Dear subscriber,

Without electricity for three days, and with temperatures hitting 95 degrees, the situation was getting desperate…

Community organizations started handing out free ice to help people preserve what food they had left.

To stave off heatstroke, residents resorted to regular cold baths for themselves and their animals.

People who use breathing machines had to rely on hand pumps, as they lingered inside for days… waiting for the power to return.

This happened just a week or so ago in Mount Vernon, Texas… and it’s a sign of bigger problems to come.

For weeks, the southern U.S. has been in the grip of a heat wave. This has put a major strain on electricity providers, as businesses and consumers run air conditioning day and night.

The Electric Reliability Council of Texas (ERCOT), which operates most of the state’s power grid, had been pleading with users to reduce their energy use. Then, on June 23 and 24, storms hit three states, including Texas…

The power grids failed in many places, leaving some 300,000 people across these states without electricity.

With grids offline, and electricity demand spiking due to the heat wave, energy prices skyrocketed.

On June 27, three days after the storms, the price ERCOT paid to providers reached $4,000 per megawatt-hour… nearly 100 times higher than the previous week. An analysis from Bloomberg’s energy data division found that ERCOT likely paid providers $1 billion for electricity on that single Tuesday alone.

The mainstream media was quick to lay the blame for this on the storms and heat wave… and they undoubtedly played a central role. But there was also another contributing factor, one that was less widely publicized: a lack of wind.

In recent years, Texas, like much of the U.S., has been investing heavily in renewables. But on the afternoon of June 27, as energy demand spiked, Texas’ wind turbines were sluggish. They were producing roughly 33% less power than on an equivalent day in 2019… when the state had far fewer turbines.

Concerns are now growing about what lies ahead… given that storms and extreme heat are hardly rare in this part of the U.S., and energy demand is typically highest in July and August.

Major news organizations and experts alike are warning of potential rolling blackouts in Texas and across the country…

Welcome to America’s energy future, and to the official launch of Frontier Fortunes: The Energy & Metals Portfolio.

I pre-launched this brand-new portfolio of investments back in May because of my expectation that America is barreling toward three severe events that will reshape our country over the remainder of this decade. (Click here to review your launch report: Frontier Fortunes: The Energy and Metals Portfolio.)

The first of these—an energy “super shock”—is now emerging.

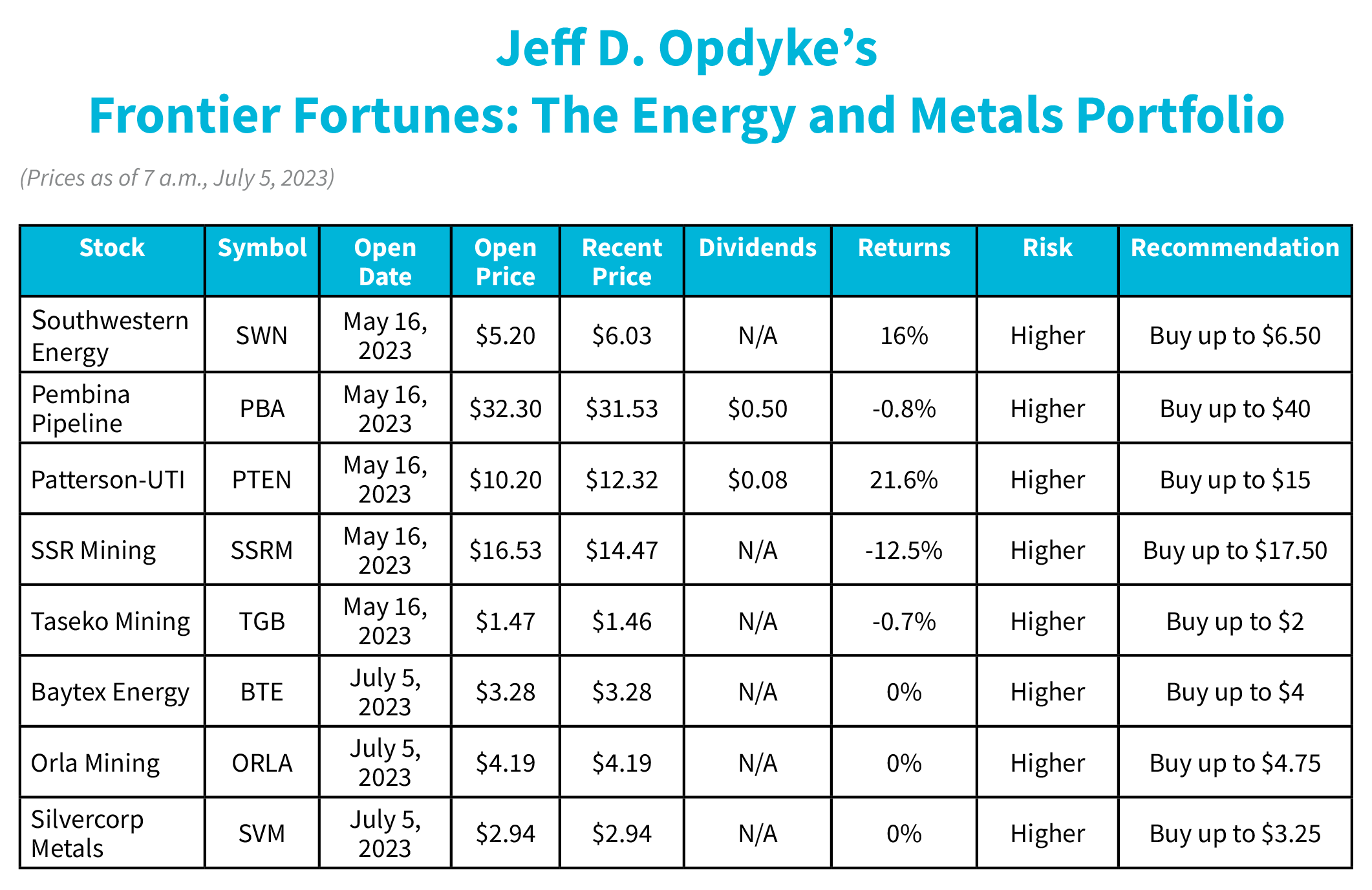

In this inaugural quarterly issue, I’m going to update you on how our initial five investments have performed in the short time we’ve owned them… and introduce three new positions we’re adding to our portfolio to round it out.

But first, let’s recap the investment case for energy and metals as America enters a new and dangerous economic era…

The Energy Super Shock Is Beginning

As events in Texas demonstrate, the U.S. is barreling toward a self-inflicted energy supply crisis, or what I’ve termed an energy super shock.

This super shock is preordained at this point because years of green energy militancy has convinced Western governments to swiftly abandon fossil fuel production.

Of course, the world cannot replace more than a century of fossil fuel infrastructure overnight… or even within the next decade.

Nevertheless, the militants have won the argument. Governments across the world are pushing an agenda of rapid green energy adoption. This, in turn, has encouraged energy companies to rein in their spending on finding new oil and gas reserves.

