Dear Global Intelligence Letter subscriber,

The government was desperate for money.

There were wars to pay for. Expensive social programs. Subsidized loans.

But there wasn’t nearly enough tax revenue to cover all these costs.

So, the government did what governments do—it stole from the future by printing money. Tons and tons of money.

And the result was typical and predictable: Runaway inflation that decimated the average family.

To be clear, I’m not talking about America over the last 20-plus years (though the above facts certainly apply).

I’m actually talking about China’s Song Dynasty, around 1,000 years ago.

Back then, China’s chancellor, Wang Anshi, was managing conflicts on various fronts, north and south. He needed cash to wage these wars. But he also needed funds to afford social programs and subsidies for the poor.

Earlier, he’d nationalized industries and imposed agricultural price controls…practices that always disrupt the proper functioning of economies. Now, the poor needed handouts just to get by.

To cover all these costs, he turned to two new innovations—paper money that had recently emerged as a stand-in for iron and bronze coins…and wood-block printing that enabled him to produce this new paper money on an industrial scale.

In doing so, Wang sowed the seeds of one of history’s most notable bouts of hyperinflation. And by using wood-block printing, Wang’s efforts represent what financial historians now refer to as the “first recorded monetary crisis attributed to the overprinting of money.”

Now here we are, all these years later, and governments still haven’t learned the lessons of the past.

Instead, our political and monetary leaders keep mocking history, pretending they’re smarter than those uneducated simpletons from yesteryear.

That’s what arrogance will do to you. It makes you think you know best because you have some fancy Ivy League degree, when in reality you’re just an overeducated mandarin pursuing the exact same money-printing policies that have literally destroyed dynasties.

Welcome, then, to the July issue of the Global Intelligence Letter, which, as you no doubt have surmised, centers on inflation.

It’s a topic I’ve been writing to you about for the last 18 months or so. Back in early 2021, when the Federal Reserve was so confidently telling us that inflation was "transitory," I was shaking my head and projecting double-digit inflation to come, which, with inflation now above 9%, is exactly where we’re headed.

Make no mistake: While the Fed is aggressively raising interest rates in an effort to knee-cap inflation, it’s fighting from an inferior position.

Raising interest rates increases debt repayment costs for consumers, businesses, and government. Given that the U.S. has record amounts of debt at all levels, the Fed has limited scope to raise rates. So, it will take a long time for the Fed to tame inflation…assuming it’s successful at all.

Which is the reason for this month’s issue.

Though we are well into this new inflationary era, I expect it to last a few more years at least.

As such, my goal this month is to steer you toward some low-risk investments that can help you navigate the period ahead by protecting your wealth from inflation, and growing it through the collection of consistent, stable dividend payments.

But first, Ernest Hemingway…

The Banker’s Bank

The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.

That’s what Hemingway penned for Esquire magazine in a 1935 piece, Notes on the Next War: A Serious Topical Letter.

Hemingway was largely focused on the rising tides of war that were evident across Europe as Hitler rose to power in the 1930s. But his opening line about inflation is as apropos today as it ever was.

Countries always look for ways to steal from the populace by inflating away the value of their currency.

It’s a move that—like a three-card monte hustler skillfully moving a bean without it being seen—is designed to enrich those in on the scam at the expense of everyone else.

America’s three-card monte hustler is, of course, the Federal Reserve, an institution that, despite the “federal” in its name, is not actually part of the U.S. government.

It’s a private institution owned by member banks—a “banker’s bank,” basically. Which, of course, means that the Fed is first and foremost in the business of catering to its members’ interests—not the interests of the American public nor the American government.

Congress has some nominal oversight in that it can request updates and whatnot, but it cannot rein in the Fed to any degree. Which is why Louis McFadden, the 1930s-era chairman of the House Banking and Currency Committee, said this of the Fed, which at that point was only about 20 years old:

Some people think that the Federal Reserve Banks are United States Government institutions. They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.

