Dear Global Intelligence Letter Subscriber,

“I can’t guarantee you’re not going to die. But if you’re that stupid, I’m not going to stop you.”

“Understood,” I replied.

The Louisiana state trooper shook his head, turned, and dashed back into his patrol car, seeking protection against the lashing rain dumping down on south Louisiana in biblical quantities.

Just hours earlier, Hurricane Katrina had stormed ashore south of New Orleans. As a Wall Street Journal reporter living in nearby Baton Rouge, I was tasked with finding a way into the city to chronicle the damage.

The trooper’s warning concerned my plan to cross the nearly six-mile-long bridge on Interstate 10 over what’s known as the Bonnet Carré Spillway.

The spillway is an overflow mechanism designed to protect New Orleans from the Mississippi River busting its banks. But in the midst of one of the most powerful hurricanes ever recorded, it was overwhelmed.

Water levels that were typically 15 to 20 feet below the bridge were lapping at the railings as I drove across.

It was an apocalyptic sight, like Mad Max Beyond Thunderstorm…

Over the ensuing weeks, I crossed that bridge several times to catalog the long-running impacts of Hurricane Katrina on my home state. For much of that period, the power was out across large swathes of Louisiana. So, I’d have to return home to file my stories.

My then-wife and I had bought two portable gasoline-powered generators a year earlier. I’d turn them on for just a few hours during the day so I could charge my phone and laptop and submit my articles over email.

After that, I’d shut them down to preserve our limited supply of gasoline so we could run a small air conditioner at night. At the very least, that allowed the four of us—me, my now ex-wife, my daughter, and my son—to sleep in one room that was cool rather than swampy.

It was a surreal time… but one I imagine is familiar to many, many Americans.

Generators are a way of life in hurricane country—so much so that, in the wake of Katrina, numerous families I know installed permanent generators that are connected to natural gas lines.

The moment a blackout occurs, the generators automatically switch on and provide enough electricity to either power the whole house, or the most important portions of it: kitchens for cooking, hot water heaters for bathing, and bedroom air conditioners for comfortable sleeping on nights when the temperature won’t slip below 80 F.

This is relevant today because very soon I expect this reality to spread far beyond the Hurricane Belt.

Recent headlines tell the story:

In short, America has a massive problem with its power infrastructure. And here in the heart—and heat—of summer seems the perfect moment to highlight the increasing weakness of the U.S. power grid, and the opportunity it represents.

As America’s grid deteriorates, and as climate conditions put increasing pressure on utility providers, consumers and businesses across the U.S. will be forced to develop their own electricity backup plans—as they have in the Hurricane Belt for generations.

That means bumper future profits for generator companies… and one American supplier in particular.

America’s Crumbling Power Grid

This month’s recommendation is part of my ongoing thesis that America will face a string of “super shocks” as the remainder of this decade unfolds. The first of these is an energy super shock. (For the full details on these events, click here to read my special report, The Era of Super Shocks.)

For years, the green energy movement has been fomenting a disaster.

It has convinced the political class in the U.S. and across the Western world to rapidly transition from fossil fuels to renewable energy sources. But the undeniable reality is that we can’t replace more than a century’s worth of fossil fuel utility infrastructure in less than a decade.

Back in 2019, energy research firm Wood Mackenzie calculated that for American electricity production to go fully green by 2030, the country would need to spend $4.5 trillion. That’s an impossibly large sum.

Combined global profits for Big Oil were $219 billion in 2022. That means America would have to spend more than 20x the annual global profits of one of the world’s largest industries to achieve the 2030 target.

Of course, this level of spending has not been happening…

Utilities recoup their investment through the electricity rates they charge consumers and businesses. Power companies and individual state regulatory bodies set those rates—and an agreed upon profit margin—years in advance. This makes it impossible for private sector energy companies to charge high enough rates to fully replace fossil fuels with renewable power anytime soon.

But by the same token, the focus on green energy is also making it hard to raise smaller sums for basic upgrades to the existing infrastructure, since investors and utilities companies know that the government’s focus is on “going green.”

That leaves the utility industry stuck between a rock and a green space: It has no way to afford the green energy investments needed to achieve the renewable transition, and it’s fearful of government and social blowback if it spends the tens and hundreds of millions of dollars necessary to upgrade or expand existing fossil fuel infrastructure.

So, the industry shuffles along… fixing what it has to fix to keep the lights on, and spending a bit here and there on a wind farm or a solar farm to show that it is at least trying to go green to some degree.

All the while, America’s power grid is falling apart. It’s now so antiquated that U.S. consumers face more power outages than any other developed nation, according to data from the Department of Energy and the North American Electric Reliability Council.

The news agency Reuters examined federal data between 2015 and 2020 and found that the U.S. recorded nearly 9,700 power outages per year, on average. That was more than double the 4,600 per year for the six previous years.

The DOE, meanwhile, reports that those blackouts cost U.S. businesses about $150 billion per year.

