Welcome to your January issue of the Global Intelligence Wire.

This is the monthly digest exclusively for Global Intelligence Lifetime Circle members, in which I cut through the media chatter and highlight five underreported news stories from recent weeks.

First up this month…blockchain is posed to explode in 2023.

Survey: 90% of Companies Are Adopting Blockchain Technology

Last year was a wee bit of a disaster in the crypto market. Bitcoin, Ethereum, and pretty much every other cryptocurrency plunged as the Federal Reserve embarked on its aggressive plan to attack inflation by hiking interest rates at the fastest pace in 40 years.

Despite that, however, 90% of companies surveyed in the U.S., U.K., and China say they’re deploying blockchain technology in various ways throughout their businesses because they know blockchain is the future.

Blockchain is the technology behind bitcoin and all other cryptocurrencies. It’s a permanent, unhackable digital ledger that can be decentralized across the internet, unlike traditional databases or digital ledgers that are focused in a centralized location.

As I’ve been saying for a long while now, this technology is going to change the world. The crazy ups and downs of the crypto market really say nothing about where we’re going as a society. Financial services, entertainment, education, social interaction, health and identity records, even anti-pirating of consumer drugs and pharmaceuticals are all heading to the blockchain.

As a Cointelegraph story notes, “Businesses that are already utilizing the technology are benefiting from two of its main capabilities: security (42%) and copy protection (42%). Those in IT-based operations are using blockchain for things such as internal workflows (40%), supply chain efficiency (34%), and software development (30%), among others.”

This is why it’s so important to own exposure to the crypto market for the long-haul (and why now is such a great time to be a buyer, when prices have fallen 90% or more in some cases). Crypto today isn’t necessarily about the price of a particular coin. It’s about the increasing adoption of crypto technology as companies and governments look for more efficient and cost-effective ways to provide services or track and compile data.

Soon enough, crypto is going to see a mass-adoption event—possibly this year, but certainly before 2025. When that happens, leading cryptos—specifically bitcoin and Ethereum—are going to run to prices that would make most people laugh. Those who own now and who patiently ride the inevitable ups and downs are going to create potentially life-changing wealth.

Moving on to another message I’ve been delivering for a while now…the dollar’s inevitable decline.

The Dollar Suffers Its Worst Quarterly Fall Since 2010

Since peaking in late September, the U.S. Dollar Index, which tracks the buck against a basket of global currencies, is down nearly 11%. For the final quarter of 2022, the greenback fell about 8.5% against the Index’s list of currencies—the dollar’s worst quarterly effort since 2010.

As Insider recently wrote, the dollar’s days of decline are only just beginning, reflecting the broader market’s “expectations that the U.S. central bank is approaching the end of its current rate-hike cycle.”

I’ve been warning of the coming dollar weakness since spring last year. That’s because from a purely outsider’s point of view, the dollar is a fundamentally and structurally weak currency thanks to the size of America’s debt and the vigor with which America’s two political parties despise one another. Both of those facts combined tell global investors and traders that America’s fiscal house is in jeopardy.

We could see that jeopardy on display in announcements over the last week.

Treasury Secretary Janet Yellen reported that America will run up against the debt ceiling this week…and over the weekend, Republicans insisted in the press that they “won’t budge” on raising the ceiling if Democrats don’t slash spending on Social Security and Medicare. Democrats responded with what was essentially, “Yeah, good luck with that.” If Republicans follow through with their threats, and if Democrats allow it, America ultimately would default on debt repayments, precipitating an epic financial disaster for the dollar.

Even if the debt-ceiling fight fades away, the reality is that the Fed is nearing the end of its rate-hike cycle, which will reduce demand for the dollar relative to other currencies.

Moreover, the U.S. economy faces a slowdown because of the impact of the Fed’s super-aggressive rate hikes over the last year. That, as the Insider story points out, underscores the fact that Europe and China are emerging as more favorable growth stories going into 2023. Traders and investors will aim to get out ahead of a slump by selling dollars to buy foreign currencies that they can use to buy assets in Europe and China.

Keeping with the Fed for a beat longer…

How the Lords of Easy Money Stole Our Wealth

Reason magazine recently published a fascinating review of a new book that digs into the true impacts of the Federal Reserve’s monetary policies over the last couple of decades, but specifically in the years leading up to and after the global financial crisis that emerged in 2007.

The book is called The Lords of Easy Money: How the Federal Reserve Broke the American Economy. It’s conclusions, backed by some solid data, hold that the Fed’s policies have gone above and beyond in helping the moneyed class grow increasingly wealthy as the American middle class and below paid the cost.