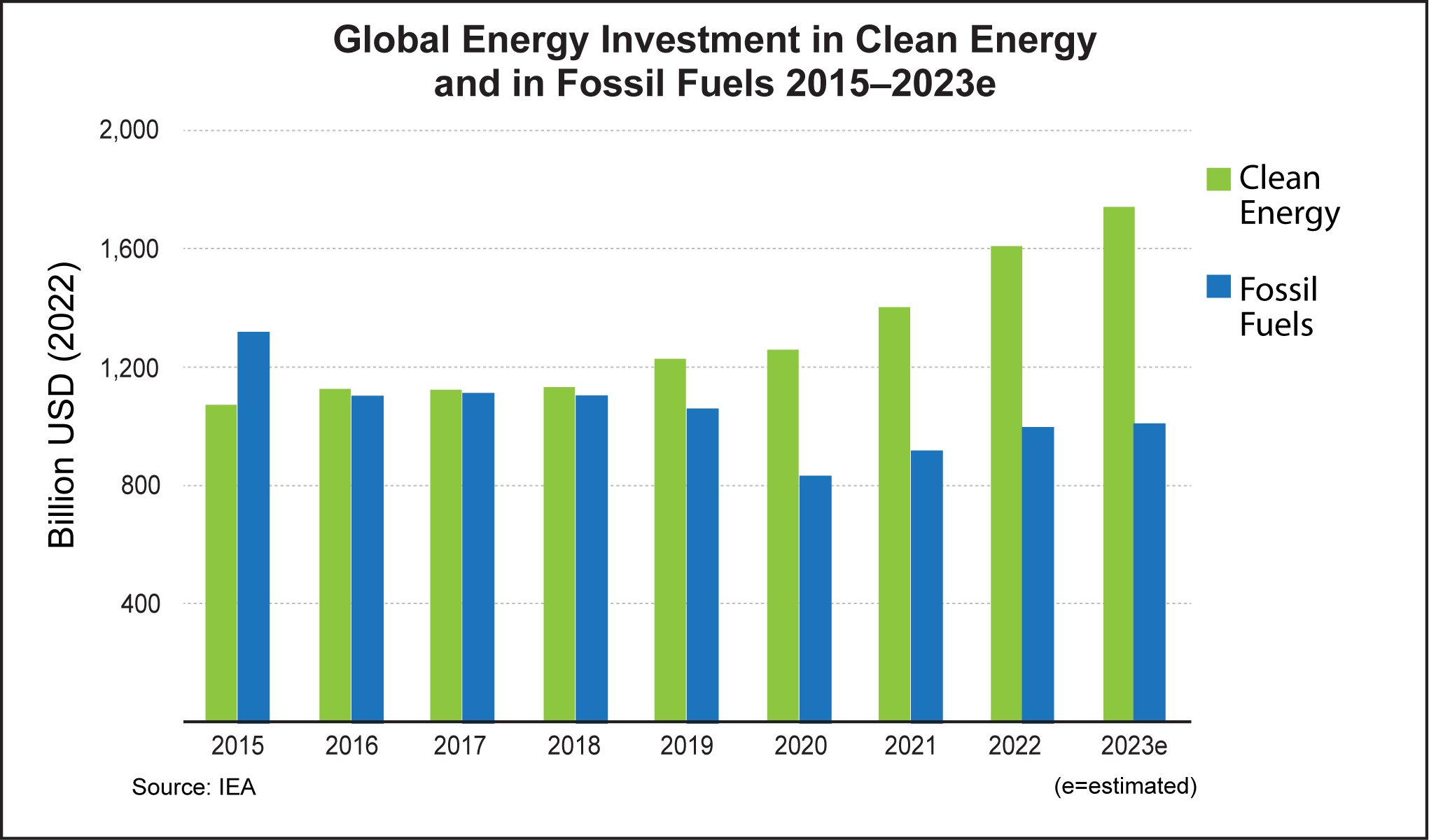

As shown in the chart below, total global investment in green energy is forecast to exceed spending on oil, natural gas, and coal by $700 billion this year, according to the International Energy Agency (IEA).

