You can’t out-save inflation.

I’ve come to the realization that too many people don’t really understand inflation.

For instance, I have a troubling number of tweets on Twitter/X in which someone joyously exclaims that inflation has slowed, proving that the current administration is lowering prices in America.

It’s almost as if elementary math never existed in these tweeters’ lives.

First the data: Inflation in America rose 2.7% last year, according to the latest batch o’ numbers from the Bureau of Labor Statistics. Now, whether that data is accurate is a whole ‘nother barrel of monkeys.

But we will take it at face value because it’s the published number.

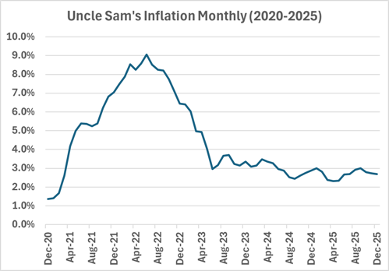

Add that number to a chart and this is what the last five years of inflation looks like:

The rate of inflation has moderated from those pandemic days, but every one of those readings is above zero.

Which, according to elementary math, means prices are still going up!

Prices are not coming down.

For instance, “food at home” is 3.1% more expensive than it was last year. Meaning… if you spent $500 a month on groceries in December 2024, the same bag of victuals cost you $515.50 the past December. Utilities are nearly 11% more expensive. Used cars are 1.6% pricier today. Shelter is 3.2% costlier. Medical is up 3.5%.

The only expense that has retreated is the volatile price of gasoline… but that could turn around in an instant for any number of geopolitical reasons at play these days.

The point of all of this is that inflation is forever present in a financial economy in which the Federal Reserve’s stated aim is to seek an inflation rate of 2%. That’s the Fed telling us all that the dollar is, in a perfect world, going to lose 2% of its purchasing power every year.

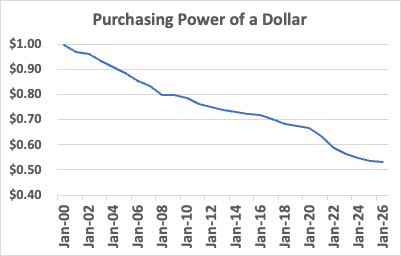

This is what that looks like:

One of Uncle Sam’s increasingly worthless greenbacks today only buys about $0.53 worth of goods and services relative to what the same buck afforded a quarter-century back.

That’s the dollar losing 2.5% per year, not 2%.

That’s the value of your income deflating every single year, like one of those helium-filled birthday balloons that slowly sinks to the ground over time as the helium methodically escapes.

This is a primary reason why I am always yapping about income opportunities here in Field Notes and in my monthly Global Intelligence Letter. You have to replace the helium, if you want your balloon to keep floating.

I went back to look at the stocks and whatnot that I recommended in my last Retirement Income Masterclass held last summer, so let me share some of the dividend yields that portfolio is currently collecting: 9.5%, 14.2%, 7.8%, 12.1%. (If you’re interested in attending my upcoming Retirement Income Masterclass, you can learn more during my Passive Income Workshop, here.)

The lowest yield in the bunch is 4.8%. And the overall portfolio is yielding north of 8% annually.

Income such as that is the cornerstone of my thinking, now that I’m about to turn 60 next week.

I want companies that pay me money. More importantly, I want companies that have a history of increasing their dividend payments. That tells me a few very important things:

- The company sells a product or offers a service that consumers want.

- The company has pricing power or it’s an innovator. Rising dividends typically means rising earnings, which stems from selling more widgets, pricing those widgets higher as inflation sets in, or innovating in a way that keeps customers coming back.

- The product or service is “sticky.” Think about cigarettes—it’s a sticky product in that consumers don’t easily kick the habit.

- The earnings are real. By and large, companies don’t pay dividends if they have no real earnings.

If I can own shares of those companies, I’m a happy camper. I can buy the stock, stuff it into my account, forget I even own it, and just let the dividends grow over time. Soon enough I am earning an outrageous annual return on my invested cash.

Let’s take Abbott Labs, for instance. I bought that stock way back in March 2000 for about $16 per share. Still own them today. Back then, my initial dividend was $0.34 per year, or a yield of 2.1%.

Today, Abbott Labs’s dividend is $2.52 per share, meaning my yield-on-cost is 15.8%. And the stock at nearly $122 now is up 7.6x. I am quite happy with that.

That’s exactly what I want in a portfolio aimed at taking me through my retirement: rock-solid companies, selling products that people need or demand, and generating a growing stream of profits that will translate into a growing stream of income for me. Abbott Labs has raised its dividend for 54 consecutive years.

What more could I ask of a stock?

That’s why I pack my Retirement Income Masterclass with historically strong dividend-paying companies.

I know retirement is a bear financially. But with a solid roster of dividend-paying aristocrats like Abbott Labs, well that means you can better fight inflation… even as the mathematically challenged try to figure out why 2.7% inflation means prices are still rising rather than coming down.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.