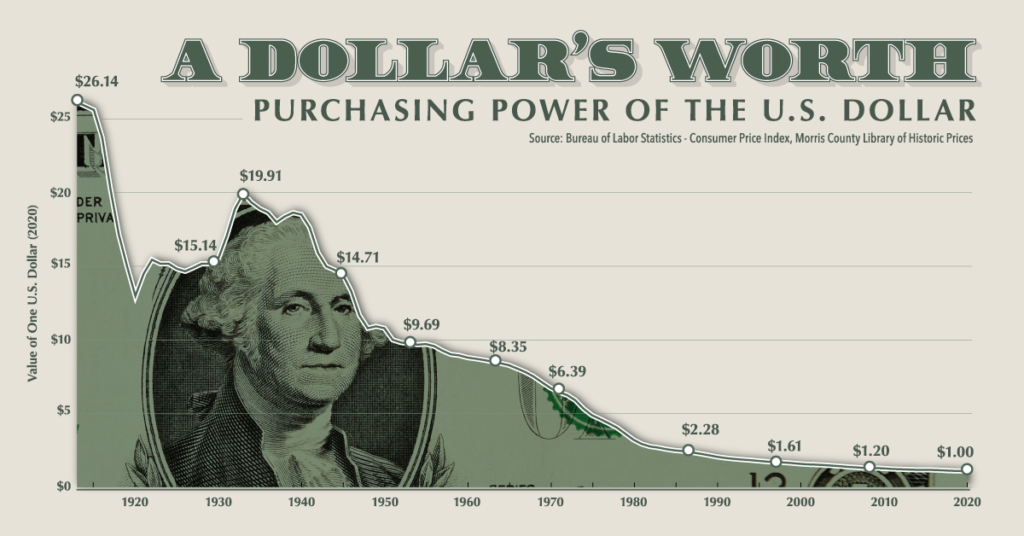

I have long been a critic of the Federal Reserve because it does little to benefit the American economy, and no one can convince me otherwise. The chart below shows the value of the U.S. dollar since the Fed’s birth in 1913. It confirms that the organization charged with managing the economy to prevent financial crises has overseen a decline in the dollar of more than 90%.

That’s a fiduciary crime in my book.

In the 100-plus years between America’s founding and the rise of the Federal Reserve, the dollar was a relatively stable currency. Yes, it had many ups and downs and financial panics. But the buck never lost 90% of its value. And when it did lose purchasing power, it ultimately regained it in time.

Not so in the years since the Fed arose. The dollar’s trajectory has resembled a never-ending ski slope.

Where does it end? Ultimately with the disbanding of the Federal Reserve at some point, or at the very least, a restructuring of the Fed and how it operates. Otherwise, the dollars in our wallet are going to be worth less and less and less with each passing year.

Next up, how to protect your wealth from the collapsing dollar…

Gold Soars Amid the Dollar Decline

Answer: Cats and dogs. Oil and water. Dollars and gold.

Question: What two things tend to repel one another?

While the dollar has been having a not-so-good time of late, gold has taken on a new shine. As Kitco News points out, gold just hit a recent high and there’s good reason to believe the trend will continue as the dollar decline keeps on keeping on.

As Kitco points out, “Uncertainty continues to dominate financial markets as central bank monetary policies push the global economy into a recession to cool down inflation.”

If you’ve been a reader of Global Intelligence and my Field Notes e-letter for longer than seven minutes, then you will know that I am a big fan of gold.

It’s not that I am a lifelong gold bug. I’m not. I never owned gold until about 15 years ago, when I first came to realize that the U.S. cannot continue to pile on ever more debt without dire consequences, and that every reserve currency in the world eventually lost the title.

Nothing is different this time that says the U.S. dollar will buck that trend.

The way I see it, gold is an absolutely mandatory inclusion in any overall portfolio. It will serve as portfolio and lifestyle insurance when the reckoning arrives.

Over the last decade, the gold market is telling anyone who will listen that the reckoning is coming. From the mid-1980s to the end of the 1990s, gold meandered within a fairly narrow range between about $250 and $490 per ounce.

And then came the 2000s…and gold took off as though on a rocket flight. From $255 in August 1999, the lowest price the metal had seen in 20 years, gold methodically marched above $1,800 per ounce by August 2011, almost in a straight line,

Since then, gold has never retreated back below $1,000. That’s a message from savvy investors and savers that a Western monetary crisis is a very real possibility, and those who recognize that are unwilling to part with their gold, regardless of market sentiment toward the metal.

I remain strongly committed to gold, as I explained in the January issue of the Global Intelligence Letter. There’s no way the West, especially the U.S., can manage its level of accumulated debts.

Something has to give in order for the global economy to heal. And gold is going to play a big role in the fix, as it always has.

Finally, the rebound in bitcoin…

“A Rare Opportunity in Bitcoin’s Price”

Over the past weekend, bitcoin pushed above $20,000 for the first time since last November, when the granddaddy of crypto fell to a low of $15,760 from a high north of $67,000 in November 2021.

In short, 2022 was a lost year for bitcoin. But 2023 might just be the recovery year. Bitcoin Magazine PRO, which publishes in-depth research on bitcoin and traditional financial markets, recently published a list of seven factors bitcoin investors should watch in 2023.

I won’t run through the full list here, but I do want to note one item, which underscores a lot of my writing over the least three or four months—what the magazine calls a “rare opportunity in bitcoin’s price.”

The point of that factor, the magazine notes, is this: “Relative to its history, bitcoin is at the phase of the cycle where it’s about as cheap as it gets.” There is a good bit of technical mumbo-jumbo to back up that point, but the nut of it is that, “Historically, purchasing bitcoin during these times has brought tremendous returns in the long term.”

This is what I’ve been saying for the last several months. Bitcoin and many other high-quality cryptocurrencies are priced for the end of the world. But the end of the world isn’t in the cards.

Once the Federal Reserve makes clear to the global markets that the rate-hike craziness is over, “risk-on” assets, especially crypto, are going to launch into their next bull run.

Yes, we’re going into a recession, but bitcoin survived the pandemic-inspired global collapse in 2020—in fact, that launched the crypto’s run to all-time highs. It will just as easily survive a recession, and will likely benefit because the dollar will weaken, and because the Fed will end up cutting interest rates.

Because of my long-range expectations, I’ve specifically been adding bitcoin, Ethereum, and a few other select cryptos to my portfolio. All have a very bright future ahead of them…and they’re going to create tremendous wealth for those who buy now at cheap prices and hold until the euphoria is once again widespread.

With that, we’ve reached the end of this month’s Wire. If you have any feedback or any topics you’d like me to address in a future issue, you can reach me through the contact form on the Global Intelligence website.

Thanks for reading and for being a Global Intelligence subscriber.