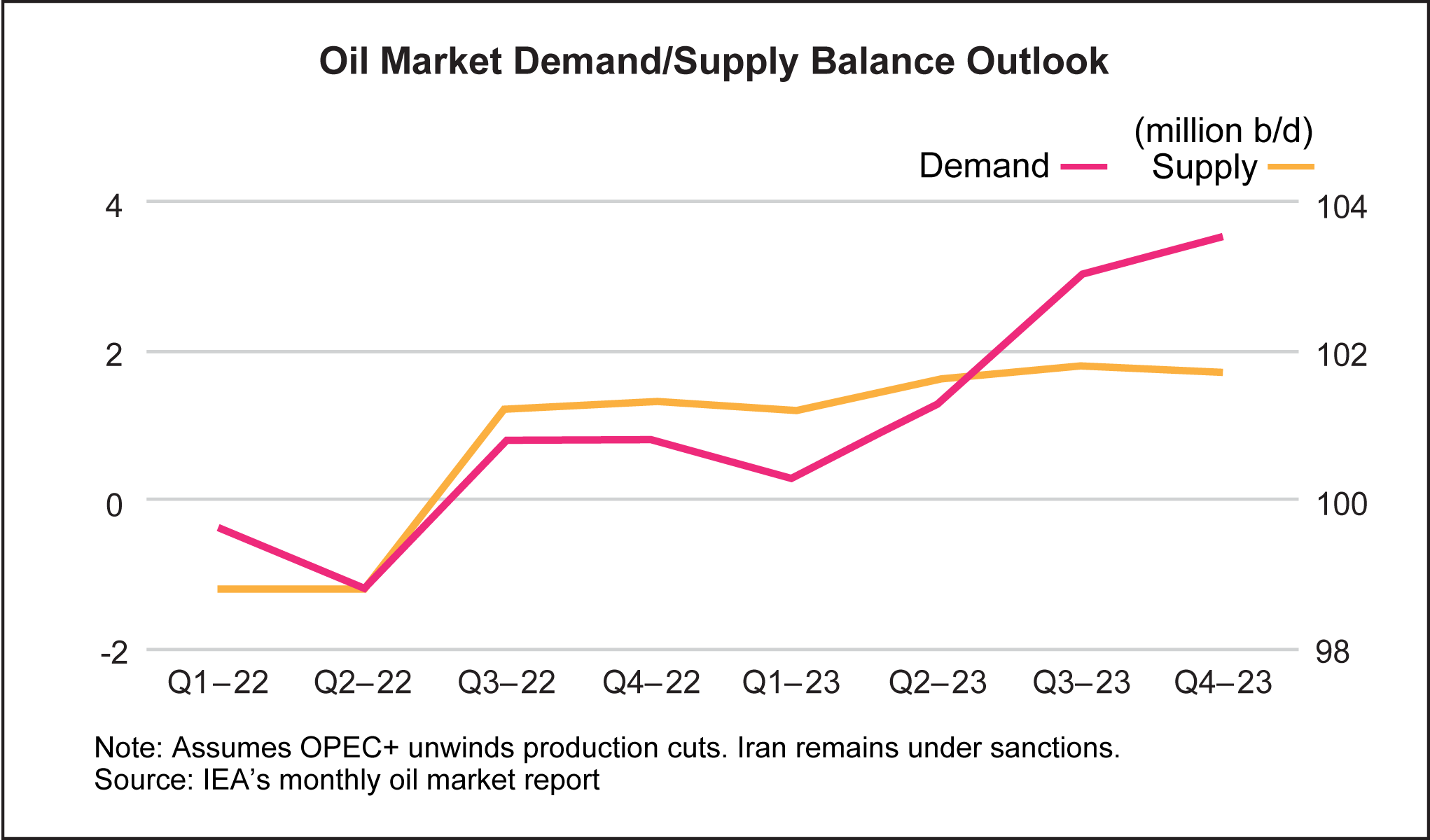

Despite this, oil demand is still growing at a rapid pace. IEA projections show demand will average an all-time high of about 102 million barrels per day in 2023.

This means we’ll reach a moment in the near future when there’s insufficient oil and gas available at affordable prices to meet demand. And green energy will not be ready to make up the difference.

IEA data shows that the gap between oil demand and oil output is likely to hit 2 million barrels per day by year’s end.

This will have dramatic impacts…

As the IEA states in no uncertain terms: “The current market pessimism… [toward oil prices] stands in stark contrast to the tighter market balances we anticipate in the second half of the year.”

Historically, oil prices in their current $70-per-barrel range (adjusted for inflation) would have meant a booming market. But today, that same price level is viewed pessimistically.

This shows that major producers are waiting until the supply crunch bites and they can sell oil for north of $100 per barrel, before fully committing to new exploration and production.

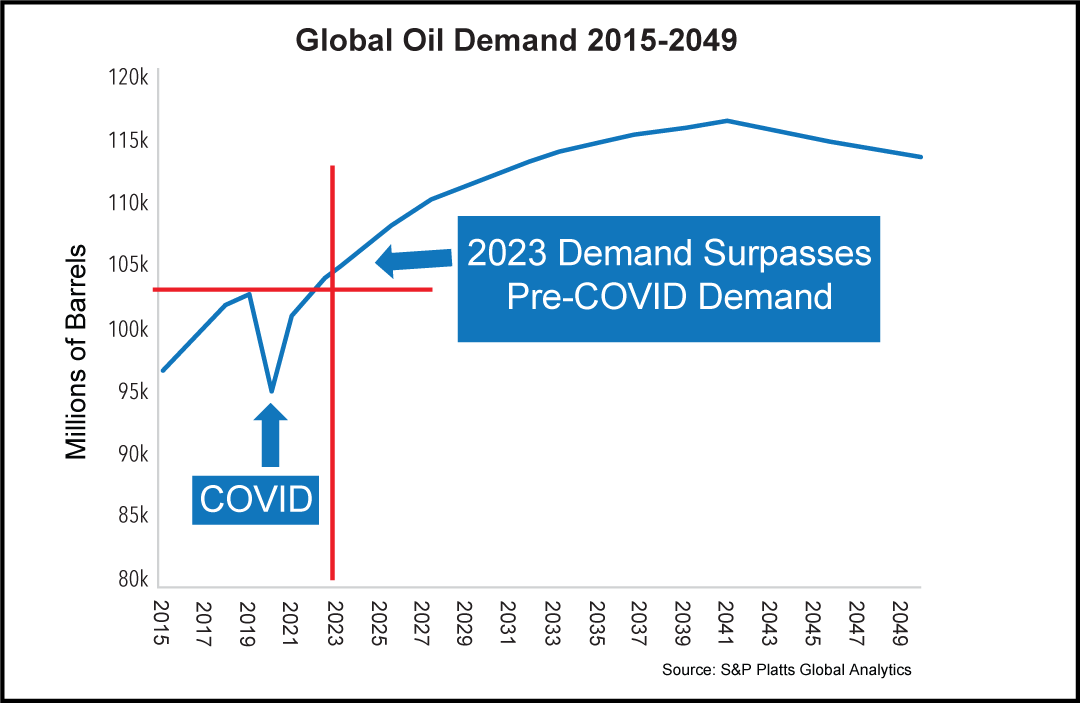

S&P Global, the company behind the S&P 500 and a well-respected provider of financial information, is “in the know” on this coming crisis, too.

It has forecast that oil demand will not only exceed pre-COVID all-time highs in 2023, but will keep growing for the next two decades.

Truly, then, it’s not hard to predict what’s coming our way…

Demand for oil and gas will continue to rise, even as energy producers fail to generate enough supply to keep pace with that demand.

That means prices will have to shoot higher. Which is why I am adding a new energy producer to our portfolio.

But before I outline that investment, let’s review the second super shock that will impact the U.S. this decade—a monetary crisis tied to a collapsing U.S. dollar and Uncle Sam’s crippling addiction to debt…

The Coming “Debt Spiral”

If, like me, you grew up in the late ’70s and early ’80s, you’ll recall America’s last great fight with inflation.

