Dear Global Intelligence Letter Subscriber,

“Please mine more nickel, OK?”

Elon Musk urged miners to mine more nickel back in a 2020 call with investors…

But why nickel?

Nickel is part of what I’ll call the “Four Horseman of the Eco-pocalypse.”

The other three are copper, lithium, and cobalt.

All four are key components in something very dear to the Tesla founder’s heart… Electric vehicles (EVs) and the global transition to electric cars and trucks that’s underway.

You see, the seedy underbelly of the green movement is the fact that it depends entirely on the mining of those four metals—which is, ironically, an extremely dirty business.

But the green movement wants more and more EVs on our roads—to replace our gas guzzlers…

This is despite the irony of EVs’ non-green origins.

We won’t argue with the eco-warriors…

We’ll just smile and exploit this opportunity… by owning financial exposure to the seedy underbelly.

They can have their Pyrrhic victory while we profit.

That’s what this month’s Global Intelligence issue is all about.

In recent months, a number of mainstream media stories have reported on the lackluster demand for EVs.

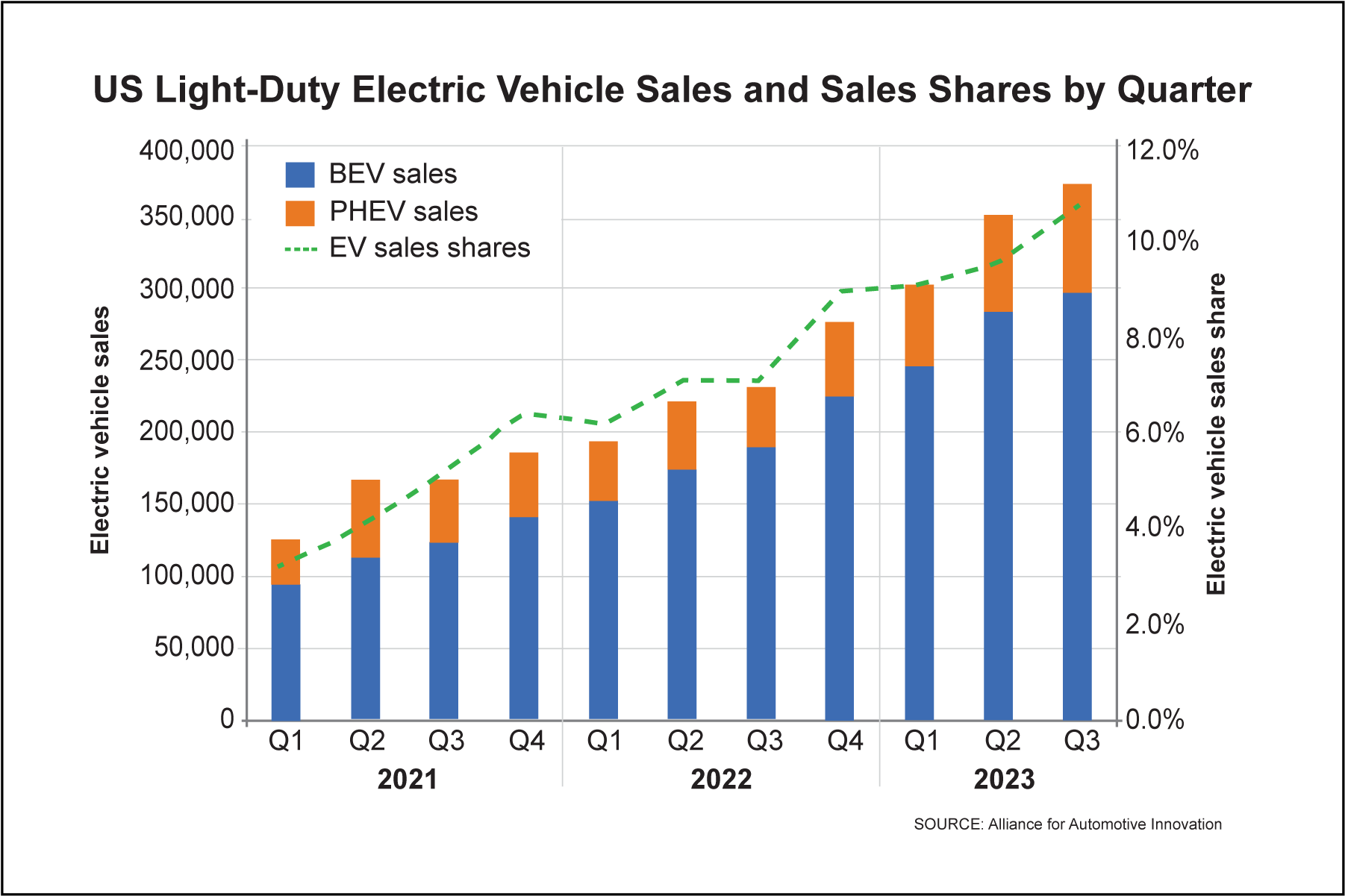

The truth is, however, that demand for EVs grows every year.

Indeed, 2023 saw US sales hit a record 1.2 million cars and light trucks.

Since Q3 2021, EV sales have increased every quarter.

So the idea that EV sales are disappointing is misstated.

Moreover, good, bad, or ugly, the world is moving permanently toward EVs as the only type of car that consumers will be able to buy.

California has mandated that EVs must represent 35% of all new-car sales by 2026, a very short two years from now. That climbs to 100% by 2035.

And where California goes, the rest of the country tends to follow—like it or not. Economically, California represents 15% of US GDP—the largest of any state. And if it were a country, California would be the fifth-largest economy in the world. So California's economic heft means that the changes and trends that begin here almost always migrate across the country.

A similar mandate is coming into force in Europe—with a similar timeframe.

And China, the largest vehicle market in the world, has mandated that 40% of cars and light trucks be EVs by 2030.

