Dear Frontier Fortunes subscriber,

Welcome to your second quarterly issue of Frontier Fortunes.

These issues contain my analysis of the key developments in the cryptoconomy, as well as a comprehensive look at the performance of each of the assets in the portfolio over the previous quarter.

I want to start this issue by discussing the hottest trend in all of crypto (and indeed, business in general): the metaverse.

The metaverse as a concept began to hit the headlines just late last year.

But already, a stampede of major corporations is investing big money in emerging metaverse worlds…and that is very good news for the long-term health of our portfolio.

Now, before I go on, I want to outline exactly what the metaverse is. Mainstream media outlets like to throw this word around, but frankly, most do a very bad job of explaining it. So, let me share my preferred definition.

The metaverse is the internet…in 3D.

Instead of staring at a computer monitor or smartphone and using the internet in two dimensions, the internet of tomorrow is going to exist in three dimensions…all around us. We’ll use virtual reality glasses and augmented reality tech to access these virtual worlds.

In the near future, you’ll be able to put on a pair of VR glasses and do in the metaverse almost everything you can do in the real world. And a lot more besides.

You’ll be able to try on clothes in a metaverse shopping mall using an avatar with your exact dimensions. You’ll be able to walk around an exact 3D representation of your vacation rental or hotel, so you know precisely what you’re booking. You’ll be able to log into your company’s metaverse office to collaborate with colleagues. Heck, you’ll be able to hang out at a virtual coffee shop with friends on a hyper-realistic alien planet in another part of the universe.

In short, it’s going to be a whole new way of shopping, playing, working, and socializing.

I know it sounds fantastical. But metaverses are emerging right now all across the cryptoconomy.

Early adopters, including me, are already touring these early iterations of metaverses…places like The Sandbox and Decentraland on the Ethereum network, and Portals, Yaku, and the Suites on the Solana network. (Note: The links won’t provide access to those metaverses…you generally need a non-fungible token, or NFT, to serve as the key to enter, or you have to download the game and/or register to play.)

The Sandbox is one of the metaverses attracting interest from Corporate America…

As the remainder of this decade unfolds, we’re going to see metaverses become the de facto experience on the internet.

When you visit Ralph Lauren or Walmart online, you will be popping into their metaverses.

I didn’t randomly pick those two names. I purposefully chose them because they’re two of the big-name companies that have announced plans to move into the metaverse.

Walmart has filed a cabinet full of patent applications for a Walmart metaverse and hundreds of products that will be represented inside that metaverse by NFTs. (These are one-off, one-of-a-kind crypto tokens that can be used to represent unique assets. You can access your special Frontier Fortunes reports on NFTs here.)

Ralph Lauren, meanwhile, filed its own patents in late March for virtual hotels and restaurants, virtual fashion shows, and virtual clothing, footwear, and fragrances that would be represented by NFTs.

While the media likes to focus on—and generally mock or pan—NFTs that look like childish digital art, what Walmart and Ralph Lauren are doing is a clear indication that NFTs are very much going to be a part of everyday life, whether the media understand NFTs or not.

Think about it this way: There was a time in the 1990s when few people gave two spits about mobile phones. We all know how that turned out…

To that end, Walmart and Ralph Lauren serve as useful props for this issue of Frontier Fortunes.

They are two, ginormous corporate names. The fact that they’re developing metaverses is a clear indication of where the future is going.

And they are just the tip of the iceberg.

Italian luxury car maker Alfa Romeo has joined a metaverse called Everdome. Urban Outfitters and Abercrombie & Fitch have filed patents for NFTs they’ll sell in branded stores in various metaverses. Disney, back in January, announced plans to build a grand, entertainment metaverse. And white-shoe Wall Street firm, JPMorgan, recently opened the Onyx Lounge in the Decentraland metaverse.

When I see that caliber of firepower telling me they’re building NFTs and heading into the metaverse…I take note and I start investing for tomorrow.

Which is where our portfolio joins the story…

Our Metaverse Plays

Several of our Frontier Fortunes holdings have ties to the metaverse and the NFT economy that is already exploding.

Indeed, The Sandbox is a direct play since it is a metaverse. And it is also benefiting from this corporate investment trend. Since the first quarter of 2022, accounting firm PricewaterhouseCoopers and banking giants Standard Chartered and HSBC have announced plans to buy land in The Sandbox. The Sandbox is also aiming to raise $400 million in new funding, which would value the project at roughly $4 billion.

Then there’s Avalanche and Render Token.

They supply the necessary underlying infrastructure for metaverses…Render because it provides video processing for metaverse worlds, and Avalanche by offering a blockchain on top of which NFT and other related services can be built.

