Dear Frontier Fortunes subscriber,

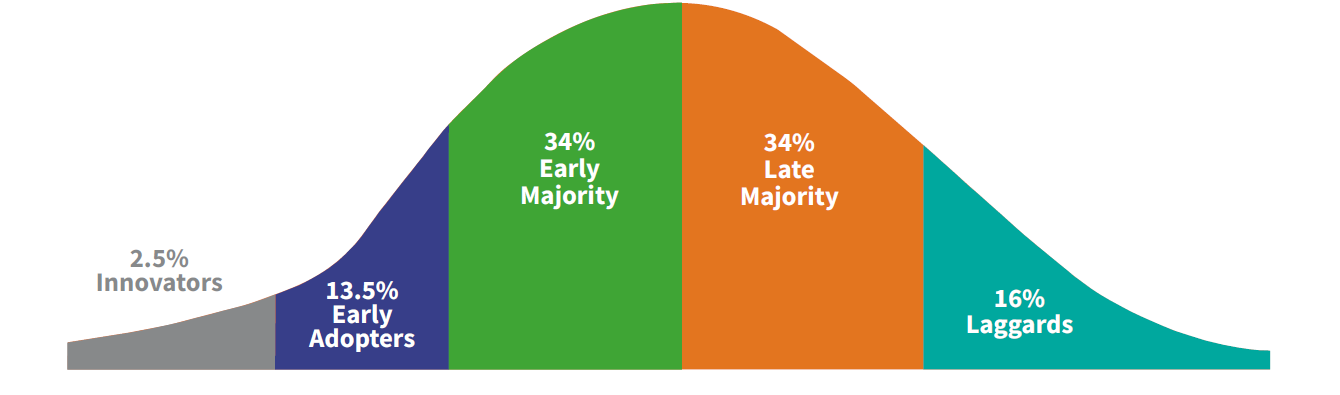

Virtually every groundbreaking new technology follows the same lifecycle.

This pattern is called the Diffusion of Innovation. It charts the order in which members of society adopt a new technology.

The lifecycle goes like this: innovators, early adopters, early majority, late majority, the laggards.

You've seen this play out in your own life over the last decade or so with smartphones.

When the first-generation iPhone emerged, the innovators were the folks eagerly buying at launch… even as the mainstream media was snidely asserting that smartphones would never represent a threat to the clam-shell phones from Nokia and Motorola.

After a while, the early adopters began to plow in because they wanted the fun of having the internet in the palm of their hand. And they saw the ways a smartphone could be useful, and how they could exploit that for advantage and even profit.

In time, the early and late majority got onboard. They didn't care so much about the tech as they did the convenience. And the fact that, well, everyone else had one, and every mobile phone plan was offering a smartphone of one kind or another… so why not?

The laggards… well, they're the Luddites always last to the party, the ones still clinging to their clam-shells years after most companies had stopped making them.

I offer that introduction because it frames this quarter's Frontier Fortunes—an important update about the rapidly shifting landscape in NFTs.

A quick refresher (that you probably don't need): NFTs are non-fungible tokens… a type of one-off, one-of-a-kind cryptocurrency. They look like digital art, but increasingly they function somewhat like a share of stock in that they represent an underlying business that's selling real products and services.

NFTs, as we currently know them, have only really existed for the past 18 to 24 months.

Early on—in the innovator phase—NFTs were mainly working to gain acceptance in a cryptoconomy dominated by currencies such as bitcoin, Ethereum, and others.

That innovator phase was both fun… and chaotic.

But now the innovator phase is over. NFTs have just crossed over into the early adopter phase—at both the consumer and business level.

In other words, we're entering into a new era of opportunity in NFTs…

Survival of the Fittest

Over the past year, the bear market has wiped out a lot of NFT projects. The figures for this are not available, but I would estimate based on my own observations within the NFT industry that 70% of the projects I've followed over the last 18 months no longer exist, or exist in such emaciated form as to be living ghosts.

But there's a sizable number that have not only survived the bear market, they've actually thrived and grown. They matured from rocky startups into ongoing, viable companies.

In other words, the weak have been weeded out. Now, only the strong remain.

This fact has not escaped the attentions of major corporations.

Where NFTs were once the playground of youngsters and people like me who saw where the world was going (the innovators), the space today is attracting a large number of companies you know by name: Nike, Adidas, Louis Vuitton, Walmart, McDonalds, Taco Bell, Goldman Sachs, Home Depot…

These are the early corporate adopters who are arriving with new, NFT-based business models.