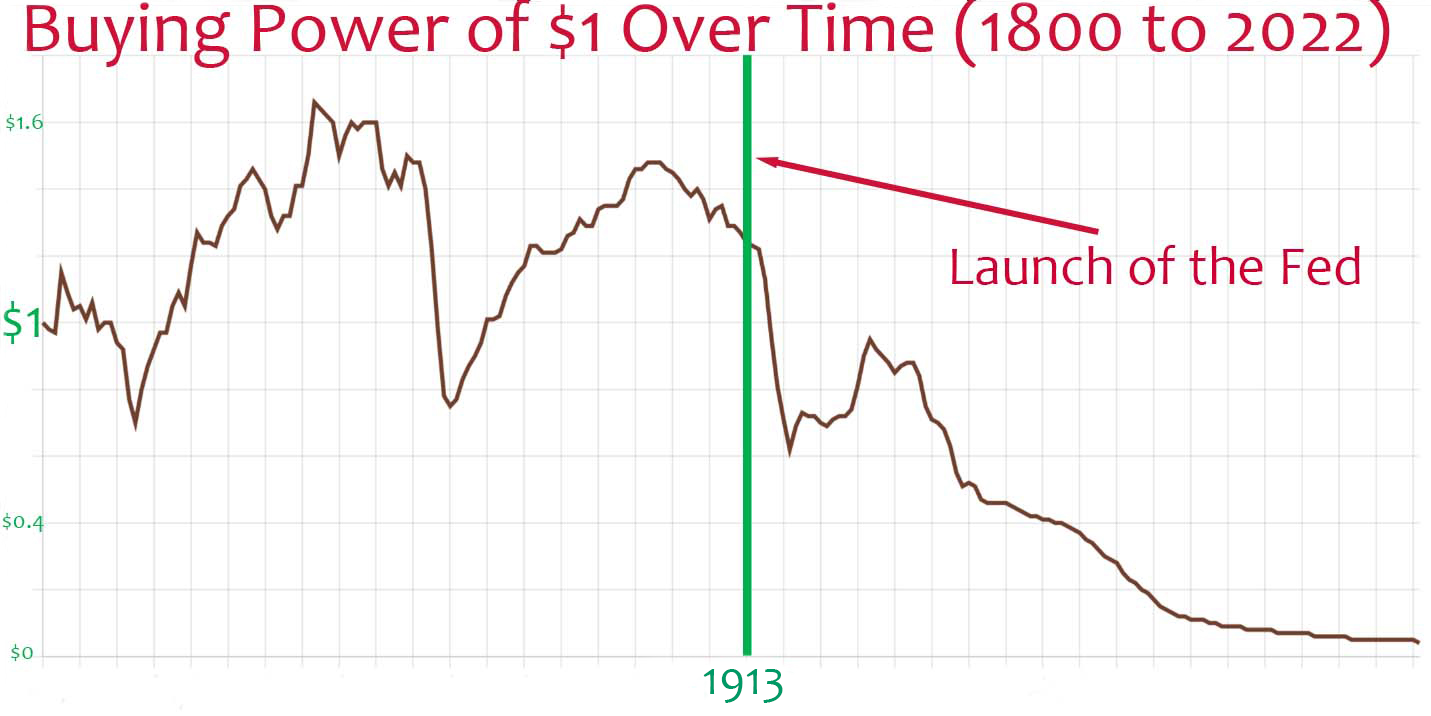

The proof that the Fed serves its own masters is in this chart of the buying power of the U.S. dollar since 1800 through 2021. For reference, the green line marks the emergence of the Federal Reserve in 1913.

Prior to the Fed, the dollar was volatile for sure. But A) America and her currency were still quite immature, B) periods of strength far outlasted the moments of weakness, and C) the range, though wide, centered around a neutral $1 reading.

Then along came the Fed.

For pretty much its entire history, the Fed has been all about the destruction of the American dollar and, in turn, the destruction of American purchasing power. A dollar bill in 1913 is basically a few pennies today in terms of its purchasing power relative to before the Fed’s birth.

Successive Federal Reserve Boards have accomplished this destruction by “managing” the economy through relentlessly printing money, thereby fueling inflation.

As part of that storyline, the Fed has turned the word “deflation” into a monstrous term in the eyes of the public, even though the 1800s had several bouts of deflation that were generally not so terrible.

That’s because deflation is not necessarily a bad thing.

In its truest sense, it’s simply a period of declining prices and a corresponding increase in consumer purchasing power.

But the Fed—the banker’s bank—can’t stomach that world because of what deflation does to the banks. It reduces bank earnings by reducing demand for borrowed cash.

Seems like a significant conflict of interest.

Regardless, we are where we are now because the Fed has continued with the ongoing destruction of the dollar.

Since the pandemic, the Fed's digital “printing presses” have been running nonstop, metaphorically speaking. Nearly $22 trillion is sloshing through the economy these days, up nearly 41% from just two years earlier. That is a monumental increase in the money supply. A never-before-seen increase. By comparison, across the entirely of the Great Recession a dozen or so years ago, the money supply increased just 12%.

And to worsen this situation, the U.S. was not alone. Central banks all over the world have been dumping cash into their economies in huge volumes.

To give that some context: Imagine your life and the life of everyone in your city is humming along as normal. And suddenly each of you has 41% more money. What’s that going to do to local prices?

People are going to go on a spending spree, and they’re all going to be competing for the same goods and services in town…and shopkeepers are going to raise prices because demand allows them to.

Spending all this excess cash will take years, which is the primary reason inflation will stick around for so long.

All of which is reason to bolster our portfolio with investments that can help weather the storm that’s still to come.

The Boring Investment Everyone Needs

Let’s start with something completely boring: U.S. Treasury Series I Savings Bonds, known as “inflation bonds” or I bonds.

I’ve highlighted these before, but they're worth revisiting because they are uniquely designed for this moment.

These are like the savings bonds we all grew up with, often given to us on birthdays and holidays by aunts and uncles and grandparents. I still have a bunch of these sitting in a bank safe-deposit box. The key difference is that traditional savings bonds (known as EE bonds) carry a fixed rate of return, while the Series I bonds carry a fixed rate plus a variable rate that changes every six months based on inflation.

Right now, the EE bonds pay a paltry 0.1%. Not much to care about, really. I bonds, meanwhile, carry a 0% fixed rate, but a 9.62% inflation component on bonds issued between May and October 2022.

After October, the Treasury Department will recalculate inflation, based on the Consumer Price Index-Urban (CPI-U) reading, and post a new inflation-rate component for the I bonds. Then the I bonds could see their rate go up or down to match inflation. (Note: You can buy I bonds at the current rate up until the last day of October and be credited the 9.62% interest for the next six months, even if the rate were to reset lower on Nov. 1.)

In essence, an EE bond is guaranteed to go up in price, even if marginally. An I bond has no such guarantees because it is tied to inflation’s ebbs and flows. If the American economy suddenly turned around and lurched into deflation, the interest rate on I bonds would ultimately fall to 0%. But you'll never lose money on an I bond. You will always recoup at least what you invested.

For my money, these are some of the best inflation-protection investments available today.

To be sure, I bonds are tied to the CPI-U, which the government absolutely manipulates to undercount inflation, in turn helping reduce Uncle Sam’s mandatory inflation-related expenses in programs such as Social Security.

But there are no other investments that at least try to track inflation directly other than Treasury Inflation Protection Securities—TIPS—and their returns are not up to what the I bonds offer. Those rates: 1.2% or lower, depending on the bond’s duration.

Buying I bonds is relatively easy. You just need an account at the Treasury Department’s TreasuryDirect website (click on the green “Open an Account” link on the right).

