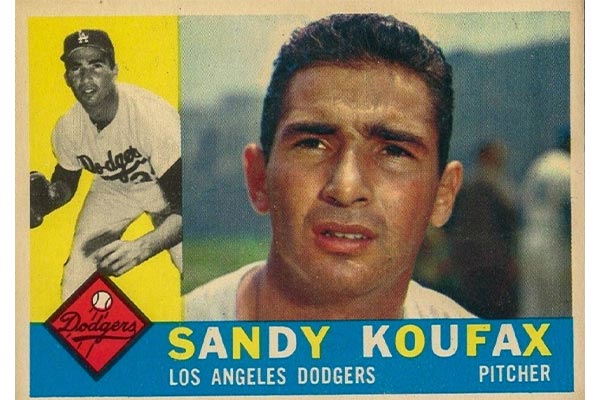

In 1960—six years before I invaded the world—a 12-card pack of Topps baseball cards cost a dime.

I know this because in 10th grade I worked in a sports memorabilia shop where I spent my paycheck buying baseball cards from 1960…still my favorite year for baseball cards because I think the horizontal card design is fetching. (Unlike so many who lament the loss of their childhood cards, I still have all of mine—thousands and thousands of them.)

As you might suspect, this missive has nothing to do with baseball or trading cards. I share this memory to focus on the dime those cards cost and to address a reader question I recently received wondering how it is that gold and silver preserve purchasing power.

Let’s jump to today to answer that question…

A pack of baseball cards nowadays costs in the range of $2.50, depending on which variation of cards you buy (and, as an opinionated aside, there are way too many variations these days).

And guess what?

That same 1960’s dime just about buys a pack of baseball cards all these decades later. But not in the way you think…

The face value of that dime—10 cents—did bupkis to protect your purchasing power. Ten cents 61 years ago is worth $0.91 today. That’s according to the Bureau of Labor Statistics, which tracks inflation data.

Based on government inflation data, the 10 cents you saved in 1960 is not nearly enough to cover the cost of your baseball card pack in 2021.

But…

That 1960’s dime was fashioned from 90% silver, and the precious metals content in that thin dime is right now worth just over $2.

The dime itself failed you. But the metal it’s made from—well, it stood the test of time. You could sell that dime for its silver value and afford your purchase today.

Which, to me, perfectly explains how gold and silver preserve our purchasing power over time.

Through the years, the value of the goods and services we buy goes up. The ability of a dollar to buy things goes down…and gold and silver compensate for it.

The reason: They’re real money. Always have been. For time immemorial. They’re relatively scarce as assets; they’re not easily mined; and they’re not controlled by governments and central banks that can—and always do!—issue more and more currency willy-nilly.

Of course, I’m just using a pack of baseball cards as an example, and that might be a pointless example. So, let’s look at something more meaningful—a house.

In 1960, the typical American house cost $12,700. Gold at that time was $36.50 per ounce. Thus, the typical house cost the same as 348 ounces of gold.

Today, that $12,700 in 1960’s dollars is worth $115,750…

And the average American home costs about $270,000…

And those 348 ounces of gold are worth…$661,000.

The dollars you saved in 1960 can’t even buy half a typical American home today. But with that bag full of gold, you could buy two, typical American homes and still have $121,000 remaining—probably just enough to afford a complete set of 1960s Topps baseball cards in mint condition.

In silver terms…you’d have needed 17,400 ounces of gold’s under-loved step-bother to buy that typical house in 1960. And today those same silver ounces are worth nearly $490,000.

Again, the precious metal had your back while your dollars robbed your wealth. And, again, you had plenty of cash to spare.

If you haven’t read the June issue of the Global Intelligence Letter yet, well it’s all about silver and why it’s primed today to move more than gold as we push farther into a new commodity super-cycle.

We’re still early in this move, so now’s the time to begin building your exposure to silver.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.