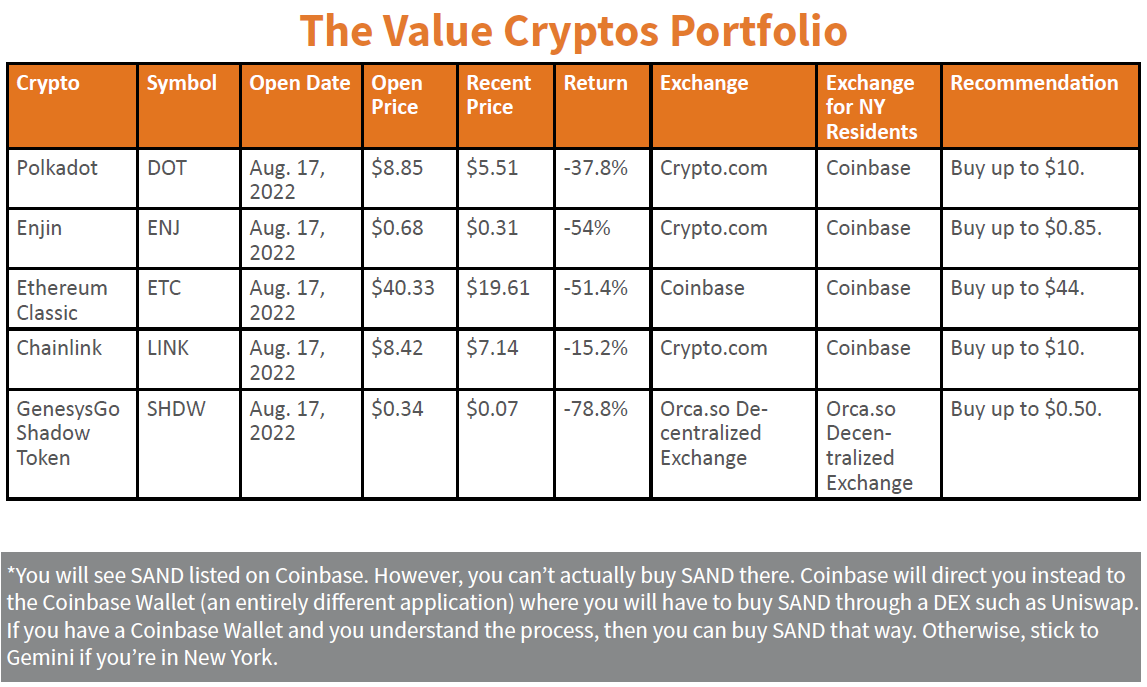

Back in August, I sent you a special alert to introduce a new portfolio of five crypto tokens that represented good value because of their rebound potential.

The five Value Cryptos are:

Polkadot

Enjin

Ethereum Classic

Chainlink

Shadow Token

In that August alert, I noted that I would explain my rationale for recommending those cryptos in more detail in this quarterly update. And I’m going to address that in a moment.

But first, we need to tackle the turmoil that has ripped through the crypto landscape.

Crypto has been in a bear market for most of this year. Until early November, that was a function of the Federal Reserve attacking inflation by hiking U.S. interest rates at an alarming pace. Indeed, the pace was so alarming that several members of Congress recently sent a letter to Fed Chair Jerome Powell asking him to justify the Fed’s actions, particularly in light of Powell’s comment that American families should expect and accept “pain.”

The problem here is that by hiking rates so aggressively, the Fed is yanking an excessive amount of liquidity (cash) out of the market. It’s forcing consumers to pay more to service their credit card debt. And, as the Fed’s own economists have been warning internally, it is threatening to send the economy into a potentially deep recession.

In such moments, investors pull money out of so-called “risk-on” assets—stocks and crypto. Which is why both have been diving for most of the year. Bonds have been diving too, as has the housing market.

In short, the Fed is destroying every asset except the U.S. dollar, which has been on the ascent for most of 2022 because of the rate hikes.

Yet despite this difficult economic environment, crypto had actually begun to stabilize in mid-summer.

When the Fed began its series of 0.75 percentage point rate hikes, crypto didn’t move. It absorbed the rate hikes in its stride. During the third quarter, bitcoin was actually up more than 6%, despite two 0.75% interest rate hikes during the quarter. Chainlink, one of our five new Value Cryptos, was up 30% in that period. Ethereum Classic was up nearly 100%.

All was looking stable, maybe even rosy…until early November.

That’s when a massive crypto fraud emerged.

U.S.-based crypto exchange FTX imploded, the result of horrific management practices and the misuse of consumer funds. The exchange was forced to file for bankruptcy, and that has hit companies all across the cryptosphere.

