Dear Global Intelligence Letter Subscriber,

When the Carter brothers bought a stretch of land in the Big Thicket more than a century ago, they had no idea of the secret that lay beneath…

Nor could they have known that this secret—once unleashed decades later—would change the course of corporate history forever.

For the brothers, their sole focus was what sat on the surface: a vast expanse of long-leaf pines.

In 1898, W.T. Carter and A.E. Carter plunked down $3,200 to buy 640 acres of woods near Houston, in an area known locally as the Big Thicket. Though the purchase price seems small by modern standards, at that time it was a princely sum… the equivalent of about $116,000 today.

The pair had started a lumber company, W.T. Carter & Bro., in the mid-1870s, and the vast plot of pines would help feed their growing mill business.

At that time, lumber was the key commodity in a rapidly developing America, serving as fuel for household heating and the primary material for construction.

By buying up this plot, and many others like it, the Carter brothers and their heirs would grow immensely wealthy… building a lumber empire that stretched across the state.

That is, until the secret was revealed and everything changed.

In 1968, the company sold off every last bit of its timber and lumber operations. All the trees and land. All the mills. And all the trains and railroad feeder tracks it had amassed to connect its lumber yards to major railways.

All it kept was a single, unseen asset… something buried beneath the Big Thicket and other lands it once controlled.

That asset: Rights to the oil and natural gas that lay hidden underground for eons… and no one really cared about until the 20th century.

Overnight, W.T. Carter & Bro. morphed from a lumber producer into an entirely new type of business—one that holds and profits from an intangible asset known as a “mineral right.”

Which is where your June issue of Global Intelligence begins.

When you think of oil and natural gas, you probably think about drilling rigs and pipelines, maybe supertankers crisscrossing the oceans, or the Exxon or Chevron gas stations nearby. But before the gasoline is sold, before the pipelines are built, and before the rigs drill holes in the ground, there are mineral rights.

These rights are the very first step in the process of bringing oil and gas to the surface. And they’ve created enormous wealth for those who lease their rights to oil and gas exploration and production (E&P) companies.

Now, we’re going to profit from the same mineral rights that W.T. Carter & Bro. tapped into decades ago… before the value of these rights spikes higher.

We’re in the early stages of an energy “super shock,” a period of markedly higher energy prices. This is due to two factors: widespread underinvestment in oil and gas exploration, and Western governments too quickly pushing renewable energy onto a world that’s not equipped to make the necessary infrastructure changes at such an accelerated pace.

The result of this will see oil prices shoot to record highs, which in turn will see E&P companies aggressively snapping up mineral rights so they can hunt for new reserves and tap into the windfall profits that will spin out of higher energy prices.

So, with this month’s issue, we’re buying more than 20 million acres of mineral rights across 41 states—and a huge “dividend” of 11.7% per year.

Oh, and the company we’re buying… it’s the heir to W.T. Carter & Bro.

The Rush for “Black Gold”

Down in Texas, the locals knew oil existed in their state as early as the mid-1800s.

But they largely saw it as a nuisance, not an asset.

Fort Worth rancher, William Thomas Waggoner, once shared a great example of that fact. In 1902, he had his ranch hands drilling for water on his property, but they struck oil instead. “I wanted water, and they got me oil,” Waggoner said. “I tell you I was mad, mad clean through. We needed water for ourselves and for our cattle to drink.”

That was a common complaint of the day in a state known for its ranching.

But very soon, all that was about to change…

Commercial oil production in the U.S. dates back to 1859, when George Bissel and Edwin Drake drilled America’s first oil well in Titusville, Pennsylvania. But at the turn of the 20th century, wood and particularly coal were still the dominant sources of energy.

Demand for oil was certainly growing around that time, but primarily as a fuel for kerosene lamps, an important consumer product back when electricity wasn’t ubiquitous.

Still, oil didn’t really take off in a meaningful way until a new technology burst onto the scene: the automobile.

In 1900, cars were still a rare sight in the U.S. But that changed almost overnight. By 1905, America had scores of automobile makers (including makers of electric cars) selling a combined total of about 25,000 vehicles per year.

As the car conquered America, and demand for gasoline skyrocketed, the great race to find and produce oil exploded across the country.

This was a new gold rush, and much of it was focused on Texas.

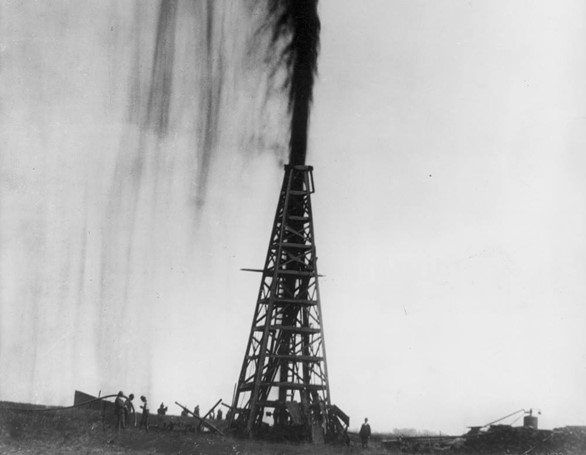

In 1901, just a few short years before the automobile started to take off, a small company known as Gladys City Oil, Gas, and Manufacturing Co. was drilling in Beaumont, Texas, just south of the Big Thicket. There, on the outskirts of town, at a place called Spindletop Hill, it hit a gusher unlike any previously found in America.

You might have seen this image at some point… it’s the blowout that happened when the drillers hit the seam of oil in January 1901.

The size of this well was unprecedented. Spindletop was instantly producing 100,000 barrels of oil per day, more than all the other wells in America combined at that time.

In the aftermath of this discovery, companies big and small began rushing into Texas… running around the state poking holes in the ground anywhere they thought they might find “black gold.”

Alas, they didn’t always own the land on which they wanted to explore. And they couldn’t necessarily afford to buy the land, either. Parcels of Texas land that had been selling for $10 per acre before Spindletop exploded in price to as much as $900,000 per acre by 1902—the stunning equivalent of turning $350 into nearly $32 million today.

