Dear Global Intelligence Letter subscriber,

I had $8,000 to invest, but nobody wanted my money…

It was 1994. I was in my 20s, working as a reporter for The Wall Street Journal.

At that time, the dollar had been falling in value against other currencies for a decade. I expected this downward trend to continue, so I decided to take the $8,000 in my bank account and buy overseas stocks.

Buying foreign stocks meant I’d gain two benefits—profiting from the growth of the shares themselves, and picking up stealth gains as the foreign currencies those stocks were priced in rose in value against the dollar.

My plan was to invest in the foreign versions of America’s blue-chip consumer-product companies—the overseas doppelgängers of Coke, Home Depot, Procter & Gamble, etc.

This was an idea I’d had for some time.

I’d spent my childhood traveling the world with my mom, who worked in the airline industry. In those days, airlines offered free travel to employees of competing carriers. So, we’d end up in Guatemala for a long weekend, or in Frankfurt, or crossing the Andes between southern Chile and Bariloche, Argentina.

No matter where we went, I noticed that people were pursuing the same life I was living in America. They were buying similar products in the same kinds of stores.

As an investor in my late-20s, I wanted to own those local companies supplying those products.

However, I stumbled upon a not-so-minor snag in my plan: It was impossible to find these sorts of investments on Wall Street.

In those days, only the very largest global giants were available as American depositary receipts, not local consumer-product companies. (ADRs, as they’re called, are foreign stocks that trade in the U.S.) At that time, online brokers such as Fidelity did not offer direct access to overseas markets. Schwab did, but the trading fees were three-digits big.

So, I spent months trolling the world for brokerage firms that would accept an American client with less than $10,000 to invest. Most never responded to my emails. When I did get an answer, it would politely—or less so—suggest I make myself scarce.

Then suddenly a positive response. Out of New Zealand.

When the brokerage responded to my initial inquiry, I replied with something similar to, “Are you sure Ord Minnett [the firm] will deal with an American?”

A few days later I got a reply: “Sure. Why not? Never worked with a Yank before.”

Thus began nearly 30 years of successful overseas investing. Through dollar ups and (largely) downs, my overseas accounts at one point grew to about 13 different countries. I’ve owned stocks in grocers, dairy companies, overnight delivery services, water bottlers, beer makers…all doppelgängers of American consumer-product companies, only they were focused on local and non-U.S. foreign markets.

This month’s cover story, as you’ve probably guessed, speaks to this idea.

As I write this, we’re on the cusp of a new economic era.

Central banks around the world are preparing to raise interest rates to tackle inflation. Once this process starts, the dollar may rise…for a short time. Ultimately, however, the process is going to kickstart a new, long-term dollar slide.

My expectation is that slide begins later this year. So, we’re going to act before that happens…to arrive at the party early, as I regularly advise.

Which is why this month we’re going to jump across the Atlantic, to learn about three consumer-product companies in Sweden, France, and Greece.

These are foreign blue-chip doppelgängers positioned to do well as this high inflation/weak dollar era plays out. And you don’t need a broker overseas to help you buy them. You can own them through a normal U.S. trading account.

At the moment, the dollar is relatively strong compared to other world currencies. Since hitting a recent low in January 2021, the buck has migrated higher by about 6%. That’s based on the Dollar Index, which tracks the value of the greenback against a basket of world currencies.

But soon, that’s going to change.

Currencies tend to move in sweeping arcs over time, and you can see their general, long-term trends by looking at charts that track data back for decades. Here’s what the Dollar Index looks like going back more than 35 years:

As you can see, the dollar is in a long-term downtrend marked by lower highs and lower lows. My estimation is that the Dollar Index tops out near 105 and sees a bottom in the mid-50s. That implies that the top end for the dollar is about 9.5% higher from here…while the bottom is more than 40% lower.

That risk-reward ratio tells me that risk defines the dollar today.

So, we’re going to not just mitigate this risk, but profit from it, by adding three blue-chip foreign stocks to our portfolio.

The first of these stocks is a doppelgänger of Procter & Gamble. In fact, it owns the #1 professional hygiene brand in the world, it recorded strong sales through the first three quarters of 2021, and its sales are poised to rise further as the world reopens.

The second of these stocks is a European doppelgänger for Walmart. This blue-chip company is in the final stages of a major restructuring that mean it’s on the verge of a new era of growth.

Our third play is a way of owning both the Coca-Cola and the Starbucks of Europe…at the same time. And this blue-chip company has the funds and vision to expand into major emerging markets in Africa.

Together, these stocks represent the perfect way to add both growth and non-dollar exposure to our portfolio.

Now, given the dollar could rise briefly in the near term, you may be wondering why we’re adding them now.

The reason is one of the great truisms of investing: Time in the market is better than timing the market.

Timing the market—trying to pick the exact moment a stock or bond or currency will rise or fall—is a game of chance. You might get lucky once or twice, but it’s never consistent.

Instead, I follow bigger trends I want to be a part of, and then I find a way to profit from them. Own the right investments that play off the bigger trends, and the timing takes care of itself.

Which is why I’m not really focused on whether the dollar rises a bit from here, or whether the weakness happens sooner than I expect. We’re acting because now is a good time to buy these companies, while the dollar is strong and other currencies are weak in comparison.

And then…we ride the buck lower to bigger profits.

To understand why these three companies are good investments, we need to understand what will kickstart the forthcoming dollar decline. That’s inflation.

Inflation is rising at its fastest pace in decades. In the U.S., inflation surged 6.8% on an annual basis in November 2021, the highest rate since 1982.

It’s a similar story overseas. In the U.K., inflation hit 5.1% in November. In Brazil, it was 10.7%. Across the eurozone, the 19 countries that use the euro, it averaged 4.9%…the highest level since the shared currency was introduced.

Now, central banks around the world are beginning to address inflation by raising interest rates.

Higher interest rates help lower inflation by removing money from the economy. As rates increase, consumers tend to keep their money in the bank to benefit from the higher rates of return on savings. This reduces spending, which lowers inflation.

So far, the movement on raising interest rates has been nascent…just a few, smaller countries. But it’s about to heat up.

