Dear Global Intelligence Letter subscriber,

At some point in 1998 or 1999, I was in Alaska on a reporting expedition. A source I was meeting near Homer took me onto a supertanker in Kachemak Bay. It was an Alaska-class VLCC (very large crude carrier), and I truly don’t know how to quantify its size.

Maybe this: I felt like a guppy next to a whale shark. A flea lost on a gorilla. They. Are. HUGE!

An Alaska-class VLCC is nearly 950 feet long—almost three football fields. They carry 1.5 million barrels of oil in vast, swimming pool-sized storage tanks below deck. To put that in some context, that quantity of oil would be enough to provide a free tank of gas to every Toyota Camry (America’s most popular car) sold over the next six and a half years.

And that’s just a single ship.

When you stand on one of these behemoths, you are struck by two thoughts:

Of course, for a moment there in 2020, it seemed like oil was a goner.

The pandemic killed air and sea travel. People globally were working from home rather than commuting into cubicles. Production processes for so many things simply stopped. As a result, demand for oil fell off a cliff.

Just about a year ago, mid-November 2020, my landlord here in Prague stopped by the apartment to pick up the month’s rent. Peter actually works offshore as an inspector on oil rigs in the North Sea. At the time, he hadn’t set foot on a rig in nine months.

He was understandably downbeat on the oil industry’s prospects.

But I had a different perspective. I thought about that supertanker in Alaska…about the insane infrastructure we’ve built to extract oil and ferry it around the world…how for better or worse we’re all dependent on oil in our day-to-day lives.

I told him that I had a suspicion that crude prices were about to take off because of a rebounding, post-pandemic global economy and the inflation it would unleash.

My words to him: “We’re going to see oil above $100 a barrel again.” (I wrote the same to you in a mailing earlier this year.)

At that moment, Brent Crude, the global benchmark for a barrel of oil, was in the mid-$40s. As I write this, Brent Crude is at about $85, nearly doubling its price over the past year. It will absolutely see $100…and probably beyond.

You see, despite that gangbuster jump in oil prices, the world has not yet fully reopened.

COVID radically shifted global oil consumption, the same way an earthquake radically shifts a mountainside road. We’ve not fully rebuilt that road—we haven’t returned to pre-pandemic consumptions levels—but we will get there next year.

A lot of money is going to be made as consumption increases.

Some of it will be made in oil production, to be sure. But I believe a better bet is those supertankers…the business of moving oil around the world. It is, after all, a natural progression:

So, that’s our opportunity this month: energy transportation. However, this is energy transportation with a twist.

We’re coming to this opportunity at a particularly uncertain moment for global markets.

Runaway inflation around the world, a winter COVID resurgence that could blunt the global economic recovery, a likely move by the Federal Reserve to cut back on the free money it pumps into the economy…

Put these factors together, and it’s clear that we need protection.

So, that’s what I’ve found us. It’s an energy transportation investment that offers a dividend yield of 10%. Better yet, it’s on a stock that comes with what is effectively a built-in, no-loss mechanism.

Plus, right now we have an opportunity to buy this stock for less than its “face value,” meaning we can lock in some capital gains straight way.

This is our way to profit from the oil boom…with little or no long-term risk to our money.

At around 950 feet, a VLCC supertanker is almost as long as three football fields or standing upright, as tall as Tokyo Tower.

Prior to the pandemic, the world was gulping down just over 100 million barrels of crude every single day. Then, when everything shut down due to COVID, demand collapsed to only 80 million barrels.

Although we’ve climbed a long way back, with daily demand now at roughly 97 million barrels per day, we’re still shy of pre-pandemic thirst.

That’s very likely a short-lived truth.

In September, the Organization of Petroleum Exporting Countries (OPEC) reported that, based on its analysis of demand, oil consumption in 2022 will exceed pre-pandemic levels. We’re set to move back above 100 million barrels per day, and close in on 101 million.

One of the factors driving that is a sudden demand for oil to fire power stations.

For much of the 21st century, natural gas was so abundant and affordable that governments, especially in Europe and the U.S., mothballed oil- and coal-fired power plants to focus on building natural gas and renewable energy facilities.

Now, that’s flipped on its head.

Today, natural gas supplies are exceedingly tight, the result of pandemic-related production problems, environmental handwringing, and other issues. In Europe, for instance, the Netherlands is shuttering a gas field that produced enough natural gas to completely quench demand in Germany, Europe’s largest economy.

The combined effect is that natural gas reserves globally are so low that bidding wars are breaking out. In one recent example, a Royal Dutch Shell supertanker sailing to Asia from France with a cargo of liquified natural gas made an abrupt, mid-ocean U-turn when buyers back in Europe overbid their Asian competitors.

Since just this past spring, natural gas prices have spiked from $1.75 per million British thermal units to about $5—an increase of 185%. (British thermal units, or Btus, are a measure of the amount of heat required to increase the temperature of a pound of water by 1 degree Fahrenheit. They’re also how liquefied natural gas is quantified.)

Because gas supplies are so tight and prices are up so much, power companies are now restarting some of those mothballed power plants, thereby significantly increasing demand for oil…

That’s probably one of the reasons why Russian President Vladimir Putin predicted in October that oil prices will top $100 a barrel.

Maybe I’m being cynical, but the head of the #3 oil-producing country in the world doesn’t make “predictions” so much as he decides where he wants oil prices to go.

Oil is going to $100 a barrel, and then some…

Skyrocketing oil prices are not just a function of an emerging global energy crisis, but of the commodity super-cycle I’ve been writing to you about for many months. (See the May issue for full details.)

That super-cycle is now playing out across the world.

Just a few weeks ago, New Zealand reported the fastest expansion of consumer prices in more than a decade. The governor of the Bank of England, meanwhile, told U.K. residents in October to expect that inflation will be higher and last longer than expected. And in late October, U.S. Treasury Secretary Janet Yellen announced that inflation, currently at 5.4%, will run longer than anticipated on the home front (a message I’ve been delivering for most of the year now).

Companies ranging from PepsiCo to Procter & Gamble, from Whirlpool to General Mills, are jacking up consumer prices—and promising higher prices to come—because inflation is raging within their supply chains for everything from cotton and corn to iron and soybeans.

Oil has a lot to do with all of that.

Higher oil prices obviously make it more expensive to transport goods from production facilities to store shelves.

