Dear Global Intelligence Letter subscriber,

I was in Hong Kong, and I was on the hunt for money.

Specifically, I was looking for passive income. And I was hoping to find it in local, run-of-the-mill shopping malls.

Sounds odd, I know. But here’s the story…

Some years back, I spent a day crisscrossing the city, stopping at one local mall in each of Hong Kong’s three regions—Kowloon, Hong Kong Island, and the New Territories.

I stayed for an hour or so in each, noting whether shoppers were exiting to the street or to elevators that connect to the apartment blocks atop the malls, and noting what bags they were holding: supermarket, drugstore, clothing, dry cleaning, etc.

My on-the-ground research confirmed what I suspected: Hong Kong’s apartment-block malls are the epicenter of basic, daily consumer spending, meaning they’re busy no matter how the economy is performing. Economic expansion or recession, people have to eat, fill prescriptions, repair shoes, and buy toiletries.

That’s what these Hong Kong malls specialize in. So, I invested in the mall operator and I’ve happily been raking in an average dividend income of roughly 9% per year ever since.

That East Asian expedition was back in the mid-2000s. But my reason for the trip is just as relevant today: the hunt for passive income.

Back then, interest rates on U.S. savings accounts were essentially zero. Meanwhile, dividends paid by U.S. companies had plunged to the point that they were yielding barely over 1% on the S&P 500.

By that time, I’d been investing through overseas brokerage accounts for well over a decade, and I knew that if I wanted to earn meaningful passive income from my stock portfolio, I needed to look overseas. That’s because foreign companies routinely pay substantially higher dividends than their American counterparts.

All these years later…and I’m looking out across the same landscape. Interest rates are still nonexistent, dividends in the U.S. remain small, and overseas stocks are still the best place to find passive income.

Which is the reason for this month’s cover story.

In the July issue, I showed you how to generate as much as 12.68% in interest income through a low-risk strategy tied to so-called stablecoins—cryptocurrencies that are no more volatile than the U.S. dollar.

But I realize that not everyone feels comfortable just yet trading and owning crypto. I also know that lots of people want to generate income in their individual retirement accounts, yet most IRAs don’t offer access to cryptos (and those that do, won’t let you send your assets to third-party financial-services companies such as the crypto-banks I highlighted).

So, this month I want to show you an investment that creates passive income the old-fashioned way: in the stock market.

And in keeping with my overarching belief that the best stock-based income opportunities exist outside the U.S., we’re going to Canada for this month’s recommendation.

It’s a company that looks a whole lot like that Hong Kong business I invested in…except honestly, it may be even better. That’s because:

And unlike many foreign dividend stocks, you don’t need an overseas brokerage account to invest in it.

Let’s start off with a couple of facts every investor should know, and which should frame the investment decisions made in just about every portfolio.

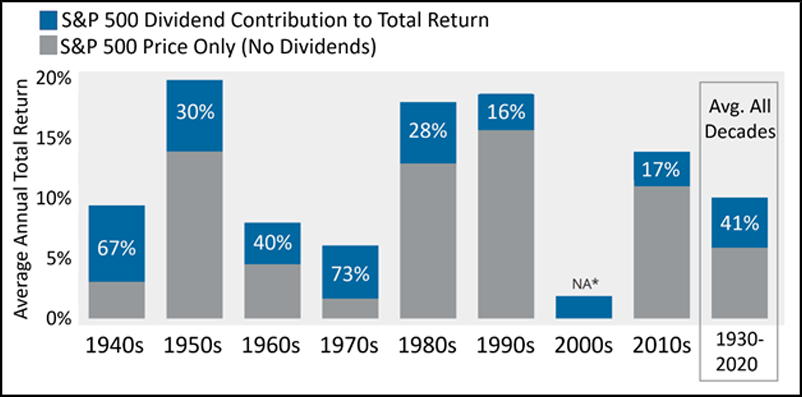

Fact #1: Dividends have contributed 41% to the S&P 500’s cumulative return over the past 90 years, versus 59% for stock-price growth.

You can see that in the chart below, which is based on data from investment research firm Morningstar. It shows dividends’ contributions to the market’s total return by decade.

(*The market recorded a net loss in the 2000s due to the dot-com and global financial crises.)

Fact #2: Between 1970 and 2020, the compounding of dividend payments accounted for 84% of the S&P 500’s total return. So, if you had taken your dividends and reinvested them in the companies that paid those dividends, then 84 cents of every dollar you earned was the result of dividends and the returns those dividends generated.

Those two data points are incredible.

That 84% figure is all the proof anyone needs for why owning dividend-paying stocks—and reinvesting those dividends—is a fabulous strategy for growing your portfolio over time.

But what about investors already in retirement who want income to fund their current living expenses?

They’re not looking to reinvest their dividends. They’re taking the cash to supplement Social Security checks or help fund a grandchild’s tuition or whatever.

So, do dividend stocks also pay off as handsomely when you have a Steve Miller Band strategy? You know—take the money and run…

Unequivocally, yes.

The chart above—and that 41% figure—is clear evidence that even without reinvestment, dividends are almost as important to generating returns as stocks moving up in price.

This is why I believe every portfolio needs stocks that spin out a regular stream of meaningful dividends.

At the same time, however, that chart also points to the challenges of hunting for dividends in America these days.

As you can see, dividends’ share of the S&P 500’s total return has been falling since the 1980s. This leads us to a question that every income investor should be asking:

There are two reasons why dividends have become less relevant to the U.S. stock market’s overall return in recent decades.

First, U.S. growth stocks have pretty much owned center stage for the last 30-plus years, and growth companies very often pay no dividends or very minimal dividends of 1% or less.

Amazon, for instance, still does not pay a dividend, despite becoming one of the world’s five biggest companies. Apple, a favorite among growth investors, yields a paltry 0.6%.

There’s nothing inherently wrong with that. Lots of investors don’t care about dividends. They would rather own companies that channel revenues into growing the business and, thus, the share price.

