Welcome to your Sunday digest…my breakdown of the things we’re thinking about and talking about in the Global Intelligence world.

First up this week…the strange world of profile pictures, or PFPs.

For those of us who grew up in the pre-internet age, it can be hard to wrap our heads around the idea of an avatar—a digital character or image that can represent your identity online.

It can be even harder for us to understand why people would pay hundreds, thousands, or even hundreds of thousands of dollars for unique avatars. After all, they’re just digital images…

Yet, for the generations of people who grew up in the internet age and who use the online world for everything from working to socializing to dating, a unique avatar is a status symbol. Which is why avatars from certain collections are in such high demand among younger people.

And where the young people go, the celebrities follow…

On Gwyneth Paltrow’s Twitter account at the moment, her profile picture is not an image of the wellness-obsessed celebrity smiling vapidly. It’s this:

That’s an NFT, or non-fungible token, from the World of Women collection.

NFTs are one-off, one-of-a-kind crypto tokens. Since NFTs can represent ownership of unique digital assets, they are used for unique PFPs.

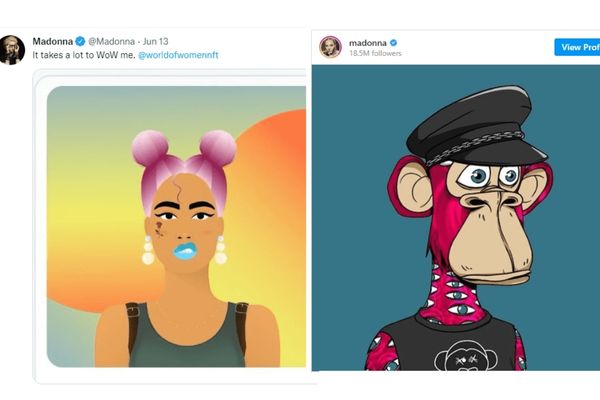

This World of Women, or WoW, collection is the latest to catch the celebrity eye. Other WoW owners include Madonna (that’s her WoW on the left below). Madonna is also among the many celebrities who own a Bored Ape Yacht Club (that’s hers on the right), the most famous NFT PFP collection. Other famous owners of Bored Apes include Snoop Dogg, Jimmy Fallon, Tom Brady, Mark Cuban, Serena Williams, Justin Bieber, Eminem, Kevin Hart…

The point being, this is undoubtedly a tough market for crypto. But even amid this bear market, the future is emerging, as the continued interest in PFPs demonstrate.

PFPs can seem quirky, strange, or ludicrous, but they are a new status symbol for the digital age…even a new form of online community with built-in benefits. For instance, in June WoW owners were invited to New York for a performance by Madonna.

With benefits like these on offer, there’s a lot of money to be made owning and trading these items. Indeed, the top five NFT avatar collections have collectively generated approximately US$6.9 billion in trading volume since January 2021, according to Dappradar.

Given the size of this market, the traditional art and investment worlds are paying close attention, and we should too. Speaking of which…

***

This fall, the William S. Paley Foundation will auction off at least $70 million in artworks by Picasso, Bacon, and Renoir, among others, and will use the money to help the Museum of Modern Art (MoMA) in New York buy digital art, and possibly NFTs.

Paley was the co-founder of CBS. Since he passed away in the 1990s, MoMA has been caring for his extensive art collection.

Now, his foundation is planning to auction 29 of the 81 pieces in the collection to build a $70 million war chest for MoMA to invest in digital art and programs. Among the pieces going on the auction block are Pablo Picasso’s Guitar on a Table, which is set to go for at least $20 million, and Francis Bacon’s Three Studies for a Portrait of Henrietta Moraes, which is expected to fetch $35 million.

Potential uses for the proceeds include launching a MoMA streaming channel, offering online courses, and purchasing the museum’s first NFTs.

This would be an important step. MoMA is one of the most powerful art institutions on earth. If it’s moving into NFTs, that clearly shows which way the wind is blowing.

Indeed, it should be noted that this would not even be MoMA’s first NFT project. Though the museum has yet to purchase a tokenized crypto artwork, it has already helped to create NFTs. Every week, crypto becomes more and more mainstream…

***

Finally this week, the World Bank agrees with my outlook on the global economy.

For many months, I’ve been warning that the rapid interest rate hikes pursued by the Federal Reserve and other major central banks were going to tip the global economy into a recession.

Then this week, the World Bank released a report saying exactly the same thing.

The authors of the report wrote: “A globally synchronized tightening of monetary and fiscal policies will likely help reduce inflation. However, because these policies are highly synchronous across countries, they could be mutually compounding in their effects—tightening financial conditions and steepening the global growth slowdown more than envisioned.”

Translation: With everyone hiking interest rates at a torrid pace at the same time, the global economy has no chance of avoiding a recession.

Commenting on the report, World Bank Group President David Malpass added: “Global growth is slowing sharply, with further slowing likely as more countries fall into recession. My deep concern is that these trends will persist, with long-lasting consequences that are devastating for people in emerging market and developing economies.”

The bottom line: We are trapped in an impossible situation with only two outcomes, neither of them good.

Option A: Everyone keeps raising rates and the global economy flatlines.

Option B: Everyone stops or slows the pace of their interest rate hikes and inflation remains high…likely for many years to come.

Given those two options, central banks ultimately will have to choose Option B…which means “risk-on” stocks and crypto will soar once again.

That brings us to the end of this week’s digest. Many thanks for being a subscriber. And if you have any feedback or questions, reach out through the contact form on the Global Intelligence website.

Enjoy the rest of your Sunday.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.