Dear Global Intelligence Letter Subscriber,

My wife and I have a running joke. Well, more like a shocked observation.

Any time we go to a shopping mall in Lisbon, Portugal, where we live… the parking lots are jam packed. Doesn’t matter if it’s a Saturday or a random Wednesday.

Or a Tuesday or Thursday.

Pretty much any day of the week that ends in “y” is a day we’re guaranteed to struggle to find parking, no matter the mall we visit.

The running joke is that we’re convinced the only Portuguese who are gainfully employed are those who manning the mall shops.

Everyone else in Portugal is clearly independently wealthy—and has nothing better to do with their days than meander around a mall, grabbing an espresso, and buying things they probably don’t need.

Not that that’s a bad way to spend your time, of course…

If nothing else, this underscores how vibrant the local economy is.

And I realized over Christmas that there’s an investment opportunity here…

My wife and I had traveled to the Almada Fórum mall in a district just across the Tagus River from Lisbon’s city center. Nice mall. Bright. Open. Airy. Three floors of top US and European retail brands. Ginormous glass dome in the center.

Almada Fórum mall in Lisbon

Back home later that night, I popped on to Google to see who owned the mall.

I do that frequently. I’ll spend time in some store or mall, or I’ll see a brand, and I will think to myself, “Hmmm, wonder if that’s a public company?”

That thought process started when I was traveling through Asia in the late ‘90s and very early 2000s. Back then, Asia—particularly China—was still considered “developing.” I thought the term was misplaced even then. Asia was clearly developed.

Everywhere I went, consumerism was in your face. Malls and shopping centers everywhere.

Branded clothing and accessories dripped off nearly everyone I passed in the streets who was between the ages of 8 and 50.

And I’d read a book in the mid-‘90s, Investment Biker, by famed hedge fund manager Jim Rogers. He’d taken a specially equipped BMW motorcycle and spent a year literally driving around the world. Snuck in amidst all the adventurous travelogue stories was a sprinkling of investment advice. He’d stop in some random African country or wherever and open a brokerage account and buy pretty much every bank, construction company, and consumer stock on some nascent stock exchange, convinced that the country’s growth would flow through the local stock market and the companies that grow alongside economies and consumers.

Because of that book, I began investing directly overseas in 1994, opening my first foreign brokerage account in New Zealand so that I could own a couple of consumer plays—a brewery and a maker of home appliances—that I knew were doing bang-up business in Asia. At that time, I had no way to play those companies through the US stock market, so I decided to go directly overseas.

And because of that, whenever and wherever I traveled, I started paying attention to which foreign companies owned what, and which local brands consumers were buying.

Which is why I now know the name of the company that owns the Almada Fórum.

It’s the company we’re adding to the Global Intel portfolio this month.

Not just because of that mall, mind you. Shopping centers are only 12% of the company’s business.

We’re going into the stock for an entirely different reason: Data centers.

Our story this month has nothing to do with crypto or artificial intelligence, per se, but we’re going to start there because the myriad ways that both are changing the world will ultimately play through data centers.

Crypto and AI both consume vast amounts of data, and the demand growth for each is explosive.

Everything that happens with AI involves gathering up and manipulating oceans of data. It’s the only way AI can function, and the technology must feed on a constant and a colossal stream of information to provide answers to questions and solutions to problems. It needs equally mountainous volumes of data to generate pictures, video, art, music, and the like.

Meanwhile, everything that happens on the blockchain is a data-creation event.

However, this isn’t data creation like it exists on the internet of today. Lots of the transactions and whatnot that have occurred on the internet over the last 25 years or so no longer exist anywhere.

Companies and consumers and governments have erased that data, or storage media such as floppy drives and thumb-drives have been lost or thrown away. Some of it has been purposefully erased because companies have no need to recall, for instance, that Martha J. McGillicutty from Meridian, Mississippi bought a Hummel figurine for $9.95 back in October of 2000 through an eBay seller that closed shop 15 years ago.