Even our blockchain music streaming service Audius is benefiting from the metaverse trend. My sources tell me it’s partnering with several leading metaverses to provide in-game music streaming. When those deals go public, we can expect the price of Audius to spike.

All of this is not to say that the metaverse future is imminent…

Fully realizing this future will require upgrades to the existing internet and blockchain infrastructure…which brings us to the other big news from the cryptoconomy in the first quarter.

As I noted in a recent mailing to you, Ethereum has taken a major step toward achieving its long-awaited Ethereum 2.0 upgrades, which promise to massively increase the speed of the network to 100,000 transactions per second, from just 15 to 17 today. It will also radically reduce transaction costs to just fractions of a penny from tens or even hundreds of dollars today.

Ethereum recently completed a highly significant technical test that proves that the upgrades can work. There will, however, be a slight delay to the upgrade rollout, which is not unexpected given the complexity of this project. Ethereum 2.0, initially slated for a May or June release, is now likely go live in fall.

Nevertheless, the successful test demonstrates that the upgrade project is progressing well. (You can read my full alert on the issue here.)

The completion of Ethereum 2.0 will be one of the most significant events in the history of the cryptoconomy and could unleash a wave of crypto innovation across the mainstream economy. This, in turn, will further boost the assets in our portfolio.

Crypto Market Volatility

Given this growing adoption of metaverses and NFTs, and the successful Ethereum 2.0 test, you might be wondering why the cryptoconomy has experienced such volatility since the start of this year.

Indeed, the assets in our portfolio have dipped of late after a strong start when we opened the positions.

While the crypto market moves in some way to the beat of its own drum, it is not completely immune to major geopolitical and economic risks.

War in Ukraine and the Federal Reserve’s decision to raise interest rates to tackle inflation, weighed somewhat on crypto, just as it weighed on stocks and bonds.

We started the year with bitcoin at $48,000. As I write this, it is back at around $39,000. Of course, those figures fail to capture the roller coaster ride in between—down to $34,800, back up to $47,700, and then back to where we are today.

Bitcoin is not part of our portfolio, but its performance is relevant to our investments.

More than 40% of all the money invested in crypto is in bitcoin. Where goes bitcoin, so goes the crypto market in general, and bitcoin has been bouncy of late as the investment community digests inflation, war, and higher interest rates.

Higher rates, in particular, scare many institutional investors because they assume that crypto is a risk asset just like stocks, and higher rates/inflation are bad for stocks. This put selling pressure on bitcoin, which affected crypto writ large.

I am confident this is a temporary situation.

I think we’ll see bitcoin and crypto prove they are far more resilient to inflation than certain market pros expect.

As inflation continues to erode the purchasing power of the dollar and other major currencies, I expect that more people are going to put their wealth in bitcoin, just as they would put their wealth into gold.

For now, inflation fears weigh heavy on bitcoin, and bitcoin weighs heavily on market direction.

But once it becomes apparent that the Fed raising interest rates is not going to dampen inflation, bitcoin and other big names cryptos will begin a steady rise higher.

This means our portfolio will rise too, though the assets in our portfolio will likely see even greater gains than bitcoin as the metaverse, NFT, and other trends achieve increasing mainstream adoption.