But there’s also the not-so-obvious costs tied to the fact that oil and its byproducts are ingredients in so many products—plastics for packaging, glues to adhere labels, artificial rubber for all sorts of uses, polyester for clothing, etc.

So, oil is strongly connected to the super-cycle and as such, it will continue to rise in price long after the energy crisis plays out. That’s why we want long-term exposure to oil in our portfolio.

However, while owning major oil companies such as Exxon, or exploration and production companies such as Apache are obvious plays on this rising oil price/super-cycle trend, what I care about right now is looking for a stock that will not only win from a sustained increase in oil demand, but which also offers us some protection from a potential market meltdown.

A crisis on Wall Street is a clear-and-present danger these days because:

The Fed’s bond buying for the last dozen years or so has been a primary fuel for higher stock prices. Take away some of that fuel, which is expected to happen late this year or early next, and we could see the market drop 20% or more.

Similarly, any move to raise interest rates, which will likely be necessary to tame inflation, would see money move out of stocks, particularly the high-flying, belles of the ball—the overly expensive technology stocks. Once those darlings are exposed as overvalued, Wall Street is going to be singing along to Paul Simon’s Slip Slidin’ Away.

So, I want an investment that gives us exposure to the oil-demand trend, yet also provides some shelter from a potential Wall Street tantrum.

A company like Tsakos Energy…

About 60% of the oil consumed globally has to move across oceans first. So, when I spoke above about meeting global oil demand post-COVID…well, it’s supertankers that will do the bulk of the heavy-lifting.

Tsakos is the world’s seventh-largest owner of these ocean-borne behemoths. It operates a fleet of 64 supertankers specially built to carry crude oil, petroleum products, and liquified natural gas around the world.

So far, Tsakos’ share price hasn’t really done a whole lot this year—bouncing around between $7 and $11 a share, and currently sitting right in the middle of that range at about $9 as I write this.

That’s because day-rates (the daily rates companies pay to lease a supertanker) are pretty much where they were when the year began…right about $25,000 per day for one of the VLCCs like I visited.

You might imagine that, given the skyrocketing price for oil, the $25,000 day-rate is a lofty price. Actually, that price is low by historical standards.

To understand why rates are currently low, let’s hop back to the insanity that was 2020 in the oil industry.

Even as oil prices plunged amid the pandemic last year, supertanker day-rates spiked. VLCC rates at one point had soared to $300,000 per day!

That was all a function of the collapse in demand for oil and petroleum byproducts.

Early on in the pandemic, existing oil had no end user, since planes stopped flying, cars stopped driving, and everything in the world pretty much shut down. That meant onshore storage tanks quickly filled up.

With onshore storage tanks at capacity, companies had to lease supertankers to store oil on the high seas. Demand for supertankers exploded. Available supertanker supply quickly shrunk. Day-rates shot the moon.

Meanwhile, as oil prices fell and fell, Wall Street started to get interested. Traders began locking in futures contracts on oil at low prices, expecting that oil would sell for much higher as the world reopened.

That put even more upward pressure on supertanker demand. Storage capacity onshore was packed. And some of the oil buyers—hedge funds and investment partnerships—don’t own oil storage tanks. So, again, they all turned to offshore supertankers for their storage needs.

The upshot of that crazy year is that tanker owners pulled in big earnings in 2020—a year in which one might rightly expect a lackluster performance.

Tsakos, for instance, saw its revenue jump to more than $644.1 million from $597.5 million in 2019. Net income nearly doubled to $27.2 million from $14 million.

All that extra cash will help supertanker firms more securely navigate the current tides because… just as quickly as day-rates spiked, they collapsed to levels last seen in 2003. That’s because the world did begin to reopen, just as oil traders expected.

Oil demand shot up. Traders sold off their oil for big profits. Refineries started refining again. Consumers started consuming again. And offshore storage needs plummeted.

Now we’re back to a more normal situation in which supertanker demand is largely a function of moving oil around the world. Day-rates have rebounded a bit, but as I noted just above, today’s $25,000 rate for VLCC-class supertankers is still low.

However, this situation is unlikely to last.

As the world burns through its stockpiled oil, it will need tankers to deliver new supplies.

Fearnley’s, one of the world’s top shipbrokers, wrote in a late October update that “There is a palpable feel in the VLCC market that we are heading into a firmer winter market, as sentiment amongst owners continues to build.”

Another shipping-industry expert, Bimco, put it this way in early September: “As [oil] demand is forecast to exceed 2019 levels in 2022, the outlook for tanker shipping is better next year.”

That tells me that 2022 should be a good year for companies such as Tsakos. That benefits us because it fattens the company’s income statement, ensuring it can pay us that chunky 10% dividend I mentioned earlier.

Yet, because the supertanker day-rates are still low, right now we have a chance to pick up a special class of crash-resistant Tsakos stock for less than “face value.”

That class of stock is known as “preferred shares.”

Tsakos has two types of stock listed on the New York Stock Exchange: common and preferred. It’s the second kind—the Preferred F-class shares in particular—where the opportunity exists to collect a capital gain and a big, annual payout as oil demand, oil prices, and supertanker day-rates rebound.

There are two primary differences between common and preferred shares:

So, basically, common shares are just like the shares of Apple or IBM or Kroger or any other stock you might hold in your brokerage account.

Preferred stock is a hybrid critter—like a rabbit and a turtle morphed into a “rabburtle.” It has traits that resemble bonds (the turtle), but it’s running around in the stock market clothing (the rabbit).

The upside of preferred shares is the big, consistent, all-but-guaranteed payouts.

The downside: Preferred shares generally don’t move much in value.

Preferred stocks typically hang out near their so-called par value, the face value of the preferred shares when they were issued; or near their “liquidation preference,” a minimum price the company would have to pay if it wants to retire, or buy back, the shares. (Which one a preferred stock hangs out at depends on how it’s structured.)

For most preferred stocks, the par value is $25 or $50, though you will occasionally see others at $10 or even $100. For Tsakos’ Preferred F-class shares, it’s $25.

Income investors like preferred shares because they generally offer big yields and they tend to be more resistant to run-of-the-mill stock market weakness. That gives them stability. And that can be especially comforting in a moment like now, when Wall Street is expensive and the Fed is very likely to soon be active.

