Dear Frontier Fortunes subscriber,

We start this issue of Frontier Fortunes by stealing the first few sentences from A Tale of Two Cities:

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair…

Frankly, if Charles Dickens were alive today, he could be writing those same words about the markets that define the new iteration of Frontier Fortunes. As I noted in a recent update I emailed to you, I have decided to combine the Crypto portfolios with the Energy & Metal portfolios.

Though those assets exist on different parts of the investment spectrum, they both are long-term beneficiaries of the energy and financial super shocks I expect will roil the U.S. over the remainder of the decade.

Already we’re seeing the early stages of those super shocks taking shape.

Oil prices, after bottoming over the summer, are rising once again. July’s Consumer Price Index reading popped higher, which in turn prompted the Federal Reserve to quickly make clear that it foresees interest rates to remain “higher for longer,” an indication that oil prices are playing havoc with the Fed’s modeling.

At the same time, fossil fuel demand continues to rise globally while oil production is slowing. That’s a recipe for higher oil prices and will lead to a rising urgency among energy companies to find new oil reserves to replaces existing fields that are drying up by the day.

That’s the energy front…

Crypto’s Fortunes Rising

Over on the financial front, America is now on track to spend nearly $900 billion on debt repayment costs for the fiscal year 2023, which ends September 30. Last fiscal year, America set a record for debt repayment costs at about $475 billion. And we’re nearly doubling that in a single year because the Fed has jacked up interest rates far higher and faster than even Ouija Board readers in the government predicted.

That has impacts on crypto, particularly the granddaddy of digital currency: bitcoin.

Though a sea of detractors scoff at and pan any form of crypto, the reality is that governments and businesses worldwide are quickly adopting crypto—a trend I strongly encourage people to take to heart.

Governments, including the European Union, increasingly see crypto as opening “unprecedented opportunities.” Businesses, meanwhile, are adopting crypto for scores of uses—from marketing to product sales to loyalty programs.

Perhaps the greatest proof I can offer that business will embrace crypto is this: Athletic-shoe giant Nike has so far earned $93 million by selling royalties on NFTs, or non-fungible tokens, the art-based cryptocurrencies. Every time a Nike NFT trades, Nike collects 10% of the sale as the NFT’s creator. That’s continually flowing free money with virtually no offsetting expense. Plus, as the value of Nike NFTs rises, the amount of royalty income rises, too.

Such an arrangement has never existed. Now that it does, corporations have an entirely new income stream to pursue. Examples like that tell you why crypto is inevitable: Business wants crypto because crypto is great for business!

Which gets us back to Charles Dickens…

We really are in the best of times/worst of times market for the two sides of the Fronter Fortunes’ portfolio.

Energy has been doing great.

Not only are oil prices and demand rising, but the serious underinvestment that has plagued the industry since before 2020 has caught up with oil- and gas-exploration firms. They’re running around looking for new reserves, and in doing so they are consuming vast amounts of oil-service resources. (I’ll show you an example of that in a moment with Patterson-UTI, the land-based oil driller in the portfolio).

Day rates for drilling rigs are popping higher quicky, and finding rigs to lease is almost impossible, particularly for state-of-the-art rigs.

Meanwhile, crypto continues to play its “worst of times” role.

Though crypto has rebounded sharply off its bear market lows (bitcoin is up 66% from lows last fall), it’s currently stuck in a one-step-up/two-steps-back loop. It’s the sign of a market in which bear sentiment is played out while bull sentiment is struggling with ambivalence that tips over into bullish sentiment, before the next mildly concerning headline scares the bulls away again.

Best of times… Worst of times.

But my message with this quarter’s impact is simply this: The “season of Light”, as Dickens called it, is upon us for energy, metals, and crypto.

Of this, I am certain. And I don’t say that with many investment opportunities…

We have all the ingredients in place to propel energy and metals prices higher. And we have a deeply unloved (in some corners, hated) crypto market that clearly has a future more vibrant than did the internet in the post-dot-com crash.

