Dear Global Intelligence Letter Subscriber,

Because of a father’s love for his daughter… gold became a currency.

At least, that’s according to the myth.

It all goes back to King Midas.

Midas was a very real historical figure who, nearly 3,000 years ago, ruled over the Phrygian Empire, in what is today western Turkey. We all know him as “Midas with the golden touch.” The “golden touch” part is where myth meets reality…

The story is that Midas did a solid for Dionysus, the Greek god of wine and revelry, by looking after of one of the god’s friends, a satyr named Silenus. In gratitude, Dionysus offered to grant Midas a wish… and we all know what the king wished for.

It turns out, though, that transforming everything to gold with just a touch isn’t the superpower one might hope it to be.

While initially intoxicated by his ability to convert a table, a carpet, a bathtub, and various household items into gold with just the tip of his finger, Midas quickly realized his greedy wish was properly stupid. He reached for a grape to begin breakfast on the morning the wish came true… and, poof, a solid gold grape. How to eat that?

Same with a slice of bread. A glass of water. Midas quickly surmised that he’d starve to death.

And then in walked his daughter.

Midas jumped up and hugged her… and that was not smart.

Distraught at getting exactly what he wished for, Midas prayed to Dionysus to take back a thoughtless wish that had quickly morphed into a deadly curse. Dionysus told Midas to wash away the wish in the headwaters of the Pactolus River up on nearby Mount Tmolos.

Midas did as instructed—and watched in awe as rivers of gold washed from his body.

Which brings us to the real beginning of this month’s cover story.

A couple centuries later, another very real historical figure, King Croesus, was ruling over the kingdom of Lydia, which rose up in the same Turkish neighborhood where Midas once held power.

By the middle of the 6th century BC—so nearly 2,600 years ago—Lydia was looking for a better way to manage commerce. Merchants and consumers in the kingdom had historically relied on barter as well as pieces of metal known as electrum, a naturally occurring fusion of gold and silver.

But Mother Nature never was really big on uniformity. How much gold or silver did a random piece of electrum really hold? What was it really worth?

Measuring purity and weight across every different piece of electrum that flowed through the Lydian economy was time-consuming and inefficient in commerce.

Locals and leaders realized they needed a better method. Something standardized, so that that both merchant and consumer knew exactly what they had and what it was worth in the local economy.

So, the Lydians went about the process of creating a purer, more homogenized golden coin—the Croeseid—with a known weight and value. It was originally minted with images of animals, and then Greek gods.

As for the gold the Lydians gathered up and fashioned into the world’s first recorded gold coins… it all flowed from the Pactolus River that Midas had bathed in to wash away his dreaded wish centuries earlier.

Though the wish and the wash are mythology, the Pactolus did, in fact, flow rich with gold, providing Lydia with a vast amount of metal to mint into coins… which, in turn, fundamentally changed commerce in a way that still reverberates today.

As you might have sussed out by this point, your new double-issue of Global Intelligence is golden.

Though we are millennia removed from the Lydians and their gold coins, gold remains a transformative form of currency—a currency that on more than one occasion throughout history has saved some monetary system and its foolish leaders from collapse.

In a world plunging ever deeper into unsustainable debt and riven by both inflation and geopolitical tensions that could worsen from here, gold’s transformative power will rise to the forefront again.

Which is why I call 2025 the Year of Gold.

Right now, gold sits at over $2,700 per ounce.

And I’ll just share right here at the top my base-case gold price for 2025: $3,250 per ounce.

But I won’t be surprised to see it flirt with $3,500 at some point during the year…

