Dear Frontier Fortunes subscriber,

Welcome to your new quarterly issue of Frontier Fortunes.

Below, I’m going to take a comprehensive look at the performance of each of the assets in the portfolio and share some important news about the Ethereum 2.0 upgrades. But first, I wanted to tell you about the best new earning opportunity in crypto…

Here in the middle of a crypto bear market, I am collecting annualized returns of 31% to as much as 198.6%.

I am not buying anything.

I am not selling anything.

And yet I am earning huge returns, even amid the current crypto downturn.

I’m earning these returns because I am effectively operating like a digital pawnshop. I am making loans against NFTs, and I am either pocketing a nice interest payment after a few days or a few weeks…or I am taking ownership of high-quality NFTs at discount prices and turning around and selling them for market value.

Frankly, I wish I’d begun doing this sooner.

So, with this quarter’s Frontier Fortunes issue, I want to walk you through the NFT-lending process and show you the opportunities that exist in this brand-new, still-emerging corner of the crypto world.

NFTs, or non-fungible tokens, are one-off, one-of-a-kind cryptos that gained fame as digital art but which over the last year have morphed into assets that provide all sorts of products and services—from online gaming to tech investing to passive-income opportunities. (Before reading this alert, I’d advise that you check out the two NFT reports I’ve prepared as part of Frontier Fortunes, if you haven’t already done so: How to Invest in NFTs and The Frontier Fortunes Guide to NFT Wallets.)

The lending/pawnshop process in the NFT space is simple to pursue.

It does not require any special accounts or any kind of identity verification…the lending platforms are easy to use…and you can begin lending with as little as 2 or 3 Solana, the cryptocurrency used in these transactions. That’s about $88 to $132 at the moment. That said, I would start out with 20 to 30 SOL, as the cryptocurrency is known, because that will give you access to better NFTs.

To be clear, this is certainly not a risk-free way to earn money.

If crypto is the bleeding-edge of finance and technology, NFT lending is the cutting edge of that bleeding edge. But it can be a fun way to collect crypto profits. Plus, there are strategies you can use to mitigate a large portion of the risk that does exist.

With that out of the way, let me explain how the NFT lending process works and why such generous profits are available.

The NFT Lending Market

I am doing my lending at a website called Yawww.io.

Yawww is a crypto company that sprang up several months ago to serve as a lending platform for NFT owners. It has since expanded into a marketplace for buying and selling NFTs and for peer-to-peer trading.

The thing about NFTs is that a.) they are addicting once you get involved with them, b.) new ones arrive almost daily, and c.) many NFT investors have limited cash they can devote to the NFT space, but a near-unlimited desire to buy and trade new NFTs.

That’s where Yawww comes in.

NFT owners head to Yawww to pawn their NFTs for a certain period of time so that they can raise capital to do whatever they need or want to do.

For some, that’s spinning up enough cash to invest in a new NFT so they can try to immediately flip it for a profit. For others, it’s using the cash raised to trade in the crypto market, or even to cash out temporarily for a real-world expense they need to cover before jumping back into the market to reclaim the NFT they pawned.

Meanwhile, lenders like me go to Yawww to put spare cryptocurrency to work. And we effectively do so as independent pawnshop dealers, picking and choosing the NFTs we’re willing to lend against.

Just like a real pawnshop, we’re either going to be repaid all the crypto we’ve loaned out, plus interest. Or we’re going to keep the collateral (the NFT) and sell it to recoup the loan repayment and interest we’re due.

That’s a broad overview of what’s going on and why this model works. People in the NFT space, just as in real life, need money for various desires, while other people in the NFT space have money to lend.

As I write this, I have five loans outstanding with borrowers who owe me a cumulative 478.18 SOL, before interest. Two other loans I had in place have concluded. One repaid early while the other defaulted, allowing me to sell the NFT I claimed for an even greater return than I would have earned from the loan.

Assuming the five outstanding loans repay fully on their due date (all are due within 27 days of me writing this), I will have turned 477 SOL into nearly 512 SOL—a gain of 30.76 SOL, or about $1,350—in less than a month and a half.

That’s a combined return of about 7.2%. If I do that every 48 days or so, I’m looking at roughly $10,260 per year in income from interest payments and resales of defaulted NFTs.

That’s an exceedingly rough guesstimate, of course, because I cannot be sure I will find enough of the types of NFTs I want to lend against, I can’t be sure which NFTs will default and what price I will sell them, and I cannot be sure of the dollar value of the Solana cryptocurrency.

Right now SOL is in the $44 range. This remains a volatile moment for crypto, so SOL could fall to $20 or climb back to $150, either of which would change the quantity of Solana that borrowers seek…which changes all the math.

The best estimate I can make at present is that I expect to earn a little less than $1,000 per month from my lending efforts.

Moreover, as the price of SOL rises back toward $150 or above $200, where it sat before the crypto bear market, then all this SOL I am collecting in the mid-$40s is going to be worth substantially more dollars.

That’s precisely my goal: to collect as much Solana as I can before the next crypto bull run begins.

Now, let’s jump into the weeds so I can walk through this process with real examples from my portfolio…

The Basics of NFT Lending

Let’s start with the Yawww listing page. Go to Yawww.io and click on the “P2P Loans” dropdown box on the left, then click on “Loan Listings.”

There you will find all the NFTs against which owners are seeking a temporary loan of a few days to a few months. You can filter the loans numerous ways—duration, return, NFT community, etc.