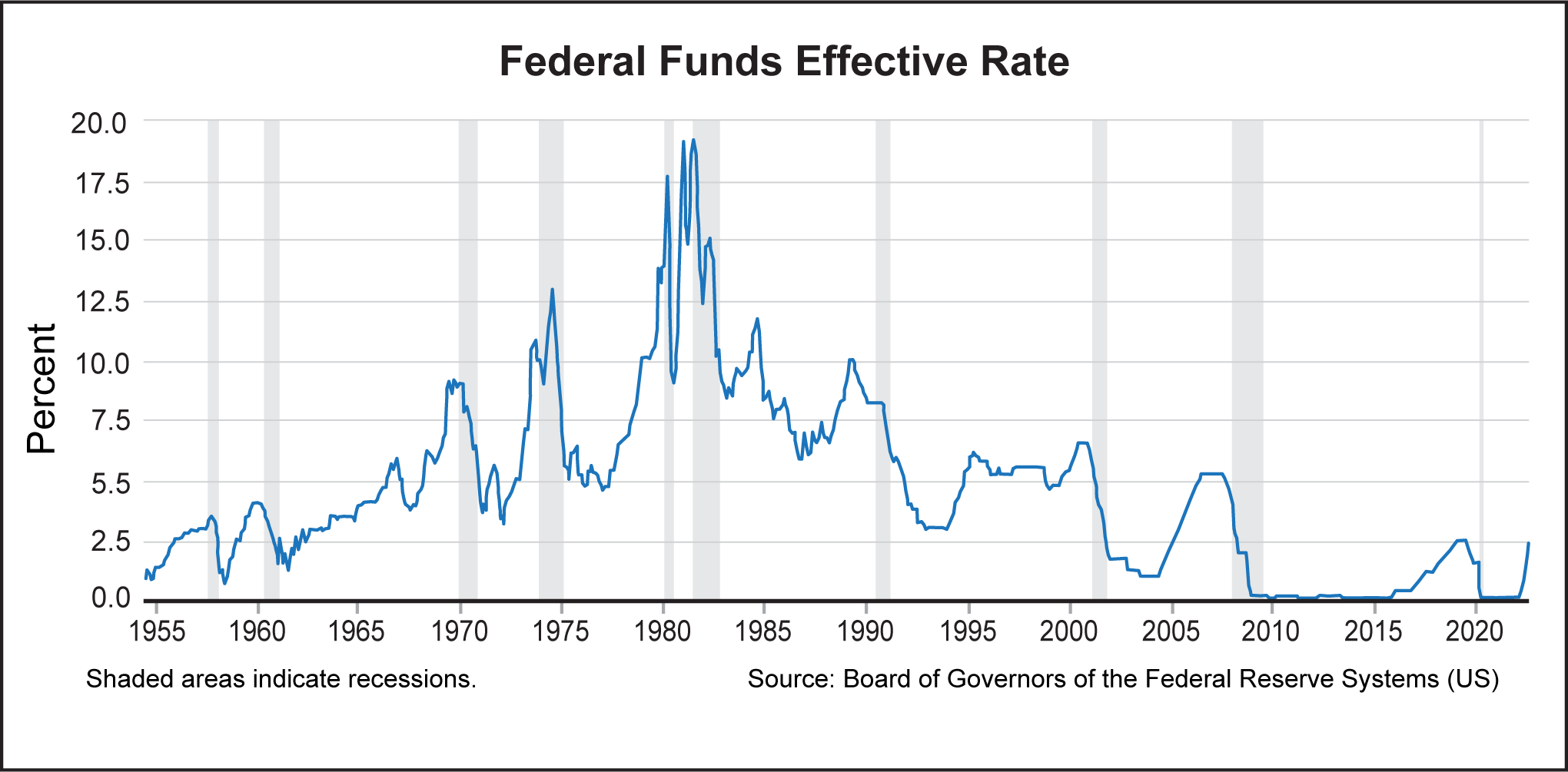

The winner in that fight was Paul Volcker, then head of the Federal Reserve, who bashed inflation into submission by raising interest rates to 20%.

That victory, though painful, launched America into what economists call the Great Moderation—a quarter-century-long period of relative economic stability defined by ever-declining interest rates and ever-more tepid inflation.

Through it’s called the Great Moderation, this era in fact produced some of the greatest wealth in human history. Low interest rates made borrowing cheap, leading to a boom in bonds, stocks, and real estate.

Eventually, however, the availability of cheap credit began to distort America’s economy.

Bubbles formed, particularly in property, and then burst spectacularly with the housing crash and global financial crisis of 2007-2009.

In the aftermath of this crash, the Fed lowered the cost of money to fire-sale proportions… all to keep the party going.

For years after the global financial crisis, the Fed held interest rates at historically and unnaturally low levels just above 0%. And it pumped trillion of dollars into the economy to keep businesses and consumers afloat.

This policy reached its zenith during COVID…

In response to the shuttered economy and the loss of tens of millions of American jobs, the government poured more than $7 trillion into the economy—a sum of money equal to roughly one-third of America’s entire annual economic output.

Now, we’re living with the consequences of these easy-money policies…

The Fed funds rate, the target interest rate set by the Federal Reserve, sat near zero for years after the global financial crisis, and again during COVID, reducing the cost of money to fire-sale proportions.

Just like parched land can’t absorb water in a flash-flood deluge, economies can’t absorb such a deluge of cash in such short order. The result is the inflation we’ve been dealing with for more than two years now.

After initially dismissing inflation for many, many months, the Fed finally decided to act by raising rates. But to make up for its early ignorance, it went too hard, too fast… pushing interest rates from 0.25% to 5.25% in the span of little more than year. This was the fastest proportional rate increase in U.S. history.

These rapid rate hikes may have tamed inflation to a certain, limited degree, but they’ve created a new, even bigger problem…

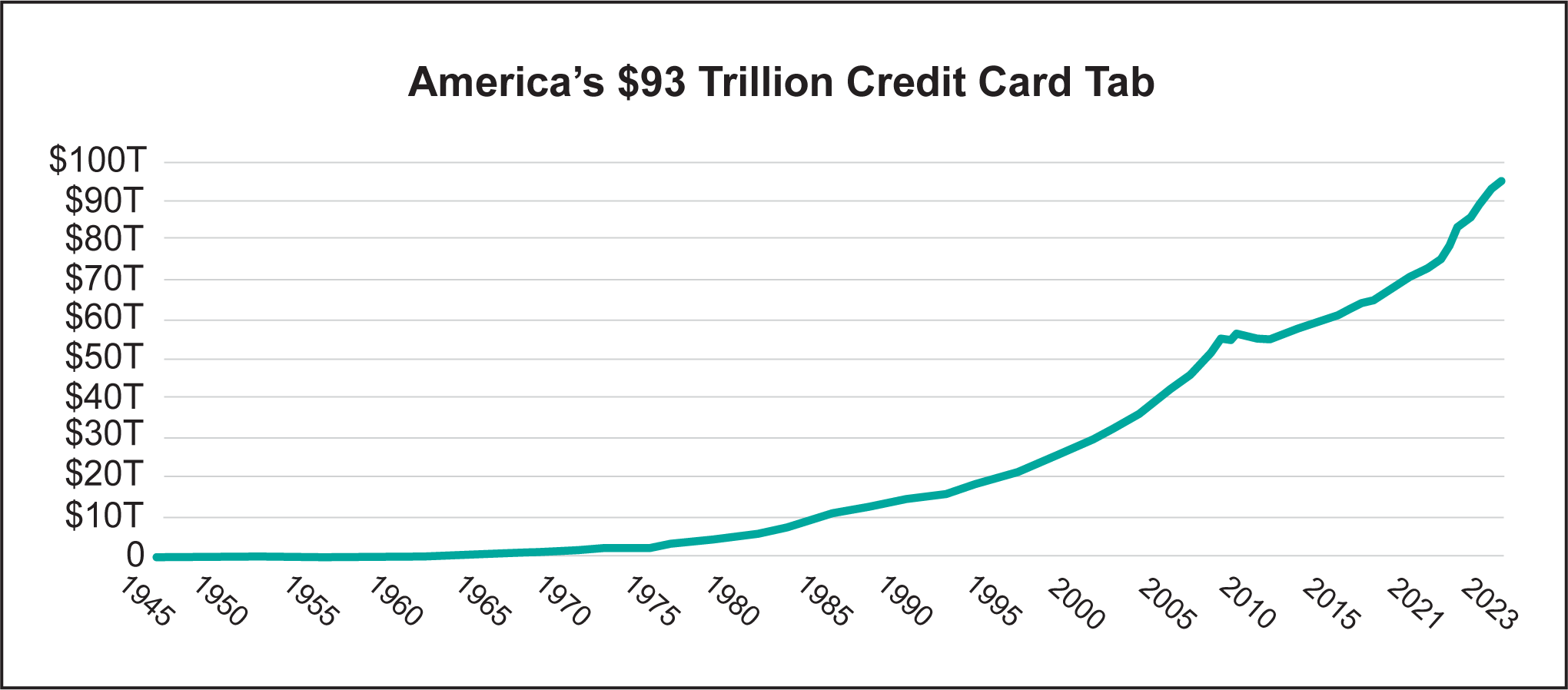

After decades and decades of cheap money, America’s government, businesses, and consumers are heavily indebted… to the tune of a combined $93 trillion and rising.