Several crypto banks locked down all accounts, forbidding their customers from accessing their money because the exchanges had so much crypto locked up at FTX.

The shockwaves of fear hit just about all cryptocurrencies. So, just as the crypto market had come to grips with the Federal Reserve’s actions, a black swan fell from the sky to disrupt the entire crypto economy.

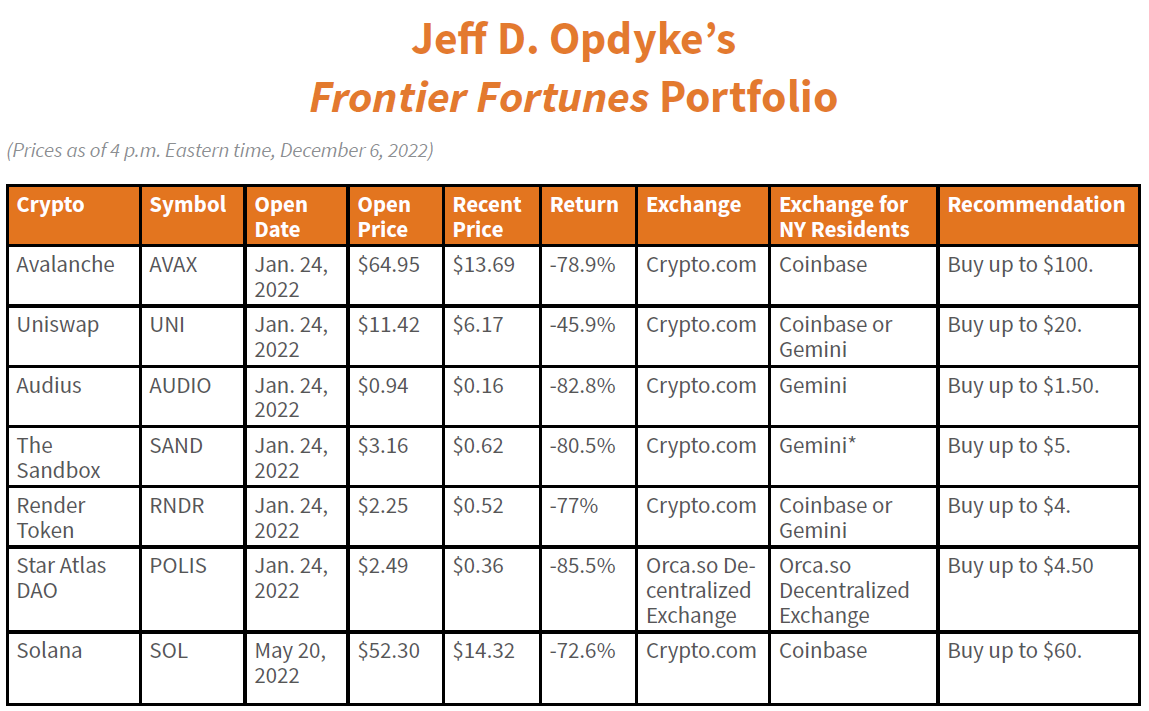

Indeed, prior to the FTX debacle, the original seven crypto currencies in our portfolio were having a pretty good second half of the year as a group. Avalanche was up 26% from the start of the third quarter to the FTX collapse. Uniswap was up 66%. Render Token up 125%. Solana up 21%. Sandbox and Star Atlas were flat, while Audius was down about 23%.

All in all, a fine showing overall and proof of the fact that crypto prices are capable of rebounding quickly. Avalanche and Render Token are great examples of that. From mid-June to mid-August—a bit less than two months—Avalanche was up 118%. Render Token, from its June lows to its high just before FTX imploded, was up 265%.

My point here is that big paper losses in crypto are not always what they appear to be. Prices can and do move with such speed that red ink can turn to black quite quickly. Which is why I consistently recommend patience.

I know the “patience” advice can feel frustrating, but crypto is a roller-coaster ride. And patience really does offer the potential for huge profits when the rebound happens.

There is a silver lining in all of this FTX drama: It’s certain to bring about much needed regulation, which in turn will strengthen the crypto industry, which will make it that much safer as the next billion crypto users onboard to take advantage of services like Diamond or whatever killer app grabs the mainstream public's imagination.

Those users, in turn, are going to bolster the use and demand for the crypto we own, even if they don’t specifically invest in those currencies.

Which leads me into why we want to own the five Value Crypto in our portfolio:

Polkadot

Years ago, when Ethereum first launched, it was founded by several men. Among them was Gavin Wood, a former research scientist at Microsoft who become chief technology officer of the Ethereum Foundation, the nonprofit group that manages the Ethereum network.

