How the “Panama Route” Saved the Union—and Could Save You…

I don’t own gold because it might go through $2,700 or, for that matter, $3,000. I own it because I’m afraid it goes to $9,000 or $10,000.

– Rick Rule, Gold investing guru

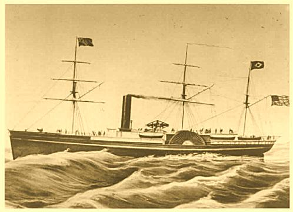

September 23, 1863—The US Steamer Golden Age sets off from San Francisco, aiming for Panama. In its cargo hold… $1.4 million in gold.

This, by the way, is not the story of a sunken ship taking a hoard of California Gold Rush wealth to the bottom of the sea. Golden Age completed its run to Panama City. There, longshoremen offloaded the gold, which was then transported across the Panamanian isthmus on a small railroad, and then loaded onto another steamer, the North Star, in Colón, for an onward journey to New York City… where the gold arrived without incident on October 26.

If you’re wondering, this is the US Steamer Golden Age, operated by the Pacific Mail Steamship Co….

The gold run from San Francisco to New York, by way of what was known as the “Panama Route,” was a key funding mechanism for the Union Army during the Civil War.

The Confederate navy tried its damnedest to snare these Treasure Convoys—their sailing times, after all, were actually published in New York and San Francisco newspapers, since the ships also carried mail, cargo, and passengers making a cross-country journey by way of Central America.

Yet, the Confederacy clocked zero success in that effort.

So it is, then, that over the course of America’s greatest internecine war, nearly $200 million in gold ($5 billion in today’s dollars) made its way from the goldfields of California’s Sierra Nevada Mountains to the East Coast along the Panama Route.

That gold played a vital role in keeping the Union economy from collapse. It helped keep the New York Stock Exchange functioning, and helped the US Treasury Department manage inflation as best it could. Though Northern inflation was running about 100% during the war, Confederacy inflation was well into the thousands of percent, forcing financial struggles upon the South.

Most important of all, California gold kept the US government in DC funded and capable of functioning across the entirety of the war. Indeed, President Lincoln himself reportedly told a friend that “the production of [California] gold mines has been a marvel to me.”

I share this little-known Civil War anecdote because it might just be the first example of gold saving Uncle Sam’s backside.

To be sure, gold has saved him and his minions other times too, most notably in 1933 when FDR confiscated private gold in order to add it to Uncle Sam’s hoard, shoring up the value of the dollar during the Great Depression. In 1971, gold played a role again, when Nixon took the dollar off the gold standard to avert yet another dollar-related crisis that began brewing in the inflation of the 1960s.

And, well, here we are today.

My bet (as if you didn’t already know this) is that we’re Thelma and Louise-ing it into yet another dollar-related crisis, for which gold once again will have to don its superhero cape to save America from itself. (Bitcoin will also play a role… but that’s a story for another day.)

I wanna tell you why that is.

This is not a long-form dissertation on the myriad ways that politicians of every stripe have methodically undermined America’s finances over the last several decades.

Instead, we’re going to focus on debt. But not the way you think.

I’m not going to rant about the $36.4 trillion in debt America owes… or the $1 trillion in annual interest expenses America now has to pay (that’s 15% of the budget, by the way, now the largest expense outside of Social Security)… and I’m not going to tell you that if interest rates rise from here, it just means that the $1 trillion in annual interest expenses rises ever higher and pushes the US toward a crisis moment.

Nope. Not telling you any of that.

What I am telling you is this: $36 trillion is peanuts.

There’s a much bigger fish that’s going to eat us…

That $36 trillion is America’s on-balance-sheet debt. The debt we see. The debt America owes to creditors who have lent money to Sammy’s Never-Ending Clown Show.

The bigger fish is “Unfunded Liabilities.”

These are the promises America has made to fund Social Security benefits that have already been earned, certain future Medicare benefits, plus benefits for federal employees and veterans who fought to keep the Clown Show from closing.

That number is not $36 trillion.

It’s not $76 trillion.

Hell, it’s not even $176 trillion.

That number is $226 trillion.

Sounds big, El Jefe. But, like, how big is $226 trillion?

You and I know what a $100 bill looks like. We can visualize $10,000. Maybe we can even guess at what $100k would look like in a big ol’ dog pile of greenbacks.

But $226 trillion?

Well, the primate known as Lucy, the anthropological forebear to us humans… she lived 3.18 million years ago. And if Lucy and every one of her descendants up through today had spent $70 million per year, every year, for the last 3.18 million years… well, we’d just now be coming up on $226 trillion.

In other words: Ain’t no way America ever pays off that debt. Never.

There’s a better chance that an all-girl’s elementary school cheer squad wins the Super Bowl 10 years running than America paying off a debt that insurmountable.

Of course, paying off the debt was never the goal.

Inflation is the goal.

Devaluing the dollar is the goal.

Crisis is the goal.

The US needs inflation because it makes today’s debt cheaper in tomorrow’s dollars. I need $1,000 to pay off $1,000 today. But with 5% inflation, the $1,000 bond I sell today only costs me about $615 to pay off a decade from now. At 10%, the payoff cost is about $385.

At hyperinflationary levels, $1,000 costs pennies.

I’m not saying hyperinflation is coming.

I’m saying that something is coming.

The US has to find a way to destroy the value of the currency in order to manage all those unfunded obligations. What that “something” is could take many forms.

Whatever the form, the end result is the same: The dollars you own in the bank today will barely afford anything soon enough. The new retiree in 1970 who collected the average Social Security check of $118 at the time, had the spending power of $33 in 1990, 20 years later.

And that was before America had a debt problem. It just had a currency problem that prompted Nixon’s move on gold.

This time around, the crisis will be magnitudes larger than what Nixon confronted, because the size of America’s fiscal disorder is so gargantuan you have to measure debt levels in geologic epochs to gain any sense of scale.

What I’m saying here is this: Take the Panama Route. (Own gold.)

It saved the Union Army and the North amid the biggest crisis America had ever seen to that point.

The crisis that’s coming is so much bigger.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.