Soon, this situation will reach a breaking point…

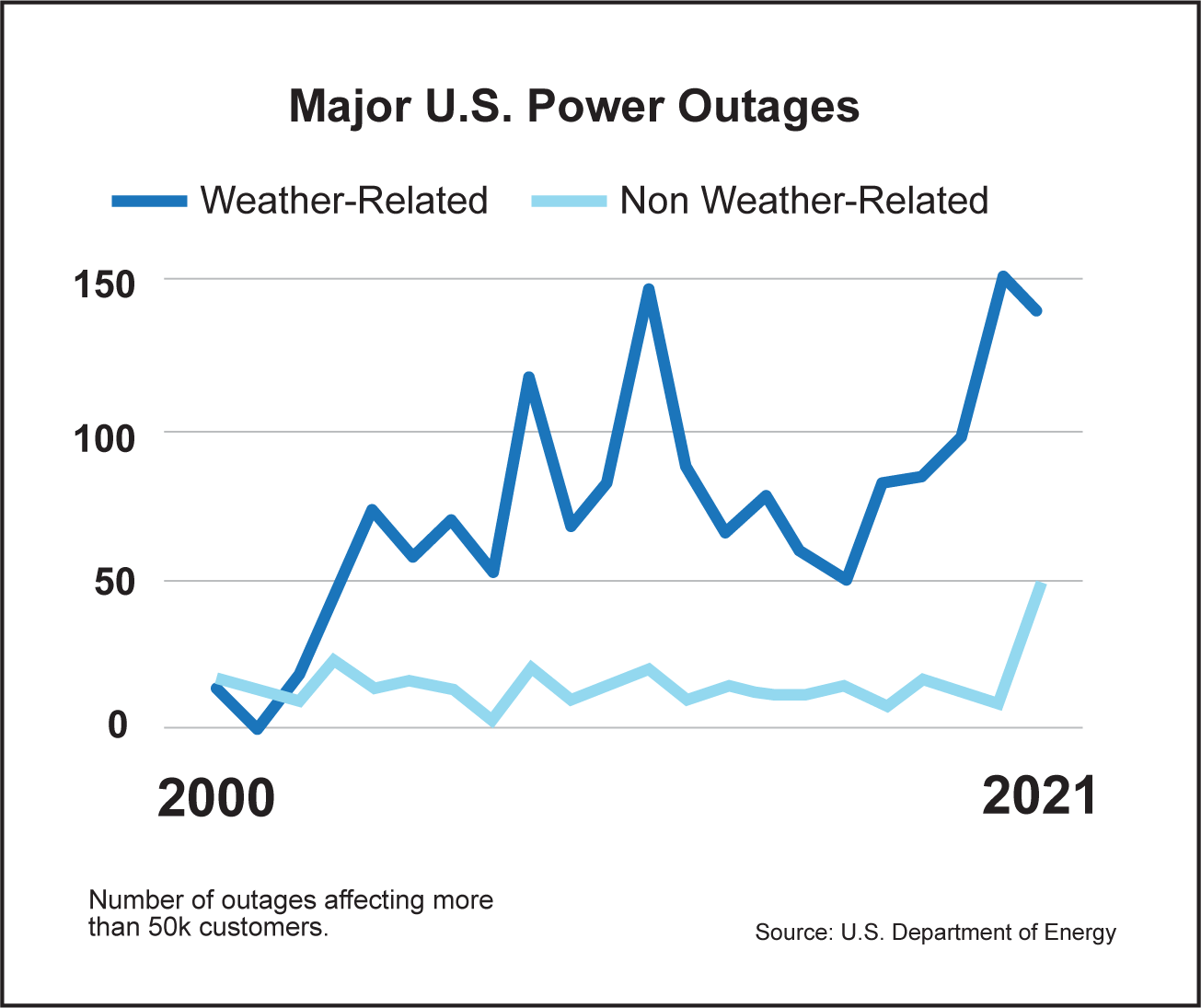

Major power outages have been spiking higher since the early 2000s.

The 7 Mega-Trends That Will Make Blackouts Normal

Blackouts are increasingly becoming a nationwide problem in America.

In just the last few years, power grids have collapsed because of Gulf Coast and Atlantic hurricanes… wildfires and Pacific winter storms along the West Coast… Midwest heatwaves… a Northeastern blizzard… and a Texas deep freeze.

Some of these outages lasted for weeks and left significant death tolls.

In Texas, the winter storm and resulting blackout of February 2021 ultimately cost 700 people their lives, according to a study by Buzzfeed News, which examined “excess mortality” during that event. (Excess mortality is the difference between the number of deaths estimated for an event and the number of deaths expected if the event didn’t occur.) Many of those deaths were due to either hypothermia or carbon monoxide poisoning as people used cars and outdoor grills in a desperate attempt to stay warm.

Now, seven mega-trends are converging that promise to put power grids across the country under unbearable strain:

America’s installed base of power-transmission infrastructure is 40 years old on average, and more than a quarter of the grid is older than 50, according to a 2020 report by industry publication Public Utilities Fortnightly.

Grid infrastructure is designed to last about 50 years, meaning that a substantial chunk of the equipment that keeps the lights on is past its prime, or rapidly approaching the end of its expected lifespan.

Every corner of the country has experienced increasingly damaging storms, heatwaves, and cold snaps in recent years and, as a result, is losing power on a more frequent basis.

As PBS, America’s public broadcaster, noted earlier this year, “the U.S. is leading the world in extreme weather catastrophes” as a result of the changing climate and the unique weather conditions that make U.S. regions susceptible to hurricanes, tornados, and many other types of natural disasters.

Yet, the country’s seven regional grid operators are underestimating the threat of severe weather, according to Reuters.

“Their risk models, used to guide transmission-network investments, consider historical weather patterns extending as far back as the 1970s. None account for scientific research documenting today’s more extreme weather and how it can disrupt grid generation, transmission and fuel supplies simultaneously,” the news agency reported after reviewing more than 10,000 pages of regulatory documents and operators’ disclosures.

