A Full-Frontal Financial Attack…

We launch into today’s dispatch with a chart, courtesy of Visual Capitalist and the Hinrich Foundation…

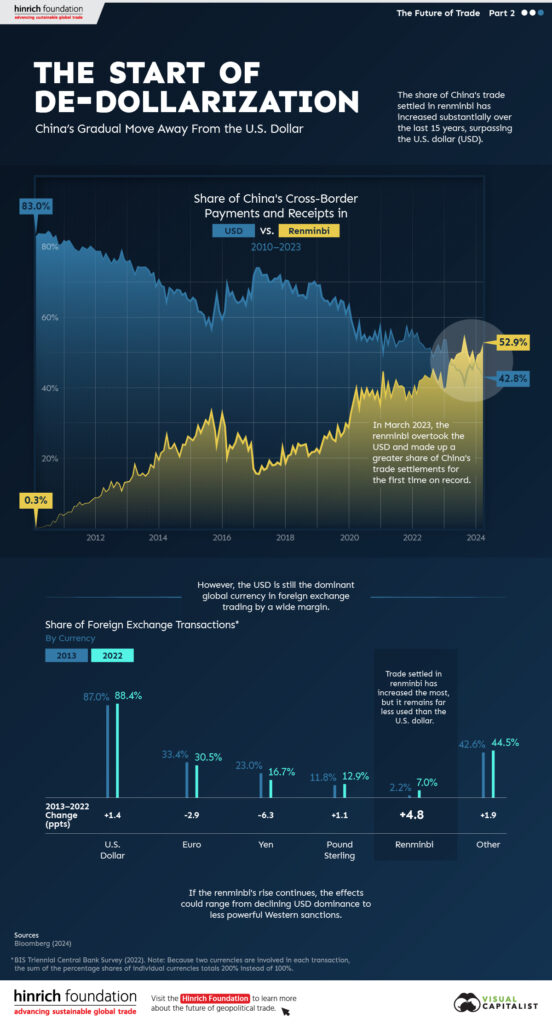

That’s the share of Chinese trade conducted in dollars and Chinese renminbi since 2010.

Now, granted, that might seem like an overly narrow way of assessing global trade—looking at one country’s dealings with the world relative to just two currencies. Moreover, the dollar remains the most important currency lubricating trade between countries.

Nevertheless, that chart is very telling… and it’s important to our point today: Namely, China is driving a de-dollarization trend that threatens American hegemony.

The risk is that if the dollar loses its role as global reserve currency, then life inside the US will devolve rapidly.

And here’s the big message: China absolutely knows this. It’s a financial nuclear weapon in China’s arsenal that China has already deployed—witnessed by that chart.

So what does that chart really show?

Well, let’s start by returning to New Hampshire, the summer of 1944, the Mount Washington Hotel in Bretton Woods. There, 44 nations converged and, as World War II was winding down, decided that the US dollar was best positioned to serve as the world’s post-war currency. War had devastated Asia and Europe, and there was simply no currency with the heft left to rebuild the world beyond the buck.

For more than 80 years now, if one country wants to trade with another country, that trade happens in USD… which means countries all over the planet have to hold USD (usually in the form of Treasury paper) to manage trade.

The system has served the world well.

But it has grown long in the tooth, and has outgrown its need, particularly among fast-growing economies since US dollar debt puts a strain on those countries’ currency reserves and exposes them to vast currency risk. Trading in dollars also imposes added currency conversion costs on countries.

Starting earlier this millennium, China began conducting more and more trade outside the dollar, increasingly requiring countries with which it trades to conduct that trade in renminbi rather than greenbacks.

Now, as you can see in that chart, more than half of China’s global trading is now happing in the Chinese currency. And there are implications to that which ultimately hurt American families.

First, China, as we all know, is the world’s factory floor. That role isn’t going away anytime soon because of the deep and intricate supply chains that China has purposefully constructed over the last two decades to ensure global dependence on Chinese workers.

As such, China can—and will—increasingly demand more and more trade occur in renminbi. And given China’s factory floor status, that means less and less demand for USD.

Second, China is pushing a new reserve currency with Russia and a host of other nations that have now signed on.

Too many Western pundits pan the idea of a Chinese/Russian currency—even if it is backed by gold and all the physical resources China and Russia have been husbanding for years. They insist such a currency will never catch on.

Arrogance and stupidity.

Many countries in the world really don’t care about the US or the dollar. They only use dollars because global trade demands it.

But America has done a crappy job in recent decades of managing the dollar. Government has taken on far too much debt (the world is now beginning to react negatively to that), and it has too often used the dollar as a weapon to force American political views onto the world. Other countries see this and are displeased, rightly concerned that if they end up on the wrong end of America’s anger, then their financial stability is at risk. Which is why so many countries (dozens) have either joined or expressed interest in joining a new China/Russia currency. They see it as self-preservation and political-risk diversification. Who can blame them for that?

The upshot… or, rather, let’s call it the Big Risk to Americans… is that these efforts lead to decreasing demand for dollars, or what the world is now calling “de-dollarization.”

As the trend unfolds—and it will; even former Treasury Secretary Janet Yellen has conceded that point—demand for US Treasuries falls. And as Treasury demand falls, yields on US debt go up out of the necessity of finding enough buyers to buy all the debt the US needs to sell every year.

And as yields on US debt rise, so too do interest rates on US mortgage, car loans, leases, home equity lines of credit, credit cards, and such.

Moreover, rising yields would heighten global worries about a fiscal crisis headed for America… which would see the value of the dollar decline. And when that happens, the cost of living in the US goes up because of all the raw materials and finished goods the US must import (America cannot, and never will produce all that it needs locally, so imports are a foregone conclusion).

All of which leads us to this point: China’s incessant and never-ending efforts to bring about de-dollarization and the end of the dollar’s global hegemony is a full-frontal financial attack on the American economy and, as a knock-on effect, the American household.

This is one of the primary reasons I continue to urge folks to prepare for the day the dollar dies (at least as a reserve currency). That will be a truly traumatic financial event, and the impacts will happen swiftly.

American families will suffer a gut punch.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.