Welcome to your February 2022 issue of the Global Intelligence Wire.

This is the monthly digest exclusively for Global Intelligence Lifetime Circle members, in which I cut through the media chatter and highlight five underreported news stories from recent weeks.

First up, why you shouldn’t listen to the naysayers who predict that the government will ban cryptocurrency.

Major Companies Are Adopting Blockchain Technology

I regularly hear that the government is likely to ban cryptocurrencies. Every time I hear that, it immediately tells me that the person speaking doesn’t understand crypto or how cryptocurrencies are making businesses more efficient.

In fact, a recent story in Forbes details the many ways that companies around the world are now using crypto to better their businesses.

For example, Allianz, a German insurance giant, is using the blockchain to “streamline cross-border, auto-insurance claims in Europe.” In the past, claims could take months to settle due to incompatible databases between countries. However, because of blockchain technology, the processing time now takes minutes and costs are down 10%.

The 50 companies listed in the Forbes story is a who’s who of global corporate giants—Boeing, Fidelity, Mastercard, etc. So, there’s simply no way government can or will ban crypto at this point. Crypto is too deeply integrated into some of the largest businesses in the world. And given that corporate money is the grease that keeps government happy, lobbyists would have a lot of sway in keeping any kind of ban at bay.

So, while crypto will remain a volatile asset class in the immediate future, it’s already a permanent part of our financial and social landscape. And this is why investing in the crypto listed in the Global Intelligence Portfolio makes financial sense.

Next up, another surprising reason why the government won’t ban crypto…

Chinese Policy Leads to an Employment Gain for Rural America

Another Forbes story underscores why the U.S. government isn’t going to ban crypto in general and bitcoin in particular. The reason: both Republicans and Democrats see value in the cryptocurrency.

That’s not to say politicians understand bitcoin and crypto. They don’t. Instead, their positive outlook is for more pragmatic reasons. They realize that bitcoin, and the mining operations necessary for its creation, means high-income jobs in the U.S. heartland.

When China banned bitcoin last year, much of that mining power migrated to the U.S., which is now home to the largest amount of bitcoin mining power in the world.

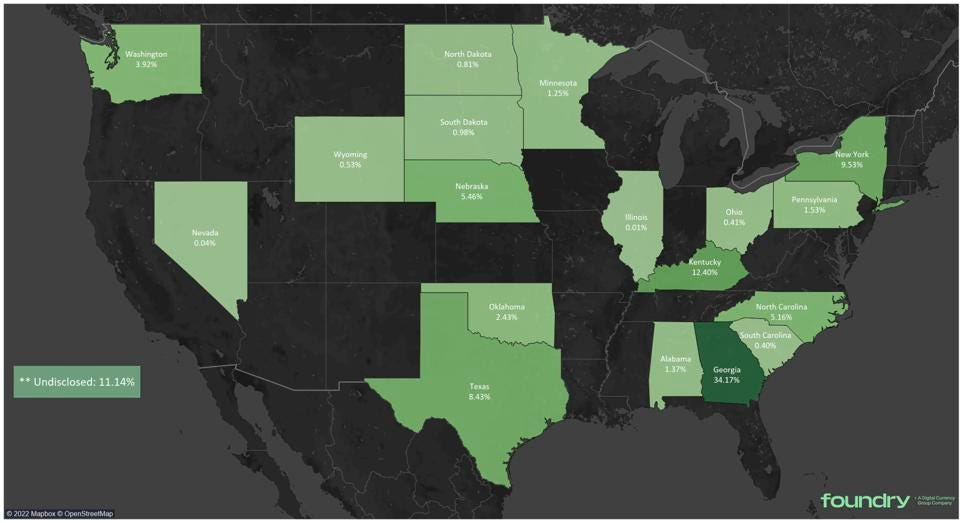

This map from Forbes shows where most of the bitcoin mining jobs are popping up:

That’s pretty much blue-collar America.

And the U.S. has an advantage: Rule of law and an abundance of low-cost renewable energy is helping power a number of these mining operations.

