Let’s pick up where we left off yesterday with the likely collapse of one or more Western currencies sometime this decade. But let’s expand on that with a clear and present danger that has just emerged…

The pending arrival of a new basket of currencies.

Now, I wanna warn you that you might reflexively roll your eyes when I tell you the list of countries behind this currency basket. But stick around for a few more paragraphs and some upcoming charts.

The countries: Brazil, Russia, India, China, South Africa…the famous BRICS quintet.

They announced at the 2022 BRICS Summit last month that they’re working to create a new global reserve currency—a basket of their own currencies—to replace the dollar.

Granted, these are not the economies most (or any) people think of when the word “safe currency” pops up in a conversation.

Then again, safety—or perceptions thereof—exist along a spectrum that itself is malleable, based on the situation.

Let me propose to you a hypothetical choice: You can accept a $100 gold bar right now from a person with a less-than-stellar reputation…or you can claim an IOU worth $200 at some point in the future from a more upstanding citizen, but who has financial problems.

Which offer would you accept?

That’s not a trick question.

If you’re logical, you take the gold bar because you have no idea if that IOU is ultimately worth $200 or two cents.

That’s the heart of this debate over the BRICS currency basket.

The BRICS countries are saying their basket will be backed by gold and other commodities—a true hard currency. Own that currency and you own the equivalent of physical gold. Maybe that currency is actually convertible into gold—who knows?

The dollar, meanwhile, is backed by history’s largest mountain of debt and an increasingly polarized and dysfunctional political system. Own a greenback and you own an IOU.

While you and I might still ride with Uncle Sam for loyalty reasons or perceptions that the dollar is the world’s strongest currency, a lot of the rest of the world doesn’t always cast such a blind eye toward the U.S. and its hegemonic currency. There is a lot of institutional anger out there in the rest of the world because the dollar has an unfair advantage—reserve currency status—that props it up against other currencies.

Clearly, numerous countries that begrudgingly use the dollar would gladly shift to a gold-based BRICS basket currency.

This project has actually been underway since 2009, when the BRICS first laid out their plan.

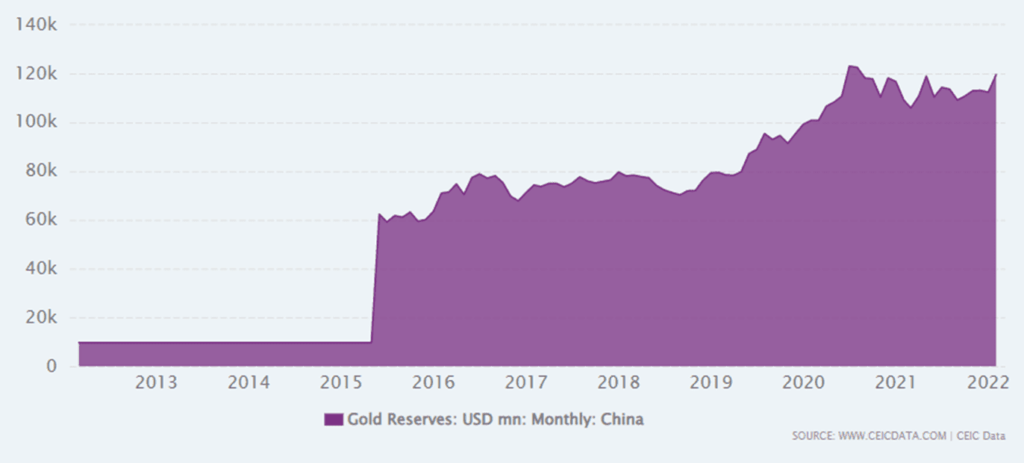

Here’s a chart of China’s gold holdings in recent years:

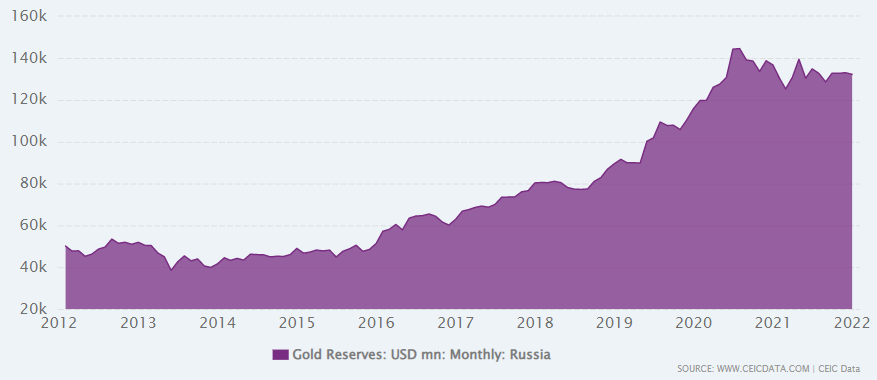

Here’s Russia’s:

Don’t worry about the numbers, just notice the trend. It’s the same with the other three BRICS nations.

Combined, the BRICS now hold a quantity of gold equal to about 5,200 tons.

The U.S. holds 8,133 tons.

Each one of those numbers presupposes that countries aren’t lying about their gold horde. And BRICS countries could actually have a lot more than they’re letting on.

Based on import/export data of gold tracked by Hong Kong’s census and statistics agency, there’s good reason to believe China is wildly under-reporting its gold.

Meanwhile, the Federal Reserve has refused a comprehensive audit of America’s gold since the Eisenhower administration in the 1950s. In fact, the last person of authority to reportedly inspect the nation’s gold was FDR, on April 28, 1943. So, you know, probably decent reason right there to suspect that maybe Uncle Sam’s gold is over-reported.

Whatever the case, China and Russia are the world’s two largest gold-mining countries. South Africa ranks 10thand Brazil 14th. A lot of that homegrown gold never leaves those borders.

The U.S. is a top 10 gold miner as well. But, again assuming reported numbers are legit, Ft. Knox has added no gold for decades.

All of this ultimately might go nowhere. Impossible to say if the BRICS follow through with their plan, or if it’s all just a stunt to rag on the dollar.

But if it does go somewhere, and if countries do begin adopting the BRICS basket at the expense of the dollar, that will affect our wallets. Dollar demand will shrink, leading to a weakening currency, which leads to higher prices on imported goods.

It would mean less demand for U.S. Treasury debt, which would force the debt-dependent U.S. to increase the interest rates it pays on its debt, thereby driving up Uncle Sam’s cost of living as well as the borrowing costs Americans pay on mortgages, credit cards, and car loans.

My point is that these events like the BRICS wanting to launch a hard currency don’t happen in a vacuum. They ripple across the world.

Again, maybe this never comes to fruition. But if it does, you’ll want to pay attention to that fact. Because it will touch your life, too

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.