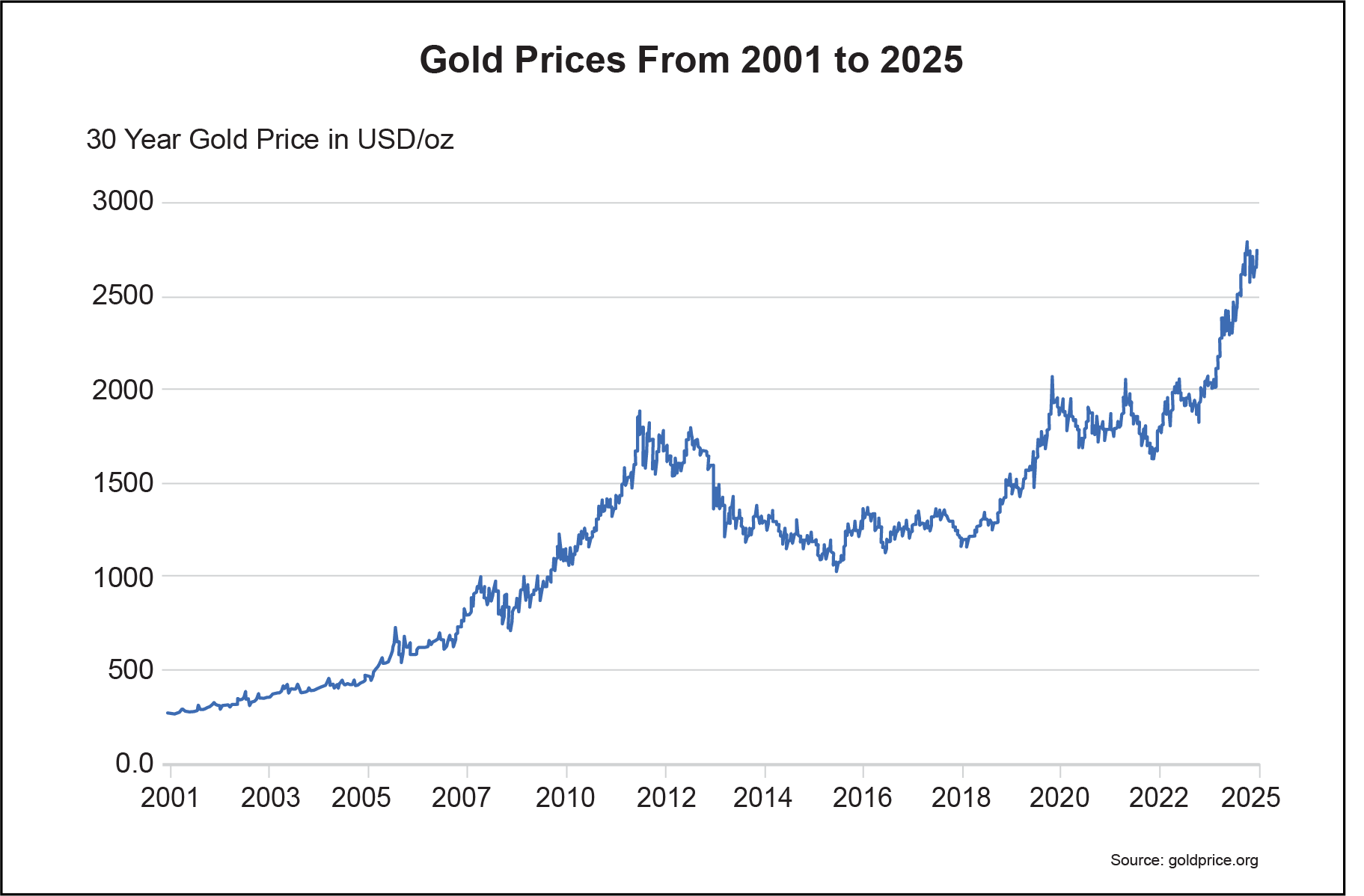

Gold has been on a helluva run since 2001.

That’s when the world fundamentally changed. The 9/11 terror attacks pushed America onto an unsustainable path of fighting wars and sundry other global threats, all funded by Uncle Sam’s ever-increasing reliance on debt.

The global gold market until that point had been asleep for more than two decades. It dove from $875 per ounce in January 1980 to just over $254 by 2001. The metal bounced around the $255-$275 range across spring and summer that year. And then in the wake of that fateful September day, gold pressed toward $300 per ounce—and has never looked back.

In the 24 years of this century so far, gold has risen in 19 of those years, and fallen in just five. The nearly 1,000% gain it has racked up over is more than double the cumulative, 430% showing that the S&P 500 stock index has managed.

“Gold’s 1,000% gain since 2001 is more than double the S&P 500’s gain.”

But honestly, comparing gold to the S&P 500 is as useful as comparing a simple fishing pole made of cane to a pricey and huge deep-sea rig. They’re both fishing rods, just as gold and stocks are both assets. But in an emergency, I’ll take the easy-to-use, easy-to-transport cane pole every time, thank you very much.

Same with gold.

If an emergency erupts—and I mean a fiscal, monetary, or social crisis—stocks won’t offer immediate access to an asset necessary for spending needs. Nor will stocks necessarily offset a currency crisis. A world of panicked investors will very likely be purging stocks “to get liquid.” Most stock prices would plunge.

But gold?

Gold is built for crises.

It has saved economies and currencies and transformed economic systems going back to, well, Croesus and Lydia all those millennia ago. Among the list of economies gold has saved, is America.

And it’s on the list twice.

FDR confiscated privately held gold in 1933—and immediately repriced it nearly 70% higher—in an effort to avert a dollar crisis that was brewing amid the Great Depression.

In 1971, Nixon cut the dollar’s ties to artificially cheap gold to save the economy from yet another dollar crisis that was brewing since the late 1960s. The world had realized the Bretton Woods system—in which a dollar was convertible into gold—was failing. Countries were exchanging vast amounts of dollars for vast amounts gold held in Federal Reserve vaults. The French even sent a warship to New York to ferry back to Paris all the French gold held in the US.

The dollar was crumbling… Nixon de-pegged the buck from gold… and gold prices shot higher.

That’s just the role gold has earned across world history. It’s the fireman that economies call on when their fiscal house is aflame, and the hydrants have all run dry.

Which is exactly what’s likely to happen again in a future that is increasingly—maybe even frighteningly—near. That’s not necessarily me telling you that—though I am telling you that.

Gold is telling you that.