The minimum purchase amount is $25 for an electronic version of the bond that exists as a digital book-entry in your account. They are available in any denomination you want, down to the penny. You can invest a maximum of $10,000 per year.

You can buy a paper version of the I bond—like the paper bonds we received as gifts when we were kids—for a minimum $50. But you can buy those only through your annual tax return, not online. Those are available only in denominations of $50, $100, $200, $500, $1,000. Moreover, the maximum investment with paper I bonds is capped at $5,000 annually.

Frankly, $5,000 is a bit small, so I would lean toward the electronic version where you have greater flexibility to invest more. And if you do want to go above $10,000, then TIPS is your best bet.

I bond interest is taxable at the federal level, but is exempt from state taxes. Also, there is no secondary market for I bonds. You cash them in through the TreasuryDirect website. But you must hold them for a year. If you cash them in before five years, you will face a penalty equal to three months’ interest. After five years, there are no penalties.

They will continue to accrue interest for 30 years, just as will Series EE bonds.

But I bonds are not the only way to generate income in an inflationary world. Another strong option is preferred shares in specific industries. And I’ve come across two preferred stocks that provide solid income, have a measure of safety, and come packaged with a unique inflation-protection kicker...

What Are Preferred Shares?

I wrote to you about preferred stocks several months ago when I recommended Tsakos Energy’s Preferred F shares.

Just to recap, there are two primary differences between common and preferred shares:

Common stockholders vote on all company matters, but they are not entitled to a dividend payment. If they receive one, they’re paid last.

Preferred stockholders get no vote, but they are entitled to dividend payments. Moreover, those dividends are set in stone—a specific payment every quarter for as long as the preferred stock exists. And they’re paid out just after bondholders are paid their interest payments, so they receive dividends before common stockholders.

So, basically, preferred stocks offer consistent, all-but-guaranteed payouts. But the price typically doesn’t move very much.

Indeed, preferred stocks typically hang out near their so-called par value, the face value of the preferred shares when they were issued. Or they hang out near their “liquidation preference,” a minimum price the company would have to pay if it wants to retire, or buy back, the shares. (Which one a preferred stock hangs out at depends on how it’s structured.) For most preferred stocks, the par value is $25 or $50, though you will occasionally see others at $10 or even $100.

Income investors like preferred shares because they generally offer big yields and they tend to be more resistant to run-of-the-mill stock market weakness. That gives preferred shares a certain stability, which can be comforting in a moment like now, when the Fed is running scared because it misread obvious inflation as transitory nothingness.

The two preferred issues I’m recommending this month have fared better than the stock market overall. More importantly, they’ve kicked off big dividends that have helped to defray much or all of their paper losses.

That’s what I want right now as an investor: A sense of security that comes pre-packaged with all-but-guaranteed income. The reason I qualify the income as “all-but guaranteed” is because these are corporations and corporations can fail for whatever reason, so we always have that risk.

In this case, however, we are going into two stable companies that operate in necessary, though certainly not sexy industries—electricity production and refined petroleum products.

Both are boring as hell, but both are also crucial in the proper functioning of our everyday lives.

Better yet, they generate sizable dividends yields…and they have a kicker that could see their yields rise if inflation continues heading up.

So, let’s dive into my recommended preferred shares…

The Utility King of California

Edison International is the holding company for Southern California Edison, the 136-year-old utility providing electrical power to more than 15 million people across central, coastal, and southern California. Basically, it’s one of the largest utility companies in the country.

Edison has a number of preferred shares, but the one we’re interested in is called Series H.

Right now, the Series H preferred shares yield 6.75%. That alone is a pretty good selling point. I mean, Edison isn’t going away anytime soon, and its cash flow is plenty large enough to cover its dividend commitments.

But here’s where we sweeten the pot.

The Series H carry a liquidation preference of $25, meaning that if and when Edison decides to redeem the shares, it must pay $25.

Well, the Series H preferred shares trade at $21.30 as I write this. A $25 buyout means we collect a very nice return of nearly 17.4% just from the company buying back the preferred shares we own. That’s on top of the 6.75% dividend yield.

So, just for illustration purposes, if Edison bought back the Series H shares exactly one year after we bought them, we’d collect a 24% gain overall. Not so bad in this market.

But, the sweeteners are potentially even sweeter.

See, these Series H shares are known as “fixed-to-floating rate securities.” This means that after a certain date, the guaranteed dividend rate changes from a fixed rate to a floating rate, or one that moves around based on underlying factors.

The factor in this case is what’s known as LIBOR, the London Interbank Offered Rate. Basically, this is the benchmark rate that large global banks offer each other for short-term lending needs.

In our case, the governing documents for Edison’s Series H preferred shares state that the company can call away the shares—that is, it can buy them back from us—on or after March 15, 2024 (the “call date”). That’s when the company would pay us $25 per share, assuming they call in these preferred shares.

If they don’t call in the Series H, then the dividend yield converts to a floating rate equal to the three-month LIBOR rate plus 2.99 percentage points. Right now, three-month LIBOR is 2.25%, meaning the Series H yield (assuming the floating rate engaged today) would be 5.24%.

That 5.24% is relative to the $25 price at which the Series H was initially issued…so a dividend amount of $1.31 per share.

But remember, the Series H right now is priced at $21.30. So, our real yield would be 6.15%.

Yes, that’s slightly below the 6.75% current yield. But the play is that inflation keeps rising—or remains elevated—and LIBOR goes up a bit from here. As that happens, the yield will continue rising on these Series H shares.

To reach the same 6.75% yield we’ll collect today, LIBOR would only need to climb to 2.76%, about half a percentage point from where it currently sits. Just to give you some reference: A month ago, today’s 2.25% LIBOR rate was 1.69%…and a year ago it was 0.14%.

LIBOR has historically been well above 3% and was above 2.76% as recently as 2018.

