Welcome to the August issue of the Global Intelligence Wire.

This is the monthly digest exclusively for Global Intelligence Lifetime Circle members, in which I cut through the media chatter and highlight five underreported news stories from recent weeks.

Some of these relate to what’s going on in the Global Intelligence world. Others highlight big social or economic changes that lie ahead as we move toward a post-COVID era. Basically, these are the stories you need to know, but probably haven’t seen in the mainstream media.

First up this week: a big interest rate move—not from the Federal Reserve but from one of my recommended crypto-banks.

Hodlnaut Boosts its Interest Rates on Stablecoins to 12.73%

Finding traditional interest income on your savings has been nigh impossible for the last decade or so. That is the result of a Federal Reserve policy to keep interest rates at near-zero percent to drug an economy that, apparently, can’t survive without life support.

Then along comes the cryptoconomy to bring us decentralized finance (DeFi) and a whole new type of bank—the crypto-bank.

These aren’t banks in the traditional sense of that word, since they operate solely online using cryptocurrencies. Nevertheless, they function a lot like banks in that they offer loans to borrowers and high-rate savings accounts to savers.

How high?

Well, one of the crypto-banks I wrote about in the July issue of the Global Intelligence Letter—Singapore-based Hodlnaut—just announced that it is raising its rates on stablecoins to a 12.73% annual yield. That’s up from 10.5%.

Hodlnaut said it adjusted the rates “to ensure maximized opportunities” for savers.

My interpretation: The business is doing well, loan demand is escalating, and Hodlnaut sees an opportunity to soak up more deposits by offering a more-enticing rate…not unlike banks looking to draw in more deposits through higher rates on certificates of deposit.

As you’re likely aware, I’m a big fan of stablecoin interest accounts.

Because dollar-focused stablecoins track the greenback so closely, these cryptos are very, well, stable. So, owning stablecoins and putting them to work in a crypto-bank like Hodlnaut is a great, low-risk way to generate passive income at rates we haven’t seen in decades.

I am putting stablecoins to work at four different crypto-banks. Why four? This is still crypto. It’s a new world. I want to spread my risk through institutional diversity.

I’m not saying stablecoins are risky, or that the crypto-banks are sketchy. I’m just saying unexpected things may happen in the cryptoconomy as this industry builds out and matures. So, I’m just being prudent.

That said, I really have no fears for my money. I see crypto-banks like Hodlnaut as a great way to actually earn a real return on idle cash. Especially as the interest rates keep rising.

Keeping with crypto a beat longer…

Our Recommended Crypto-Mining Stock Announces a Massive Jump in Profits

Argo Blockchain, a publicly traded crypto-mining firm I recommended in the DeFi special report (which is available as part of your subscription), announced its latest quarterly earnings earlier this month. And it was a big number!

Pre-tax profits for the first half of 2021 soared 2,040% to ₤10.7 million ($14.8 million) from just ₤500,000 in the same period a year ago.

Part of that reflects the huge growth in bitcoin prices.

In the first half of 2020, bitcoin ranged between about $7,000 and just under $10,000. In the first half of this year, bitcoin ranged between $29,000 and more than $63,000.

Another reason for this profit jump is that Argo has been expanding its operations. In the first half of the year, its mining capacity was 1,075 petahash, a 57% increase from a year ago. (Petahash is a measure of the calculations that Argo’s army of computers can crunch per second. It’s those calculations that work to unlock fractions of a bitcoin.)

Because of all that, Argo’s revenue nearly tripled over the past six months and its mining margins (the difference between the cash it earns from mining and selling bitcoin, and the cost of operating its miners) rose to 81% from 39%.

This is a taste of what’s to come for Argo as bitcoin prices march higher. I remain confident that we will see a six-figure bitcoin and, ultimately, a seven-figure bitcoin later this decade. (If you want to know why, see my bitcoin special report).

Companies such as Argo are going to benefit as bitcoin’s price rises. Mining costs are generally stable because each machine consumes a known amount of electricity, and electricity costs are pretty much set. So, every increase in bitcoin’s price will simply drop to Argo’s bottom line as profit…unimpeded by nothing other than a slightly bigger tax bill.

To that end, Argo is in the process of expanding its operations further. It’s building out a new facility in West Texas that will rely on renewable energy to power its machines.

A final point about Argo: I noted in last month’s Global Intelligence Wire that the company was mulling over listing its London-based shares in the U.S.

Well, the company has filed the necessary paperwork with the Securities and Exchange Commission to have American Depositary Receipts listed in New York. They will likely be available in the third quarter. That could provide some juice to the stock price.