It's useless information in corporate terms.

Today?

Well, that same information is just as useless.

However…

Martha’s Hummel addiction will increasingly play out on the blockchain, even if she pays using her Mastercard and doesn’t know a bitcoin from a baloney sandwich. And Martha’s information, useless as it is, will still exist on the blockchain 100 years from now because the blockchain is a permanent, digital ledger. Everything ever written on it is immutable and will never go away, meaning it cannot be erased or destroyed.

So long as a single copy of a blockchain exists, all the data ever written to it over the years still exists.

And the thing is, everything in our life is rapidly migrating onto the blockchain because it is infinitely more efficient and cost-effective than any technology we have today.

One small example I often use when talking to people about the way blockchain is already changing our world is the process of moving money from the US to Europe. If I want to send $250,000 from a US bank to a European bank to buy a house, let’s say, that movement will cost me nearly $1,100 in transaction fees if I use a low-cost money transfer app like Wise.com. If I use a traditional bank, my fees will be markedly higher.

Either way, the transfer will take at least a day, and likely up to a week if I were to use a local bank or credit union in the US.

Blockchain gives me a better option…

I can trade $250,000 for $250,000 worth of US Dollar Coin, a so-called “stablecoin” that tracks the buck 1:1. My cost: generally nothing, or a minimal fee of a couple dollars at most. Then, I can zip that money across to Europe in seconds. My cost for that: fractions of a penny.

So from a fee of $1,100 or more, I can shrink my cost to well under $10 simply by using a stable cryptocurrency instead of wiring dollars directly.

That kind of efficiency and cost savings is already reshaping the financial world. Giant financial services companies including Fidelity and BlackRock are seriously talking about moving all traditional financial assets onto the blockchain, including stocks, bonds, currencies, commodities, even real estate.

So imagine the quantity of data that will be created when almost the entire planet is spending, investing, learning, watching sports, going to concerts, phoning a friend, sending texts, running businesses, and on and on… all on the blockchain.

Every single one of those categories represents untold billions and trillions of transactions, and each transaction generates a digital signature embedded on the blockchain.

