Economists Got it All Wrong… Again.

Smoke ‘em if you’ve got ‘em… or, said another way, spend ‘em if you have ‘em—or even if you have to borrow ‘em.

The economist community was flabbergasted last week when the latest retail sales data showed consumer spending jumped 4%, “smashing expectations” in this inflationary age, or so claims a CNBC headline.

Those expectations wrongly supposed that inflation would likely curtail the consumer’s willingness to spend, which paired with the Federal Reserve’s aggressive rate hikes would lead to a slowing economy… a reduction in inflation… and, thus, a return to a Goldilocks existence.

Alas, not so much.

Spending continues to run hot.

So hot, in fact, that consumer debt has now hit an all-time high of $16.9 trillion—about $51,000 of debt per American.

A big reason for the increase: Consumers are loading up spending on their credit cards, which seems weird and counterintuitive when you think about all the interest rate hikes that have now pushed credit-card interest rates to well above 20%. You’d think those higher rates, and higher prices overall at Walmart and Target, would dampen spending desires.

But in fact, by spending and borrowing now, consumers are behaving logically… given the economic environment.

Which means the economist community should have been in no way surprised by the surge in consumer spending.

Let me explain…

Those who’ve read Field Notes for a while will know that I’ve been saying inflation is an entrenched reality. It’s not a wham-bam-thank-you-ma’am type of inflation that’s here today and gone tomorrow.

We are just now experiencing the early stages of the reckoning that has been preordained for a while. The Federal Reserve spent decades keeping interest rates much too low, and allowing excesses to mass in the economy, the financial markets, and the housing market.

That growth in what’s called the “money supply” (the quantity of dollars sloshing around the world) has led us to this point, where inflation is a semi-permanent bugbear, like the in-law that came for Christmas and stuck around well past their expiration date.

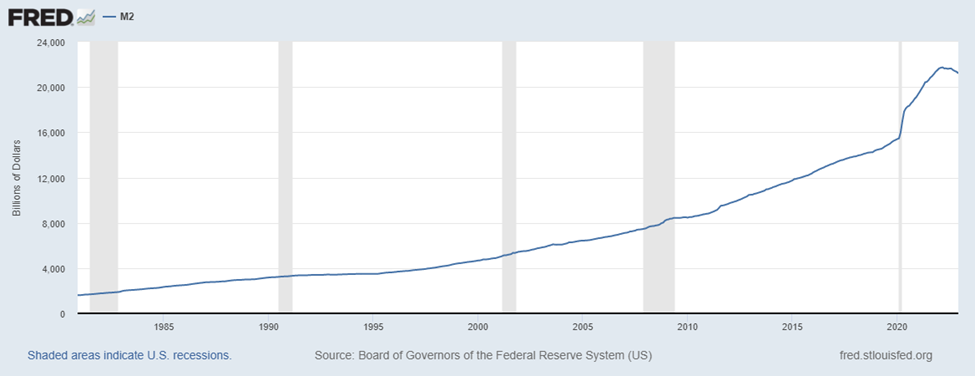

Just to give you a visual, this is what the money-supply growth has looked like since the Reagan administration:

The numbers are very tiny, I know. But all that really matters here is the trajectory of that blue line. The money supply expanded over that time to more than $21 trillion from about $1.6 trillion—a growth rate of more than 6% per year. The U.S. economy in that same period grew at about 5%.

That gap might not seem like much, but it means trillions of extra dollars looking for a reason to be spent. And an excess amount of dollars chasing the same amount of goods is, by definition, the fuel for inflation.

That gap also speaks to the reason inflation has taken off now.

You see that moonshot in 2020—the ginormous sum of money Uncle Sam splashed out in the wake of COVID shutting down the economy…

Well, the annualized growth in money supply from 1980 to that point was in the 5.5% range, pretty much in line with the annualized growth in GDP. The two were in alignment, generally speaking.

But suddenly ramping up the money supply was the tipping point that fueled inflation. Didn’t help that Russia instigated a war (befouling energy and food-commodity markets) and that Mother Nature tossed a bunch of droughts at the planet (adding to food-commodity woes).

Connect all the dots… and all of this means that consumer spending should be expected to remain hot. It’s a simple mental calculus, really, and it has been on display for decades in every single country that experiences real inflation.

Consumers are not stupid creatures. They’re spending precisely because of inflation.

Maybe you’ve heard the term “wisdom of the crowds”—the idea that a large group of people is collectively smarter than an individual, like, say, an economist or a Federal Reserve chairman surprised by buoyant consumer spending.

The crowd—we consumers—reflexively know that inflation is not going away, that it’s going to stick around for a lot longer than the econo-types forecast with their statistical models and University of Chicago economics degrees.

Consumers are willingly trading paper assets today for physical goods because they expect those physical goods are going to require larger and larger sums of paper assets tomorrow.

And they’re willingly loading up their credit cards to do so because they know the dollars they earn tomorrow will more easily pay off the debt they’re accumulating today.

It’s no different, really, than what Uncle Sam has been doing for decades in targeting a 2% inflation rate. His minions know that inflation drives up the amount of income the government takes in, allowing it to more easily repay the debt it has taken on.

This is why consumers are spending, even borrowing to spend. As a collective, they’re sending the message that inflation is a long-term problem.

As I’ve been writing, however, the challenge comes in the Federal Reserve’s ability to actually combat entrenched inflation. The Fed has no control over many of the factors causing inflation (post-COVID supply-chain issues, post-COVID and war-related energy supply issues, drought and war-related food supply issues).

The Fed has raised interest rates sharply—the most aggressive rate-hike regime in three generations. Yet, inflation has barely nudged lower. Proof that the Fed has very little sway in this fight. As they say in Texas, it’s “all hat, no cattle.”

So, gird yourself for long-haul inflation. If you haven’t already started, now’s as good a time as any to begin methodically trading some of your paper dollars for physical assets such as gold, silver, bitcoin, and real estate in overseas locations where rental demand is consistent and you can earn a return that keeps pace with or even outpaces inflation.

This inflationary age is no different than any other inflationary age—aside from the fact that this time around, the Fed doesn’t have the capacity it did in the 1970s, when America’s cumulative debt burden (government, business, consumer) was insignificant.

Today, that debt burden is highly significant. And it means the Fed either destroys the global economy to win the game… or that it must accept higher inflation as the baseline going forward.

In either case, physical assets are the ultimate winner.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.