This Event Will Kick-Start Bitcoin’s Next Bull Run.

It’s never too early to prepare for riches.

A bit less than a year from now, a much-anticipated event will occur—probably around April 26.

On that day, bitcoin will go through its next “halving,” a technical process whereby the amount of bitcoin rewarded to “miners” will decline by half to just 3.125 bitcoin from the current 6.25.

Bitcoin is created when computers solving complex math puzzles. This process is called “mining,” and like real mining, it’s been designed to get increasingly difficult over time.

Roughly every four years, the rewards that miners receive is cut in half. The final halving is expected to occur in 2140 when the number of bitcoins circulating will reach the maximum supply of 21 million. (The circulating supply is already over 19.3 million today.)

Next year will see bitcoin’s fourth halving, and the world eagerly anticipates this event because the last three halvings have seen the crypto’s price explode higher.

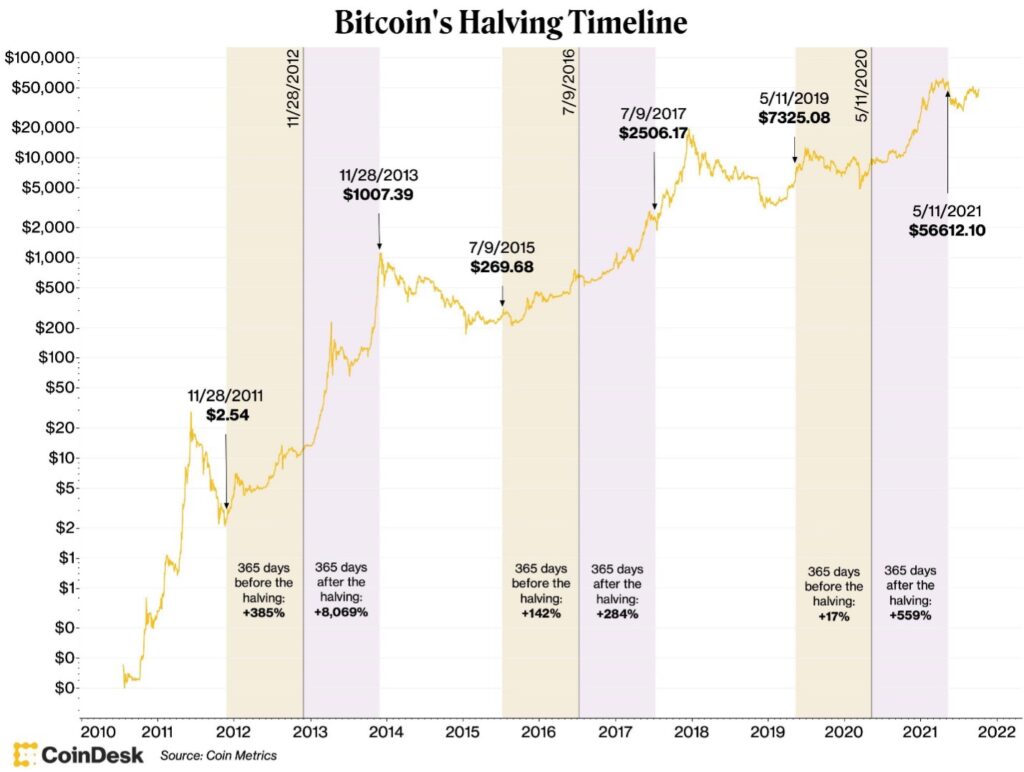

Here’s a chart from CoinDesk that shows how bitcoin’s price moved in the years before and after each halving:

The first halving saw bitcoin soar to more than $1,000 from just $2.54. Had you owned just $254 worth of bitcoin one year before the halving, you’d have had more than $100,000 a year after the halving.

The second halving saw bitcoin’s price surge more than 830% over a two-year period, and the third saw bitcoin reach all-time highs before the bear market growled awake.

Now, we’re a bit less than a year removed from the next halving. If history is a guide—and I believe it is—bitcoin’s price will likely start making a move later this year, ahead of the next halving in 2024. And then, post-halving, bitcoin will likely see its next massive run… to somewhere between $350,000 and $500,000.

Yes, I know that’s a crazy large price prediction for an asset that currently trades in the $27,000 range… an increase of up to 1,700%. But bitcoin’s history, as depicted in that chart, is remarkably consistent.

That’s not to say it’s a remarkably safe investment. Clearly, bitcoin, like all crypto, is volatile. And the price changes between bitcoin’s peaks and troughs are remarkably insane.

Nevertheless, bitcoin’s history is series of lurches and pullbacks, with the lurches driving the price sharply higher every time.

Personally, I believe we’re already in a stealth bull market for bitcoin and crypto. Prices for bitcoin, Ethereum, Solana and other major cryptos are up sharply off their lows late last year. Bitcoin is up more than 61% in six months. Ethereum’s up slightly less. Solana is up nearly 140%.

I sense this stealth bull market in the commentary I see on the crypto side of Twitter, where I’m active daily. And I hear it in the conversations I have with crypto teams around the world regularly. Though the media hasn’t yet caught on this year, it’s clear that crypto is no longer in its so-called “winter phase.”

Still, this early stage of a bull market is always volatile, as bullish and bearish investors grapple over who’s right. For investors like me, we’re in the accumulation phase. As such, I’ve been using this moment to add to my crypto holdings, particularly bitcoin. I’ve been selling off other assets I own to grab more and more bitcoin.

My expectation is that bitcoin is going to see a six- and then seven-figure price before the end of the decade.

I realize this whole world of crypto can be mind-numbingly confusing. I started down this rabbit hole in 2017 building Ethereum mining rigs with my son. Since then, I’ve become a crypto expert with deep ties to various crypto projects, including to teams running businesses based on non-fungible tokens, or NFTs (one-off, one-of-a-kind cryptocurrencies that are often depicted as cartoonish digital pictures).

Because I want as many people as possible to understand the wealth-creation opportunities that crypto and NFTs represent, I’m giving two crypto-based presentations at International Living’s Ultimate Go Overseas Bootcamp in Denver this September.

One presentation will focus on why crypto is the most inevitable trade ever… while the other will highlight how I’m using crypto and NFTs to earn daily, weekly, and monthly income that annualizes to between 50% and several hundred percent.

Though there’s definitely a learning curve with crypto, it’s not insurmountable. I’m not some tech-savvy 20-year-old who grew up with video games and social media as my sources of communicating with friends.

I’m 57 years old. I got into crypto in my 50s. I spent a lot of time researching it… understanding what it does, and the promise it holds. And I began to see how dramatically crypto was going to change nearly everything about our world.

Those changes are now happening.

All we need to do is look around at the companies now moving into the crypto space. I reference them all the time: McDonald’s, Walmart, Home Depot, Taco Bell, Gucci, Ralph Lauren, JPMorgan, Goldman Sachs, BMW, and so many more.

Those companies are telling us what the future will look like.

And I’m telling you how to participate in that future today, so that when tomorrow arrives, the little bit of money you put to work in crypto today becomes a whole lot more money than you ever expected.

The next bitcoin halving will very likely launch a new bull market in crypto, as every other halving has done. The best advice I can give you today is to understand where crypto is taking us.

Because in that journey, a vast amount of wealth will be created.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.