Amid this Texas oil rush, state politicians came under pressure to legally recognize something called “mineral rights.”

Prior to 1907, wealth beneath the land in Texas—commonly assumed to be gold, silver, and salt—was typically considered the possession of the state government… a legacy of Texas’ prior status as a part of Mexico and Spain.

But that year, Texas lawmakers approved statutes declaring that property owners could legally sell rights to the minerals beneath their land. In other words, the land and the rights to the minerals beneath it could be sold separately.

Leasing rights emerged several years later. By 1947, oil and gas mineral rights covered nearly 54 million acres of Texas, almost a third of the state.

W.T. Carter & Bro. was right in the middle of all that action.

The forested land it owned spanned a great swath of East Texas, where much of the state’s early petroleum industry grew up.

The company began leasing some of its land to E&P companies, exacting not just rent for the land, but royalties from the oil that producers sold. The company also began building some oil rigs itself and was making good money producing oil.

In fact, the lumber company was making such hefty profits off mineral leases and oil production that by 1968, it sold off all of its timber operations to focus exclusively on oil and gas mineral rights and production.

But that’s not the last time the company reinvented itself.

Thirty years later, the business would change again… giving rise to the company we’re going to invest in today: Black Stone Minerals.

Black Stone’s Intentionally Disastrous IPO

From 1968 to the early 1990s, W.T. Carter & Bro. drilled for oil and leased mineral rights to others on the lands it had accumulated over the previous century. In 1992, however, the company shifted focus…

That year, it bought the mineral rights held by Texas-based Kirby Lumber Co.—the first time it had acquired mineral rights rather than land itself.

Four years later, it sold off its production operations to focus exclusively on acquiring and leasing mineral rights. Changing its name to Black Stone Minerals, the company snapped up 14 million acres of mineral and royalty rights across a number of states from Bethlehem Steel Corp.

With its now-diversified footprint across the country, Black Stone had become America’s largest oil and gas mineral rights company.

Black Stone remained a private company until 2015, when it finally went public on the New York Stock Exchange. That happened at one of the worst moments for oil.

Crude oil prices that had topped $130 per barrel in 2008 had plunged into the $30s by the time Black Stone held its initial public offering. Wall Street begged the company not to go public, telling company executives that the shares would not find a receptive audience.

And, indeed, Wall Street was right.

The stock quickly fell from $9.25 on May 1, 2015, when it first began to trading, to $7.20 a month later. By February 2016, shares were trading at just $6.72, a decline of nearly 30%. (Note: These prices are adjusted to include dividends paid.)

But Black Stone management was not deterred. In fact, the Houston-based company explicitly wanted to go public at a bad time.

Management knew that the $427 million raised in the IPO would give it a substantial war chest to snap up mineral rights at fire-sale prices from owners desperate to sell in a down market.

That’s how Black Stone has grown into a company that today holds more than 20 million acres of mineral and royalty rights across 41 energy-rich American states.

Those rights are within several of America’s most prolific oil and gas fields: the Permian Basin in West Texas, the Haynesville Shale that stretches from East Texas to western Alabama, and the Bakken oil fields across western North Dakota and eastern Montana.

And those assets now put Black Stone in an enviable position as the new oil boom begins…

Crisis and Opportunity in Oil

Back in early 2021, long before rampant inflation took hold, I told you to prepare for markedly higher prices, writing “an inflationary wave is soon going to roll over the economy.”

Inflation was just 1.7% when I wrote that. By the middle of 2022, it had reached a 40-year high above 9%.

Predicting that inflation would spike wasn’t a spot of magic or luck. All the plot points leading to higher inflation were plainly visible.

Similarly, for some time now, I’ve been telling you to prepare for much higher oil prices because once again, those plot points are clearly visible to anyone paying attention.

Before COVID arrived to stop the world in its tracks, E&P companies had begun to slow their search for new oil and gas reserves. The root cause of this was the green energy movement and politicians happy to pander to it for money and votes.

To be clear, I’m a fan of green energy. I’ve invested personally in this sector. It will build a wonderful world for our grandchildren.

But the green lobby has dangerously misrepresented how quickly this technology can replace our existing fossil fuel-based energy infrastructure. And it has fostered an anti-fossil fuel agenda in the halls of government around the world.

Faced with so much political animosity and legal uncertainty, oil and gas companies have been reducing their exploration activity.