So, let’s go through some of our portfolio positions so that I can tell you what’s going on, and where I see opportunities to deepen your exposure, if you wish to.

We’ll start with crypto to get the sour news out of the way first.

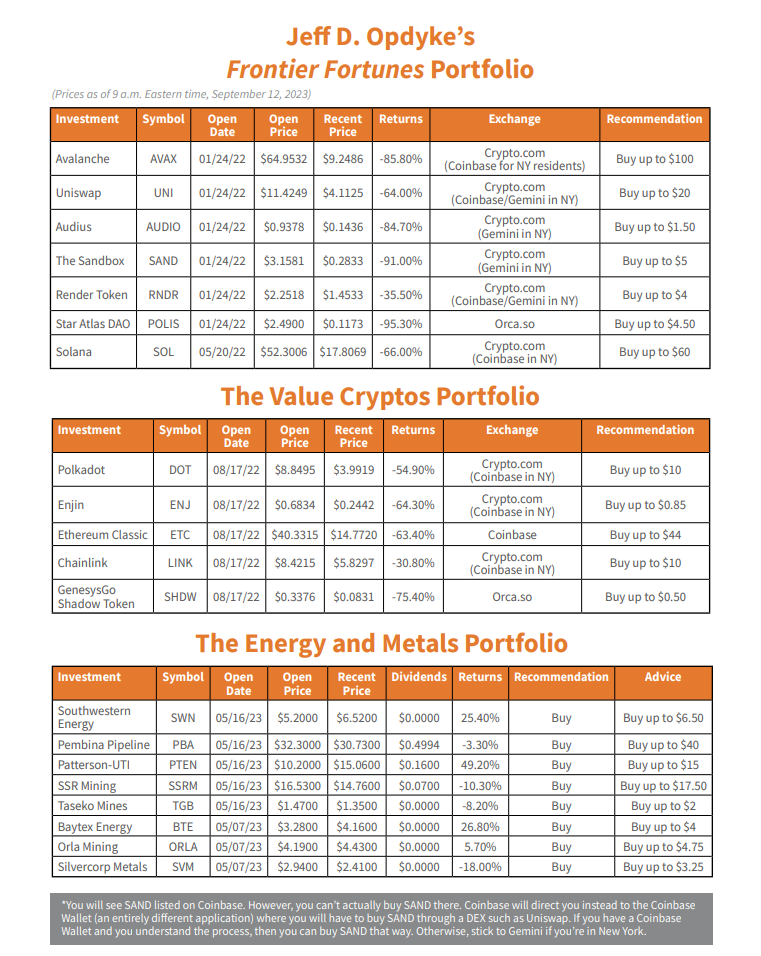

Our crypto portfolio remains in a quicksand of red ink. There’s no charitable way to frame it: The market for crypto fell off a cliff when the Fed began its aggressive rate-hike regime.

And while crypto has begun to recover, it’s still ugly out there for now.

“For now” are the operative words.

I have not lost even a smidgeon of faith in crypto’s future. In fact, throughout the bear market, I’ve been a crypto buyer, and I’ve been adding lots of crypto projects that offer a stream of income. Primarily, that income is in Solana, a major crypto we already own. I am deeply involved in the Solana ecosystem and regularly talk to crypto teams that are building on the Solana network or attend Solana network events around the world.

I am convinced that Solana is going to emerge as one of the world’s most important and most widely used blockchains (the digital infrastructure on which all cryptocurrencies are based). Just recently, in fact, global online e-commerce platform Shopify just recently announced it will begin allowing users to make purchases with crypto in the Solana network.

It’s doing so for two primary reasons:

1) Solana transactions are exceedingly cheap, just fractions of penny, whereas Ethereum transactions cost tens or even hundreds of dollars at busy times.

