Dear Global Intelligence Letter Subscriber,

A decade ago, my son, then in his mid-teens, walked into my office and told me that I really needed to learn how to buy, trade, and invest in bitcoin.

“It’s going to be huge, Dad,” he implored. “Just listen to me.”

He was already trading bitcoin almost every night and on weekends. He’d be up $500 in a day, then lose most of it the next. And then he’d be sitting on $1,000 or more a few days later.

At the time, I was a Wall Street Journal financial writer. I’d written the paper’s famous “Heard on the Street” investment column. I’d written several books, including The Wall Street Journal Guide to Personal Finance. I was regularly on CNBC, MSNBC, Good Morning America, and others, and on the phone daily with some of the biggest names among mutual-fund managers and hedge-fund traders.

In short, I was stock market through and through.

That’s where real wealth grew.

Bitcoin? Crypto? Traded through shady online accounts that originally began as a marketplace for enthusiasts of a Dungeons & Dragons-type card game called “Magic: The Gathering”?

That was just a digital casino without any house rules…

“Nah—I’ll pass,” I told my son. “But thanks for the input.”

That is, perhaps, the single worst investment decision I’ve ever made.

I look back on those days and I’m filled with regret.

First, I rejected out-of-hand my son’s thoughtful input into family finance, which is just bad fathering.

And second, bitcoin at that time was in the $200 range. Had I pulled $10,000 from stock market profits and funneled that money into bitcoin back then, that investment would today be worth $3.5 million.

Now, would I still be holding onto those bitcoin today? Maybe not. I’d quite likely have sold along the way, particularly once my investment was well into the six-figure range.

But the point remains: I didn’t listen to someone who knew something, and I missed out on life-changing wealth.

Sure, he was teenager. But he was active every day in the bitcoin community. He read what people were saying about bitcoin’s future. He processed the good, the bad, the risks. He knew precisely what they were because he had been living them every day with his trading. And he brought all that information to me.

Like any parent who thinks he knows better than his child, I discounted his research and fact-gathering.

And I lost out.

That is the genesis of your March issue of Global Intelligence.

See, I don’t want you to make the mistake I made a decade ago. I don’t want you to miss out on the wealth bitcoin will continue to create.

Granted, bitcoin won’t rise tens of thousands of percent from this point forward, but it will rise—easily a 2x, very likely a 10x, and quite possibly a 15x.

Maybe even more.

(In your 2024 Crypto Strategy Report that I emailed to you a few weeks back, I explain exactly why I think bitcoin will ultimately be valued over $1 million. It’s a case I’ve been making for several years now.)

A lot of people—too many people—are going to miss this wealth-creation opportunity because they simply refuse to listen… to me or to anyone else who knows what they’re talking about. They have mainstream-media fueled impressions of what bitcoin is (or is not)… and they’re set in their ways financially, just like I was.

Alas, they’re going to turn on the TV soon enough and they’re going to see bitcoin at $150,000. And then they’ll see it at $500,000… $700,000… $1 million. And they will have missed every last penny of profit they could have collected.

All because they didn’t listen.

So, this month I’m asking you to listen…

If you haven’t invested yet in bitcoin—now’s the time.

If you have invested and can afford to increase your stake—now’s the time.

I’ll give you all the reasons in this month’s issue… and I just hope you’ll be convinced.

I’ll also explain how much of your portfolio I think you should put into bitcoin… and I’ll give you an easy and simple way to invest in bitcoin right now—one that didn’t exist before.

I’ve told the story of why you should invest in bitcoin—and in other cryptos—before… most recently for Global Intel subscribers in your 2024 Crypto Strategy Report.

But this issue of Global Intelligence is my last chance to make the urgent case for owning crypto now… before an event taking place in just about a month’s time, which will fundamentally change bitcoin forever.

My journey down the bitcoin and crypto rabbit hole began in 2017. This time, I listened to my son.