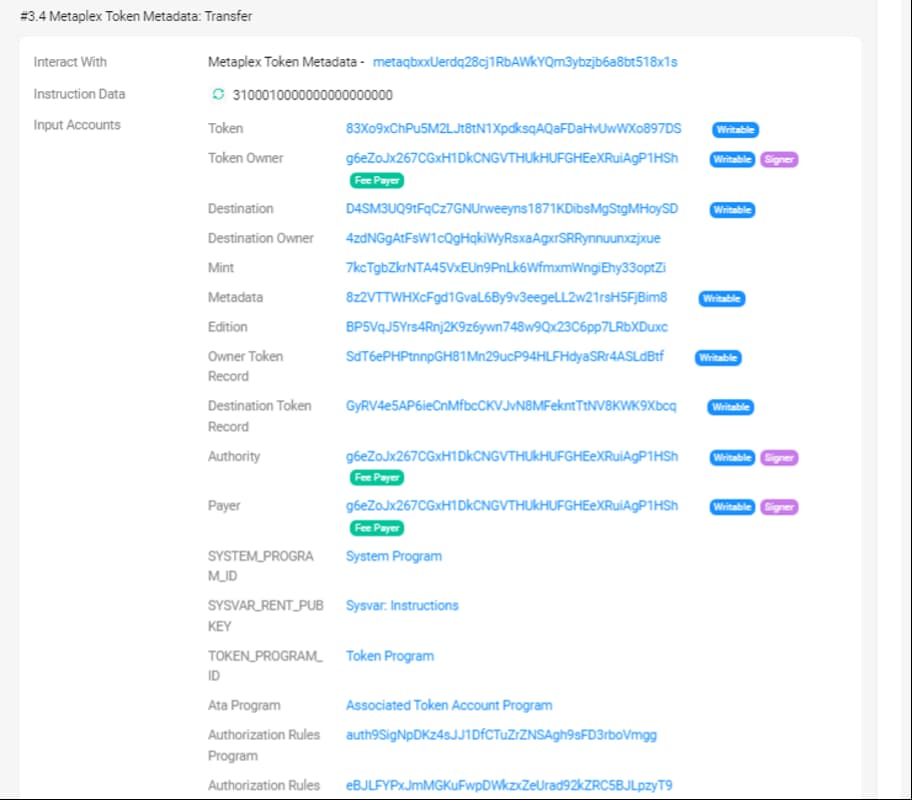

The image below shows part—part!—of a single transaction on the Solana blockchain…

Multiply that across tens of millions of transactions per day that are occurring on the multiple thousands of different blockchains and crypto networks that exist, and that are all generating data like this.

Ultimately, we’re talking about a volume of permanent data that is exponentially larger than anything that exists today…

All that data has to go somewhere.

And where it’s going is vast data centers.

The photo shows what these centers generally look like.

These data centers have been popping up all over the world in the last few years because companies like Amazon, eBay, Google, and others generate so much data that they cannot begin to store it all in-house. So, they build—or more commonly lease—these vast warehouses of servers and storage drives to manage their data flow, the digital records they need to run their business.

Netflix, to choose one example, runs more than 18,000 servers across 6,000 data centers in more than 175 countries. To put that into context, the world has 195 countries. So Netflix data centers are pretty much everywhere.

Lots of this data being generated today is temporary in nature. After a few months or years, companies dump the data they don’t need. But again, in the blockchain world, that’s not really an option. The data is encoded onto the blockchain, and there it sits until the end of time.

To my way of thinking, data centers have emerged as a 21st-century utility—as necessary for humanity’s daily living needs as are power companies and water providers.

Without data centers, much of modern life simply stops: banking, retail, supermarket shopping, airports.

Back in May of last year, for instance, a power outage at a data center in the United Kingdom caused the cancellation of more than 150 British Airways flights, affecting the travel plans of at least 25,000 people going into a holiday weekend.

And back in late 2021, an outage at one of Amazon’s data centers in Virginia meant that Amazon sellers had no way to connect with customers or ship orders. Existing Whole Foods orders immediately got cancelled. Canvas, an online teaching platform, lost service for more than 30 million users. And some college professors had to cancel exams scheduled to be taken online that day.

In short, data centers sit at the epicenter of human existence these days, and they’re only going to grow more and more necessary to our lives as crypto and AI technologies spread.

Indeed, I came across a New York Times story last summer while doing my daily reading that noted “demand for data centers is so great that as soon as one is on the drawing board, the space is quickly scooped up, even before it goes to market.”

That’s in the US, which leads the world by a long shot in the number of domestic data centers.

But as you might suspect from the Lisbon setting at the beginning this story, we’re not investing in the US this month.

We’re putting our money to work in European data centers… where demand growth is ramping up quickly.

The company that owns Almada Fórum… the company we’re investing in this month… is a multi-category real estate investment trust (REIT) based in Madrid, Spain. It’s the largest REIT in the Iberian Peninsula (Spain and Portugal).

The company’s operations are spread across shopping malls, as I noted in the intro, as well as office towers, logistics warehouses, and increasingly, data centers—which is obviously our big interest.

The company’s name is Merlin Properties.

To be fair, data centers are the smallest part of Merlin’s business—just 8% of the value of all the assets Merlin owns currently, and about 3% of gross rental income.

But this is actually an advantage for us—because it gives us big growth opportunities. And it means the wider investment world isn’t yet heavily focused on Merlin’s data-center operations. At the moment, there are several other REITs that investors are focused on that are data-center specific. Problem is, prices for those REITS have already mooned.

