Dear Global Intelligence Letter Subscriber,

Having grown up in hurricane country—south Louisiana—I can confidently say that among Mother Nature’s various natural disasters, ‘canes are the most considerate.

Earthquakes erupt violently without warning. Same with volcanos and tornados. Very inconsiderate.

Though rain is predictable, flash floods generally aren’t. Nor are violent hailstorms that can tear apart roofs and smash-up cars exposed to the elements. Even forest fires can start and spread with such ferocious, wind-driving speed that they trap homeowners or give them barely a few hours to flee harm’s way.

But hurricanes?

Many of them amble off the coast of West Africa, tropical waves that are little more than a dust storm, and they take their own sweet time gathering strength for a week or two before ransacking some coastal region from Texas to Maine.

Most tropical waves peter out into nothing or veer off and die a feeble death in the cold North Atlantic waters. Those that do strengthen into something that hits the US are quite often little more than thunderstorms on steroids. And the few that will blow up into devastating storms—Katrina, Camille, Betsy, Sandy, Hugo, et al., always allow you days to prepare before they roar ashore.

Considerate.

At this point, you’re probably wondering where this month’s issue of Global Intelligence is heading.

Well, it’s not heading toward an investment recommendation tied to weather or hurricanes.

No—this is about preparation.

I’ve chosen hurricanes as the metaphor for sharing this bigger message on preparation because of laziness. Not my laziness, mind you. The laziness of those who refuse to act when they know mayhem, disaster, and potential death will blow ashore soon enough.

They have time to prepare. They have time to secure important documents. To pack up cherished items and heirlooms. And, more important, to remove themselves and their families from a situation that could well prove terminal.

Yet, too many do none of that.

I’ve seen it in action. New Orleanians were throwing “hurricane parties” before Katrina’s arrival back in 2005. Literal parties. The message being, “We don’t care! Bring it on!” Of course, Camille brought it on in August 1965—one of the most devastating ‘canes ever—and she killed 24 of 25 people at a hurricane party in an apartment complex in coastal Mississippi.

Some people just can’t be bothered.

Others perceive the risk to be so small they don’t see the point in preparing for something that will never happen—or which will be minimal, if it does materialize.

Which brings me to the hurricane that threatens to devastate America’s financial system. Very few investments will weather that storm.

But some will.

And one of those few (neither gold nor silver) is the subject of this month’s issue…

You know this story. I’ve been warning about this storm for a long time.

We’re preparing for a storm that we have no way of avoiding at this point.

The smart weathermen are telling Americans they’re in harm’s way and to begin preparing for what’s to come. Many aren’t listening.

I’m one of those weathermen, but I am far from alone.

JP Morgan CEO Jamie Dimon: At one point it will cause a problem and why should you wait. The problem will be caused by the market and then you will be forced to deal with it and probably in a far more uncomfortable way than if you dealt with it to start.

Elon Musk: True national debt, including unfunded entitlements, is at least $60 trillion—roughly three times the size of the entire US economy. Something has to give.

John Paulson, hedge fund billionaire: Other countries do not want to rely on the dollar as much as they have in the past… That points to the intermediate and long-term depreciation of the dollar versus other currencies.

Ray Dalio, former chairman of Bridgewater Associates, the world’s largest hedge fund: The worse [US debt] gets, the more we are going to have that long-term problem. You can see it in the numbers. It’s just a matter of numbers. We are near that inflection point.

Thomas Hoenig, former Federal Reserve board member and retired CEO of the Fed’s Kansas City bank branch: The day of reckoning lies ahead. The federal government is still borrowing more than the private sector over time can fund without causing interest rates to rise and hard times to become more likely… Even the [Congressional Budget Office] looking ahead is projecting that our national debt, in 10 years, will be greater than $50 trillion.

International Monetary Fund Managing Director Kristalina Georgieva: It cannot go like this forever, because the ... burden on the US is going to cripple spending that is necessary to make for servicing the debt. To pay 17-plus percent in debt service [as a percentage of the annual budget] is just mind-boggling.