Of course, you don’t have to wait until the U.S. listing is complete to own Argo. You can buy the London-listed shares through Fidelity, Interactive Brokers, Schwab, and E-Trade. The symbol is ARBKF, and they remain a buy up to $3.

Wall Street Insiders Are Increasingly Worried About the Fed: Survey

I have never been one to give the Federal Reserve much credit for the way it manages the economy, and I see no reason to start now.

For too long the Fed has pumped free money into the economy. This has produced irrational asset bubbles in stocks, bonds, and housing. And it is fueling a bout of inflation that will prove quite painful for American pockets.

Lately, it seems I am not alone with this “Fear the Fed” mentality.

A new survey from Deutsche Bank found that “central bank policy error” is the third biggest worry for Wall Street pros. Moreover, the percentage of pros concerned about a Fed policy error is now at 43%, more than double the roughly 20% who noted that worry in April.

The top worry in the survey is “higher than expected inflation,” which I will argue is basically the same as Fed policy error, because it’s Fed policy error that is bringing us the high inflation we’re now seeing.

And who’s been writing to you about inflation worries for pretty much the entire year?

Little ol’ me.

I don’t pretend to be an economist. But, then again, you don’t need to be an economist to see what’s so plainly obvious: free money is worth exactly what it costs to produce.

When you continually dump more and more and more—and more and more and more!—free money into the economy, well at some point all that free money has an impact.

We’re just now beginning to see that impact as inflation tops 5%. It will go higher from here.

The Fed will have to act at some point by raising interest rates. When it does, there’s a very good chance that the stock market throws its usual tantrum, or what has come to be known as a “taper tantrum.” Any time the Fed tightens its policies—or tapers the flow of free money it provides—the stock market has a conniption fit.

It’s a lot like a baby that screams the minute mom or dad takes away the binky or the security blanket.

What this means is that “policy error” is baked into the cake.

I mean, if we already know what to expect of Wall Street when the Fed is forced to raise interest rates, then by definition the policy error has already happened.

The Fed has kept rates too low for too long. It has turned Wall Street, the bond market, and home buyers into “free money addicts.” It’s going to have to take away the crack-pipe soon because of high inflation—and there’s no methadone to ease the transition back into normal, everyday life.

There is, however, still time to buttress your portfolio with assets that should weather the worse inflation to come. Gold, silver, industrial commodities, some agricultural exposure…maybe even bitcoin. (Check out my specific recommendations in your Global Intelligence Portfolio Tracker.)

I’m not certain how bitcoin will play in an inflationary world since it has never faced that before. But I suspect it might just hold its own.

A Noted Economist Predicts Stocks Could See 10 Years of Negative Returns

Next up, a bit more on the Fed—from renowned economist John Mauldin.

Like me, Mauldin sees that “policy error” is done and dusted, as they say. But he goes a step further in this interview. If you don’t want to read the whole shebang, I’ll share with you what I think is the most important paragraph in the entire story:

While [Mauldin] didn’t have a specific prediction for how much stocks could sell off, he said we could enter a bear market—or a drop of at least 20% in the broader market—and he thinks stocks will face seven to 10 years of negative returns from current levels.

This is a concept I have been writing about relatively frequently of late. It’s the idea of “reversion to the mean.”

Or as Blood, Sweat & Tears sang eons ago in their classic ’70s hit, Spinning Wheel:

What goes up, must come down.

Spinnin’ wheel, got to go ’round.

We’ve had more than a decade of up, up and away (another ’70s song, by Fifth Dimension). It will absolutely end at some point.

Extremes—high or low—always return to the average. Which means the stock market is racing toward a cliff.

When the collapse comes—and it assuredly will—stocks will fall to valuations below the long-term average.

How far below?

Who knows?