They are, in turn, bringing in the early adopter consumers who see the fun and profit potential of owning digital Nike sneakers and digital Gucci handbags. Basically, this is the early stage of the mass market to come. (Nike has already earned over $185 million in NFT revenue.)

For us, this morphing of the industry represents an emerging opportunity… to collect passive income.

Numerous NFT projects that have survived and grown over the last year have a history of sending regular distributions to holders.

By "regular" I mean periods ranging from daily to quarterly, though most tend to distribute weekly.

And by "distributions," I mean these projects are sending NFT holders income much like a Wall Street company pays a quarterly dividend. Only in this case, the distributions are in cryptocurrency payouts in the form of US Dollar Coin (USDC), a stablecoin that tightly tracks the value of the U.S. dollar on a 1:1 basis, and Solana, the token of the Solana network and one of the dozen largest cryptocurrencies in the world.

Both of these tokens are traded on virtually every major crypto exchange… meaning they can easily be converted back into U.S. dollars.

Now, to be clear, NFTs remain volatile and risky, even those that distribute cash to holders.

The distribution amounts ebb and flow like the tide, meaning they can fluctuate significantly from week to week.

As this is crypto, the tokens that the distributions are paid out in also can move meaningfully.

Moreover, the value of the NFTs themselves can—and regularly does—rise and fall, so even while you're bringing in varying amounts of income, the underlying asset is bouncing around in price.

So, these assets have a vastly higher risk profile than dividend-paying stocks. That's just the nature of being so early to this emerging space.

But the rise of these income-generating projects marks a new moment in NFTs. And it marks a new opportunity for those who understand both the risk and the earning potential as this early adopter phase plays out over the next 18 to 24 months.

The "New NFTs"

Distributions paid out in USDC and Solana are a new trend in the NFT space.

When NFTs first emerged on the Solana network, there were a number of projects that offered "distributions" to owners. However, the vast majority of those payments came in the form of an in-house token… meaning a brand-new cryptocurrency specific to that project.

Generally, the goal of these projects was to develop a use-case for their new cryptocurrencies, which would create sustainable demand for the tokens.

A project known as Big Shot Foxes is a good example of this. It built a gaming ecosystem based on an in-house token that was never convertible into SOL or USDC.

There is nothing inherently wrong with NFTs that distribute in-house tokens. Indeed, I personally own some, such as ABC and Taiyo Robotics, that spin out in-house tokens with real value.

However, generally speaking, this is a challenging way to build a business. The NFT market is new and dynamic. Projects can quickly fall out of favor. And once interest in a project fades, demand for the in-house tokens falls, which means the price of the token collapses.

That's what happened with Big Shot Foxes. The project faded to nothing and the tokens aren't tradeable and, thus, are worthless today.

Over the past nine months or so, we've seen the rise of something new in the NFT space—real Web3 businesses with real customers spending real money.

Web1 was the first internet… the dial-up web of Ask Jeeves and AOL Online. Web2 is the current age of the internet, dominated by big data firms like Google, Amazon, Facebook, et al. But now we are moving into Web3… a decentralized era built on blockchain technology, the backbone of crypto.

New Web3 businesses are being formed daily. And one of their preferred ways to raise money is by selling NFTs.

In exchange for buying these NFTs, investors can gain distributions, essentially a form of profit sharing, in the form of regular USDC or Solana payments.

On the Solana blockchain, these new Web3 businesses can broadly be divided into two categories: online gambling and web development services.

Both categories have shown strong growth, despite the bear market.

Since the start of the year, I have been building a portfolio of these "new NFTs," and I'm going to share this portfolio in its entirety with you today.

At this point, let me say that I am not specifically recommending this as a portfolio of NFTs you should go buy right now. Instead, think of this more as Jeff's Guide to the New World of Income NFTs.

I want you to see what income NFTs exist, what they're up to as businesses, and the kinds of returns they can spin out.

My goal here is show you how the NFT space is morphing into a more mature market.

The New Bull Market

The emergence of these businesses is evidence of a wider trend… The Web3 economy, though still nascent, is beginning to take off.

Almost everyone I talk to in crypto these days—meaning project founders and big investors all over the world—is sensing a new bullishness taking hold.

In recent months, the Federal Reserve has finally slowed its roll with interest rate hikes. Moreover, the economy seems to be weakening, which should temper the Fed's willingness to enact further rate hikes. That's bullish for "risk-on" assets such as crypto.

It may seem counterintuitive to say that crypto could surge in a slowing economy. But when a new technology is truly groundbreaking, like crypto, it can take hold in a good economy or bad. Case in point: the first iPhone was launched in 2007, on the cusp of the Great Recession.