I’d recently lost my job and gone through a divorce, and I decided to rebuild my life by moving to Southern California from south Louisiana to return to school at UCLA in a screenwriting program.

My son, who missed having Dad around, called me and said he wanted us to build crypto mining rigs together, long-distance, so that we could talk regularly and do something fun. I told him to let me read up on bitcoin, Ethereum, and crypto in general, and I’d call him back later in the week.

I read.

And I read.

And I read some more.

And the more I read, the more I realized the true nature of cryptocurrency and blockchain, the technology on which all crypto is built. I could see how crypto was going to change our world in a million ways—big, small, and revolutionary.

I was in.

So, my son and I started building mining rigs.

Soon enough, I was down that crypto rabbit hole: learning about the technology behind crypto and the mining process, the ways that companies were beginning to incorporate early iterations of a blockchain strategy into their operations. I was learning the strange new crypto lexicon… and the personal infrastructure necessary for buying and owning crypto.

(If you need a refresher on some of those bitcoin basics… your 2024 Crypto Strategy Report is the place to go.)

In short, I became a crypto expert after initially panning the idea of investing in a digital asset.

Today, I’m ecstatic that I did.

Though the ride has been tumultuous—two bull markets and two rapacious bear markets—I’ve held on tight through it all because of my conviction that crypto will define our world, and that prices for certain cryptocurrencies will see levels the mind doesn’t want to believe are true.

More importantly, I’ve seen my wealth grow to a degree that would not have happened in traditional financial markets. One example: Shadow Token, a smaller crypto project that has built a very real product that strengthens the Solana blockchain. I spent just under $1,700 to buy into this project in November 2021. Today, my stake is worth $85,000—a 50-fold increase in just under two-and-a-half years.

Shadow is just one example of the wealth coursing through crypto these days now that we’re in the early stages of a third bull market.

This bull, however, is very different from previous bull markets. It promises to be the mother of all bull markets.

Not just crypto bull markets.

I mean all bull markets of all time.

A bold statement, for sure. Possibly one of those statements so bold that people will roll their eyes.

But let’s put today’s crypto bull market in context…

A once-in-humanity paradigm shift is underway across the world.

As a species, we’re transitioning from physical money held in our wallet as coins and paper bills to digital money held on the blockchain and that only exists as 1s and 0s.

This new form of money will be the fastest and most efficient form of money history has ever seen, and that has society-changing implications. I’ll come back to those in a moment.

First, it’s important to understand that we’re just weeks away from one of the most anticipated events in crypto… the event that will “fundamentally change” bitcoin as I mentioned above.

This event is the bitcoin halving, which is slated to land in late April.

This is a technical event that, every four years or so, doubles the difficulty of mining bitcoin and decreases by half the amount of bitcoin mined per day. It’s all very inside baseball, for sure. Nevertheless, the halving has dramatic impacts on bitcoin.

The imminent halving is one event fueling bitcoin’s rise (and bringing the rest of the crypto market with it)…

Another event that has pushed bitcoin’s price rise is a Securities and Exchange Commission ruling in January that allowed US financial institutions to begin marketing a particular type of bitcoin exchange traded funded, or ETF, one that tracks bitcoin’s ever-changing “spot” price.

That ruling opened a floodgate.

Money has poured into the various bitcoin spot-price ETFs that have launched. One in particular, BlackRock’s iShares Bitcoin ETF, has already surpassed $15 billion in assets under management in just two months since its launch. That’s the fastest move to $15 billion ever seen by any ETF in any sector of the market in the US.

It’s an astoundingly large number, already 30% the size of the SPDR Gold Trust, the largest gold ETF in the world, which has been around for 20 years.

Overall, the entire assortment of US-based bitcoin ETFs now holds more than $60 billion in assets and 4% of the entire supply of bitcoin. Every day, bitcoin ETFs as a category are seeing net inflows of between $150 million and more than $670 million.

Now, pair that demand with the fact that the amount of bitcoin mined on a daily basis is about to halve.

No doubt you see the implication there.