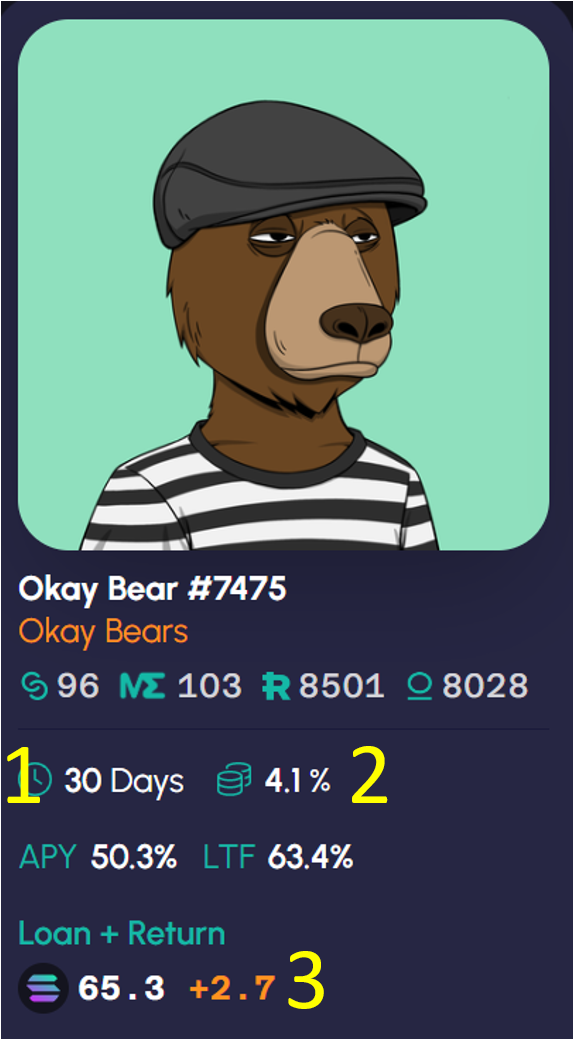

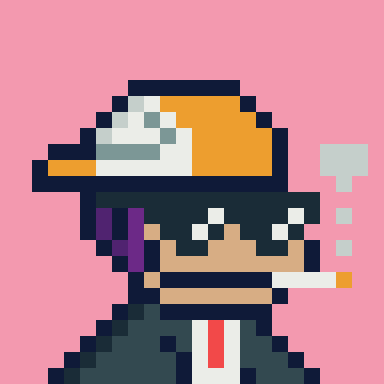

Among the 120 requests for loans, I found one for Okay Bear #7475, a high-quality project with a big following of very passionate owners. This is the NFT:

Let’s go through the numbers for this loan request. The owner of Okay Bear #7475 is:

Looking for a loan of 30 days in duration.

Willing to pay interest of 4.1% for those 30 days, or an annualized percentage yield (APY) of 50.3%.

Wants 65.3 Solana, for which the lender will earn 2.7 Solana when the loan comes due.

As for the other numbers:

LTF is “Loan-to-Floor” value…in this case, 63.4%. That’s the value of the loan (65.3 SOL) relative to the lowest price, or floor price, for an Okay Bear NFT on the various secondary markets.

The floor price is shown beneath the image, where you see 96 (that’s the floor on Yawww) and 103 (that’s the floor on Magic Eden). Note: LTF is calculated based on the Magic Eden floor price, since that’s where the greatest amount of NFT trading is done on the Solana blockchain.

The last two numbers (8501 and 8028) are “rarity rankings,” or where this NFT ranks among the entire collection of Okay Bears NFTs, of which there are 10,000. From these numbers, we can see that this is a common, lower-ranked Okay Bear.

So, in our case, the owner of Okay Bear #7475 is seeking a loan of 65.3 SOL, which is 63.4% of the value of the lowest-priced Okay Bears NFT on Magic Eden. This means that a lender is putting up 65.3 SOL for an asset worth about 103 SOL. In other words, a lender has a wide margin of error here…a financial cushion in case the value of Okay Bears NFTs begins to weaken during the 30 days in which this loan could be outstanding.

I say “could be” because borrowers can repay at any time.

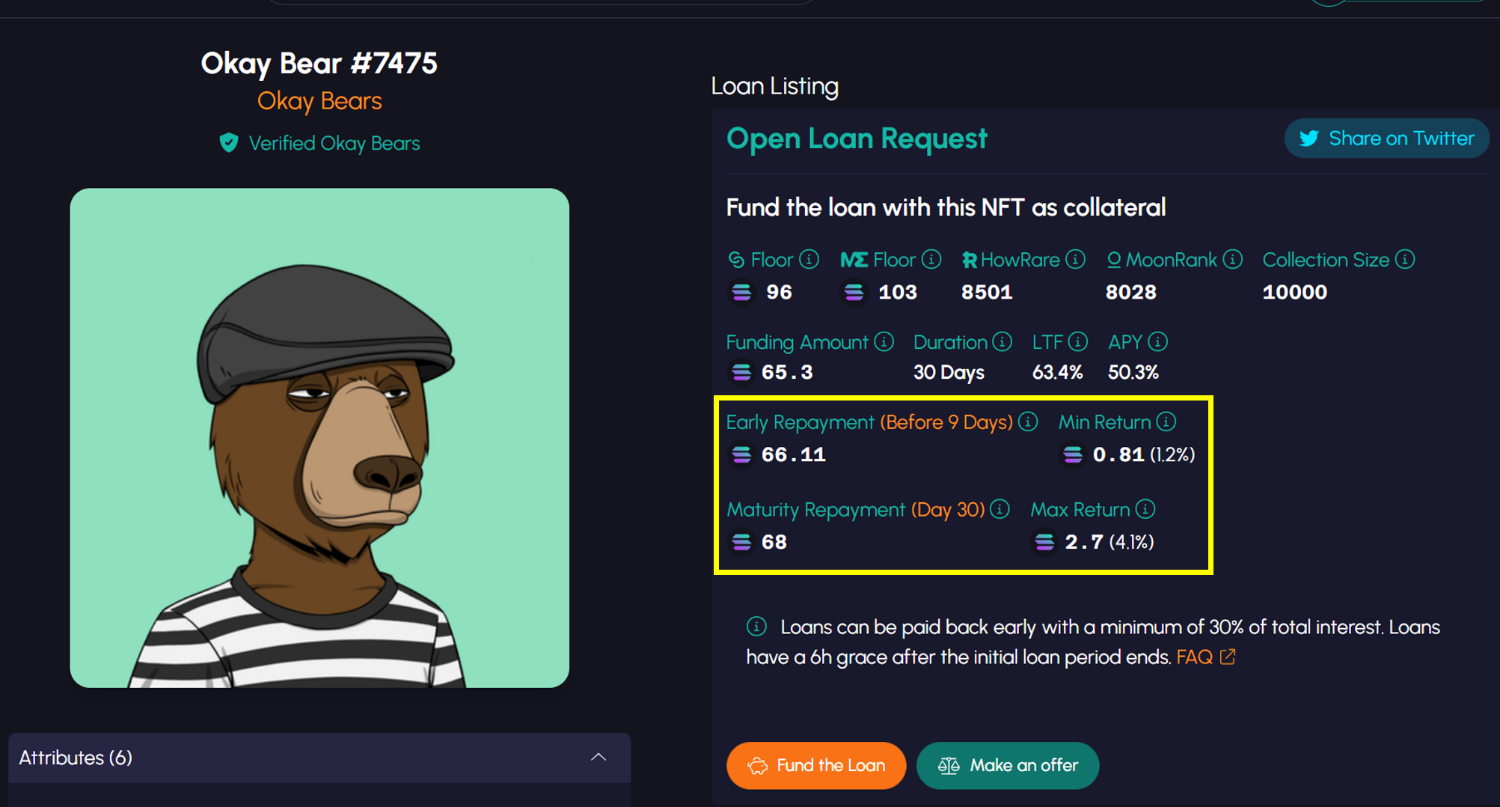

If you click on the NFT, Yawww will take you to a page that spells out the minimum return.