Even current Federal Reserve Chairman Jay Powell and Treasury Secretary Janet Yellen are telling Congress, to paraphrase, “Stop acting like kids quarreling on a playground about the color of the grass when the school is burning down.”

Sadly, we’re not likely to see Congress act until the hurricane has already made landfall. That’s just the way modern American politics works. Rancor, discord, immature name-calling, a refusal to work in bipartisan fashion for the betterment of the country, pushing for pointless impeachments on the most idiotic of made-up reasons…

And all the while, the winds that will cause the New American Depression are growing ever stronger.

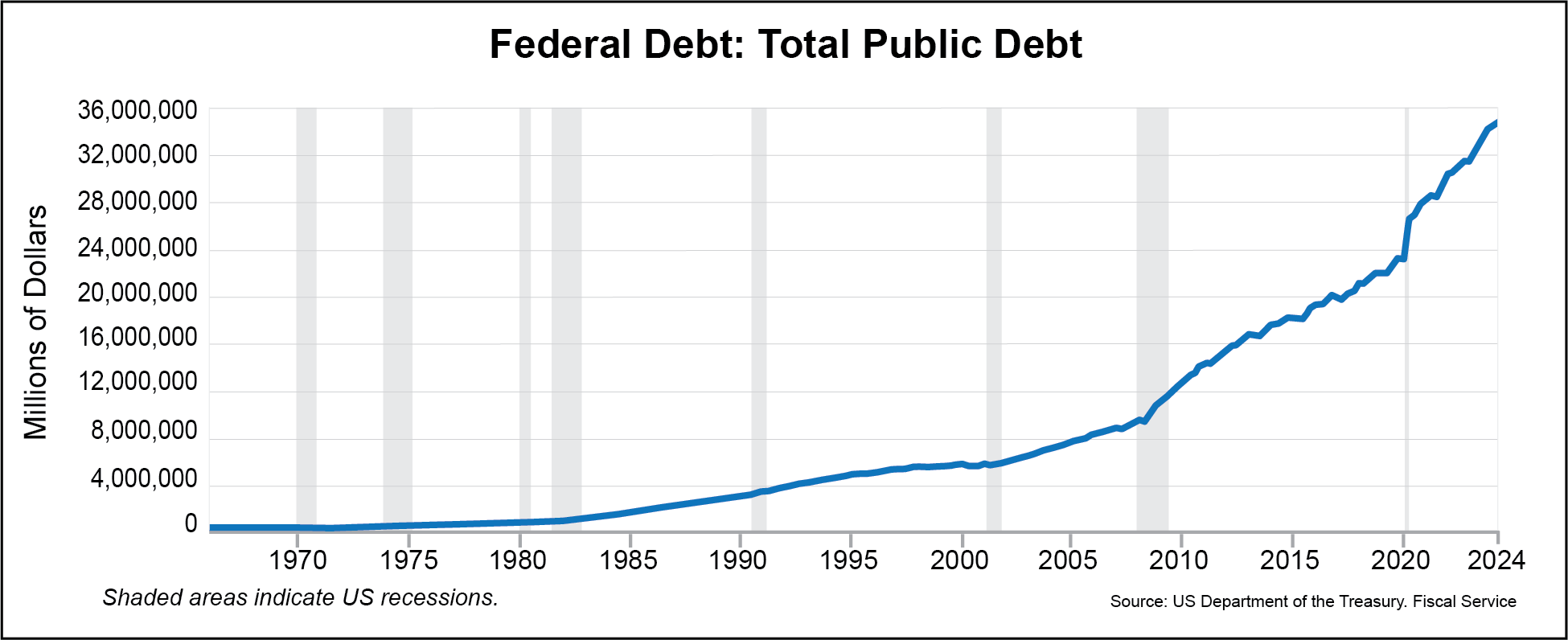

Earlier this year, an analyst at Bank of America calculated that the US government is now taking on $1 trillion in new debt every 100 days, or about $3.65 trillion every year—and constantly growing by the day. That’s what Kristalina Georgieva at the IMF is referencing in her comment about 17% being a “mind-boggling” number. America is adding every year an amount of debt equal to about 17% of the budget.