But if you want—or need—regular passive income from your investments, Wall Street’s overall low level of dividends makes the quest challenging.

The second reason dividends have become increasingly irrelevant in America is that companies over the last 40 years have gradually moved away from dividend payments to, instead, focus on spending shareholder money on stock buyback programs.

There is something inherently wrong with that.

Consider the S&P’s data for the first quarter of 2021, just one quarter in a very long-running trend:

The vast difference you can see in raw dollars and percentage growth is Corporate America eagerly engaging in stock-price manipulation for the benefit of C-suite executives.

Buying back stock artificially inflates corporate profits because it reduces the number of shares that exist.

The per-share profits grow larger simply because of a reduction in the number of shares. This pushes up the share price, which allows executives to dump at higher prices the stock options they’ve been given, thereby creating windfall wealth that otherwise wouldn’t (I argue “shouldn’t”) exist.

Securities laws once deemed this activity illegal. The Securities and Exchange Commission didn’t permit buybacks until 1982…coincidentally the decade when dividends started becoming less relevant to returns. Now, buybacks are a standard part of Wall Street’s manipulation.

Give me dividends over buybacks any day. Dividends are cash in my pocket that no one can take away. Buybacks are cash in executives’ pockets, and the temporary stock price boost can just as easily retreat.

Overseas companies aren’t as affected by these issues for a couple of reasons.

Investment opportunities abroad aren’t nearly as overexploited as they are in the U.S., where much of the world puts its money to work.

All the money flowing into U.S. stocks necessarily drives down the yield. That’s because yield moves in opposition to price. A $10 stock with a 50-cent dividend yields 5%. That same stock at $20 paying the same 50-cent dividend now yields just 2.5%.

So, all the cash that has flooded into the U.S. over the last decade of bull-market euphoria has pushed down the yield on the S&P 500 to extreme lows of just over 1.3%.

That’s barely above its historic low of 1.1%, which was reached just before the 2000 dot-com crash.

Moreover, while stock buybacks do occur overseas, they tend to be much less frequent. Partly, that’s because in much of Europe and other regions, shareholders have to vote to approve buybacks, while in the U.S. corporate boards decide on whether to pursue a buyback program (sort of like putting monkeys in charge of guarding the bananas).

Rather than buybacks, foreign companies tend to be much more focused on paying larger dividends.

That’s a function of investment culture abroad. In most overseas markets, investors expect to share in corporate profits, and, as such, even the smallest of companies, as well as growth companies, often pay a dividend. I know this from nearly 30 years of personal experience operating from brokerage accounts on five continents and investing across more than 20 countries.

Aside from the Hong Kong mall operator I mentioned, I’ve found substantial dividends in a British water utility, an Egyptian dairy company, a Russian financial-services firm, a Chinese supermarket chain, a Canadian burger chain, a New Zealand appliance maker, and a South African telecom company, among many others.

Yields I’ve picked up with those stocks have ranged from 5% to more than 11% a year.

So, based on my own experiences, and based on the research I do all over the world when looking for dividend stocks, I know that overseas is often the better option for dividend investors in an era when U.S. dividends have fallen to minimal levels.

Which is why I’m taking us north of the border—to Ontario, Canada—for this month’s recommendation.

The investment I am recommending this month is Slate Grocery REIT—a Canadian company that trades in Toronto, but which is available through traditional U.S. brokerage firms such as Fidelity, E-Trade, and Charles Schwab.

You won’t, however, find it on Robinhood or Webull or other app-based brokerages because most of those don’t offer access to many non-U.S. companies. (That’s one of the reasons I am not a fan of those invest-like-it’s-a-video-game firms.)

Before I tell you about Slate, I want to tell you about the stock because it’s a bit different than a typical stock.

Slate is part of a class of stocks known as “Canadian income funds,” sometimes called “income trusts.”

The word “fund” here is a bit misleading. It’s not a fund in the sense of a mutual fund or an exchange-traded fund, meaning we don’t own a few shares of Company A, a few of Company B, etc.

Instead, we own a collection of income-producing assets inside a single company. And under Canadian securities law, income trusts must pay to shareholders 90% of the company’s net cash flows (basically, the net cash a company generates).

This required income distribution makes Canadian income trusts very popular with dividend investors.

Roughly 60 such income trusts exist, giving out quarterly or monthly dividend payments that amount to annual yields of between 2% and 10%.

As a REIT—a real estate investment trust—Slate’s income derives from a collection of 80 shopping centers across the Southeastern U.S. The centers are anchored by supermarkets and also include a collection of other everyday consumer services ranging from walk-in medical clinics to Dollar General stores.

It’s the supermarkets that attracted my attention, however. They’re low-price leaders including Kroger, Walmart, Winn Dixie, Fresco y Más (catering to South Florida’s Hispanic communities), and others.

Though the U.S. economy is picking up, Americans on the whole are not necessarily better off. In fact, the middle class has been in decline for years, according to research from Brookings, Pew Research, the University of California, Los Angeles, and many others.

Census Bureau data from late last year show that more than a third of adult Americans struggle to pay basic expenses for housing, food, and transportation. The Federal Reserve, meanwhile, found that a third of Americans can’t afford a surprise $400 expense without going into debt or selling possessions.

And yet a third survey showed that 54% of adult Americans (125 million people) live paycheck-to-paycheck.

These studies highlight the reality that vast numbers of Americans do everything they can to make ends meet. Most prominently that includes cutting costs by shopping at well-known, low-price grocery chains such as those that anchor Slate Grocery’s properties.

The pandemic-ridden year of 2020 shows just what I mean.

Many Americans saw their income plunge last year as economic activity slowed sharply. And yet Slate Grocery continued its trend of posting net-income growth, which translated into the company’s largest-ever annual dividend payments.