With that as a backdrop, I came into 2023 with the goal of sharply increasing the amount of Solana that I own.

As noted above, Solana is one of the biggest cryptos in the world. Moreover, it has a dedicated fan base, a dedicated band of Web3 developers building all manner of projects for this network, and it's one of the fastest blockchains out there.

That's going to serve it well as more and more consumer- and business-facing services look for a crypto home as blockchain technology invades every facet of our daily lives.

My expectations are that in the next bull market, Solana, now bouncing around the $20 to $25 range, is going to soar past $100. Over the longer term, I expect it to set new all-time highs north of $260.

As such, I have been in "Solana accumulation mode." Prices are cheap and I want to hoover up as much as I can for the big price run to come.

To that end, I've been building my portfolio of Solana-based income NFTs.

My 3 Criteria for Evaluating Income NFTs

Before I add an income NFT to my portfolio, it must adhere to each of the

following three criteria:

1. Only SOL or USDC distributions.

The projects I gravitate to are (or will be) distributing SOL or the USDC stablecoin.

I prefer not to deal with in-house tokens. Even when those cryptos are convertible into SOL or USDC, in too many cases there is limited or no liquidity in the in-house token, which makes conversion difficult or impossible.

Worse, sometimes that token has value only within a specific project's ecosystem. This is a risk because if that ecosystem loses its appeal, the token is useless.

SOL and USDC don't lose appeal because they are among the most popular tokens in the cryptoconomy and are listed on virtually every major crypto exchange. Thus, they can be easily converted back into dollars.

2. Proven projects or proven teams.

The projects that make my shortlist of income-generating NFTs either have a proven track record… or they're in turn-around situations, meaning their income has dropped recently for understandable reasons and I think those reasons are temporary, so I am grabbing the NFTs on the cheap.

Alternatively, they're new, but they're fronted by a team that has proven its mettle in a previous Web3 business.

3. A demonstrable payment history… for the most part.

Almost all of the projects I own or buy have a demonstrated history of payouts over several months or longer.

Not all of them, however.

A few have not yet begun to pay out for various reasons. For instance, I sent you an alert back in January about a new project called Orbital, which is a marriage of two other investment-oriented projects: Revenue Rebels and Droid Capital.

Both of those parent projects are successful… have a proven track record… and their founders are well-regarded in their respective communities. As such, I have great faith in Orbital's management and I expect it will soon be pumping income into my portfolio.

How Do NFT Projects Earn Money?

As I mentioned, the wave of new income-generating NFTs can broadly be divided into two categories: online gambling and Web3 development services.

Gambling has proven to be hugely popular in Web3, just as it is in Web2 and in real life. Thus, these projects have seen persistent demand, even in a bear market.

A project I own called Degen Fat Cats is a quintessential example of this.

DFC, as it's called, offers two online games—Degen coin flip and Degen dozer. The first is a simple coin-flipping game… players simply pick heads or tails. The second is similar to those real-world arcade games in which a blade moves back and forth, pushing on a pile of quarters.

The games are simplistic, but player demand and engagement are massive and that's driving a very real revenue stream coming from Web3 gamblers as well as gamblers who don't necessarily care about NFTs but are just looking for online wagers.

The "house"—i.e. the project—is earning fees and vigorish just like a traditional casino. With a coin-flip game, for instance, the setup is pari-mutuel meaning it's player-vs-player, and the house is simply collecting a fee for providing the service and website.

Degen Fat Cats is one of the forerunners of this new wave of

revenue-sharing Web3 businesses.

DFC pays out "affiliate distributions" every week, and in its Discord channel it posts all the statistics that define that week's payout. For the week ended February 16, gamblers playing DFC's games wagered nearly 163,000 Solana, worth almost $4.1 million. The week before, they gambled nearly $5 million.

I mean, think about that number for a moment. Assuming Solana and DFC wagering were to remain at current levels for the rest of the year, that would imply roughly a quarter of a billion dollars in annual gambling turnover… on an NFT platform.

There are companies listed on Wall Street that would kill for that level of revenue.

Until I see demand weaken, I don't mind owning a few gambling-related projects and the revenue they spin off.

In the other growth category of Web3 services, you have companies like FloppyLabs.

Don't let the cutesy name fool you. This is a genuine Web3 business that delivers back-end services to a broad range of other NFT projects.