I’d rather invest in a data-center REIT that the Street hasn’t yet fully valued.

That’s Merlin.

Before I get into the data-center side of the company, let me tell you about the other components of this business, since those are compelling in their own ways, and are the source of the income stream that’s generating a healthy, 5.1% annual dividend yield for us.

The point I want to make is: This is a solid business producing solid income for us, even before we consider the data center component. The potential for data-center growth is extra gravy with what’s already a good meal…

Merlin’s biggest segment is office buildings, which comprise nearly 57% of the company’s asset base. The company is the #1 office tower owner in the Iberian peninsula, with properties in Madrid, Barcelona, and Lisbon—cities that have been attracting scads of regional and multinational companies because they rate highly for standard-of-living as well as cost-of-living.

Tenants include companies such as Deloitte, Oracle, General Electric, Sony, American Express, Procter & Gamble, Levis, and scores of others. Occupancy at 92.3% is solid and still rebounding after the pandemic and the work-from-home culture that is beginning to fade.

Better yet, inflation is flowing through the rental income Merlin charges. Year on year, rents are up 7.5%.

Merlin's second-largest component is shopping malls… like the one I visited in the intro… at about 18% of the company’s assets. Aside from the Almada Fórum in Lisbon, Merlin owns and operates malls all across Spain. Its tenants include some of the biggest names in US and European retail: Toys “R” Us, Calvin Klein, H&M, McDonald’s, Pandora, Sephora, Starbucks, and too many more to name.

The malls are mainly urban and occupancy sits at 97%, a historically high level. Tenant sales, meanwhile, are running above pre-COVID levels, underscoring my anecdote about Portuguese malls always seeming packed.

During a recent conference call with investment analysts, Merlin’s management said that in the post-COVID world, “we’ve never managed to exceed 2019 (levels). Now, we’re above that.” The shopping centers are “seeing an incredible foot-fall” and “better sales per square meter.”

Management calls the shopping center division the “real darling” right now.

Logistics, at about 17% of Merlin’s asset base, is only marginally smaller than shopping centers. As with offices, Merlin is the #1 player in Iberian logistics. Its tenants include UPS, DHL, Ikea, Jaguar, Ford, Airbus, Amazon, among others.

Spain and Portugal are considered excellent logistical waypoints because of easy access to the Atlantic and Mediterranean, giving shippers quick ability to get product into southern Europe and northern Africa. Merlin has 2.8 million square feet of logistics space across Iberia, nearly double its nearest competitor.

Across those three segments, combined occupancy is well into the mid-90% range—very healthy. Performance is equally strong, with the key measure of income up 16%, year over year. That measure is known as funds-from-operations, or FFO. As I noted in the January issue on KIMCO Real Estate, REIT profits are impacted by a variety of large non-cash charges for items such as land and building depreciation, or by large one-time benefits from the sale of land or buildings.

To smooth out the ongoing, underlying profit stream—basically to create apples-to-apples comparisons from one period to the next—REITs calculate FFO in what is essentially a stand-in for a traditional company’s earnings-per-share.

Merlin’s operations are performing so well that the company raised its FFO guidance for 2023 to €0.60 from €0.58 ($0.65 from $0.63).

Those three lines of business alone are enough for me to recommend Merlin.

Spain and Portugal are both growing their economies at a rate faster than the European Union average. Both are also hugely popular draws for tourists, expats, and multinational businesses that want easy access to Europe and Africa (just a short ferry ride from Spain), and affordable destinations for expat workers. Those trends play across Merlin’s shopping malls, office buildings, and logistics segments.

But perhaps the best comment I can make right here is to quote Ismael Clemente, Merlin’s CEO, who answered an analyst’s question in the conference call by saying, “We’re happy campers. We’re buying the shares every semester.” I mean, when the executive team tells you “we’re happy campers,” and that they they’re buying the shares themselves, you’ve probably latched onto a good stock.