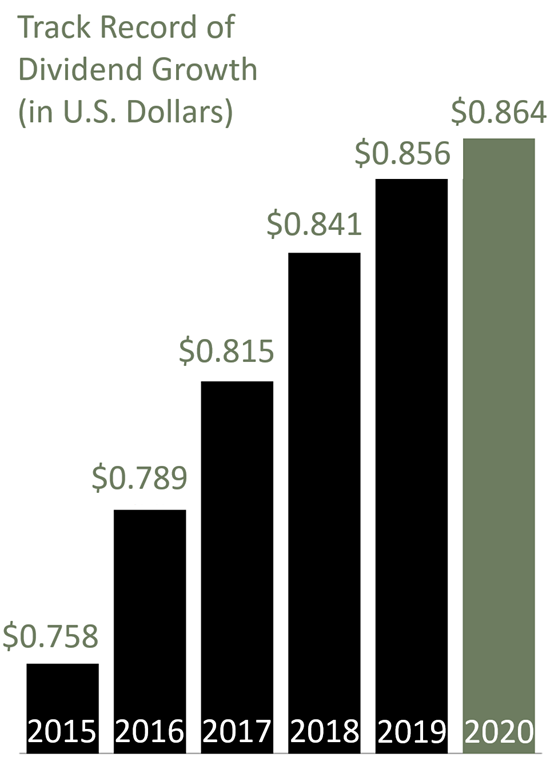

You can see the progression of Slate’s dividend payments in this chart:

As this shows, Slate’s dividend rose almost 14% between 2015 and 2020 to reach $0.864 last year.

It’s not hard to understand why: Regardless of whether the economy is up or down, people have to eat. But in a down economy, people strive to contain their costs.

Those who would typically hit up casual-dining eateries cook at home instead, necessitating extra trips to the supermarket. And those who typically eat at home anyway often scale down to lower-cost supermarket chains.

Walmart, America’s largest grocer, had record sales last year, for example, driven in part by a strong showing in its supermarket division. Kroger, America’s #2 chain, reported explosive sales in 2020. Southeastern Grocers had a great year, too. That trend was evident all across the supermarket sector.

Such sales, in turn, drive demand for supermarkets, which drives demand for leasing space in the centers that Slate operates across the eastern third of the U.S., primarily in the Southeast. That’s where incomes tend to be lowest and reliance on low-cost supermarkets is high.

And if we’re not talking about a pandemic year?

Well, it’s not like eating and supermarket demand ever go out of style. The chart above shows that even in normal economies, Slate’s business—and its dividends—have continually grown.

The primary reason we want to own Slate Grocery is because of its dividend payments. The share price itself is never going to explode higher. This isn’t a tech company—it’s a real estate company whose primary tenants are supermarkets, which are low-margin businesses.

So, Slate isn’t a stock to own for rapid share-price growth.

Slate, instead, is the equivalent of an equity certificate of deposit, by which I mean it’s functionally a CD that happens to be a publicly traded stock.

Based on its record financial results last year, Slate distributed cumulative dividend payments of $0.864 per share.

Assuming the same level of income this year (which is probable), Slate’s shares are yielding 8.1% as I write this.

That’s a substantial yield from a stable company whose operations are so basic, so necessary, and so simple to understand that you could draw an outline of the business with a Crayon.

That’s an equity CD to me: a stable stream of income from a non-volatile source—supermarket sales and sales of basic, everyday necessities. It’s as vanilla as you can get.

Better yet for income investors, there are a few sweeteners:

While Slate is a Toronto-listed company, the dividends are paid in U.S. dollars, so there’s no need to worry about any currency conversion.

The company also pays its dividends monthly, rather than quarterly. I’ve met numerous dividend investors through the years who try to structure their portfolios so they generate a regular stream of monthly cash, rather than the fluctuating payments of the traditional, up-and-down quarterly dividend cycle. Slate’s monthly dividend policy makes that simple to pursue.

And better yet, those dividends—$0.072 per share per month—will quite likely grow for a few reasons.

First, rent increases.

Lease rates often rise as existing rent agreements expire. And in a world where inflation is on the rise, those lease payments are very much likely to increase. That will lead to more income that Slate shares with us.

Then there’s expansion.

This past spring, Slate signed a deal to acquire a collection of 25 properties anchored by popular supermarket chains such as Walmart, Kroger, Tom Thumb, Stop & Shop, and others. The properties give Slate increased presence in both Dallas and New York (two huge markets).

The list of so-called “essential tenants”—those that cater to daily needs—represents 74% of income from those properties.

I like that because these are the types of businesses that consumers need no matter what’s happening to the overall economy. They are a stabilizing force for a shopping center operator.

Because Slate was able to grab the portfolio at a great price, the income it generates will immediately begin to flow through to the dividend payments once the deal closes later this year.

Beyond that, Slate also recently signed an agreement with a leader in telecom-infrastructure development to station 5G antennas atop its buildings.

This deal will help national telecom providers such as AT&T, Verizon, Amazon, Google, and others deploy and expand their 5G networks.

These are long-term leases that will each produce $30,000 in annual payments, with no associated costs. That’s money that, aside from some taxes, flows directly to Slate’s bottom line and into our dividends. Those payments will start in 2022.

Similarly, Slate is now researching opportunities to place solar panels atop its roofs, which would lower utility costs and allow the company to sell power back to the grid.

It’s also looking to drive additional revenue though “pop-up retail” and temporary, seasonal retail, both of which have become popular trends.

And Slate told shareholders recently that potential tenants have been touring its shopping mall properties. This strong interest in renting space has created “a deep pipeline of quality new-lease transactions that will further drive profits and occupancy,” the company said.

But it should be noted that its occupancy level is already quite high at 93.1%

All told, Slate is a growth-company of a different sort…it’s a dividend-growth company.

With portfolio expansion, lease-rate increases, and the other efforts to generate income with little to no associated costs such as the 5G contract, I expect we’ll see at least a 10% increase in monthly dividend payments over the next year. That would imply cumulative, annual dividends of $0.95 per share, and a yield of 9%, based on today’s price.