For instance, FloppyLabs builds staking platforms other projects use and pay for so that they don't have to build this service themselves. (Staking is the process of depositing, or locking up, an NFT in a specific crypto wallet in order to earn distributions or other benefits.)

Such fee-for-service businesses are increasingly necessary as Web3 expands because NFT teams don't want to spend time building back-office infrastructure when they'd rather be building their product. Paying service providers like FloppyLabs makes a lot of sense.

Another prominent NFT project in the software-as-a-service space is Helio. It's a provider of Web3 payment solutions that enable consumers to easily spend crypto on their purchases.

At the moment this is still quite a young business and quite a young opportunity, though it clearly gaining traction because it's so simple to use. Just to give you a hint of what's to come: Helio has signed on two monster-sized customers in the retailing space: Shopify and WooCommerce, huge e-commerce platforms in Web2.

As those two make crypto payments available to their Web2 clientele, Helio is in position to become one of the payment giants of Web3, sort of like PayPal emerging out of eBay to become a global online-payments solution provider.

To me, companies like FloppyLabs and Helio are the Web3 equivalent of Web2 companies like Salesforce or Zoom that provide software-as-a-service. And though the economy FloppyLabs services is quite small at the moment (between $2,000 and $5,000 per week in sales), it's growing and I want that exposure—as well as the SOL-denominated income that FloppyLabs spins out.

FloppyLabs is finding success as a Web3 software-services provider.

My point here is that the NFT space is quickly evolving into so much more than just digital art. These are real businesses… often with significant revenue streams.

How Much Can You Earn?

There are currently 13 projects in my income NFT portfolio.

From these investments, I am currently earning between 14 and 15 Solana per month. With SOL at $25 as I write this, that equates to roughly $350 to $375… from investments that in total cost me roughly $10,500.

On an annualized basis, the returns I'm earning per NFT go as high as 116.4%, though that bounces around as both Solana and distributions move up and down.

I've included a list of these assets in the appendix to this issue, including information on their floor prices on secondary markets, distribution amounts, links to Twitter pages and Discord channels, and annualized returns from distributions.

Here, I'm going to highlight a few of the key projects so you can see the level of income these projects can offer.

I also want to reiterate that this is not a recommended portfolio. Instead, I want to share with you what I'm doing with my own money so you can see the kinds of opportunities that exist.

As a rule of thumb, I intend to hold these projects for a long period, but if prices for a particular NFT run up so dramatically that the return shrivels, I will be a seller of that project in order to capture the capital gains. (Note: Distributions and annualized returns are correct as of Feb. 23, and reflect the average over the past month.)

Let's start with DFC.

As mentioned above, Degen Fat Cats runs a hugely popular coin-flip game and a new coin-dozer game. DFC is one of the earliest, best-established businesses in this new Web3 economy, and has been paying out distributions for many months.

The floor price for one of these NFTs is 19.06 SOL. DFC offers weekly distributions of 0.167 SOL per NFT, which means it delivers an annualized return of 45.6%.

Another prominent income NFT in the gambling space is Immortals.

This project operates a wheel-spinning, player-vs-player wagering game

called Solana Shuffle, among other similar offerings.

At time of writing, a floor price Immortals NFT costs 14 SOL and the project pays out weekly distributions of 0.2454 SOL. That equates to a massive 91.2% annualized return.

The pixelated NFTs from Immortals deliver an impressive annualized return.

On the web development side, you have Helions. This project runs a Web3 payment-solutions platform similar to what Venmo and PayPal are in Web2.

Helio just recently launched Helio Play, a way for content creators to charge for their video/podcast content using fiat currencies or crypto.

This project makes quarterly payments, and its first payment at the end of December was $3.27 USDC per NFT. That should rise nicely across 2023 and beyond.

A floor price Helions NFT is 4.49 SOL, which means the quarterly distributions of $3.27 equate to annualized return of 11.7%.

Helions aims to be the Venmo of the Web3 economy.

Goofy as these NFTs can look, I don't really pay attention to them for the artistic quality, or lack thereof. I see them no differently, really, than a stock certificate in the sense that they might carry images of a pen-and-ink drawn eagle or a mine shaft or some other symbol of their underlying business.

What matters to me is what's behind the picture—the business operations.

And increasingly in the maturing NFT space, those operations are turning real profits… and distributing a large portion of that to their holders.