Still, what has me most encouraged about Merlin shares is the coming growth in its data-center business…

I’m gonna start the story of the data centers at the end…

The growth the company sees over the remainder of this decade implies that data centers and logistics combined will likely be more than 50% of the business. Today, they represent about 15% of the business. As Mr. Clemente told analysts, the growth “will change the business… a very significant change for the company.”

In short: A huge amount of growth is baked into the data-center business.

And it’s clear from listening to management talk about data centers that they’re kinda giddy about it all.

Mr. Clemente said data-center plans the company put in place earlier in 2023 for growth expectations out to 2027 and 2030 “should probably be shortened because we are seeing significant demand.”

Driving that demand: Generative AI—think: ChatGPT, only at a much larger scale and not focused on helping Junior write a book report. Companies like Amazon Web Services, or AWS as it’s called, are huge providers of generative AI services that companies are using at an enterprise level to analyze reams of data to create novel solutions to various business problems.

Right now, Merlin isn’t generating any income from the three data centers it operates in Spain (a fourth is coming to Lisbon). Those centers just launched in fall 2023 and were actually housing data-center customers before the official handover happened because demand for data-center access is so great.

This year, Merlin expects to generate the equivalent of roughly $12 million from data centers, “but it will ramp very quickly immediately thereafter,” Mr. Clemente said.

That’s why I want to be in Merlin now, before the ramp, when no one is really paying attention. Because once they do start paying attention, the share price is going to move higher and the dividend yield, which is north of 5% right now, will collapse.

We have a chance to get in early, lock-in a solid dividend stream that will continue to grow, and we will benefit from stock-price growth as more investors become aware of Merlin’s expanding data-center operations.

Right now, Merlin is in what it calls the data-center “demonstration phase.” The company started with about 9 megawatts of installed capacity, and demand in the demonstration phase was more than expected, so Merlin has upped that to 15 megawatts. (The main measure of capacity in the data-center industry is electricity consumption—watts, kilowatts, and megawatts. A megawatt is 1 million watts.)

By the end of Q1, Merlin hopes to start work on a new Lisbon data center. The company filed the license for the project last February, but approval is taking longer than expected because of a government shakeup in Portugal. During that time, however, Merlin lost two would-be anchor tenants to Ireland and Spain, so the company is pushing Portuguese officials as hard as it can.

As Mr. Clemente said, “The demand for Lisbon and AI is super high—super high!”

Assuming Merlin can start construction by the end of Q1 or early in Q2, it expects to have the Lisbon facility running by the end of Q3 or Q4.

The demand that Merlin sees for Lisbon is why the company has upped its expansion plans. Management originally expected to have 70 megawatts of supply available in its data centers by 2027. Now, it’s aiming for 82 megawatts before 2027.

Backing out a bit to look at the bigger picture, that demand growth is because Europe is underserved by data centers. Moreover, some of the older, existing data centers are becoming obsolete. AI, in particular, demands extremely low latency (the time required for data to move from one point to another). AI, particularly when we get into artificial and virtual reality that must constantly regenerate on the fly, requires that data be sent, processed, and received at blindingly fast speeds.

That puts Merlin at an advantage…

Its centers are state-of-the-art and built specifically for AI needs. The centers in Lisbon and Bilbao, Spain, are AI campuses aimed at what are known in tech as “hyperscalers” like Amazon, Google, and Microsoft that need to process data globally and at extreme speed. Both data centers can hold about 100 megawatts of IT power, meaning they can easily be scaled up as demand grows.

Equally important is that both cities are hubs for the web of undersea internet cables that spider across the world to keep us all connected. Bilbao is home to three; Lisbon has at least a dozen, many of which feed Africa and southern Europe through the Mediterranean.

As such, both cities are ripe for data-center growth.

And Merlin offers tenants another benefit that might not seem like much now, but which promises to be increasingly important: green technology, particularly related to water.