For that reason, I recommend that you:

Though the company is based in Toronto, you will find Slate Grocery trading on the over-the-counter market in the U.S. under the symbol SRRTF.

As I write this, Slate trades at $10.25. But even at $12.65 per share, you’d still be locking in a current yield of 6.8% and an expected future yield of 7.5%. That’s an excellent return.

Wall Street values REITs based on a metric called “funds from operations,” or FFO. This is basically the REIT equivalent of net profits that give us the ubiquitous “earnings per share.” That’s what Wall Street uses to calculate a company’s price-to-earnings ratio, the gauge by which investors determine if a stock is cheap or expensive.

Based on Slate’s most recent four quarters of reported FFO, the stock currently trades at an FFO ratio of 10. That’s cheap.

I mean, you can snap up a stock whose market valuation is only barely above its dividend yield. And those are rare finds among stable companies these days.

Frankly, Slate Grocery is everything I love in an income investment: It benefits from everyday consumer needs, the source of its dividend payments is stable, and its business is resilient.

With Slate, you’re grabbing shares of a company you can stuff into your portfolio and forget about…knowing it’s going to fulfill its role of dropping meaningful dividend payments into your account every single month, like clockwork.

Now, before I sign off, I want to circle back to that Hong Kong shopping mall company I bought all those years ago.

It’s the final piece of the story about why dividends play such a critical role in an investment portfolio, and why Slate Grocery should not only be a strong source of passive income, its share price should weather whatever economic weaknesses emerge.

Like Slate, the Hong Kong mall operator is a REIT. In the run-up to the global financial crisis that hit in late-2007, its shares were generally yielding in the 3% to 4% range, which was then a healthy payout.

By late-2007, however, the U.S. was in the early stage of the housing-inspired economic crisis. Hong Kong’s main stock index, the Hang Seng, would ultimately fall nearly 60% by spring 2009, shadowing the collapse in the S&P 500.

My Hong Kong REIT fell, too, of course. But it was down only about 33% by late-2008, and then actually rose as the world’s stock markets continued their decline.

The reason: the dividend.

By late-2008, the dividend yield had risen to more than 6%. (Remember, a falling share price means a rising dividend. If we use our example from earlier, a $10 stock with a 50-cent dividend yields 5%. If that stock falls to $5, but offers the same 50-cent dividend, the yield is 10%.)

The mall operator’s dividend of 6% was then well above the norm for the stock, prompting investors to step in and buy the shares.

They knew the firm’s malls are an essential part of Hong Kong’s daily life, no matter the economy. Which means they knew the dividend was likely pretty safe (indeed, the dividend rose continually throughout that period). So, investors shifted cash into the shares, which slowed and then stopped the price decline.

The dividend, in effect, acted as a brake on the share price. It prevented the stock from collapsing because investors saw a dividend north of 6% as a substantial yield for a solid company with unceasing consumer demand. At that level of income, they were happy holding the stock, regardless of the economy.

That’s what I would expect for Slate Grocery.

I am not saying the shares cannot or will not fall during bad periods for the overall stock market. But the everyday necessities provided by Slate’s tenants mean that its income will very likely remain robust enough for the company to keep paying dividends.

And those payments, in turn, should provide a certain level of support for the shares in the event bad times roll around.

At the end of the day, that’s what I went looking for in Hong Kong years ago, and it’s what I see now in Slate: an above-average yield in a company with strong demand for its services, and the capacity to weather even a significant economic downturn.

Well, COVID’s back.

As I write this in late-July, stocks are struggling amid fears that the COVID-19 Delta variant will thwart the global recovery in the near term. That’s a possibility. What is certain, however, is that the big trends we care about are longer-lived than temporary COVID fears.

I don’t say that to downplay the pandemic. I’m merely pointing out that Wall Street’s nature is such that it knee-jerk reacts to anything vaguely unsettling, before coming to grips with it and moving on to the newest shiny object.

Back in early 2020, Wall Street’s collapse was justified—no one had any clue what COVID-19 would mean as it spread globally. Now, however, we have vaccines that are quite effective at halting COVID’s progression, and which are good at minimizing the severity of the Delta variant.

Nevertheless, the variant’s explosion among the world’s unvaccinated is causing fears in the market that global economies will slow and, maybe, slip back toward recession.

Our positions in the Invesco Swiss Franc Trust and Norwegian krone have been impacted marginally (the franc’s flat; the krone’s down about 3%). Those moves aren’t unexpected. They’re a function of uncertainty sending global investors into the dollar for temporary safety. It always happens this way.

But the rationale for owning the franc and krone hasn’t changed. The dollar remains fundamentally troubled by masses of debt that just…keep…growing. We’re closing in on $29 trillion in national debt, nearly 130% of our gross domestic product. That’s unsustainable.

We want the safety of the Swiss franc, which has always been a safe-haven currency, and which over time will continue its incessant, long-term march higher against the dollar.

The krone, meanwhile, has oil going for it. I’ve been saying oil will very likely approach $100 per barrel this year. Brent Crude (a global benchmark) is north of $70 now. Assuming economies continue to reopen, oil demand will keep rising—as will oil prices.

The krone, an oily currency because of Norway’s status as an oil-rich economy, will resume its trend of strengthening against the dollar. So, if you don’t own the franc or the krone, now’s a solid moment to build a position.

Our equity positions, meanwhile, are in the black. MSCI Global Gold ETF is up about 13%. Yara International, the Norwegian maker of agricultural chemicals, is up more than 6%. And MSCI One Belt One Road ETF, is up just under 3%. The trends they represent remain intact: debt, inflation, and the commodity super-cycle.

As with the franc and krone, they’re temporarily overshadowed by COVID concerns. But once that passes, it’s onward and upward.

Finally, there are our crypto positions, most of which are under water. That, too, is partly a function of the current COVID worries since Delta variant fears are impacting all risk assets, and cryptocurrencies (aside from my recommended stablecoins) are quintessentially risk assets.

