Welcome to your March 2022 issue of the Global Intelligence Wire.

This is the monthly digest exclusively for Global Intelligence Lifetime Circle members, in which I cut through the media chatter and highlight five underreported news stories from recent weeks.

First up, the man who turned the House of Mouse into an entertainment giant is changing address.

A Legendary U.S. CEO Invests in the Metaverse

Bob Iger, who led Walt Disney as its CEO for 15 years, is moving into the metaverse.

During his tenure, Iger moved Disney away from its primary role of running amusement parks and producing kids’ movies, and turned it into one of the world’s leading entertainment giants, with acquisitions of 20th Century Fox, Lucasfilm, Marvel Studios, and Pixar Animation Studios.

Now, Iger has invested in and joined the board of a company called Genies, a maker of personal avatars for use in the metaverse realms that are beginning to emerge.

The metaverse is a new vision for how the internet will operate. Instead of staring at the internet on smartphones and computer screens, we’ll view it all around us using 3D glasses and augmented reality technology.

Genies has become popular with celebrities including Jennifer Lopez, Rihanna, and others. And as I’ve been writing for a while now, this is where mass-market adoption begins.

First, you see companies like Walmart, Nike, and Adidas move into the metaverse. Then you see celebrities like J-Lo tweeting about mini-me avatars and suddenly the mass-market begins to get interested. Soon enough, everyone has an avatar of themselves running around in metaverses.

I realize many people will shake their head at the idea and maybe move onto the next item, convinced that this is just a fad among the younger generation. But avatars are the iPhone of tomorrow—a technology that few thought they needed but which is now a ubiquitous, necessary accessory in just about every aspect of life.

People are going to do everything in the metaverse: shop, play, socialize, earn, participate in meetings, go to parties, and attend sporting and entertainment events. And many—probably most—are going to quickly move away from the basic avatars offered for free by various metaverses. They will want an avatar of themselves that they can dress however they want with digital clothes, shoes, and accessories. And, yes, that’s coming too.

It’s not just Nike and Adidas that have moved into the metaverse. Brands such as Ralph Lauren, Gap, Abercrombie & Fitch, Louis Vuitton, Gucci, Balenciaga, and others are all either in various metaverses already, or they’ve filed patents for the digital clothing and accessories that they want to sell in the metaverse.

Remember this: Bob Iger is 70 years old. This is not a youngster’s fad. It’s where business is going and some of the biggest business leaders on the planet recognize that and are acting on it now.

Next up, why another American business leader thinks the value of Ethereum is about to skyrocket…

Ethereum Could See Gains of Over 1,400%

Bill Barhydt, CEO of digital cash-payment app, Abra, says that he expects the value of Ethereum to reach prices in the $30,000 to $40,000 range (on par with what I’ve been saying for more than a year).

His rationale: Ethereum is about to go through an upgrade which will see transaction speeds increase by 600,000%, subsequently knocking transaction costs down to fractions of a penny.

When that happens, the world is going to rush to build products and services on Ethereum, or ETH as it’s called—meaning the use cases for ETH are going to explode.

ETH is already one of the busiest, most popular blockchains in the cryptosphere, but ETH’s transaction times are slow, the volume of transactions it can process per second are minimal (17 transactions versus up to 50,000 on rival crypto network Solana), and the costs can be outrageous (tens to hundreds of dollars compared to less than a penny for Solana).

All of that will change with the ETH 2.0 upgrade that could happen as early as this summer. When it does, we’re going to see an influx of businesses using ETH for new services and products in metaverses, stablecoins, decentralized finance, gaming, non-fungible tokens, and a rash of back-office services that will provide businesses with vast cost savings and efficiencies. As users buy and spend ETH for all of these services, it will ratchet up demand for the crypto.

As I write this, ETH costs around $2,600 per token. The arrival of ETH 2.0 could easily see the token value rise to five or 10 times that price, relatively quickly, and then continue growing from there. Which is why I urge you to add Ethereum to your portfolio and get in before this meteoric rise.

Moving on to…

Has Gold Reached Its Peak?

In the wake of Russia’s invasion of Ukraine, gold hit a new all-time high of nearly $2,080 per ounce. This makes sense—wars that involve major nuclear powers tend to pump an abundance of fear into global markets. Gold is one of the primary beneficiaries of this fear since it has a multi-thousand-year history as a store of value.

But the question is: Where next for gold? Do we go higher from here, or have we topped out?

Some of that will depend on the length of the war. If destruction escalates, or if Putin does something crazy like attack NATO, gold will reach unheard of prices. On the other hand, the minute peace arrives, gold will tail off. However, that decline would be temporary at best and just a breather for the gold market.

I’ve made the case recently that we’re likely to see gold approaching $2,500 before 2022 is over. Now, others are calling for the same price. Some say $4,000 to $5,000 is not out of the question before this latest bull-cycle in gold slows.

The reasons are ones I’ve touched on repeatedly in the Global Intelligence Letter and my daily Field Notes. Inflation has been running increasingly hotter month by month (despite the Federal Reserve’s assertions that higher prices would be temporary). Uncle Sam carries so much debt now that interest rates can never go high enough to tackle inflation. And these two factors combined mean that the dollar is blithely walking into a crisis some time this decade.