Everybody’s worried about water supplies these days, and governments are cracking down with laws aimed at stopping water waste. Well, unlike others, Merlin’s data centers do not rely on water to keep the equipment cool (computer servers and storage drives can run extremely hot and need to be cooled to run efficiently). As such, the company is regularly fielding calls from would-be clients who want help redesigning data centers that consume water for cooling needs.

To me, Merlin is a fantastic, backdoor way to play the growth of AI and the exploding demand for data centers in Europe, which lags the US, the global leader in data centers.

Buy Merlin Properties REIT (symbol: MRPRF) at prices up to $11 per share.

RISK: Medium. (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

As a Spanish company, Merlin trades in the US as a “foreign ordinary.”

You should be able to buy it through most brokerage firms. I spot-checked Fidelity, E-Trade, and WeBull (the app-based trading platform) and all three were able to trade Merlin.

In the US, I will warn you, trading volume can be exceedingly thin on this stock. So do not rush in on up days. FOMO (fear of missing out) is not your friend here.

Unusual volume can push the price higher, so give it a bit of time and let the share price settle again. Better yet, put in a “limit order” to buy the stock at no more than $11, then just let the market fill your order over time.

We have time to let this play out as Merlin brings its existing facilities on line, and as it ramps up spending on new facilities. The company has earmarked about $110 million to add another 24 megawatts of IT power in the next year.

With just 9 to 15 megawatts at the moment, we’re getting in on the ground floor of a new data-center business right as it’s about to shift into fast-growth mode, and before the broader investment community recognizes Merlin for what it is: A data-center REIT masquerading as a shopping mall and office REIT.

Better yet, we’re going to get paid as Merlin builds out its data-center business. As I noted earlier, Merlin pays a dividend based on the income from its other business lines. That yield at the moment amounts to 5.2%—a nice, plump payout for our patience as the company continues to build out the data center business. I expect we will see those dividends increase over time as the shopping malls, office buildings, and logistics facilities continue to perform well and grow.

Because Merlin is a European business, it reports its operations semi-annually and pays dividends twice a year, a very common practice in many parts of the world. The company will pay its next dividend in late April or early May, so we’ll start collecting dividends fairly soon.

Finally, I will note that we’re also going to benefit from currency issues.

If you read my daily Field Notes e-letter, you will know that I regularly write about what I see as long-term weakness in the US dollar because of America’s extreme debts and laughably sad governmental dysfunction.

I won’t go into all of that here at the bottom of this month’s issue. I will just say that the dollar will likely grind lower over the remainder of the decade. As it does, assets priced in foreign currencies will rise in value in dollar terms. So any price appreciation we see in Merlin will be compounded by dollar weakness.

Same goes for dividend payments. Merlin pays its dividends in euros, and as the dollar declines against the euro, the dividends we receive in euros will buy more dollars—a nice little benefit.

But again, buy these shares wisely. Do not rush into them on up days. Set a hard limit of $11 and let the market come to you rather than you chasing the market.

For me, this is likely to be a long-term hold because data-center demand growth is going to mimic the rise in mobile telecoms and the internet circa late 1990s.

We have many years of growth before this area is saturated, particularly in Europe, which is only now trying to catch up to the US.

I’m going to use this month’s portfolio review to provide some more context on crypto.

I’m doing so because this promises to be a very consequential year in the crypto market…

I noted a few times last year that the Securities and Exchange Commission was very likely to approve an exchange-traded fund based on the spot-price for bitcoin—the daily, ever-changing price you see quoted everywhere. I said that was likely to happen early in 2024, and, lo and behold, the SEC approved several spot bitcoin ETFs in January.

And bitcoin immediately sold off, falling to roughly $39,000 from nearly $50,000 just before the ETFs were approved.

Mainstream media writers and naysayers quickly started bagging on bitcoin, jabbering ignorantly about how a spot-price ETF ultimately meant nothing, that bitcoin had basically flopped, and that crypto is clearly still in a bear market.