Along with COVID, the cryptoconomy is also being impacted by a continual stream of stories about governmental regulation. On that front, New Jersey, Alabama, and Texas have recently alleged that BlockFi’s interest accounts violate state securities laws. BlockFi says those states don’t understand its products and the company is fighting back.

It’s important to note that these moves do not affect existing BlockFi customers.

Since BlockFi’s crypto interest account is one I recommend for anyone who wants to earn passive income from stablecoins that shadow the U.S. dollar, I’m monitoring this situation very closely and will keep you posted on any further developments.

Overall, however, I see no real reason to worry. A lot of the angst stems from regulators who don’t understand crypto and are applying 20th-century regulations to 21st-century finance. There will be a shakeout period, as I’ve said many times.

But by holding tight, and understanding that crypto and decentralized finance (DeFi) is our future, we will come out way ahead.

By Ian Bond

Ian Bond is a pseudonym for a banking senior executive with over three decades of experience in wealth and asset management. He also owns online stores that generate millions of dollars in annual revenue. The pseudonym is used to protect his employer.

What do basketball legend Shaquille O’Neal, lifestyle guru Martha Stewart, and former House Speaker Paul Ryan have in common?

They’re among the numerous celebrities and prominent figures who’ve jumped aboard the hottest investment trend in the U.S. by launching a special purpose acquisition company, or SPAC.

SPACs are publicly traded companies that are created solely to raise money for the purpose of buying another, as-yet-unidentified business. For this reason, they’re often called “blank-check companies.”

In essence, the individual or investment team who launches the SPAC—called the sponsor—is asking for your trust. You provide capital by buying shares in their SPAC. Then, using that cash, they look for a private company to acquire and take public through a merger with the SPAC. After the merger, your SPAC investment becomes stock in whatever company they’ve bought.

These vehicles can be a great way for ordinary investors to get in on the ground floor as companies list on the market. And they’ve taken the investment world by storm.

Two years ago, 59 SPACs were launched on Wall Street that collectively raised more than $13 billion. In 2020, 248 SPACs raised more than $83 billion. And by the start of June, the figures for 2021 had already exceeded last year’s total, with some 330 SPACs amassing more than $100 billion in capital.

This SPAC frenzy has seen some truly breathtaking deals. For instance, since fantasy sports betting company DraftKings went public in April last year by merging with a SPAC, its valuation has risen from $3 billion to $20 billion—netting SPAC investors massive gains.

That’s not to say, however, that this space is without risk.

For every DraftKings, there’s a Nikola Corp. The electric truck startup has plunged about 80% from its market high since listing through a SPAC merger last year. That fall came after the company’s now-ousted chairman was accused of exaggerating claims about its technology.

Moreover, there are now concerns that with large numbers of SPACs out there hunting for companies to buy, sponsors will be inspired to take gambles on risker ventures.

While these concerns are valid, my take is the opposite: I believe this is a perfect time to profit from SPACs…as long as you adhere to the key rules of investing in them.

If you recognize my name, it’s probably as an investor in online stores. I’ve written in these pages before about how I built my multimillion-dollar retail website businesses and how you can tap into this opportunity. (I also blog about this topic at Professional Website Investors.)

What you may not know is that I’m also a Wall Street insider, having spent decades working in senior executive positions for some of the world’s leading investment banks including Goldman Sachs and Citigroup. Over my career, I’ve researched and traded virtually every asset class you can imagine. That includes SPACs.

I first became aware of SPACs back in the ’80s. In those days, these were shady instruments that existed only in the highly dubious “penny stock” markets. That started to change in the 1990s and 2000s, when the SEC enacted a series of reforms to clean up the sector. Those reforms enabled the big investment banks to get involved and SPACs became legitimate.

Still, SPACs didn’t really enter the mainstream until the past several years. There are a few reasons for this.

Back in the mid-2000s, few high-quality private businesses were interested in going public through SPAC deals. Then came the 2008-2009 global financial crisis.

After the crash, private enterprises became reluctant to go public at all given the widespread economic volatility. In fact, in the period stretching from just before the crisis until the COVID pandemic, startups on average stayed private longer than at any other time in history…preferring to raise money by going through multiple venture capital rounds rather than risk listing on turbulent markets.

Consider, for instance, that Amazon went public at a $300 million valuation in 1997, while Uber went public in 2019 with a $75 billion valuation (which means much of company’s explosive growth phase was already over).

But by around 2018, with stocks bouncing around near record highs, many startups were eager to try fundraising in the markets.

The problem was that the traditional process for listing, an initial public offering, is time-consuming and it involves extensive due diligence proceedings. Moreover, around this period, the U.S. was struggling through a bitter election and later a global pandemic. So, companies turned to SPACs as a faster, easier way to debut on the market.

At the same time that all this was occurring, markets were seeing an influx of money from ordinary investors. Given the extreme valuations in stocks, these investors were eager to hear about new, high-growth opportunities. The conditions were perfect for SPACs.

SPAC sponsors are typically well-known entrepreneurs or investment firms, though as I mentioned at the outset, celebrities have been getting involved as well.

Generally, before launching their SPAC, the sponsor will identify a broad business class they want to invest in, say space tourism or real estate or computer technology. Then, in partnership with an investment bank, they will conduct an IPO for their SPAC so that it’s publicly listed. Sponsors are often rewarded with a 10% to 20% ownership stake in the SPAC for free or very little consideration.

During the IPO, investors can buy SPAC units. These are typically set at $10 each and comprise one share and a fraction of a warrant. This piece of a warrant is a contract that allows the investor to purchase an additional share in the future at a certain price, often $11.50.

SPAC units are offered for roughly 45 to 52 days, before the shares and warrants start to trade separately. You can buy SPAC shares through a standard brokerage account just like any other stock.

After sponsors raise capital through their IPO, they usually have 18 to 24 months to make a deal. If they don’t, investors get their money back. Sometimes all the money is returned, though often fees of 5% or more are deducted.