I mean, ask yourself: Why has gold’s price risen to a record high of more than $2,700 from $250 over the last 24 years?

It’s not because gold has reported a string of impressive earnings results. The metal earns nothing. And it’s not because gold pays such a meaty dividend. The metal pays nothing.

Gold has marched persistently higher for a single reason: Ever-deepening global worry that the world’s Western nations have (either intentionally or not) orchestrated an approaching financial calamity that will see fiat currencies de-peg from the “thoughts and prayers” that have kept the dollar, the euro, the yen, the pound, and so many other extremely debt-laden currencies from collapse.

When the system goes, there is no circus performers’ net to catch us below. There’s no “in case of emergency, pull” ripcord anywhere in sight that will unfurl a giant parachute to save us all from the pain that awaits at the bottom.

All we have are two assets to keep us safe when the Western fiscal world burns: gold and bitcoin. I’ve made the case for both before… including for bitcoin in your March 2024 issue, and for gold last September. I’ve included both in your report on the best-performing assets of the 2020s.

With this double-issue, I want to give you two more ways to play gold’s bull run… because the case for owning gold has never been more urgent.

I am not going to spend the rest of this double-issue outlining the sundry ways that crisis could manifest in America. I’ve laid out various scenarios over the years here in Global Intel and in my daily Field Notes e-letter. (You’ll find a summary of how crisis could play out in the US in my Era of Super Shocks briefing.)

But here’s the bottom line: The price of gold over the last 24 years says more about the gold market’s expectations than anything I could write.

A more useful discourse for this issue is why I am declaring 2025 the Year of Gold…

It’s not so much about the crises to come. They’re coming. They are what they are. And that’s that.

The Year of Gold is about three things:

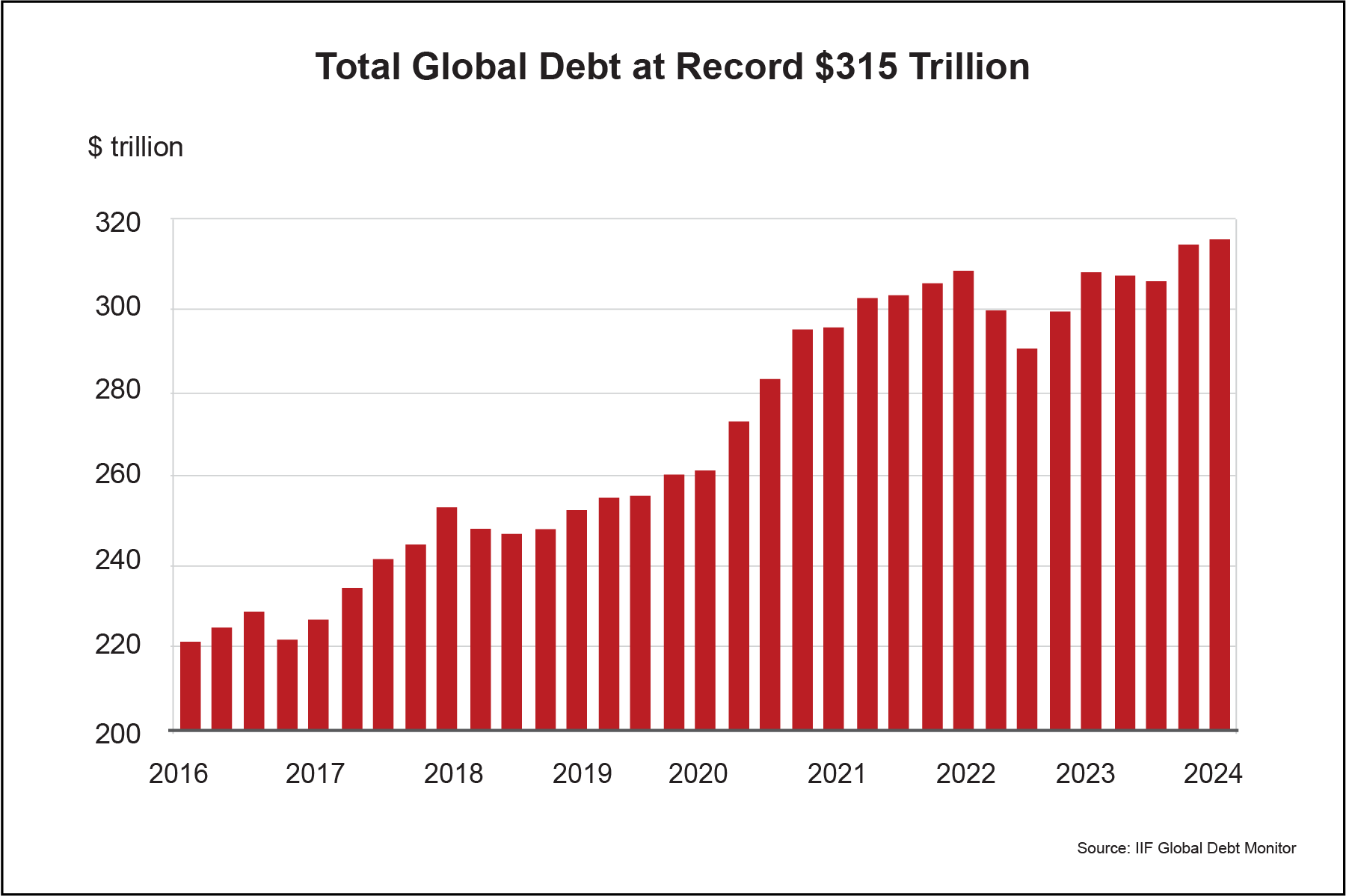

On point #1, global debt exceeded $315 trillion as of 2024. That represents nearly 333% of global GDP. So, for every one dollar created in the productive economy, global politicians have created $3.33 worth of debt. (The West is responsible for two-thirds of the debt.) Doesn’t take a Mensa member to know that such math is not sustainable.

Global debt in every quarter going back to 2016.

Then again, there’s no indication yet among any of the major countries that a serious debt-reduction campaign is afoot. No politicians can afford that chase because “debt reduction” is just a euphemism for “austerity,” which is just another way of saying “I’ll lose my job to angry voters hurt by the austerity I support.”

Which is why global central bankers, except in the US, have been so active in the global gold market over the last few years. They see the graffiti on the wall, and it’s not an encouraging message.

The last few years have seen record gold-buying among central banks, according to the World Gold Council. It tops even the banks’ mad rush for gold in the 1960s, when the world recognized that the US monetary system faced a Come To Jesus moment, years before Nixon had to pull the plug on the dollar’s ties to the yellow metal.

Though many haters in America pan gold as an archaic relic with no economic utility, the fact that so many central banks are trading US dollars for gold today says, exactly opposite of the naysayers, that the world’s bureaucratic bankers are essentially doomsday prepping. These bureaucrats are not conspiracy theorists. They’re some of the most sober-minded bankers on the planet.

The concerns that drove the gold market in the last few years are likely to continue… Central bankers will continue to trade out of dollars and other assets and into gold—as they look out across an increasingly chaotic financial, political, and social landscape in 2025.

As the World Gold Council noted in a January update: “With only December data yet to be revealed, central banks will no doubt be substantial net purchasers [in 2024] for the 15th consecutive year.” And this is a trend all the smarter gold-market players expect to continue in 2025.

Or said another way: A massive quantity of money will continue flowing into gold.

On the second of the three reasons 2025 is the year of gold—inflation—I’ll be short.

Inflation is not done. I’ve been saying this for many months.

Sure, inflation has come down from the post-pandemic highs, but that was expected.

The Fed across the second half of last year was acting like it had slayed the demon. I kept saying, “Not so fast—inflation has not gone away. There’s simply too much idle cash floating around a global economy that has not yet sopped it all up.”

And here we are today with the Fed warning that maybe it can’t cut interest rates as much as expected because progress toward bringing inflation to heel has stalled. In Fed meeting minutes released in January, Fed officials slowed their roll regarding interest-rate cuts in early 2025 because “participants cited recent stronger-than-expected readings on inflation.”

Assuming the status quo—meaning assuming certain policies don’t change inside the White House—the Fed likely will cut interest rates four times this year. Not necessarily because inflation goes away; it won’t have gone away. Instead, the Fed will cut rates to reduce the financial strain on Uncle Sam, since higher rates have pushed America’s annual debt-servicing costs to $1 trillion—an insanely large number representing 15% of America’s 2025 spending.

Interest rates don’t exist in a vacuum. They cross borders. Currency investors, central banks, and businesses all over the world watch interest-rate movements like watching league standings for their favorite sports. Rates rise or fall relative to those in other countries. As they do, the currency tied to a particular country’s latest rate move will rise or fall against other currencies.

Thus, if the Fed does cut interest rates, the dollar will very likely weaken.

And a weaker dollar would see gold prices rise since gold (along with bitcoin) is the ultimate anti-dollar/anti-fiat-currency trade.

Which, you might think, would mean that the Fed hiking rates would be bad for the dollar. And in a world that’s right-side up, that would be true.

But we live in Bizarro World these days. The Fed raising rates would also see gold push higher, because that highlights what I mentioned a moment ago: Uncle Sam’s increasing fiscal strain with his debt-servicing payments. Higher rates would mean America’s interest payments shoot well past the $1 trillion mark, and global bond investors would grow more and more worried that the US is rapidly approaching a dark moment where debt payments, and the need to issue ever-more debt to deal with those payments, spiral out of control.

Gold would clearly race higher on those worries.

But there’s also the potential that inflation surges even higher than expected…

As we go into Donald Trump’s second trip on the presidential merry-go-round, inflation could take off again—both because of Trump’s domestic policies, and how his administration impacts world affairs. Indeed, Trump’s “Empire building” desires could quickly destabilize geopolitics… which speaks to point three of my three reasons 2025 is the Year of Gold.

First: Trump’s domestic policies and inflation.