So, you can see that LIBOR follows inflation higher, meaning these Series H shares serve as an inflation hedge.

If inflation keeps rising, LIBOR will rise. If inflation dies away and LIBOR declines back to, say, 0.14%, well we’re still collecting more than 3%, which is not a bad yield in a world where inflation has disappeared.

Plus, we have that built-in 17.4% gain waiting for us if and when Edison decides to call in the Series H shares.

Here’s how I see it playing out:

We will collect seven quarterly dividend payments between now and March 2024. That will be a cumulative $2.516, essentially a guaranteed 11.8% of our total purchase price.

If Edison calls in the Series H shares in March 2024, we will collect another 17.4% from the difference between our buy price and the liquidation price. That will give us a combined return of 29.2%. Truly, not a bad total return for this market. Better still is that we will have the general stability of utility companies and preferred stocks, which should limit the downside.

If Edison does not call in the Series H shares in March 2024, then we will continue to collect nice dividend payments every quarter that will also help us keep pace with inflation.

No matter how I look at it, Edison’s Series H is a solid income investment in the current market, with potentially meaningful upside.

A Key Cog in the Energy Market

Global Partners LP is a regional energy distribution company across the Northeast U.S. and part of the Atlantic Seaboard. It began as a heating-oil supplier back during the Great Depression, and today it operates businesses across numerous related categories. These include:

Owning, leasing, or supplying gasoline to about 1,700 gas stations that operate under well-known brands including Shell, BP, Exxon, Gulf, and several unbranded chains.

Running 342 convenience stores tied to gas stations.

Operating 25 bulk product terminals that distribute gasoline and other petroleum products to various customers.

Overseeing storage capacity for nearly 12 million barrels of petroleum products such as gasoline, heating oil, and the like.

In short, Global Partners is a key cog in the energy market for consumers and businesses.

What we particularly care about is Global Partners’ Preferred Series A shares. These operate a lot like Edison Series H in that they are “fixed-to-floating rate” shares.

The only difference here is the call date. Where Edison converts to a floating rate possibility in March 2024, Global Partners potentially converts in August 2023, so basically a year from now.

At the moment, Global Partners Series A shares yield 9.41%. And that’s not a distressed yield, meaning it’s not because the share price has fallen. In fact, the Series A shares have spent the past year bouncing around between $25.50 and $28—quite a steady stock, given that the S&P 500 is down about 20%.

As I write this, the Series A shares are $26.70, a bit above their $25 liquidation preference.

Now, because they’re higher than the liquidation preference, it means we will take a small loss if and when Global Partners redeems the Series A shares. At current prices, we’d lose $1.70 per share, or about 6.8% of our purchase price. But a single dividend payment is $0.609 per share, so three quarters’ worth of dividends will offset that loss.

Given that the call date is August 2023, we are guaranteed at least four dividend payments before the company even considers calling in the Series A shares. That’s income of $2.4375 per share.

If Global Partners does call in the shares in August 2023, the worst we’d see is a 2.8% gain over the next year ($25 liquidation price we would receive, plus the $2.4375 in dividend payments, minus our $26.70 cost).

That’s a full percentage point more than the S&P 500 yields, and that’s with a stock that has demonstrated a high degree of stability so far in a down market.

Now, if Global Partners does not call in the Series A shares, then on August 15, 2023, the shares convert from fixed-rate dividend payments to a floating rate. The math: three-month LIBOR plus 6.774%.

With LIBOR at 2.25%, we’d be looking at a yield of 9.024%, or $2.256 per share. Given our $26.70 purchase price, that’s a real yield to us of 8.45%. That’s a great yield.

In terms of Global Partners’ ongoing operations necessary to fund these dividends—well, as I noted, this company has existed since the Great Depression, and it continues to meet the energy needs of customers in its expanding footprint.

In all, Global Partners fills the gas tanks of more than 930,000 cars and 26,000 diesel trucks per day, and it supplies heating oil to 34,000 homes every winter.

Buy Edison International Series H Preferred shares at prices up to $21.50.

Risk Profile: Lower Risk Income (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 20% Trailing Stop-Loss

Buy Global Partners Series A Preferred shares at prices up to $27.

Risk Profile: Lower Risk Income

Stop/Exit: 20% Trailing Stop-Loss

Both stocks trade on the New York Stock Exchange and are available through any U.S. brokerage firm.

The caveat here is that the ticker symbol is different from one firm to another.

Each brokerage firm has a different naming system for preferred shares.

At Fidelity, for instance, Global Partners Series A Preferred shares are listed under the symbol GLP/PA, while Edison International Series H Preferred shares are under SCE/PH.

At E-Trade, the symbols are GLP.PR.A and SCE.PR.H.

At other firms like Charles Schwab and Interactive Brokers, the nomenclature might be slightly different. It all depends on how a brokerage firm set up its systems to handle preferred-share listings.

If you are struggling to figure that out, just head to the search function at your brokerage firm and type in the name of the security or the stocks primary ticker, and you will see the list of securities you can trade. (The primary tickers are GLP for Global Partners and SCE for Edison).

Last month, I introduced my personal rating system so that you know how I view the risk/reward calculus with each recommendation. It’s designed to give you a broader insight into a stock relative to your own comfort with risk.

I classify each of these as Lower Risk.

Preferred stocks are not crash-proof, but they generally do not express the same kind of volatility we see in traditional stocks. That’s because with companies like these two, investors have a certain level of confidence in the ability of the business to generate ongoing profits that will fund those all-but-guaranteed dividends.

This basically means that preferred-stock investors are paying more attention to the dividend and a company’s ability to continue paying it. So long as they are comfortable with that, they tend to hold onto preferred shares, or grab more when share price drifts lower (a lower share price means a higher dividend yield).

As such, the dividends and the dividend yield are the primary drivers of stock price with preferred shares, not corporate earnings (which are what drive common shares).

