At the end of every rainbow is a pot of…bitcoin?

I’ve always wanted to believe that old saw about gold and rainbows, but I’ve literally driven through two rainbows just after storms in south Louisiana and I didn’t even find one of those chocolate coins wrapped in gold foil.

But this chart—it gives me hope that rainbows do lead to pots of gold…or at least gold equivalents

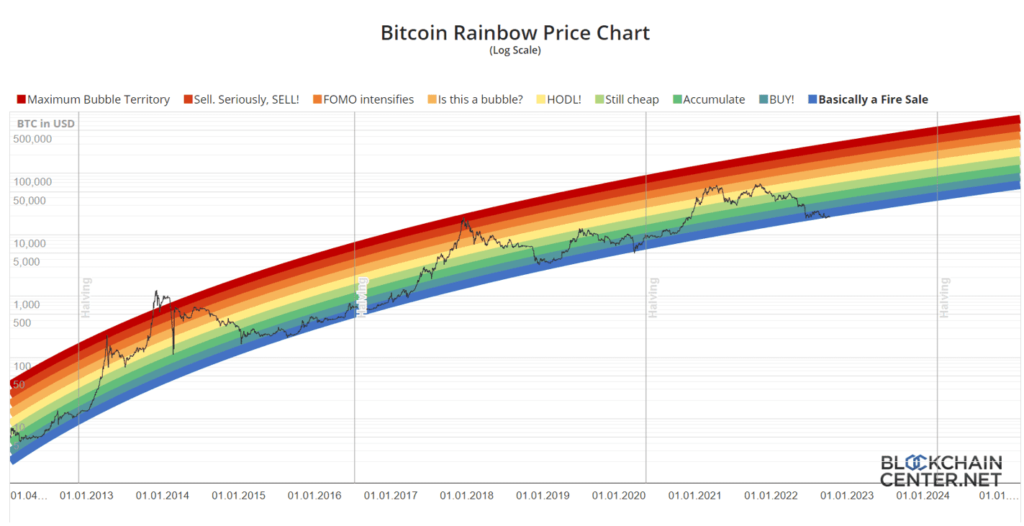

That’s the Bitcoin Rainbow Price Chart, a fairly famous graphic in the crypto community. It overlays bitcoin’s price (the black line) on top of a rainbow, the colors of which define where the price is at the moment in terms of value: “Maximum Bubble Territory” in the dark red at the top, to “Basically a Fire Sale” in the dark blue band along the bottom.

The chart has been darn-near perfect in calling tops and bottoms.

For the last week or so, I’ve been working on a crypto presentation for the upcoming International Living conference in Atlanta later this month and the Rainbow Chart has helped color some of my up-to-the-moment thinking on crypto.

What this chart shows is that bitcoin has a long history over its lifespan of following the rainbow.

Like all assets, the granddaddy of crypto oscillates between overbought and oversold. In doing so, it has traced a fairly consistent path through the rainbow, assuming you put any faith in this kind of data…and I do tend to put some faith in this stuff.

I’ve been deep inside the investment world long enough to realize that asset prices are a living creature to a degree because they move based on human psychology and emotion…and humans tend to react (and overreact) the same way over time, which is why technical market analysis has such value.

The Bitcoin Rainbow Price Chart, with bitcoin’s price line hugging the bottom of the dark-blue band, says that bitcoin at its current price in the $20K range is in the “Basically a Fire Sale” range.

That’s not to say bitcoin can’t or won’t go lower in the short term—of course it can.

But the longer-term trend is clear: bitcoin is headed much, much higher.

That longer-term view is all I really care about as an investor in crypto and NFTs (non-fungible tokens). Short-term volatility means nothing unless you’re a trader hoping to make bucks on the daily ebbs and flows. But that’s just noise to those of us who see the bigger opportunities looking out over the years.

Bitcoin tends to be the Pied Piper of crypto in that wherever it goes, the rest of the market is sure to follow (which is more of a Mary Had a Little Lamb analogy, but you get the picture).

Higher bitcoin prices, therefore, imply higher prices throughout the crypto/NFT sector.

With that as a fundamental truth over the past dozen years, you look at that rainbow and you have to be bullish on bitcoin and crypto writ large.

Even if bitcoin just tracks the bottom of the blue band (the very worst it could perform according to this technical analysis), we’re looking at prices in the $65K range out in the summer of 2025.

More likely, of course, is that bitcoin rises off the bottom, as it historically has done, and tests the yellow, orange, and red bands. I can’t say where along that rainbow those tests will occur. What I feel confident saying, however, is that bitcoin has a very good chance of rising into the low six-figure range over the next year to 18 months.

That underscores why I have remained so bullish on crypto and so blasé about the current bear market. Bear markets always end. A new bull market always begins.

And as I will be talking about in my ATL presentation, businesses around the world are diving into crypto, regardless of the economy, the depressed prices for crypto, or the broader (laughably wrong) sentiment that crypto is dead.

I mean, Walmart—Walmart!—just launched a metaverse.

If that doesn’t tell you where we’re headed, then nothing I write ever will. That’s the biggest retailer in the world telling the world that “We’ve seen the writing on the wall…and the wall is digital.”

Now is a moment to be accumulating high-quality cryptocurrencies and high-quality NFTs.

Just follow the rainbow. Because in this case, it actually will lead to pot of gold at the end.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.