Why Gold’s Run Isn’t Done…

On July 23, 2001, I bought a house.

This house:

I won’t offer the exact address, or even the city, because I don’t want to create any issue for the current owners.

I will only note that it’s in northern New Jersey, and it is the best house I’ve ever owned, simply because of the memories I made there with my son (then 5 years old) and my then wife. (For the record: northern New Jersey is among the absolute prettiest places in America.)

I paid $290,000, which I look back on now with awe. Such a price tag seems so affordable to my 2025 brain, but at the time I thought it was an absolute ton of money.

Three years later, we sold that house when my then-wife landed a job as COO of a new specialty surgical center in south Louisiana. Proceeds: $384,000—an average 9.8% per year uplift in price. Not bad.

Today, Zillow says the value is $740,000—a return of 4% per year, based on my original purchase price in 2001. Again, not bad relative to an inflation rate that averaged 2.5% during that same period.

Now, the reason today’s (financial) walk down memory lane comes about is because of a new entry I saw while perusing the USDebtClock.org website.

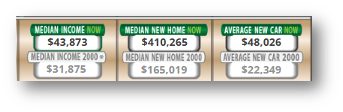

This entry that I screenshotted:

Back in 2000, roughly the same time I bought that house in Jersey, the median home price in America was just over $165,000.

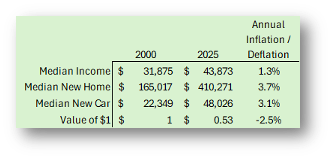

Today’s it’s nearly $410,300—the same roughly 4% average annual increase that my former Jersey home experienced.

But during that period, median income rose by just over 1% per year.

The dollar in that time lost about 47% of its value, or an average of 2.5% every year.

Costs going up faster than income… while the purchasing power of the dollar continued its slow-motion collapse… This is the story of modern America writ large.

I popped all the numbers into Excel to give you a quick reference to what this decay looks like numerically:

And all of that got me to thinking about… gold

As in: How did gold fare during this period? The general consensus is that gold is an inflation hedge, so surely it would have hedged the inflation we all felt… right?

Well, you might be surprised. But…

YES!

Gold didn’t just hedge inflation… it destroyed inflation.

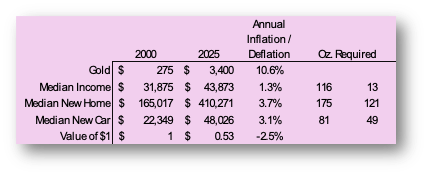

Here’s that same chart, but with the added impact of gold…

Gold gained 10.6% on average over the last quarter century. If this were a football game, the commentators would be bored at this point and calling it a blowout.

Twenty-five years ago, you needed 175 ounces of gold to buy the median home, and 81 ounces to buy the average car.

Today, that median home, even though it increased in price by 2.5x, only requires 121. The average car that once required 81 ounces, now needs just 49.

What that really means is that:

- 175 ounces of gold from 2000 would now buy you that $410,000 home… and you’d still own nearly $184,000 worth of gold.

- 81 ounces for a new car in 2000 would now buy you the $48,000 automobile… yet leave you with $109,000 in gold.

Or think about it in terms of salary.

Back in 2000, the median income in America would have afforded 116 oz of gold. Today, it will buy just 13 ounces… meaning that the median salary 25 years ago is today worth $394,400.

Clearly, median income went nowhere, while gold rocketed in value.

I had a follower on Twitter/X post a question about gold, saying “I fear that gold’s best performance has already happened.”

I read similar comments from Field Notes readers wondering the same, and I understand that sentiment.

Since pre-pandemic lows in 2019, gold has nearly tripled.

Then again, from its post-dot-com collapse to mid-2003, Amazon was up 900%. A great reason to say, “You know what—that run’s over. I’m not diving in at this point.”

And that would have been a fantastic decision…

If those saying it had been right.

Alas, those who were saying it were shockingly wrong. (A Prudential Security analyst in that era actually did downgrade Amazon to a “sell.”)

Amazon rose about 9,000% from there.

Now, I’m not saying gold is going on a 9,000% rampage anytime soon.

I am saying, however, that gold has a lot more juice to squeeze from the markets before its time in the sun is done.

I say this too often, but it remains true: There’s not a single legitimate effort anywhere within the American body politic to structurally address America’s extreme debts. DOGE was a joke from the outset and is actually saving very little money relative to its own operational costs. And the GOP’s embrace of Trump’s “Big Beautiful Bill” will add between $1.3 trillion and $5 trillion to the deficit.

Thus, the idea that gold’s best performance has already happened is fundamentally flawed because for that to be true, America would need to be actively reducing its debt and shrinking its annual debt-repayment costs. That’s the kind of thing—the only thing—that would drive investors out of the gold market and back into the likes of US Treasuries…

Not happening.

So, gold goes much higher from here.

We will definitely see $5,000 per ounce, probably before the end of 2026.

Worse, we could very well see $10,000 per ounce before the end of the decade, maybe surprisingly sooner. And just to be clear, $10,000 per ounce will happen because America’s fiscal and monetary situation has decayed so dramatically that even Americans are dumping dollars to own gold (and bitcoin and Swiss francs).

I just hope more and more Field Notes readers will heed these warnings.

Things move slowly, until they move quickly.

And once they’re moving quickly… you’re too late.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.