With this Okay Bear NFT, the minimum return in the event of repayment anytime during the first nine days is 0.81 SOL, a 1.2% return on the 65.3 SOL loan. After nine days, the return pro-rates daily until full repayment of 2.7 SOL on Day 30.

Also note that all borrowers have a six-hour grace period in which they can repay after the loan is due. If the borrower fully repays the loan and all interest due within that six hours, they reclaim their NFT. If not, the lender can claim the NFT and transfer it to their own wallet.

As for the rarity rankings, they’re relevant to the degree that you will sometimes come across rare or extremely rare NFTs.

If the owner is seeking a loan below the floor price, that can potentially be a huge opportunity because in the event of default, you can sell the NFT for a much larger price than the floor value.

A friend who fueled my interest in NFT lending loaned 300 SOL against an extremely rare Degod (a hugely popular project) at a time when the floor price for Degods was right near 300, so basically a 100% LTF value.

However, Degods with the traits that this NFT possessed were trading at a minimum 900 SOL at that moment, meaning a default would have resulted in a massive 600 SOL gain instead of the 20 SOL he earned in interest. (The borrower repaid with about one hour remaining before default…my friend was disappointed, to say the least).

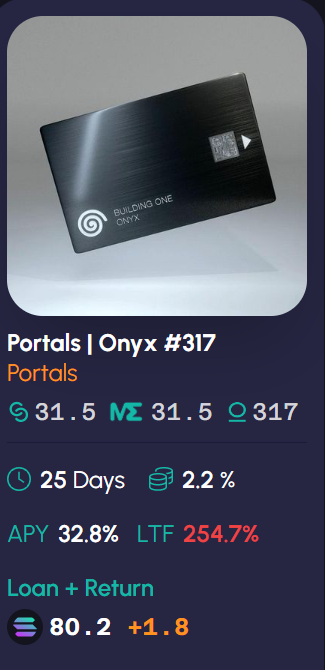

In other instances, owners of rare NFTs will seek loans well above the floor (because they are rare), but that too can be an opportunity. Here’s an example of what I’m talking about:

Portals is the largest and most important metaverse on the Solana network, and could well emerge as the largest on any network. (The metaverse is the internet in 3D. Instead of staring at a computer monitor or smartphone, we’ll view the internet of tomorrow in three dimensions using virtual reality glasses and augmented reality technology.)

Here you can see that the owner wants 80.2 SOL, or nearly 255% more than the floor price. In a normal situation, I would laugh at something that ridiculous.

However, that 255% doesn’t tell the real story.

Yawww bases all loans on a project’s floor price since Yawww doesn’t have the capability of factoring in rarity. And in this case, an Onyx Portal is very rare.

Portals has three types of NFTs: Ivory, Onyx, and Visions.

Ivory NFTs are common, accounting for 4,500 out of Portals’ total collection of 5,000. Meanwhile, there are only 425 Onyx NFTs and just 75 Vision NFTs.

As such, an Onyx is worth way more than a floor-model Ivory Portals, which sell for 30 SOL as I write this.

A floor-model Onyx fetches 158 SOL.

So in this instance, the owner of this Onyx Portal is looking for a loan that’s just 50.6% of its true value.

That means, despite the outsized LTF, this is a loan I would make (some other lender took the loan as I was writing this). The return of 2.2% or nearly 33% annualized is pretty good, and the LTF of roughly 50% offers the lender a huge cushion. In the event of default, it is likely that this Onyx would recoup the loan, plus interest…and a very large profit of at least 75 SOL.

Learning about rarity rankings and their impact on loan value takes time.

Early on, I would suggest that you research any NFTs you come across where the owner is asking for 200% or more of the floor value. The best place to do your research is the major secondary markets like Magic Eden. Chances are very good that the NFT has rarity traits that mean it is far more valuable than the floor price, and it might represent an opportunity.

Just be aware that that’s not always the case.

Sometimes borrowers are just using the lending process as their exit strategy, hoping to get more for their NFT than it’s worth on the secondary market.

They’ll seek a loan for their NFT with the promise of a big interest payment…which they never intend to pay. You’ll be stuck holding an overvalued NFT that you either must sell at a loss, or that you have to hold on to in hopes the NFT rises in value enough that you recoup your original investment.