Literally hundreds of billons of dollars will be flooding into an asset where the supply is about to cut in half.

That means all those billions will be gobbling up increasing amounts of existing bitcoin supply. And that drives prices higher.

That’s happening even as mainstream investors are just now coming back into the crypto market after suffering deep losses during the “crypto winter” over the last two years.

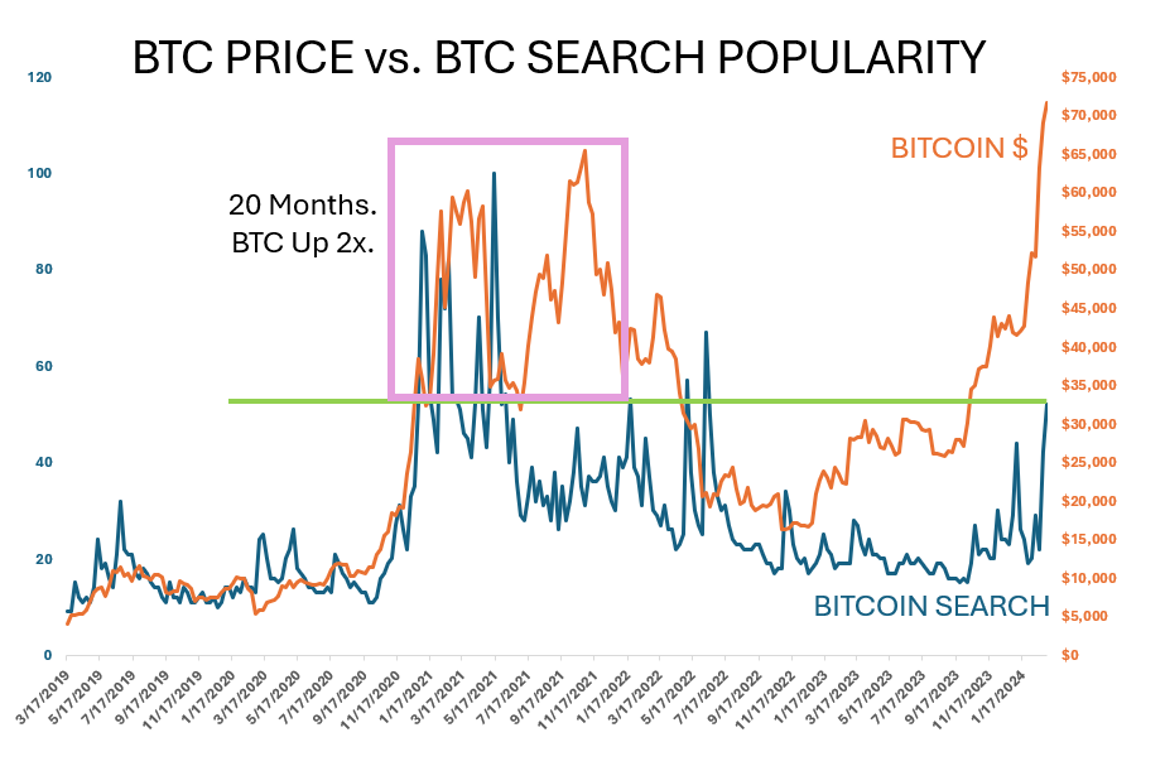

Consider this chart… which shows a third event driving bitcoin’s price—the rise in searches for “bitcoin.”

The chart shows bitcoin’s weekly closing price over the last five years overlaid atop the number of Google searches for the word “bitcoin.” You can see on the far right that bitcoin searches are spiking alongside bitcoin’s price. That says that as bitcoin’s price takes off again, interest in crypto rises, meaning the masses are once again searching for information on how to buy bitcoin, where to buy bitcoin, and (most likely) how high can bitcoin go.

Last time this happened during the previous bull market, bitcoin’s price, then at an all-time high, doubled from there.

In mid-March 2024 bitcoin just set a new all-time high north of $73,000.