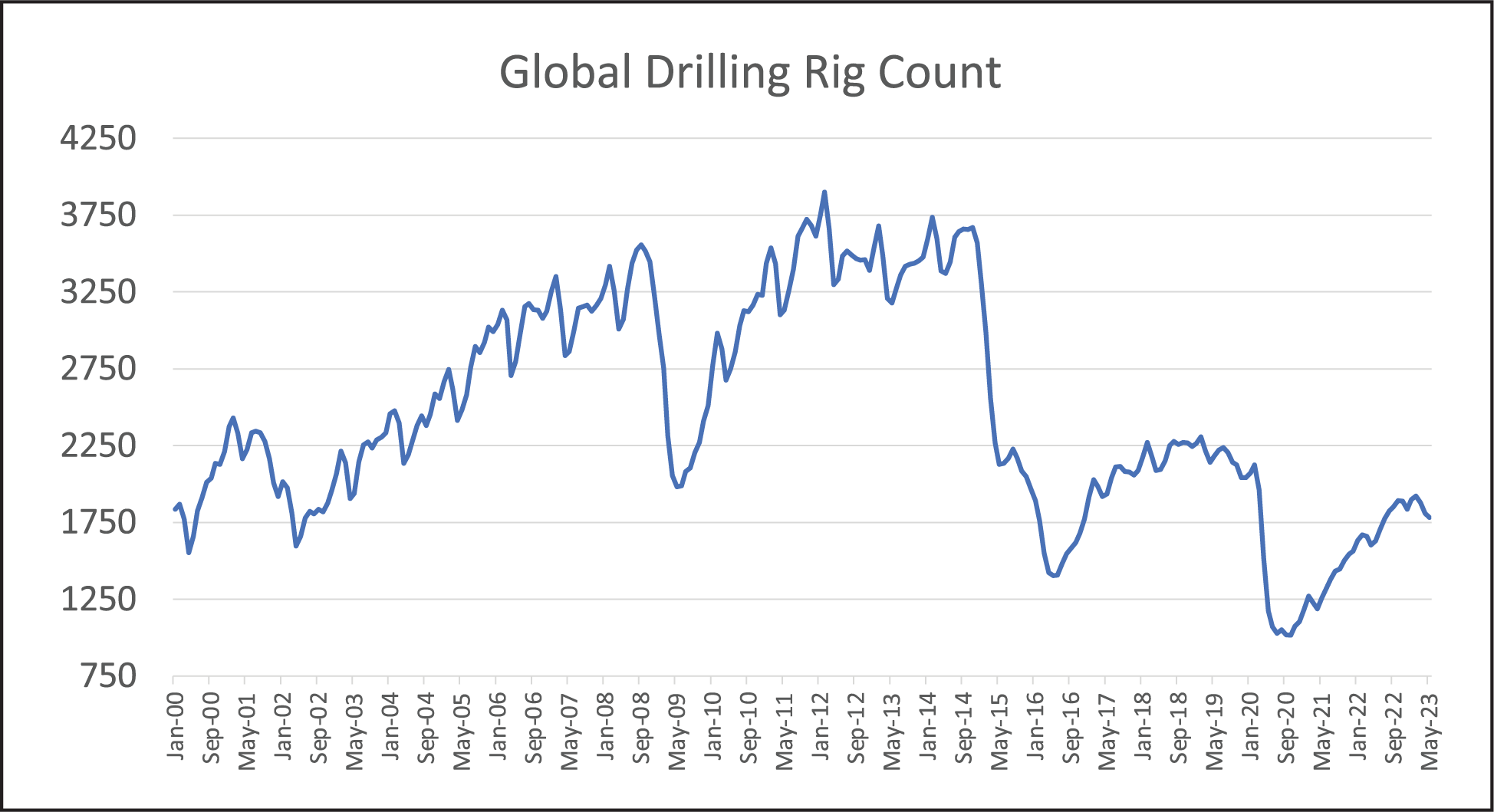

In the early 2010s, E&P companies were operating more than 3,500 drilling rigs globally. By 2016, that had fallen to just 1,400, which you can see in this chart of global drilling rig counts tallied by oil services giant Baker Hughes:

Then COVID arrived and the world economy came to a standstill. Oil demand fell off a cliff because few cars were on the roads, public transit was offline, and ships and planes were idled. At one point, oil prices fell below $0 because there was simply nowhere to store the fuel.

The media were saying the end of fossil fuels was nigh and demand for oil might never return to pre-pandemic levels.

