Time to Invest or Pare Back?

Finally… This week, the Federal Reserve cut interest rates.

It’s been a long time coming, frankly. My bet is that the Fed will prove to have been late to the party yet again. Meaning, we will probably still see a recession.

But that’s not what I’ll cover in today’s dispatch.

Instead, we’re going back in history today to look at every other instance in the last 50 years in which a Fed rate-cut cycle started with slicing interest rates by 0.5%.

My goal is to sus out where stocks are likely headed based on historical precedent.

In other words: Should we be invested in stocks right now? Or should we be paring our positions?

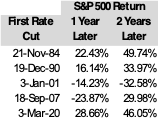

Going back to 1971, there are only five examples of half-point rate cuts launching a rate-cut cycle.

Here they are:

Before I offer up my thoughts on where we go, let me address 2001 and 2007.

They are total outliers.

The January 2001 cut came just months before the 9/11 terrorist attacks. Those attacks fundamentally changed America and Americans.

I was living and working in New York City at the time, writing for The Wall Street Journal. I saw up close and personal the way thinking and actions changed.

In short, Americans grew scared. Frightened of everything. They overreacted to pretty much everything as well. The America that you and I knew in the 1960s through the 1990s—that America died on 9/11.

The stock market returns one- and two-years post-9/11 reflect that. Americans were inward looking. They wanted safety away from cities. They wanted to hole-up in their nests and were leaving stocks in order to buy primary or secondary housing outside metro areas.

As such, the returns in the two years following that January 2001 rate cut, I think, reflect a mental shift among Americans that had nothing—or at least very little—to do with the economy per se.

As for 2007, the 0.5% rate cut that September happened just before the US housing crisis that launched the Global Financial Crisis and the Great Recession.

Again, that to me is an outlier because of the impact of that event. Bankruptcies soared. Banks failed. Countries in southern Europe began to teeter. People and businesses were fleeing stocks to shore up their finances with cash.

And it took a good two years before that crisis bottomed out in the summer of 2009.

So, for those reasons, I think we can cut out those two examples as showing us anything about the historical trend…

Maybe, El Jefe—but what about 2020, the year of COVID? That was an existential shock too!

Mucho true. However, the 0.5% rate cut in March of that year happened after the external shock of COVID. Indeed, the rate cut was directly a result of COVID and the government trying to goose a stalled economy.

Moreover, COVID was never going to be the equivalent of 9/11 or the Global Financial Crisis. It wasn’t going to change America the way 9/11 did. And though the global economy shuttered temporarily, it reopened quickly with workers and money flooding into the system, much different than the multi-year crisis born of 2007’s housing collapse.

Personal bankruptcies actually fell in 2020, 2021, and 2022 because of all the stimulus money the government pumped into the economy (which, by the way, helped fuel the inflation that the Fed was fighting with higher interest rates, which then precipitated the most recent rate cut).

So, 2020 is not an animal that is at all comparable to 2001 and 2007.

And where does all of this leave us?

Well, I’m betting that Wall Street is going to have a jolly ol’ time over the next two years. History says so.

My bet:

- 1 year from now, the S&P is up about 20% from where it was the day the Fed announced its 0.5% rate cut on September 18.

- 2 years from now, the S&P is up above 40% from the rate-cut date.

All of which makes me feel good about the Global Intelligence portfolio[BM1] . Our financial stocks should do well in a lower-rate environment. Same with the real estate investment trusts and our housing play.

Commodities and gold should do well, too.

Gold loves lower rates. And given that inflation is still a thing (despite the Fed’s fight supposedly having been won; the alleged reason for a rate cut)… commodities such as copper should accelerate.

So that’s my take on the Fed’s 0.5% cut.

In short… It’s good news for stocks.

We should see higher prices from here.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.