If the stock market dives, preferred shares tend to hold up better and rebound back toward their par value/liquidation preference. That’s the protection I want right now as an investor.

I’m not saying preferred stock is crash-proof. It’s not. But it has attributes that help stabilize the price and push it back up relatively quickly.

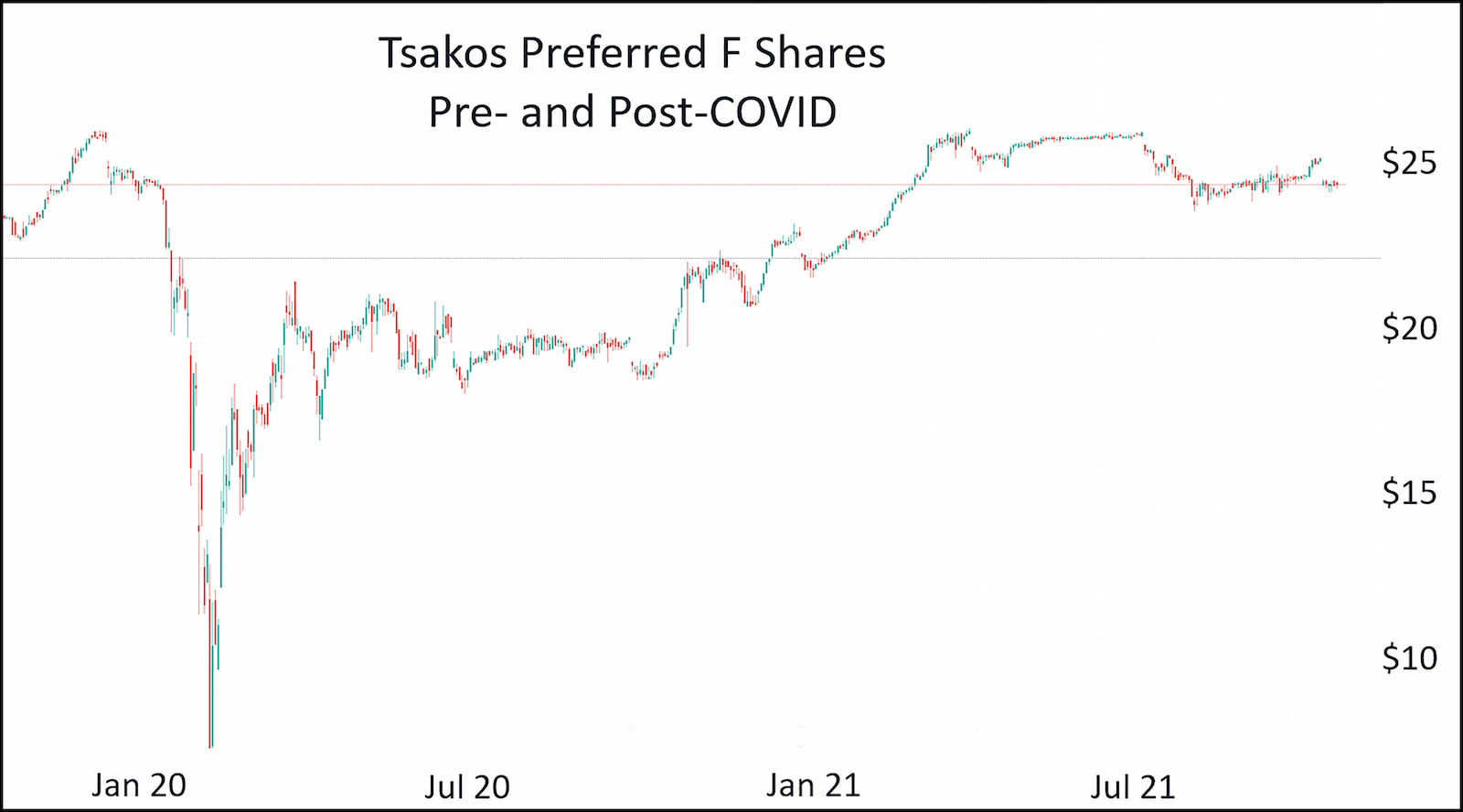

This is exactly what happened with Tsakos Energy’s Preferred F shares during the COVID panic in early 2020.

Between mid-February and mid-March 2020, the F shares dove more than 50%—an annoying loss on paper, no doubt. But they rebounded because at lows in the $10 range, those F shares were yielding nearly 24%—a yield too meaty for traders to overlook.

Investors know a preferred stock dividend isn’t likely to get cut. Plus, if it does get cut, then most preferred shares are designed so that all missed dividend income must be repaid before common shareholders see a penny, or they must be repaid in full when the company buys back and retires that class of preferred stock.

Because those are the rules of the game, investors tend to snap up preferred shares when yields rise. They know that:

That’s also our opportunity here.

There’s one other facet I want to tell you about regarding preferred stocks: They can trade at a premium or a discount to their par/liquidation value.

If a preferred carries a par value of $25 and it’s trading at, say, $30, then it’s trading at a 20% premium. If, on the other hand, the shares are priced at $20, then it’s trading at a 20% discount to par.

So, when preferred shares are trading at a premium, then you’re locking in an assured capital loss, assuming the company buys back the shares. Conversely, if the shares are trading at a discount, then you’re assured of a capital gain, if the company buys back the shares.

I say “if” because that’s another little quirk of preferred stock. Some of it is so-called “perpetual,” meaning it has no specific date on which a company can/will repurchase its preferred shares. It just exists for, basically, time immemorial—or until a company dies or merges with another company or whatnot.

Other preferred shares have what’s known as a “call date,” the date on or after which a company can repurchase all or some of its preferred shares. If a company calls in those shares, it buys them back from investors at the par value/liquidation price, plus any accrued dividends.