Jump ahead to 2020 and Wood, who left Ethereum in 2017, released Polkadot. It was a new blockchain with a unique way of managing traffic on the network by creating parallel networks called “parachains.” These are basically secondary super-highways that run alongside the primary super-highway, and they allow crypto projects to operate their own blockchain that’s basically piggybacking onto the Polkadot network.

The benefit is speed and transaction costs.

Indeed, Polkadot announced in September a new way to optimize its network that will see transactions occurring at between 100,000 and 1 million per second, and at a cost of just fractions of a penny. That would make it faster than virtually any other blockchain out there, topping even the 100,000 transactions per second that Ethereum plans to reach when its upgrade project is complete.

The question that people always ask is: Won’t that make networks like Ethereum obsolete?

Not at all.

Polkadot is what’s known as a Layer 0 blockchain. Basically, that means it’s the base layer of blockchain infrastructure—the layer upon which other blockchains and services are built. Ethereum, by contrast, is a Layer 1 blockchain that supports other services, like crypto tokens. So, they have different functions.

Another primary difference is that at Layer 0, Polkadot enables cross-chain interoperability, meaning that unlike most projects, Polkadot can work on multiple different blockchains. That alone gives Polkadot a leg up in the cryptosphere because there is tremendous need and demand among crypto users to cross blockchains easily.

That, in turn, should see Polkadot emerge as a key piece of the global blockchain infrastructure. Consumers, businesses, and other crypto projects will demand speed, negligible transaction costs, and the ability to operate hassle-free across blockchains.

That’s Polkadot’s reason to exist, and it means demand for the token, which fuels the network, should grow.

Already, Polkadot is a highly respected and valued crypto project. Though much-older Ethereum is 25x larger, Polkadot nevertheless has climbed the ranks of cryptocurrencies to become #11 in terms of its market capitalization (the cumulative value of all the Polkadot tokens that exist).

Enjin

Enjin is a token that operates on the Ethereum blockchain and is primarily used on gaming and NFT platforms.

Gaming is a massive industry globally. Estimates calculate some 3.2 billion gamers in the world, spanning every age range from little kids playing learning games on tablets…to octogenarians wiling away some time with games on their smartphone.

That’s nearly half the world, and the number is growing every year.

The vast bulk of that activity is happening in Web2, but Web3 gaming is now stepping up. Across the Web3 space, developers are creating a huge number of games. They range from simple coin-flip games tied to wagering real money (many of these are quite popular) to epic, universe-wide, space-based games so lifelike they look like they really exist somewhere.

All of those are fueled by cryptocurrencies and NFTs.

Cryptocurrencies are used, for instance, to pay for services or to upgrade characters, or to wager. NFTs, meanwhile, provide a way for users to own the individual characters or tools/weapons in the game.

As this new gaming space evolves, in-game assets such as spaceships will generate income for users, who will lease them to gamers who cannot afford one (these ships can already cost hundreds to thousands to tens of thousands of dollars).

That’s going go to be one of the compelling reasons Web3 gaming explodes across the population: income. Many Web3 games are designed to generate income for users by allowing them to monetize an in-game asset, like a spaceship, a car, a high-level character, or even a particularly powerful weapon. Or games will allow players to earn in-game currency, like Enjin, that can then be easily converted back into dollars or euro or whatever sovereign currency a player wants.

Enjin is one of the best-known tokens in this gaming arena.

Behind the scenes, Enjin is, well, an engine. It’s software that Web3 developers use to create digital assets that are then incorporated into a game. Players typically interact with those assets by way of the Enjin token, meaning they buy and sell in prices denominated in the Enjin token.

In crypto terms, Enjin is a grandpa. It has been around since 2017, meaning it has seen the highs and lows for which this industry is notorious, and it continues to grow. That gives me faith in this team.

More important to our potential profits is the fact that Enjin’s platform records about 60 million global visits every month, indicative of both how popular Web3 gaming is becoming, and the heft that Enjin has in this space. Those gamers are spending millions of dollars on NFTs and in-game currencies, which ultimately reflects in Enjin’s crypto price.

Given the growth profile for Web3 gaming, and Enjin’s profile as a leader in gaming/NFT tokens, I see much higher prices for this crypto as we return to a bull market.

Ethereum Classic

Years ago, when Ethereum was still the new kid on the block, it split into two separate blockchains amid an internal spat: the Ethereum we know today…and Ethereum Classic, which is actually the original Ethereum, confusing as that sounds.