We’re talking new debt. Not debt payments that shrink the debt. This America is borrowing ever-more money to make payments on existing debt and to cover spending that exceeds the country’s annual income—what’s known as the deficit, the gap between tax receipts and spending.

Every year, that year’s deficit is piled atop all the existing debt from all the previous years’ deficits. The pile is up to $35 trillion now.

Repaying that debt isn’t even part of the conversation at this point. America will never repay that much money. Moreover, there’s no real vision anywhere for even beginning to reduce the debt. After all, spending more than you earn, by definition, negates your ability to shrink the debt you already owe.

So it is, then, that the US is now awaiting a fiscal and monetary hurricane that the country has no way of avoiding at this point without Congress passing severe austerity measures.

My initial instinct is to say, “Of course, that’s not going to happen because voters would vote the bums out of office.”

But today’s America feels almost dystopian in so many ways. Crime is so common that drugstores lock much of what they sell behind plexiglass. In some places, criminals face no repercussions for stealing food or liquor or even iPhones… in broad daylight… while being captured on video in the act. (San Francisco, famously, chose to make shoplifting less than $950 a misdemeanor and not even prosecute.)

Serious people talk in serious tones about the likelihood of a new civil war.

Politicians at the federal level openly call for a national divorce, while those at the local level talk of secession. Rights are vanishing in federal courts, while state politicians enact laws that proudly and defiantly flout the constitution.

It’s clear Americans increasingly hate each other.

So maybe a crisis is exactly what Congress wants so that lawmakers have the cover they need to implement all manner of financial and social revisions under the guise of an emergency.

Whatever the case, the next few years are likely to see the New American Depression sweep the land.

And one of the biggest casualties is going to be the dollar.

When I say the dollar will “collapse,” I don’t mean it will go to zero.

No currency goes to zero unless a particular series of notes is literally demonetized so that it’s no longer legal tender.

I don’t expect that for America.

What I mean is that the value of the currency relative to its purchasing power and relative to other currencies is going to decline sharply. After all, that’s all money is: A mechanism by which labor is turned into peanut butter-and-jelly sandwiches, a Happy Meal, a new car, a house, a Disney vacation, whatever.

Let me pause for a moment to note that money and currency are not the same animal.