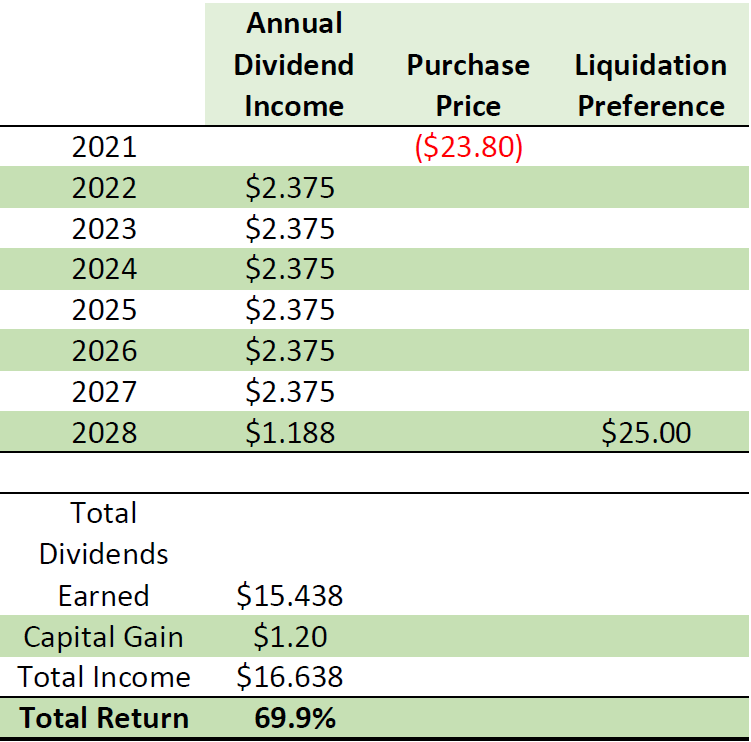

As I write this, Tsakos Preferred F stock is trading at $23.80. Meaning, we can buy the shares at a nearly 5% discount to their $25 liquid preference. It’s not massive, but it means we’re effectively locking in a capital gain since Tsakos will repurchase the shares at some point for $25 apiece.

To be clear, we could see paper losses as the Preferred F share price moves around. But real losses aren’t likely because we’re buying below the liquidation preference.

So in essence, right now we have an opportunity to buy the stock below its “face value” and collect dividends for owning it. And all just as the oil industry is about to boom.

Tsakos’ F shares have a call date of July 30, 2028. So, we have more than six years to collect quarterly dividends that currently amount to a yield of 10% annually.

I am recommending a buy price up to $25 to all but ensure that we don’t face any losses when/if Tsakos gets around to buying back its Preferred F shares. (By the way, if you do end up buying at $25, your yield is still a very meaty 9.5%.)

Just to be clear, there is no guarantee that Tsakos will immediately repurchase its F shares the moment the call date arrives in 2028. The company could go on paying quarterly dividends for many years thereafter. And that’s perfectly fine—just means we continue collecting our big dividend payments.

Tsakos does, however, have a long history of regularly buying back its preferred stock. At some point, the company will repurchase the F shares. Tsakos can choose to buy back the shares for cash or give the equivalent value in its common stock, but either way we get $25 in value.

So, by locking in a buy price at or below $25, we don’t face a capital loss and, instead, we just collect quarter after quarter of big, fat dividend income…and an eventual capital gain in the range of 5% or so.

We will collect our first dividend at the end of January and then every three months thereafter. The quarterly payments will be $0.59375 per share, or $2.375 per share per year.

You will be able to grab Tsakos Energy Preferred F shares through any U.S.-based brokerage firm.

But there is a caveat: the stock symbol.

There’s not a single, universal symbol for Tsakos F shares, or indeed preferred shares from any company. The symbol is a function of where you do your stock trading.

Common stock symbols are identical from one brokerage firm to the next. AAPL, for instance, will always be Apple, no matter which firm you use. Ford will always be F.

However, preferred symbols are a function of each brokerage firm’s back-office system when it comes to assigning trading tickers to preferred shares and other units that are not straightforward common stock.

At Fidelity, for instance, Tsakos’ Preferred F symbol is TNP/PF.

At E-Trade, it’s TNP.PR.F.

And at Interactive Brokers, it’s TNP PRF.

If you’re using a brokerage firm different from those four, log into your account and use the “search stock symbol” function and type in “Tsakos Energy” or “Tsakos Energy Preferred.” You should see the common shares pop up (symbol: TPN, universally) as well as the Preferred F shares.

Click on the F share if you can, or make note of the symbol, and use that when setting up your trade.

With this trade, we’re not setting a stop loss, as we’ve done in the past. There’s no real reason we want to exit the stock in the event of a market-wide selloff. If that happens, we will patiently sit on paper losses, happily collecting our 10% dividend yield, knowing full well the shares will return to a price range very near the $25 liquidation preference, and that we will one day be taken out of our position at $25.

With this investment, we are not going to shoot the lights out in terms of capital gains. We’re specifically investing in these shares because we want to grab a stable, 10% yield in a company where demand for its services is going to be robust as oil consumption rebounds, and oil prices increase amid the unfolding commodity super-cycle.

Two items I want to bring to your attention this month in our portfolio review.

We start with Carter’s Inc., the baby-clothes maker we own. Carter’s just reported its third-quarter earnings at the end of October. Wall Street was wagering the company would post earnings of $1.73 per share. Alas, Carter’s did not post $1.73 per share. It posted $1.93.

In its earnings release, Carter’s Chairman and CEO Michael D. Casey noted that the company “meaningfully exceeded our earnings objectives for the third quarter,” and he told Wall Street to expect even better going forward.

“We are raising our previous sales outlook for the fourth quarter… This improved outlook reflects the benefit of [among other things] favorable trends in international demand.”

I’m going to say those favorable trends are rooted in the increased number of pregnancies that have been popping up all over the Western world. As I noted in my original recommendation on Carter’s in the September issue, those who watch population trends were expecting a baby bust because of COVID.

But my research found that the expected baby bust was really a late-developing baby boom. And here we are: Our baby clothes-maker is reporting better-than-expected numbers.

Carter’s strong earnings, and its expectations for an even stronger fourth quarter, tells me that the quiet baby boom thesis is playing out.

The company’s share price has been weak-to-down since we bought it (we’re currently up a bit over 1%). I expect that trend to reverse, especially as we’ll likely be hearing about a dividend in either November or December. I’ll let you know when/if that happens.

Moving on to crypto…

Our BlockFi crypto interest account is pushing higher again. BlockFi just recently announced that the interest rate it’s paying on stablecoin deposits has jumped to 9% as of Nov. 1. BlockFi was paying 8.25%.

BlockFi’s rates fluctuate because of conditions in the crypto market. Crypto prices have rebounded strongly in the last month or so, and demand for borrowing is strong, so BlockFi is sharing that increased income with depositors.