But before I go further—please understand that I am not picking on Trump. I received a letter from a subscriber recently who casually referred to Trump as my “nemesis.” This, no doubt, is because of Field Notes dispatches like this one where I’ve said Trump’s policies could super-charge inflation again. But, truly—Trump is not my nemesis. I have a Santa Claus-sized Christmas sack filled with an unending supply of disdain that I eagerly toss out to about 98% of American politicians, regardless of political party. If Kamala Harris, Mickey Mouse, or Jesus H. Christ were in office and offered up the same agenda, I’d be writing the same story this month.

I am about issues, their impacts, and the dots they connect with. I’m not terribly interested in personality. (And, frankly, Trump has caused a tidal wave of euphoria to rush through the crypto market, so for me he’s Crypto Bro #1.)

The market’s Trump concerns—aside from “Empire building,” which we’ll get to—revolve around his deportation, taxation, and tariff policies. I’ve written a lot about that in Field Notes, so I will just offer up a Cliff’s Notes version here: All are inflationary. Basic economics really.

One example and then we’ll move on: I’ve seen estimates that show immigrants (many of them undocumented) comprise as much as 80% of the agricultural labor force. So, a huge proportion of the workers who pick the vegetables and man the slaughterhouses and feed the chickens and pigs that then become the food on American dinner plates are undocumented workers. Deporting those workers doesn’t open up jobs for Americans. Americans have shown over many years that these are jobs they do not want.

The upshot of deportation, then, is that there are not enough workers to meet consumer demand for bacon, eggs, skinless chicken breasts, etc. Demand stays the same but supply drops. Simple Econ 101 tells you that consistent demand on limited supply pushes up price—i.e., inflation.

And based on the previous section, we already know how inflation flows through the gold market.

Thus, Trump’s policies, if fully enforced, are tailwinds for gold.

As well, on the geopolitical side of things, Trump’s rhetoric and his actions could create problems in the world that then lead to higher gold prices.

First up, we have his stated desire to take over Greenland, the Panama Canal, and push Canada to become America’s 51st state. Now, I cannot say how much of that is Trump using bravado to angle for something else—concessions from Panama and Canada on trade, for example. That is very much his style.

But if he goes through with a threat to basically invade Greenland (he explicitly refused to rule out using the military) and forcibly split it from Denmark, then he will have created an international incident with a NATO country that’s friendly to the US. Europe would be up in arms and taking action against America… and, of course, Trump would retaliate against Europe big time.

That would quickly morph into massive global instability.

Same if Trump decides he wants to reclaim the Panama Canal by force, or if he imposes economic sanctions on Canada in some effort to “encourage” Canadians to change their Thanksgiving date to the fourth Thursday in November.

None of that is normal. Worse, it sends a message to China that taking Taiwan by force is peachy-keen, and to Russia that it’s OK to begin rebuilding the old Soviet Union by invading former satellite states in the Baltics and Balkans.

Those are the kind of chess moves that precipitated World War I. Gold would sense that analog and begin to shoot much higher, much faster.

Question is: Will any of that happen?

I think yes. There’s a good possibility Trump forces the Greenland issue, since he sees the icy land as key to American national security at the top of the world, where both China and Russia are also staking claims to arctic resources.

I also think he’s dead serious about the Panama Canal, since it would once again allow the US to control one of the world’s most critical waterways.

Canada is a lark (probably)—a dig at Canadian Prime Minister Justin Trudeau (whom Trump mocked as the governor of the 51st state). There’s simply no way Canadians would agree to relinquish their sovereignty.

For now, we’ll have to wait to see how this component of the gold story shakes out in coming weeks and months.

But we’re not going to wait on building two positions in gold…

Pick No. 1: The Goldilocks of Gold

We have numerous ways we can own exposure to gold. Indeed, in our Global Intel portfolio already, we own a gold mining ETF and a miner.

In my personal portfolio, I think I own pretty much all the various ways of owning gold. I have super-rare gold coins whose price is based less on gold and more on numismatic value. I have beaucoup basic bullion coins that were used in world trade in the 19th and 20th centuries. Their value is almost purely tied to the ebb and flow of gold prices.

In several different IRA accounts, I own a large slug of a gold ETF, a fund with the sole purpose of tracking the price of physical gold, since I cannot own the physical metal in that particular account. I own shares of one of the world’s largest gold miners in another IRA. And in yet a different IRA, I own what’s known as a “gold streamer.”

And gold streaming is our first play this month.

Streamers, to me, are the best of all worlds when it comes to gold exposure. They combine attributes of mining and attributes of ETFs, and mash them together into a single investment. In doing so, they sidestep the worst attributes for both asset classes to create what is essentially the Goldilocks of gold.

The streamer we’re going into is called Sandstorm Gold Royalties.

First, let me explain how streamers work.

A gold prospector goes out searching for gold and comes across what he thinks is a motherlode. But he doesn’t have the capital to buy all the equipment he needs to build a mine or to process the rock to separate out the gold.