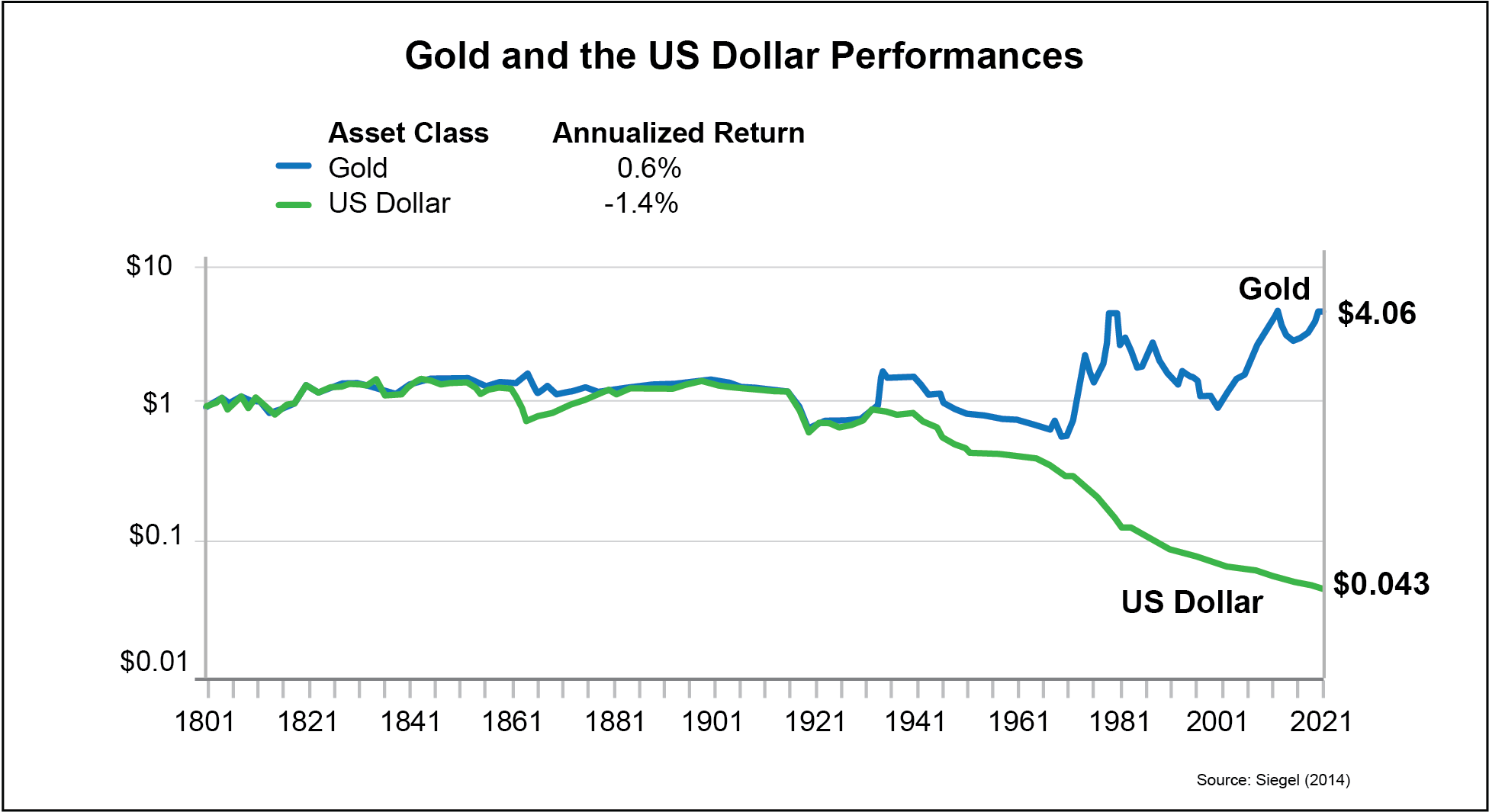

Both are mediums of exchange. Both are portable, divisible, and fungible (one dollar bill is the same as another). But money is a store of value that remains generally constant relative to those peanut butter-and-jelly sandwiches.

Currency is not a store of value. It loses value over time because governments have no constraint on how many currency units they can print. And as history has proven, governments unconstrained will print as much currency as they can.

That’s why a dollar today would only buy about $0.56 worth of goods and services back in the year 2000. Or why it would buy a measly $0.13 worth of goods and services in 1971, just before Nixon severed the dollar’s ties to gold.

(Just to note: It wasn’t always like this. Prior to the birth of the Federal Reserve in 1913, a dollar’s purchasing power remained consistent, fluctuating in a fairly narrow range going back to at least 1800.)

This is the primary reason gold has performed so well over the last quarter of a century…

Back in 2000, a base-model Toyota Camry, the best-selling car in America, started at $19,820. You’d have needed 72 ounces of gold, then $275, to afford that new car.

Today, a base-model Camry is $27,515, and you’d need just 11.8 ounces of gold to afford one.

In dollar terms, your new-car cost inflated by 39%.

In terms of gold ounces, your cost declined by 84% because the price of gold—an asset with a real value that central bankers and governments cannot control—is up more than 8x.

But as I stated, this issue of Global Intel is not about gold. I just needed to use gold to establish the idea that when currency loses value, the savvy among us who hold that currency reflexively feel the loss in our purchasing and go in search of assets that will preserve value.