BlockFi has also been in the news of late because various states want to ban residents from opening new BlockFi interest accounts (existing accounts are unaffected). Regulators claim those accounts are securities (they are not) and wants BlockFi to be properly registered to offer them.

BlockFi for its part is taking the time to explain to regulators that their perceptions are mistaken. And some regulators are taking the time to listen. This is a good thing.

I want regulation in crypto. Regulation would be the catalyst that cements crypto as the next iteration of money, and it would curb a good bit of the volatility in crypto.

Right now, every time some mainstream news organization burps up the notion that some federal agency might think about possibly regulating crypto, the market falls out of bed.

Problem is, I know how the news cycle works. “News” is very often fabricated in morning meetings. It goes something like this:

“Hey, so, XYZ Newspaper had a story on some 13-year-old who made a million dollars trading Dogecoin,” says an editor who has no clue about crypto. “That seems way too risky. There’s gotta be a federal agency looking to regulate this. Mary Jane—you have a 13-year-old. You write it.”

Mary Jane calls around and gets in touch with a middle-manager she knows at some non-financial agency, who tells her he remembers hearing someone in a Zoom call a couple months ago mention that someone else heard that the SEC or some other agency is thinking about looking into crypto…

And THAT turns into a regulatory story that sends crypto prices into a frenzied tantrum.

So, I welcome the rollout of smart, forward-thinking regulation because it will lessen market fluctuations caused by uninformed media speculation.

By Seán Keenan

Seán Keenan is the managing editor of International Living magazine. He was on the ground in El Salvador during early September when the country became the first in the world to adopt bitcoin as legal tender.

It took until after nine in the evening—late by tropical standards—before the conversation finally turned to surfing. Waves, boards, currents, the ones that got away; topics that usually stoke the fire of conversation in places where the ocean has that magical mix of warm water and consistent swell. Prior to that point, pretty much every conversation I had in El Salvador concerned bitcoin.

But the story of bitcoin in El Salvador is interwoven with surfing. It’s no accident that the focal point for one of the year’s biggest international finance/tech stories—El Salvador’s adoption of bitcoin as legal tender—is a mile-long stretch of black-sand coastline.

Some of the planet’s finest waves peel off the point break in El Zonte. I caught a few on my first morning there. If you mess up your take-off, they’re punishing. The blood tracks I earned down my right shin are testament to how insistently they’ll drag you along the seafloor. Nevertheless, when you catch a good one, the ride is smooth, and long, and glorious.

That point break is enough to bring riders from every corner of the world to the “town” of El Zonte, which is in reality little more than a cluster of single-family homes and surf lodges.

Among those who came in search of the perfect wave was Californian Mike Peterson. He developed a liking for the sleepy community and started doing charity work there when an anonymous donor offered a gift of $100,000. The caveat? That the money be distributed in bitcoin, not fiat currency, and that the locals in El Zonte be educated in how to use the crypto.

Peterson, an early bitcoin adopter, was amenable. The project, and later the town itself, became known as Bitcoin Beach as El Zonte grew into one of the first places in the world where bitcoin was used for everyday transactions.

On my second night in El Zonte, I ate in an open-sided diner serving burritos and the Salvadoran specialty pupusas (a flattened meat-stuffed corn dough dish). The restaurant didn’t have windows, and my beer didn’t come with a glass. Roxana, the waitress/cook/owner simply yelled across the dirt road to the adjacent store. The kid inside grabbed a bottle from the refrigerator, opened it, trotted over, and placed it on my table.

No windows, no doors, and not even a cash register, but…I paid for my meal with bitcoin. It’s a strange contradiction.

There, in a dimly lit shack, as the evening rain hammered on the corrugated roof and made conversation a near impossibility, Roxana and I held smartphones up to each other, scanning QR codes, and smiling when the plink of an app notified us that $6.50 worth of bitcoin had left my BlueWallet and was accepted into her Bitcoin Beach crypto wallet.

“Imagine if you gave someone a smartphone for the first time,” Roman Martinez suggests. “They’d be a little confused for the first hour, but a day or two later they’ll be using it without any problems. That’s what we’re working on with the Bitcoin Beach project. We’re trying to get people to adopt the idea of bitcoin, for sure, but we’re also educating them on how to use it, and what it can do for them.”

Roman is co-owner of a local real estate business and a community leader in El Zonte. His community work doesn’t come with an official title, but he’s only half-joking when we laugh about him becoming mayor one day. If the way he’s received in the homes and businesses of the village is anything to go by, he’d win any election by a landslide.

Roman was organizing community projects—raising funds to put kids through college, paying others to do environmental work on the beaches, rivers, and woodlands around the place, setting up community English classes—when Peterson received the bitcoin donation.

Peterson had the money, while Roman had the community infrastructure. It was a perfect marriage. So, they teamed up to create Bitcoin Beach. Now, just two years after its establishment, their project is the inspiration for a grand national experiment.

When I was visiting El Zonte, it was full of crypto miners, podcasters, vloggers, developers, and investors. Mostly from North America (although I also spoke to bitcoiners from Saudi Arabia and South Korea), they were drawn to the village by a sort of pilgrim’s zealotry.

From Warren Babb, a 23-year-old kid from North Carolina who works remotely for a bitcoin mining operation, to Jack Kruse, a Chicago neurosurgeon looking to set up a clinic here, they all have huge plans for what they can do for El Zonte.

They’re here because Roman and Mike’s Bitcoin Beach project—which started out as a plan to incentivize locals to save funds instead of falling into the credit/repayments trap that blights most developing countries—reached the ear of El Salvador’s young president, Nayib Bukele.

Citing Bitcoin Beach as an inspiration, Bukele moved to adopt bitcoin as legal tender—a fiscal move that may end up being as significant as Nixon’s decoupling of the dollar from the Gold Standard. Since Sept. 7, 2021, it’s been compulsory for all businesses in El Salvador to accept bitcoin.

Except don’t hold your breath on that one. While I could buy pupusas in El Zonte on Sept. 5, high-end cafés in the diplomatic zone of the capital, San Salvador, were making excuses on Sept. 8. “The machine’s not set up yet,” they told me at Café Sucrée, as I attempted to pay for my carrot cake with bitcoin. Instead, I had to use some U.S. dollars, the co-official currency alongside the world’s leading crypto.