Once the sponsor strikes a deal, it’s subject to approval by shareholders. If the acquisition is not approved by the majority of investors, the sponsor will still have the rest of the timeframe to close a deal or be forced to return investors’ money.

Each individual SPAC shareholder also has the option to opt out of any deal, meaning if you don’t like the target or the terms, you can take your money back.

When a deal is complete, the SPAC and the acquisition target will merge and your existing SPAC stock will become the acquired company’s stock and begin trading based on the merits of that company.

The most important thing to understand about investing in SPACs is that you can choose when to invest.

You can buy into the SPAC during its IPO. However, by doing so, you are placing your faith completely in the sponsor. That’s because at that time, the sponsor has no idea what company they’re going to buy. Under securities laws, sponsors cannot negotiate with companies before the SPAC is established.

Alternatively, you can wait until the sponsor has identified an acquisition target and revealed the terms of the deal. To my mind, this is always the better strategy.

After their initial listing, SPAC shares can fluctuate somewhat in value as rumors spread about the acquisition target, but generally they remain around $10 until a few weeks or a month before the merger is complete and the combined company debuts on the market.

So, the way to profit in this space is to identify a number of SPACs launched by high-quality entrepreneurs or investment firms, and follow them as they try to find an acquisition target. Then, once they’ve announced a deal and released its terms, you can decide whether you want to invest.

Now, you may be thinking: By then, isn’t it too late to invest?

Actually, no. The reason is that Wall Street isn’t paying attention.

One of the perks of my job as a senior banking executive is that I have a Bloomberg terminal on my desk. The service, which costs about $1,500 per month for an entry-level subscription, gives me access to a vast amount of market news, research, and insights that are hidden from ordinary investors.

On this terminal, I can look up a stock and see all the latest ratings and price targets from all the Wall Street investment firms tracking it. The more firms tracking a stock, the more research there will be. For instance, with big names like Apple, Amazon, Facebook, or Google, you’ll typically have more than 50 firms producing investment research and price targets.

So, how do SPACs stack up?

Well, most SPACs have only two or three firms providing research. And these firms are typically the underwriters of the IPO for the SPAC, placing them in a highly conflicted position.

Institutional investors simply don’t commit resources to investigating SPACs…that is until they announce an acquisition deal. Then they start to rate the SPAC on what its prospects will be after the deal closes. But this process takes them some time and they rarely invest until shortly before the combined listing.

This means that we have a window of opportunity between the announcement of the deal and the merger. If you’re willing to do the research, you can genuinely get in on the good SPAC deals before institutional investors.

This has long been true of SPACs, but now there’s also another, more immediate reason why I believe we can find excellent value in this asset class—the newfound negativity surrounding it.

SPACs have started to lose their luster due in large part to the Securities and Exchange Commission’s new focus on them.

In April, the SEC released a warning to retail investors about SPACs, advising them to be mindful of high sponsor or management compensation, celebrity involvement, and the potential to be drawn in by baseless hype.

More recently, it demonstrated its willingness to crack down on dodgy SPAC deals. In mid-July, for instance, several parties involved in the planned merger between a SPAC and space exploration company Momentus forked over $8 million to the SEC to settle allegations that they misled investors.

To me, these moves are of no real concern. Investors should welcome the SEC punishing any violations such as these. And its statement in April merely outlined facts about the SPAC sector that every investor should know.

Still, as a result of these moves by the SEC, there is downward pressure on SPAC shares. Retail investors are showing greater eagerness to sell below the $10 buy-in price or exit the first time that the stock trades above the $10 mark.

This new nervousness among retail investors—alongside the fact that there are lots of good private companies ready to go public, and institutional investors typically ignore SPACs until the acquisition deals are nearly finalized—means we have an excellent opportunity to profit from SPACs.

The key, of course, is knowing how to tell the quality SPAC deals from the duds.

There are four rules of thumb I apply to every SPAC deal to see if it is worthy of investment. Note, here, that I said “SPAC deal.” You should invest in a SPAC only when you know the merger details. As such, these rules cannot be applied until you know the acquisition target.

Rule #1: Stick to sponsors with track records of success in the sector.

According to a study by Wolfe Research, the single biggest make-or-break factor in the performance of a SPAC after its merger is the sponsor’s experience in the field of the acquired company. This marries with my experience.

Forget celebrities and politicians and sports stars. Sponsors should be professional investment or asset management firms that have relevant expertise in the sector they’re exploring. Indeed, the bigger the investment firm’s other assets similar to its acquisition target, the lower your risk is likely to be.

Also consider this: If the sponsors are buying into a field in which they have expertise, and the SPAC does poorly, their reputation and ability to run their current business may suffer. So, they have extra incentive to succeed.

Rule #2: The acquisition company must have current earnings.

When it comes to the acquisition target, I’m looking for a company that is trying to get public quickly through a SPAC, skipping the traditional IPO process. I’m not looking for a “concept stock” or “story stock.”

So, forget companies with no revenue history in areas like space tourism, electric vehicles, or other “sexy” fields. These are moonshots. Some of them will pan out, sure, but most won’t. Basically, if the acquisition target has zero current earnings, that’s a deal-breaker for me.

Rule #3: The acquisition company must have been in business for more than five years.

Sometimes brand-new startups can appear to be attractive acquisition targets. They might seem to possess an exciting new technology or have an advantageous position in an emerging sector. But when it comes to my investments, I prefer companies to have a management track record spanning at least five to 10 years.

SPACs can get companies onto a stock exchange quickly, without the vetting they get with a traditional IPO. Ineffective management can go unnoticed (or be willfully avoided by the sponsors) until it’s too late.

My view is that with so many terrific “older” companies seeking to go public, there’s no need to gamble on two or three-year-old businesses within unproven management teams.

Rule #4: Wait until the deal is about to close, or already closed, before investing.