2) Solana is exceptionally fast—between 4,000 and 6,000 transactions per second (and there’s proven technology that can ramp it to more than 600,000 transactions per second). By comparison, the Visa and Mastercard credit card networks run at global speeds of about 1,600 transactions per second.

So even while Solana is down 60% in the portfolio, I have been stuffing it into my wallet as frequently as I can, either as Solana coins or as high-quality NFTs that pay distributions to me in additional amounts of Solana.

My recommendation right now is that if you are certain that you can willingly stomach the vertiginous ups and downs that are inherent in crypto, then owning Solana at any price under $30 is going to prove very profitable in time. As I write this, Solana is at $20.55, a price range I’ve bought at on multiple occasions.

Similarly, I would be a buyer of Uniswap right now at prices under $5 per token.

(Note: In case you’re wondering about the difference between a coin and a token... A coin is a crypto asset that fuels transactions on a specific blockchain. So, Solana is a coin because it powers the Solana blockchain, just as Ethereum and bitcoin are coins because they power their own blockchains. Tokens are secondary assets that trade on a specific blockchain. So Uniswap is a token that trades on the Ethereum blockchain.)

Uniswap is the world’s largest decentralized exchange, by several country miles. A decentralized exchange, or DEX, is basically the crypto version of a stock brokerage firm like Fidelity, but without any centralization. It’s all peer-to-peer trading, but in an organized fashion.

Uniswap controls more than 60% of the trading volume that happens on DEXes, and there are literally hundreds of them. More importantly, Uniswap so far this year has regularly seen monthly trading volume that exceeds Coinbase, one of the biggest and most respected centralized crypto exchanges in the world. Coinbase is basically the Fidelity of crypto and has outstripped Uniswap for years.

That has changed. In Q1 2023, Uniswap managed $155 billion of trading volume to Coinbase’s $145 billion. In Q2 2023, Uniswap won with $110 billion to $90 billion for Coinbase.

And while Coinbase could certainly regain top billing at some point, the data show that by owning Uniswap, we own exposure to what is clearly one of the single most important building blocks in the cryptoconomy—no different than owning Microsoft or Google as the cornerstone of a tech/AI portfolio. (If you are new to crypto and want to understand how to obtain a crypto wallet for digital assets, and how/where to trade cryptocurrencies, then you should take a look at this report.)

Elsewhere in the crypto corner of the Frontier Fortunes portfolio, two other currencies I want to point out are Chainlink and Render Token.

Chainlink, or “Link,” as it’s called, is an “oracle.” Oracle networks venture forth and gather up real-world data and bring it onto the blockchain so that various blockchain-based services can use that data in completing tasks.

So, for instance, a gambling service might need baseball scores to settle blockchain-based wagers autonomously. But those scores are not on the blockchain; they’re on the internet somewhere. So, Chainlink, through various services, pulls that data onto the blockchain where services can use the information.

This is 100% the future of our world. Way too many services to name are already using oracles, and many, many more will soon do so. Chainlink is the industry whale.

In late-August, SWIFT, the global money transfer network, partnered with Chainlink and 10 global banks including Citi, BNP Paribas, and BNY Mellon, to test a service that tokenizes financial assets and moves them around the planet across the blockchain. (“Tokenization” is the process of taking something and turning it into a digital asset that lives on the blockchain, the digital highway on which all cryptocurrencies operate.)

Tokenizing financial assets in this way reduces costs to almost nothing, and speeds up transfer time to seconds or minutes, rather than hours or days.

Link is down about 30% for us, but this crypto is going to pop substantially higher in the next crypto bull market. I’m so confident of that assessment that I buy Link every week as a part of an automatic investment plan. I don’t really care about the cost right now… I am just dollar-cost averaging into a crypto that is 100% necessary for where the world is headed.

As for Render, this is a crypto company that renders graphics, meaning that it processes all the digital data to produce a video file. That is a power-intensive process. Not enough render power and your graphics lag horribly.