The Federal Reserve announced last month that it expects to raise interest rates three times in 2022. In a vacuum, that would imply the U.S. dollar strengthens—and we could see that happen…for a while.

Alas, the Federal Reserve, the dollar, and the U.S. economy don’t exist in a vacuum. Big economies all over the world will begin raising interest rates, too.

When they do, money will leave the dollar and flow into other currencies. And as a result, the dollar will slide in value relative to those currencies.

You see, while countries all over the world are dealing with inflation, the U.S. faces a particular headwind. Namely: debt.

Despite all the pontificating some members of Congress do about America’s vast debt, the reality is that lawmakers simply don’t care. All you need to do is look back over the last 76 years—the post-war era—to see that Congress has run a deficit in 68 of those years, meaning Congress has overspent Uncle Sam’s income and has taken on debt to make ends meet.

Total debt after all those years: Approaching $30 trillion, a sum so large Congress will never be able to pay it off.

As an investor who regularly looks to where we will be, rather than where we are, I want to begin preparing our portfolio for the likelihood that America’s worrisome accumulation of debt will ultimately play through as a weaker dollar.

Here’s the scenario I see playing out, starting this year

:1. U.S. interest rates rise.

Just last month, the Federal Reserve announced that it expects to raise interest rates three times in 2022, as I noted.

Right now, the Fed Funds rate—which the Fed changes to manage the economy—is at 0.25%. The likelihood is that the Fed raises this by 0.25% in each of those three projected rate hikes. That would move U.S. rates to 1%.

As the Fed raises rates, interest earned on the dollar will rise, which will bring in foreign cash through something called the “carry trade.”

This is a straight-forward concept: Money flows to where it earns the best, safest return.

If dollars yield, say, 0.5% and the euro yields nothing, as it does now, then currency investors will sell euros to buy dollars. Selling one currency to buy another pushes down the value of the currency sold, and pushes up the value of the currency bought.

In that process, investors pick up that 0.5% interest-rate difference as profit.

Of course, that’s a two-way street…

2. Non-U.S. interest rates rise.

America is not the only one raising interest rates.

Norway has raised rates twice already, to 0.5%, and says more hikes are coming. The U.K. raised rates to 0.25% in December and, like Norway, signaled that that’s just the start. New Zealand has recently raised rates. So did Mexico, for the fourth time. Brazil hiked rates—as did Poland, South Africa, and South Korea.

Meanwhile, Canada, now with an interest rate of 0.25% on its dollar, says it will hike this spring.

The major economy I care about right now—the eurozone—claims it sees no reason to hike. The European Central Bank is stubbornly sticking to the Federal Reserve’s 2021 playbook, insisting that inflation is “transitory.” Yet inflation is very real in Europe—right up against 5%. I experience it every day here in Prague.

My bet: As 2022 unfolds, the ECB is forced to reconsider its position and raise rates, just like the Federal Reserve.

And as that happens…

3. Money shifts location.

This goes back to the carry trade I mentioned above.

When interest rates in other countries rise to levels that compete with or exceed the U.S., then money flows reverse course. Money leaves the dollar and heads into the pound, the euro, and others.

Part of the reason is to capture higher rates, where they exist.

However, in instances where rates are equal, there’s a secondary desire: to diversify out of the dollar.

The dollar has long been the world’s safe-haven currency, and with good reason—the U.S. had a stable economy and a stable political system.

Today, however, neither of those is true.

America represents a great deal of political and economic risk these days, as noted by a growing collection of observers.

Debt levels are unsustainable at 130% of gross domestic product. (Debt levels in Britain and the eurozone are high, but remain less than 100% of GDP.) American society is top-heavy and controlled by a moneyed, uber-elite class that buys political influence. And discord between red and blue states is truly a cause for concern.

Just last month, military leaders warned that contested 2024 elections could see U.S. troops split into warring factions that lead to, well, civil war in America (their words, not mine). This political rancor will start to build as the 2022 mid-terms approach.

With those foreseeable risks, cautious investors will trade dollars for other currencies where they perceive less risk.

That will be the pound and the euro, since both represent very large, stable economies that can support large inflows of cash.

And even if dollar fear remains muted, there’s a pressing question that we must ask: How much can the Fed raise interest rates before it causes even greater problems?

As the U.S. raises rates, it will increase the size of its debt repayments. And America is already borrowing just to repay the interest on its existing debt.

Plus, it’s not just the government. Businesses have accumulated the highest levels of debt on record, about $11 trillion. Consumer debt—about $15 trillion—also sits at historic highs. A third of that is non-housing debt, meaning a lot of variable-rate credit card debt.

As interest rates push higher, the cost of running businesses and households rises. That will flow through the stock market as reduced corporate profits, and it will reduce family spending.

It’s easy to see, then, how interest-rate increases could easily undermine an economy much-too dependent on debt.

The Fed, as much as I bag on it, isn’t filled with stupid people. Fed officials certainly know there’s a limit on how high they can push rates, and that the limit isn’t too far from where rates currently sit.

As such, I expect that even while the Fed will act to raise rates before Europe, the ECB will catch up later this year. (In fact, I wouldn’t be surprised if the Fed ends up backing off from its promise to raise rates three times, and actually raise rates just twice in 2022.) In time, major overseas economies like Britain and the eurozone will be able to push their rates higher than the Fed can push America’s rates.

Throw all of that into the mix and the picture I see tells me to begin building positions in foreign stocks that are focused primarily on foreign markets, and which are earning their profits and paying their dividends in foreign currencies.

A weaker dollar has two benefits for us when we buy foreign stocks like my three recommendations today:

Even if the share price never moves, and the dividends never increase, we still earn more money just by owning foreign assets.

That’s because as the dollar declines, the value of other currencies rises, by necessity. It’s a teeter-totter thing. Currencies all trade in pairs against one another—dollar/yen, euro/pound, franc/yuan, etc. As one goes down, the other must go up. So, when the dollar is on the decline, the value of other currencies is rising, which is a benefit to us.