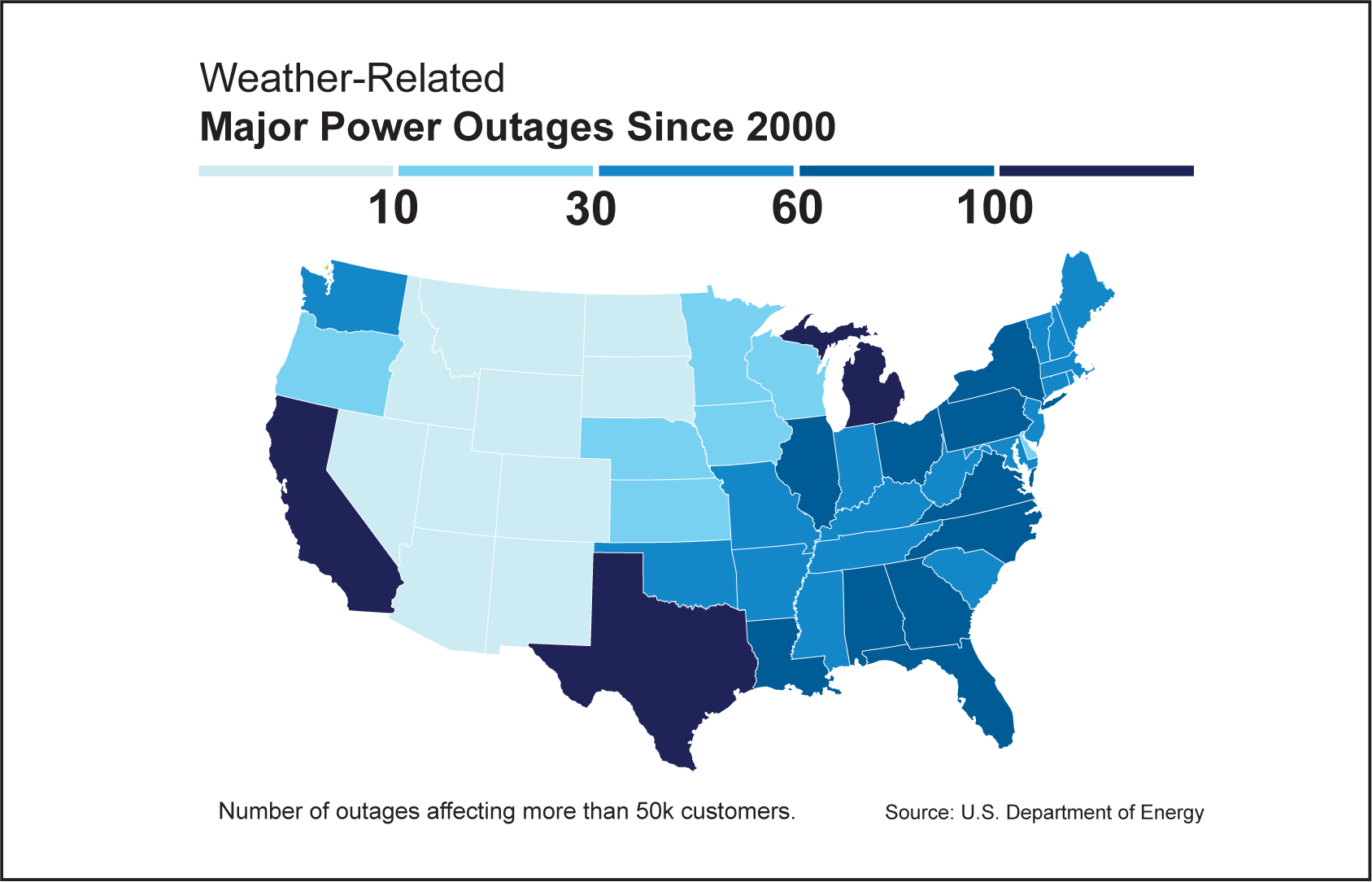

Texas and California are among the worst-hit states for weather-related power outages, but the phenomenon is increasingly common across the country.

Electric cars need, well, electricity. So, the growing use of these vehicles is placing added pressure on the power grid.

According to a Washington Post article from 2021, the reality is that “America’s electric grid will be sorely challenged by the need to deliver clean power to those cars. Today, it barely functions in times of ordinary stress, and fails altogether too often for comfort.”

The newspaper’s story was based on a contemporaneous report by analytics firm Brattle Group, which noted that “electric vehicles will be a major disruptor for the U.S. electric power sector,” and that investment of much as $125 billion is needed across the grid by 2030 to handle the added load.

The pandemic rearranged the workforce like an earthquake rearranges the landscape. Even though some companies have begun forcing employees back into cubicles, nearly 13% of the workforce now works from home, and more than 28% work a hybrid model, according to WFHResearch, which tracks global working trends.

This decentralization of the workforce has increased electricity demand since you need more electricity to power 50 individual homes than one office with 50 cubicles.

This is one of the biggest trends among the elderly population—remaining at home instead of shuffling off to a nursing home.

An AARP study found that 87% of those over 65 aim to age in their own home. This dovetails with an increase in overall life expectancy. More people at home, and living longer, increases demand on the power grid. Plus, it demands reliable, always-on power to ensure that necessary medical equipment has the juice it needs to function.

All of us own an increasing number of electrical toys and tools for at-home jobs, entertainment, communication, transportation, etc. Moreover, the size and power demands of these individual devices are getting bigger. Consider, for instance, the prevalence of smartphones today and how often the average family is charging these devices.

4G and 5G communication are now considered essential services, as unending access to the internet has become central to our lives. Plus, we’re quickly moving into the age of the Internet of Things, where even washing machines and refrigerators communicate with us and each other. That puts demand on cellular towers to maintain always-on power, too.

In essence, then, power demand is spiking ever higher, even as the challenges of providing electricity increase every year.

Importantly, several of these mega-trends demand you never lose access to electricity.

If you’re aging in place and your oxygen machine stops running, you’ve got a problem. If you work from home, but have no means of accessing the internet for days at a time, you’ve got a problem. If you own an electric car and you can’t charge it for a week or more, you’ve got a problem getting around.

But of course, not a single utility company can guarantee that power will never fail… particularly given the decaying state of the U.S. grid.

That means businesses and consumers face an ongoing and increasing risk of losing power, which will push them toward the solution set provided by the company we’re investing in today: Generac Holdings.

America’s Generator Giant

Generac is one of the America’s largest makers of consumer and industrial generators. Along with the portable generators you might see at a football tailgate party, or powering a parked food truck, the company makes permanent generators for homes and businesses that run on natural gas or liquid propane.

It also supplies electrical management software as well as solar-powered battery-storage solutions for homeowners who have solar panels and want to store excess power for use later.

About 60% of its business comes from the consumer residential market, with commercial and industrial applications comprising the rest. And while generators might seem like a relatively small, niche market, Generac is actually an S&P 500 company—one of the largest companies in the U.S.—with more than $4.3 billion in sales over the last 12 months.

Let’s dig into the investment case for Generac by first addressing the bad news…

The company is recovering from an inventory glut that built up last year, particularly in the residential market. That was the result of the COVID pandemic.

The pandemic saw the “work from home” trend explode. As part of that, homeowners were eager to build always-on power into their properties in the form of generators. But as COVID has disappeared from the public discourse, demand for the generators has fallen.

As company management noted late last year, it fully expected 2023 would see slower sales growth simply because the COVID years had built up a “significant excess backlog” of home, stand-by generators (the permanent generators that kick on automatically when the power drops off).