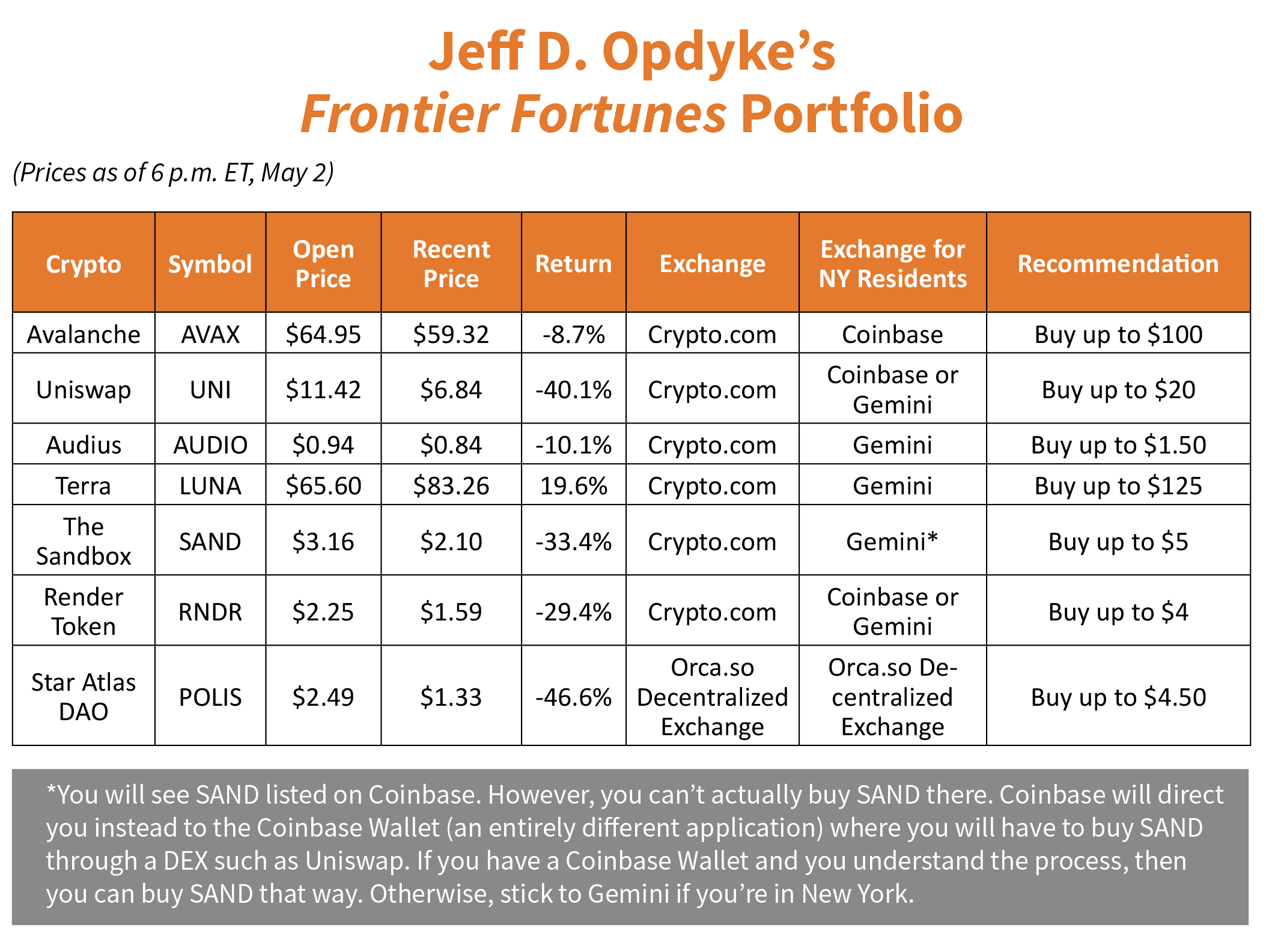

With that, let’s break down the individual performances of the assets in our portfolio, beginning with those that have metaverse exposure…

Audius

Audius, the Spotify of the blockchain, has had a big quarter.

Recently, the company bought the naming rights to Denver’s Red Rocks Amphitheater, demonstrating how crypto continues to integrate into society. And as mentioned above, it is partnering with various metaverses to provide in-game music.

Audius is already a partner inside the Portals metaverse on the Solana blockchain. Portals, I’m betting, is going to emerge as one of the world’s largest and most popular metaverses, meaning Audius is going to have a huge audience of users.

And though it has not been officially announced, I’m hearing from very well-placed sources that Audius will very likely appear in the Yaku metaverse, as well. This is an Asian cyberpunk-themed online world of gaming and gambling that is acquiring a cult-like following. (I’ve recently sent you an alert about Yaku non-fungible tokens, which you can view here.) Audius would serve as a music source within Yaku’s “capsules,” its in-game, 3D apartments.

As such, our key theme with Audius remains solidly intact: That Audius will be the major music-streaming service in the blockchain/metaverse world, and as such has a very big future ahead. We’re down about 10% in Audius as I write this, but I expect it to rebound strongly.

Avalanche

Avalanche, a fast-growing Ethereum competitor, is quietly becoming a destination for NFT sales.

Avalanche runs what’s called a Layer 1 blockchain—the train tracks on which other crypto projects build out their products and services.

Granted, right now Avalanche’s NFT volume is tiny relative to NFT goliaths Ethereum and Solana. But given the monumental volume that NFTs will represent in the future, there’s plenty of room for multiple blockchains, and Avalanche is certain to gather in its share of NFT volume because it’s one of the fastest-growing Layer 1 blockchains in the game. (Avalanche is capable of about 4,500 transactions per second.)

Meanwhile, Avalanche has also pushed higher in recent months on the back of news that Grayscale, one of the largest crypto-focused investment funds, has added Avalanche to its Digital Large Cap Fund.

Another of our investments, Terra, also grabbed $100 million worth of Avalanche to strengthen its stablecoin reserves. I’ll explain more on that below.