As I mentioned above, SPACs will typically trade around their offer price, usually $10, until near or just after the close of the acquisition. Occasionally, they will trade up a bit prior to the merger date. That doesn’t bother me. I’m patient and like to buy after the deal is closed.

As a long-term investor, I am OK not picking the exact bottom. I prefer knowing the deal is finalized as planned before investing my money.

Finding deals that adhere to these criteria will be challenging. However, with some research, it’s certainly possible. Recently, I’ve seen two deals that match up well with these rules.

Before I share these examples with you, I want to emphasize that these are not investment recommendations. Further research is needed before I would buy into either of these SPACs. However, these provide a good outline of the kinds of SPAC mergers I look for.

The first is Starboard Value Acquisition Corp. (SVAC). The sponsor of this SPAC is Starboard Value LP, an investment firm noted for identifying undervalued companies, typically in the technology space. SVAC went public on Sept. 10, 2020 at $10 per share, raising $360 million. In February, it announced a deal with Cyxtera, which owns more than 60 data centers.

Another example is Altimar Acquisition Corp. II (ATMR). This SPAC was launched by HPS Financial, spun out of an impressive investment group acquired by JP Morgan called Highbridge Capital. ATMR was launched earlier this year, also at $10 per share, raising $345 million. In mid-July, it announced a merger with Fathom Digital Manufacturing, a company that uses 3-D printing to make prototypes and complex manufacturing parts with reported revenues of $150 million last year.

In both of these cases, the deals have been announced but not closed, and they involve sponsors with solid track records choosing established companies in growth (but not flashy) industries. And even though these deals have already been announced, the share prices of the SPACs have yet to move significantly. At time of writing in late-July, SVAC is trading at $9.92 while ATMR is at $9.85. This is what I mean by a window of opportunity.

Over the next few years, I predict there will be a ton of private companies acquired by smart sponsors at really attractive valuations. If you can keep your ear to the ground, and tolerate the inherent risk, SPACs can be a great way of adding real growth to your portfolio.

■China has just launched a brand-new market…and it’s very good news for the planet.

Perhaps the most underreported story in the world last month was the long-awaited trading debut of China’s national carbon market.

Carbon markets give companies a limit on the amount of emissions they can release per year and then allow them to buy and sell emissions units based on whether they expect to be under or over their quota. The idea is that this will incentivize firms to lower their emissions over time.

China’s carbon market starts with about 2,200 companies from the country’s coal and gas power sector. This industry accounts for a large amount of China’s carbon emissions, which are the highest of any country in the world at more than 10 billion metric tons per year. That’s more than double those of the U.S., according to World Bank data.

While it’s certainly good news for the planet that China has launched this market, prices will need to increase sharply if they are to encourage Chinese companies to cut their emissions. On the market’s July 16 trading debut, carbon closed at 51.23 yuan ($7.90) per metric ton. That’s way too cheap to spark a significant change in behavior.

By way of comparison, carbon costs around $60 per ton on Europe’s carbon market. And in a 2016 paper, the World Bank estimated that carbon would need to cost 157 yuan ($24) to reduce Chinese emissions in 2030 by just 16% from their baseline forecast.

Pricing aside, China will also have to include more industries if it wants this market to succeed. Two thousand firms is simply too few to have a substantial impact on national emissions. Chinese officials said they plan to expand the market to cover as many as 10,000 emitters across a swath of sectors, but there is no date for implementation.

Still, China’s leadership, which is notoriously sensitive to criticism, wouldn’t have launched a project on this scale unless it was committed to making it work. So, it will be fascinating to see how the market evolves.

I’m particularly interested in seeing whether China allows speculators to access the market. At present, the participating firms trade carbon among themselves. However, allowing financial institutions to get involved could be an effective way to raise prices. Plus, it could lead to some novel investment opportunities.

■Africa’s most populous country joins the digital currency bandwagon.

The U.S. is researching a digital dollar. Europe has plans for a digital euro. China’s already field-testing the digital yuan. Now, Nigeria is reportedly getting involved, with plans to begin testing its own central bank digital currency later this year.

Central bank digital currencies, or CBDCs, are our sovereign currencies like the dollar, euro, etc., but they will exist digitally on the blockchain…just like bitcoin. Governments want CBDCs because they will give them massive financial control. With CBDCs, they will be able to see each and every transaction we make. And they will be able to more precisely control the amount of money in the economy.

According to news reports this month, Nigeria has been researching a CBDC for years and plans to begin testing it as soon as October. The speed at which Nigeria is pushing ahead with a CBDC has caught many analysts off guard. However, it is not surprising that the country has decided to move down this route.

A 2021 study by British research platform Merchant Machine found that 60% of Nigeria’s more than 200 million people don’t have bank accounts, yet the country has a relatively high internet penetration rate of 70%.

In this environment, the use of cryptocurrencies has been booming. That’s because if you have a smartphone and internet access in the developing world, it can be easier to open a crypto-trading account than a bank account.

Indeed, in Nigeria, Africa's largest economy, crypto-trading volumes have grown 128% over the past year. And according to a recent poll by Statista, one in three Nigerians have owned or used bitcoin, compared to one in six Americans.

Since governments find it hard to monitor cryptocurrency transactions, this means Nigeria is losing track of a significant proportion of its economy. The CBDC is a way of regaining control…which is why it’s pushing ahead so quickly.

This is a pattern I expect to see play out again and again over the coming years in countries with large unbanked populations. As crypto becomes increasingly popular in the developing world, governments will have to embrace it, as El Salvador has done by making bitcoin legal tender, or they will need to develop CBDCs.

■Bitcoin ATMs are coming to a Circle K near you…but you shouldn’t use them.

The last time you stopped off at your local Circle K to top up on gas or grab a coffee, you may have noticed a new addition to the store—a bitcoin ATM machine.

These kiosks allow you to buy three cryptocurrencies: bitcoin, Litecoin, and Ethereum. You insert cash and the machine sends the crypto to your online wallet.