The point here is that the world’s three largest car markets are driving mass adoption of electric vehicles.

Whether consumers want them or not, EVs are soon to be the only kinds of new cars and trucks that will be available.

Which means… massive demand for nickel.

At the moment, nickel’s most common use is in the manufacturing of stainless steel. That accounts for about 70% of global demand.

Batteries are a distant also-ran, consuming just 5% of global demand.

In the last couple of years, however, nickel has emerged as what the energy industry labels a “critical metal”…

That’s largely thanks to the rise of electric vehicles and the battery technology necessary to power them…

Those batteries gobble up a lot of nickel, since it is the key player in the lithium-ion batteries that power most electric vehicles.

The typical Tesla battery contains about 110 pounds of nickel, while the typical non-Tesla electric vehicle contains about 90 pounds of nickel.

The typical gas-powered car: 0 nickel.

All of this, in a roundabout way, sends us all the way down to South America…

To Brazil, to be specific.

There, we have the opportunity to buy a major nickel producer that’s way undervalued…

I usually hold off until later in my monthly newsletter before revealing the name of the company I’m recommending.

But this month I’m sharing the name of the company up front because I need to tell you the story of why this stock is undervalued. It’s much easier to do that by telling you here that the company I’m recommending this month is Vale, S.A.—a multinational mining giant and the world’s largest producer of iron ore and nickel.

Today, the stock sits at a price nearly 50% lower than its post-COVID highs. At that price, the shares trade at a Lilliputian price-earnings ratio of just 6.6, yet it offers a Brobdingnagian yield of nearly 11%.

Better yet, we’re moving into an inflation/interest rate environment that looks to be highly supportive of the company’s operations and its share price.

So why is this stock undervalued right now?

Because the Brazilian government is currently meddling in Vale’s affairs. That has depressed the stock price in the short-term.

But long-term, there’s not much the government can do to hamstring Vale—and the future looks bright.

