Welcome to your February issue of the Global Intelligence Wire.

This is the monthly digest exclusively for Global Intelligence Lifetime Circle members, in which I cut through the media chatter and highlight five underreported news stories from recent weeks.

First up this month… even artificial intelligence suspects that the dollar’s days as king of the hill are coming to an end.

AI Predicts the Decline of the Dollar

I’m sure you’ve heard of ChatGPT, the new AI tool that can do pretty much anything you prompt it to do, from drawing a picture of a mouse in the style of Pablo Picasso, to writing a speech on artificial intelligence as though it were delivered by a mob boss.

I’ve been playing around on ChatGPT and it’s a bit freaky to see what it’s capable of.

Recently, Insider asked ChatGPT to weigh in on “whether the U.S. dollar or China’s yuan would be the world’s dominant currency in the future.”

The reply: “In recent years, there have been efforts to reduce the dollar’s dominance and increase the use of other currencies, such as the euro and the yuan, in international transactions… Predicting which currency will be dominant in the future is uncertain, but it is likely that the world will see a shift towards a more multipolar currency system, in which several currencies play a significant role, rather than one dominant currency.”

Clearly, ChatGPT has a good handle on this.

Insider notes that ChatGPT’s knowledge base—an enormous volume of data from the internet and other sources—largely stops at the end of 2021… meaning ChatGPT has no information about the increased push by Russia, China, and others to increasingly bypass the buck and create a new global reserve currency. (Get more details on that in the cover story of your January issue of the Global Intelligence Letter.)

It tells me, as well, that there is an extreme amount of information globally that ChatGPT is drawing on that explicitly details the decline of the dollar’s relevance outside America, otherwise the AI would not have had enough information to explain that the world is looking to shift to a multipolar currency regime.

Yes, this is just a computer. And, yes, technology has its failings. Nevertheless, the information it was able to assess in answering that question is a sign that the U.S. dollar is likely to lose its role as global reserve currency… and that will have a significant impact on life in America.

Keeping with money, we move on to…

Mastercard’s Blockchain Transactions Are Up 38%

Michael Miebach, CEO of Mastercard, recently told Wall Street analysts and shareholders that the payments giant is already processing 2 billion tokenized transactions per month, up 38% in a year. These tokenized transactions are essentially moving money around the world on the blockchain (the digital ledger technology behind bitcoin and all other cryptos).

Moreover, Mastercard is now enabling such digital payments in 110 countries.

The big benefit here: Less fraud, according to a very interesting story in Forbes on Mastercard, Goldman Sachs, and other traditional finance companies that “are using the blockchain to rewire global finance.”

This story is the thunderclap that comes after the lighting bolt of stories I’ve been writing for well over a year now on cryptocurrencies redefining everything we know as normal—from entertainment and education to identity verification and financial services.

The bulk of mass media writers and commentators continue to pan crypto as a fad, much like they panned the internet as a fad back in the day.

The only equation you need to ask yourself is: Do cryptocurrencies and the blockchain benefit business financially?

If that answer is a demonstrable “yes,” then you can know with 100% certainty that crypto and the blockchain are the future. And what Mastercard’s CEO is saying is that blockchain is faster and safer—for consumers and businesses—than is existing technology.

Yes, the government is being, well, dimwitted about the technology, but business, and the gajillions of dollars it spends to buy political support, will shape the laws that ultimately emerge… and those laws will be favorable to crypto.

Which is why I have continually advised everyone to put some portion of their wealth into crypto.

You don’t have to dive in as deeply as I have, but you should have some exposure to bitcoin and Ethereum, the #1 and #2 crypto. As crypto increasingly goes mainstream (that’s already happening), those two tokens are going to see higher prices.

Let’s stay with crypto and government for a moment…

The SEC Cracks Down on Crypto Staking Services

Earlier this month, the Securities and Exchange Commission fined U.S.-based crypto-exchange Kraken $30 million and forced it to stop offering “staking-as-a-service” to its American clients.

Staking is basically a process in which crypto owners pledge their tokens back to the network on which those tokens exist as a way to secure the blockchain and validate transactions. For that effort, crypto owners earn a fee in the form of more crypto.

Well, the SEC has determined that staking falls under the definition of a “security,” and that Kraken was selling this service as an unregistered security.

I’m no lawyer, so I won’t comment on the legalities of whether staking falls within the parameters of something called the Howey Test, a 1940s Supreme Court ruling that lays out when a product is a security.

Instead, I will point you to what the chief legal officer at Coinbase said about the Howey Test and staking.

But as someone deeply down the rabbit hole of crypto—who works in crypto daily, and serves as CEO of the NFT division of a European blockchain—I do have a particular set of thoughts on this topic.

I understand (to a degree) what the SEC is doing—trying to protect Americans from some of the crypto scams and implosions that have happened. But as is typical with the U.S. government, it is going about this in an entirely paternalistic fashion, treating Americans as though they are too dumb to manage their own financial affairs.

Moreover, the SEC is imposing 20th century rules on a 21st century financial technology. That’s like building a Lamborghini… with wagon wheels. The SEC is harming Americans by limiting their access to new technology, and they’re harming innovation by forcing those with the best ideas to take their operations offshore.