Again, just more proof of why the government won’t ban bitcoin and why I continue to recommend investing in crypto.

Moving on to…

Why the Federal Reserve Is Powerless to Tackle Inflation

As I was writing this month’s Wire, the inflation reading for January popped up on a business news channel. The annualized inflation rate for January 2022 rose to 7.5% compared to January 2021. It’s the highest reading in 40 years.

Which proves that inflation isn’t going away anytime soon.

What I find curious is that the number apparently surprised economists. It shouldn’t have, given that so much free money has been poured into the system and supply-chain woes continue to impact the nation—I recently walked into a Walgreens to buy some meds and was shocked at how bare the shelves were.

I’ve been writing to you for a year now about inflation and the Federal Reserve’s bogus promise that inflation was “transitory.” The Fed is trying to manage the narrative but the harsh reality is that consumer prices are rising rapidly. The question is: Will the price rise be contained?

The Fed next meets mid-March. I’d say there’s a 100% chance the Fed raises rates by 0.25%. If it doesn’t, then that says the Fed is out of touch. If it raises by more than 0.25%, it says the Fed is freaked out.

In reality, 0.25% won’t be enough to fight 7.5% inflation. The Fed would need to sharply raise rates by multiple, full percentage points…and that’s just not going to happen. It can’t happen. It would destroy the economy and it would sharply raise government’s cost of managing the $30 trillion in debt that Uncle Sam now carries.

So for now, we need to continue to protect ourselves by owning hard assets such as gold and silver, like those listed in the portfolio, while the inflation saga continues.

Next up…high fashion finds its place in virtual reality.

Luxury Fashion Arrives in the Metaverse

In the February issue of Global Intelligence, I wrote in detail about the rise of the metaverse—the merging of reality and technology to create an alternate, virtual reality on the internet. Instead of passively looking at the internet on a flat screen, we’re going to experience the internet in three dimensions, all around us.

It’s easy to see that in terms of gaming only. But then along comes this headline: Gucci buys virtual land on The Sandbox as part of metaverse experience bid.

Gucci’s rationale for spending an undisclosed sum of money on digital land is that it aims to create a virtual fashion experience. Which I know sounds a bit hokey. Who needs digital clothing? But people being people are going to want to deck out their metaverse avatars (digital representations of ourselves) in fashion—just as they do in the real world.

And Gucci isn’t the only fashion brand moving into this emerging market. Ralph Lauren, Abercrombie & Fitch, and even Gap are also moving into the metaverse. Walmart recently filed a patent for digital clothing and Nike last year bought a digital fashion house to begin designing and selling goods emblazoned with the famous swoosh.

All this proves why we should be investing in the metaverse now. Without question, it will be a young person’s game early on. They’re always the ones quickest to adopt new trends. But big-name brands are already seeing and investing in the potential of this new iteration of the internet. And soon enough, granny and gramps will be part of the movement as well.

So now is the time to invest because by the time it’s mainstream, you will have missed a massive wealth-creation opportunity.

Finally…we end with a fun little lifestyle story about crypto.

“Bitcoin Family” Settles in Crypto Tax Haven

Maybe you’ve heard of the “Bitcoin Family.”

They are a family of Dutch nationals who sold their home and liquidated everything they owned to put it all into bitcoin when the cryptocurrency was in the $900 range. Today, it’s in the $43,000 range. They then spent the next five years traveling across 40 countries, before settling in Portugal.

Why settle in the Iberian Peninsula, you might ask?

Well, Portugal is perhaps the single best crypto tax haven on the planet. The country imposes a 0% tax on crypto profits. As long as you don’t generate crypto as payment for services, you owe nothing. Portugal views crypto as a payment mechanism, rather than as an asset or property.

By settling in Portugal, the family lives a tax-free life. It’s nice to know that such options exist out there…

And that brings us to the end of this month’s Wire. If you have any feedback or any topics you’d like me to address in a future issue, you can reach me through the contact form on the Global Intelligence website.

Thanks for reading and for being a Global Intelligence subscriber.