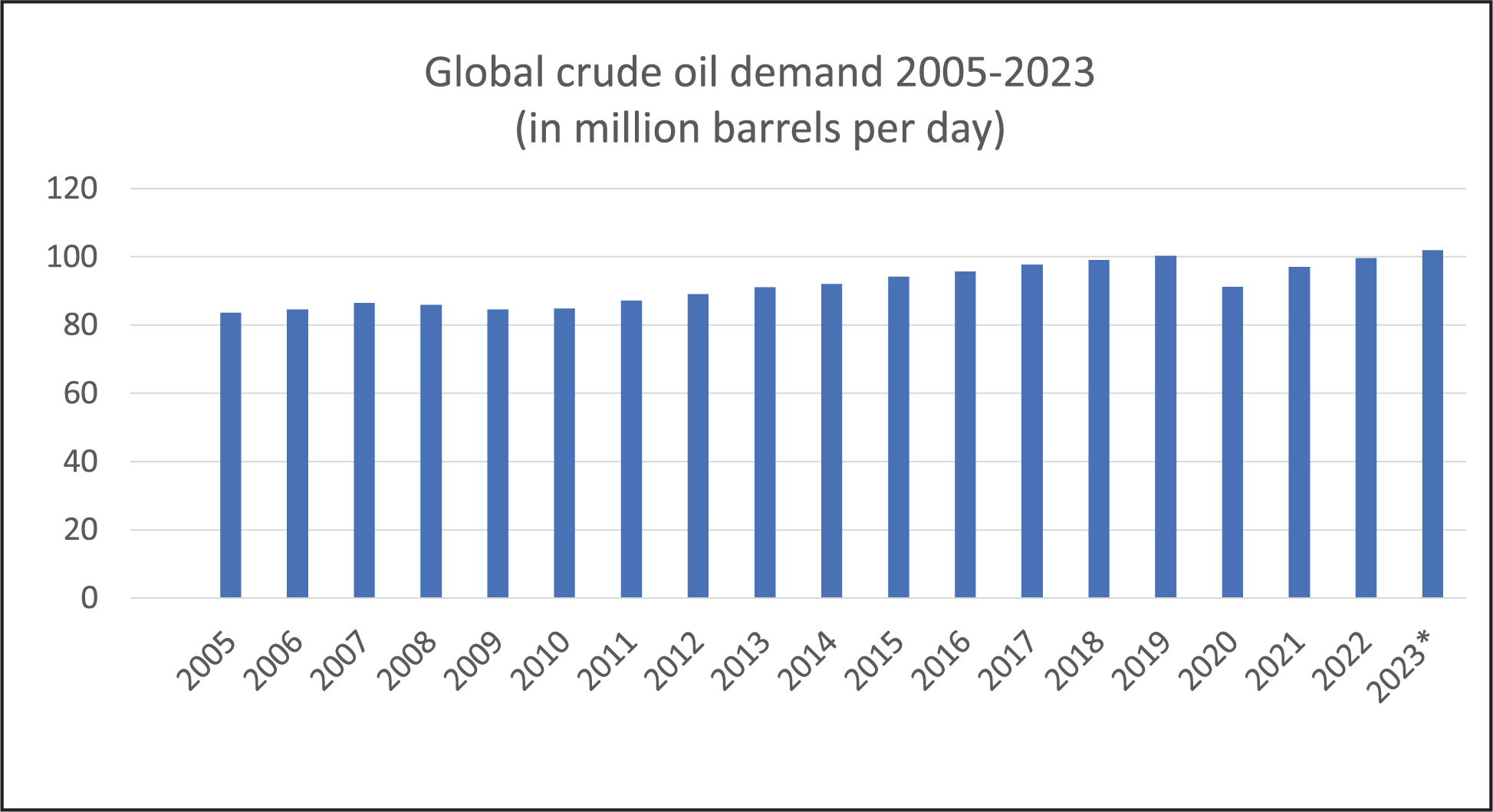

As I wrote at the time, that idea was simply moronic. The post-COVID world was clearly going to rebound like a Super Bouncy Ball hurled at the pavement. And indeed, today the world is consuming 102 million barrels of oil per day, well above the barely 100 million it consumed in 2019, before COVID struck.

* Levels for 2023 are estimates.

But that now leaves us with a significant problem…

Exploration for new reserves has been very slow to return. That’s because a) oil companies want to keep prices elevated, and b) E&P companies remain unsure of government intentions. They don’t want to spend tens of millions of dollars sinking exploratory holes in the ground, only to be hit with new and expensive environmental mandates or lawsuits that hamper their ability to profitably tap a new reserve.

That’s a big part of the reason the global rig count has only climbed back to about 1,800, despite oil prices sitting in the $70 range these days.

So, we’re now in a situation where global oil demand is rising, even as available oil supplies are shrinking with every barrel pulled from the ground. And green energy is still decades away from being able to pick up the slack.

Soon, rising global demand for energy—particularly in fast-growing emerging economies—is going to slam headfirst into reduced production capacity.

At that point, the world is going to be hit by an energy “super shock.” As this crisis plays out, I expect prices for a barrel of oil will rise into the mid-$100s, with spikes toward $250.

But here’s the thing…

Once oil is regularly entrenched above the $100 mark, and once you have politicians frantic about high energy prices, E&P companies are going to be much more amenable to poking a bunch more holes in the ground.

In that world, Black Stone’s mineral rights are going to print money.

The Purest Play on Oil Prices

At this point you might be thinking: What exactly does a mineral rights and royalties company do, since it’s not actually producing any oil and gas?

Basically, it’s an Airbnb for exploration and production companies.

E&P companies pay a rental fee to Black Stone to tap into its mineral rights on a particular piece of land. Then, if they happen to find sufficient oil and gas to make the well profitable, they pay Black Stone a royalty based on current energy prices for each barrel of “oil equivalent” they pump from the ground.

Note: Oil is sold in barrels. Natural gas is sold in millions of cubic feet. “Oil equivalent” measures the amount of energy each commodity generates so that they can be fairly compared financially on an apples-to-apples basis.)

That’s Black Stone’s entire business model: Generate income from leasing activities and royalties.

I would argue it’s the purest play on energy prices you’ll find without going out and buying barrels of oil to store in a warehouse or in your backyard.

Black Stone faces no exploration and production costs. It doesn’t need to build drilling rigs. It doesn’t have to hire roustabouts to operate those rigs. And it doesn’t have to figure out the logistics of getting oil and gas from the field to the pipelines and refineries.

It just owns a bunch of invisible mineral rights that it leases out.

The company’s current flow of cash is based on leasing activity taking place on just 26% of its acreage. That means there are growth opportunities across the other 74% of those 20 million acres of mineral rights it owns.

To that end, Black Stone employs a team of engineers, geologists, and so-called landmen, the specialists who negotiate lease deals with exploration companies.

They’re all out surveying land, building profiles of geologic formations that potentially hold pockets of oil and gas, and then marketing those to E&P companies looking for new opportunities to expand production.

Most recently, those efforts have resulted in Black Stone signing deals with multiple E&P companies to develop fields in East Texas and the Austin Chalk, a geologic formation which runs from the Texas-Mexico border through central Louisiana.

That business model of collecting what is effectively rental income for providing access to minerals, and the royalties Black Stone collects from the energy that its renters produce, has seen the company pull in revenue of between $400 million and $665 million per year going back to 2017.

That, of course, is dependent on oil and gas prices, as well as the occasional pandemic that comes about. But all the signs now point to revenue growth…

As I’ve written about for more than a year now (such as in the March 2022 issue), the oil and gas industry is moving into a new boom phase as energy demand expands globally. E&P companies are already ramping up spending to locate and produce more oil and gas—though still not at sufficient levels to keep pace with increasing demand. Black Stone’s portfolio reflects this shift.

Back in 2020, when oil prices plunged in the wake of the COVID pandemic, the number of rigs operating on Black Stone acreage fell to 29 in June of that year, from 94 in January, a shockingly quick collapse.

Today, rig counts are back to 95, with more on the way.

As a result, earnings per unit soared to $2.12 last year, from just $0.49 in 2020. I use “per unit” there instead of “per share” because unlike a typical Wall Street company, Black Stone is a master limited partnership, or MLP, which I will explain in a moment.

This year, earnings are likely to be in the range of $1.80 per unit, but that doesn’t speak to any weakness. It’s just a reflection of the ebb and flow of oil and gas prices.

Last year, oil prices raced to nearly $115 per barrel. Today, they’re in the $70 range. But that’s not likely to impact dividends.

The company has a robust balance sheet with a paltry $10 million in total debt. It’s earning well over $2 per unit in “cash flow” (the real earnings of a company after accounting for non-cash expenses like depreciation).

That’s plenty enough wiggle room to continue paying its generous distributions of $1.90 per unit, or almost 12% per year.