Raising interest rates to more than 5% makes the cost of carrying all that debt unmanageable.

A fifth of America’s 3,000 largest companies are what’s known as “zombie companies”—companies that don’t make enough money to cover their debts. The only reason these companies are still in business is that rock bottom interest rates have allowed them to refinance again and again... kicking the can down the road.

But now, rates are no longer rock bottom. As Bloomberg warned: “The end result could be a prolonged stretch of bankruptcies unlike any in recent memory.”

Consumers are in a similar position. Credit card debt hit a record high in 2022. Now delinquencies are skyrocketing.

And as for Uncle Sam, the cost of servicing the debt is growing at worrying levels.

Interest payments on the debt have doubled in the past two years alone to more than $660 billion. They’re projected to top $1.4 trillion within the next decade.

This is what the early stages of a “debt spiral” look like.

Uncle Sam is spending more and more simply on servicing the interest on his debt, even as the amount of the underlying debt grows by trillions of dollars every year.

To be clear, this crisis will take longer to play out than the energy super shock. But it’s just as inevitable…

As America’s fiscal situation worsens over the reminder of this decade, other nations will increasingly move out of the dollar… leading to a collapse in the value of the greenback. Which is why we want exposure to anti-dollar assets like gold and silver.

So in summation, before the end of this decade, America will face an energy super shock, and then a monetary super shock.

It’ll also face a societal super shock, but it’s still a bit unclear how that’ll play out because there’s so much uncertainty in our increasingly partisan political system.

That’s why I’ve focused my largest retirement account on preparing for the energy and monetary super shocks… and it’s precisely why I put together the Energy & Metals Portfolio.

All of which brings us to our new energy and metals investments…

Our New E&P Play: Baytex Energy

Let’s start with our new energy producer: Baytex Energy Corp.

Baytex is a small oil-and-gas exploration and production company, a so-called E&P play, based in Alberta, Canada.

When I say “small,” I mean the company has a market cap of just $1.8 billion. Still, it’s a profitable company with drilling and production operations in western Canada and down in the prolific Eagle Ford energy fields of south Texas.

Here’s why I’m particularly bullish on Baytex: The company recently acquired Houston-based Ranger Oil. This more than triples Baytex’s footprint in Eagle Ford.

Moreover, the transaction comes with six benefits that aren’t yet reflected in its share price. With the Ranger purchase, Baytex:

*Oil is sold in barrels. Natural gas is sold in millions of cubic feet. “Oil equivalent” measures the amount of energy each commodity generates so that they can be fairly compared financially on an apples-to-apples basis.

That yield is based on oil averaging about $75 per barrel.

But $75 is likely to be a low expectation, based on what’s going on in the industry. My bet is that we’ll see oil north of $100, and on its way to $150. In the super shock to come, don’t be surprised to see temporary spikes as high as $250.

Given these benefits, Baytex trades at prices that are deeply undervalued.

As I write this, the stock fetches just $3.25. At that price, Baytex shares are valued at just 2.2 times the per-share earnings that the company reported over the last 12 months. That’s an insanely low number.

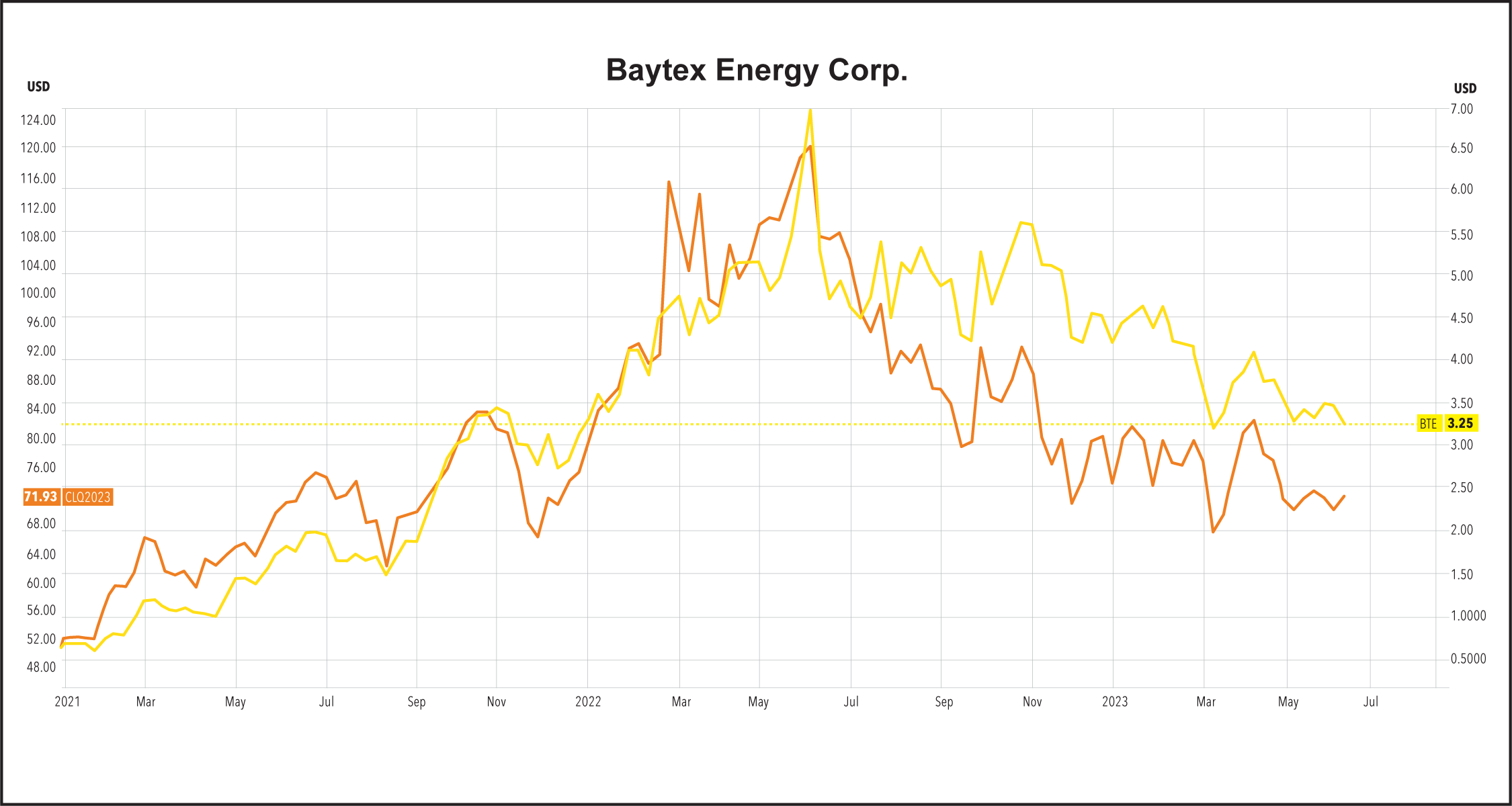

To a degree, the company’s earnings were goosed by higher oil and gas prices, which have come down a bit. Similarly, I would expect to see Baytex earnings soften a bit this year, even with the acquisition. However, I honestly don’t care too much because of this chart:

Yellow is Baytex. Orange is the price of oil.

