Sometime in 1911, maybe it was 1913—history seems unclear on this—coal miners began carrying caged canaries with them into the mine. When the little canary keeled over, carbon monoxide gases were at unsafe levels and it was time for the miners to scram.

And, thus, we have the “canary in the coal mine” cliché—a big warning from a small animal that trouble is afoot.

Now, I’m wondering if Hungary is a canary…

See, the small, Central European nation announced last week that it has increased its gold reserves to 94.5 tons from just 31.5 tons. I know not many people—aside from Hungarians—care about how much gold Hungary is buying. Frankly, most Hungarians probably don’t care, either. And 94.5 tons, while certainly a lot of gold, only puts Hungary at #39 on the league table of countries ranked by gold reserves.

Of course, Hungary was at #60 as of April 1. So, there’s that…

More relevant, to me, is Hungary’s rationale: The country’s central bank said the tripling of its gold reserves is about “managing new risks arising from the coronavirus pandemic.”

Seems to me that’s polite, ministry-speak for: Central banks and governments globally have lost their collective mind over the last year printing cajoodles of cash and taking on way too much debt.

Money supply all over the world is on the rise without a corresponding increase in economic output. That’s the financial equivalent of stuffing your face with Twinkies morning, noon, and night, but never getting off the couch to exercise. At some point, that strategy kills you.

Which is my way of getting ‘round to the point that Hungary’s increase in gold is another picture in a much larger mosaic that says all is not well in the global economy.

The world’s major economies—and the U.S. in particular—have taken on way too much debt, and a reckoning is coming.

When I and others say things like that, we’re not running around and screaming about the “sky falling” tomorrow. Crises—true, deep, reverberating, life-changing crises—build over time. They’re not like some kind of flash-crash that happens on a Tuesday and all is better on Wednesday.

They’re more like super-volcanoes. The pressure builds, quietly. Over years. Over decades. A bit of rumbling here and there. Smart people who hear the rumblings and go in search of the source come back and voice their worries. The naysayers who think everything is always and forever just so damn peachy, tell the worrywarts to bugger off because all the worrywarts do is harsh the world’s mellow.

And, really, who wants to listen to the worrywarts, anyway?

That’s a psychological thing, by the way: The Optimism Bias or “the illusion of invulnerability.”

We tend to underestimate the probability that bad things will happen. But, of course, bad things happen all the time. Job loss, bankruptcy, divorce. The list is long.

The naysayers disregard that. Smart people, on the other hand, look at the evidence. And they find ways to protect themselves and profit from the future they know will unfold. To wit…

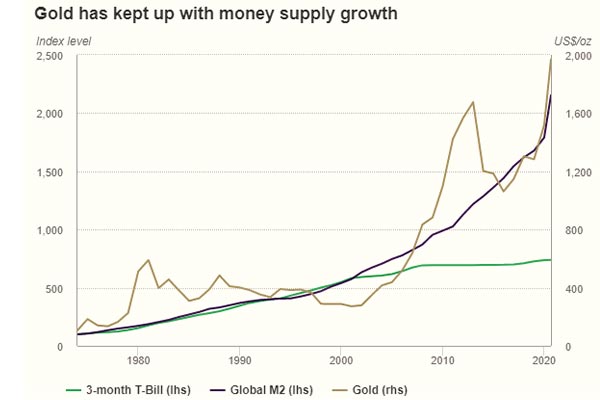

I pilfered that from the World Gold Council. The purple line shows the money supply. The gold line shows, well, gold.

This chart highlights that gold, like all assets, has its moments of exuberance and ennui. But in the 40 years it has traded freely—unencumbered by its former role of backing every U.S. dollar—gold has methodically tracked global money supply.

There is every expectation that global money supply will only rise from here. Governments, after all, are going to keep spending.

Thus, I have every expectation that gold prices will continue to rise. Will they surge 20% to 50% to 100% this year?

I don’t know.

I never think about gold that way.

I think about gold in terms of the canaries.

The mine is filled with dead canaries everywhere. It’s obvious to anyone who considers the data from an honest, unbiased perspective.

Gold is the ultimate “long game.” It’s the only asset on the planet that has thousands of years of history of repairing the damage humanity has inflicted on economies.

I know a reckoning waits in the offing. My bet is that it happens this decade. And gold is one of the key tools we can use to protect our nest eggs.

Numbers tell the story. History tells the story.

And now, Hungary is telling the story.

Another canary is gasping.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.