And because it’s an MLP, these are required dividends. The company’s profits must flow through to the unitholders. Those distributions, of course, can fluctuate as profits fluctuate, but they are guaranteed to arrive simply because of how MLPs operate.

Buy Black Stone Minerals (BSM) at prices up to $17.25.

Risk Profile: Medium (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 35% Trailing Stop Loss

Black Stone trades on the New York Stock Exchange, so you will have no trouble buying this stock through any U.S.-based brokerage firm, such as Fidelity, Charles Schwab, or Robinhood.

I’ve given Black Stone a Medium risk rating because of the industry it’s in.

Oil, as you well know, is a volatile asset class, and where oil prices go, so goes Black Stone.

You can see that exceedingly tight relationship in this chart:

Black Stone is the orange line… oil prices are in yellow. The two are like twins moving through life holding hands. Which, along with the fat yield, is a primary reason I want to own Black Stone.

This stock gives us direct and near-pure exposure to oil prices.

Yes, that means we will see Black Stone dip anytime oil prices dip. But it also means we’ll see Black Stone’s share price surge as oil prices surge.

As I’ve noted, I expect we’re going to see oil at $150 per barrel, with spikes to $250 as the energy “super shock” plays out.

So, we’ll weather whatever dips happen because we know that higher oil prices are going to drive up the value of our stock over time.

And we know that even as oil prices ebb and flow, we’re going to continuously earn a handsome quarterly payout for patiently holding Black Stone Minerals in our portfolio.

Investing in MLPs

I mentioned above that Black Stone is an MLP, a unique type of corporate structure that operates fundamentally differently than most companies you’ll find on the New York Stock Exchange.

In short, the profits and losses of MLPs flow through the company directly to “unitholders”—its investors like me and you—in the form of a distribution, or what is effectively a dividend.

The MLP arrangement is widely popular in the energy industry, particularly among pipeline companies. The upshot is that this flow-through of profits to unitholders means Black Stone’s yield is huge relative to a traditional Wall Street stock.

While the typical S&P 500 dividend-paying stock yields about 2.65% today, Black Stone is spinning out 11.7% in quarterly distributions, or $1.90 per unit per year.

For income investors, Black Stone is a stock-market ATM tied to an asset that has unending demand. This is a stock you stick in your portfolio and you don’t worry about it.

However, because Black Stone is an MLP, the shares you own are treated differently for tax purposes.

MLPs are what the IRS refers to as a “pass-through entity,” meaning profits and losses flow directly through the company to the unitholders.

As such, MLPs avoid the double-taxation associated with traditional corporations. By that, I mean that traditional companies are taxed at the corporate level, and then any distributions to shareholders are taxed at the personal level.

With an MLP, only the unitholders are taxed. However, because of how MLPs function, a portion of the income you earn every year is considered a return-of-capital, and you’re not taxed on that.

Each year, you will receive a tax form in the mail (or email) known as a K-1, which you will report on your tax return. It’s not complicated.

Also be aware that while MLPs are fine to hold in an IRA, there is a quirk. Any MLP distributions inside an IRA that exceed $1,000 annually are subject to something called “unrelated business taxable income” or UBTI. They are immediately taxable. That means owning an MLP in an IRA, a tax-deferred account, or a tax-free account, can negate some portion of the account’s tax-advantaged status.

In short: Talk to your tax pro if you’re looking to own Black Stone inside an IRA.

This month’s portfolio review isn’t so much focused on the portfolio specifically as it is on the stock market generally. As we near the end of the Federal Reserve’s historic rate-hike cycle, I want to look at where we’re headed next.

But first, a brief recap…

Over the past year, the Fed lost its mind. It pushed up interest rates so far, so fast that it literally broke several major banks in the process. Many more banks are now teetering on the brink of insolvency, and many a wise commentator is warning of further bank failures to come.

That’s where this recap is coming from—the perspective that while all seems quiet on the financial front, it’s probably not.

The Fed opted not to raise interest rates at its just-completed June meeting, signaling that the Agents of Chaos will instead head to the beach to taunt sharks this summer. They’re stopping—for now at least—to assess the damage they’ve caused and to figure out if there’s other damage still to do.

While inflation has grudgingly declined to the 4% range, it remains elevated. The jobs market has generally held up, even if the quality of jobs being created is subpar. And housing prices have not fallen off a cliff, though they’re certainly coming down in major markets.

In short, the U.S. economy is in a decidedly weird place… and the Fed, recognizing this fact, is waiting to see if other shoes are, in fact, about to drop before deciding on its next move.

All of which brings us to where we’re going next…

My expectation is that those other shoes will drop.

Economic crises function a lot like volcanoes: It takes a long time for the pressures to build before the side of the mountain blows off. Yet, geologists can tell the eruption is coming because of all the seismic tremors underground.

Three of the largest bank collapses in U.S. history earlier this year were our seismic tremors.

Credit availability has begun to constrict because of the Fed’s hikes and the bank failures. That typically helps fuel a recessionary environment since it slows businesses’ ability to grow and consumers’ ability to spend.

So, looking ahead to the second half of the year, the likelihood remains that a recession takes hold. It will probably be mild, but still a recession. Indeed, the economy is already slowing, growing at just 1.3% in the first quarter of the year. For the second quarter, which ends this month, I’d bet we see growth of maybe 0.9% to 1.6%.

Frankly, I’m not overly concerned about a recession hitting in the third or fourth quarters, since many of the stocks in our portfolio are well-positioned to not only weather the storm, but come out ahead.

Our top performers share a few traits. They’re either income-oriented preferred shares, royalty trusts, or real estate investment trusts (REITs)—like Tsakos Preferred, Edison Preferred, Slate Grocery REIT, and Pizza Pizza Royalty—or they’re tied to the energy super-shock commodities, such as Transocean, Enterprise Product Partners, and Southern Copper.

I expect those will continue to play well for us because they’re either paying us very good dividends at a time when investors are seeking income amid ongoing inflation, or they’re benefiting from rising demand in the energy sector.