NFT Loan Examples

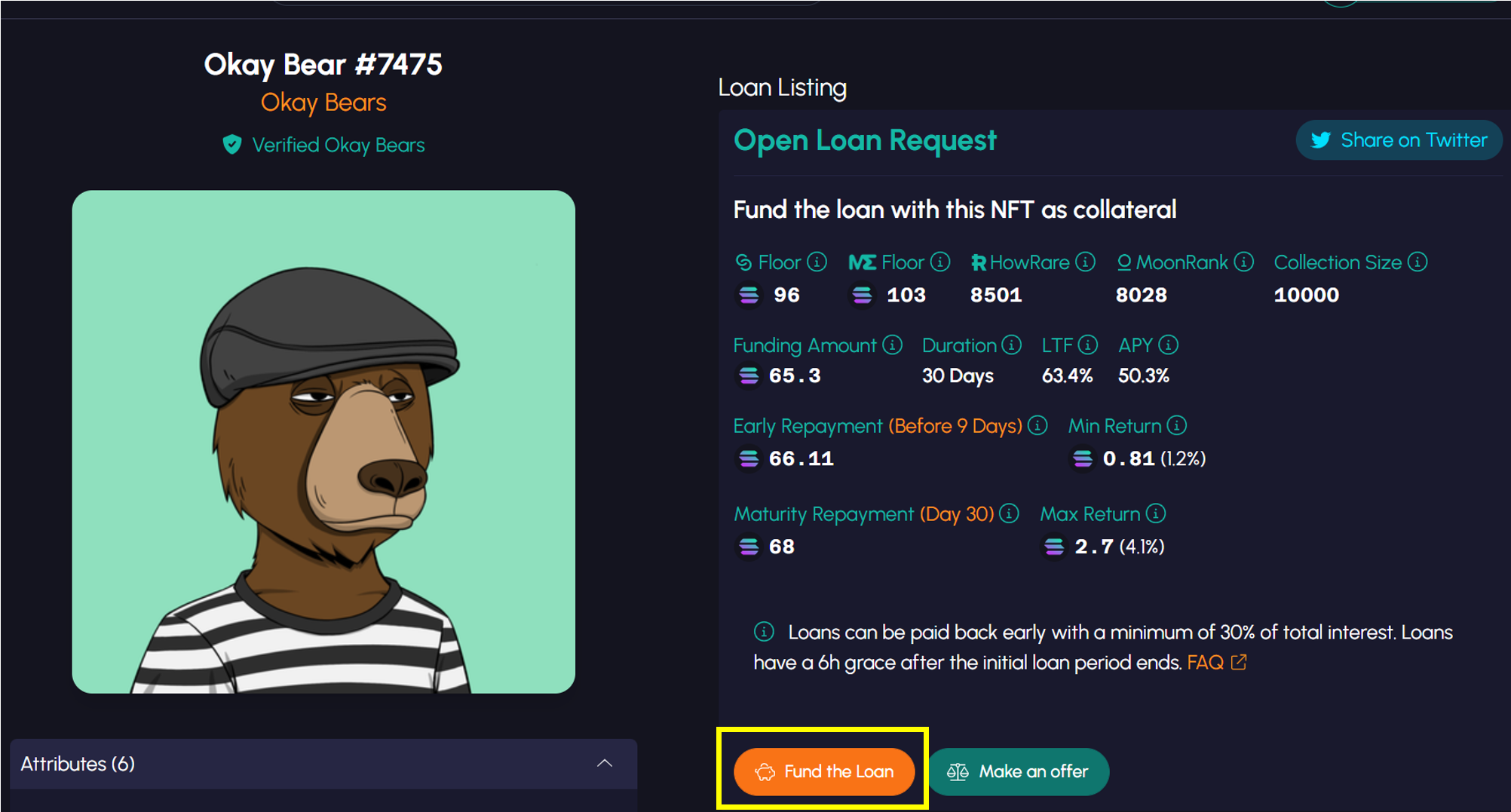

To see how easy the lending process is, let’s go through the loan I made against that Okay Bear #7475 I showed you earlier.

Here, I’m collecting a 4.1% return in one month, or just over 50% on an annualized basis. And with a loan-to-floor of just 63%, I have a big cushion.

In the event this Bear’s owner defaults, I can sell the NFT in the 100 SOL range and pick up a huge profit…which is why I’m actually hoping for a default.

To fund the loan, you simply click on “Fund the Loan.”

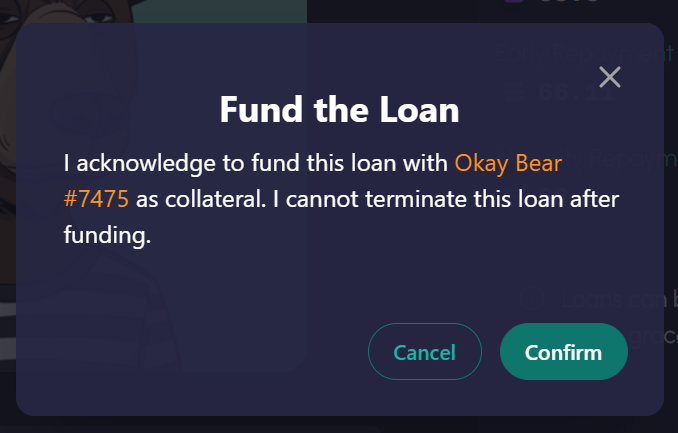

You will see this dialog box pop up:

Click “Confirm” and your crypto wallet will pop up and ask you to approve the transaction. (Learn how to set up and use a wallet in the Frontier Fortunes report, The Frontier Fortunes Guide to NFT Wallets.)

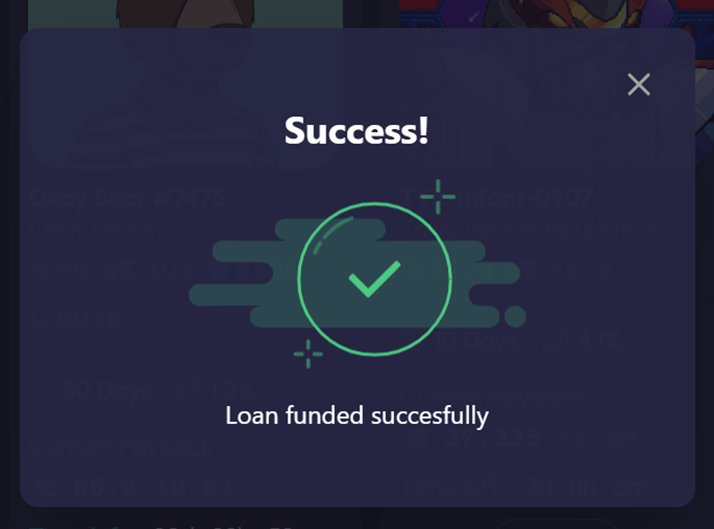

Click on “Approve” and the Yawww website will process the transaction for 30 seconds or so, and then you will see this box appear:

You have successfully funded a loan.

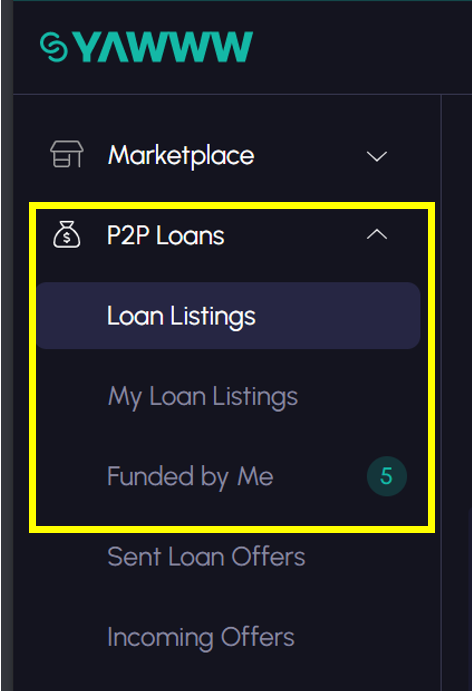

The Solana will leave your wallet, and you will find the loan you’ve made on the Yawww website under the “Funded by Me” option in the P2P Loans drop-down menu:

Click on “Funded by Me” and you will see all the NFTs on which you’ve made a loan. Here’s the ones I’ve made:

As you can see, the rates and repayment periods vary significantly…from 0.8% over 17 days for Okay Bear #5157 to 4.2% over 10 days (an annualized return of 198.6%) for Taiyo Robotics-Infant-0907.