In the precious metals world, that’s gold.

But gold isn’t something any of us can easily spend. It’s a store-of-value asset, the truest form of real money. But none of us can walk into a Dunkin’ Donuts and buy a box of 25 Munchins for 0.004 grams of gold. Physical gold wouldn’t even be visible at that size.

So, as with gold buyers, people who perceive that their home currency is rapidly losing value will go in search of a better currency. Venezuelans watching their bolivars turn into literal toilet paper (yes, people were using it for that) in recent years turned to trading gold and crystal coins from inside a video game for dollars in the real world they could use to buy consumer goods at home. Digital video-game tokens had become a true currency in the real world.

Maybe some Americans will do something similar when the dollar’s real decline kicks off, trading for digital tokens or some other currency that could be exchanged for real-world goods.

But the savviest savers will be heading into…

Swiss francs, the national currency of Switzerland.

Many, including me, are already there.

Goes back to that whole preparation thing.

I regularly mention francs in my daily Field Notes e-letter, and the very first issue of Global Intel back in March 2021 was all about the Swiss franc and why it’s part of the solution-set for surviving that hurricane to come.

But we’re pushing ever closer to the storm’s landfall, and I am using this month’s issue to really push home the idea that you need to diversify away from the US dollar and into a currency that will be a safe port in the storm to come. That’s why I want to make an up-to-date case for a play that’s the largest portion of my own largest retirement account.

If you missed that first issue, or you haven’t diversified into francs yet—you need to know, now, today: This might be the most important crisis protection play in our portfolio. And even if you have some holdings, you might think about adding to them.

A question I always hear at International Living conferences, and a question I often receive from Field Notes readers and from my followers on Twitter/X is, “Why the franc?” Readers also raise a very good question: “If all currencies today are fiat currencies, why does it matter if I own the Swiss franc or the dollar—won’t they all go down?”

Let’s start with, Why the franc…

History.

Switzerland of the late 18th century was a satellite state of Napolean Bonaparte’s French empire. Napolean had grabbed Switzerland to serve as a mountainous buffer preventing the Austrian empire from expanding westward, since sending an army across the Alps would be a fool’s errand.

But then Napolean got his butt kicked at Waterloo, and suddenly the European map was in play as powers all sought to exploit France’s sudden weakness. Europe held a series of diplomatic meetings among continental powers, the so-called Congress of Vienna in 1815. And there, Switzerland pledged eternal neutrality in order to fend off any further worries of invasion or subjugation.

That neutrality became Switzerland’s calling card in the runup to World War I, and led to exploding demand for Swiss accounts during the interwar period of the 1920s and ‘30s.

Originally, the Swiss were promoting “numbered accounts” (i.e. no name on the account) as a way for wealthy French citizens to evade France’s new inheritance taxes during the first decade of the 1900s. But by the 1910s, the drums of pending war were loud and the moneyed class from all over Europe began stashing wealth in those secret numbered accounts.

During the interwar period, when countries needed tax revenue to rebuild armies, France and Germany grew annoyed at the amount of money evading taxes by hiding in Switzerland. French officials raided Swiss banks in Paris in 1932 and were shocked at the quantity of francs that locals had secreted.

The Swiss government, angered by the French raids, passed strict secrecy laws in 1934—the “duty of absolute silence”—that prevented anyone from gaining access to any information about any Swiss bank account.

And thus was born what might be the world’s first tax haven—giving the Swiss franc its reputation as a “safe-haven currency.”

Swiss numbered accounts no longer exist in today’s world, where the US and global banks demand transparency to thwart terrorism and tax evasion. But the Swiss franc maintains its status as a safe haven in times of turmoil because of the country’s ongoing neutrality, because the Swiss central bank is widely viewed as one of the most independent in the world (not subject to politicians’ whims), and because the franc is considered to be one of the world’s best-managed currencies.