I also expect we’re going to see the dollar weaken over the remainder of the year, which will play well through our gold exposure (Sprott Physical Gold Trust and iShares MSCI Global Gold Miners ETF) since gold is the anti-dollar. Moreover, a weakening dollar should continue to benefit our non-dollar stocks, such as French drugmaker Sanofi.

Two of our foreign stocks—Equinor and Yara—are both tied to natural gas and have both retreated in recent months as gas prices have returned to normalcy. Nevertheless, they remain important holdings in the portfolio.

Europe continues to seek secure sources of natural gas to replace the energy Russia once supplied to the continent, and Equinor, as the #2 gas producer on the continent, is clearly a long-term winner in that hunt. It is shipping more and more gas to continental Europe, and is developing new fields.

Yara has weather on its side, as well as lower natural gas prices. Mother Nature has not been kind to farmers of late, throwing at them droughts and floods, and they’re going to need to replenish nitrogen fertilizer in the soil, which means they will be calling on Yara, one of the world’s leading suppliers of nitrogen fertilizer.

But that fertilizer is the byproduct of natural gas. So lower natural gas prices mean a lower cost structure for Yara, and that should flow through the company’s earnings in the coming quarter.

We’re down 17.6% on Yara at the moment, and that just means this is a great entry point if you don’t own the stock or if you want to deepen your exposure.

So overall, our stock portfolio is faring well in this market, and it should hold up strongly in the economy that’s on the way.

By Kristin Wilson

Kristin Wilson is International Living’s Go Overseas Mentor.

Editor’s Note: For this month’s Expert Insights article, we’re doing something a little different…

One of the most important financial trends we’re seeing today is the growing number of Americans retiring overseas. According to Social Security Administration data from May, more than 702,000 Social Security recipients are now living abroad. That’s up significantly from the 500,000 to 600,000 range a decade ago.

And it’s not just retirees… With the rise of remote work, professionals are leaving, too. According to a Gallup poll from the end of 2022, up to 15% of Americans say they want to leave the country permanently, while even more would be willing to leave under the right conditions.

To dig into the causes of this trend, I spoke to International Living’s Go Overseas Mentor Kristin Wilson. For 20 years, Kristin has lived, worked, and traveled across 60 countries. And through her relocation consultancy business, she has helped thousands of people settle into new lives abroad.

In our wide-ranging Q&A below, we explored the reasons more and more people are moving overseas… where they’re moving… and the financial implications of relocating.

Jeff:

Kristin, I’d like to begin by exploring your background a little bit. How did you become a go-overseas mentor and what exactly does that involve?

Kristin:

I got the travel bug in college. During my undergrad, I spent a semester in Costa Rica as a Rotary ambassador, and then a semester in Australia studying international business. In 2005, after getting my MBA, I moved back to Costa Rica. From that time until the pandemic, I was either living full-time in Costa Rica or Nicaragua, or traveling internationally as a digital nomad… except for a few periodic stints back in the U.S.

For my first seven or eight years overseas, I worked in real estate. But in 2011, I opened my relocation business to help other people achieve what I’d done. Basically, I provide full, personal, one-on-one guidance to help people take all the necessary steps to move to their dream destination overseas… covering everything from logistics to finances to visas and more.

Jeff:

The data shows there’s been a big spike in interest in moving overseas since the pandemic, among both retirees and professionals of all ages. Is that your experience?

Kristin:

Without question. I think that what happened in 2020 motivated people to take action because they saw how freedoms could be taken away overnight. Plus, it was a big reminder that we don't have endless time here. For a lot of people, that lit a fire under them.

I also think the shift to remote work has been a big motivating factor. When everything went online, lots of people took the opportunity to move overseas. This made the live-overseas lifestyle more mainstream, and the major U.S. news outlets started covering it.

The trends toward working remotely and retiring abroad had been happening for some time. But very quickly, because of what happened in the pandemic, this went from something that might’ve been considered an alternative lifestyle to something that had widespread societal understanding, acknowledgment, and acceptance.

This lifestyle has been further legitimized in the years since by the 50 to 60 countries that’ve launched new digital nomad and remote working visas to attract the growing numbers of mobile professionals.

Jeff:

When people come to you for guidance on moving overseas, do they have a particular destination in mind?

Kristin:

I would say the vast majority of people, at least 70%, don’t know where they want to go. They might have a handful of places in mind, either various different countries or multiple cities across a couple of different countries. But by the time they finish working with me, they’ve usually changed their mind.

I don't make explicit recommendations to people until I get to know them. Ultimately, the process is not really about instructing people where to go… it's more about uncovering which place is the best fit for them. And actually, that takes a little bit of time.

Often, clients are surprised by the result. They might come in with their mind set on Portugal because they've watched so many YouTube videos about living in Portugal. But then once we work together, they may uncover a different destination that's a better fit.

So far, I've helped people move to around 40 different countries. The most popular ones are definitely Costa Rica and Mexico, followed by countries in Western and Eastern Europe. I’ve also helped people move to Southeast Asia, places like Thailand and the Philippines, but not to the same degree.

Jeff:

How many of your clients are retirees or people close to retirement? And among retirees, is reducing their cost of living their primary motivation for moving overseas?

Kristin:

That’s a great question… I would say about 75% are retirees or close to it, but they aren’t people who’re looking to rely solely on Social Security while living abroad. Usually, they have other forms of income or savings.

They just want to reduce their cost of living while collecting Social Security. They could afford to stay in the U.S., but they want to move abroad for lifestyle as well as financial reasons.

Jeff:

To what extent are your clients aware of the cost of living in their target countries, and do they understand the financial requirements for getting visas?

Kristin:

One of my clients’ biggest priorities is calculating the cost of living, so they can get a clear idea of what their lifestyle will look like. It’s often one of the first things we do together… sit down and go over budgets, and ensure their financial plan aligns with their destination of choice.