I suspect that on the days that bitcoin is particularly buoyant, a large number of machines will, mysteriously, develop technical problems. After all, this is Central America, and while I don’t wish to be patronizing or colonial in my attitude, the application of the law is a touch more…malleable here than we’re accustomed to.

While in El Zonte, I grabbed a chance to speak with the region’s mayor, Tito Cartagena. He’s a quiet man whose intelligence and vision are immediately apparent. He’s also a bitcoin believer. I bombarded him, slightly rudely, with skeptical questions about crypto volatility, internet coverage, adult education, and municipal finances.

He answered patiently, boiling everything down to a worst-case scenario that simply makes sense: El Salvador’s economy, for better or worse, relies on remittances sent from Salvadorans abroad. According to World Bank data from 2020, remittances accounted for almost one-quarter of the country’s GDP—one of the highest proportions in the world. Each year, the transaction fees on those remittances alone cost some $400 million. Tito, and Nayib Bukele, would prefer that money to go into El Salvador’s economy rather than the bank accounts of Western Union or Ria.

In time, crypto-believers hope the adoption of bitcoin helps revitalize El Salvador…that it becomes a fiscal template for any country, anywhere, that has suffered the punitive repayment demands of the World Bank (which wouldn’t even extend credit to El Salvador back in 1992, when it finally emerged from decades of civil war and post-colonial mismanagement), or which finds itself with a poor credit rating from Moody’s.

That’s the dream that is fueling the bitcoin revolution in El Salvador.

Build a de-dollarized economy independent of Big Finance. Populate it with empowered Salvadorans holding stakes in an asset which grows exponentially in value. Boost the national holdings with a crypto-magnet policy of offering permanent residency to those high-net-worth individuals who will invest three bitcoins into the Salvadoran economy. Create a paradigm of community credit and microfinance that spreads from the grassroots level through to the upper echelons of national government. Release El Salvador from dependence on another country’s currency, and the powerlessness that ensues when a national economy is rocked by decisions made thousands of miles away in Washington, D.C. Above all, believe in the good that bitcoin will do for El Salvador.

Too big a mental stretch?

Well, whether or not any of that happens, there’s still that $400 million to aim for. And now that there are 50 Salvadoran government-developed bitcoin ATMs in the U.S., meaning that Salvadorans can instantly transfer bitcoin or dollars for next to no commission…it looks like some of that $400 million is coming home. And that in itself, Tito Cartagena assures me, will be a win.

On my final day in El Zonte, I talked to Roman Martinez again. We bumped into each other early in the morning, checking the surf. Roman’s industrious energy and hyperactive networking mode hadn’t yet engaged, and he was quiet and contemplative. Perhaps he hadn’t had a coffee yet. We sat on the sun-warmed wall that fronts the ocean and he leveled with me.

“When I was a kid, my dad was a fisherman. Most of the time, things were pretty OK. We weren’t rich, but we had a home. You’ve seen the rain here, though. It doesn’t last for long, but the river gets muddy, and it washes all the way out to sea. On those days, my father didn’t catch fish. It was fine if it was just a couple of days, but if it was a week or more, he didn’t make any money, and we didn’t eat. Nobody had any savings. That’s what Bitcoin Beach is all about. Getting away from that sort of poverty. We just want people to have some savings, just enough to get them through those bad weeks.”

We talked about bitcoin’s infamous volatility, and whether it will prove to be the one thing Salvadorans won’t tolerate. He thinks it will be fine. Ten percent of a dip matters when you have $10,000 invested; less so when you have $10. Market volatility is a factor of life in places where breadline existence means buying beans when they’re cheap and drying them for use later in the year when they’re more expensive.

Juggling small-scale speculations between two currencies, with little or no commission, is well within the ability level of the average Salvadoran. All they have to do, Roman points out, is learn the technology. It is, he says, a case of giving them the fishing net rather than the fish. For once, that aphorism feels appropriate.

By the time you read this, you’ll have seen coverage of protests, violence, and mass resistance to bitcoin’s adoption. My own experience of the rollout was different. I’m not saying that there was no resistance, but it’s fair to say that it’s been over-reported.

On the day of the rollout, Sept. 7, I was in San Salvador. More precisely, I was at the Chivo ATM on the Plaza del Salvador del Mundo—ground zero.

Chivo, which in local slang means “cool,” is the name for the government-led initiative concerning all things bitcoin (has nobody realized yet that nothing any government does will ever be considered “cool?”). In effect, it’s a branding exercise covering the state-owned bitcoin wallet as well as the ATMs across the country and in the U.S. where Salvadorans can trade their dollars for bitcoin (and vice versa).

On Sept. 7, the place was almost deserted. Journalists and film crews outnumbered Salvadorans by 20 to one. It was, honestly, a bit of a tumbleweed moment. Heavy clouds loomed over the scene, the only upside being that I managed to capture a shot of a rainbow’s end falling just above the Chivo ATM. Symbolic? I hope so.

What befuddles any report on El Salvador’s bitcoin experiment is emotion and confirmation bias. It comes down to faith in bitcoin’s future. The big-picture plans of figures such as Nayib Bukele, Tito Cartagena, and Roman Martinez are based on the belief that bitcoin will, over the next decade, increase in value.

The bitcoiners I spoke to in El Salvador believe that premise as holy writ. I’m inclined to agree with them, but I can see why it’s a tougher idea to sell to a Salvadoran earning less than $10 a day. For them, the fall in bitcoin’s value which started immediately after the rollout (caused by crypto holders in China dumping their coins as their administration made moves to ban private crypto ownership) gave them a rude introduction to the asset.

Or did it? On Sept. 8, the day after tumbleweed day, the bitcoin ATMs in central San Salvador were thronged. Lines stretched for a city block around the cathedral plaza, and the mood was buoyant, celebratory. Significantly, bitcoin was down by almost 10% from the previous day.

Seán recorded a brief video report about the long lines at bitcoin ATMs in San Salvador on Sept. 8. Click the image to view it.

Here’s where belief and confirmation bias become important. Were they buying or selling? I managed to speak to three people in line before I was politely moved on by security. Each of them was buying bitcoin, getting in on what they saw as a temporary dip in price. (On the day bitcoin was adopted as legal tender, prices fell from around $51,000 to about $43,000 per coin. At time of writing, they’ve soared again into the $60K range.)