We’re down about 9% in Avalanche as I write this, but as with Audius, this is a temporary blip and it will go much higher from here.

The cryptosphere will demand multiple blockchains, just as the consumer world demands multiple restaurant chains. Each one offers something different that appeals to a different set of users. So, I expect Avalanche to remain one of the leading competitors to Ethereum for years to come, even after the Ethereum 2.0 upgrades are released.

Indeed, the moves by Grayscale and Terra demonstrate that leading crypto investment funds similarly view Avalanche as an excellent long-term hold.

Render Token

Render Token, a Solana network project, is focused on graphics processing, and that is going to be a HUGE part of the metaverse. I can’t write huge any huger to define just how huge I mean.

The metaverse is all about the visual content—much of which will be 3D, some of which will be 2D, and a lot of which will be a combo of both. By that I mean, think about a scenario in which you are inside a 3D metaverse bar with friends (as 3D avatars) watching a 2D sporting event on a bank of TVs on the wall.

That is 100% about the success of rendering that scene around you—making sure the 3D and the 2D work together in a way that is as seamless as being inside a real bar with friends, and watching a game on TV. You turn to talk to friends, and everything remains 3D, but then you turn back to watch the 2D game. The same needs to happen in the metaverse.

Render is the company that’s making that possible.

It’s down 30% as I write this, having been up just over 10% in recent weeks. This just shows the volatility in crypto at present.

Still, the overall trend lines are very positive for Render.

Since we opened our position, Render has been listed on Coinbase and Kraken, two of the largest centralized crypto exchanges.

It has also announced it’s working on a technology that would bring 3D graphics to the non-fungible token space—a project that would take NFTs in a new direction and open all manner of opportunities for NFTs being used in advertising and media. This project has amazing long-term potential.

Solana has emerged as a true force in Layer-1 blockchains. It’s the Apple to Ethereum’s Microsoft, meaning Solana has a fanboy appeal that is undeniable.

As projects continue to build out in Solana, particularly graphics-intensive metaverse projects, we’re going to see Render Token recover any lost ground and advance many times higher than our opening position.

The Sandbox

The Sandbox is our literal, direct metaverse play. It operates a metaverse on the Ethereum network. Indeed, it’s one of the most popular metaverses that exists today.

Its token is also down about 33%, amid the recent volatility.

As I noted above, sometimes a cryptocurrency falls due to nothing more than broader sentiment in the market as a whole. That is what is impacting The Sandbox. It is being weighed down momentarily by the fact that bitcoin is down and there are broader based worries about what’s going on in the economy with inflation and concerns about the Federal Reserve raising interest rates.

But on an individual level, what I see at The Sandbox gives me great confidence.

I mentioned above that PricewaterhouseCoopers, Standard Chartered, and HSBC have recently partnered with The Sandbox. Well, they join a host of giant brands that have already invested in digital real estate there, including Gucci, Warner Music Group, Adidas, and video game giant Ubisoft.

Again, that just reinforces what I noted at the outset of this dispatch: that the world’s biggest, most-recognizable brands are racing into the metaverse in droves.

Moreover, Ledger, the world’s leading crypto hardware wallet, just recently announced that it has bought land in The Sandbox as part of its push to create a destination of crypto-newbies to learn about cryptocurrencies, NFTs, crypto-security and whatnot.

In short, all the news about The Sandbox is positive. And being down 33% is not a matter for concern in the crypto space, where a coin can erase that decline in a couple of hours.

Star Atlas DAO

Star Atlas is our other pure metaverse play.

This is one of the most anticipated metaverses taking shape on the Solana network. It’s going to be a massive and expansive space-based game, with graphics so amazingly lifelike that it truly feels like these worlds and spaceships and characters really exist somewhere.

Star Atlas DAO is the governance token for the game now in development, meaning whoever owns the tokens has voting power in the business that runs the Star Atlas metaverse. Right now, however, these tokens are our worst performer—down about 46%.

This decline is a case of ennui mixed with overall market sentiment.

Star Atlas is going to be a powerhouse game globally, without question. However, the game is still months away from becoming reality.

When it was launched, there was obviously a lot of excitement surrounding it. Now that it’s mid-development, only the hardcore fans are paying attention. As such, the Star Atlas DAO tokens have taken a breather and retreated.

Moreover, there hasn’t been any news coming out of the project since December. That should change soon, though, as Star Atlas is about to releases its “Structures” collection—the mining rigs and power plants that will be critical to the game, since this is a play-to-earn game built around mining assets across the universe.