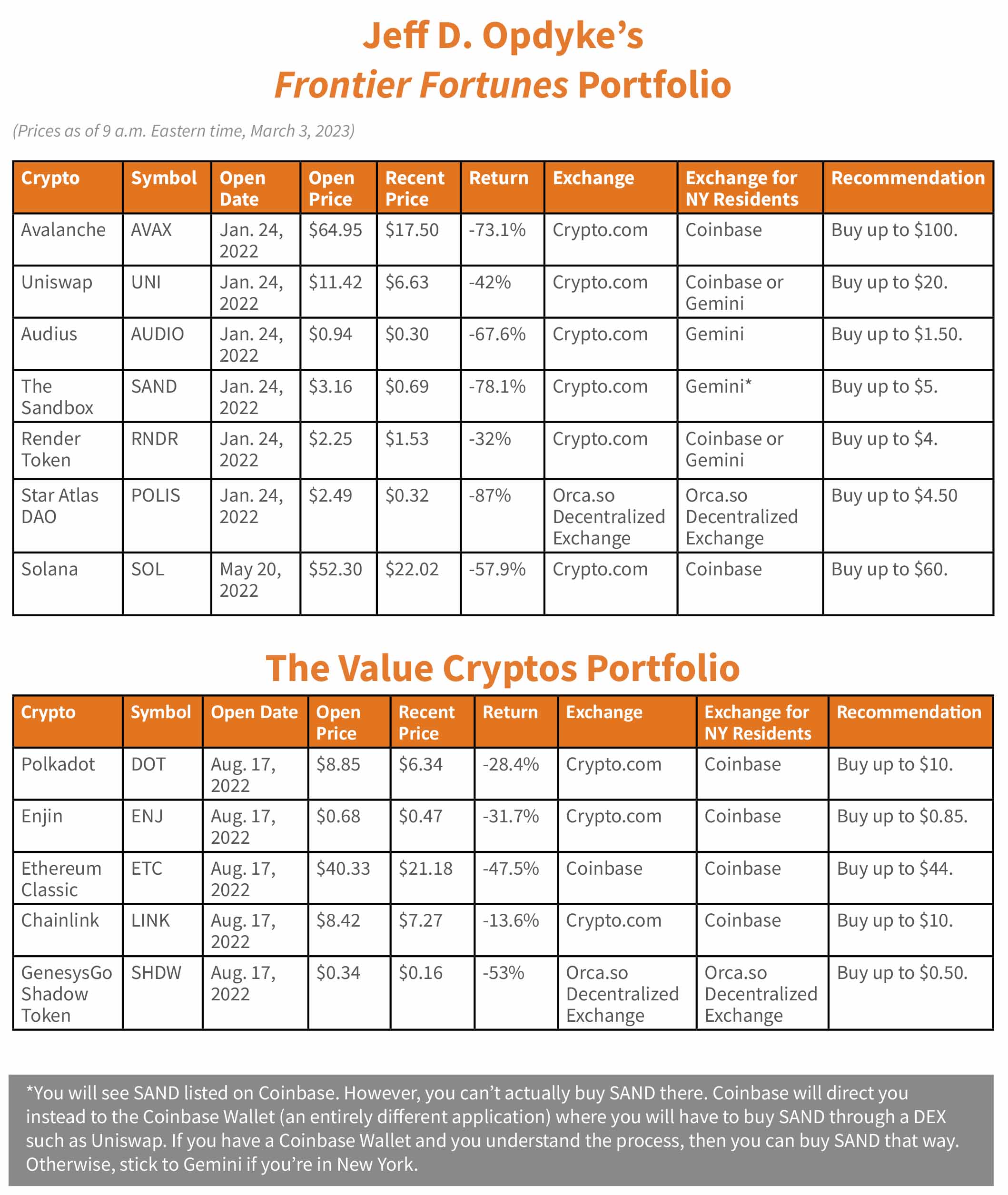

Our current portfolio of cryptocurrencies remains underwater, but signs of recovery are emerging as the Fed has tempered its aggressive interest rate hikes

Across the cryptosphere, prices are on an uptrend, and there is a newfound, if cautious feeling that we've seen the bottom for this cycle and that the early days of a bull cycle have either begun or are very near.

Bitcoin is a great example of this. As the granddaddy of crypto, it's a bellwether for the market. As goes bitcoin, so goes the crypto market overall (for the most part).

Since bottoming late last fall, bitcoin is up nearly 40%. Ethereum, the #2 crypto, is up similarly.

Many smaller cryptos are up significantly more.

Avalanche is one.

It's one of the top 20 cryptocurrencies in the world, and since bottoming in December the tokens are up nearly 70%.

A driving factor is that in January, Avalanche partnered with global tech giant Amazon and its Amazon Web Services (AWS) unit.