That reaction is yet another notation in the ever-larger tome I call The Idiots Guide to Crypto Idiots.

Bitcoin fell for a very specific reason: Investors who had owned a particular bitcoin trust—the Grayscale Bitcoin Trust—immediately began unloading billions of dollars of the trust’s Wall Street-listed shares.

They did so for two very good reasons…

First: Many of them (including me) were buying the trust at a very steep discount to its intrinsic value, certain that the SEC would be compelled to approve an ETF at some point and that when that day arrived, Grayscale shares would soar.

Indeed, I told Field Notes readers in January 2023 that I was snapping up the trust at a discount of more than 40% to the underlying value of bitcoin inside the trust because I knew that when the SEC approved ETFs, that valuation gap would evaporate in a blink.

Which is precisely what happened.

Investors wisely sold out of the trust to turn paper profits into very big gains of 100% or more in just a year…

Second: The Grayscale trust charges an annual management fee of more than 1%. The new ETFs charge annual fees of about 0.25%.

So, investors wisely sold Grayscale shares with the idea of pushing those proceeds into the new ETFs.

Those processes took a bit of time to play out.

But look where we are today: As I write this, bitcoin is right at $52,000, well above where it was before the ETF-related sell-off occurred.

The naysayers who were panning bitcoin just a few weeks ago are looking like absolute chimps at this point.

This is important to remember going forward: The mainstream media and the naysayers do not own bitcoin or crypto. They are not intimately involved in the space. And, so, they really do not understand the role that cryptocurrencies and blockchain increasingly play in society, finance, and entertainment today.

Many of them wrongly think that crypto is a haven for drug-dealers and money launderers. The reality is vastly different. Even the FBI has said that it’s far, far easier to commit financial crimes with real dollars than it is with crypto, because the blockchain is wide open, while dollars change hands unseen.

Everyone can see everything that happens on every blockchain, and government has plenty of digital sleuths who can comb through the blockchain and track back every transaction to figure out who’s on the dirty end of an illegal incident.

Moreover, bitcoin was never, ever going to be about one moment in January 2024 when the SEC finally relented.

All the SEC did was open the door to the next transformation, as bitcoin now becomes available to millions of institutional and individual investors who never wanted the hassles of trading crypto through dedicated cryptocurrency exchanges that require digital crypto wallets.

In short, crypto is now in the process of going mainstream.