That slowdown is exactly what has happened.

Sales in the first quarter of this year were down 22% compared to the same quarter in 2022. Second-quarter sales, when they’re reported in August, will likely be down as well in comparison to last year’s Q2 effort.

I will note, however, that even as consumer sales have come off their COVID-induced highs, commercial and industrial sales remain strong. They rose more than 30% in the first quarter, and are up 25% over the last 12 months.

Still, as a result of the overall sales slowdown, Generac’s stock price has fallen sharply.

Just as investors bid up the price of video-call company Zoom and other stocks to unrealistic levels during the COVID years, Generac saw its shares hit an all-time high near $510 in October 2021. But as lockdowns ended, investors began selling the stock.

By last December, the shares had to fallen to just over $92, an 82% decline from those all-time COVID highs. The shares have since rebounded and are trading today in the mid-$140s.

Now frankly, $510 was never a legitimate price. That was entirely based on pandemic-investing hype. But that just means the market is giving us an opportunity to buy Generac at a fair price as we look to benefit from those mega-trends I laid out above.

Though COVID has passed, those trends will have long tails that play out over a decade at least. They will be the reasons that Generac’s sales consistently grow again starting in 2024. As such, we want to invest today.

While the sour comparisons to 2022 sales are the primary focus right now, Wall Street will begin factoring the 2024 expectations into its thinking in the coming months. So, we want to own Generac before that happens.

The Impending Spike in Generac’s Sales

Of the seven mega-trends I laid out above, two in particular will help drive Generac’s sales in the coming years.

The number of Americans over 65 is projected to double over the next several decades from 52 million to 95 million.

About 65% of Generac's home standby-power customers are over 60. And as much as 85% of home sales are retrofit applications, which is basically older Americans renovating their homes with permanently installed generators that can assure the electricity is always available for the medical equipment they rely on.

It doesn’t hurt that older Americans are flocking to two states—Texas and Florida—that see some of the worst extreme weather.

You can see the trend at play in this chart from Generac:

This chart shows the increase in activations, or the number of generators put in place by the company. Clearly, the COVID years caused a big bump. But this chart also demonstrates that even before the pandemic, the trend was clearly on the upswing. In our post-pandemic world, I would expect the trend to continue.

COVID made vulnerable homeowners and businesses acutely aware of the kinds of extreme crises that can strike without warning. More people and businesses are going to want to be prepared for whatever’s next.

That might seem like a random market to cherry-pick, but it’s actually a significant opportunity.

We are increasingly dependent on mobile communications and broadband data delivered to our phones and a growing range of internet-connected devices. That’s consuming vastly larger quantities of cellular bandwidth and, in response, telecom companies have been building new cellular towers and rolling out 5G technology at a fast pace.

By 2026, estimates are that the U.S. will have some 5.3 million towers, a 30% jump from 2021.

But those towers are subjected to the same weather challenges homeowners face, and they need a source of always-on power to maintain connections to the network. That means an industrial generator.

It’s the same calculation for the vastly growing number of data centers that consumers and businesses rely on for cloud-computing, data storage, and tens of millions of apps. Generator power ensures those data centers are never offline.

In all, Generac expects what it calls the “served addressable market”—the size of the market in terms of overall industry sales—to reach $72 billion by 2025. That’s a massive jump from just $14 billion in 2018.

Right now, the company estimates that market penetration for generators in America is 5.75% of the population. Management calculates that each percentage point of additional market penetration equates to $3 billion of opportunity for Generac to pursue.

So, given that the company’s sales for 2022 were $4.5 billion, and given that Generac owns 75% of the market, every 0.1% penetration gain means about $225 million in additional sales for Generac. That’s significant growth potential.

Buy Generac (Symbol: GNRC) up to $150 per share.

Risk Profile: Medium (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 35% Trailing Stop Loss

Generac trades on the New York Stock Exchange and, as such, is available through any U.S. brokerage firm.

I’ve given the shares a Medium risk rating because this is a large, S&P 500 company with a clear and established market. The valuation risk has largely already been excised in the huge, post-COVID decline in the shares.

Additionally, I’m not worried too much about competitors here. Generac certainly has competition from the likes of American Honda, Cummins, Caterpillar, and a few others, but all of those have larger focuses on other business segments such as diesel engines or farm equipment.

Generac is a specialist, and in a market built on brand reputation, the company is widely viewed among industry players as best of breed. It has been around since 1959 and today has more than 5,000 dealers around the country. More telling: Generac controls about 75% of the U.S. generator market.

The primary risk we face with Generac is the possibility that extreme weather events suddenly lessen, and power outages are reduced as a result. In that case, consumer and business minds will be less focused on the need for backup generators.

But this mega-trend of extreme climatic events shows no signs of abating.

As I was writing this, the National Weather Service issued a warning to 110 million Americans that “temperatures will reach levels that pose a health risk and are potentially deadly to anyone without effective cooling and/or adequate hydration.”

Phoenix, meanwhile, shattered a 50-year-old record of 119 consecutive dates with daytime temperatures of 110 F or higher. More relevant might be the fact that as Phoenix baked, wildfires scorched Canada, flooding rains swamped the Northeast, and water temperatures off the southern coast of Florida hit 97 F—five degrees higher than normal.

As year after year of events like these demonstrate, we have entered a new normal with the climate, which means demand for generators will rise.

In terms of my expectations for the shares, I forecast we’re going to see this stock test the $210 range within the next 12 to 18 months, which is a roughly 46% move up from here.

Consumers and businesses are already increasingly demanding access to always-on power amid a rising number of blackouts from degrading power infrastructure and extreme weather events. It’s not like America’s power grid will be fixed anytime soon. There’s not enough money for that.

So, access to electricity is going to remain a nagging issue for a long time in this country.

Which means Generac is a long-term winner of the energy super shock… as well as all those other mega-trends now unfolding.

In examining the Global Intelligence Portfolio this month, one fact stands out: The market has determined that the Federal Reserve is no longer a factor.