Question is: Will we double from here and see bitcoin touch $140,000?

No.

We’ll go higher.

Before I get into how high bitcoin will likely go, let me share with you some history about the three previous halvings bitcoin has gone through and what they meant for bitcoin’s price.

As I noted above, the halvings mean that mining bitcoin becomes twice as difficult, while the number of daily mined bitcoin falls by half.

Bitcoin’s price has gone up astoundingly with each of the three previous “halvings.”

The first halving occurred in November 2012. From there, bitcoin rose nearly 10,000% to an all-time high. (It doesn’t look like that in the chart above because the scale is so warped by the fact that bitcoin was in pennies early on and is now priced in tens of thousands of dollars.)

The second halving arrived in July 2016. From that moment until its next all-time high, bitcoin gained nearly 2,900%.

The third halving landed in May 2020. Bitcoin went on to gain nearly 700% before reaching its last all-time high north of $69,000.

Considering those moves, and considering the arrival of bitcoin ETFs—which did not exist for any of the prior halvings—I suspect we’ll see bitcoin gain at least 250% before the next bear market arrives.

(There will always be bear markets… that’s a fact of investing.)

That could put bitcoin at $245,000 to $250,000, likely before the end of 2025.

I do have a caveat, though.

That 250% gain is based on bitcoin’s price on the day of the halving in late April. (Right now, some sources say the halving will happen between April 20 and April 25. The exact date is subject to when a particular “block” is mined on the bitcoin blockchain, which will trigger the halving.)

My $245,000 is based on bitcoin’s price as I write this in mid-March.

If bitcoin is higher by late-April—let’s say it’s $80,000—then my price target pushes toward $280,000.

If bitcoin is lower—call it $50,000—then my price target will move down to $175,000.

Whatever the case, my point is simply that bitcoin is moving into the halving at the same moment that tens of billions of dollars are flowing into bitcoin ETFs, a conjunction that has never before happened.

And with bitcoin Google searches taking off again, we have a series of events coalescing to drive bitcoin’s price sharply higher.

And frankly, that could mean that my expectation of a 250% gain is milquetoast. We could very well see bitcoin ultimately pop 300% to maybe even 500%.

At the higher end, that would imply a bitcoin price shooting above $400,000.

To a lot of people, that just sounds unbelievable.

I get it.

I was there myself when my son told me $200 bitcoin was going to be $5,000 bitcoin. I laughed.

And I was an idiot.

Now, you will still see plenty of arguments for why you shouldn’t get in on bitcoin—even as the price is surging.

I want to address those arguments head on—because you’ll probably hear them from talking heads in the mainstream media.

I am all too aware of the naysayers who attack crypto. Who tell the masses that government will ban crypto, and that crypto has no viable use case. That it’s just a speculative gamble backed by nothing but air and hype.

These are absolutely moronic beliefs.

Here’s why…

First, government is never going to ban crypto.

The reason: Crypto is the ultimate source of financial information.

The blockchain is wide open, every transaction visible to everyone who looks. That openness means government can—and will—see every dollar that flows through your life: where you earn your money, who pays you and how much, and where you spend your money. Taking this to its logical extreme… government would have the ability to know that your neighbor paid you $7 for a Hummel figurine at your annual spring garage sale. Government would also know how many soft drinks you buy each day or week or month. How many cheeseburgers. How many bags of chips, or six-packs of beer. It would know how much gasoline you buy.

Taken to a dystopian extreme… If government ever decided that you indulging in more than one cheeseburger a month is bad for the financial costs to society (i.e. government healthcare spending), it would be able to lock down your wallet to prevent you from making what government decides is a banned purchase.

So, government wants blockchain—the tech behind bitcoin and all crypto. It secretly adores that tech.

(I should say, the transaction information on the blockchain isn’t in the form of Name, Address, Social Security Number. It’s in the form of a long, alphanumeric string that defines a crypto-wallet address. But if someone is paying you, they’ll know your address… which means they could look up every transaction associated with that address on the blockchain. And in a world where any payments you make to the government, or they make to you, happen on the blockchain—the world that’s coming—government will absolutely know your address.)

