The Frightening Numbers Behind an Energy Super Shock

Numbers can lie. Numbers can speak the truth. Numbers can amaze.

For today’s dispatch, we’re going with Door #3. Numbers can amaze—as you’ll see by the numbers from a report last year showing why an energy crisis is in our future.

I term it an “energy super shock” because “crisis” seems too insignificant for what’s to come.

Here are the numbers:

- The Biden administration in late 2021 held the largest oil-and-gas lease sale ever: 80 million acres out in the Gulf of Mexico. The bidding ended with $192 million raised, a laughable $25 per acre. Nearly 97% of the bids were uncontested.

- A few months later, 448,000 acres in the state of New York went to bid for the right to build a bunch of windmills. The bidding drew lots of competition, and ultimately concluded with cumulate bids of $4.37 billion, or about $9,000 per acre.

Now, green energy fans should smile at those numbers…

But for those of us who realize the bigger problem at hand, those numbers say inflation will worsen, that Americans might not be able to afford power in some cases, and that family pocketbooks are soon to feel ravaged.

Now, as I regularly note, I am not hostile toward green energy. I see lots of opportunities there. I own green-energy investments. And a world free of fossil-fuel emissions will be a better world.

However…

We are not ready for that world.

We do not have the infrastructure in place to manage the transition as quickly as the greenies want it to happen.

“But, Jeff, you dunderhead—that $4.37 billion spent on New York windfarm land is precisely the type of infrastructure investment you’re yapping about!”

And it is precisely the root cause of the super shock racing toward us.

See, the bigger problem here is that the world’s demand for energy is growing faster than the capacity of green energy to step up and cover the fossil-fuel shortfall.

And, yes, there is a shortfall.

Global oil demand crossed a record 103 million barrels per day back in June, and demand has continued to grow.

Daily oil production, meanwhile, is down to less than 101 million barrels. That deficit is likely to keep growing, or so say all the global energy agencies that track global oil supply and demand.

Green energy can’t make up the shortfall because demand is growing faster than the ability for green energy to meet it.

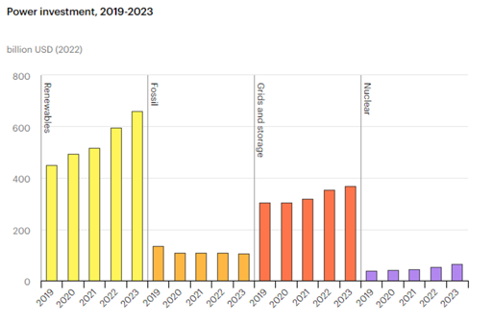

Yet green energy is sucking up almost all the financial oxygen. Consider this chart from the International Energy Agency:

Renewables are consuming a huge sum of investment dollars, while investment in fossil fuels has collapsed and is still falling.

Again, green energy zealots will cheer that and smile smugly.

Alas, that trend is problematic for everyone, because, as I noted above, green energy output isn’t growing fast enough to meet growing energy demand globally.

So, we face that coming energy super shock.

Oil prices will rise sharply… Natural gas, too.

My bet is that $150 oil becomes the norm—with spikes to $200 or more.

And it’s not like the oil and gas companies can just turn on a spigot to increase supply. Developing oil and gas wells takes four to 10 years. Problems that emerge today won’t see solutions until the back half of this decade.

But that’s assuming money flows into oil and gas exploration… and as you can see in the chart above… it’s not.

Some of that $4.37 billion thrown at windfarm land could have gone to developing any/many of the more than 9,000 drilling permits in the U.S. that have already been approved but which the energy industry has not yet used. Moreover, the U.S. has more than 10 years of unused oil and gas leases it could call on but doesn’t. That’s something like 14 million acres on land, and another 9 million acres offshore that are under lease, but which oil and gas exploration companies are not using to, well… explore for oil and gas.

Maybe the land offers poor prospects.

Yes, maybe. But, then again, the Bureau of Land Management says that at least 25% of those leases are on acreage with “medium or high potential for oil.”

Ok, well maybe the Feds aren’t willing to give exploration companies the greenlight.

Nope. Not the case here. Not even relevant.

At least 90% of the acreage is on state and private lands, where G-men have no voice.

Ok, well then, maybe those unused permits and leases just mean the industry isn’t interested in drilling anymore because it knows the future is green?

Maybe… but more likely it’s because it’s hard to gather up financing for the heavy costs of drilling wells—particularly deep-ocean wells—when so much cash is pouring into the green sector.

What we’re left with is a world that is grasping for as much power as it can gobble up. But it cannot rely on green energy to supply that increasing power. And it cannot rely on the fossil fuel industry to supply that increasing power because the fossil fuel industry can’t attract enough investment.

And, so, we will end up with higher and higher oil and gas prices.

And higher and higher inflation.

And deep pain in household pocketbooks. We will end up with an energy super shock that sees energy stocks shoot the moon.

But I don’t want to see this super shock inflict pain on your pocketbook. Which is why I made sure our Global Intelligence Portfolio is insulated against anything the upcoming energy shock can throw at us… or any other crises to come.

Filled with assets like bitcoin, energy stocks, and a basket of foreign currencies, not only will it protect us from the shock to come but see us thrive as oil prices churn higher.

Like I said at the beginning of this dispatch, numbers can speak the truth… and they can amaze—in a frightening way.

Get ready to be amazed by the meteoric rise of oil prices to come.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.