When the Fed Reverses Course, This Metal Will Soar…

We humans are a forgetful bunch. Sure, we have a pretty good memory for certain things specific to our lives. But broader history passes us by like a leaf in a gutter’s eddy after a rain storm.

If, for instance, I ask you to recall the last period the Federal Reserve raised interest rates multiple times before this most recent rate-raising era, I have to imagine you’d be hard-pressed to do so. Heck, I am hard-pressed to do so and I pay far greater attention to these things than most.

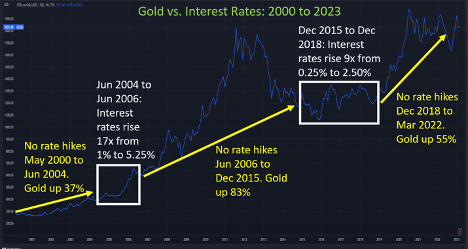

The answer, by the way, is December 2015 through December 2018, when the Fed raised interest rates by 2.25 percentage points over a nine-hike cycle.

And, getting to the heart of this dispatch, I imagine that a related question—how did gold respond after the Fed stopped raising rates—would similarly be beyond the immediate mental recall of most of us.

The answer: Gold prices rose 55% between December 2018 and March 2022, when the Fed launched into its recent prescriptive course of interest rate hikes.

My point: Gold reacts positively to news that the Fed’s interest rate hikes have come to a halt. Which means gold today has a tailwind beginning to spin up—yet another reason to own some hunks of inert yellow metal.

For a while now, I’ve been predicting that the Fed will slow its roll with these interest rate hikes.

I originally thought that day would come last November. I was off by a month—December was when the Fed noted in its policy meetings that the time had come to probably stop with the crazy, oversized, and aggressive rate hikes.

To be sure, inflation hasn’t really abated, and lots of economists say the Fed is gonna ramp up its hyperactive rate-hike machine again. I disagree with that because higher rates are now a big problem in the economy. (And just to note, we’re coming back to gold, but I need to run off onto a tangent for a moment.)

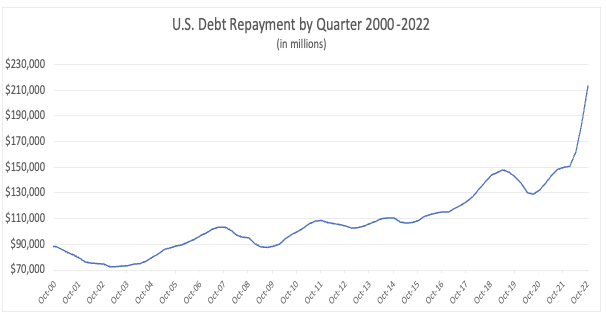

Because the Fed pushed interest rates higher and at a faster pace than at any time since the 1970s, Uncle Sam’s debt repayment obligations last year rose faster than even non-partisan government agencies expected. In the fourth quarter alone, interest payments soared to $213 billion. You can see the obvious spike here in Bureau of Economic Analysis Data:

I mean, does anyone really think that line can just keep going up at that trajectory? Because that is exactly what will happen if rates keep going up, and as Treasury sells new debt every week.

Predicting a debt crisis here isn’t exactly rocket science.

At the same time, news is now emerging—again as I predicted at various points last year—that housing foreclosures are on the rise, particularly among sub-prime borrowers. They’re now at a higher rate than during the 2007-2008 housing collapse.

Meanwhile, credit card delinquencies are up even as credit card debt has hit a record high.

Every time the Fed nudges rates higher, the pain immediately screams through the mortgage and credit card markets.

The Fed clearly sees this. Meaning that continued rate hikes would tell us the Federal Open Market Committee—the Fed’s rate-hiking band of financial misfits—is either channeling the ghost of the Marquis de Sade, or it has an agenda that cares not about the American consumer or the American government’s ability to continue as a going concern.

In my world view, the Fed will soon acknowledge that inflation this time around is globally entrenched and caused by factors beyond central bank control (any central bank, not just the Fed). And it would be right, as I have been saying all along.

No central banker can control war. No central banker can control a pandemic or the shutdown of an economy. No central banker can control Mother Nature’s weather whims. Those factors have played the defining role in inflation by way of supply-chain snafus, energy crises, food shortages, etc.

When the Fed owns up to this truth, it will accept base inflation running at 5% to 7% as a new norm. And it will halt interest rate increases, recognizing that the free markets will do more to adequately address inflation than the Fed can by uselessly raising interest rates.

All of which is a gold story. (Told you we were coming back to gold.)

I pulled up rate hikes and gold prices going back to 2000. Prior to that, America had no significant debt and spending problem, and the gold market didn’t really care. After 2000, America’s financial situation began to deteriorate and gold prices began to care a lot, an indication of growing concerns about the increasing instability of America’s finances.

Here’s the chart. Don’t mind the small print. All that matters is what I’ve highlighted:

Whenever the Fed stops raising interest rates… boom!

Gold races higher.

So, those last 900 words or so are simply to tell you to prepare for a significant rally in gold. Uncle Sam’s rapidly escalating debt payments and a demonstrably weakening financial condition among American households are the canary singing a song of death by interest rates.

The Fed will listen. It has to. Or else.

Golden tailwinds, as I noted above, are spinning up.

My prediction: Gold, now at roughly $1,800 per ounce, sees $2,750 at minimum before 2025… and more likely $3,300.

Stay tuned. More on gold to come…

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.