Yet, I’ve seen that same line of people reported in serious international newspapers as an indication of the opposite sentiment…that the impoverished folk of El Salvador were desperate to quickly convert the $30 worth of bitcoin Bukele distributed to each Salvadoran family into a currency—U.S. greenbacks—that they trust.

I’d say that the truth is somewhere between the two. The Salvadorans I saw in Barrios Park, across from the Metropolitan Cathedral, looked to me like middle-class professionals. People who could easily survive a $3 hit. And yes, there were protests, and violence, and the smashing of Chivo ATMs on a later date, but I think there were additional factors at play.

Nayib Bukele does not enjoy unanimous support for his vision, his politics, nor his personality-led approach to governance. There are concerns he possesses autocratic tendencies.

In El Salvador, bitcoin has become intertwined with the cult of Bukele, and the two are inseparably linked. If you don’t like Bukele, you probably don’t like bitcoin either. Because, really, why otherwise would there be violent protests at introducing bitcoin as one of two currencies, with no plans to take the dollar out of circulation?

It seems more likely to me that the protesters are mad with Bukele first, bitcoin second. But that’s conjecture. Doubtless, there are plenty of business-owners who see the introduction of bitcoin as an administrative hassle that will cost them time and funds. Though they don’t seem the sort to be smashing windows in the capital.

Ultimately though, Bukele’s general popularity is enough to buy the experiment some time. And the big picture/big vision approach stands to win, either way, as long as bitcoin rises in value long-term.

If El Salvador’s poor cash in their free bitcoin as fast as they can, then El Salvador’s national holdings grow. If El Salvador’s poor hold, then their own assets grow.

Trust is hard-won in these regions. The very fact that a country outside of the U.S. uses the currency of the U.S. is testament to that inbuilt skepticism. When the government of a country is so historically inept that it cannot establish and hold its own currency, that creates a national ill-feeling that’s hard to recover from. Nation-building is a complex process, but perhaps an old aphorism has validity here: to be a proper nation you need a currency, a national beer, and an airline.

Bitcoin isn’t a national currency. In many ways, it was intended to be the antithesis of one. But for many in El Salvador, it comes loaded with less political charge than the dollar. It may not belong to El Salvador, but El Salvador now has more claim on it than any other nation.

Many, not least the banks and the money-transfer companies, think it will fail El Salvador. Some are hoping it will.

But there’s a definite chance that it will all work out, and if it does, I’ll be back there in a hurry, tucking into a plate of Roxana’s best pupusas as the sun sets over those perfect right-hand waves.

■Take advantage of this “airdrop” of free cryptocurrency by Nov. 15.

In the cryptoconomy, airdrops are promotional campaigns in which cryptocurrency is given out to users, often for free. These giveaways are generally intended to highlight a new or emerging crypto or expand the user base of an existing one.

In the past, some of the cryptocurrencies handed out in airdrops have turned out to be exceptionally valuable. One of the best-known airdrops was of Bitcoin Cash. In August 2017, people who owned bitcoin were eligible to claim an equal amount of Bitcoin Cash. At its peak, Bitcoin Cash was worth about $4,000 per token.

As I write this, an airdrop event is currently underway on the SushiSwap cryptocurrency exchange. SushiSwap is a decentralized trading protocol. So unlike exchanges like Coinbase or Binance, which are managed by corporate organizations, SushiSwap facilitates automated transactions between buyers and sellers using “smart contracts”—complex computer programs that self-execute. Though the platform is automated, I use SushiSwap and it is legitimate.

Between Nov. 1 and 15, anyone who makes at least one transaction on SushiSwap can receive an airdrop of SOY tokens into their crypto wallet. SOY Finance is a decentralized finance (DeFi) platform, and the SOY token is its native currency. Each day during the airdrop, 1/15 of a total pool of half a million SOY tokens is being divided among the eligible participants, with each participant receiving an equal share.

Now, decentralized exchanges like SushiSwap are the deep-end of the crypto pool. However, if you have become comfortable trading on the major crypto exchanges like Coinbase, I encourage you to give it a try. Just be aware, the process is a tad more involved.

To participate in the airdrop, you need to have a Coinbase or Binance wallet (which is different from a Coinbase or Binance account) or a third-party wallet. Personally, I use a Metamask Wallet when trading through decentralized exchanges such as SushiSwap or Uniswap. You can download that for free here.

Once you download it, you can transfer any crypto you buy through Coinbase, Binance, or any other exchange to your Metamask Wallet. (I recommend using the Binance Smart Chain, rather than the Ethereum blockchain, for transfers since it’s much cheaper. Learn more about that here.) Then, you can connect your Metamask Wallet to SushiSwap to begin trading. Once you’ve traded, head to SOY here to claim your tokens. It may take 24 hours for SOY to recognize your eligibility.

Maybe SOY will end up being a worthless token. Then again, maybe the token will end up being worth hundreds or even thousands of dollars. Last year, Uniswap conducted an airdrop of 400 Uniswap tokens to every user. Today, those tokens are worth about $10,000. So, I don’t see the downside of picking up some SOY tokens for free (minus transaction fees). You can find more information about the SOY airdrop here.

■Ethereum 2.0 upgrade project gathers pace…causing a spike in ETH prices.

In the September issue of the Global Intelligence Letter, I brought you an in-depth article on Ethereum 2.0—a major, forthcoming upgrade to the Ethereum blockchain that’s designed to make the network faster and more efficient.

The rollout of Ethereum 2.0 could prove a defining moment in the development of the cryptoconomy. The upgrades are set to improve network speed from its current 15 transactions per second to as many as 100,000 transactions per second. With that kind of transaction speed, the Ethereum network could help revolutionize all manner of industries, from banking and finance, to gaming and supply-chain logistics.

One of the key steps in this upgrade process is eliminating Ethereum mining in favor of a proof-of-stake model. At present, new Ethereum tokens are created when computers solve complex math problems. That process is called “mining.” However, under proof of stake, new Ethereum tokens would be created by people depositing, or staking, their Ethereum on their network. This model is far faster and more energy efficient.

Recently, Ethereum made some major progress in this improvement plan. In late October, the Altair upgrade was rolled out. Basically, this tested a core component of Ethereum’s new proof-of-stake system, and it went off without a hitch. Following the success of this upgrade rollout, Ethereum prices skyrocketed, soaring to record highs above $4,400 per coin.