Over the past year, Atlanta-based Bitcoin Depot has installed more than 700 of these machines at Circle K locations across 30 states. And it plans to boost that number to more than 6,000 by the end of 2021. However, I would advise against using these machines because they seem to be a complete rip-off.

Bitcoin Depot does not have information about its fee structure on its website, but online reports have claimed that the company charges a transaction fee of about 20%. That’s an insanely high figure. Compare that with the fees on my recommended exchange Binance.US, which can be as low as 0.1% depending on your transaction type and payment method.

My advice is to always buy your crypto through a reputable exchange with clear fee structures.

■Planning a trip to France? You’ll need one of its new “health passes.”

In late-July, France began enacting its new passe sanitaire, or health pass, policy. From Aug. 1, any adult wanting to visit a movie theater, cultural venue, sports match, restaurant, café, or shopping mall has to show one of these passes to enter. From Aug. 30, the passes will also be required for children aged 12 to 17.

If you’re traveling from the U.S., your vaccination card from the Centers for Disease Control and Prevention will be sufficient to enter France, but it will not qualify as a health pass. To get your health pass, you will need to go a French doctor or pharmacist after arriving and present your CDC card. Then they will be able to use this to create a paper or digital French health pass for you.

■If you want to refinance a loan or take out a new one, there’s probably never been a better time.

With interest rates at or around record lows, money is incredibly cheap at the moment. However, it may not stay this way forever.

The Federal Reserve has stated that it plans to maintain current interest rates until 2023 at least. However, inflation is rising rapidly, with the consumer price index increasing by a massive 5.4% in June from a year earlier.

If inflation rates continue growing like this (and I expect they will), then the Fed is going to come under significant pressure to raise rates sooner. That’s why if you had planned to take out or refinance a loan, I’d act soon.

Right now, you can get 15-year fixed refinance mortgages at rates of just 1.85%. Auto loan rates, meanwhile, are available from just 2.49%. I seriously doubt we’ll see better deals than these in the months or years ahead. For a comprehensive list of your loan options, visit the comparison site Bankrate.

■Forget $1 homes in Italy. Get a house in Japan for free.

This may come as a surprise given Japan’s large population of 126 million, but the country has a big problem with abandoned homes.

According to a 2018 survey, there are around 8.5 million empty homes in Japan. That means one out of every seven houses in the country is abandoned.

These empty houses, called akiya, are the largely the result of the country’s rapidly aging population and increasing urbanization. To deal with these akiya, many local authorities in Japan sell them for as little as $500 or sometimes even give them away for free.

Of course, “free” is never really free and there are a lot of caveats with this.

First, most of these homes are located outside Japan’s major cities and require considerable renovation, though you can find some that are in good condition or located in urban centers. (Even in Tokyo, 10% of homes are abandoned.)

Second, to get a house, you must be willing to live in it for at least part of the year. Some akiya contracts will require that you live there permanently, though others allow you to live on a temporary basis. Lastly, and most problematically, home ownership does not qualify you for residence status in Japan (though Americans can spend 90 days in Japan visa-free).

However, if you love Japanese culture, and the idea of your own home in rural Japan sounds appealing, it may be possible to get one very cheaply. You can read more about akiya, and learn about some Japanese-language sites with listings of them, here.

■Are you a fan of the great outdoors? Well, if you’re 62 or older, you can get a lifetime national park pass for $80.

Uncle Sam operates more than 2,000 federal recreation sites including 63 national parks. And when you hit 62, you can get a lifetime pass to access all of them for an incredible one-time fee of just $80.

America the Beautiful—The National Parks and Recreational Lands Senior Pass (quite the mouthful) is available to purchase online from the United States Geological Survey’s online store here. Note, however, that there’s an extra $10 fee for online orders. There are also currently shipping delays due to the pandemic. So, if you need your pass in a hurry, you can find a list of physical locations where you can buy them here.

Also note that if you’re an eager volunteer who has more than 250 service hours with federal agencies that participate in the Interagency Pass Program, you qualify for a free annual America the Beautiful pass. You can find more information about the free pass for volunteers here.

■Here’s a simple trick to make your printer ink last much longer.

This may sound strange, but your choice of font has a big influence on how much ink your printer uses.

Arial, one of the most popular fonts, consumes a considerable amount of ink. If you switch to using Calibri, Times New Roman, or Century Gothic instead, your ink will last up to 30% longer. You can also further extend this by printing lighter versions of the font, say gray instead of black.

Another strategy for extending your ink is to download an ecofont. These fonts have small, barely noticeable holes throughout each letter, which means they use up to 50% less ink. You can download a Vera Sans ecofont here. (Click on the green download button in the “Font Info” box on the top right.) And you can learn how to install a font on Windows here and on Mac here.

■Does it seem like everyone has a cold at the moment? It’s not your imagination…

According to the Centers for Disease Control and Prevention, cases of common viruses that cause cold and flu symptoms, including respiratory syncytial virus (RSV) and human parainfluenza viruses, are much higher in the U.S. this summer than in past years. Similar surges are being reported in Australia, Europe, and South Africa.

The reasons for this are pretty obvious. The lockdowns of recent months not only prevented the spread of COVID but colds and flus as well. Now, as the economy reopens, people are mingling again. However, they don’t have immunity to the latest viral strains, since they weren’t exposed to the viruses last winter.

As a result of this surge, infectious diseases experts are advising people who are particularly susceptible to viruses such as RSV—including the elderly and very young children—to follow basic precautionary guidelines. These include washing your hands frequently and getting plenty of rest, which helps ensure your immune system is in top fighting form.

Thanks for reading and here’s to living richer.

Jeff D. Opdyke, Editor

Global Intelligence Letter

© Copyright 2021 by International Living Publishing Ltd. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of International Living, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit www.internationalliving.com/about-il/customer-service. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We expressly forbid our writers from having a financial interest in any security they personally recommend to readers. All of our employees and agents must wait 24 hours after online publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.