Here’s what that looks like when you own a foreign dividend-paying stock:

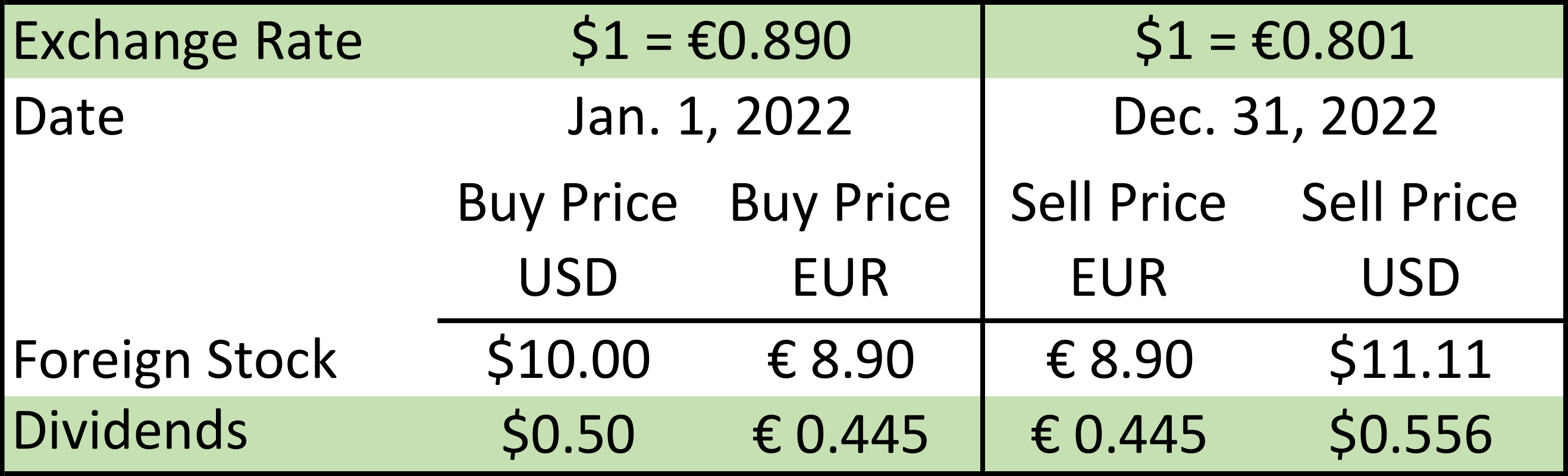

On Jan. 1, 2022, you buy a European stock in, say, Paris at €8.90 per share. You will pay $10, based on the exchange rate as I write this of $1 equals €0.89.

If over the course of 2022 the dollar loses 10% against the euro, that $1 now only buys €0.801.

On Dec. 31, 2022, you sell that same stock at the same €8.90 per share. But instead of recouping $10, you get $11.11. (The way the math works in currency trading, the dollar losing 10% means the euro gained 11%.)

The stock did nothing for the entire year. But because the dollar weakened against the euro, the value of your euro-denominated asset rose.

The same math plays out with the dividend.

The value of the dividend payment in euros didn’t budge. But the weaker dollar means that same dividend payment drops more greenbacks into your account.

In terms of stock-market investing, it’s the proverbial win-win.

Of course, the flip side is also true in that a stronger dollar means the U.S. dollar value of the shares and the dividends is lower. But when you’re buying at a time when the dollar is already relatively strong (as we are today), you mitigate some of that risk. Buying dollar strength is the same as buying euro/pound/yen weakness.

We’re “sweeping the floor” or “buying the dip.” Meaning we’re grabbing overseas assets at prices that are relatively cheap in dollar terms.

The three foreign stocks we’re grabbing on the cheap and adding to the Global Intelligence Portfolio as long-term plays are: Essity, Carrefour, and Coca-Cola HBC.

These three stocks all fit into a theme I write about all the time: consumer staples. That gives us some immunity in this new economic era.

Since these companies sell staples (or addictions, in one instance), consumers buy their products, no matter how the economy is performing. That means these companies have some pricing power…even during times of high inflation. That will allow them to maintain their earnings and their dividend payments to us.

Let’s start with…

Essity is a Swedish doppelgänger to Kimberly-Clark or Procter & Gamble. It owns Tork, the #1 professional hygiene brand in the world. As such, it is a major supplier of hand soap, paper towels, and toilet paper for public washrooms, kitchens, and dining areas around the globe.

Roughly 90% of Essity’s business is outside the States, which means that as investors we are only marginally dependent on dollar-based sales. Essity’s main business is in Europe (56% of sales), followed by Asia and Latin America (30% combined; China alone is 13%).

Tork aside, the company owns brands that are top five in global market share—and usually top three—in categories including incontinence care, wound care, consumer tissue, feminine hygiene, baby care, and others.

In October, Essity released its third-quarter results, in which it reported “the highest-ever market shares in our branded retail business” and that the company is “gaining market share in over 70% of our sales in this area.”

Sales were up 9% in the third quarter over 2020’s COVID-affected, third-quarter results. This is despite the fact that new variants continued to close offices and other public spaces.

The company has big room for further growth as the world reopens. And its share price doesn’t yet reflect the good news.

This is my preferred type of company as a long-term investor—one that benefits from what I call “non-optional” demand.

I can go weeks or months and never eat a steak. I don’t have to go shopping for clothes very frequently. But if I’m the parent of a newborn, diapers are a necessity. If I’m a woman within a broad age range, there are feminine hygiene issues I have to address. And every building, university, restaurant, etc. has to stock their restrooms with certain products.

Yes, there are other competitors out there who service all those needs. But Essity is a global leader in each of these categories.

Moreover, generally those are “sticky” categories, meaning end-users find a product they like and trust, and they stick with it.

This is the kind of stock you buy, stick in your portfolio, and go about your days, knowing that somewhere around the world, every second of every day, someone is buying a product that puts money in your pocket.

We could go with Kimberly-Clark or P&G—both are excellent companies, and both have vast global sales as well. But as this cover story lays out, we want reduced exposure to the dollar as this decade plays out. More than half of Kimberly-Clark sales come from North America. It’s roughly the same for P&G.

By owning Essity, we replicate the strength of two blue-chip American companies. And we pick up dividends in Swedish kronor, one of the world’s top currencies.