I am not so sure the market is necessarily correct. The Fed could very well exert more pressure on the economy and, thus, the stock market at upcoming meetings. But for now, the market seems convinced the Fed is pretty much done with its nearly year-and-a-half-long campaign of ultra-aggressive interest rate increases.

And I’m not going to argue with Wall Street’s beliefs because the overall bullishness of late has seen our portfolio make a strong move up in recent weeks.

That move is led by Transocean, a deep-water driller in the oil-and-gas industry. The stock is now up nearly 74%. And if you heeded my suggestion in the December year-end wrap up to grab the shares under $4, you’re up more than 100% today.

Transocean has been benefiting from the trend I’ve been writing about for many months now: energy exploration-and-production (E&P) companies trying to play catchup after years of under-investing in the search for new reserves.

Suddenly, they realize demand for oil is going to outstrip available supply, likely by the end of this year, and so they’re locking down every drilling rig they can find. In turn, that’s giving Transocean pricing power in the day-rates it charges E&P companies to lease its rigs.

This is a trend with legs, and I expect we’re going to see Transocean’s share price, $8.60 as I write this, shoot past $20 over the next year.

We’ve also seen a very nice pop in Farmland Partners REIT, which own farms all across the country that it leases to farmers. The shares were underwater earlier this year, but that was a temporary phenomenon. Food prices are rising, as are farm incomes, and that was always going to be the factor that exerted the most influence on the stock.

And it has. Which is why we’re now up more than 20%.

We’re also up around 20% in Tsakos Preferred, Pizza Pizza Royalty, and Edison Series H Preferred. And the reason is because investors want income in an inflationary world. That’s precisely why we added these to our portfolio… they provide big yields. With Tsakos, we’ve already earned more $3.56 per share in payments, a 15% return just from dividends.

REITs, MLPs, and preferred shares are going to continue to be solid investments to hold because of the dividend income they offer.

In an inflationary environment, investors want that income to offset their rising costs. And in an environment where the Fed slashes interest rates (if you saw my recent Field Notes column on this idea, you’ll know I think that’s possible as we go into 2024), investors want the dividend income because they can’t get any yield from bank deposits.

So, we’re in a good position with the dividend plays we own.

The real laggards in our portfolio are still in the crypto space. But that’s turning around now. I can tell you from my daily interactions with crypto investors and crypto team members that there is a real bullishness returning to that market.

It doesn’t hurt that the courts recently ruled against the Securities and Exchange Commission in a long-running fight it had with a cryptocurrency known as Ripple. The SEC had basically argued that Ripple was a security and needed to be regulated as such. The SEC’s legal loss is a bullish sign for the industry because it effectively said the commission’s take on crypto is simply wrong, heavy-handed, and not easily justified.

As a result, we’re seeing bullishness in crypto prices. In the last month alone, bitcoin is up around 20%. Ethereum is up about 15%.

We’re still underwater in the portfolio based on our original entry price, but given the new bullishness, I fully expect we’re going to see those red numbers turn green in those two cryptos very soon, likely before the year is out.

Even though crypto prices are up, I still recommend that you add some bitcoin and Ethereum to your portfolio (on any pullbacks of 5% or more), as long as you’re a risk tolerant investor who can handle the volatility of this asset class. There’s simply too much happening in crypto these days that says higher prices are inbound.

Investment giants BlackRock and Fidelity have both filed paperwork with the SEC to launch exchange-traded funds tied to the spot price of bitcoin, something the SEC has so far forbid. But given the weight that BlackRock and Fidelity can throw around at the congressional level, and given the beatdown the SEC suffered in the court system, I would bet the SEC greenlights these ETFs. And when it does, tens and hundreds of billions of dollars are going to race into them.

That will confirm today’s bullish sentiment, and it will see vast buying of bitcoin, driving the price up sharply. So, our continued patience will very likely pay off in a big way.

By Kim Iskyan

Kim Iskyan is the CEO of Porter & Co., a boutique

investment research company. Porter & Co.’s

flagship publication,

The Big Secret on Wall Street, focuses on

investment strategies similar to those Kim describes

below. To learn more about Porter & Co., visit their

website

here.

Warren Buffett is rightfully an investment legend for one reason: His unparalleled ability to compound wealth—over decades.

Any fund manager can have a hot quarter, year… or, maybe, string a few of them together. But the annals of investment history are littered with flash-in-the-pan fund managers who graced the cover of Forbes magazine… only to see their good fortune run out and their funds plummet to the bottom of the performance tables.

Mean reversion—that’s the tendency of things to converge to the average over time—means that outperformance (that is, beating the market) is always temporary.

Well… almost always. A paper by quantitative investment firm AQR published in 2018 shows that over a 40-year time horizon (from 1976 to 2017), no other fund manager, or single stock, compares with Buffett’s record of wealth compounding, as reflected in the performance of Berkshire Hathaway, Buffett’s traded holding company.

Over that 40-year period, Buffett had an 18.6% “excess return” (which is the return above that of U.S. Treasuries). That compares with a 12.7% excess return for the overall stock market, as measured by the S&P 500.

That means that Berkshire Hathaway shares performed 5.9 percentage points better than the broader stock market.

In stock market jargon, this outperformance of the market is called “alpha.” Over the period of a few years, 5.9% of alpha doesn’t mean a whole lot. But compound it over 40 years, and the results are extraordinary…

Starting with $10,000 and compounding for 40 years, this 5.9% of alpha means the difference between $1.6 million (what the S&P 500 returned) and $16 million (Berkshire Hathaway’s return).

That’s the magic of Albert Einstein’s eighth wonder of the world: compound interest.

What does that mean for your money? Not that you should buy Berkshire Hathaway shares…

While Buffett’s long-term performance is extraordinary, over time Berkshire Hathaway’s asset base has grown (it now has a market capitalization of $760 billion—it’s the ninth-biggest stock on the S&P 500), which means it’s become far more difficult to find attractive stocks. In other words, it’s a lot harder to generate a big return on nearly three-quarters of a trillion dollars, than on the average person’s portfolio of, say, a few hundred thousand dollars.

But that also means it’s possible for regular investors to follow the framework that Buffett himself laid out…

You see, the real secret to Buffett’s success is not ephemeral genius or a freakish talent for stock picking. It’s a framework that anyone with time and discipline can follow to generate life-changing investment returns.