No way in hell government bans a technology that will give it this much power.

The only question is what safeguards will the government put in place to protect Americans’ financial freedom and financial privacy…

Business also wants blockchain tech.

The blockchain radically reduces business costs. It annihilates middlemen. Realtors, financial intermediaries, cashiers, attendants… their jobs are about to vanish, or at least shrink markedly in number.

I’ve used this example before but it’s worth repeating because it defines the opportunities that businesses see to exploit crypto and blockchain for fatter profits.

If I transfer $200,000 to Europe from the US today, the fee will be about $1,000 at the low end. The process will take a day or two, and definitely longer if I’m sending money from a local bank or a credit union that doesn’t have direct relationships with overseas banks.

On the blockchain, I can send that same amount of money for literally fractions of a penny, and it will arrive at its intended destination within a couple minutes if not a couple seconds. Or less.

For multinationals moving money all over the world to pay suppliers, manufacturers, and local employees, the prospect of saving hundreds of thousands or even millions of dollars annually on wire transfer costs—and saving days on transfer times—is a huge deal. Companies and their political lobbyists are absolutely going to push as hard as they can for blockchain.

And given that the business lobby is the puppet-master pulling the strings of Congress, you can bet that business is going to ensure that lawmakers see the world from their profit-oriented point of view.

So, again, I will say that there’s simply no way that government bans crypto.

More likely, government will work with business to shape the legislation that defines the guardrails in crypto.

And to those pundits who say, “Well, the US is going to have a digital dollar on the blockchain, so there’s no reason to have any other crypto.”

Those pundits clearly do not understand the cryptosphere…

Most crypto is not a replacement for fiat currency, and never set out to accomplish that in the first place.

Lots of cryptos are used to govern the way various websites work, meaning those who own the crypto vote on services offered, procedures and processes, etc. Or they’re the lube that makes internal processes flow frictionlessly. Or they provide services, such as tracking in real time the temperature of products like food and pharmaceuticals as they move through the shipping process. A blockchain-based dollar would not be built for those purposes.

Moreover, a blockchain dollar would very likely ride atop a blockchain the government itself builds, and government isn’t inclined to open up access to that blockchain to the world for fear that hackers would have an easier time exploiting users.

Government wants blockchain tech for its own purposes… So does business—the institutional money pouring into bitcoin right now is another sign of that… And, as always, government and big business will come to an accommodation that allows both to get something they want.

So, how do we benefit from this great leap into the future…?

We own bitcoin. Simple as that.

I could tell you to go off and invest in several cryptocurrencies, such as Solana, Ethereum, or Chainlink… and in fact I did just that in your 2024 Crypto Strategy Report. Some cryptos will perform far better than bitcoin.

But bitcoin is as close as it gets to a “sure thing” in crypto…

Bitcoin is the granddaddy. The Big Kahuna. Bitcoin drives the overall market. That’s why you want to own it.

When bitcoin begins to move, the rest of the market follows. If you think of the crypto market like a train, bitcoin is the engine—the first to move. Only much later does that final boxcar start to advance…

Here in Global Intel, I want to own the engine as a near-permanent part of the portfolio.

(If you want to profit from the boxcars, be on the lookout for an email from me in the coming weeks. I’m revamping my Frontier Fortunes crypto investor service as an active portfolio rather than static, as it has been historically. I’ll be adding fast-growth, smaller crypto tokens, as well as introducing readers to active strategies such as pursuing income from opportunities in decentralized finance, DeFi as it’s called, and how to benefit from “airdrops”—sort of like “crypto IPOs”—that are seeing crypto owners collect thousands, even tens of thousands of dollars in free money.)

My recommendation today is to buy bitcoin now, before the halving happens.

And today, thanks to the recent SEC decision covered above, you don’t have to own a crypto wallet and set up an account at the likes of Coinbase or another crypto exchange.