Once you’ve funded a loan, there are three potential outcomes—early repayment, repayment on due date, or default.

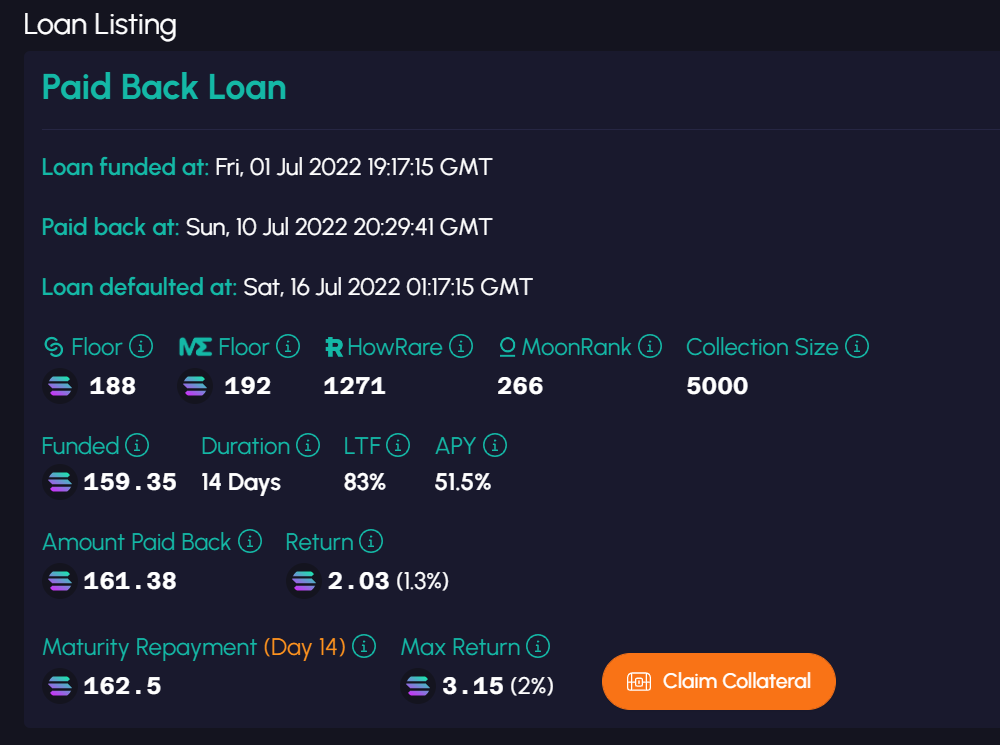

Here’s an example of one that repaid early:

This is a project known as Solana Monkey Business. It’s arguably the bluest of blue-chip NFTs on the Solana blockchain. By that I mean it’s like building a tech portfolio and starting with Apple, Microsoft, or Intel.

Here are the loan details:

You can see from the numbers that I funded this loan request at 159.35 Solana for a projected interest payment of 3.15 SOL after an expected 14-day loan period. I did so at a loan-to-floor value of 83%.

Turns out this borrower wasn’t about to lose their Monke, as they’re called. The borrower repaid the loan early, after about nine days, returning to me 161.38 SOL, which is the original loan amount plus 2.03 SOL in interest payments. So, I pocketed a return of 1.3% and overall I picked up just over $70 in profit after just nine days.

And then there was the default…

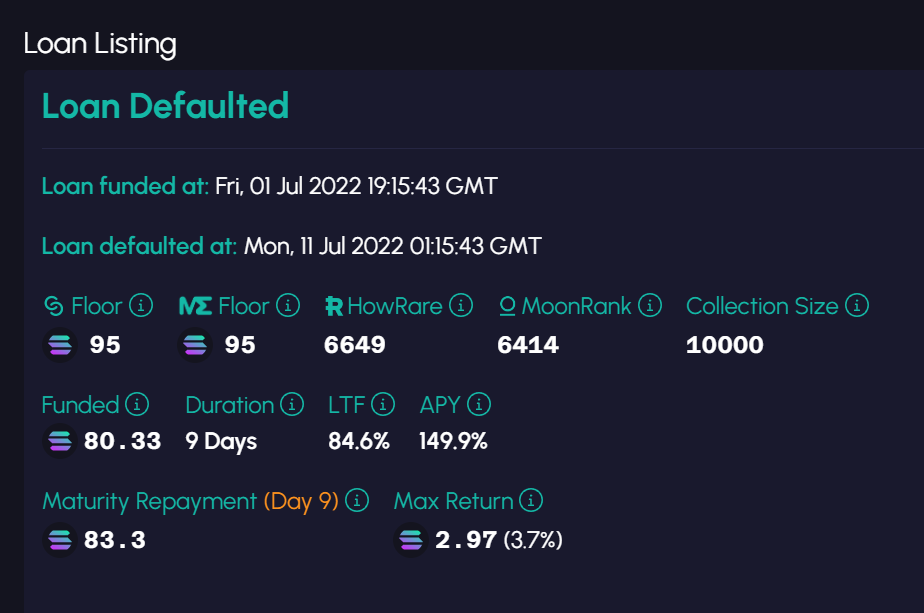

I loaned 80.3 SOL against this Okay Bear:

This is a middle-ranked Bear and the loan was just under 85% LTF, with the expectation of earning 2.97 SOL after just nine days. Here are the numbers:

However, the Bear’s owner defaulted and I ended up owning this bear instead of being paid back. (When a loan defaults, you will see a “Claim Collateral” button. Click on that and the NFT will move to your NFT wallet.)

I see defaults as a good outcome.

In fact, with pretty much every loan I make I am actually hoping for a default. It’s why I aim to fund loans with a wide gap between loan value and floor price. I hope to resell at the floor and earn more than I would make on interest payments alone.

I took possession of this particular Bear and immediately listed it at just above floor on Magic Eden—at 98.88 SOL when the Bears’ floor price was 95.