Deconstructing Buffett’s Framework

Conventional wisdom holds that Warren Buffett is a traditional “value investor.” That’s the kind of money manager who buys companies that trade at deeply discounted valuation levels. Think stocks that trade below book value, for example.

But the reality is that many of these so-called cheap stocks are generally lower-quality, higher-risk businesses. The discounted share valuation reflects the market pricing of poor business fundamentals.

Buffett practiced this style of investing in his early money management days in the 1950s and 1960s. But in the 1970s, his investment style evolved to instead focus on paying fair prices for high-quality companies, as captured in his famous quote:

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

So, Buffett doesn’t make a practice of buying “cheap” stocks—that is, those that trade well below the average stock market valuation. And he’s avoided buying “expensive” stocks.

The real source of Buffett’s alpha is from picking stocks that exhibited two key features: they were both “safe” and “high-quality.”

And what does that mean? It’s simpler than you might think: Companies that are profitable, growing, and offer a high payout (like a dividend). And, critically, he didn’t buy these companies at rock-bottom prices (part of the problem is that high-quality companies rarely trade at cheap multiples), or expensive prices.

Two Characteristics of the “Inevitables”

Earning market-beating returns with this approach is a lot like diet and exercise—the process is simple, but not easy. Implementing this investment framework requires patience and discipline. In the case of wealth compounding, you’ll need the discipline to follow the process not just for months or years… but for decades. That’s the only way to unlock the true benefits of the Buffett approach.

So, how does Buffett find these safe, high-quality outperformers?

He looks for “Inevitables.”

That’s not a cartoon superhero family in tight-fitting red Spandex. It’s actually Buffett’s term for businesses whose competitive advantages are so clear and entrenched it’s hard to imagine even a well-financed competitor making much of a dent in their margins.

As he explained in the 1996 Berkshire shareholder letter:

“Companies such as Coca-Cola and Gillette might well be labeled ‘The Inevitables.’ Forecasters may differ a bit in their predictions of exactly how much soft drink or shaving-equipment business these companies will be doing in 10 or 20 years…

In the end, however, no sensible observer—not even these companies' most vigorous competitors, assuming they are assessing the matter honestly—questions that Coke and Gillette will dominate their fields worldwide for an investment lifetime.”

A key characteristic of Inevitables is that they’re highly capital efficient.

Capital efficiency describes how well a company transforms profitability into shareholder returns. It’s one of the least understood, but most important, parts of Buffett’s investment framework.

Not all profits are created equal. When a business earns money, there are two ways that those profits can be used…

For most businesses, some portion of profits must be diverted back into the capital spending, to replace or upgrade plants and equipment, for example. But the most attractive companies—and those that over the long term generate the best returns—have minimal capital requirements, which maximizes the free cash that’s returned to shareholders.

This is the magic of capital efficiency—where companies with minimal capital requirements can send a large portion of profits to investors, instead of sinking it back into the business.

Capital efficiency also ties into the concept of safe businesses—companies with robust economic moats. Because of their strong positions, these companies can avoid allocating excess capital toward warding off competitors.

Only businesses with high capital efficiency and strong competitive positions can enjoy a robust and growing earnings stream, while also having enough profit left over to support high shareholder payouts. That’s why they’re inevitable.

Few companies in the world meet these criteria. But when you find one that does—and one that meets five key criteria described below—that you can buy at a reasonable valuation… then it’s time to simply buy, hold, and forget, while you let compounding work its magic.

The Five Green Flags

A capital-efficient “Inevitable” stock will meet each of these key criteria:

Green Flag 1: High profitability (operating margins >10%)

Operating profits are what’s left over when operating expenses—that is, recurring business costs like salaries, rent, and marketing costs—are subtracted from revenues. These exclude the impact of interest and tax payments, and thus reflect the economics of the core business.

Broadly speaking, operating margins over 10% indicate a highly profitable core business with excellent potential for compounding shareholder capital.

Green Flag 2: Growing (positive revenue growth over the last 10 years)

Screening for companies with growing revenue helps us avoid “value traps.” These are companies that trade at low valuations but which face growth challenges from technological disruption or competitors taking market share.

In recent years, retail stocks like Sears or JC Penney are cautionary tales. These one-time industry stalwarts were unseated by the rise of Amazon and e-commerce. The shares of both appeared cheap at certain points prior to their ultimate demise. But falling sales provided a key warning signal of the disruption in their business models, no matter how cheap the shares appeared at the time.

Green Flag 3: High free cash flow conversion (>10% free cash flow margins)

Free cash flow is defined as net profit minus capital expenditures. Capital expenditures include things like plants and equipment—spending necessary to maintain and/or grow the business.

In other words, free cash flow is the profits that are available to be returned to shareholders—after the capital needs of the business are met. This strategy focuses on companies that can convert at least 10% of sales into free cash flow, indicating the high potential for shareholder returns.

Green Flag 4: Safe—a durable competitive advantage that will last for 10+ years

As we mentioned earlier, Buffett describes inevitable businesses as those that enjoy competitive advantages so entrenched that it’s hard to imagine even a well-financed competitor making much of a dent in their margins. These moats make a virtually impenetrable barrier to entry, which secures the business against encroachment by competitors.

Green Flag 5: Fair valuation—avoid paying a more than 10% premium to the market multiple

As with any general framework, some rules can be bent, and others can be broken. For a good enough business, you can afford to stretch on price, and occasionally pay a premium valuation above the 10% limit. But your returns will be dictated by the price you pay—and it pays to wait.

The bottom line is this: Find businesses that check off the first four green flags, and avoid overpaying.

The Valuation Question

Valuation is the price you pay to buy a share of a business. There are many metrics for valuation, but the most common and straightforward is the price-to-earnings (P/E) multiple. In simple terms, this is the total market valuation of the business, divided by the last 12 months of earnings.