So, he approaches an investor and, for a sum of cash, gives the investor a contract that guarantees either a portion of the gold the prospector processes, or a portion of the net profits the mine earns. In other cases, the prospector could allow the investor to buy the gold the mine produces at a big discount to the spot price of a gold.

That’s the essence of streaming.

It gives mining companies access to capital they need to fund a mine, to pay down debt, or to fund ongoing operations.

It gives the streamer access to gold without all the pesky costs and issues of actually operating a mine. That’s why I say streamers are the best of miners and ETFs smashed together. We get exposure to gold prices, as with an ETF, and we get exposure to production growth, as with a gold miner. But we have none of the costs and risks associated with exploring for gold, the regulatory gymnastics of permitting and building the mine, and the ongoing costs of running a mine.

Sandstorm owns 230 streams across more than 40 mines in the US, Canada, Australia, and all over parts of South America, Africa, and Asia. Mines are owned by some of the biggest names in the industry: Glencore, Ivanhoe, BHP, Vale, Rio Tinto, and Lundin.

At the moment, 62% of the company’s revenue stream comes from gold, with copper, silver, and “other” accounting for 18%, 12%, and 8% of revenues, respectively. As part of its growth strategy, Sandstorm is pushing to increase gold streams to more than 80% of revenue by 2029. It aims to accomplish that by funding new-mine construction projects on the books at Glencore, Ivanhoe, and Barrick Gold, among others.

That’s a big part of Sandstorm’s MO: The company’s development team approaches gold miners in jurisdictions all over the world and offers to fund construction in exchange for a share in the metals stream that results.

Sandstorm is pursuing this growth strategy because, as the company told shareholders in a recent report, “the case for gold has never been stronger.”

Near term, Sandstorm management sees issues tied to inflation, national debt, and ongoing wars. Longer term it sees other issues that will drive persistent inflation, as well as rising threats to the dollar’s hegemonic role globally (which I wrote about in your June 2024 issue), and an effort to bring physical gold onto the blockchain for a faster, more efficient, more transparent market, a move that would increase demand for gold since it would be far easier to own and trade.

Most of Sandstorm’s contracts with mining companies are known as NSR, or Net Smelter Return, contracts in which Sandstorm collects a portion of the gold that comes right out of the smelter, before the miner accounts for the cost of operating the mine and the business.

Basically, it’s pretty close to a pure play on gold prices so that as gold rises, Sandstorm’s share price follows suit.

But it’s not exactly a pure play, like an ETF would be… which is where our opportunity lies.

Take a look at this chart:

The red and green candles represent Sandstorm’s share price going back more than a decade. The darker red/purple line is the price of gold.

That’s a peas-and-pods chart.

Except there at the far right, as the chart comes to an end. Gold surged. Sandstrom not so much.

You can’t see it very easily because of the chart’s scale, but in October 2022, gold was in the $1,600 range. Today, it’s $2,700—a nearly 70% lift.

Over the same period, Sandstorm moved from a low of $4.50 to its current price of $5.80—a gain of just 29%.

Same time period. Same underlying assets. Less than half the price appreciation.

What gives?

What gives is that Sandstorm in 2022 gobbled up other companies: Nomad Royalties, and part of the portfolio at BaseCore Metals. The combined cost was about $1.1 billion—a huge bite at the apple—largely funded with debt. Investors, in turn, were worried that maybe it was too much apple, too much debt. Indeed, the shares ultimately sank to a low of $3.90 in February 2024.

Since then, the stock has continually nudged higher, following gold, just without the same ferocity. The proximate cause for that is investor sentiment that is shifting because Sandstorm is doing such a good job of paying off the debt it used in those acquisitions.

Just after those purchases in 2022, Sandstorm debt stood at $637 million. Today, just over two years later, the company’s debt load has shrunk to $355 million. And the company will continue using its ample free cash flow to continue paying down the debt in big chunks.

In practical terms that you and I really care about, eradicating the debt means fattening the stream of dividends we receive from the stream of gold that Sandstorm collects. Right now, that yield is just under 1%, so it’s not terribly exciting. But owning any stock where the dividend is rising has a powerful effect of driving the share price higher.

Moreover, as debt-servicing costs roll off, Sandstorm will be reporting fatter earnings. And, per management, the company will be using more of its available profits to buy back shares from the open market. Fatter earnings lead to a fatter stock price and so do share buyback programs. By reducing the share count, a company’s earnings spread across a fewer number of shares, meaning that earnings-per-share (EPS), a much-watched metric on Wall Street, rises faster than it otherwise would… and EPS is the E in the Price/Earnings ratio. A bigger E results in a bigger P.

Of course, a streamer is only as solid as the streams from which it benefits. And there, Sandstorm is a standout. COVID slammed all gold companies globally because the pandemic shut down mining operations. That year, Sandstorm’s streams produced 54,000 ounces for the company, down from 64,000 a year earlier.

But in the years since then, Sandstrom’s streams have continually grown, and based on production growth and new-mine construction, are expected to reach 125,000 in the next few years.