Essity pays its dividends once per year, when it reports its full-year results. That’s common for foreign companies. Essity’s last dividend arrived in March 2021, for fiscal year 2020. That dividend was 6.75 kronor per share (about $0.74), a yield of about 2.4%, and represents an 8% increase over 2019. And, again, 2020 was a fairly rotten year.

I expect Essity will pay an even larger dividend this coming March because 2021 was a better year.

My bet: Essity pays us a dividend of between 7.25 kronor and 7.40 kronor ($0.79 to $0.81 per share). That would imply a yield of as much as 2.6%, a nice sweetener on top of the price rise we will see. Combined, the dividend and the price movement should far exceed inflation.

Again, that yield is based on kronor prices.

Over the course of 2022 and beyond, I am expecting to see the kronor rise against the dollar so that our shares and our dividend payments are worth more.

Now, we jump across the Baltic Sea and head to Paris to own Carrefour, the doppelgänger for Walmart Supercenters and Costco Wholesale.

Carrefour hypermarkets, supermarkets, mini-markets, and cash-and-carry outlets are all over France, Italy, Spain, Poland, and Romania (five of the nine largest populations in Europe), as well as parts of Latin America and Asia.

As with Essity, Carrefour is precisely the kind of blue-chip doppelgänger I want to own because it is a seller of non-optional consumer goods—primarily basic foodstuffs.

During 2020, Carrefour’s sales dipped, as with most companies in the world. But the dip was a negligible 2.3%—and a sizeable portion of that resulted from a falloff in gasoline sales, which one would expect when economies are shut down and no one is driving anywhere.

But 2021 was clearly a better effort.

Through the first nine months of the year (the company’s most recent financial results), sales were up 4% overall. That will likely continue into the fourth quarter so that the full-year results are equal to or better than 2019, which I think is the fairest comparison, given what 2020 was all about.

To be fair, Carrefour has been a 20-year loser to this point. Its share price, once above €83 in the late 2000s, is now hanging out around €15, a price at which the shares have been rooted for the last four years. A big part of the reason for that: Carrefour grew too big, too fast, and spread its tentacles too widely in terms of stores and product offerings.

Efforts at a revival, however, are already bearing fruit.

Management is in the end stages of a multi-year restructuring program in which the company has been shrinking its footprint by selling off assets and streamlining and reducing the number of products it sells. All of that should begin paying off as 2022 and 2023 unfold.

Already, Carrefour is saving €3 billion a year from its efforts, and it’s eyeing another €2.4 billion in savings by 2023. Overall, it aims to generate more than €1 billion annually in free cash flow (basically money left over after a company pays for all expenses). And it aims to generate that free cash flow starting with the just completed 2021.

If successful, some of that money will clearly flow into enhanced dividend payments.

Right now, Carrefour is paying out €0.48 per year, an annual yield just under 3.1%.

For nearly a decade, Carrefour paid its dividend in additional shares of stock. But with the annual payment in May 2021, the company returned to paying cash, and noted that going forward “the ordinary dividend, paid in cash, is expected to grow regularly.”

So, I expect that when Carrefour pays us this year, the dividend will be in the €0.50 to €0.52 range, pushing the yield to about 3.3% at the high end of that range.

And I expect we will see Carrefour’s share price begin to push higher from here as the benefits of the company’s restructuring plays through earnings over the course of 2022.

Finally, we venture to Greece…by way of London.

Our third play is Coca-Cola HBC, once known as Coca-Cola Hellenic Bottling.

It’s an Athens-based company that produces, bottles, sells, and distributes Coca-Cola products (Coke has distributors like this all over the U.S. and the world).

So, we’re not so much buying a doppelgänger of Coke as we’re buying a clone. It’s quite literally the Coca-Cola of Europe.

This clone’s footprint is almost entirely European. It sells the various Coke brands into major European markets such as Ireland, Italy, and Austria; into developing markets including Poland, the Czech Republic, and Slovenia; and into emerging economies including Russia, Romania, and Ukraine. In all, Coke HBC is in 23 European countries—and Nigeria, in West Africa.

I won’t go so far as to say that Coke is in the exact same category of “non-optional consumer goods” as are our previous two plays. It’s not. I mean, no one needs a Coke to live or manage health and hygiene needs.

But it is an affordable, discretionary expense (nee, addiction?) that countless consumers treat themselves to daily across the planet. Sales can certainly fall in bad times, but they tend to rebound quickly. I want in on that.

What I like about Coke HBC is that it not only serves the big, developed European markets (think: stability), it serves the developing and emerging markets, where incomes are rising, allowing more and more consumers to treat themselves to a Coke more frequently,

Sounds like a broken record, I know, but 2020 was bad for Coke HBC. Overall sales slipped a meaningful 12.7%, underscoring my point above about Coke not being an essential item.

But 2021 was a big improvement.

Coke HBC reports its official results half yearly, but provides quarterly “trading updates” to the market. Through the first half of 2021, sales were up nearly 14%. In the third quarter, unofficial data showed sales up more than 17% relative to the third quarter of 2020. Faster-growth emerging markets saw a 26% sales rise.

The company also announced in the third-quarter update that it’s on track to complete the acquisition of Coca-Cola Bottling Co. in Egypt, a large, high-growth economy.

Aside from the obvious brand—Coke and the various Coke products—Coke HBC is also a retail coffee company, which adds a nice sweetener to the mix. Coffee, arguably, is more addictive than Coke, and it’s one of the non-essential essentials that consumers aren’t going to live without.

Coke HBC owns the Costa and Caffe Vergnano brands, two very popular coffee chains in Europe. As such, we not only own the Coca-Cola of Europe…we own the Starbucks of Europe too. And for what it’s worth, I can say that living in Europe, there are a lot of locals who prefer the European chains to Starbucks.

Though the company is Greek in origin, its shares primarily trade in London.

The shares have been largely flat for the past year, trading between £21 and £28. As we move into 2022, I see reason for the price to advance. Coke HBC has a history of bolt-on acquisitions as it grows. Egypt is just the latest example. There are plenty more of those opportunities across various parts of Europe, Central Asia, and the Middle East/North Africa that would make perfect sense.