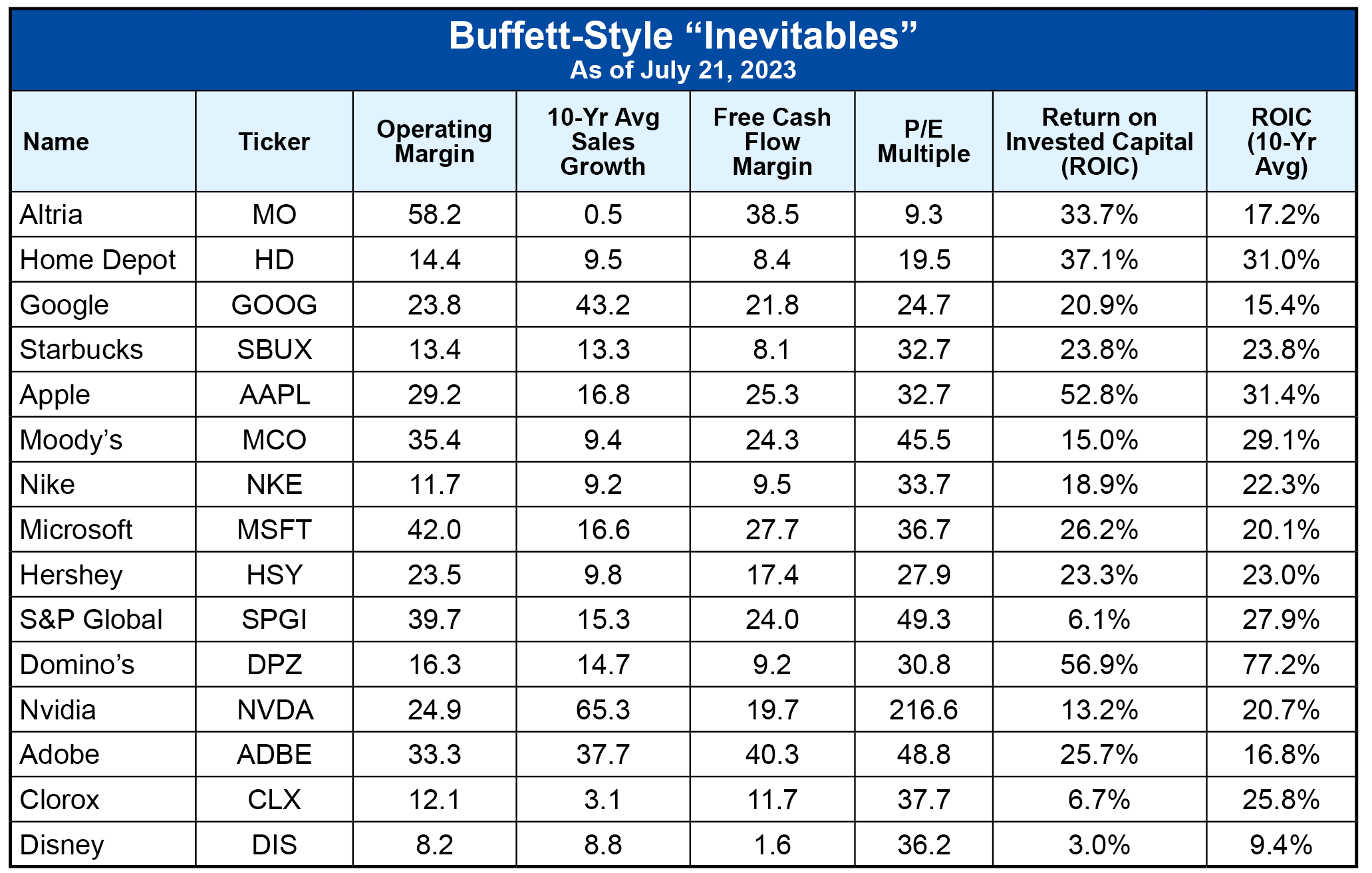

In a perfect world, you would aim to pay between 10-15 times earnings for stakes in world-class businesses. Of course, we don’t live in a perfect world. The best capital efficient stocks often trade at premium valuations—often 20-30 times earnings, or more.

If your goal is to outperform the market, as mentioned, you should avoid paying much more than a 10% premium to the current valuation of the S&P 500, which today trades at a P/E of around 26. So, a 10% premium to that would equate to a P/E of 28.6.

The 15 “Inevitables”

We’ve sifted through the universe of U.S. listed stocks to uncover 15 “Inevitables” that meet most of Buffett’s criteria, and the “green flags” discussed above. Many of these are household names that are highly capital efficient and have wide moats. A handful—in green—trade below or at the current P/E multiple of the S&P 500.

Long-term compounding takes time and patience. Even world-beating businesses like those in the table above have down years. But history has shown that for these kinds of companies, buying and leaving them alone is a recipe for long-term portfolio success.

And if Mr. Markets puts some of these stocks on sale—that is, if a general market correct cuts their share prices by 10%, 20% or more—it’s a great time to buy. And hold.

Goodbye petrodollar, hello petroyuan?

The U.S. dollar is the preeminent currency used to pay for oil globally. Whether it’s France buying oil from Canada, or Saudi Arabia selling oil to China, the greenback is used to complete these transactions.

This so-called petrodollar is a major source of economic and political power for America… but now, its dominance is being challenged.

In June, Indian Oil Corp. became the first state refiner to pay for Russian crude in China’s currency, the yuan, according to a blockbuster recent report from Reuters. The news agency also claimed that at least two of India’s three private refiners are paying for some Russian oil imports in yuan.

Payments are occurring in yuan since Russia has been locked out of the dollar and euro settlement systems over its invasion of Ukraine. But India doesn’t recognize these financial sanctions, and so has continued to buy Russian oil, which is available at a discount to standard international prices.

It’s unclear how much oil trade is now occurring in yuan, but the number could be significant.

Russia is currently supplying 42% of India’s oil, up from less than 1% before the invasion. It also replaced Saudi Arabia as China’s top oil supplier in the first quarter of this year, and China has shifted to the yuan for most of its imports from Russia.

India is somewhat wary of clearing payments for oil imports in yuan, since it fears retaliation from the West. However, the discounted Russian oil is proving too hard to resist. Which demonstrates that when the price is right and the situation warrants it, even friendly nations will turn away from the dollar.