The aim is to bring a greater number of institutions and businesses into the crypto market. And if you're going to have a major tech player driving that change, Amazon is about as big a player as you could hope for, given AWS's global reach.

Under the tie-up, AWS users can access the Avalanche blockchain—known for its speed and low transaction costs—in order to build out all manner of financial services, including Web3 payments solutions that will allow consumers to use stablecoins or other cryptos to complete purchases.

It will take time to build these new services, of course, but this collaboration demonstrates that Web2 behemoths see the opportunity in Web3, and that Web3 (the cryptosphere) is where we are inevitably headed.

Uniswap has made a nice move off the bottom as well. It's up more than 30% since touching its lows late last year.

Uniswap is the largest decentralized exchange (DEX) on the Ethereum network.

The DEX is by far the global leader in daily trading volume, with nearly $800 million worth of crypto trading across Uniswap's five platforms on the Ethereum, Polygon, Optimism, and Arbitrum One blockchain networks.

Just this month, Uniswap's Decentralized Autonomous Organization (the online community of investors that governs the token like a board of directors) voted to deploy the third version of its platform, v3, on Binance Smart Chain, the blockchain operated by crypto exchange Binance.

At present, Uniswap competitor PancakeSwap is the leading DEX on BSC. By moving to this blockchain, Uniswap will likely capture a significant portion of PancakeSwap's volume.

Audius, meanwhile, has had a huge move, up more than 134% since late December.

Audius is a Web3 music-streaming platform similar to Web2's Spotify.

The reason for the move is quite bullish: Coinbase, a giant among centralized crypto exchanges, added Audius to its roadmap in January.

Coinbase typically adds a crypto to its roadmap as an indication that it will soon begin supporting trading in that currency.

That's a big deal.

Lots of cryptos trade on exchanges that are a challenge to get to, especially for Americans. Investors having access to Audius on Coinbase would very likely see demand for the token rise, which would in turn likely push the token's price higher.

Sandbox, one of the leading metaverse tokens, is up 94% since recent lows.

A big part of the reason: Saudi Arabia, which is trying to migrate its oil wealth into technology, in February partnered with Sandbox to explore metaverse opportunities.

Beyond announcing the memorandum-of-understanding, neither the Saudis nor Sandbox have detailed what this partnership ultimately means.

But as a giant in the Ethereum-based metaverse space, Sandbox is likely to see an ongoing stream of such deals as we move forward over 2023 and beyond, because companies and governments all over the world are now looking to build an early metaverse presence.

And then there's Render Token, a leader in the market for on-the-fly, high-speed graphics rendering, which is essential for the emerging world of artificial, virtual, and augmented reality.

Render is up 255% just this year so far—an example of what I mean when I say the crypto can move with lightning speed.

The reason for this is a higher profile for the token.

Late last year, Apple's App Store listed OctaneRender, a mobile app that enables people with graphical processing units (GPUs) to participate in the Render Network.

Separately, Revolut, the U.K.-based financial technology firm, recently added the Render token as a tradable asset on its platform.

Solana, meanwhile, is up more than 150%.

The #12 crypto has had a tumultuous few months. As if the Fed's excessive rate hikes weren't enough, the collapse of the FTX crypto exchange sent Solana diving. FTX and its founder, Sam Bankman-Fried, were heavily invested in Solana, and the unwinding of that position—along with fears that Solana-based projects would collapse—drove the cryptocurrency into the single-digits.

The last couple of months, however, have proven those worries wrong.

Projects on Solana continue building, and the network is now among the fastest around. Moreover, a bullishness is clearly evident among Solana project teams, as I covered in detail earlier in this issue.

Finally, a note on Star Atlas DAO, the token that governs the Star Atlas gaming metaverse that's still under construction. Star Atlas continues to build what is widely expected to be one of the most impressive gaming universes.

The primary game—the game everyone is waiting for—still has a good ways to go before launch, but the project is soon to launch a lesser game called Star Atlas: Golden Era (SAGE) that should be out in the next few months.

In my view, this is mainly to prove what Star Atlas is up to in order to bring in more institutional investors as the project continues to build out.

It's clear that the full Star Atlas game is going to be popular because of its revenue model (play-to-earn) and the story that defines the universe—namely a cosmic war between factions as they try to mine various planets in a distant world for resources that they can sell for real dollars.

The DAO—the decentralized autonomous organization owned by the community and which rules over the gaming universe—has $1.6 million in its treasury, so this is a very real organization. And it is generating marketplace fees as people like me own assets in the Star Atlas world that we will be able to lease to other players for income.

