This is the story of the Toyota Camry. It has absolutely nothing to do with cars.

Instead, it’s the story of how a car can demonstrate the increasing worthlessness of dollars and the value of buying and holding gold, even as knuckleheads all over the traditional media claim that gold has no real value beyond jewelry and a few uses in electronics.

For 20 years now, the Camry has been America’s bestselling car. That gives us a fantastic vantage point in using a single, big-ticket item to examine inflation and its destructive impacts on wealth.

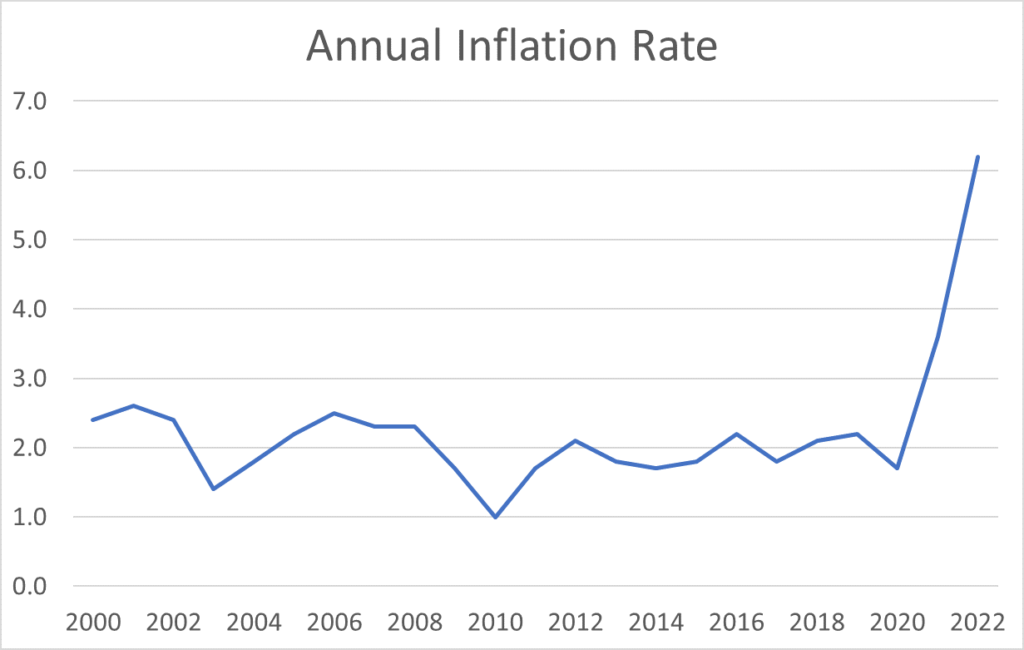

The thing is, inflation for much of the last two decades was fairly tepid, or at least it seems so outwardly. Only recently did the annual inflation rate jump above 3%. The average rate over the past 22 years: 2.2%

Now for that Camry…

Like I said, this has been America’s most bestselling car over that period. This means we can track inflation really well using the price of a new Camry, instead of the traditional method of calculating inflation, which uses a basket of items that fluctuate based on all kinds of variables.

Back at the turn of the millennium, a new Camry cost an average of $17,518, according to Cars.com. For 2023, the base model Camry carries a sticker price of $26,220.

Now, here’s where we move away from Camrys (as I said, this was never story about the Camry or cars) and into the real point of this dispatch, which as I alluded to at the top, is gold.

Twenty years ago marked the bottom for gold. Since then, gold has seen two decades of strength. Yes, we’ve had some retracements in that time, but gold that started the millennium bouncing around in the $200 to $300 range sprinted straight up to $1,225 between 2001 and 2010, and since then has never slipped below $1,000 per ounce.

There’s a message in that: The dollar is a disaster, America’s political environment is quite likely to cause a monetary crisis, the Western fiscal situation is soon to implode, and the only source of wealth protection is gold (and very likely bitcoin, but that’s a different story).

As such, gold hoarders see zero reason to part with their metal. They’re holding it as insurance against a fiscal or monetary crisis that, at this point in the game, seems like destiny. So, they—we, the gold holders—refuse to be shaken out of our gold by temporary dips in price.

Let’s now return to our Camry and look at it relative to gold…

Back in 2000, when gold was averaging about $275 per ounce, a new base-model Camry cost the equivalent of 63.7 ounces of gold.

Today, the average Camry sticker price requires 14.5 ounces of gold.

Thus, those 64-ish ounces you could have bought for roughly $17,500 in 2000 fully paid for a Camry 22 years later—and left in your safe the remaining 49 ounces of gold, or about $88,000, the cost of another three Camrys.

Meaning…gold has fully kept pace with the price of goods over the last two decades. In fact, the price of gold has far exceeded inflation over the past two decades.

The gold you bought in 2000 for $275 per ounce, is worth $1,800 per ounce today. It preserved, and even grew, your spending power remarkably well. That is precisely what gold is supposed to do.

Yet the dollar—managed by the Federal Reserve and a political body with economic smarts of a slug—has plunged in value relative to goods and services. Indeed, what $275 would have bought you in 2000 now requires $485 to buy today, according to the Bureau of Labor Statistics’ inflation calculator.

So, here’s my message to you today—a message I regularly repeat: Buy gold. Hold gold.

It’s one of the very few assets that holds up against the impacts of inflation over time. Yes, it can be volatile in the moment and it can drop in price. But over time, gold’s trend reflects the amount of worry there is in the world about Western debts and the full faith and credit of a government and an economy beset by some very obvious and serious problems.

I will soon be dumping some money into my SEP IRA for the 2022 tax season, and I can promise you that every last penny of that deposit is going into gold.

The dollar is a liar.

A Camry is not.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.