Other factors that make me want to add Sandstorm to the portfolio:

In short: It’s the cheapest streamer, and a darn good company.

A misvalued opportunity for us.

Sandstorm is a Canadian company with shares that trade on both the Toronto and New York stock exchanges. Be aware of that when you search for Sandstorm through your brokerage account. The US version of Sandstorm shares trade under the SAND symbol, but if you just search “Sandstorm” you might see the Canadian version (ticker: SSL) pop up.

Be sure you’re buying SAND.

Because the shares are listed on the NYSE, you’ll be able to buy SAND through any US brokerage platform.

Pick No. 2: A High Risk, High Reward Gold Miner

Our second play is a much riskier take on gold: G Mining Ventures.

I’m sure you’ve heard the term “junior miners”—the teensy-cap companies that are focused on the earliest stages of gold mining: from prospecting to exploration to early-stage feasibility studies. Basically, gold companies that have not progressed into production.

Well, G Mining is a junior miner that has just recently morphed into a gold production company.

G began producing its first gold last fall at the Tocantinzinho Gold Mine in the Amazon region of northern Brazil. As I was writing this, the company announced its 2025 production guidance, which has the one Amazon mine producing as many as 200,000 ounces of gold this year.

That mine, with about 2 million ounces of indicated reserves, is expected to produce gold at a cash cost of between $590 and $655 per ounce. Just a reminder that gold today trades at more than $2,700 per ounce. That’s a wide margin.

The industry uses another metric as well to gauge the cost of mining operations vs. the price of gold: all-in sustaining costs, or AISC, which takes into its calculus those cash costs, as well as all the other costs necessary to sustain mines, explore for new resources to replace mined resources, and the administrative costs of running the business.

For G Mining, the Tocantinzinho’s AISC is between $995 and $1,125 per ounce. That’s still well under gold’s current price, and the prices I think gold sees going forward. So, I am happy to have G Mining in our portfolio.

For now, G Mining has just the one mine operational in Brazil, but it’s developing two other prospects that have potential to meaningfully ramp up the company’s production in coming years:

Both Guyana and Brazil are mining-friendly political jurisdictions, meaning G Mining investors face a low risk of some political stunt like a country nationalizing a mine once it’s in production.

Though G Mining expects Oko West to produce those 350,000 ounces I mentioned a moment ago, the reality is that the company sees opportunity to grow the deposit base through mine expansion, which would pump up the annual production numbers.

I tell you that because the global mining industry is high on the Guyana Shield, world renowned among miners for its rich deposits of gold, diamonds, bauxite, and iron ore. Though Guyana has a long and rich history of gold mining, vast and remote areas of the country have never been explored, which has the global mining industry intently focused on the exploration and mining results that are coming out of the region. Expectations are that the Guyana Shield is going to dish up so-called Tier-1 gold deposits—those that produce at least 500,000 ounces of gold per year over a minimum 10-year lifespan.

Because the industry is so focused on the Guyana Shield, and because G Mining has a proven track record and an asset with big production capacity, my bet is that the larger miners have already pinned a takeover target on G Mining.

I’m not saying that a takeover is imminent or that it will 100% happen. And a potential takeover is not why I am recommending G Mining. I’m just saying that a takeover is a possibility, and if it comes, it will be at prices higher than the current share price, because the current share price undervalues the company.

On a price-to-net-asset basis (meaning the price relative to the company’s net assets, primarily its future production of its known reserves), G Mining is trading at less than 1x, meaning we’re buying the assets at a discount.

In a takeover, a buyer would very likely pay a premium to snap up G Mining’s high-quality mining assets.

Until that day comes, however, G Mining will continue pursuing its goal of emerging as a mid-tier gold miner—basically one rung below the industry giants like Barrick Gold or Newmont Mining (which we already own in our portfolio).

G Mining is another Canadian company. The shares we’re buying are foreign shares that trade in the US. I spot-checked Fidelity, E-Trade, and Webull and G Mining was available on all three, so you should have no problem trading these shares.

Sandstorm

As I write this, Sandstorm shares are priced at $5.77.

To me, Sandstorm is better than an ETF like the SPDR Gold Shares ETF. It will track the price of gold, but it comes with a production booster that an ETF can’t offer. It’s why I say streamers marry the best of gold miners and gold funds.

“I expect Sandstorm’s shares will head toward all-time highs, perhaps tripling.”

This is not as risky as a pure mining stock, which faces all kinds of existential risks from regulations and permitting processes. Still, this is a stock whose fortunes are tied to another asset—gold. Although the long-term trend is up, gold’s price does bounce up and down. If some event comes along to shock the gold market downward, Sandstorm would certainly feel that. That’s why I’ve given these shares a higher risk rating.

But if, as I expect, Sandstorm continues growing and paying down its debt… And if, as I expect, gold prices continue to push toward—and beyond—$3,000, Sandstorm’s shares could test all-time highs in the mid-teens, perhaps tripling from where we are now.