For now, though, the DAO token we own is underwater because the entire market for what are known as "alt-coins" continues to be weak until the next bull market. But this will rebound as the game development cycle progress.

The Value Crypto Portfolio

We're seeing the same trendlines in our Value Crypto Portfolio as with the main Frontier Fortunes Portfolio. Our positions are still underwater, but they've been moving nicely

Polkadot, which runs a network similar to Ethereum, is up nearly 50% since late December lows. There's not a lot of news on Polkadot to explain the move, other than an overall uptrend in crypto prices right now. Polkadot, as a top 15 crypto, benefits from the rising tide.

It's a similar tale with gaming token Enjin and Ethereum Classic, the original version of the Ethereum network before a split occurred several years ago. They are up 100% and 40%, respectively, since December as part of the broad market uptrend.

Chainlink has gained about 30% since late last year. Link, as it's called, is an "oracle" that brings real-world data onto the blockchain so they can be used in automatically executing "smart contracts."

Link, as the leading oracle, has been inking deals left, right, and center with all kinds of companies.

MakerDAO, one of the largest decentralized-finance lenders, recently partnered with Link to enhance the stability of its stablecoin, DAI.

StarkWare, which creates systems to expand and speed up blockchain networks, recently hooked up with Link to accelerate development of its StarkNet ecosystem.

Meanwhile, a fashion-and-lifestyle project called PLAY! POP! GO! is integrating a Chainlink service into its business. This will ensure fair, random trait generation for the Web3 products PLAY! PLOP! GO! sells.

Finally, GenesysGO Shadow Tokens are up about 80% from recent lows. Initially, the tokens were awarded to Shadowy Super Coder NFT holders on the Solana blockchain. The bulk of those distributions are done now, so there will be very little dilution of the currency going forward. That's good for the price.

As we move toward the second quarter now, the cryptoconomy feels like it's on more stable footing after an awful 2022.

The great unknown is the Federal Reserve. It appears, at present, to be tapering its interest rate hikes, which should facilitate more funds flowing into crypto.

If the Fed about-faces once again and deliver bigger-than-expected rate hikes, then crypto prices would retreat. But assuming the Fed acts rationally, 2023 looks to be a much better year for the entire crypto market.

Jeff D. Opdyke

Editor, Frontier Fortunes

In this appendix to this month's issue, I'm listing the investments in my income NFT portfolio.

Also included are links to each project's Twitter and Discord accounts, current distribution schedules and amounts, and a buy-in price I've calculated for myself for each project.

I currently own 13 income-generating NFTs. I have listed 12 below. The other is an NFT called Dope Growers' Society. Although I own that project, I have serious concerns about it, which I highlighted in an alert to you in January , so I have not included it here.

I have divided this appendix into two sections: the NFT projects that are already delivering income to owners, and those that are scheduled to begin paying out distributions in the coming months.

Before I list the portfolio, an important note: Almost all NFTs have a rarity function, meaning some NFTs within a specific collection are rarer than others, and thus are sold on secondary markets at substantially higher valuations.

For the most part, however, NFT rarity is largely irrelevant in the income-oriented collections. Those for sale at the floor price are good enough because they typically generate the same level of income and, thus, offer the biggest bang relative to cost.

That said, there are examples where rarity is a factor.

For instance, a project called Liquid Capital Doubloons offers two types of NFTs: gold and silver. Gold doubloons earn a 2x distribution, while silver earns 1x. (The income is based on an investment strategy the team uses to squeeze profit out of various decentralized finance operations that have sprung up in the NFT space over the last six months or so.)

So, that's a rarity-based trade that can make sense financially if you can grab a gold doubloon at less than 2x the cost of buying two silvers.

That said, here are the current holdings in my portfolio:

Current Income-Generating NFTs

Degen Fat Cats

DFC is a gaming/gambling project that runs a hugely popular coin-flip game and a new coin-dozer game.

Oak Paradise

This project runs an online casino, along with online poker and a sportsbook.

Note: You must own three Oak Paradise NFTs to earn distributions. Or if you own fewer, you need to have a Twitter Blue account (Twitter's paid subscription service) and use an Oak Paradise NFT as your Twitter profile picture.

SolBookie

This project is one of Solana's top sports-betting sites.

This is a turn-around play. The team recently offered a "free play" promotion as a marketing gimmick to bring in new bettors. The plan worked, but destroyed profitability in the short-term.

I expect SolBookie to return to normal profitability in the coming weeks and months. Assuming that happens, the current distribution is deeply understated and could be 5x to 10x higher.