And Coke HBC has the cash to pursue those opportunities. In the first half of 2021, free cash flow exceeded €277 million ($313 million). On an annualized basis, that’s more than half a billion euros. There’s a lot you can do with that much free cash…make strategic acquisitions, upgrade bottling plants, or pay enhanced dividends.

Coke HBC’s policy is to target dividend payouts of 35% to 45% of net profits. So as profits rise because of acquisitions, plant efficiencies and such, we can expect a greater payout.

Right now, Coke HBC is yielding 2.3% per year. It paid out €0.52 per share last August, down a bit from €0.56, because of the COVID-induced profit decline. The flip-side of that means we can likely expect a dividend increase this summer (when Coke HBC distributes its annual dividend) because of the sales improvements the company saw in 2021.

Buy Essity (symbol: ETTYF) at prices up to $33.50 per share.

Buy Carrefour (CRRFY) at prices up to $4.75 per share.

Buy Coca-Cola HBC (CCHGY) at prices up to $36.50 per share.

A couple of notes I want you to know.

First: All of these are available in the U.S. from traditional, online brokers such as Fidelity, E-Trade, Schwab, and Interactive Brokers. However, you will not find them on the app-only, gamified exchanges such as Robinhood and WeBull.

Second: These are foreign shares traded in the U.S. as American depositary receipts, which means that they look a bit different than the same shares overseas.

ADRs represent the same benefits—same dividends, same voting rights, etc.—but the price is in dollars, not the local currency. And the share you own in the U.S. might represent the same, more, or less than the shares overseas.

Carrefour is the perfect example. Each U.S.-traded share is just one-fifth of a Parisian share back in the home market.

So, the price you see is the dollar value of one-fifth of the euro price. So, don’t be alarmed when you see Carrefour trading in the mid-teens in Paris, but just $4 in the U.S.

Essity and Coca-Cola are 1-for-1, so their prices are simply the dollar equivalent of the home-market price in kronor and pounds.

A final note: I don’t expect we’re going to see immediate profits in dollar terms, simply because the dollar could have a moment of strength as interest rates go up.

So, don’t fret if you see a bit of temporary weakness. Which, of course, brings us back to the question: Why buy now?

Same reason you buy car insurance before you need it. After you need, it’s too late. As I’ve written at the beginning, I much prefer to be early to a party.

I can’t tell you the exact date the dollar begins its long, necessary decline. I can only tell it’s likely to happen this year for all the reasons I’ve laid out.

And while the forthcoming Fed interest-rate increase could bump up the dollar for a time, it’s also possible that some unknown, unpredictable catalyst could kickstart the decline much sooner than anyone expects.

It’s better to own the insurance you need while you can, then go about your life.

We start our 2022 pursuit of wealth with good news from our two real estate investment trusts: Slate Grocery REIT and Farmland Partners REIT.

Slate, a Canadian company, runs a string of shopping malls across mainly the eastern half of the U.S. that are anchored by middling to value-priced supermarkets. An absolutely perfect play for the inflationary world we’re in, and which we will remain in across 2022.

Not only is inflation rising, the Fed is about to start raising interest rates. Both of those hit consumer wallets, forcing more and more Americans to reduce their spending. Meaning more and more American food shoppers are going to gravitate to the exact supermarkets that anchor Slate’s shopping centers.

That might be a reason Motley Fool at the end of December labeled Slate one of “3 Rewarding Dividend Stocks to Set You Up For 2022.” Frankly, I don’t care what Motely Fool has to say. But I know it has a big following, and relatively tiny Slate getting exposure from Motely Fool clearly has some impact on the stock price.

Overall, Slate had a good December. As talk of inflation and rate hikes drove the financial news, Slate shares methodically marched higher—up 11% on the month. Overall, that means we’re now up about 14.5% since adding Slate to the portfolio back in August.

I suspect we will continue to see consistent gains in Slate as this inflationary economy plays out, and as interest-rate hikes start to play through American pocketbooks. Slate remains a buy up to $12.65.

As for Farmland Partners…

Our REIT that owns farmland across the U.S. has been on a buying spree of late. In December, it added about 9,400 acres of farmland in three purchases: in eastern Louisiana, Colorado, and California. Those farms are growing crops ranging from corn, wheat, and cotton, to soy, citrus fruits, and sweet potatoes.

The shares have continued to nudge higher, up about 3% in December, giving us an all-in gain so far of about 6.8%.

Again, this is a company that is going to benefit from inflation. Farmland’s revenue is tied not only to the rent it receives from farmers, but to a portion of the income that the farmers earn from their crops. Rising crop prices means rising income for Farmland…which makes for a happier stock price. Farmland Properties remains a buy up to $13.

Keeping with food for a second, let’s move to Yara International, our Norwegian fertilizer maker.

As you might remember from the December issue, I’ve put a “hold” on Yara because right now natural gas costs have forced the company to curtail a certain amount of production. Prices have continued to rise, so I am not lifting my hold yet.

But Zacks Equity Research, which tracks Wall Street analysts, last month did note that the analyst community is more bullish. Over the last month, consensus earnings estimates are rising for 2022, which, in turn, has pushed Yara stock to #1 ranking in the Zacks ranking system—basically meaning it’s a “strong buy.”

Yara also has a price-to-earnings ratio under 10. That’s a measure of how investors value a dollar’s worth of earnings, and under 10 is considered quite cheap.

Still, I want to wait. I want to see how the natural-gas price issue plays out as we move past the winter heating season in the Northern Hemisphere. That will give me more clarity on what to expect with Yara reopening shuttered production facilities. I’ll bring you an update on this soon.

By Ian Bond

Ian Bond is a pseudonym for a banking senior executive with over three decades of experience in wealth and asset management. He also owns online stores that generate millions of dollars in annual revenue. The pseudonym is used to protect his employer.

In the 1920s, a new technology revolutionized how people shopped in America: the automobile. Between 1908 and 1924, the price of a brand-new Ford Model T fell from $850 to $300. Car ownership was now possible for ordinary Americans.

With people able to travel more freely, businesses started opening bigger stores away from traditional urban centers. Perhaps, the most famous example of this trend was Sears, Roebuck and Co. Sears started as a mail-order company and didn’t branch out into physical retail until 1925. But by the end of the 1920s, it had 324 stores across America.