Wrap all of that together—the good and the bad—and we have an opportunity today to pack away a stock with appealing long-term price appreciation at a government-induced sale price.

Let’s call it The Stinky Finger Discount…

Let me explain…

There’s certainly nothing wrong with Vale’s business. It’s growing nicely, and the company is increasing its exposure to one of the hottest sectors on the planet these days: fulfilling the swiftly expanding commodity needs of the world’s move toward green energy and EVs.

But the Brazilian government just can’t keep its stinky fingers to itself…

Before we get into the strength of Vale’s business, let me first tell you what’s going on with the Brazilian government. Because, as I’ve said, government meddling is the reason Vale’s stock price has come under assault.

Here’s the issue:

That about sums up the drama in a few bullet points.

Thing is, Wall Street hates drama.

And any whiff of C-suite discord, particularly discord involving the government of a developing nation (where nationalizing private assets is always a worry), is enough to send investors racing for the exits.

Which is why Vale shares are down nearly 25% since late-December.

Investors have been steadily selling Vale shares.

As a Brazilian news site reported: “The market has not welcomed the [government’s intrusion], which the company’s shareholders read as authoritarian—executives who received calls from Mr. Silveira took them as threats.”

When that kind of news hits the public, you can bet a stock will sell off sharply. Shoot first, to hell with the questions later! Just get me out before the government nationalizes the company and my stock plunges to zero!

Such a reaction is understandable, particularly in this case, because Vale was once a government-owned company. However, Brazil privatized Vale in 1997, nearly 30 years ago, and today the government only holds 8.7% of the stock—and that’s held indirectly through a pension fund for employees of a state-owned bank.

In short: Not a lot of swagger to demand anything from Vale.

Moreover, eight of Vale’s 13 board members are independent, more than enough to outvote any plan that threatens corporate autonomy or that would undermine the company’s business operations by, say, installing a CEO with precisely zero experience running a mining company.

So we come to the truth: The Brazilian government has limited ability to impose its desires on Vale.

Which means short-sighted investors dumping their shares has given us a fantastic opportunity to exploit their fear and to buy into one of the world’s premier mining companies at a steep discount.

And that opportunity arises right as two events are creating a tailwind that should drive the shares higher from here…

Event #1 that benefits Vale is the ever-expanding push into electric vehicles, and the re-electrification of the world that aims to reduce the use of fossil fuels.

I’ve already told that story above…

Event #2 that benefits nickel is entrenched inflation and US debt…

Inflation is fuel for higher commodity prices. As fiat currencies continually lose value, hard assets such as commodities generally gain in value.

As Global Intelligence readers know well, the US (and much of the world, really) has had an inflation problem since 2020. Much of the commentary would imply that the COVID pandemic was the source of the problem. That’s a bit inaccurate.

COVID was simply the event that allowed decades of free-money fiscal policies to finally root as entrenched inflation. The money-printing processes are now in overdrive to keep up with ever-higher interest payments, meaning already-colossal debt levels are ballooning higher and higher.

At this point, there’s no way to avert a crisis.

America’s national debt is now accumulating at the rate of $1 trillion every 100 days. That's $3.65 trillion per year, an amount of money equal to 50% of President Biden’s $7.3 trillion proposed 2025 budget.

Here’s a simplified but proportionate comparison…

Imagine earning $100,000 per year in family income and having $479,000 in existing debt. And each year you’re spending every last penny of your income, and you’re adding $50,000 in additional debt from excessive spending and the interest that’s accumulating on your existing debt.

The risks are self-evident.

That is precisely the situation America faces, and the challenges are clear, no matter the path the country takes.

Path #1: The Fed cuts interest rates to reduce the pressure on America. Lower interest rates would mean smaller debt repayment costs, which would at least delay the crisis to come while the Fed and Treasury figure out a nifty way to quietly default.

