The dollar is dead—long live the dollar!

By which I mean that we—as a society of savers and investors—might have just found a new safe-haven asset.

For eons (or 77 years, technically) the U.S. dollar has been the world’s primary safe-haven investment.

In times of fear, war, global economic dyspepsia, or pandemic, investors and savers the world over reflexively rush to the safety of Uncle Sam’s green, linen security blanket.

The two big reasons: stability relative to the rest of the investment landscape, and because there are enough dollars floating around the world to sate demand. (As much as I like Norway’s currency, the krone, and as superior as Norway’s fiscal management is to the U.S., the quantity of free-floating dollars is about 65x the dollar value of free-floating krone; there’s simply not enough krone for the world to rush into.)

This is a topic on my mind because of what transpired in the crypto market last week (and, to be clear, this isn’t so much a crypto story as it is a safety-of-your-investment-while-earning-a-real-income story).

I doubt you need to be brought up to speed, but just in case…the crypto market soiled its diaper last week. Maybe it was because Elon Musk tweeted a bit of ignorance; maybe it was because China announced a semi-new crypto policy. Whatever the ultimate cause, cryptocurrency markets were as volatile last week as they’ve ever been.

That is, all except one class of crypto—the genesis of this dispatch.

You might have heard of them: stablecoins, cryptocurrencies that are designed to be, well, stable. As stable as a U.S. dollar. Their purpose: To maintain a constant, stable $1 valuation—which I will come back to in a moment.

Stablecoins are relatively new animals in that they’ve only been around since 2014. And until now, they’ve never really been tested in a crisis. When I first started looking into stablecoins several years ago, there was always an underlying message of “beware the ides of every day! For in any crypto, vast losses await ye.”

I never bought into that mainstream media misinformation because of the research I’d done on bitcoin, Ethereum, crypto mining, etc. Then again, I never put my money where my mouth is with stablecoins because, frankly, I didn’t see a compelling reason. I mean, if I’m earning even 0.01% on a bank account, then why do I want to earn no interest on a stablecoin?

My how the turntables have turned…

Stablecoins today are a fantastic source of passive income. Depending on where you go and how you invest your dollars, you can find interest-like income payments of 8% to as much as 12%. (Check out my brand-new report, Profit From the DeFi Revolution, to learn more. You can read it in your Global Intelligence Crypto Library here.)

That is not a typo: 8% to 12%.

On U.S. dollars, in an investment that has practically zero volatility.

Which steers us right back to my main point today…

See, during the craziness of last week—when bitcoin and Ethereum and just about every other crypto crashed—stablecoins met the enemy face-to-face…and they stood their ground.

In short: stablecoins won the week.

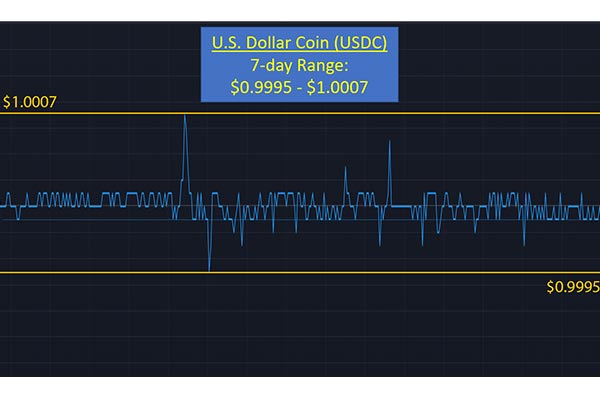

Let me show you a couple of charts of some stablecoins over the last seven days:

And there are other stablecoins I could show, too. Gemini Dollar’s (GUSD) seven-day range was between $0.995 and $1.005. For Paxos Standard (PAX), it was $0.9981 to $1.0042.

Yes, those fluctuations might seem a bit unnerving…until you realize the scale. At most, the widest divergence was exactly one cent. At best, it was just over one-tenth of a penny.

That shows you just how stable stablecoins can be. They fluctuate a bit as money moves in and out. But the fluctuations are typically fractions of a cent, and they quickly self-correct to maintain a price as close to $1 as possible.

All in, stablecoins as an asset class now hold more than $100 billion of investor/saver cash. A year ago, it was less than $11 billion.

Frankly, that nearly 10x growth in 12 months has significant ramifications.

For one, the growth in stablecoin assets, pared with the rock-solid stability they displayed last week, lays to rest any past worries about stablecoin price activity in a crisis. Stablecoins aced that test.

And second, it says that the world of “decentralized finance,” or DeFi, is very much our future and that traditional bankers should be quivering.

DeFi is essentially all the personal financial services you and I use daily, but on the blockchain—saving, investing, borrowing, buying insurance, selling a house, and whatnot. Stablecoins are a primary component of DeFi. (Get all the details in your brand-new DeFi report. Read it here now.)

Crazy as this might sound, last week actually strengthened the crypto market in general and DeFi in particular. Stablecoin success amid historical crypto stress means investors now have a new safe-haven asset—one that actually earns them a meaningful amount of money.

Moreover, they no longer need to totally exit crypto in sour moments, as they did in the past. Now, they can just move to the sidelines, holding their cash, worry-free, in what are essentially digital dollars. It’s functionally no different than selling stocks during a crash on Wall Street and letting cash idle in a brokerage account until you’re ready to invest again.

The only difference—and it’s a huge one—is that with stablecoins, the dollars are earning a real and significant rate of return.

It also shows that you don’t have to stomach the risks of bitcoin or Ethereum if your tolerance for volatility is low. You can still be a part of the crypto revolution in an entirely safe manner, and, better yet, earn a rate of return on safe, stable cash we haven’t seen since the early 1980s.

All hail the (crypto) dollar!

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.