For the rest of the 20th century, the car remained central to retail. Whenever Americans wanted to make a big purchase, they’d hop in their vehicles and drive to their nearest mall or big-box retailer.

Now, that’s all changing.

For the past decade, stores have been disappearing in huge numbers. This has been called “the retail apocalypse.”

In 2019, around 10,000 physical stores were closed in the U.S. During pandemic-afflicted 2020, the figure was a record 12,200, according to real estate data firm CoStar Group.

The primary reason for this is pretty obvious: the rise of ecommerce.

A century on…we’re living through a new retail boom. The only difference is that this time, the real estate is digital rather than physical.

Ecommerce was thriving before COVID, of course. But the pandemic massively accelerated its adoption. In 2020, U.S. ecommerce sales hit $759 billion, a 32% rise from 2019. That growth momentum continued in 2021. Ecommerce sales were up 16.4% in the first three quarters of 2021 compared to the same period in 2020.

Globally, it’s a similar story. Ecommerce sales worldwide surged 25.7% to $4.2 trillion in 2020, and are forecast to rise another 17% in 2021, according to an Insider Intelligence report.

This trend is creating unprecedented investment demand for a new kind of asset: online stores.

Independent online stores are currently selling for big valuations.

In 2014, when I first started looking at listings of ecommerce stores, these businesses were selling for 17 times to 20 times monthly net profits. So, a store that earned $3,000 in profits every month was available to buy for $51,000 to $60,000.

Today, stores with established earnings are selling for 40 times to 45 times monthly profits. So, that same store would now sell for $120,000 to $135,000.

What this means is that there’s never been a better time to become a builder of online stores.

Now, I know what you’re thinking: “I’m not a software programmer or website developer. I don’t know how to build an online store.”

But nowadays, launching an online store is little more difficult, technically speaking, than starting a Facebook page. Instead, all you need to get these stores up and running, and earning profit, is some elbow grease and a bit of business sense. You can complete the entire process in as little as a few weeks. And the total cost to get started is as little as $1,000.

Then, when you can build a track record of earnings, you could turn around and sell your store for six figures.

I started buying online websites for my personal portfolio in 2015.

I’ve been a Wall Street banker since the 1980s. When my finances took a hit in the 2008 crash, I started looking for an additional source of income to bolster my retirement funds. In my research, I came across online stores available for sale.

Before then, I’d had no idea you could buy income-producing websites from reputable brokers online. And frankly, I was astonished by how cheap these assets were.

At 17 to 20 times monthly profit, these sites were available for a monthly yield of around 5% to 6%. On an annual basis, the yield was around 60% to 70%.

That kind of return piqued my interest, but running a website sounded like a job and I had no desire to buy myself a second career. Then I learned about the sales model these sites use…something called dropshipping.

Dropshipping allows you to sell physical products from an online store without ever holding any inventory. Your suppliers take care of all that for you. Your focus as a dropshipper is on building, running, and marketing your ecommerce website.

Here’s how dropshipping works:

When I learned about this model, I realized that so much of the process could be automated or outsourced. I also quickly realized the technical hurdles of running a website are not nearly as challenging as most people assume. You just need some basic online business know-how to operate these websites. No technical website or coding skills required!

My mind made up, I took the leap and bought a dropshipping store. In the years since, I’ve purchased over two dozen dropshipping stores. In the end, some weren’t worth pursuing but I learned from those experiences. Today my wife and I operate nine high-ticket stores that generate millions of dollars in revenue a year.

I decided to purchase a website because I was interested in earning a steady income from these stores straight away. However, if your goal is a single big payday, you should become a builder.

I know store builders who regularly start a store, grow its revenues, sell it off, and then take some time off…before starting the process all over again and building a new one.

Of course, the longer you hold and operate a store, the more valuable it becomes. To get the 45 times monthly net profit valuation I mentioned above, a store generally has to have been in business for three years.

However, in the current ecommerce environment, even younger dropshipping websites that are 1.5- to 2-years-old are going for 30 to 36 times monthly profit. “Starter sites” that are only 1- to 1.5-years-old trade around 20 times monthly profit.

The other advantage of building stores from scratch is that it’s a very cheap process. In terms of capital, you’re risking very little. You can get a store up and running and achieve your first sale with a budget of as little as $1,000. Most of this amount would go toward advertising since setup costs are minimal.

Here’s a basic rundown of how you’ll get an online store off the ground:

Step 1: Identify your niche

The first step when setting up your online business is choosing a niche, by which I mean deciding what you’re going to sell.

The best strategy is to focus on something specific, like pool tables or high-end barbecues. If your product line is too diverse, you’ll find it hard to stand out and attract customers.

I also always recommend going with high-ticket products priced $500 or above. Since you don’t have to handle shipping or store any inventory, it doesn’t matter to you if the items are large or expensive or difficult to transport.

Plus, the profit margins tend to be greater on high-quality, high-ticket items. For instance, if you have a site selling pool tables at an average price of $3,000 per unit, and you’re making a 10% net profit margin on each sale, then your monthly profit would be $3,000 if you can sell just 10 units per month. (Dropshipping stores tend to average 10% to 15% net profit margins. Gross profit margins tend to be in the high teens to 20%.) In this case, your website is worth as much as $135,000 if you choose to sell it on.

If you have an idea for a niche, you can do some research on Google Trends. This is an excellent way of investigating the long-term viability of a product since it will show you if the product’s search popularity is growing or declining. Ubersuggest is another useful tool for investigating keyword trends.

Step 2: Design your store

When you’ve identified your niche, the next step is building your store. Do this before contacting any suppliers.

I use Shopify as the platform for all my websites. The platform is easy to use with simple, clear drop-down menus. The ecosystem in Shopify allows you to pick a website domain, set up your store, and take payments with a built-in shopping cart. And it has a robust support system, if you have any questions.

You can sign up for Shopify’s free trial. Their basic plan is $29 per month after that. And you can buy a domain name for your store right through the Shopify dashboard. I recommend choosing a dotcom address where possible.