Render solves this by effectively pooling together the world’s spare graphics processing power. Computer graphics cards from all over the world are linked to the Render network and take bits and pieces of processing requests and manage them separately. In doing so, graphics can be rendered almost instantaneously.

As with Link, this is going to be an immeasurably important task in the new, blockchain-based internet we’re moving toward. Augmented and virtual reality will be commonplace on phones, tablets, laptops, TVs, and heads-up-displays in autonomous vehicles. Render will have a very big role in processing that.

Moreover, Render could play a role in the booming artificial intelligence arena. AI needs rendering capacity to generate the graphics it comes up with. And it needs that capacity on the fly to render images and videos as the landscape changes or as a viewer’s perspective changes.

To me, Render is going to be a very big winner as crypto and blockchain replace the internet we know today. Render is down about 36%, but again this is a crypto that can pop higher with lightning speed. At these prices, in the $1.45 range, Render is very good buy for the bull market to come.

Good News for Our Energy Positions

Now, let’s have some good news.

Energy prices are going up, as expected, and the energy components of our portfolio are performing quite well.

Oil prices are rising for a variety of reasons, including production cuts by Saudi Arabia, OPEC, and others. But a primary driver is what I’ve been writing about for some time: Soaring demand for fossil fuels globally.

The International Energy Agency noted in a recent report that the world saw record oil demand in August because of booming summer air travel, increased oil use in power generation amid high temperatures globally, and surging Chinese petrochemical activity.

That increasing demand is running up against inadequate supply.

This is not a Peak Oil issue, and it doesn’t imply that that the world is running out of oil. On the contrary, we have the oil. It’s just that the energy industry has been reticent to “drill, baby, drill” because of the governmental and social castigation of the fossil fuel industry.

Amid the green-energy movement, energy companies have sharply scaled back their hunt for new reserves. Why bring on new supplies and face a potential backlash from government or environmental militants?

The result is what we are now facing: ramping demand meeting inadequate supply… which naturally leads to higher oil prices. Econ 101.

In recent months, however, we’ve begun to see oil- and gas-exploration companies accelerate their search for new reserves.

Patterson-UTI, the onshore drilling company we own in the Frontier Fortunes portfolio, told shareholders in July that it expects the number of drilling rigs in action across the country to rise through the end of the year and into 2024. Rising oil prices are driving demand for rigs, which is incentivizing drilling activity.

The company has also taken over competitors NexTier Oilfield Solutions and Ulterra, a leader in oilfield drill bits. Those acquisitions put Patterson as the leader in onshore drilling in the U.S., the world’s largest market for oil and gas drilling.

Over the summer, a Morgan Stanley analyst reiterated his “overweight” rating on the stock, the most bullish rating the Wall Street investment firm offers. The analyst notes that the company is seeing “remarkable growth” and that it should maintain solid earnings growth of nearly 45% per year for the next five years.

My take is that we are ultimately going to see a 100% gain on our initial price of $10.20 per share. As I write this, the shares are just over $14. So we’re up more than 38%, and still just below our buy limit of $15 per share.

We have a similar story playing out with Southwestern Energy, one of America’s premier natural gas companies.

The story here is that demand for liquefied natural gas is ramping up globally, particularly in Europe, where countries are still grappling with the ongoing Russia/Ukraine war. That war, as you likely know, has disrupted Europe’s energy market because the continent was largely dependent on Russia for the great bulk of its oil and natural gas supplies.

But as the war has raged on, and tit-for-tat sanctions between Europe, the U.S., and Russia have been bandied back and forth, energy supplies from Russia to Europe has dwindled down to basically nothing. Europe has since turned to the U.S., the global leader in natural-gas production. Because of that, natural gas deliveries to America’s LNG exports facilities have hit a record… and they’re projected to set a new record next year.

That plays directly into the strength of Southwestern Energy, which generates 60% of its sales to LNG facilities.