I set the sales price knowing that I must pay a royalty to the Okay Bears project and a marketplace fee that, combined, total 9.5% of the sales price. That’s a key point to note: Always consider the impact that royalties and marketplace fees will have on your profits in case of a default.

Magic Eden’s fee is always 2%, but royalties vary from project to project. When you click on an NFT for any particular project while on Magic Eden, you will see “Artist Royalties” listed in the “Details” section.

My defaulted Bear sold at 98.88 SOL and after fees I collected 89.486 SOL on a loan of 80.3 SOL…meaning I earned more than 9.1 SOL on my original loan rather than the 2.97 SOL I was anticipating—a return more than 3x my expectation.

That leads me to the rules by which I play this NFT lending game.

My Lending Strategy

To be clear, these are my rules, based on my tolerance for risk, the kinds of returns I seek, and my willingness to take in certain defaulted NFTs and stash them in my offline hardware crypto wallet if necessary. You should adapt these rules based on your risk tolerance and profit expectations.

Always and only loan against high-quality NFT projects.

In the event that a borrower defaults and I end up with the NFT, I want to know that it is an NFT I would be happy holding in my crypto wallet.

That’s not to say I am looking to keep all the NFTs that default. I am not. I will sell the vast majority of them, as I did with the Okay Bear above. But I want to know that if I do end up with a defaulted NFT, it’s an NFT I’d personally want to own.

There are many owners of lower- and mid-quality NFT projects seeking loans, and I am sure there are opportunities in those. But keeping with my strategy, if I have no desire to own a particular NFT, then I have no desire to lend against that NFT, regardless of the income potential.

Only lend up to 85% of the floor value (LTF).

This gives me a margin of safety in the event an NFT project as a whole begins to weaken. I have 15% downside protection. In many instances, I’m actually lending at an LTF of 80% and below. With Okay Bears #7475, my LTF was 63%—a huge cushion.

That margin of safety also means that in the event of a default, I have a much bigger return awaiting me since I can sell the defaulted NFT at the floor place. That gooses my return even higher.

That said, with certain projects (particularly Solana Monkey Business) I will go to an LTF of roughly 90% because of the quality of the project and the demand for Monkes among NFT buyers and collectors. If a default occurs, I certainly don’t mind owning a Monke at a discount to the floor price. But that’s about the only project for which I will violate my 85% rule. Maybe with Degods, too, but I’ve not yet found a loan for one of those I want to fund.

Moreover, with certain projects, such as with the Portals Onyx NFT I showed you, I will go way above the stated LTF if I know the real floor price for a particularly rare NFT is substantially higher than the requested loan.

Limit the loan duration to 30 days or less.

I do not want to be in the business of making long-term predictions on the market value of a particular NFT project. While I am confident about all the projects I choose to lend against, you just never can tell what a fickle market will do several months out.

I much prefer what I call the “meter-drop” strategy. This is based on what a taxi driver in Portland, Oregon once told me: He’d rather take 10 customers on 10 very short trips that one customer on one very long trip. Each time he drops the meter, he automatically earns as much as he’d earn driving several miles with one long-haul customer.

It’s the same for me and my NFT lending. With the same amount of SOL, I’d much rather churn though several loans in 90 days than have one 90-day loan. I will generally earn more with less risk.

Immediately list defaulted NFTs for sale.

With very limited exception, I will immediately list for sale the NFTs that I receive in a default. So far that has only happened with the Okay Bear, but it is the marching orders under which I will operate. I want to recoup my loan and my expected interest rate for sure, and a bit of extra profit on top of that—which goes back to why I like funding loans with an LTF of 85% or less.

I list the NFT at or very near the floor price, depending of course on rarity.

And frankly, I am not eager to lend against most rare NFTs that seek loans above floor price. The market for a high-dollar, rare NFT is narrower than for a floor-model of that same collection.

In the event I need/want to sell quickly, I’d rather be able to sell at the floor than wait for a rare to sell at higher prices. (And I don’t want to be in the business of selling rare NFTs at the floor.) I will make exceptions to this in certain instances, such as for that Onyx Portal.

The only NFTs I will consider not selling after a default are Solana Monkey Business, Taiyo Robotics/Taiyo Infant Incubators, and a Vision Portal, assuming one ever pops up.

The guy running Taiyo is one of the smartest developers on the Solana blockchain, has built a string of successful internet businesses, and has structured the Taiyo project as a generator of wealth for its owners. So, if I can lend against a Taiyo at a low LTF value and end up with it through default, I will gladly stuff that NFT into my hardware wallet to keep as part of my collection.

As for a Vision Portal…they’re 1,000 SOL right now, or about $44,000 each. I am convinced they will see a six- or seven-figure price tag at some point. If I can lend against one at the right price, I will gladly do so on the chance that it defaults and I pick up a Vision on the cheap.