Revenue Rebels

This project operates almost like a real-world fund-of-funds that are common among high-net-worth investors on Wall Street, in which an investment manager puts client funds to work inside other investment funds.

Revenue Rebels invests in other NFT income projects, based on the trading/investment strategy of the founder, known on Discord as Stoizy. And he has an admirable track record.

Of the income Stoizy generates, 45% returns to Revenue Rebels holders, while another 45% goes back into the project to continually increase the amount of investible SOL. That's a hidden value.

All that extra SOL going to work will increase distributions over time. Plus, if the entire project were liquidated today, each NFT holder would collect between 2 and 2.5 SOL just from the dissolution of the community fund.

The project recently halved its payout while seeking new opportunities, but it's flush with cash.

Revenue Rebels have four different rarities based on the style of each Rebel's wings.

Tier 3 NFTs, which have the lowest ranked with fire/water/ice wings, have a 1x multiplier. Tier 2 (turtle/stone/volcano wings) have a 1.1x multiplier. Tier 1 NFTs (acid/cheetah wings) have a 1.4x multiplier. Legendary NFTs have a 5x multiplier.

Mathematically, Tier 3 Rebels are the most cost-effective buys at the moment. Those have a floor price of 2.47 SOL, with a daily distribution of 0.02 SOL and an annualized return of 29.6%.

Note : Revenue Rebels must be staked here to earn distributions.

Immortals

A new project started late last year by a team that includes a founder of the popular High Roller Hippo Clique, an NFT project that runs gambling and casino gaming.

Immortals operates a wheel-spinning, player-vs-player wagering game called Solana Shuffle, among other games. The community recently decided to switch to weekly payouts from 2x per week.

Note : You must stake your Immortals here, and you must claim the distributions weekly by going to this site and clicking the "Claim" button.

Looties

This project operates another popular gaming platform and is well-known for its "Lootboxes," in which players purchase a box with SOL and can win up to 100x their purchase price.

Looties takes a 4% fee for each transaction. Three of those percentage points go to NFT holders in the form of a weekly distribution.

This is another turn-around project. The site was recently compromised, prompting the team to temporarily warn everyone away. Distributions sank. That has been rectified and a new, more-secure site is up and running now.

Helions

This project runs a Web3 payment-solutions platform similar to what Venmo and PayPal offer in Web2. The team just recently launched Helio Play, a way for content creators to charge for their video/podcast content using fiat currencies (like U.S. dollars) or crypto.

Helio makes quarterly payments, and it's first payment at the end of December was $3.27 USDC per NFT. That should rise nicely across 2023.

Note: Buying now will make you eligible for your first payment in the second quarter, since you must own your Helions NFT for an entire quarter before qualifying for distributions.

FloppyLabs

This project provides back-office Web3 services for other NFT projects.

Liquid Capital Doubloons

As mentioned earlier, this project is tied to an NFT and crypto investment strategy operated by the team. Doubloons come in two varieties: gold and silver, with gold earning a 2x distribution to silver's 1x share.

Future Income-Generating NFTs

I have invested in several projects that have not yet started distributing income but will soon. These include:

Orbital

This is a combination project pairing the founders of Revenue Rebels and Droid Capital that will focus on each team's different investing style. I sent you an alert on this project back in January. (I can't display the NFT for this as they haven't yet been released.)

The team has finished selling NFTs and raised almost half a million dollars. It has begun investing some of that money and will distribute its NFTs to owners in March. Weekly distributions of SOL will begin shortly thereafter.

Future Traders

This is from the team behind the lending platform Yawww, which I've written to you about in a past quarterly issue.

They've built a new platform that brings Wall Street-style options trading to NFTs. That platform is still in beta, but it looks sleek and smooth.

My bet is that options trading in NFTs is going to find a big audience because it represents a new income opportunity and a way for NFT owners and traders to mitigate risk in this space.

Distributions will be in SOL and based on trading fees the platform earns. Those distributions will begin once the platform is fully operational and open to the masses, which will be soon. The current floor price for a Future Traders NFT is 3.37 SOL.

King Demons

This is the collection tied to DegenLabs that I mentioned to you in a recent alert. It's from an established Web3 gaming brand with more than 40-plus partnerships across the NFT space.

The project comprises two NFT collections—Demons and King Demons—both of which will launch later this month. Only King Demons will earn income distributions.

King Demons will earn SOL weekly, based on gaming fees the project earns and income generated by a new online auction marketplace that DegenLabs is about to launch.

© Copyright 2023. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.