That’s scheduled to happen in the coming weeks, which should revive interest in what Star Atlas is up to.

This one was always going to be a longer-term play. We got in early and will ride the gains as the game arrives. So, I counsel patience.

Terra

Our last two tokens—Terra and Uniswap—aren’t metaverse plays. They’re straightforward crypto opportunities.

Terra (LUNA) has been on a tear of late and recently set an all-time high above $115.

Investors reacted positively to the fact that the Luna Foundation Guard, a Singapore nonprofit that’s part of Terra, purchased nearly $200 million worth of bitcoin to serve as a layer of security for TerraUSD (UST). It also announced it will acquire $100 million worth of Avalanche for the same reason.

UST is Terra’s dollar stablecoin—a cryptocurrency that is stable because it is pegged to the value of an underlying asset, in this case the U.S. dollar. UST operates on the Terra blockchain and has been growing in popularity. It is now the 10th largest cryptocurrency overall by market capitalization.

The bitcoin and Avalanche purchases are part of a plan to add $10 billion worth of bitcoin overall. The company said this bitcoin will be used to “backstop short-term UST redemptions.” To me, it’s a fine idea. Terra is creating a reserve account built around the most important coin in the cryptosphere, and one that will see six- and seven-figure values as this decade unfolds. It’s like backing your bank account with a bundle of gold.

LUNA is a governance token for the Terra network, and it benefits—it rises in value—as the Terra blockchain grows in size and reputation.

As I write this, Terra has drifted down to the $80 range. We’re still up about 20%. Because Terra continues to grow, our investment in LUNA will grow as well. The story here hasn’t changed: Terra remains a stablecoin powerhouse and we will benefit by owning its governance token.

Uniswap

Just this week, I had a discussion about Uniswap with my landlord here in Prague, Peter, who comes to me for advice on investing in crypto. He owns Uniswap and wanted to understand why it’s down. It’s off by about 40% since we opened our position.

As I told him, market volatility aside, it’s the “rotation thing.” This refers to a period in which investors trade out of one sector of the crypto market, say metaverse plays, to own another sector, such as Layer 1 blockchain plays.

Uniswap is a decentralized exchange (DEX) operating on the Ethereum and Polygon networks, and is the world leader by a long shot.

It controls roughly 40% of the global market for decentralized trading, meaning trading that doesn’t occur on a centralized exchange like Coinbase or Crypto.com, but rather through automated online systems. It’s next closest competitor controls less than 9% of this market.

But DEXs, as they’re called, aren’t in favor at the moment simply because there’s so much focus on NFTs and metaverses.

Plus, as noted, bitcoin and Ethereum, the peanut butter and jelly of the cryptosphere, have fallen of late and have taken down a great deal of the market with them.

But there’s simply no reason to worry.

Uniswap is the 900-pound gorilla in this space. It sucks up the bulk of the oxygen in the DEX space and that’s not going to change anytime soon. Moreover, there’s a catalyst to drive Uniswap higher: Ethereum and its promised upgrade that will see network transaction speeds explode to 100,000 per second.

When that upgrade happens, transaction costs on the Ethereum network will nearly evaporate to less than a penny apiece from tens to hundreds of dollars right now. This means the volume of trade across Ethereum-based DEXs is going soar.

Uniswap will be a primary beneficiary of that.

Free Bonus Report

Here at the end of our first quarter holding these seven cryptocurrencies, I see no reason to change course on any of our positions.

We are in a period of particular market volatility, but these are quality assets whose long-term potential remains high above our entry prices. So I counsel patience. We will recover these paper losses and push into profit territory in the months ahead. As always, I will send you an alert should my position change on any of our assets.

In the meantime, as we hold these assets, we can boost our earnings in them through staking…

Staking is the process of depositing your crypto into an account to earn additional coins in that same crypto. It’s just like putting U.S. dollars into a savings account and earning interest payments.

There are a number of reputable companies in the cryptoconomy that offer returns of up to 4% for depositing assets from the Frontier Fortunes Portfolio .

That’s not a massive gain, to be sure.

But it is an easy, low-risk way to grow your assets, rather than simply letting them sit idle in a crypto wallet or exchange account. And the small gains we earn today will be worth a lot more in the future as these assets rise in price.

So, as a special bonus, I’ve prepared a brand-new report to show you how and where to stake the assets in our portfolio.

In this report, I’ll explain why companies offer this return…the risks involved…and specific sites where we can stake the cryptos in the portfolio for additional gains. You can access it here.

I hope you find it informative and many thanks for joining me in exploring the new frontiers of the cryptoconomy.

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2022. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. Registered in Ireland No. 285214. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this report should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this report should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.