Both of these companies have strong businesses with continuous demand that will continue to generate enough cash to cover the quarterly dividends.

The risk with these preferred shares is an economy that collapses in a way I don’t envision.

For these shares to plummet, we’d really need to see a Great Depression-style event that causes mass consumer and corporate bankruptcies that rip through the economy and destroy corporate profits, jobs, and consumer wallets to such a degree that demand for electricity tanks, and driving/transport shrivels.

Basically, we’d need to see Song Dynasty-style hyperinflation that annihilates everything.

I don’t see that happening—at least not until a currency/debt crisis later this decade.

However, we are very likely to see a recession by this fall, and both of those preferred shares should be fine in that environment.

Both will continue to find buyers eager to tap into the meaty dividends as inflation continues to strangle wallets.

And if inflation does peter out? Well, we’ll either see our shares called in (not a bad thing)…or we will see LIBOR collapse.

But because of the way the floating-rate trait works for both Edison and Global Partners, we will still be collecting dividend yields well ahead of the market as a whole.

For this month’s portfolio update, I want to focus on what’s happening right now in the cryptocurrency space known as decentralized finance, or DeFi.

Frankly, it’s a warzone. Every day, it seems, another DeFi player drops a bomb on its investors, either shutting down or limiting access to funds, or curtailing withdrawals. The question isn’t so much “why” this is happening, but “where” this will ultimately lead us.

Of course, the why is relevant, so let me start there: DeFi companies like Celsius Network, Voyager, Vauld, and others are struggling because the value of the assets they own—their crypto—has collapsed in the bear market, while fearful investors are rushing to cash out.

Vauld is a good example of what’s taking place writ large: Clients pulled out nearly $200 million in just a few weeks in response to the collapse of the TerraUSD stablecoin, Celsius suddenly pausing withdrawals, and the Three Arrows Capital crypto hedge fund defaulting on its loans.

The result is that Vauld has assets worth about $330 million, paired against debts of roughly $400 million. Moreover, lots of those assets are locked up in financial instruments that mature over the next three to 11 months, and which Vauld cannot easily tap. So, it stopped all deposits and withdrawals, and is working with Swiss crypto-bank Nexo in a restructuring deal. (Nexo has done a good job managing its business and will quite likely emerge as one of the winners of the weeding out that’s now taking shape in the DeFi space.)

Even BlockFi, the U.S.-based crypto-bank I recommend, went looking for a deep-pocketed partner to ensure that it has the capital to keep going. It signed a deal last month with crypto exchange FTX, one of the most financially robust exchanges, for a $250 million line of credit. As such, BlockFi is in good position, so I wouldn’t fret about an account there.

Now for the real question: Where does this moment lead?

It leads to regulation.

I’ve been saying for many months now that regulation is needed in the crypto space. Yes, crypto has long been billed as decentralized and resistant to government interference. That was always a nice pipedream, but it was never going to be the long-term reality.

Legislative bodies are going to step in with rules and regulations that determine how crypto-banks operate, the risks they can assume when investing client dollars, and probably limits on the returns they can promote on stablecoins, which are designed specifically to shadow fiat currencies like the dollar or euro.

Prior to the industry’s current troubles, numerous crypto-banks were promoting annual returns of as much as 20% on stablecoins. Those rates will be coming down to more logical levels, though they will likely still surpass what you can earn on traditional dollars invested in a savings account or certificate of deposit.

Regulations, likely adopted at a global level, will define what crypto-banks can invest in and own as assets, which will determine the future rates of return they offer on their crypto-savings accounts. Indeed, the European Union has already authored such rules, which are set to come into effect at the end of next year.

So, do not buy into the talk that crypto-banks and DeFi are dead. That’s demonstrably wrong.

Banks including JPMorgan are already working to build their business in the DeFi space, and have stated that traditional banks as the world has known them for centuries are not long for this world.

Tyrone Lobban, head of the firm’s Onyx Digital Assets division, told a recent crypto conference in Austin that “the overall goal is to bring these trillions of dollars of assets into DeFi, so that we can use these new mechanisms for trading, borrowing [and] lending.”

The assets he’s talking about are U.S. Treasuries, money-market funds and others that “could all potentially be used as collateral” for DeFi services.

That’s a sign that crypto, despite this chaotic period, is not going away, and that we, as individual investors, should continue to hold up to 5% of our assets in crypto.

By Michael Fritzell

Michael Fritzell

is the author of Asian Century Stocks, a newsletter focusing on Asian equities.

In 2017, Bernstein analyst Michael Parker called it the most important asset class in the world.

Twenty-five years ago, this asset class didn’t even exist…at least not in the way we understand it today. But now it is the foundation of the world’s second-largest economy.

In fact, it’s grown so important that Parker warned if it ever wobbled, commodity prices and demand for capital goods would collapse around the world. And the fallout could spark a global economic recession.

That asset class is Chinese real estate. And right now, it’s falling apart.

In the first quarter of 2022, sales at China’s top 50 property developers declined 47% year on year. And since then, China’s zero-COVID policy has pushed the market even deeper into the abyss.

Given these figures, it would be tempting to assume that China is facing a 2008-style housing and financial crisis. And the global economy could be next.

But China is not a market economy. The same rules don’t apply as in the West.

Rather than a full-blown crisis, the current slump has been at least partly engineered by China’s government, who will not allow the sector to collapse.

Instead, it’s part of an ambitious power grab that could see private-sector developers largely, or completely, pushed out of China’s real estate market.

China’s Great Real Estate Boom

Before 1998, residential property in China was owned by the government. Individuals were allocated housing by their work units or municipal housing authorities and enjoyed highly subsidized rent.

From 1998 onwards, employees were allowed to purchase the property they lived in. The average discount was about 70% of the property’s market value. Those who bought a property ended up making a fortune, with prices rising almost 15x in the years since.