The Wrap Up

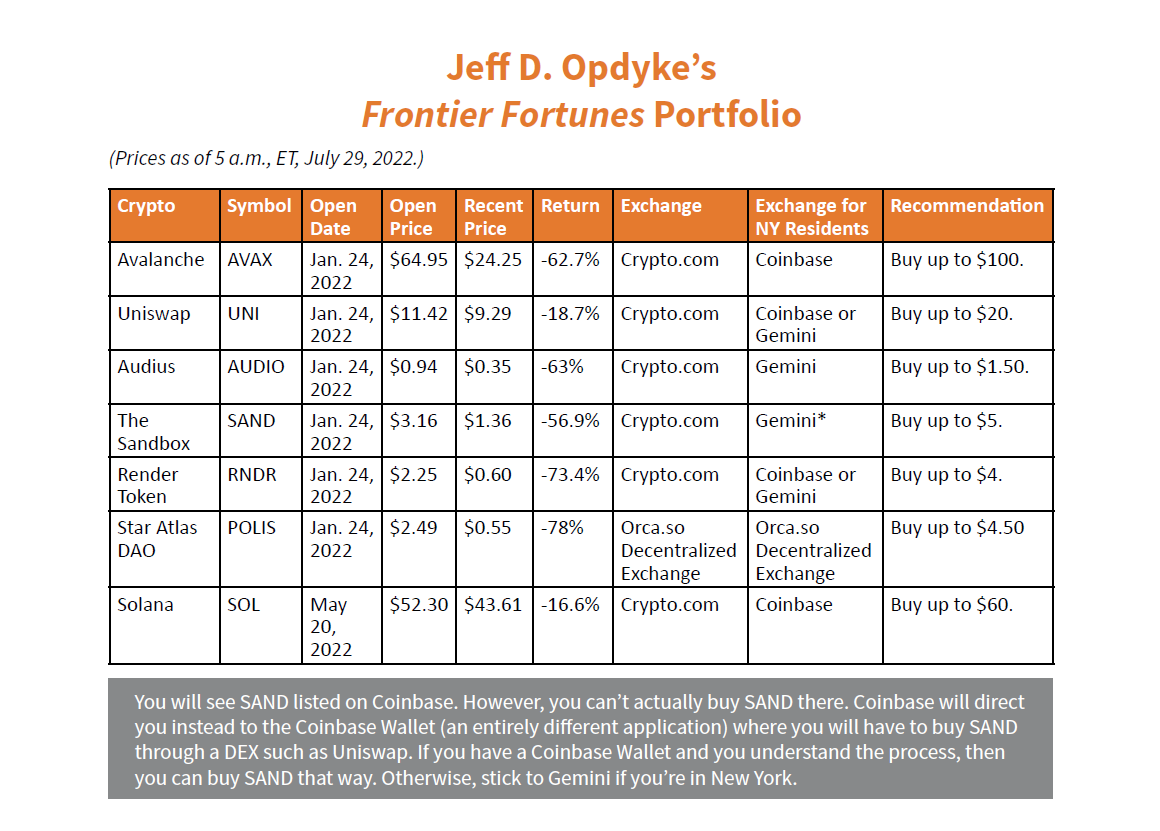

As highlighted above, these are the loans that are currently outstanding in my portfolio:

I share this so that you can see the kinds of projects I’m lending against (all high-quality) and the kinds of returns and time periods I pursue.

Just to give you a bit of a head start, the high-quality projects to look for include:

Solana Monkey Business

Communi3 Mad Scientists

Okay Bears

Degenerate Ape Academy

The Suites (three types exist: Club, Owner, and Executive. I would focus primarily on Owner and Executive)

Portals (I would lend against all three varieties: Ivory, Onyx, and Vision)

Taiyo Robotics/Taiyo Infant Incubators

Blocksmith Labs

SOL Flowers (particularly “OG Flowers”)

Degods

Cets on Creck

Stoned Ape Crew and its second collection, Nuked Apes

OG Atadians

Boryoku Dragonz

SOLgods

So, this is how I am using this bear market in crypto to pack away ever more Solana.

There are, of course, risks to any investment strategy. In this case, the market for NFTs could theoretically collapse. The value of Solana could plunge. Maybe Yawww fails. This is, after all, the cutting edge of a space that itself is already cutting edge.

That said, I don’t see those events happening.

Rather, serving as an NFT pawnshop owner is an emerging income opportunity that can generate a nice return and which allows you to mitigate the risks you take on through the selection of projects you choose to lend against.

This crypto bear market will end at some point and a new bull will begin. And when it does, Solana’s price is going to surge well past its previous high near $260.

So, I want to generate as much Solana as I can at these cheap prices, and NFT lending is an opportunistic way to do so.

Over the past quarter, the crypto downturn worsened, as the Federal Reserve stepped up its attacks on inflation by raising interest rates.

Rate hikes put downward pressure on risk-on assets like stocks and crypto. This pressure will remain in place until the markets realize that the Fed will have to relent in its assault on inflation and start cutting rates again.

That day is closer than most people assume.

The Fed has been raising interest rates by substantial amounts in recent months, again hiking rates by 0.75 percentage points at its recently concluded July meeting.

But here’s the thing: These rate increases are not happening in a vacuum. They’re having real impacts on very important segments of the U.S. economy…

Consumer and business sentiment have cratered. Rising mortgage rates are dramatically cooling the housing market. A recession is already apparent. And there’s talk now that Wall Street is going to see lots of negative earnings revisions in the second half of the year.

In this environment, the Fed is going to have to back off or risk much worse problems than high inflation.

So, I expect we’re going to see a Fed rate cut toward the end of this year. And that will see risk-on assets like stocks and crypto rally.

There’s also another big positive on the horizon for crypto…Ethereum 2.0.

The world’s #2 cryptocurrency says that by this fall it will go through its so-called merge, where the Ethereum blockchain migrates from its current, slow method of processing transactions to one that radically ramps up the speed.

This is the key step in the Ethereum 2.0 upgrades.

If all goes as planned, Ethereum’s speed will jump to as many as 100,000 transactions per second from about 15 to 20 today. Meanwhile, costs will fall to fractions of a cent from tens to hundreds of dollars now.

Recent moves toward the merge have excited the crypto market.

After bottoming at $970 in June, Ethereum is now back at about $1,700. Other crypto assets have been moving up with it.

As such, once the merge occurs and the Fed moves off its overly aggressive rate-hike stance, we should see bullish sentiment return to crypto.

So, my message is one you hear a lot from me: patience.

Now, as for the crypto we own…

AUDIUS

Audius has spent the past quarter building out its service. The Ethereum- and Solana-based music streaming platform has recently introduced a new option that allows fans to send Audius tokens as a tip to their favorite artists. It’s the latest example of how crypto is changing social interactions.

What’s even more important is that Audius is gaining traction.

It’s up to 7 million monthly listeners from about 5 million last fall. And there are now 250,000 artists on the service, 2.5x the number from the same period last year.

Moreover, it’s increasingly attracting performers with huge followings, such as deadmau5 and Skrillex, two of the biggest names in electronic dance music, or EDM. That’s relevant to the degree that EDM is largely the domain of Gens Y and Z…who also happen to be the most frequent users of and believers in crypto.

So, while Audius is down about 63%, I have no concerns. Audius continues to emerge as a force in the crypto and NFT space as a streaming service.

Frankly, you’re going to read that a lot from me: I have no concerns.

We are very early in crypto and NFTs. As such, we have to go through the violent ups and downs, just as did the earliest investors in the internet two decades ago when it was all shiny and newfangled and moving so fast it was hard to keep up.

AVALANCHE

Avalanche’s performance over the past quarter serves as a fantastic example of how quickly crypto can move higher.

On July 19, Avalanche was trading at about $13.75. A day later it hit $26.36—a nearly 100% move.

Though we’re down about 63%, these kinds of moves are why I talk about owning good crypto projects and high-quality NFTs, and then riding out the inevitable storms. Crypto has a very big future across business, government, entertainment, education, and society as a whole, and owning/holding the solid projects is the path to wealth.

