What are you most worried about?

That’s not a figurative question. I am truly curious.

Are their financial/investment matters that cause you concern? Are their social issues? Political or economic issues? I’d actually really like to know what you’re worried about in your own life.

If you have a spare three minutes, shoot me an email at jopdyke@globalintelligence.com. You might see me address those thoughts here. (Also, absolutely tell me if something truly excites you at the moment too, like crypto or precious metals or whatnot. Whatever you want to share, I’d love to hear from you.)

But, first, let me show you two charts that cause me a fair amount of concern…

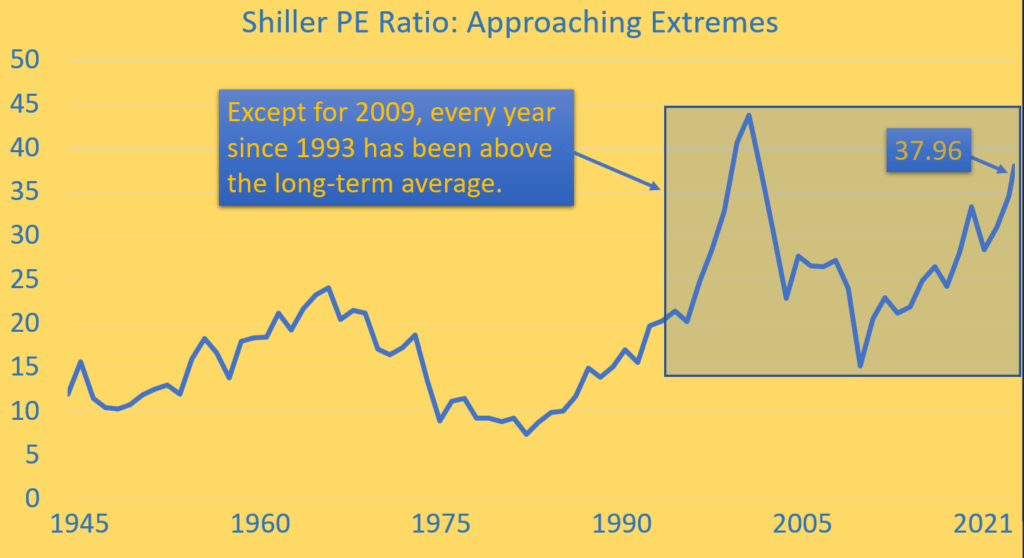

Chart #1: The so-called Shiller PE Ratio

This ratio tracks the price of the S&P 500 stock index relative to corporate earnings over a 10-year business cycle.

The idea is that while the traditional price-to-earnings ratio (the ubiquitous PE ratio) tells you static information only about right now, the Shiller PE tells you about inflation-adjusted earnings over a decade.

It’s a more holistic way of thinking about stock market value, and my preferred way of gauging where we are in terms of over, under, or fairly valued. You can easily surmise where I think we are today.

What this chart shows is that, at this point, we’re climbing Everest without oxygen. We are approaching extreme risk.

Perhaps the more worrisome part of this chart is that box I’ve overlayed onto it. Only once in the last three decades has the Shiller PE dipped below the average of 19.4 going back to 1945, what I consider the modern age for the stock market.

I have a good suspicion why this is: Starting in the ’90s, the Federal Reserve began dumping monumental sums of cash into the economy to bolster asset prices, and it hasn’t stopped. All that free money has to go somewhere, and a vast amount of it flowed into the stock market.

The one time the Shiller collapsed was the result of the 2008-2009 housing catastrophe/global financial crisis—which, ironically, was precisely the fault of all the free cash the Fed pumped into the economy and which overinflated the housing market.

And then there’s Chart #2…

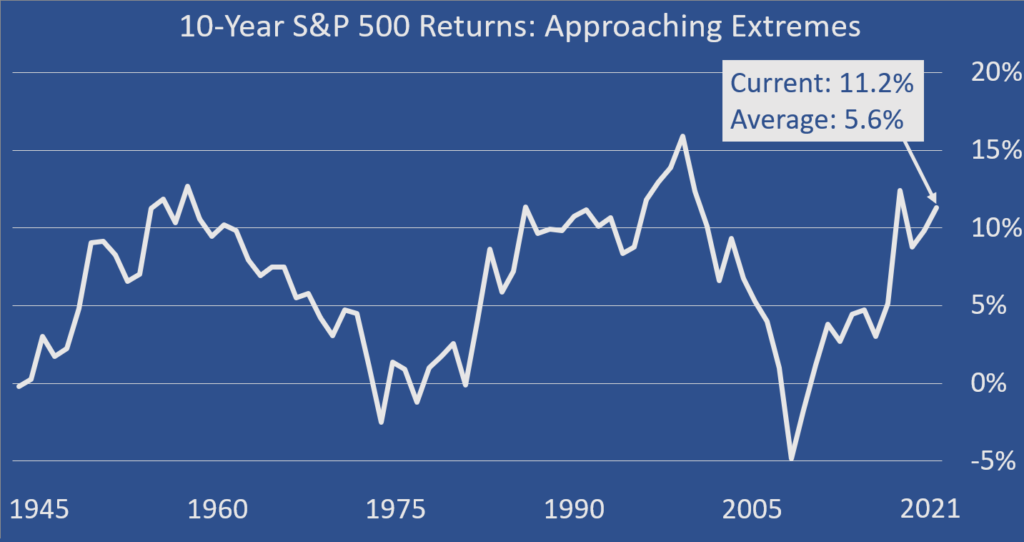

I went back and looked at the rolling, 10-year return for the S&P 500 back to 1945. So, each plot point is the annualized return an investor would have earned by holding the S&P 500 over the previous 10 years.

Across the modern era of investing, that averaged about 5.6% over any given 10-year period.

Today, we are exactly double the average.

What causes me pause here is something called “regression to the mean”—that idea that what goes up, must fall, and what goes down must rise. Given that we are now approaching extreme highs again, it seems logical to expect a downward trend emerging.

To get back to roughly 5.6% by the end of the decade, we’re looking at average annual returns from here of about 4.3% per year. Some years will be up; some down. But over the decade-long haul, we’re very likely looking at subpar returns.

And what would cause this? Most probably, it will be the rising inflation we’re now seeing, and the likelihood that the Fed raises interest rates at some point.

Wall Street doesn’t do well with meaningful inflation and rising interest rates. It’s peachy-keen with sub-3% inflation. And it’s drunkenly giddy at sub-1%, which explains the Street’s crazy run ever higher over the last 12 or 13 years.

But that party is facing “last call.”

Higher inflation and higher interest rates are going to slam profits for many, many companies. And since corporate profits drive stock market prices…well, it’s not a leap to see how falling profits mean falling stock prices (some companies will win, particularly those that are beneficiaries of inflation and the commodity super-cycle I’ve been writing about in the Global Intelligence Letter ).

I can’t tell you when the bottom falls out, only that the bottom is rusted and the weight is excessive, and sooner or later it gives way.

But that brings me back to my original question: What are you most worried about? I really am curious about that. Again, I’d love to hear from you. You can reach me here: jopdyke@globalintelligence.com.

In the meantime, be wary of what’s happening on Wall Street. Every dog gets tired of running after a while…and they just fall over.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.