I expect the use of non-dollar currencies in international trade to grow substantially over the coming decade, which is bad news for the long-term health of the buck.

Australia’s policy to lower energy prices may deliver long-term pain.

When Russia invaded Ukraine last March and shook up the world’s energy markets, Australia decided to cap natural gas prices to suppress the huge increase in energy costs. The cap was set at AU$12 ($8) a gigajoule on domestic wholesale gas sales, with some price cap exemptions for small, domestically focused producers.

So far, the strategy has helped keep prices down. Wholesale electricity prices have fallen since the cap was introduced six months ago, and the government is extending the cap to mid-2025.

But this may choke investment in new natural gas supplies.

Critics contend that the market is facing a dilemma: short-term relief versus long-term distress. The price caps have forced larger companies to suspend work on new gas projects or slow spending.

“You could argue it’s a success given that the prices have come down considerably,” said Kevin Gallagher, chief executive of Santos, a $16 billion Australian energy company. But he added the only way for gas prices to remain sustainably low is to bring in more supply. “That’s just economics 101,” he said.

Price controls drive up demand, but do nothing to increase supply, said Ian Davies, chief executive of Senex, an Australian producer of natural gas.

Australia’s approach may look good now, but the strategy is likely to ultimately cause a large increase in prices as supply struggles to keep up with demand. In effect, this policy is a microcosm of the shortsighted thinking that’s fostering dramatic underinvestment in oil and gas exploration across the Western world.

China is no longer America’s top trade partner.

For much of the 2010s—and during the early years of the pandemic—China was America’s top trading partner. But Beijing’s now been supplanted by our neighbor to the south, Mexico.

Around $263 billion worth of goods passed between Mexico and the U.S. during the first four months of the year. As a slice of America’s trade pie, Mexico accounted for 15.4% of goods exported and imported by the U.S. Canada was slightly behind at 15.2%. China lagged at 12%.

This shift is due to Trump administration tariffs on some Chinese goods in 2018 and pandemic-era supply-chain disruptions that altered international trade and investment flows worldwide.

Another factor in this trade growth with Mexico and Canada is “nearshoring” or “friendshoring,” the practice of bringing supply chains for crucial goods to countries that are closer physically and politically.

This doesn’t mean that Mexico is “the new China,” as some headlines have suggested. China and the U.S. are, and will remain, deeply intertwined economically. Still, Mexico is undoubtedly an economy on the rise…

How to avoid printer ink scams and save money in the process.

Americans are wasting some $10 billion each year on name-brand ink, according to the Public Interest Research Group.

Name-brand suppliers typically charge over $100 for color ink for a typical home printer. But the actual ink in these cartridges probably costs only a few dollars to make. That’s an enormous—and exploitative—markup. But there is a solution…

Aftermarket ink looks just like the name-brand kind and is sold by online retailers and office supply stores. These cartridges usually cost about half the price of a name-brand alternative, and in terms of quality, they’re virtually as good.

To use one, just insert it into your printer as normal. But first, make sure to turn off your printer’s automatic software updates. Manufacturers have been abusing them to make printers less compatible with cheaper ink cartridges.

Also, when you insert an aftermarket ink cartridge, your printer may flash a message saying something like it “can’t guarantee the quality or reliability of this cartridge.” Just ignore it.

Travel baggage-free to Japan with this new program.

As the summer holiday season gets into full swing and Japanese airlines, hotels, and restaurants gear up to receive more travelers, the island nation wants to put your mind at ease regarding a very common question: “What clothes do I pack for my trip?”

In a bid to invite more sustainable tourism while offering convenience, Japan Airlines Co. and Sumitomo Corp. have joined forces to offer rental clothing during visits to Japan.

Prior to boarding a Japan Airlines-operated flight, visitors can use a website to select apparel based on their size and seasonal needs. One set of clothing will cost 4,000 to 7,000 yen ($28 to $49), and people will be able to rent up to eight outfits for as long as two weeks, in three sizes: small, medium, and large.

Chosen styles—smart, smart casual, and mixed—will be delivered to a traveler’s designated hotel. The service will run on a trial basis through August 2024.

Personally, I think it would be cool to see this succeed and serve as a beta test for similar clothing programs in other countries. Who doesn’t want international travel to be more convenient?

A free 55-inch smart TV could be yours, if you endure unending ads.

It seems like advertisers are doing everything they can these days to get your attention. Now they’re willing to give you a free 55-inch smart TV… but with a very sneaky catch: a smaller second screen attached to it continually shows ads and other content.

The TV itself comes courtesy of a startup called Telly, which has begun shipping the TVs to people who don’t mind seeing targeted advertising, news, weather, and sports scores on an attached lower screen.

To get one, you have to visit their website and answer some basic questions. Of course, you must agree not to modify the TV or use ad-blocking software.

This is a novel idea, but it’s also a tad strange. I wonder if this venture could really see sustained success. How many people really want to constantly see a second screen with ads? And how effective are those ads going to be when your attention will be on the top screen?

Despite these concerns, 250,000 people have already signed up to get their Telly sets, and the company plans to send out 500,000 by the end of the year. Clearly, many are willing to give this tradeoff a spin. Maybe it’ll be one of those cases where it’s just so crazy, it might work.

A sip or two of pickle juice can soothe pesky leg cramps.

We’re smack in the middle of the dog days of summer, when aches and pains like leg cramps tend to wreak havoc on our bodies. But according to the latest research, there’s one simple solution you can do besides gently stretching the cramped muscle: take a sip of pickle juice.

Athletes have long sworn by pickle juice to alleviate cramping, and experimental data in healthy college-aged men suggest pickle juice inhibits muscle cramps through a nerve reflex in our throats.

Pickle juice may also work for cramps that aren’t induced by exercise. A randomized controlled trial published in 2022 found that a sip of pickle juice reduced muscle cramp intensity in patients with cirrhosis.

Just don’t overdo it. “A sip is all it takes. We’re not telling people to chug pickle juice,” said Elliot Tapper, a hepatologist at the University of Michigan and the 2022 study’s lead author.

More rigorous research may be needed to really assess pickle juice’s effectiveness for reducing leg cramps. But it’s safe and cheap enough that anyone can give it a try.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2023. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.