Path #2: The Fed raises interest rates to attack inflation. This is a potentially catastrophic risk. The modern Fed seems like it wants to channel the ghost of Paul Volker’s 1970s Fed that beat back inflation. Problem is, the debt-addicted America of the 2020s is radically different than the more financially prudent America of the 1970s.

Higher interest rates today would jack up the debt repayment cost on the country’s $35 trillion in existing debt, and that $1 trillion we’re adding every 100 days. That would push the $1 trillion every 100 days to $1.5 trillion or $2 trillion, and suddenly America would be caught in a debt cycle with the potential to fuel hyperinflation or a currency collapse.

Even if we don’t see a currency collapse, we’re quite likely to see a never-ending decline in the dollar—something that has been a common theme for the dollar for more than 100 years.

As such, I want to own hard assets, since they tend to serve as an antidote to dollar weakness and persistent inflation.

We already have exposure to gold, the purest anti-dollar investment. We have exposure to silver, which is deeply misvalued and will explode higher at some point. And we have exposure to copper in our portfolio through Southern Cooper, which is up nearly 80% since my initial recommendation in your March 2023 issue.

Now, we’re adding nickel because of those two factors above that will directly impact nickel demand and the price of the commodity going forward.

And there’s no better way to play nickel than by owning one of the primary nickel miners when the share price has been (temporarily) hit by government meddling.

Vale is the world’s largest miner of iron ore and nickel. The company’s mines stretch from its home market of Brazil to Canada, Indonesia, and New Caledonia in the South Pacific. It’s also a player in copper, as well as fertilizers (phosphate and nitrogen), coal, and manganese.

It’s the nickel we really care about.

And it’s obvious Vale increasingly cares about nickel too, because of the opportunity company executives see in that market.

As Vale termed it in a recent presentation to shareholders, “A new Vale is emerging…”

One of the primary building blocks of the new Vale is building a company focused on energy-transition metals—meaning nickel.

I’m going to focus here on nickel because of the demand growth that is already taking shape. But I just want to be clear that iron ore is not an also-ran product we should overlook.

The world gobbles up iron ore because of its use in everything from cars to construction. As a middle-class increasingly emerges across the developing world, demand for iron ore continually grows. Iron ore prices have been weak of late because of concerns about the housing market in China, which is a major consumer of the world’s iron ore.

For now I’m going to sidestep iron ore because I want to focus on the explosive growth for nickel… but just note for now that this is also a factor in Vale’s business. (More on how it affects the business below.)

Vale’s research indicates that EV sales globally should rise to 23 million cars and light trucks annually by 2025. That’s up from 10 million EVs sold in 2022. So more than doubling the sales volume in three short years. By 2030, annual EV sales are expected to double again to 46 million.

That means the auto industry is going to be consuming a huge quantity of nickel every year.

Hence why back in that 2020 call with investors, Elon Musk urged miners to “mine more nickel.”

Vale calculates average annual nickel demand growth at about 19% per year through 2030.

To that end, Vale has begun investing billions of dollars to increase nickel production…

In 2023, Vale produced 165,000 tons of nickel. For 2024, the company expects to produce as much as 175,000 tons.

And out to 2030, management is penciling in nickel production of between 210,000 and 230,000 tons.

That’s going to positively impact Vale’s income statement and its dividend stream, and it will help balance out some of the variability in the iron ore business. (Vale is also ramping up its copper production to meet explosive needs for cooper—arguably the most important metal for the world’s energy transformation—and that too will balance out iron ore variability.)

Risk: Higher. (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Vale is a Brazilian company, so its shares trade in in the US as American Depositary Receipts, or ADRs, a US-listed version of a foreign stock.

Though this is a foreign stock, and not all foreign shares are available through every US brokerage firm, Vale is a global giant and widely traded in the US at big firms such as Schwab and Fidelity, as well as smaller firms such as Robinhood and Webull.

So you should have no problems buying these shares.

I’ve given Vale a higher risk rating for a few reasons.

That said, Vale has proven to be a resilient company. Management has navigated various crises over the years, including rising interest rates, COVID’s impact on commodities and global demand, the Great Recession, and on and on.