This entire process is very simple as the interface is extremely intuitive and easy to use. When your store is set up, you can then contact suppliers…using your demo store to demonstrate your ability to sell their products.

Step 3: Learn SEO and online advertising

Running your store requires some basic knowledge about SEO content writing. SEO, or search engine optimization, is the process of publishing good content in the right way so your website ranks higher in internet search rankings.

There are some tricks to this, but broadly speaking, the best strategy is simply to publish clear, detailed, and informative content about the products you’re selling. The better your content, the more people who will visit your site, the higher you’ll rank in the search rankings on Google and other search engines. Google offers a free video introduction to SEO here.

While SEO can encourage people to visit your site, you will need to invest in advertising to make a profit. You can learn how Google advertising can drive paid traffic to your store here.

All of this is easy enough to master. However, if online advertising or SEO sound intimidating, you can outsource this work to freelancers at a low cost. You’ll find accredited freelancers in these fields on sites like Upwork and Fiverr. I’ve spent well over six figures on both sites hiring freelancers to manage my businesses, and have always been pleased with the results.

Step 4: Increase your sales and sell your site

It’s often best to reinvest any profit you make from your store back into more advertising for the first few months at least. Once your sales stabilize at a good level, you can think about flipping your site. This is achievable within a year, but a realistic goal is two to three years.

The best way to sell your site is through one of the major website brokers like Empire Flippers or Quiet Light. Getting a site listed on one of these sites involves a multistage due diligence process that can take months to complete.

You must open your books to them and answer a host of detailed questions about the business. On Empire Flippers, only 9% of prospective sellers make it through its due diligence process. It’s easier to get a listing on other sites like Flippa and Exchange by Shopify, since they have far less stringent—and in my opinion, overly lax—due diligence procedures.

Once your site is listed, the price updates automatically based on its most recent monthly profit.

When parties express an interest in purchasing your site, Empire Flippers will arrange online meetings between the buyers and sellers. If a sale is agreed, it handles the entire migration of the site from seller to buyer and holds the funds in escrow, only releasing them to the seller once the buyer is satisfied.

So, there you have it…building a site to selling it in four easy steps.

Of course, this is a big oversimplification. The process is far more involved. However, the rewards can be truly spectacular…and they’ll get even better

At the moment, top sales prices are around 45 times monthly earnings. But I anticipate those multiples will go higher from here…particularly as the global ecommerce sector is projected to grow by $1 trillion by 2025, according to research firm Euromonitor International.

The bottom line: I’ve worked on Wall Street since the 1980s and I’ve never come across a more surefire path for turning $1,000 into six figures in as little as two or three years.

■Major industrial and tech giants are betting big on the metaverse.

In a recent Field Notes column, I predicted that 2022 will be the Year of the Metaverse.

The metaverse is a new vision for the internet that merges the real world and the digital world. In the metaverse, we won’t simply look at the internet on a computer monitor or smartphone, we will view it all around us through virtual reality glasses or smartphone apps that makes images on the screen appear holographical and three-dimensional.

In the future, we will go to the metaverse to shop, work, chat, hang out, watch concerts and movies, and do basically anything else you can do in the real world. I know this future sounds fantastical, but I promise it is coming.

As you read this, the Consumer Electronics Show, the world’s largest technology trade fair, is taking place in Las Vegas. And the metaverse is the topic on everyone’s lips.

Companies showcasing metaverse tech at CES include Korean automotive giant Hyundai, which is allowing visitors to create virtual avatars of themselves and test-drive concept cars in the metaverse. Meanwhile, Samsung is highlighting its metaverse ambitions by showing off a virtual reality home-decorating platform.

To be clear about my prediction of 2022 as the Year of the Metaverse, I don’t mean that metaverse VR headsets will be a fixture in every home by next December. But this will be the year that leading global tech companies begin rolling out the tools needed to build and navigate this virtual world. Which means this is the year we need to pay attention to this trend as investors.

I’ll be following related developments closely in the coming months and looking for ways we can use the rise of the metaverse to grow our portfolios.

■Hit your step count and earn free crypto…at the same time.

Looking for a fun way to shed some pounds in 2022? Check out the free smartphone game Coin Hunt World, which awards free bitcoin and Ethereum to players.

I’ve previously highlighted this smartphone game in a Field Notes column, but since then, it has become available in a host of new locations. It’s now accessible in the U.S., Canada, the U.K., and El Salvador, and it’s coming to the Philippines soon (though the app is only available on Android phones at present). The fact that it isn’t yet available in the Czech Republic (where I live) is, to my self-important way of thinking, a humanitarian crisis.

Coin Hunt World is a geolocation game like Pokémon Go. When you open the app on your phone, it shows you a cartoon map of your real neighborhood featuring various colorful objects such as keys. When you move in real life, your icon in the game map moves, too. So, to play the game, you have to walk around in the real world to collect keys on your virtual map.

When you collect enough keys, you can use them to unlock a vault. You’ll then be asked a question, and if you answer it correctly, you will receive free bitcoin or Ethereum. Usually you’ll earn about $1 worth of crypto, but you can reportedly earn $100 or more depending on the rarity of the vault. When you collect enough crypto, you can withdraw it or convert it to dollars (or other fiat currencies) using an Uphold wallet.

Coin Hunt World is part of a new class of games called “play-to-earn.” Many play-to-earn games require that you make an initial crypto investment. Coin Hunt World is one of the few that allows you to earn without having to pay a penny. So, it’s a great way to explore this emerging space.

Play-to-earn games are exploding in popularity all across the cryptoconomy. Like the metaverse, I expect this to be another breakout trend of 2022.

■401(k)s have long had one key advantage over IRAs…but now that advantage is even bigger.

Both 401(k)s and individual retirement accounts (IRAs) offer tax breaks since contributions to these accounts are not taxable in the year you make them. But 401(k)s have one key advantage over IRAs…and that advantage just got a lot bigger.

A 401(k) allows you to contribute much more money to it, tax free, than a typical IRA does. In 2021, the IRA contribution limit was $6,000, or $7,000 if you’re eligible for catch-up contributions. By contrast, the 401(k) contribution limit was more than three times higher at $19,500. (The amount was $26,000 if you were eligible for catch-up contributions.)