As you point out, finances generally play a key role in determining whether you can get permanent residency. Most countries want you to prove that you have a minimum level of income before you can qualify for a retirement or digital nomad visa. Often, these numbers are easily achievable. For instance, in the case of Portugal’s D7 retirement/passive income visa, the requirement is around $9,120 per year in passive income, plus $4,560 if you want to bring a spouse.

Still, all these financial aspects need to be considered, and often clients only have a vague understanding of them when we start working together.

Jeff:

I’m curious to know what kind of responses you get from people when they learn about the low cost of living in most places overseas. It must be a relief, right?

Kristin:

Absolutely. They’re so relieved that the destinations they’ve dreamed of aren’t out of reach financially. I’ve almost never had a client move overseas and see their cost of living go up compared to the U.S. Across the board, it usually goes down. That’s true whether they move to Mexico, Costa Rica, Panama, the U.K., France, Spain, Portugal, Italy… You know, basically anywhere in Europe is cheaper than the U.S., aside from a few major cities.

Jeff:

How prepared are your clients when they come to you? Does it all start with you, or do they come to you later in the process having already spent some time preparing for an overseas move?

Kristin:

People who come to me usually have been thinking about moving overseas for some time, often at least one or two years… sometimes up to 10 years… or in some cases their entire lives. They've always had the idea that they wanted to move overseas, but they just couldn’t figure out how to put the pieces into motion, because it's a very broad task that's really undefined.

So, when they come to me, it's usually because they've spent at least a couple of years researching online and they're ready to begin taking practical steps. In a lot of cases, they know a lot of things that they should be doing, but they're not exactly sure what to do, in what order and when. I help them by creating a plan and putting it into action.

Jeff:

What financial steps do people need to take before making a move? And what do people overlook?

Kristin:

Financially, there’s a lot to consider. You have to organize your finances so you can manage them from overseas in the future. That could mean closing or opening certain bank accounts, opening digital-only accounts, or opening offshore bank accounts in the country you want to go to. You also need to figure out how you’re going to receive any pension or Social Security income… and how you plan to access and spend your money.

You may also need to wire funds abroad if applying for a residency permit or Golden Visa, depending on the category and country. [Editor’s Note: “Golden Visas” give you permanent residency or citizenship in a foreign country in exchange for investing a certain sum there. Often this involves buying real estate above a certain valuation, making a contribution to a government fund, or investing a specified amount in a local business.]

All of this means people are changing their financial setup from how it’s been their whole adult lives. It’s a lot to think about, and understandably people find it intimidating or don’t know where to begin.

Jeff:

To what degree do factors like tax reduction or financial privacy play into people’s minds when choosing an overseas destination? Are there people who move solely for those reasons?

Kristin:

For retirees, taxation is less of a factor. If you don’t intend to earn income in a foreign country, you don’t generally need to pay local taxes. But for digital nomads, who are working and earning overseas, where they keep their tax domicile is a major concern for them.

Circumstances around taxation are complex and vary significantly from country to country. Of course, I’m not an accountant or tax adviser, but I have professionals in each country that I refer people to. I would say that, in terms of motivation, paying less tax is a contributing factor, but not the deciding factor, for most digital nomads.

When it comes to financial privacy, I do regularly see clients who are very concerned about governmental overreach in the U.S. and are interested in moving overseas for that reason. These clients tend to use encrypted email accounts, and keep all their finances encrypted. They prefer to communicate on certain privacy-focused apps like Signal or Discord, and they’re using VPNs.

For clients like this, my experience is that they prefer to keep moving rather than settle in one country. They might go to Germany, then Mexico, and then Panama. Constant travel, in and of itself, provides a certain type of privacy that you don't get if you have a brick-and-mortar house, business bills, utilities in your name, etc. So, a nomadic lifestyle often appeals to them.

Jeff:

Last question… do clients consider the possibility of qualifying for a second passport in the future when they choose an overseas destination?

Kristin:

Interestingly, they’re not always linked. By that I mean, the people who want a second passport or citizenship often make that a priority whether they’re living overseas or not. And people who move overseas may end up getting a second passport, but their motivation in relocating was more about the lifestyle benefits, not qualifying for a second passport.

Part of the appeal of many Golden Visa programs is that you’re not required to live in the country full-time. So, the people who invest in these programs might have two or three different passports but still live their home country, such as the U.S. They just want to have a backup plan so they can travel with different passports, or so they can go and live in another country, if they want to, and have that flexibility.

Global concern is rising about a shortfall in oil supplies.

As I outlined in our cover story this month, the world is heading for an energy supply crunch.

After years of underinvestment in energy exploration and production, companies are now finally beginning to spend on E&P again. But even this increased activity is not enough to keep pace with exploding demand…

According to new data from the International Energy Agency, the gap between oil demand and oil output is predicted to reach around 2 million barrels per day by year’s end.

In light of this, the IEA forecasts oil prices will push higher as 2023 progresses, stating “The current market pessimism… stands in stark contrast to the tighter market balances we anticipate in the second half of the year.”

The fact that analysts view the current market with “pessimism” tells you everything you need to know…

Historically, oil prices in their current $70-per-barrel range (adjusted for inflation) would have meant a boom market. But now this price level is viewed as unfavorable. Which means major producers are waiting until the supply crunch bites and they can sell oil for north of $100 per barrel, before fully committing to new E&P.

That’s bad news for prices at the pump… but good news for our new investment in Black Stone Minerals, as well as our other energy investments such as Transocean.

Apple makes a big bet on the metaverse.

If you’ve scanned the mainstream media headlines in recent months, you might have come away with the impression that the metaverse’s 15 minutes of fame are over, that related investment is drying up, or that it was a passing fad.

Yeah, about that… Earlier this month, Apple unveiled its first new product in eight years—a mixed-reality headset. Dubbed the Vision Pro, it merges virtual reality, in which you’re transported into a virtual world, with augmented reality, where you see virtual objects in your real environment. Apple will launch the product early next year with a whopping price tag of $3,499.