So, I’m confident Vale can navigate the current situation with the Brazilian government.

For us, we’re able to snap up Vale at what I consider a ridiculously cheap price…

At the current price of just over $12 per share, Vale is trading at a price-earnings ratio of just 6.5. To put that into context, Vale has been growing its per-share earnings at an average annual rate of more than 30% over the last decade, while revenues have been growing at about 11%.

Even if earnings growth slips to 10%, we’re still grabbing these shares at an earnings multiple well below the actual rate of earnings growth. (Translation: We’re buying Vale’s earnings stream at a discount, and it’s the earnings stream that determines the stock price over the long term.)

We’re also picking up a dividend yield north of 10%...

Now, to be fair, there is a risk that Vale trims its dividend if the iron ore market falls. That would reduce the company’s income, and the company would respond by cutting back on its dividend, which is fairly common in the commodity sector, since profits can ebb and flow across a wider range than the typical non-commodity company sees.

But the market pretty well knows this…

Vale’s dividends move around regularly. So far this decade, Vale’s semiannual dividend payments have ranged between $0.055 per share to $1.50. So we can expect the dividend amount to bounce around. The market certainly expects it.

I tell you that because dividend cuts on Wall Street are typically accompanied by investors fleeing the stock. But with companies like Vale, dividends that rise and fall are largely expected, so no one freaks out.

Moreover, the company generates a ton of cash flow every year, and it uses a good chunk of that to buy back shares, thereby reducing the number of shares that exist… which flows through the earnings-per-share calculation (that’s net profits spread across the number of outstanding shares).

As share count decreases, per-share earnings increases, which propels the stock higher over time, since per-share earnings are part of the P/E calculation—and it’s the P/E ratio that investors rely on to ascertain whether a stock is cheap or dear.

So Vale has a history of returning value to shareholders by way of a robust dividend and a commitment or share buybacks that ultimately flow through the stock price.

As such, I see Vale as a compelling way to play the energy transition and the move to EVs across the global auto fleet.

Yes, there is a governmental overhang, but that overhang is the reason we have an opportunity to buy one of the world’s largest miners on the cheap…

I do not expect an immediate rebound in the share price. This issue will resolve itself over the course of the year. But it seems clear the Brazilian government will back off (it has already begun doing so) and will likely accept a token victory of some sort that does nothing to upset Vale’s corporate governance.

When that’s announced, the overhang will vanish and Vale’s share price will return to a more normalized valuation. That’s a P/E in the 10 to 12 range. I'm going to assume a P/E of 10 just to be conservative. With 2025 earnings that should come in around the $2.50 to $2.60 range, and that could imply a stock price in the mid-$20s, more than double where we are today.

And the shares will only grow from there as the EV movement consumes more and more nickel... and as EV mandates around the world come into effect.

This month’s portfolio review is coming to you from an incredibly beautiful hotel—the Jumeirah Zabeel Saray—in one of the most energetic cities I’ve ever visited—Dubai. And I’ve visited cities in 78 countries.

I’m here because I was attending the Token2049 crypto conference, one of the world’s largest crypto conferences. It drew in more than 3,000 attendees and hundreds of crypto-focused companies from across the planet.

This month’s portfolio review is being dispatched from the Token2049 crypto gathering in Dubai…

And I tell you that because in the 10 days leading up to the conference, the crypto market fell apart, as it is wont to do from time to time. The purported culprit this time was selling related to US tax season and the hostilities between Iran and Israel.

Sounds logical, though honestly who knows? This is crypto. It has a hive-mind of its own.

But here’s what I do know: Crypto is in the early stages of a bull market.

And I don’t necessarily mean that from an investment perspective. I mean that from a societal, financial, and business perspective.

I regularly allude to the dot-com boom and bust, and I will here again.