Now, in 2022, the 401(k) contribution limit is increasing by $1,000 to $20,500. However, the IRA contribution amounts are remaining unchanged. That means that this year, you can further lower your tax bill and increase your retirement income by sticking some extra cash in your 401(k).

■Google is no longer the most-visited site on the internet.

According to data from cloud infrastructure company Cloudfare, social media app TikTok replaced Google as the world’s most-visited site in 2021. This is despite the fact that Google’s numbers included all the visitors to its search function, maps, email, and other services.

Cloudfare reports that TikTok claimed the top spot from Google in August last year and has held it since then. Earlier this year, the Beijing-based company said it had more than 1 billion visitors every month.

I wanted to highlight this story because it shows just how quickly the online economy can change. I’m a fan of TikTok, but most people I know in my age range have scarcely heard of it. Yet despite this, it rose from just the seventh most-visited site in 2020 to the top spot this year.

The point is that young people nowadays use the internet differently than Generation Xers and baby boomers. The rise of TikTok is a symbol of that. So is the rise of crypto and the metaverse. We can ignore that reality, or we can embrace it and profit from it. As you know, I am already embracing it in a big ol’ bear hug.

■Here’s how to quickly bring up your vaccine card on your phone.

With the Omicron variety of COVID spreading rapidly across the globe, travel companies and dining establishments are generally being more diligent in asking for vaccination records. Most will accept a photo of your vaccination card; however, a photo can quickly get buried in your photo library…particularly if you were vaccinated many months ago.

An easy way to be able to bring up your vaccine record on demand is to add it to the digital wallet on your smartphone.

On an iPhone, you can simply point your camera at the record’s QR code and it will be pulled into your wallet. You can access it any time you like simply by opening the Wallet app.

On Android, you need to find the digital record of your vaccination in your email or in your text messages. When you pull it up, click “Save to Phone” and then save it to Google Pay.

An alternative approach is to pin a photo of your vaccination record to the top of Apple’s Notes app or the Google Drive app. That way, you never have to go scrolling through your old photos to find your vaccination certificate again.

■Use this app to reduce your bill at the gas pump.

In late 2021, gas prices in the U.S. hit their highest levels in seven years. So, there’s never been a better time to try out the GasBuddy app.

GasBuddy is a service that shows you where to find the cheapest gas prices near you.

The app lists the prices at all the gas stations nearby. You can then use the filtering function on the app to narrow the selection based on the type of fuel you want and how far you are willing to travel.

Since GasBuddy uses crowdsourcing to collect this data, the prices may not always be precisely accurate; however, the app shows you when the prices for each station were last updated.

So, if you have a flexible schedule and are willing to travel around a bit, GasBuddy can be a great way to shave some money off your gas bill.

■Here’s why you should make a video of your home at the start of every year.

A good financial habit to get into is to record a video of your home and its contents at the start of every year. A methodical video of your home and all its contents can be a huge help in the event you need to claim on your home contents insurance.

To make the video, walk through your home, opening every closet and drawer. Narrate it as you go, showcasing all the things of value in your home. When you’re done, save the file online in your Dropbox, Google Drive, or iCloud. That way, if you need to make a claim in the event of theft, fire, or some other unfortunate circumstance, you’ll have clear proof of your home contents.

Separately, it’s also a good idea to reassess your home insurance when the year begins, in order to make sure you have enough coverage to rebuild your home in the event of a disaster. This is particularly important as home prices have been rising rapidly.

To determine whether you have enough coverage, talk to a local building company about the construction costs per square foot for a home of your type in your area. That will help you figure out whether it might be time to bump up your insurance coverage.

■Looking to redesign your home this year? These services can help.

If you’re planning to do a little home redecorating in 2022, check out the website HomeStyler. This service allows you to recreate your home in 3D. You can then redesign the space and get a cool, interactive computer visualization of what a new sofa, color scheme, or floor plan might look like.

The app is easy to use and navigate and features a comprehensive database of furniture from brand-name suppliers. It also offers a free, basic plan that will be more than sufficient for most people’s personal needs.

Offering a similar service is Planner5D. This service is available as an app as well as a website. When you use the app, you can capture an image of your room with the camera on your phone and Planner5D will create a virtual representation of the space, which you can then redesign at will.

This increased convenience comes at a cost. Planner5D has a brief, three-day free trial, but it costs $59.99 for a yearly subscription. Still, it offers a quick, convenient way to get a 3D visualization of your new design ideas.

■Take these steps to avoid injuries if you’re looking to get fit for the new year.

Once New Year rolls around, we all tend to feel some motivation to get back in the gym or otherwise take steps to improve our fitness. This is a positive desire; however, it’s also important to protect yourself from injuries…particularly if you’re north of 50 like me and haven’t exercised in a while. According to the Consumer Product Safety Commission, people aged 50 and over made more than 107,000 visits to the emergency room in 2020 due to exercise-related injuries (and that was in a year when many gyms were closed). Here’s some tips to avoid becoming part of this statistic.

First and foremost, the most common mistake people make when getting back into exercise is pushing themselves too hard, too fast. Your goal in restarting exercise should be to form a new habit of going to the gym or exercising at a certain time, not running a certain number of kilometers or hitting a certain number of reps. That can come later, once you reform the habit of working out.

Second, invest in some new equipment, particularly new shoes. Studies have shown that exercise shoes wear out after about 100 miles of use, and using older shoes can result in injuries like shin splints. So, ditch that old set of trainers gathering dust in the back of the closet and treat yourself to a nice new pair. In particular, choose a pair focused on the exercise you want to do, like running shoes for jogging, or basketball shoes, which are designed for side-to-side movements, for activities like cross-fit.

Finally, vary your exercise activities. Even if weight loss is your primary goal, don’t focus solely on cardio activities such as jogging, walking, cycling, or swimming. Make sure to include resistance training into your regime as well. Weight lifting is one of the best ways to strengthen muscles, and stronger muscles provide better shock absorption, meaning they can protect your joints during your cardio workouts.

Thanks for reading and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2022 by International Living Publishing Ltd. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of International Living, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.