This sparked a real estate boom in China. The people who purchased their homes in those initial years began leveraging their home equity. They took on debt and often used it for down payments on second and even third homes.

As a result, China’s floor space under construction increased massively, rising from around half a million square meters (5.4 million square feet) per year to close to 7 million in less than two decades.

The dilapidated housing stock from the pre-1998 era was gradually replaced with modern housing. Today, China’s homeownership rate is 90%, among the highest in the world.

Private property developers drove this rapid rise in China’s residential property market. But problems soon emerged.

Certain private sector developers that had enjoyed top-level government connections borrowed heavily from state-owned banks to buy land. Some of them had no hope of ever paying back the vast amounts they'd borrowed. Yet they continued to enjoy preferential access to loans.

Meanwhile, Chinese households became deeply indebted. Today, interest on their loans exceeds 16% of household income, on average.

An Unbalanced Market

China operates “closed capital accounts,” which means money can’t be moved overseas except under strict rules. This fact, combined with the low interest rates on bank deposits, led many ordinary Chinese to believe that property was the only way to protect the purchasing power of their savings from being slowly eaten up by inflation. But high demand for property meant housing became hugely expensive.

The price-to-income ratios of the Beijing, Shanghai, and Shenzhen residential property markets is over 40x, compared to just 12x in New York City and San Francisco. Meanwhile, the average price per square meter of residential real estate in the 100 largest cities in China is higher than in the U.S., even though Chinese incomes are only 15% of those in America.

It’s important to note that this is offset to a large degree by the high rate of household savings in China. Gross domestic savings in China are about 45% of GDP, compared to only around 18% of GDP in the U.S.

Also, the super-hot property markets in Beijing, Shanghai, and other major cities may be sustainable at this level, since demand is partially driven by foreign buyers with larger incomes, such as overseas Chinese in Singapore, the U.S., and elsewhere.

Still, there can be little doubt that property speculation became widespread in China, encouraging developers to make risky bets.

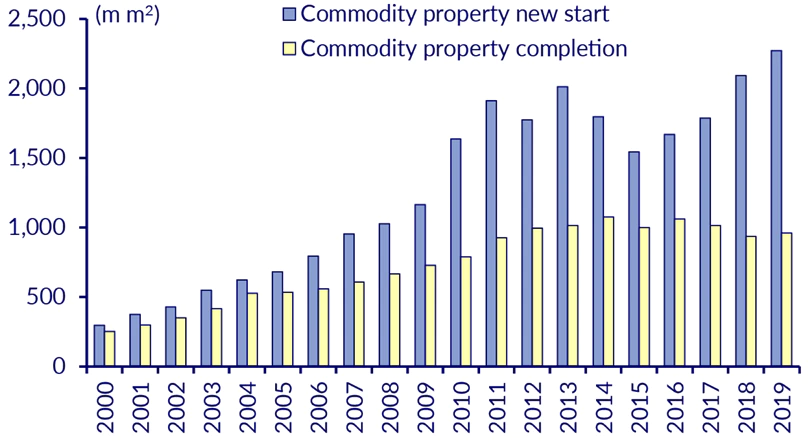

The following chart shows the scale of this problem. In 2019, more than twice as much housing was started than was completed.

Source: CLSA

Assuming an average apartment size of 90 square meters (1,044 square feet), construction was commenced on roughly 24 million apartments in 2019. Only 11 million were completed. This pattern repeats year after year.

It’s unclear exactly where this “unfinished” housing ended up. Real estate in China can be presold, so a lot of it is probably owned by investors who’ve never received delivery. The rest is likely on developer balance sheets.

“Supply-Side Reform”

This situation presents a serious problem for the Chinese government. First, local governments rely on land sales to developers to balance their budgets. Second, with real estate and related industries now accounting for 29% of GDP, any weakness in the market is likely to cause mass unemployment. And social stability is the Chinese Communist Party’s top priority.

Around 2015, Liu He—the right-hand man of China’s all-powerful president, Xi Jinping—tried to tackle the problem using a so-called supply-side reform program. Even though the measures were marketed as “supply-side,” what the government actually did was stimulate demand. It did this by handing out cash to individuals in shantytown developments. It also lowered the thresholds for mortgage borrowing.

In a way, the policy was a success. The government managed to reduce housing inventory to more comfortable levels. But it didn’t solve the actual problem that was fueling over-construction. So, while Liu He’s supply-side reform of 2015 helped shrink inventory temporarily, inventory is now building up again.

The arithmetic is simple: The country as a whole starts construction on 24 million apartments per year, but only completes and sells 11 million.

Could the demand for property increase in the future to account for the excess inventory? That’s possible. China is in the midst of a vast urbanization program, bringing 20 million people to the cities from the countryside each year. That could, in theory, support demand for an additional 6 to 7 million homes annually.

But many of the newly urbanized citizens are factory workers who live in dormitories. And with the government’s latest crackdown on the sector, sales volumes are falling, not rising.

China’s “Three Red Lines”

In August 2020, China’s central bank met with 12 property developers and told them to improve their balance sheets. They were told to respect maximum leverage ratios set out along its so-called “three red lines”:

Most of China’s developers failed at least one of the three requirements. Prominent private developers China Evergrande, Guangzhou R&F, and Sunac failed on all three counts.

The three red line requirements forced many private developers to reduce their debt. They have tried to achieve this by selling assets, slowing down the pace of construction, and introducing discounts to homebuyers. But it hasn’t been enough.

Other than the three red lines, the government also reduced the availability of mortgages, slowed credit growth, and introduced a cap on banks’ allowable exposure to property loans. The government also prohibited property developers from raising cash through private equity.

Private developers have essentially been cut off from all sources of funding. Meanwhile, state-owned enterprise (SOE) developers enjoy preferential access to loans. The government is urging banks to lend to SOE developers so that they can buy up assets from private developers.