What’s clear here is that Baytex shadows oil prices. That is further evidence of the company’s robust operations. When an oil company is profitable with a strong outlook, it will begin to track the price of oil, as in this case.

So, if oil goes higher, as I fully expect, then Baytex’s stock is going to follow suit.

Thus, Baytex is effectively a pure play on oil prices… with a dividend payment soon to be built in. And we will have the financial benefits inherent in the Ranger purchase.

That deal, which happened over the spring, is immediately accretive to Baytex’s finances, meaning it will immediately enhance production and cash flow. This means it could even outperform the oil price increase to come.

Right now, not many people are paying attention because the markets are blasé about oil and gas.

But the macro fundamentals say that those who are paying attention, and who use this moment to buy cheap oil and gas assets, are going to be long-term winners as the oil super shock plays out, starting later this year.

My Recommendation: Buy Baytex Energy (BTE) at prices up to $4.

Risk Profile: Higher (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 55% Trailing Stop Loss

Orla Mining—A Young Gold Miner With Huge Potential Upside

The most important asset you can own for wealth preservation as the dollar goes through its necessary reckoning is gold.

As confidence in the dollar falls, gold rises. So, we’re adding further gold exposure to our portfolio through Orla Mining, a Canadian company with projects in three highly stable mining jurisdictions—the U.S., Mexico, and Panama.

Last year marked Orla’s first commercial production. The company produced 109,600 ounces, very near the top end of its expected production of between 100,000 to 110,000 ounces. For 2023, it’s expecting to produce about the same amount of gold.

All of that gold is coming from a single project known as Camino Rojo in central Mexico.

Orla also has the South Railroad project in Nevada, and Cerro Quema in Panama. Both of those are a few years away from production, but when they start up, they’re expected to add a combined 230,000 ounces or so to annual production, effectively tripling Orla’s current annual haul.

And that production volume will continue to grow over the following years…

Orla is spending $35 million this year to expand Camino Rojo production through new exploration activities around the existing mine. To that end, Orla is exploring a deep prospect—called the Sulphide Project—beneath the current open pit mine.

Analysis of the exploratory drilling done so far indicates that “measured and indicated” gold could amount to 7.3 million ounces.

Those so-called M&I reserves carry the least confidence, but they do lead to some level of increase in what’s known as “proven and probable” reserves—those with a high degree of confidence.

Right now, Orla has about 3.6 million ounces of proven and probable gold reserves, so the Sulphide Project could sharply increase the companies reserves. That would lengthen the mine’s life, and boost the share price because investors take proven and probable reserves into account when valuing a miner.

Some patience is required here, but when the market starts to anticipate Orla’s future, the share price will shoot higher.

To be clear, Orla is a small miner. At the current share price of $4.20, the company’s worth just $1.3 billion. Newmont, the world’s largest gold miner and which owns 14% of Orla, has a market cap of nearly $35 billion, more than 25x larger.

Though it’s small, Orla sports huge profit margins that stand apart from other miners, which is a key reason I want Orla in our portfolio.

The industry tracks a metric known as “all-in sustaining costs,” or AISC. These are the costs to sustain production, such as energy and labor, royalties, exploration expenses, and admin costs, among others. It’s a shorthand way for the industry to compare companies and their leverage to gold price movements.

Across the gold-mining industry, you’ll regularly find those costs are in the range of $900 to $1,200 per ounce, meaning it costs a typical miner that much money to produce one ounce of gold.

For 2022, Orla’s AISC was just $611. For this year, they expect those costs will rise to about $800 or so. That’s still well below the industry’s average.

The upshot is that as gold prices rise, Orla collects even wider profits. And if gold prices decline, Orla has a much bigger buffer that allows it to remain profitable as other miners begin to struggle.

Ultimately, we’re buying into a very young gold producer, early in its productive life, and which has both a low cost of production and a clear path to increasing the quantity of gold it mines every year.

Frankly, I won’t be surprised to see Newmont Mining snap up the entirety of Orla at some point, and at a price much higher than today’s $4.20.

Until then, we will benefit as a rise in gold prices lifts Orla’s share price.

My Recommendation: Buy Orla Mining (ORLA) at prices up to $4.75.

Risk Profile: Higher (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 55% Trailing Stop Loss

Silvercorp Metals—The Cash-Rich Silver Miner With Fat Profit Margins

The third and final stock we’re adding to the Energy & Metals Portfolio is Silvercorp Metals. This, too, is a small Canadian miner… even smaller than Orla.

Silvercorp currently has a market cap of just $500 million. That’s teensy.

Nevertheless, Silvercorp represents a fantastic opportunity to own a highly profitable miner primarily focused on silver, but which also produces two much-needed industry metals—lead and zinc.

Though this is a Canadian company, its operations are in China. Some will see that as an obstacle, and I understand why. But I see it as a strategic advantage.

Labor in China is less costly than in the U.S. and Canada, and on par with Mexico. And it puts Silvercorp closer to the smelters (its customers) that gobble up all the lead and zinc the company produces in three mining districts.

The result is that Silvercorp’s margins are basically double its peer group.

It also sports a low AISC, which the silver industry uses as well. Last year, AISC was about $8.77 per ounce. This year, it will be in the $8.94 range. But with silver prices in the mid-$20s, Silvercorp’s low AISC means fat profits.