G Mining

I’m also giving G Mining a high-risk rating because, well, this is gold mining, and this is a very small company (market cap is less than $2 billion, so it’s a so-called small cap). Lots of risks are associated with mining, and with small-cap stocks. So if risk and volatility make you squeamish, then I would tell you to steer clear of this investment.

The shares have already had a big run since last summer, and we could see some consolidation or even a pullback.

But gold prices are going to continue trending higher, G Mining is going to produce upward of 200,000 ounces of gold this year, and the industry is going to continue to focus on opportunities taking shape in the Guyana Shield.

For those reasons, I want G Mining in the portfolio, despite the risks and volatility.

G Mining gives us a leveraged play on gold prices, meaning that the company’s share price has the potential to rise faster than gold prices rise.

But again, this could be a bumpy ride. So I am urging you to embrace that reality, to expect it, and to know that you’re going to need to sit on your hands—even double down—if prices temporarily pull back.

And with that, I’ll wrap up this month’s double-issue.

We’re moving into a new era socially, politically, and economically as the new administration takes office. And I firmly believe—because of the West’s ongoing debt issue, and more—we are approaching a crisis moment. That moment will reshape and redefine America as we progress toward the 2030s.

This next half-decade is going to be eventful.

And gold will be one of the primary assets to benefit.

For this month’s Portfolio Review, we have to focus on bitcoin… the “Robin” to gold’s “Batman.”

As I write this, BTC is up about 12% for the month of January alone, and at one point was up about 20%, when bitcoin touched a new all-time high of more than $109,300.

First off, if you hold bitcoin, well, good on you. We have two bitcoin positions in the Global Intel portfolio—the crypto itself, plus a bitcoin ETF—and they are up, respectively, 180% and 66%. (The difference is explained by the fact that we added the ETF just last year, whereas BTC has been in our portfolio since I first launched Global Intelligence, in 2021.)

If you are a regular Field Notes reader, and you took my advice in January 2023 to buy the bottom of the crypto market, then you’ve more than 5x’d your money. Good deal!

But there’s so much more to come…

I think bitcoin will see shockingly higher prices. So, I want all of us to ride this bull market substantially higher and with fully loaded bags.

In all previous crypto bull markets, crypto bros and tech nerds were the only meaningful market participants—and that group, broadly speaking, isn’t the investment class. They never looked at bitcoin as an investment, per se. They saw it as a gamble, a lark, a lottery ticket. Easy come, easy go.

During this crypto bull run, however, proper investors have flooded the space, led by BlackRock and its BTC-focused exchange-traded fund that in the year since its inception has amassed nearly $60 billion in assets, almost double the size of BlackRock’s gold ETF, which has been around for 20 years.

We have staid and sober insurance companies buying bitcoin to hold as part of their asset base. And we have America’s first crypto president in Donald Trump, who has sparked euphoria in the market with his pro-crypto stance and his lineup of pro-crypto picks for various roles inside the SEC, the Treasury Department, and elsewhere in government.

Moreover, as you likely know, Trump is proposing an American Strategic Bitcoin Reserve Fund, which in turn has launched a global arms race among countries and cities that are now looking to build their own strategic bitcoin reserves. The UK, Hong Kong, Switzerland, Poland, Brazil… as well as Florida, Pennsylvania, Vancouver (Canada), and Bern (Switzerland)… they’re all among the countries, states, and cities that are now exploring their own bitcoin reserves.

But building a bitcoin reserve isn’t like building, say, a reserve of US dollars. Because the government prints money, there will always be a larger and larger supply of dollars, making every existing dollar worth increasingly less in terms of spending power.

There will never be more than 21 million bitcoin, making every bitcoin worth increasingly more as sovereign/state/city demand lifts off—and 21 million is a tiny, tiny number in a global demand context. Right now, just four entities—BlackRock, Grayscale, MicroStrategy, and the US government—own more than 1.1 million bitcoin, or more than 5% of total supply.

Moreover, an estimated 1.6 million to as many as 4 million bitcoin have been permanently lost because owners forgot the password to their crypto wallets, died without leaving instructions on how to access a bitcoin wallet, or have thrown away old computers on which they held their bitcoin.

Whatever the reason, the supply of bitcoin is more constrained than even 21 million would suggest. As governments commence buying, we’re going to see sharply higher prices for bitcoin—well into the mid-six figures and ultimately past seven figures. I want us to hold for this much bigger run to come.

To be clear, you don’t have to own bitcoin through a crypto wallet. I have a large slug of one of my IRAs in Grayscale’s bitcoin ETF since I can’t hold actual bitcoin in that account. I want deep exposure to bitcoin in my retirement accounts and, well, ETFs are the way to accomplish that. We own the VanEck Bitcoin Trust in the Global Intel portfolio. (For a recap of why I chose that one… see your March 2024 issue.)

As we launch into 2025, I am intently watching the crypto machinations inside the new presidential administration; how its pronouncements shape the actions of other countries—and the impact they have on bitcoin’s price.

I won’t be surprised to see bitcoin flirt with $200,000 or more before the year is out.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke

Editor, Global Intelligence Letter

© Copyright 2025. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.