Owning bitcoin has never been easier or simpler. You can own bitcoin in an ETF directly in a brokerage account, just like owning shares of Apple or Microsoft.

If you already have a crypto wallet and own bitcoin through a crypto exchange… I recommend you continue to hold your crypto here (and add to your position when you have spare cash and on days when bitcoin is down 5% or 10%).

You’ll find a refresher on that process in your 2024 Crypto Strategy Report.

If you’re comfortable with that process… I still say that owning crypto directly like that is the best way to do it (as I explain in that report).

But if you want the simplicity of buying through a brokerage account… The option below is for you.

Buy VanEck Bitcoin Trust (symbol: HODL) at the market price.

RISK: Venture Investing. (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

The VanEck trust is traded in the US, so you will be able to buy it through any brokerage firm.

As I write this, the fund is trading at just over $82 per share.

I could have recommended any of several bitcoin ETFs, including those from BlackRock and Fidelity. Frankly, they’re all pretty much the same operationally—they all own only bitcoin in the trust. The only difference is share price and annual management fees. I’m recommending VanEck simply because its fee at 0.20% per year is slightly lower than the 0.25% that Fidelity and BlackRock charge.

Note: As I was writing this, VanEck announced it will charge 0% fees through the end of March 2025, or until the assets under management hit $1.5 billion. Right now, the ETF has about $500 million under management, $200 million of which flooded into the fund within 24 hours of VanEck axing the fee.

The VanEck bitcoin ETF will simply track the price of bitcoin up and down. There is no internal managing that happens. There are no portfolio managers looking to make buy and sell calls as bitcoin’s prices moves up and down. The fund’s entire purpose is to make owning bitcoin easy for institutional and individual investors who do not want the hassles of buying, selling, and owning bitcoin through a traditional crypto exchange such as Coinbase.

This is purely a buy-and-hold investment that will automatically shadow bitcoin’s price movement.

I’ve given this investment our highest, "Venture Investing" risk rating because, well, this is crypto. Prices in this corner of the financial markets are exceedingly jumpy. Bitcoin can rise or fall 15% or more in a day. You absolutely have to be cognizant of that fact, and you absolutely have to be willing to stomach it.

Actually, you have to expect it, because it’s guaranteed. I cannot tell you how many times I’ve woken up to big moves down in bitcoin… only to see those moves erased within hours or days. (VanEck's symbol, HODL, is crypto slang for "hold"... or "Hold On for Dear Life"... Some crypto trader was typing too fast and wrote HODL and it stuck and became a meme.)

If seeing bitcoin down 10% or 15% in a day will cause you to panic and sell, then I urge you to skip this month’s recommendation. You will not be comfortable holding this investment. Worse, you will potentially sell into the weakness only to see bitcoin rebound quickly and move even higher—and that’s going to make you frustrated and mad.

So if you go into this ETF, do so planning to sit on your hands afterward. Do not sell into downward price pressure.

I hate saying “trust me,” but trust me when I tell you that you will be well-rewarded for your patience and for stomaching the guaranteed volatility.

That leads right into the question… “How much should I invest?”

With any investment, never put at risk more money than you can afford to lose. That’s especially true with crypto because of that volatility I mentioned. Only put into the VanEck Bitcoin Trust an amount of money you are comfortable losing.

Now, I truly do not think you will lose that money, but the value will definitely ebb and flow by large amounts.

I would say that most portfolios can easily withstand a 5% position in bitcoin. So that would be $5,000 on a $100,000 portfolio. If bitcoin were to collapse to zero and you lost five grand, well, dividends and interest payments alone in the remainder of your portfolio could cover the loss in a single year. So, to me, 5% is not a terribly risky way to play what can be a terribly volatile investment.

If you’re more comfortable with risk, and you see the opportunity that bitcoin represents, then I’d go as high as putting 10% of my portfolio in bitcoin. But no more.