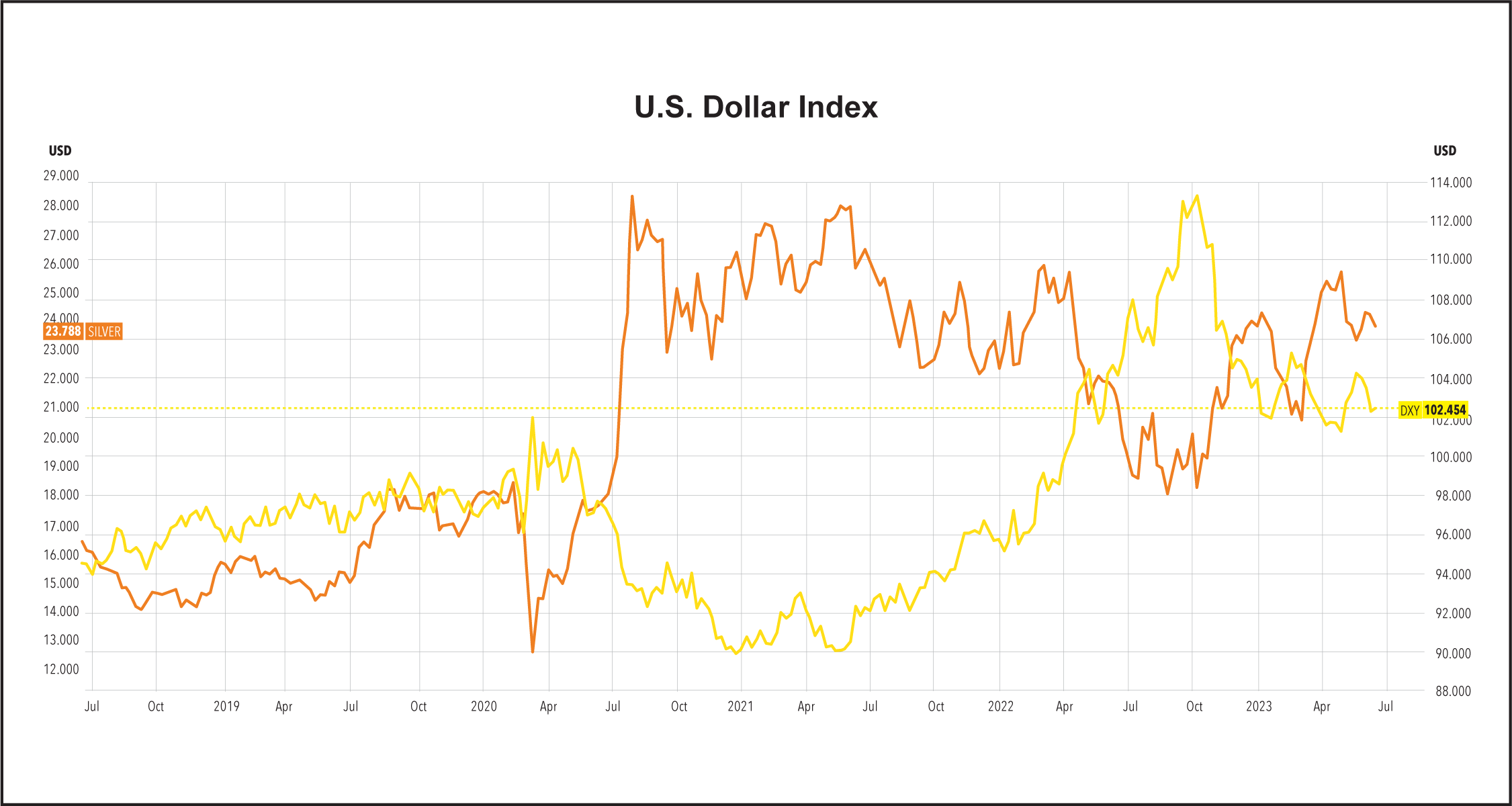

If we’re moving into a stage where the dollar debt-bubble is at risk of popping, silver is in a prime position to boom.

As the dollar declines, silver will rise in value, which is quite clear in this chart of silver (in orange) vs. the dollar (in yellow). They move in opposition.

So, if we expect the dollar to weaken, we can expect silver prices to strengthen, which would flow through Silvercorp’s income statement and bring us a higher share price.

That said, Silvercorp does have “China” hanging over its head, and that has resulted in a discounted valuation relative to industry peers.

Silvercorp is now addressing that by stepping out from behind the Chinese curtain. In May, it announced plans to buy Celsius Resources, an Australian copper/gold miner. Aside from reducing its reliance on a single country—China—I am particularly bullish on the Celsius purchase because of the exposure to copper.

That metal plays into our energy super shock because of the green energy militancy. The greens are clearly winning the debate on our energy future, which is propelling adoption of electric cars and forcing power companies to build new electrical plants that use green technology.

Copper is the huge beneficiary there. World demand for copper is so explosive that some well-respected energy analysts expect that consumption over the next 12 years will exceed total consumption between 1900 and 2021.

With Silvercorp, then, we’re grabbing a small miner producing a very healthy 5.5 million ounces of silver every year, along with 57 million pounds of lead and nearly 20 million pounds of zinc. Those numbers should ramp sharply higher this year—to roughly 7 million ounces of silver, 72,500 pounds of lead, and more than 28 million pounds of zinc.

And we have the growth of gold and particularly copper to look forward to.

Finally, strengthening our case is the fact that Silvercorp has no debt and $210 million in cash on its balance sheet. That’s $1.19 per share in cash on the books for a stock that trades at just $2.83, as I write this.

More than 40% of the stock’s value is just cash, meaning we’re buying the business itself for just $1.64, which sharply lowers its real valuation.

And we’re getting paid to hold the stock. Silvercorp pays a small dividend of about 0.9% annually.

Silvercorp is a high-quality, undervalued asset any way you look at it.

My Recommendation: Buy Silvercorp (SVM) at prices up to $3.25.

Risk Profile: Higher (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

Stop/Exit: 55% Trailing Stop Loss

Recommendations Recap

Buy Baytex Energy (BTE) up to $4.

Buy Orla Mining (ORLA) up to $4.75.

Buy Silvercorp (SVM) up to $3.25.

All of these stocks have a Higher risk rating and should be bought with a 55% Trailing Stop-Loss. (What does this mean? Before you act, read a full breakdown of my five-level risk assessment scale here.)

As for our existing portfolio, I want to run through our investments to tell you what’s been going on with them since we opened our positions.

Patterson-UTI (PTEN), our onshore drilling rig company, jumped out of the gate strong. It’s up about 22% very quickly. That’s thanks in part to a merger deal Patterson agreed to with NexTier Oilfield Solutions, which provides well completion services (the process of turning a drill site into an operating well).

The merger creates one of the world’s leading drilling and well completions businesses, with 172 super-spec drilling rigs.

A super-spec rig is a particular type of rig with greater horsepower, pressure ratings, and other advantages over traditional rigs. Basically, it’s the industry’s top-tier rig.

Patterson expects the deal will be accretive to earnings starting in 2024, and that the larger company will distribute at least 50% of free cash flow to shareholders. That means we can expect dividends to rise.

Patterson is now an even more formidable player in the onshore drilling arena. That’s an industry with a bright future in the energy super shock era.

As I relayed in the original Energy & Metals Portfolio report, exploration and production companies have under-invested over the last many years, and now that oil demand is clearly going to exceed supply very soon, they’re running around to lock down any drilling rigs they can find so that they can begin exploring and producing more oil and gas.