The gold market has known this for a decade now, which is why gold prices have never fallen below $1,000 an ounce since 2009. Gold buyers—including most of the world’s central banks—have been regularly adding to their holdings in up markets and down. And there’s only one reason why savers and central banks buy gold bullion: safe-haven preparation for the day a Western currency collapses from too much debt.

So my advice is this: If the war in Ukraine ends in the near term and gold pulls back from its current run, use that moment as a buying opportunity for gold. The shoot’em up war will be over…but the financial war with debt and the dollar has yet to play out. Prepare yourself by adding gold to your portfolio.

Next up…a different kind of metal to keep an eye on.

Uranium Is on the Rise Thanks to Clean Energy Initiatives

I have been a uranium fan/investor since before Japan’s Fukushima disaster in 2011 sent the price of uranium plummeting. Frankly, it’s been a grind watching the nuclear metal melt down. Uranium fell from more than $72 per pound to the high-teens.

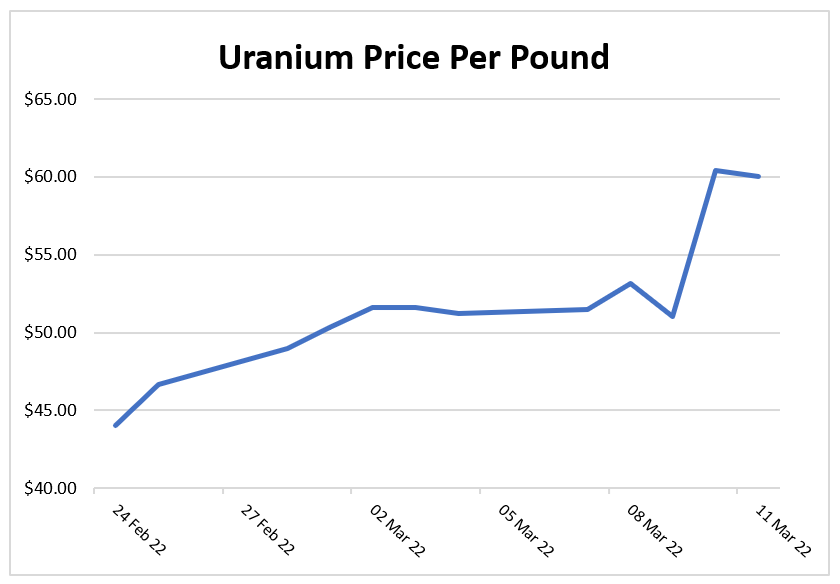

Today, however, uranium sits at 11-year highs north of $50. This is yet another impact of the war. Western nations have imposed various sanctions on Russia and in turn, Russia has imposed counter-sanctions on the West. Uranium falls into those counter-sanctions as it just so happens that Russia is a top-seven exporter of the energy metal. This has helped drive uranium prices higher since late-February in what almost looks like a moonshot.

As with gold, though, there are more factors at play. Uranium has been on the rise for the last two years, moving up to the $30 to $40 range late last year from the low-$20s in March 2020. The reason: A move toward green energy and the increasing realization by countries that they have no way to meet clean energy goals without relying on nuclear power.

You see, nuclear energy has a benefit that wind and solar energy (the golden children of alt-energy) don’t offer: Always-on power—or what’s known as “base load” power. It’s the idea that when you flip a switch, there’s already juice in the lines to illuminate your lights. To that end, France has announced it will build 14 new nuclear power plants and as of March, the World Nuclear Association reports that 55 reactors around the world are currently under construction.

I wouldn’t be surprised to see uranium prices backslide a bit once the war ends and talk of sanctions-lifting emerges. But, as with gold, that’s going to be a buying opportunity for uranium miners. Uranium was on the rise before the war…and it will continue to rise after the war. Watch this space…

Finally…let’s discuss how the war will impact food supplies.

The Link Between War in Ukraine and Global Food Prices

World War II history buffs might recall that one of Hitler’s prized targets was Ukraine. He wanted the country within the Reich’s sphere of control for one primary reason: its Black Earth—a band of extremely rich soil that gives Ukraine the capacity to be the breadbasket of Europe. Indeed, Ukrainian soil could literally feed all of Europe if it had the kinds of modern agricultural practices and technology that are common in the West.

As it stands today, Ukraine can do very little to feed anyone because of the ongoing conflict. In fact, the war is likely to cause a global price spike in all kinds of food commodities and food supplies.

Ukraine is one of the world’s leading wheat exporters (as is Russia). It’s also a huge player in sunflower and rapeseed oil. We are, however, racing toward a critical challenge: Spring planting season is approaching but farmers cannot cultivate their land with a war underway all around them. Many farmers have actually laid down their ploughs to pick up guns to defend their homeland.

This is going to have a meaningful and noticeable knock-on effect on world food prices. Exacerbating that fact are the tit-for-tat sanctions between Russia and the West which will also hit global food prices because of Russia’s heft as an exporter of wheat, edible oils, and other grains.

So, steel yourself against what’s to come. Prices for all kinds of foods are about to increase even more as spring and summer unfold and Ukrainian fields lay fallow. And it’s why I include commodity investments in the Global Intelligence Portfolio, such as our fertilizer play, Yara International.

And that brings us to the end of this month’s Wire. If you have any feedback or any topics you’d like me to address in a future issue, you can reach me through the contact form on the Global Intelligence website.

Thanks for reading and for being a Global Intelligence subscriber.