Mixed-reality headsets are the tools people will use to interact with the metaverse. This is the next evolution of the internet… an interactive 3D experience that we view all around us, rather a static 2D experience that we stare at on our phones.

Now, obviously, the price point for the Vision Pro is astronomical, and few expect this first version to go mainstream. But this is just the opening salvo in the metaverse revolution. As people get to experience devices like these, and as the price tags fall over time, headsets like these will become as normal as iPads and iPhones.

The mainstream media is always reactionary… too quick to name something the future, and too quick to dismiss it before engineers have even had time to build the necessary tech.

A better way to see where the future is headed is to look at the big tech giants. A company like Apple never invests this heavily in a space unless it believes huge profits lie ahead.

China moves to dominate the electric vehicles market by securing control of the world’s lithium.

Lithium is one of the linchpins of the electric vehicles market. This rare-earths metal is the key component in lithium-ion batteries… the primary form of batteries used in EVs.

In 2022, global lithium supply was 671,782 metric tons, about 1,376 metric tons higher than global demand, according to S&P Global Commodity Insights. But with sales of EVs and other renewable technologies expected to explode higher in coming years, the world is heading for a major lithium shortage.

Research firm Benchmark Mineral Intelligence expects demand for lithium to outstrip supply by around 300,000 metric tons per year by 2030—almost half the current supply levels. So, the battle to control the world’s lithium supply is gathering pace… and China is taking some bold steps by making risky investments in resource-rich nations beset by sanctions and political instability.

In the past two years alone, Chinese companies have spent $4.5 billion acquiring stakes in nearly 20 lithium mines, most of them in Latin America and Africa, according to data compiled by Rystad and Benchmark. Those include investments in countries with significant terrorist risks such as Mali… places where American and European companies are wary of operating.

Given the pace of these acquisitions, China is on course to control one-third of the world’s lithium supply within just the next 18 months, according to the Swiss financial firm UBS AG. And that could give its domestic EV manufacturers a major advantage over their Western competitors.

Two easy ways to cut down on international money transfer fees.

If you frequently transfer money overseas, you’ll know how fees can eat into your bank balance. Some fees range as high as 6% per transfer, meaning you’d have to shell out $60 on every $1,000 transaction.

Thankfully, there are a few easy ways to cut down on fees. If you’re in the U.S., the best service for international cash transfers is WorldRemit. Opening an account is free, and it offers some of the lowest transfer fees on the market. However, there is a limit of $5,000 per transaction when sending money from the U.S., with a max of $9,000 per 24 hours.

For intrepid world travelers managing money across borders, Wise is an even better option. This company aims to provide “borderless banking” and is ideal for those managing money in multiple currencies.

It’s free to set up a Wise borderless account, and each individual account can hold multiple currencies. For example, when you add a euro balance, your Wise euro account comes with its own SWIFT number, just as it would if you opened a bank account in Europe. (A SWIFT number facilitates international money transfers between bank accounts.) Wise allows you to hold up to 50 different currencies in your account.

Beware the rise in social media scams.

According to the Federal Trade Commission, online shopping is now the most common type of fraud. Users lost $1.2 billion to these scams in 2022, up from just $42 million in 2017.

Here’s how the scams work: Nefarious actors place convincing-looking product ads on social media hubs like TikTok and Facebook Marketplace. But when a shopper buys the advertised product with their debit card, the scammer either ships something that doesn’t reflect the ad, or they simply don’t ship anything at all. Then, they virtually disappear, with not just your money, but potentially with your card details as well.

This past March, the FTC ordered TikTok, Facebook, and other social media companies to better vet advertisers. But it remains to be seen what steps they will take. So, here’s how to protect yourself…

Before placing an order for any item you find on social media, use Google to vet the company and product, read reviews and comments, and visit the company’s own site.

If you’re using Facebook Marketplace, ask the seller for proof that they have possession of the item. This is as easy as asking sellers to write your name on a piece of paper and having them photograph it next to the item. Simple, but effective.

How to stop hackers from accessing your security camera or Ring doorbell.

You know the cameras mounted outside people’s homes to deter potential criminals? Or the cameras parents place in their child’s room to make sure they’re safe? Turns out they can be hacked, and the footage can be viewed by anyone with the requisite skills, or even the company itself.

Before Amazon acquired Ring, the camera-maker allowed employees to access their customers’ video and failed to protect their cameras against hacking. Though many of these problems have since been remedied, there are still additional steps you can take to increase protection.

The most important thing you can do to stop hackers is turn on end-to-end encryption (E2EE) for your footage. E2EE makes sure your footage can’t be seen by anyone and also makes it much more difficult for people to hack into it.

To turn this on for a Ring camera, open the Ring app and tap on Video Encryption. Then, select Advanced Video Encryption, and from there you can activate E2EE.

The process should be similar for other reputable camera-makers. Google’s Nest fully encrypts data automatically, so you don’t need to turn on E2EE.

Why drinking red wine today could boost your memory in old age.

A glass of red wine a day keeps the neurologist away…

Red wine, along with things like cocoa, broccoli, tomatoes, and tea, is chock full of flavanols. And according to a new study involving institutions like Columbia University and Harvard University, adding more flavanols to your diet can help improve memory and cognition

The study followed 3,500 participants, divided into two groups, over a three-year period. The first group was given flavanol supplements of 500 milligrams each, while the other was given a placebo. The first group’s cognition and memory improved and had a sustained increase in baseline memory levels as compared to those who received the placebo.

You don’t have to take supplements to see the benefits, however. They can come from moderately consuming the foods listed above.

Aedin Cassidy, a professor at Queen’s University in Northern Ireland, explains “the dose required for these improvements in brain health are readily achievable—for example, one mug of tea, six squares of dark chocolate, a couple of serving of berries [or] apples.”

That’s not to say you can overdo it and drink multiple glasses of wine a night. But it’s nice to know that things like tea, cocoa, and red wine offer benefits besides their taste.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2023. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.