We’re in a multi-year upcycle for Patterson. The stock, though up 22% already, remains under our buy-up-to price of $15. So, it’s still on the buy list.

***

Southwestern Energy (SWN) is up about 16% so far. It’s one of America’s leading natural gas exploration and production companies. Its operations are centered in two of America’s most prolific gas basins: Haynesville in northwest Louisiana, and Appalachia, spread across West Virginia, Ohio, and Pennsylvania.

A third of its production is sold into the liquified natural gas (LNG) market, a fast-growing market for which America is the 800-pound gorilla globally. Many of the world’s countries do not have oil and gas reserves and, thus, must import energy resources from elsewhere. They’re increasingly shopping in America because of our abundance of gas, as well as the large collection of 160 LNG facilities in the U.S. that turn gas into a super-frozen liquid easily shipped in quantity overseas.

That’s a trend with a long life still ahead of it. The green movement is not going to radically diminish gas demand in the U.S. because utilities need it to produce power. They’re not going to suddenly shut down all their natural gas-fired power plants.

Moreover, much of the emerging world cannot afford to shift to green energy tech. They’re going to remain reliant on LNG for a long time. And, finally, the world absolutely needs natural gas to ensure enough food supplies to feed the planet. Natural gas is the primary ingredient in manmade nitrogen fertilizer.

So, natural gas will remain an in-demand commodity for many a decade yet. And Southwestern will remain a beneficiary. The stock price has moved up recently on speculation that the industry is about to go through a wave of consolidation, meaning lots of merger-and-acquisition activity. If that happens, Southwestern is one of the obvious candidates for a major oil and gas company to snap up (at a meaningfully higher price).

Given this, I'm increasing our buy up to price for Southwestern to $6.50.

***

Our final play on the energy super shock is Pembina Pipeline (PBA).

As its name implies, Pembina operates a spiderweb of pipelines, mainly across Canada, that gather up oil and gas at the production well and transport it to various facilities downstream for processing, refining, and storing.

We know demand for oil and gas isn’t going away. We know there’s now increasing need to find new energy fields. And we know there’s unquenchable demand for LNG around the world. All of that means more and more business for Pembina.

Moreover, Pembina is months away from potentially pulling the trigger on a new LNG facility in British Colombia. This would be one of only two major LNG terminals on North America’s West Coast.

That facility, once operational, is guaranteed to see huge demand from Asia, since it would shorten the travel distance, reducing time-to-market and transportation costs.

As much as 70% of Pembina’s business is so-called “take or pay” contracts, meaning a client pays for a certain amount of volume through Pembina pipelines, whether they use that full allotment or not. That business model provides an earnings stability that, in turn, leads to a meaningful dividend yield that’s now a very plump 6.4%.

The shares were down marginally because of Canadian wildfires that have caused pipelines to temporarily shut down. Obviously, that’s a momentary problem and those who sold because of that were reacting in knee-jerk fashion.

Are summer wildfires going to fundamentally change this business? Not even remotely.

As such, Pembina's shares are already rebounding and remain a great buy right now. Buy up to $40 per share.

***

Now, let’s move into our two metals plays.

Taseko Mines (TGB) is our small-cap play on copper’s explosive demand due to the green energy push.

Rewiring the planet and transitioning the world’s auto/truck fleet to electricity or hydrogen power requires an extreme quantity of copper. More copper than you can imagine. So much copper that Daniel Yergin, one of the world’s foremost energy experts, estimates that from now until the end of 2035, the green energy movement will necessitate as much copper as the world used over the period from 1900 to 2021.

That’s a lot of copper.

Thing is, the world doesn’t yet produce enough copper to meet that demand.

You can see where this is going: Demand for copper to meet all those green energy uses will see copper prices rise. At the very least, it will see a massive increase in copper production to meet the demand, even if prices stay generally the same.

Either way, copper miners such as Taseko benefit. They’re either going to produce and sell more copper at similar prices to today, or they’re going to produce and sell similar levels of copper at higher prices.

Both options mean a fatter flow of profits through the company’s income statement… which means higher earnings… which reflects in a higher share price.

Taseko is flat at the moment because of China. The Middle Kingdom is the world’s largest consumer of copper, but the country continues to struggle with its post-COVID rebound.

The Chinese central bank has even cut interest rates to stave off a double-dip recession. Because copper (at least at the moment) is so tied to China’s ups and downs, China’s current weakness has been a drag on Taseko’s share price.

But as with Canadian wildfires affecting Pembina, China’s economic malaise is not a permanent state of affairs. The long-term trends are all positive for Taseko and the wider copper-mining sector.

Taseko, now at $1.46, remains a buy up to $2 per share.

***

Finally, we have SSR Mining (SSRM), our one stock that is definitely lagging. It’s down 12.5% at the moment.

There’s no fundamental reason for this except ongoing uncertainty about whether the Federal Reserve will raise rates even more. Higher interest rates would imply lower gold prices, which would flow through gold-mining companies like SSR.

But the Fed is a side issue, really. In the short term, it’s a factor, sure. But in the long term, there’s a limit to how far the Fed can raise rates.

As I outlined above, U.S. debt cannot handle ever-higher interest rates. The move over the last 14 months to jack up interest rates at an historic pace now has the Congressional Budget Office warning that America will pay $663 billion in interest payments on existing debt in 2023.

That’s more than double what Uncle Sam paid in just 2021!

The CBO also says the problem is only going to worsen from here, with debt payments rising to $745 billion next year, and $1.4 trillion by 2033.

That promises to cause increasing woes for America as it struggles to manage its finances. Gold will win big in that moment.

SSR is a mid-tier miner operating in the U.S., Canada, Argentina, and Turkey. It produced about 625,000 ounces of gold last year and is on pace to produce about 700,000 ounces this year. The increase stems from an expansion project in Turkey, as well as resumption of operations at a Turkish mine that closed down temporarily last year to deal with a cyanide leak.

Back in early May, the company announced it had acquired up to 40% interest and operational control of a gold-copper project in northeastern Turkey. That mine, SSR reported, is “one of the highest margin and lowest capital intensity development projects globally.”

It’s expected to add 80,000 ounces of gold production annually by 2027.

All told, a 12.5% decline is just an opportunity to buy at a better price. SSR is a world-class miner with substantial production. The shares remain a buy up to $17.50.

Jeff D. Opdyke

Editor, Frontier Fortunes: The Energy and Metals Portfolio

© Copyright 2023. All rights reserved. No part of this report may be reproduced by any means without the express written consent of the publisher. This report presents information and research believed to be reliable, but its accuracy cannot be guaranteed. There may be dangers associated with international travel and investment, and readers should investigate any opportunity fully before committing to it. Nothing in this e-newsletter should be considered personalized advice, and no communication by our employees to you should be deemed as personalized financial or investment advice, or personalized advice of any kind. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after on-line publication prior to following an initial recommendation. Any investments recommended in this letter should be made only after consulting with your investment adviser and only after reviewing the prospectus or financial statements of the company.