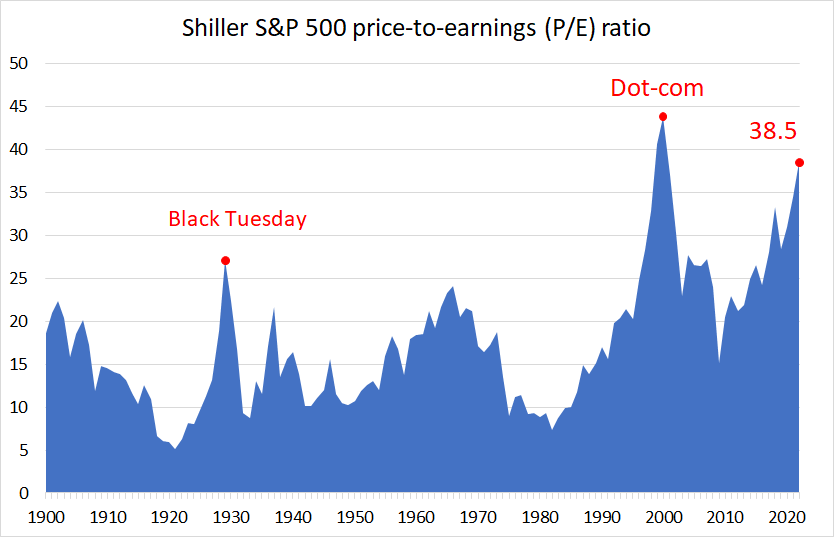

I tend to pay attention to the Shiller S&P 500 price-to-earnings ratio, which is a 10-year, inflation-adjusted take on the traditional price-to-earnings ratio.

Where the traditional P/E is a one-off snapshot in the moment, the Shiller P/E is designed to offer a more holistic measure of stock market value based on the ebbing and flowing of corporate profits across a business cycle.

Today, the Shiller P/E is at around 38.5. Only one other time in the last 150 years has it seen such a lofty perch—just before the dot-com crash, when the Shiller P/E hit 44.2.

Across its history, the Shiller P/E has oscillated between 10 and 20 for the great bulk of its life. Its average is right near 16, meaning we’re more than double the average today.

When the collapse comes, it’s not hard to imagine the Shiller P/E ultimately bottoming out below 10 (let’s call it seven) before returning to its more normal, 10 to 20 range.

That’s yet another reason to look at the asset protection recommendations in our Global Intelligence Portfolio such as the Swiss franc, Norwegian krone, and physical silver.

Climate Change Proposals Point Toward a New Era for Global Trade

Finally this month, we conclude with a topic at once incredibly important and tediously depressing: climate change.

Maybe you saw this month that the U.N. released its latest report from the Intergovernmental Panel on Climate Change. The report concluded—to the surprise of virtually no one—that we’re already witnessing the impacts of climate change and they’ll keep getting worse until humanity massively reduces its greenhouse gas pollution.

While I have a vested interest in humanity enduring for at least another few generations, I’ll admit that my interest in climate change is largely financial.

Because whatever you think about climate change, this issue has more potential than any other to entirely reshape society and global markets over the next decade or so.

Let me give you one prominent example.

You might recall that in the Intel Updates for the August issue of the Global Intelligence Letter, I mentioned that China recently rolled out its carbon market. This market gives certain companies a limit on their annual carbon emissions, and then allows them to buy and sell emissions units based on whether they will exceed or fall under their quota.

The idea is to incentivize companies to lower their emissions so they can sell off their excess quotas on the market.

As I outlined in the August issue, China’s carbon market will need significant reforms if it’s to achieve its desired goal. At the moment, the price of carbon, at about $8 per metric ton, is too cheap to encourage any significant change in behavior. (And getting China to change its behavior is key, since it’s the world’s largest polluter by far, with more than double the annual carbon output of the U.S.)

However, now Europe is thinking about wading in and essentially forcing China to increase its carbon prices on some exports.

The European Union is currently developing a plan for a “carbon border adjustment mechanism,” as Nikkei Asia reported in this article.

Basically, this mechanism would be an import tax on energy-intensive products from any destination with a lower carbon tax than Europe’s, which stands at about $60 per metric ton.

The mechanism is only a proposal at this point, but it has already drawn a strong pushback from China, which is worried about the impact on its exports. (Though, seriously, when has China ever been happy about anything?)

The plan still has to be approved by the individual national governments of the EU member states, and it will likely be many years before it’s introduced. However, I think this story highlights the economic future we are moving toward.

The era of big government is back, both in the U.S. and around the world, which likely means the era of big taxation is just around the corner.

For decades the world had moved toward lowering trade barriers. But as a big-government philosophy takes hold, I expect to see a whole raft of new import taxes.

Some will be for entirely justifiable reasons, like getting China to stop blanketing the world in smog. Others will simply be a return to the unjustifiable national protectionism that impeded economic progress for generations.

Either way, as this decade unfolds, I expect policies like these to play a much bigger role in shaping the profitability of companies from Beijing to Berlin to Boise. Which in turn will shape which investments we should have in our portfolios.

And with that, I’ll bring this month’s Global Intelligence Wire to a close. If you have any feedback or any topics you’d like me to address in a future issue, you can reach me through the contact form on the Global Intelligence website. Talk to you again in September.