SOE developers have even been given exemptions on their need to adhere to the debt limits set out in the three red lines policy if they engage in mergers or acquisitions.

In other words, the government is encouraging SOE developers to pick the carcasses of the private developers that fail.

For example, SOE developer COLI acquired stakes in Shimao and Agile projects worth 3.7 billion yuan ($555 million). And SOE developers Beijing Capital Group and Huafa Group acquired assets from Sunac China for over 20 billion yuan ($3 billion).

The divide between private and SOE developers is most evident in the prices of their stocks and bonds. The offshore bonds of China’s private developers have continued to fall, suggesting that many—if not most—private developers will default on their offshore debt.

Meanwhile, SOE developers are coasting through the current crisis. They continue to enjoy the full backing of the government and the banking system it controls.

Housing in Xi Jinping’s China

When Xi became general secretary of the Chinese Communist Party in 2012, one of his first initiatives was his trademark “anti-corruption campaign.” This campaign had two different purposes: to deal with the problem of corruption within the party ranks, and to allow Xi to consolidate power and gain an advantage over rival factions.

According to Japanese journalist Katsuji Nakazawa, Xi has extended his anti-corruption campaign to the private sector. In other words, government measures to go after private property developers might be a way for the party to wrestle back control.

The timing of the current campaign is not a coincidence. Xi will be seeking a third term as general secretary at the National People’s Congress in October 2022. He is now shoring up party support to ensure that he remains in power for at least another five years.

Longer-term, Xi likely envisages a future with greater wealth redistribution and greater government control over the economy.

Unlike his predecessors, who promoted a hybrid form of socialism and capitalism, Xi believes that a communist society and economy can be achieved.

So, will there even be a private property market in China longer term?

Smartkarma-affiliated analyst Travis Lundy believes that local governments will increasingly sell land to local government financing vehicles (LGFVs), who will then build low-income housing rented to households on a rent-to-own basis.

The government could then deal with the over-construction problem by simply renting out excess inventory to low-income households. And it could slowly reduce the amount of construction while securing jobs for displaced construction workers elsewhere.

By nationalizing the property sector, the government can reassert control over the economy. And eventually, take away power from the private developers that built up China’s housing market from humble beginnings into the most important asset class in the world.

■Is the SPAC party coming to an end…or just changing its tune?

In mid-July, the largest-ever SPAC, Pershing Square Tontine Holdings, announced it was returning funds to investors after it had failed to find a company to merge with.

SPACs, or special purpose acquisition companies, are publicly traded companies that are created solely to raise money for the purpose of buying and taking public another, as-yet-unidentified business. For this reason, they’re often called “blank-check companies.”

They are a way for investors to acquire a stake in a company as it lists on the market, and a way for private companies to quickly go public without the time and expense of an initial public offering.

SPACs took the investment world by storm during the pandemic, since many young, private companies were eager to go public to take advantage of lofty stock market valuations.

However, with the recent market downturn, the interest in listing on stock exchanges has waned, meaning SPACs are struggling to find companies to merge with. SPACs generally have two years to find a company to acquire before they must return their money to investors.

That’s what’s happening now to the funds in Pershing Square Tontine Holdings. The SPAC, started by billionaire Bill Ackman, raised a record $4 billion, but this will now be handed back.

In a funny way, this is the best outcome.

Right now, lots of SPACs are desperately hunting for companies to acquire before the two-year time limit expires. Given the lack of quality companies interested in going public, the fears are that a lot of dodgy deals will be made. Often no deal is better than a bad deal.

In fact, given the challenging environment for SPACs, Ackman is promoting a variation on this concept…something called a SPARC, or special purpose acquisition rights company.

Under this model, instead of selling shares to investors, the SPARC would give away “special purpose acquisition rights” to investors for $0 each. Then, when the SPARC finds a target company, it would ask investors to put up the necessary funding to complete the deal.

SPARCs would not be bound by a time limit, and they would have greater freedom to identify a quality company, since they wouldn’t be trying to find a business with a valuation close to the amount raised.

However, there are still a few questions to be answered about this new concept. For instance, with a SPAC deal, a private company is merging with an existing public company (the SPAC), so the normal IPO disclosure rules do not apply. That’s a big part of the appeal for private businesses. It simplifies the whole process.

But with a SPARC deal, the SPARC has no funds, so it will be asking investors for money at the time of the merger. This means the standard IPO rules will apply. So, in that case, will private companies be interested?

Still, it’s an interesting concept that may open up some interesting profit opportunities. I’ll keep you apprised of related developments.

■We’re getting ever closer to a battery revolution.

An electric vehicle battery that can be recharged in minutes and allow a car to travel hundreds of miles between charges…

For years, I’ve read stories that promised this world-changing development was not only possible, but just around the corner. Now that may actually be true.

Scientists have already developed next-generation battery cells with capabilities far exceeding current batteries. But those exist only in laboratories.

Now, companies are building factories to produce these new battery cells so that carmakers can begin testing them in road vehicles. These production facilities will also test the scalability of the technology.

Among those looking to mass produce next-generation battery cells are QuantumScape, which is building a factory in its hometown of San Jose, and Massachusetts-based SES, which is opening a production facility in Shanghai.

It will likely be years before these batteries appear in cars in showrooms…if the technology is scalable at all. But increasingly, it seems the dream of an electric car that can significantly outperform a gasoline-powered vehicle in terms of mileage may actually be achievable.

■Inflation may be at a 40-year high, but prices are actually down on these common items.

We’re living through a new era of high inflation. In June, consumer-price inflation hit 9.1%...its highest level in four decades. And yet, not everything is rising in price. In fact, major retailers are getting ready to offer big discounts on certain items.