And perhaps worst of all… the SEC, a bumbling and bureaucratic agency, thinks it knows best, even though it is not working with the industry to fashion laws that actually make sense.

Even an SEC Commissioner, Hester Pierce, has said as much. In response to the Kraken fine, Pierce wrote that “Using enforcement actions to tell people what the law is in an emerging industry is not an efficient or fair way of regulating…

“Most concerning, though, is that our solution to a registration violation is to shut down entirely a program that has served people well… A paternalistic and lazy regulator settles on a solution like the one in this settlement: do not initiate a public process to develop a workable registration process that provides valuable information to investors, just shut it down.”

Hester Pierce for president!

Moving on to $10,000 gold and $500 silver…

This Economy “Is the Biggest Bubble in History”

I am not one to regularly tout the thinking of Rich Dad Poor Dad author Robert Kiyosaki. I think a lot of his pronouncements are reactionary and designed to maintain a presence in the public debate…

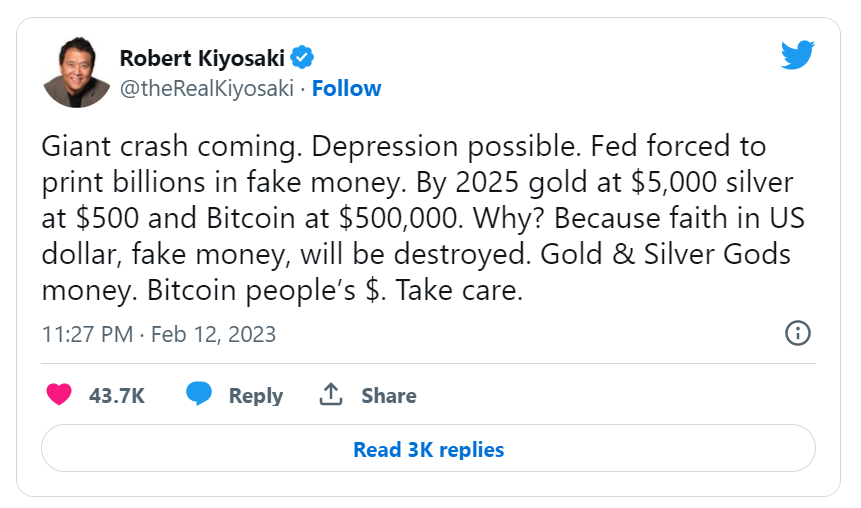

But he does say things on occasion that make me think. And just recently, he posted this tweet:

I mean, to a certain degree, he’s right. The Federal Reserve is going to be forced to continue printing money. It really has little choice, given the situation Uncle Sam finds himself in after decades of easy money, and a political class that drives up the debt through egregiously stupid spending priorities.

As Yahoo points out, Kiyosaki now says the economy “is the biggest bubble in history” and to dump paper assets.

I am not going to go that far and say dump paper assets. The right paper assets—tied to energy, farming, commodities, mining—can preserve wealth, just as many of them did in the Great Depression.

But I will say that Kiyosaki is right when he says to own gold, silver, and bitcoin.

All three might very well feel the initial pain of an economic crisis—a typical knee-jerk reaction when everybody wants to sell everything to just hold cash. But as rationality returns, all three are going to soar to unexpected heights because the crisis is going to expose the fundamental weakness of the U.S. dollar.

Finally this month, The Big Short, Part 2?

Continued Rate Hikes Would Spell Disaster for the Economy

Michael Burry—the head of Scion Asset Management, and a key character in The Big Short movie that chronicled the American housing crisis in 2007-08—is at it again. He’s warning those who will listen that the Fed’s push for a “soft landing” is likely to fail, and that the stock market faces a big drop.

He is now comparing today’s stock market to the dotcom bubble of the early 2000s.

The point he makes stems from the market rally that occurred even as dotcom stocks were in a deep funk. That rally was basically what Wall Street calls a “dead-cat bounce,” and the bear market shortly thereafter resumed.

He argues, rightly, that U.S. consumers have spent down their savings because of high inflation that is now entrenched, and that corporate profits are sliding and will likely continue to slide (since U.S. consumers are running out of available cash).

Question is: Are we in a bear-market trap, as Burry thinks we are? Is the current strength in the market real or is it illusory?

I am going with “real.”

The Federal Reserve has slowed its rate hikes, and it’s going to have to stop them altogether very soon, or risk destroying the economy in ways it doesn’t want to.

Some will argue that the Fed has no intention of saving the markets this time… that it will let investors suffer for the sins of past Federal Reserve decisions that created this mess.

Maybe that’s true.

But I tend to think that the Fed is going to bend the knee to Wall Street, investors, consumers, and congressional leaders who are going to increasingly demand that the Fed stop purposefully killing the economy and consumers.

I am working on the belief—and clearly the stock and crypto markets are too—that the Fed will ultimately have to rejuvenate the economy by stopping rate hikes or even cutting them.

Either of those is bullish for risk-on assets.

And if the Fed doesn’t follow that script… then go back and re-read what Kiyosaki says, because disaster awaits.

With that, we’ve reached the end of this month’s Wire. If you have any feedback or any topics you’d like me to address in a future issue, you can reach me through the contact form on the Global Intelligence website.

Thanks for reading and for being a Global Intelligence subscriber.