This Asset Has Doubled Against the Dollar.

Snow crunched under foot as I traipsed along a narrow, cobblestone alley in the heart of Old Town Zurich.

Just there in the distance… the Limmat River.

Just behind me, one of the best fondue joints—Swiss Chuchi—in all of Europe.

I was headed for neither.

Instead, my aim was the Splendid Piano Bar, an old-school drinkery populated primarily by locals and that, inside, has the feel of a classic bordello or a 1920s speakeasy. I was there to meet a money manager.

But for today’s dispatch the Splendid Bar itself is our main character…

The building dates to the 1200s—back when what would become the United States was just Native American tribes living off the land. Originally, this was a stable and hotel-ish kinda joint, a place where travelers could retire for the night and exchange weary horses for fresh ones.

Over time, the place morphed into a luxury hotel, such as they were in the Late Middle Ages. And by World War II, the hotel that then existed had become a favored spot for American GIs who spent some of their R&R time in Zurich.

In short: The history of the Splendid Bar is, in a way, a microcosm of Switzerland—a place of shelter.

Which is really the point we’re aiming for today.

For well over a decade now, I’ve been telling readers to own the Swiss franc, the local dinero. (It’s also been affectionately called the “purple-back.”)

Not because it was going to be a fabulous investment… but because it was going to be a fabulous insurance policy against the ongoing and never-ending destruction of the dollar relative to purchasing power.

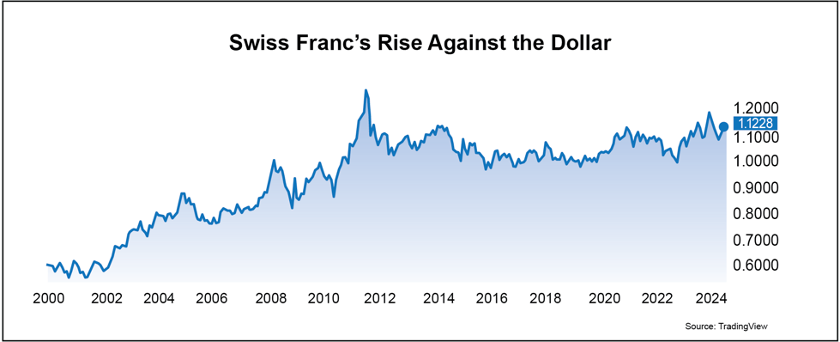

Back in 2000, one Swiss franc bought $0.55 when converted into dollars. Today, it will buy about $1.10… and before the dollar’s recent strength (which I believe is temporary), a franc would have bought about $1.12. Even has much as $1.19 at one point last year.

The point is: The franc has more than doubled against the dollar.

But let’s reverse that.

The math means that a saver who put, say, $10,000 into Swiss francs in 2000 would have collected nearly 18,200 francs in their account by the end of 2024 (with the franc at $1.12).

At the end of last year, those francs would be worth more than $20,300.

Had that same saver stuffed that same $10,000 into a US bank account and earned 1% per year on average—about what a savings account would have earned over the last 24 years—that 10 grand would have barely grown, and would have lost tremendous purchasing power.

The saver who put their dollars into francs would be well ahead of inflation.

Here’s what I mean:

- $10,000 from the year 2000 has the same purchasing power as $18,575 today.

- Yet $10,000 invested in a high-yield savings account averaging about 1% per year over the last 24 years would have grown into about $12,700… trailing inflation by nearly $6,000.

- That $10,000 put into francs would be worth $20,300… about two grand ahead of inflation.

In short, the Swiss franc is the Splendid Bar of global currencies: A place of shelter.

Europeans in particular have known this since World War I, when Europeans of means began stashing their cash in neutral Switzerland and the franc because they knew the drumbeats of continental war threatened to devalue their local lucre—and they rightly feared that governments on a war footing would usurp the people’s money or inflate it away to nothing to pay for the bloodshed.

Since then, the franc has taken on the mantle globally of “safe-haven currency”—a role it still holds today.

That role plays into a significant financial decision I made a few years ago: I sold more than 90% of the stocks I own in my largest retirement account—a six-figure IRA—and put more than 40% of that cash into Swiss francs.

It’s a drastic move, no doubt. Bold.

Crazy?

Any financial planners reading this are probably shaking their head and agreeing with the “crazy.”

But I made this move because I’m fundamentally worried about a Western world that has become much too reliant on—let’s call it addicted to—debt.

Moreover, governments, businesses, and consumers today all hold record amounts of debt. In the US alone, total debt among those groups is now just a hair shy of $102 trillion. That’s a collection of IOUs larger than the global economy.

That ain’t small.

And it’s worryingly problematic because we’ve now reached what I’ll call the “bargaining stage of grief.” In this case, that’s the ivory tower lot and the political clown show offering up all kinds of rationalizations about why monumental debt is no problemo for America.

The most egregious is Modern Monetary Theory, a laugh-a-thon that posits governments need not worry about debt or printing as much money as they want because they can just play with tax policy to push and pull on the amount of money in the economy, thereby negating any worries of a debt crisis.

Thoughts and prayers and tears of laughter.

Anywho…

With such egregious amounts of debt sloshing through Western economies, we are not headed for our happy place.

We’re on the road to perdition.

And when the debt crisis hits, stocks will crash—just as they did in 1929… but safe-haven assets like the Swiss franc and gold will soar.

I see no convincing evidence anywhere that we can step off this road and catch a Greyhound back to a safer destination.

Ultimately, I suspect a reckoning as our only path out. A financial, governmental, legal, and social reset. Basically, what we saw in the 1930s that led to the Great Depression and World War II, a reset that destroyed vast wealth globally…

That reckoning is coming.

Could I be wrong?

Sure.

But just in case I’m right, I don’t want the assets I need for retirement to live through another clobbering like we’ve seen too many times so far this century. (The dot-com crash… 2008… COVID…)

At my age (59 now), ain’t nobody got time for that.

I want shelter for my assets.

I want the Splendid Bar.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.