During COVID, customer demand for some goods spiked massively. Think: garden furniture, home exercise equipment, large electronics, home office furniture, couches, etc. So, retailers duly ordered large quantities of these items.

However, because of the global supply chain problems, there were big delays in getting these items to the retailers.

Now, these items are arriving, but the demand is no longer there. Customers have already shifted their spending back to eating out, going to concerts, jetting off on vacation, and so on.

That means stores are going to have to offer discounts to move these items. And you can expect deep discounts, since these are large items that cost a lot to store in warehouses.

So, if you’re in the market for some new outdoor furniture, exercise equipment, or large appliances, visit your nearest big-box store.

Also, check out online retailers that specialize in these fields. Many e-commerce businesses are especially sensitive to warehousing costs, so may offer even more generous discounts.

■The cheapest way to vacation this summer is…

While every other travel sector is jacking up prices, there’s one vacation industry that’s having to slash costs just to get consumers in the door: cruises.

Daily rates for hotel rooms have increased by almost 20% since 2019, according to industry data firm STR. Meanwhile, airfares were up more than 12% between April and May alone, according to the Labor Department.

Cruises, however, are down in price compared to 2021. This is because cruise lines have now brought their full fleets back online, after operating limited numbers of vessels last year. Meanwhile, stringent COVID testing requirements remain in place on many cruises, while the cost of flying to departure ports has risen.

These factors have made it hard for cruise companies to fill staterooms, so they’ve been offering big discounts. Disney Cruise Lines, for instance, has slashed prices on some voyages by up to 35%.

If you are interested in a cruise vacation, one big tip is to book from a travel agent. They tend to get commissions from the cruise lines, rather than charging you a fee. And they have access to discounts and benefits that you won’t typically find when you book by yourself online.

■Here’s a secret way to get discount stays…even at 5-star resorts.

Given the soaring cost of hotels, this could be a good moment to try out Priceline.

Priceline.com is an online travel agency for finding discount rates on airfares and hotel stays. By using its “Express Deals” or “Name Your Own Price” services, you can often get amazing deals on top-class accommodations…even 5-star resorts.

The catch: booking this way is a bit of a gamble.

Generally, when using these options, the actual hotel name and its exact location is hidden from you until you pay. The reason for this is that sometimes hotels don’t sell all their rooms (even in this travel environment) and are willing to offer a lower rate to fill them, but they don’t want to publicly reveal a discount price that anyone could find on Google.

So, they offer the lower rate through Priceline or one of its competitors like Hotwire, with the hotel name hidden until the customer actually completes the purchase.

This means, when booking through Priceline, you’re sometimes not entirety sure of the place you’re getting.

However, there is a way to get around this, with an extension for the Chrome web browser called TravelArrow that is able to work out the name of the hotel based on the available data with a high degree of accuracy.

Just be aware, once you book through Priceline, you typically can’t cancel. Still, if you’re looking for a great hotel deal, it’s certainly worth a try.

■How to check your vacation rental for a hidden camera.

According to a survey by a real estate investment firm, more than 10% of vacation home renters say they’ve found a hidden camera during a stay.

That number seems scarily high, but it could well reflect reality. After all, spy cameras are now very cheap to buy and difficult to spot. Fortunately, there are some simple ways to find a hidden camera device.

First, most hidden cameras are located in everyday household items like lamps, clocks, and thermostats. Check those items carefully for any reflective glass that might indicate a lens. Shining a flashlight or your smartphone light on the items can help with this.

Second, download the app Fing. Hidden cameras often connect to the local WiFi network to stream footage. Fing can search local WiFi networks to determine if any camera devices are connected to them.

The final step you can take if you’re truly concerned, is to buy a hidden camera detector. These can be easily bought online through sites like Amazon.

If you ever do find a hidden camera, you should report it to Airbnb or whatever vacation rental company you are using. Airbnb does allow hosts to have these devices, but they must inform guests and they should never be placed in private areas like bathrooms. You should also report any hidden cameras to the police, just in case criminal charges or litigation follow.

■Here’s something to think about before you buy your next smartphone or laptop.

In June, the European Union unveiled a new mandate that states portable devices like smartphones, keyboards, and wireless earbuds should use a common charger cable by 2024. By 2026, the same rule will apply to laptops. The legislation is aimed at reducing e-waste.

This means that within the next few years, all those unique charging cables we have for things like iPhones, iMacs, Microsoft Surface tablets, and such will disappear. Instead, all new devices will use a USB-C cable…the current standard for most Android devices.

Of course, the law only applies to Europe, but it’s unlikely Apple and Microsoft will develop separate devices for the European market. Instead, devices in the U.S. and around the world will likely also change to reflect the new European standard.

That means, we need to think about future-proofing any new electronics purchases. If you buy any new devices, like a power brick, make sure they come with a USB-C connection. And if you’re an iPhone user and your Apple connector breaks, consider getting a third-party replacement that has both Apple and USB-C connections. Those cost as little as $15 on Amazon.

■Artificial intelligence and big data are taking over healthcare.

Imagine if you got a call one day from your health insurer asking you to change your behavior because you were at risk of a serious illness… Well, get ready because that day is coming.

Increasingly, major insurers like Cigna and UnitedHealthcare are using AI and big data to scan medical records and claims documents to determine when members might have a certain condition…anything from depression or obesity to diabetes. Now, they are exploring the idea of using this technology to alert at-risk members and encourage them to enroll in targeted healthcare programs.

Early trials in this space have, unsurprisingly, not gone especially well. People like hearing medical advice from their doctor…less so from the insurer that’s claiming a big chunk of their paycheck.

Still, the companies are undeterred. They know that if they can increase sign-up rates in the targeted programs, they’ll need to spend less on member healthcare, which will boost their bottom lines. It seems like targeted healthcare interventions like this are the future…whether we like it or not.

Thanks for reading and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2022. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.