The Swiss government manages spending and saving exceptionally well compared to others—with a debt-to-GDP ratio under 40% today, while America’s is set to hit 130% in 2025. The G7 average is 128%.

Now, the second question: Won’t all fiat currencies go down?

Yes, the will.

And no, they won’t.

All fiat currencies will decline in value against hard assets, particularly gold. That’s because all fiat currencies are subject to inflation, which erodes their purchasing power. If a currency was still backed by gold, then that currency would not lose purchasing power because it would maintain equilibrium with the rising cost of goods.

But the value that’s most important to the consumer isn’t a currency’s worth relative to gold, but a currency’s worth relative to other currencies.

Currencies function on what is effectively a see-saw—one side going up means, by definition, that the other side must go down. And that’s where the franc’s real strength lies and why I say that all fiat currencies will not go down. Some will go up relative to the dollar. The franc is one of them.

That’s visible over the last 24 years.

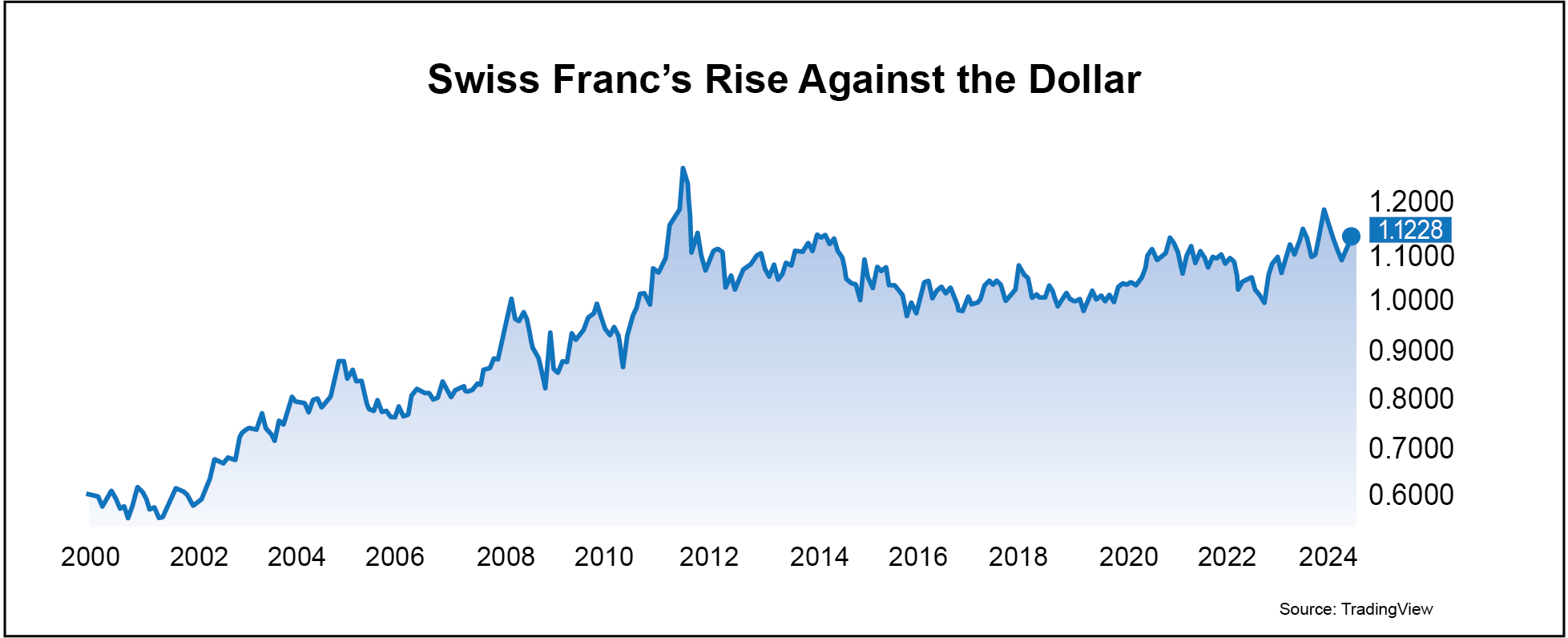

Back in 2000, one Swiss franc bought $0.55 when converted into dollars. Today, a franc will buy about $1.12.