And if you want to expand your exposure to crypto overall as this bull market takes off after the halving, then I’d stick 5% in bitcoin now, and save the other 5% for the new Frontier Fortunes revamp. (Again, I’ll email you about that in the coming weeks.) The kinds of crypto that will go into that portfolio have true moonshot potential.

Here’s a sneak peek…

I originally told Frontier Fortunes readers about 0x0 (and AI-focused token) in May of last year. The price was about $0.07. Today, less than a year later, it’s at $0.47, and it’s on its way to more than $1. So an initial $1,000 investment is now worth more than $6,700, a near 7x return in 10 months. That’s the power of smaller cryptos (in the right sectors) and the kinds of returns we will be targeting.

For now, own bitcoin before the halving, accept that volatility is guaranteed… and know that much higher prices are coming.

For this month’s portfolio update, we shift from a digital commodity (bitcoin) to a physical one—copper.

The red metal is quietly up more than 30% since last summer, which in turn has helped pushed up the price of Southern Copper, one of the world’s largest copper miners and a holding we’ve had in the Global Intel portfolio for exactly a year now.

In that time, we’re up more than 47% as I write this. The shares are now a hold.

But why has copper begun to move higher?

As with so many commodities, we have a supply/demand issue unfolding right now. Copper traders are also front-running the Federal Reserve’s expected interest rate cuts.

As I wrote in the March 2023 issue of Global Intel, the global transition toward green/renewable energy is, ironically, entirely dependent on one of the dirtiest industries on the planet: copper mining.

Assuming green energy demand grows at its projected pace, then over the remainder of this decade the world will consume as much copper as it consumed over the last century.

Alas, there’s not enough supply coming online to meet that expected demand.

Investors are aware of that fact, but they seem to be focusing on it more now because the global economy seems to be moving into Goldilocks mode: Not too hot, not too cold. That’s a good market for copper because it hints at consistent economic growth as well as consistent investment in rebuilding the world’s energy grid along greener lines.

Of all the world’s base metals, copper is the one most identified with economic ebbs and flows since it goes into everything from electrical wiring to piping. So, with the world’s traders sensing a generally OK global economy—and knowing that supply cannot match demand—they’ve been driving up copper’s price.

Which is driving up the share price for Southern Copper on expectations that higher copper prices lead to higher corporate profits.

And then there’s the Federal Reserve…

Fed Chairman Jerome Powell on a couple of occasions now has stated that the Fed sees lower interest rates in 2024 and will pursue what the Fed says will be at least three rate cuts.

I absolutely agree that rates have to come down. Not because of the economy, but because of the impact high rates are having on America’s debt. It’s jacking up debt repayment costs to about 15% of the federal budget—much too high.

Assuming the Fed does begin to cut rates, that will drive copper even higher. Rate cuts would be economic Red Bull—an energy infusion because businesses and consumers would have more free cash to spend on purchases rather than debt repayment.

And because we know copper is a canary in the economy, rising economic expectations would flow through copper prices positively. In short, copper prices would rise.

All in all, then, we’re in a good position with Southern Copper as 2024 plays out and as we move into 2025.

I will give you a heads up that if Southern Copper reaches gains of 100%, I will recommend you sell half and allow the other half to continue to run. That way we’re playing on house money. But that’s for later…

Elsewhere in the portfolio, our preferred shares—Edison Series H and Tsakos Preferred F—are both up more than 30%. Some of that is dividend income, some of it is price expansion.

Two thoughts here:

Finally, I will note that Sprott Physical Gold Trust is up just over 13%. That’s in response to gold prices hitting a new all-time high near $2,200 per ounce.

I’ve been saying for a while now that gold will see new all-time highs, and here we are.

My bet is that we still have higher highs to touch in the gold market, and Sprott will follow the gold price higher. To the degree that you have free cash available from time to time, continually add to your position in Sprott on down days.

You will be happy to own gold when America's inevitable debt crisis—and the financial reset—arrives.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2024. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.