Although the Ethereum 2.0 project is proceeding well, the full end of Ethereum mining is now not expected to occur until around May/June next year. However, if that schedule holds and the full transition to proof-of-stake goes smoothly, you can expect another significant jump in Ethereum prices around that time. I’ll keep you informed as the upgrade project progresses.

■Is there a technological solution to the U.S. housing crisis?

Since the start of the pandemic, housing prices in the U.S. have been on a tear. In July, prices were up an insane 19.7% year on year, according to the S&P Corelogic Case-Shiller index.

A key reason for this is a shortage of supply. Research by Realtor.com found that the U.S. hasn’t been keeping up with demand for new houses since 2011 and is now 5.24 million homes short.

Overcoming this situation could take years, since building new homes is generally a slow, laborious process. Although now, two companies are aiming to change that.

Major home-builder Lennar Corp. is partnering with technology startup Icon to create a community of 100 3-D printed homes in Austin, Texas. While 3-D printing tech has been used to develop homes before, this would be the biggest-ever development of its kind in the U.S. and a crucial test of the technology’s ability to churn out high-spec, high-quality homes.

I’ll be keeping a close eye on how this project turns out. One of the reasons I’m such a crypto-bull is that I look at the traditional finance sector and see a huge amount of inefficiency. Cryptocurrencies and blockchain make it easier, cheaper, and safer to provide a whole swath of traditional financial services, from issuing loans and transferring money to paying insurance contracts. And any technology that makes something easier, cheaper, and safer wins 99% of the time.

The same logic would hold true in construction. In recent decades, we’ve seen significant technological improvements to housing components. But in a macro context, building houses remains a slow-moving process involving considerable customization.

3-D printing is the first technology in history with the potential to introduce manufacturing-level efficiency to this industry. If the Austin development is a success, it could signal a major change ahead in how we construct homes.

■Several top Asian destinations are reopening to American travelers.

In recent weeks, three major Asian destinations have announced relaxations to COVID travel restrictions.

On Nov. 1, Thailand introduced new rules allowing quarantine-free entry to tourists from 60 countries, including the U.S. Tourists must be fully vaccinated and will need to present a negative PCR test before departure and complete another PCR test on arrival. If the result is negative, they’re free to travel around Thailand.

Similarly, Vietnam has announced plans to reopen its popular resort island of Phu Quoc to vaccinated foreign visitors in late November. Beginning on Nov. 20, charter flights for international travelers with vaccine passports will be allowed to visit the island. Tourists will need to show a vaccine certificate and a negative COVID test.

Meanwhile, Singapore started allowing quarantine-free travel from the U.S. again on Oct. 19. Visitors must have proof of vaccination and have a negative PCR test result 48 hours before departure and complete another test on arrival. There also are other restrictions/requirements if you have traveled overseas within 14 days of arriving in Singapore.

Personally, I’m delighted to see travel restrictions easing in Asia. I was a frequent visitor to Asia before the pandemic and am planning to visit Singapore again soon, likely in May next year for a cryptocurrency conference. I’ll be sharing all the details of that trip, and the crypto insights I gain at the conference, with you in our daily Field Notes mailings.

■Be wary of any app on your phone labeled “Calculator” or “Alarm Clock.”

In recent years, so-called stalkerware apps have exploded in popularity. These apps are designed to record your locations, conversations, web searches, text messages…basically everything you do on your phone.

Often, the apps are billed as ways to monitor the online activities of family members. Anyone who has access to your device could install one on your phone without your knowledge and use it to track your entire life.

According to a study by web security company NortonLifeLock, the number of smartphones infected with stalkerware apps soared more than 60% between September 2020 and May 2021. The apps are more common on Android phones, but iPhones are by no means immune.

There are a few steps you can take to protect yourself from stalkerware apps. First, the apps tend to hide in plain sight on your phone by calling themselves something innocuous like “Calculator.” So regularly scan your list of installed apps for anything that feels odd, or for duplicates of generic apps like “Calendar” or “Alarm Clock.”

Second, check your battery usage. These apps often run constantly in the background, so if you find that your battery is draining faster than usual, investigate your list of active apps and make sure they are all familiar to you.

Finally, regularly update the software on your device. These apps generally violate the terms of service on the Apple App Store and Google Play Store, so a security update may remove them from your phone.

■Never pay for a scanner again.

Several times over the past few decades, I’ve shelled out for a scanner because of an immediate need to scan some official document or other. And invariably, some months later when I tried to use the device again, it refused to turn on, or the drivers were out of date, or it had some other fault that made it inoperable.

Thankfully, nowadays, the only device you need to scan a document is your smartphone.

Earlier this year, Google released an excellent app called Stack. With this app, all you have to do is take a picture of a document with your smartphone camera and Stack will convert it into a PDF. The app is also loaded with all the editing and cropping tools you’ll need to make the PDF look seamless.

Best of all, Stack can read some of the data on your scanned documents, such as the amount paid on a bill, for example. And it allows you to organize your scanned documents into folders, like “Receipts.” This makes it a very useful tool for keeping track of deductions come tax season.

The app is free, but at present it is only available on Android in the U.S. If you have an iPhone, your preinstalled Notes app has an in-built document scanner, though this lacks some of the functionality of Google’s Stack.

■It might be possible to trick your body into living longer.

Historically, our ancestors preferred to chow down on red meat. However, when hunting parties returned without a tasty mammoth carcass to divvy up, they resorted to eating plants instead. The result of this is that if we eat a plant-rich diet, our bodies believe we are doing so due to a lack of available food in our environment. And they react by switching on our so-called longevity genes.

Longevity genes are those with the ability to slow aging and cell growth. Scientists now believe that we can activate these genes using stressors related to diet and exercise.

While eating a plant-rich diet is a primary method of turning on your longevity genes, you don’t have to become a full vegetarian for this to work. Walter Longo, head of the Longevity Institute at the University of Southern California, recommends getting at least 50% of your protein from plant-based sources, like lentils, tofu, broccoli, and quinoa, to activate this stressor.

OK, so this diet plan doesn’t sound nearly as enticing as steak and mashed potato or a big bowl of spaghetti Bolognese. But researchers at Harvard University have found that healthy habits like these can add nearly 15 years to life expectancy. That’s a lot of extra living for eating some lentils.

Thanks for reading and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2021 by International Living Publishing Ltd. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of International Living, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.