The franc more than doubled against the dollar.

But let’s reverse that.

The math means that a saver who put, say, $10,000 into Swiss francs in 2000 would have collected nearly 18,200 francs in their account.

Today, those francs would be worth more than $20,300.

Had that same saver stuffed that same $10,000 into a US bank account and earned 1% per year on average—about what a savings account would have earned over the last 24 years—that 10 grand would have barely grown, and would have lost tremendous purchasing power.

The saver who put their dollars into francs would be well ahead of inflation.

Here’s what I mean:

That’s what I mean when I say that while all fiat currencies will lose value relative to gold, certain fiat currencies will gain value relative to other fiat currencies, namely the dollar.

And it’s there that the value of the Swiss franc stands out.

It’s why Swiss francs currently represent about 44% of my largest investment account, and about 23% of my overall nest egg.

And it’s why I am recommending again that you own Swiss francs in your portfolio.

Buy the Invesco CurrencyShares Swiss Franc Trust (symbol: FXF) at the market price.

Risk: Low/Like Cash (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

You could own francs directly through EverBank or Wise.com, both of which offer access to the franc. But you would need to check your eligibility because, as Wise notes, “Whether or not you can open a Swiss franc account in the USA will depend on the specific bank or provider you pick. Factors like your citizenship and residency may also make a difference…”

For the me, the Invesco Trust is easier, particularly if you’re investing through an IRA or a brokerage window inside a 401(k) plan.

The trust is basically a Swiss franc exchange-traded fund, or ETF. Its sole purpose is to hold Swiss francs and benefit from what I expect will be continual and long-term appreciation against the dollar.

The shares trade on the New York Stock Exchange, so you will not have any problem accessing them through any US-based brokerage firm.

I’ve not given a “buy up to” price because this is a currency ETF and the price movements on a daily basis are fractional. Just buy it at the market price and forget you own it. Moreover, I’ve given it a risk rating of low/like cash because this is a currency and the movements are not sharp and dramatic, as they can be with stocks and crypto. If a currency sees a 1% move in a day, it’s been a helluva day!

As such, this is not going to be an investment that leaps or sinks in value, so no sleepless nights.

This, to me, is a near-permanent insurance policy for a nest egg—a way to protect yourself from a dollar crisis or, at the very least, to top inflation over time since the franc will very likely continue to rise in value against the dollar, even as the dollar loses ever-more ground to inflation.

Now as I noted, I hold an outsized position in francs in my personal portfolio—some 23% of my overall nest egg. I am not recommending that you should follow suit and put 23% of your nest egg into francs.

I did so because I am in my late-50s and have weathered all the stock market crises Wall Street has thrown at us over the last 30 or so years. And frankly, I don’t want to risk another crisis destroying the bulk of my wealth as life pulls me, begrudgingly, toward retirement.

If nothing else, I want that largest retirement account to survive whatever Wall Street throws at us next. So, given my views on America’s fiscal disaster-to-come and the impacts that will have on the dollar, I put the largest portion of that account into francs (with gold running in second place at 27% of that account).

For me, I want to know a big part of my financial life is safe. (That doesn’t mean I am risk averse. After all, crypto is probably 20% of my overall net worth.)

You should gauge your own tolerance for risk, based on your own expectations of where the US is headed fiscally, and what that would mean for the dollar. There are lots of people who think the status quo remains constant and that the dollar will always be a strong reserve currency. They’d never go heavily into any other currency, including the franc, because they see the dollar as the safest haven.

More power to ‘em, though I think they will rue that decision.

In my world view, America faces an existential crisis because of the impossible debts it has racked up in buying economic growth through credit (and from politicians buying votes). This cannot continue. And that’s not me saying that; that’s American business leaders, global financial leaders, even the highest-ranking bureaucrats in the US monetary system saying that.