Ethereum has gone on to grow into the world’s #2 crypto, trailing only bitcoin. ETH Classic, as it’s called, is #23 in the crypto universe, 56x smaller than its sibling.

The reason for owning ETH Classic is short and sweet: It’s the last vestige of the original Ethereum blockchain.

Why is that relevant, since ETH is moving on to a new-and-improved version?

Well, let me first explain Ethereum’s switch.

Ethereum was originally built on what’s called a “proof of work” protocol, or PoW. Basically, this means a computer graphics card (they have high processing power to render data-intensive graphics) crunches bazillions of calculations at vast speeds in order to solve a mathematical puzzle. When it does, it unlocks a piece of Ethereum.

As of September, ETH switched from PoW to “proof of stake,” or PoS.

PoS does away with the energy-intensive process of data crunching by way of graphics cards, and replaces it with a model in which Ethereum owners “stake” their Ethereum with “validators” to secure the network.

Staking simply means depositing Ethereum to a particular validator’s account…and validators are simply owners of at least 32 Ethereum who are then given access to the network so that they can use their computer’s processing power to help confirm the legitimacy of transactions. They are paid in additional slices of Ethereum for doing so.

Well, there are an untold number of businesses and blockchain services all over the world that were built atop Ethereum’s PoW network over the last many years. They are not willing or see no benefit in moving to Ethereum’s new PoS network.

Instead, they can easily migrate to ETH Classic because the network is identical to what they’re built on and they don’t have to switch technologies.

Beyond that, ETH Classic is a “store of value” coin, much like bitcoin—a coin that preserves value like digital gold. It has a fixed supply of 210.7 million coins, which will never change. (The supply of regular Ethereum is constantly fluctuating.)

ETH Classic is part of the Value Crypto portfolio for all of those reasons. Before the crypto bear market attacked, ETH Classic had topped $136 per token. As I write this, it’s trading at around $19. When the bull returns, I fully expect ETH Classic will climb back toward that previous high.

Chainlink

I’ll argue that very few cryptocurrencies are as important as Chainlink in terms of where we’re headed as a society.

Link, as it’s widely called, is what’s known as an “oracle.” This is a technology that collects real-world data and brings it onto the blockchain so that “smart contracts” have access to the information.

Smart contacts are basically just computer coding on the blockchain that allows a program to act, based on predefined inputs, without the need for a human to sign off on the transaction. Link is “poly-chain,” meaning its use-cases are not limited to a single network like, say, Ethereum. It can operate across multiple blockchains.

Here’s an example of how Chainlink could change one of the most fundamental transactions in our society: buying a piece of real estate.

At the moment, after you and a seller come to terms on the price, you have to put your money in escrow, then wait for the title agents and lawyers and escrow agents and such to determine tax payments, make sure the title is clear of other encumbrances, etc. Only when all of that is complete can the transaction finalize with you giving a cashier’s check to the seller.

With oracles like Chainlink, the largest oracle in the cryptosphere, all of that would be accomplished automatically and almost instantly.

After you and the seller agree on a price, the smart contract tied to your real estate transaction would use Link to source the necessary data through the various government databases (when they’re on the blockchain), and it would authenticate them.

Then, it would automatically authenticate that the seller does, in fact, have legal title to this property, and that the buyer has deposited the correct amount of money (in any cryptocurrency the buyer/seller have chosen) in a blockchain-based escrow account.

If all of that is verified, the smart contract would automatically transfer the crypto to the seller and the land to the buyer. There is no need for any human to play a role in any of the processes, other than the buyer/seller establishing the initial parameters of the transaction.

Real estate—though a huge industry—is just one example of the scores of opportunities Link can exploit.

It could gather real-world weather data for insurance adjusters in the field who need to determine if a customer’s weather-related insurance claims line up with weather events in the area.

Or it could be used by online gambling sites to bring real-world sports scores onto the blockchain to determine wagering outcomes. Indeed, the National Basketball Association currently uses Link to automatically update the on-court performance of individual players and teams as part of a program tied to NFTs that basketball fans own.

Smart contracts are the future of our world because they are decentralized and do not require anyone to trust anyone else. So long as all the parameters are met, a smart contract will faithfully execute whatever the task is. And if the parameters are not met, then no one is scammed or hurt by the failure.

As billionaire investor Mark Cuban once tweeted: “Being able to create businesses on decentralized platforms leveraging smart contracts…create[s] a unique ability to offer more efficient biz processes and disrupt industries.”

As with all other crypto, Link, a top 25 cryptocurrency, has come down sharply, from $52 to just under $7. But that just tells you how the market values this oracle in more-bullish times. And those bullish times will return, which is why I want the industry’s largest oracle in our portfolio.