I attended a crypto party at a much-too-loud club in Dubai and found myself in a discussion with a guy who’s been in crypto since 2011 and who today runs a crypto-marketing firm. He asked me where I thought we were in the crypto cycle and before I could answer he told me we’re in the early days of the dot-com boom, before the bust happened.

He used some drunken math, reliant heavily on the number 15 for some reason, to explain his rationale.

I politely disagreed.

We are in the era that arrived after the dot-com bust.

That’s when today’s modern internet emerged. The wannabes with a crazy dream came to life in the late 1990s and died ingloriously in the 2000 bust. The companies that survived the bust—and the upstarts that learned from the companies that failed—built the internet we know today.

Same with blockchain. The boom of 2019 to 2021 was the time of crazy dreamers who brought crazy projects to the blockchain. Most of them failed. Many people—yours truly, included—lost lots of money.

But some crypto projects survived and grew. Today they’re still growing. And as I witnessed here in Dubai, lots of upstarts have arrived with sharper, more focused business models that are providing very real and useful services that businesses and consumers actually need or want.

To me—continuing the dot-com analogy—we are somewhere in the early 2003 range, when a new bull market in tech had quietly begun. It would soon draw in the doubters as the quiet bull turned into a booming bull market that lasted until the housing collapse/Great Recession of late 2007.

We’ve only just begun to draw in the doubters who were burned when the last bull market in crypto collapsed into a vicious bear market. Moreover, we’ve not yet really begun to attract the so-called “normies”—the people who don’t really understand crypto. They’re coming. And they will be coming in large numbers.

All of that to tell you that we have big opportunities still in our Global Intel crypto positions…

For many a month, our positions in bitcoin and Ethereum were well underwater. Today, they are well above water and primed to go much higher.

We’re still down in Aave and Band Protocol, but I think we’re going to see them have their day in the sun, too, before this bull market is over.

And I see an opportunity in Grayscale Ethereum Trust. It’s up 3.9% as write this, while Ethereum itself is up more than 24%.

The mismatch is tied to the fact that Grayscale is a trust and not an exchange traded fund. I will not bore you with the mechanics of what that means. Instead I will tell you that in practical terms the value of the Ethereum the trust holds is $29.43 per share. But each share of the trust is trading at just $22.47—meaning there’s a $7 gap between the shares and the true value of the Ethereum each share represents.

That’s the opportunity.

When the SEC approves an Ethereum exchange traded fund, which it did for bitcoin back in January, that $7 gap vanishes in a heartbeat… which is precisely what happened with Grayscale’s Bitcoin Trust. I dove into the bitcoin trust personally in January 2023 at a more than 40% discount, and told Field Notes readers I’d done so and why—because I was confident the SEC would approve a bitcoin trust and the discount between share price and asset value would vanish.

And it did.

It will do so again with the Ethereum trust, meaning a gain of more than 30% awaits investors who grab the Grayscale Ethereum Trust today and hold on through the ups and downs until SEC approval arrives.

As I said, we’re in the early stages of the real growth of blockchain—as it becomes the new version of the internet we know today. And just as the likes of Google and Facebook and others emerged during that period, so too are the blue chip cryptos of tomorrow emerging right now.

Ethereum is clearly going to be one of those.

And the Grayscale Ethereum Trust is a great way to play that emergence and pick up a nice gain when the SEC approves ETFs and unlocks the trust’s hidden value.

Thanks for reading, and here’s to living richer.

Jeff D. Opdyke

Editor, Global Intelligence Letter

© Copyright 2024. All Rights Reserved. Reproduction, copying, or redistribution (electronic or otherwise, including online) is strictly prohibited without the express written permission of Global Intelligence, Woodlock House, Carrick Road, Portlaw, Co. Waterford, Ireland. Global Intelligence Letter is published monthly. Copies of this e-newsletter are furnished directly by subscription only. Annual subscription is $149. To place an order or make an inquiry, visit https://internationalliving.com/page/faq/. Global Intelligence Letter presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.