Avalanche is one of those solid projects. It’s a competitor to Ethereum in that it is a so-called “Layer 1” blockchain—or as I like to say, it’s the train track atop which run all kinds of trains (services for businesses and consumers). Audius, for instance, is the service (the train) that runs atop either Ethereum or Solana (the train tracks).

Avalanche is a blockchain of blockchains, meaning it allows others to build their own blockchains for their own purposes. For instance, that could be a university that wants a private blockchain for an entire ecosystem of university services.

What’s telling to me is that during the second quarter of this year, the amount of Avalanche that crypto owners locked into decentralized finance (DeFi) contracts increased to 152 million tokens from 115 million, a very healthy 32% jump.

What that means is that investors have been buying Avalanche at these cheap prices and increasingly depositing the tokens into what are essentially savings accounts or crypto versions of certificates of deposit.

It’s a bullish sign in that it says investors want to own Avalanche long-term and are using the crypto downturn to accumulate more.

RENDER TOKEN

Time magazine recently published a story called “Into the Metaverse,” making it the first mass-media outlet to address what is 100% clear: That society is moving inexorably toward a new version of the internet…the metaverse, the internet in 3D.

The big caveat Time rightly raised, however, is that right now, “We lack the computing power to pull off the metaverse as we imagine it.”

That’s very true. The metaverse as envisioned requires that everything in your field of view moves with you as you progress through space or change your perspective.

That requires a huge amount of rendering power, or the capacity of computers to instantaneously draw and redraw everything around you as you move.

And that is Render Token.

To refresh your memory, Render corrals the power of computer graphics processing units (GPUs) all over the world to create a global web of decentralized computing power. In practice, this means that teams building out various metaverses can tap into a vast amount of processing capacity to render metaverse graphics on the fly.

That is going to be a huge—huge!—component of the success of the metaverse over the remainder of this decade. Despite being down about 73%, Render is going to be right at the heart of that, which is why I remain so bullish on this crypto.

SOLANA

Solana is the new addition to the portfolio. We moved into Solana because it is one of the fastest-growing currencies in crypto, and has a huge and increasing share of the NFT market.

There are now days in which Solana has more NFT trading volume than Ethereum, even though Solana is a fraction of the size of Ethereum. In fact, Solana has become such a force in the NFT space that Ethereum-based NFT marketplaces have moved onto the Solana blockchain in an effort to grab some of the trading volume that happens there.

The big news about Solana from the past quarter touches on this reality.

The number of active wallets on the Solana blockchain is up sharply. In June there were 32 million active users of Solana wallets, up from an average of 20 million in the first four months of 2022. That growth is outpacing what many other blockchains are experiencing.

What does that mean?

That even as this crypto bear market carries on, Solana is attracting an ever-larger base of users. That’s pretty darn bullish.

I am confident that Solana has a very bright future, given its use in NFTs and its role in the emerging metaverse space. At $44, our Solana position is down about 17%, but I won’t be surprised to see Solana pushing $80 to $100 by the end of the year.

STAR ATLAS DAO

We’re down 78% in Star Atlas DAO. Part of that is because the play-to-earn gaming trend has fallen out of favor at the moment as crypto/NFT traders focus on utility plays. It’s also an ongoing function of the fact that Star Atlas won’t be released for many months yet.

Nevertheless, the team continues to build out the Star Atlas game and ecosystem.

In June, the company announced six new projects that will arrive over the next month or two. Star Atlas also hosted its first Council of Peace Assembly, an online gathering of different Star Atlas factions in order to showcase what will be a monumental, decentralized gaming metaverse.

I point this out only to highlight that in many ways Star Atlas is shaping up as the Star Wars of Web3. By that I mean there is a huge fan base that not only interacts with the media (the game for Star Atlas; the movies and TV shows for Star Wars) but that are also actively engaged in the lore and activities surrounding that media.

Star Atlas promises to be a blockbuster globally.

On an operational note, Star Atlas has partnered with MoonPay, the leading provider of crypto-payment infrastructure. The partnership will allow Star Atlas users to more easily move between fiat currency and crypto payments within the Star Atlas ecosystem.

THE SANDBOX

This is our direct play on the metaverse since Sandbox is, in fact, a metaverse. It’s one of the largest metaverses to exist yet.

Lots has been happening in metaverse news of late, and specifically with The Sandbox.

On a large scale, global consulting firm McKinsey recently released a report estimating that the metaverse could reach $5 trillion in global spending by the end of this decade. That includes spending on gaming, socializing, e-commerce, remote learning, and fitness (move-to-earn is an emerging trend that’s taking shape now in the crypto/NFT space).

The Sandbox, on the Ethereum network, is going to be a big player in that. It’s already a big player. Companies that have already moved into The Sandbox include Samsung, Adidas, Gucci, Atari, PricewaterhouseCoopers, among others.

Just this month, publishing/entertainment giant Playboy announced it’s launching in The Sandbox. And despite the crypto bear market, Amioca Brands, the company behind The Sandbox, announced earlier this month that it raised more than $75 million in venture capital money to expand and acquire metaverse targets.

This just reiterates what I’ve already written: The bear market is a temporary phenomenon, and the biggest players are exploiting this moment. That gives me added confidence that we are right to own crypto exposure in general and The Sandbox exposure specifically as our metaverse play.

We may be down 57% in Sandbox, but we are going to see big returns here when the crypto thaw begins.

UNISWAP

Finally, we have our position in Uniswap, which is down about 19%.

We were down more. Uniswap is up 80% in one month—again, reiterating just how quickly and dramatically crypto can move when the sentiment shifts.

Gamified stock-and-crypto trading firm Robinhood added Uniswap to its platform earlier this month, giving Robinhood users access to the crypto for the first time.

Moreover, Uniswap is moving into the popular NFT space. It recently announced the purchase of Genie, an NFT marketplace aggregator, meaning that buyers can search for NFTs from various collections across multiple marketplaces at once. Right now, Genie’s focus is the Ethereum blockchain, though that is likely to expand as Solana and others gain in popularity.

Either way, Uniswap’s move into the NFT space brings in a huge source of potential revenue. And once the Ethereum merge is complete, Ethereum is likely to see a large increase in its already-market-leading NFT transactions volume…which would only serve to benefit Genie and Uniswap.

As such, I continue to counsel patience with Uniswap. It’s the leader among decentralized crypto exchanges, and it’s going to become a key player in NFT trading.

For us, that’s a win-win.

Jeff D. Opdyke

Editor, Frontier Fortunes

© Copyright 2022. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. Registered in Ireland No. 285214. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this report should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this report should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.