And just to give you a sense of how strongly I feel about Chainlink, I have my crypto exchange account set up to buy a certain dollar amount of Link every week, so that I can build an ever-larger position in Link over time.

Shadow Token

Shadow operates in the Solana blockchain ecosystem. Solana, which is in our primary crypto portfolio, has emerged as one of the most important networks for NFTs. Shadow plays a part in Solana’s growth.

It is the in-house token tied to an NFT-based technology project called Shadowy Super Coders. These NFTs represent a stake in an underlying tech company called GenesysGo, which has emerged as a leader on the Solana blockchain.

GenesysGo provides a unique date-storage solution that improves the network’s transaction speed while at the same time strengthening data security—two issues that Solana desperately needed addressed.

The company has also created what’s known in the blockchain world as a “canary network,” a test network where projects can launch and test their computer coding and how their products/services function on a live blockchain without it actually being live on the blockchain. Think: Canary in a coalmine. You send the birds in to see how they fare before you send in the real workers.

Shadow Token has a role in those services in that project developers must spend Shadow to pay for services they need, or they must stake a large amount of Shadow to lock in data-storage needs. (By staking, they are effectively taking large blocks of Shadow out of the supply, limiting availability of Shadow tokens for others who need to buy Shadow to pay for one-off services.)

It's a highly symbiotic arrangement that ultimately benefits those who own Shadow Tokens, since business demand for the token is organic rather than forced (and lots of token demand in crypto is forced).

At the moment, that’s hard to focus on because the FTX debacle was particularly hard on the Solana blockchain. FTX was a big proponent of Solana, owned a big slug of Solana, and had developed very popular decentralized exchanges for the Solana network where users were converting between crypto and fiat currencies (like the dollar) in large amounts. The collapse of those services, and FTX dumping Solana, has ripped through the price for Solana as well as a ton of currencies on the Solana blockchain.

Prior to the crypto decline, Shadow was pressing up against $3. Today, it’s consistently bouncing around the $0.10 range, which I consider a deeply discounted bargain, given what GenesysGo brings to the Solana ecosystem.

In a normalized environment, and when Shadow and GenesysGo’s services mature and expand over the next few years, I won’t be surprised to see a double-digit price on Shadow Tokens.

My Recommendation: Protect Your Assets With a Hardware Wallet

I’ve mentioned the FTX scandal a couple of times, and one of the most important lessons from that event is the need to keep a large slug of your crypto and NFTs on what’s called a hardware wallet.

These are USB-sized drives that are built with special encoding that prevents hackers from gaining access to your crypto assets. They also serve as a place to safely store your crypto instead of keeping it on a crypto exchange.

One of the truisms of crypto is “not your keys, not your crypto.” That refers to the keys that control a crypto wallet, a long alphanumeric string that defines your wallet on the blockchain. When you keep crypto on an exchange, the crypto is in your name nominally, but the wallet in which it’s held is owned by the exchange.

If that exchange is hacked, or if that exchanges locks down amid a crisis—and numerous have in the wake of the FTX collapse—you do not have access to your crypto.

By keeping your crypto and NFTs on a hardware wallet, you have 100% control since you own the only set of keys to that wallet.

While I do not foresee any problems with the exchanges I recommend such as Crypto.com, Coinbase, and Binance.US, this is simply the prudent course as we navigate the current volatility.

I primarily use a Ledger Nano X wallet, which looks like this:

Every time I want to buy an NFT or list one for sale, I have to punch in my PIN code. It’s a hassle at times, but in no other asset class I can think of is “better safe than sorry” more relevant.

If you buy one, only buy from Ledger itself. You can find their website here. Never—NEVER!—buy from a third-party vendor on Amazon or eBay or anywhere else, regardless of whatever discount they might be touting. Sellers can open the package, jot down the “security phrase,” then repackage the item as though it was never tampered with.

Then, they can use another Ledger and with your security phrase, drain everything you store on your Ledger into theirs. So always buy directly from Ledger. The company has a good tutorial video to demonstrate how you use the wallet. You can view that here. (I gain no benefit from recommending this device to you. I’m merely highlighting the option I use.)

And with that, I will wrap up this quarter’s issue of Frontier Fortunes. It has been a heckuva dramatic quarter, but I will assure you that brighter days are ahead.

As I noted, I am buying Chainlink every week, and I have begun adding to my positions in bitcoin, Ethereum, and Solana, in particular. We are seeing steeply discounted prices, yet the future for crypto is brighter than it has ever been.

Patience is a necessity right now, but those who own high-quality cryptos are going to reap huge rewards.

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2022. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.