They’re sending a message to Congress that a Cat 5 hurricane is spinning just offshore, and that it threatens America’s fiscal future, its monetary system, and the dollar’s status as a safe currency.

Alas, Congress isn’t listening.

It’s at a hurricane party…

On August 12, America will enter a new age.

On that day, the US will stop importing uranium that was mined and enriched in Russia.

It’s huge news for America, even though most people probably don’t even know it’s happening. Most Americans aren’t paying attention to news about nuclear plants and uranium.

The US has been relying on Russia for decades to meet its uranium needs. Uncle Sam’s capacity to meet his own nuclear fuel needs has been in decline for nearly 40 years, and now roughly 90% of America’s uranium comes from mines in Canada, Russia, and Kazakhstan.

That changes in August thanks to a bill President Biden signed in May that bans uranium imports from Russia, the latest in an ongoing series of sanctions against Vladimir Putin as a result of the war in Ukraine.

That bill also doles out $2.7 billion in government cash to help rebuild America’s decimated uranium industry.

And a big winner in that will very likely be Energy Fuels (UUUU), one of the plays in our Global Intel portfolio.

Energy Fuels has struggled over the last nine months, down about 33%. In the portfolio, we’re down about 18%. Frankly, I’m puzzled by the downdraft in the price. If you read the headlines back across the last nine months, there’s nothing that implies Energy Fuels should be underwater. A small sampling of what I mean:

Uranium is in short supply, pushing up prices and mining stocks

Energy Fuels GAAP EPS of $0.07 beats by $0.11, revenue of $10.99M misses by $0.03M

Uranium prices seen rising even higher on supply tightness, rising demand

World's top uranium producer warns of supply shortages over next two years

Uranium names soar as Kazakh producer warns again of potential production hit

Energy Fuels preparing two additional mines for production

World's top uranium producer says global output won't cover market needs this decade

Energy Fuels GAAP EPS of $0.02 in-line, revenue of $25.43M misses by $0.94M

Energy Fuels begins commercial production of separated rare earths at Utah mill

There’s nothing in those headlines to suggest lower stock prices. Yes, Energy Fuels missed revenue targets twice, but the misses were minor, and certainly not worthy of haircutting the company’s value by 33%.

What I know is that the US is banning Russian imports and pumping money into rebuilding America’s uranium mining industry, and that’s a boon to miners such as Energy Fuels.

The company is restarting a few shuttered mines with an annual production capacity of between 1.1 million and 1.4 million pounds by late 2024 or early 2025. And it will begin production at three new mines, bringing another 5 million pounds online over the next couple of years.

Of particular interest, to me, is that Energy Fuels is known as a “near-term” producer, meaning it has the capacity to ramp up production quickly at already-approved and operable mines as uranium prices strengthen. Most other US producers are not in that situation. They own significant uranium assets, but their mines have not been approved or the mines have not yet been fitted out to produce and processes uranium ore.

Energy Fuels has also moved into rare-earth metals, some of which are a byproduct of uranium mining. The world is quickly gobbling up rare-earths because they go into everything from smartphones to electric vehicles. China controls the rare-earth market and has demonstrated a willingness to use its horde as a tool to slap Western economies by banning exports of rare-earths.

That gives Energy Fuels another tailwind, since manufacturers all over the world seek non-Chinese sources of rare-earth metals for their production processes.

I can’t say that Biden banning Russian uranium, or global manufacturers seeking non-Chinese sources of rare-earths, will cause an immediate jump in Energy Fuels’ share price. But I can say that both those are structural elements that build an even stronger case for owning the stock longer term.

I would use this opportunity to grab some UUUU at a discount. At just under $6 per share, the stock seems undervalued relative to its fundamentals and the fundamentals for the overall industry.

I expect a nice pop in the share price.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke

Editor, Global Intelligence Letter

© Copyright 2024. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.