The company’s CEO recently told investors that the country needs more natural gas production to meet the next wave of LNG growth that will come from Europe as well as Asia. That, in turn, helps explain why a host of investment funds and hedge funds have been snapping up large blocks of Southwestern stock. Mutual fund giant T. Rowe Price, as well as Invesco, State Street, Renaissance Technologies, and Vanguard have all been big buyers in the last couple months.

We’re up about 29% so far, and at $6.68 as I write this, the shares are slightly above our $6.50 buy limit. If they pull back below that, I’d be a buyer. This is a stock that was in the $50 range during the last energy bull market around 2008. I’m not saying we go back to $50, but I will not be surprised to see a $20 to $25 price on this stock.

The one energy play that’s struggling at the moment is Pembina Pipeline, a Canadian company that transports oil and petroleum fluids through Canada and parts of the U.S. The issue here has nothing to do with the company, and everything to do with the wildfires that have ravaged Canadian wilderness this summer. Those fires have forced closure of many pipelines for safety reasons.

Excluding the dividends we’ve earned, we’re down about 3.5% in share price—a marginal decline. But now is a great time to add Pembina to your portfolio, if you don’t own it and you have a bit of investable cash to put into the stocks. Plus, you’re grabbing a dividend yield right now of 6.45%, a very healthy payout that will grow in time as Pembina grows.

The real weakness in the portfolio right now is on the metals side.

We’re down in three of the four metals stocks we own. The one bright spot is Orla Mining, a small gold mining company that only recently began production. That’s visible in the company’s most recent financial results. For the second quarter, Orla reported net income of $12.8 million, compared to a $597,000 loss in last year’s second quarter.

Moreover, Orla’s so-called “all-in sustaining cost” (the cost of running its mining operations) was just under $700 per ounce of gold mined. Yet, gold averaged $1,975 per ounce. That’s a huge gap. Much of the industry’s all-in sustaining costs are in the $1,100 to $1,300 per ounce range.

Orla told Wall Street to expect all-in sustaining costs to come in at about $700 to $800 for the full year, a reduction of its previous estimate of $750 to $850 per ounce.

In short, Orla is doing very well. As it ramps up gold production, and as gold prices move higher, Orla’s profits are going to expand nicely, and the share price will continue to push higher.

Right now, we’re up about 13.4% and are right at our buy limit of $4.75. If we get any meaningful pullback in gold that sees Orla’s price come in a bit, I would be a buyer.

Elsewhere, copper miner Taseko, gold miner SSR Mining, and silver miner Silvercorp Metals are all down between 5% and 10%.

Nothing to worry about though.

Copper is going to have an epic bull run—a bull run for the ages—as China demand ramps up and as the push for electric vehicles and renewable energy continue to reshape the world’s power grid. Copper is the most important commodity in the re-electrification of the planet.

Yet, mining supply is not keeping up with growing demand. At some point… boom! Copper prices will shoot the moon and take Taseko’s share price along for the ride. We’re down about 5.4%, so the stock is a great buy here.

The issue here is twofold: Earnings for the recent quarter were a bit lighter than a year ago, though nothing at all worrisome. That was due in part because silver and lead production has declined between 5% and 9% from a year ago.

The other issue is one that has long dogged Silvercorp: Its mines are in China and Bolivia, not the world’s safest jurisdictions. For that reason, Wall Street always under-appreciates the company and awards it cheaper valuations than its peers.

But Silvercorp is watering down the China issue. Earlier this year, it agreed to buy an Australian copper/gold miner called Celsius Resources. And just recently is announced it will acquire OreCorp, an Aussie company with a gold project in the African nation of Tanzania.

Given Silvercorp’s expanding gold production, and given that gold and silver prices are going to be much higher soon enough, Silvercorp is a good buy at these levels.

As I noted at the outset, the past 18 months or so has been the best of times and the worst of times for the Frontier Fortunes portfolio. But given what’s shaping up in energy, metals, and crypto, we’re on the cusp of rewriting one of Dickens’ most famous opening lines.

“It was the best of times … and then it got even better.”

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2023. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.