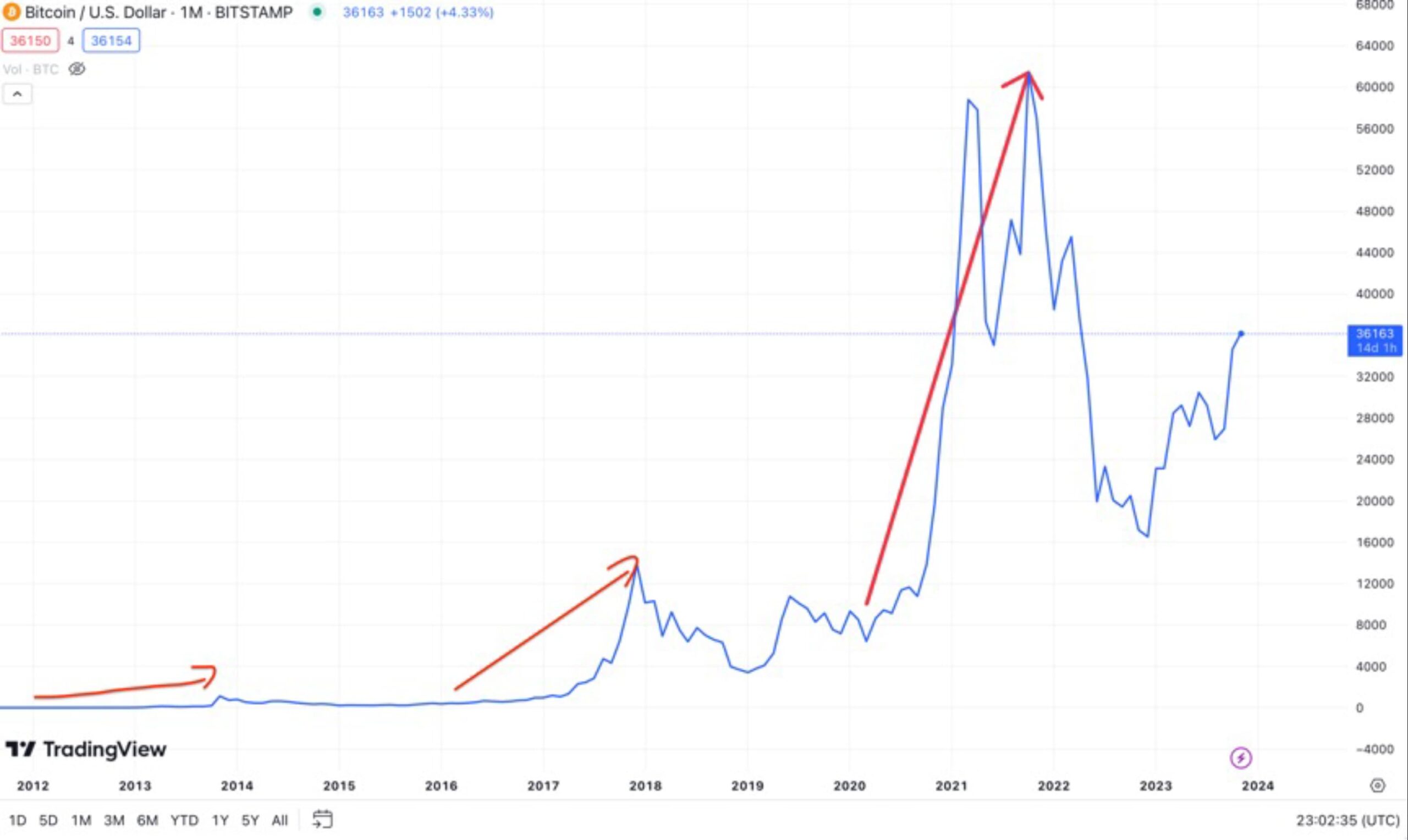

On top of that, we have the bitcoin halving coming up in late April. This is a technical event that happens every four years to make new bitcoin increasingly harder to create. What’s important here is that each of the last three halvings preceded bitcoin’s push to what were then all-time highs…

If you look at a chart of the price of bitcoin, you’ll see that every so often, the price suddenly appears to leap by an order of magnitude. On Nov. 28, 2012 one such leap takes bitcoin from the double digits into the hundreds. Starting on July 9, 2016, bitcoin leaps from the hundreds to the thousands of dollars… The last leap began on May 11, 2020. Over the course of that leap bitcoin ascends from being priced in the thousands to the tens of thousands. These leaps are tied to events known as “halvings”… and the fourth halving is happening this year.

The last record high—north of $65,000—came in November 2021, about 18 months after bitcoin’s third halving in May 2020.

My expectation is that the fourth halving in April will launch bitcoin on an epic run well past $100,000.

Cracking that six-figure threshold is going to be a monumental event, and it will drive the masses into crypto for fear of missing out on the bull market.

What I’m saying is that you really want to position yourself now for what’s to come in crypto.

You want to be patient.

And you want to completely tune out any of the negative BS you read or hear in the mainstream media.

As I ask my friends: Would you have a root canal done by someone who read about the procedure in a magazine… or would you go to a dentist?

Why entrust your wealth to people who have never even traded a bitcoin in their life?

Those of us who are trading crypto day in and day out know far better.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2024. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.