3-bed homes in Florida for $49 per month.

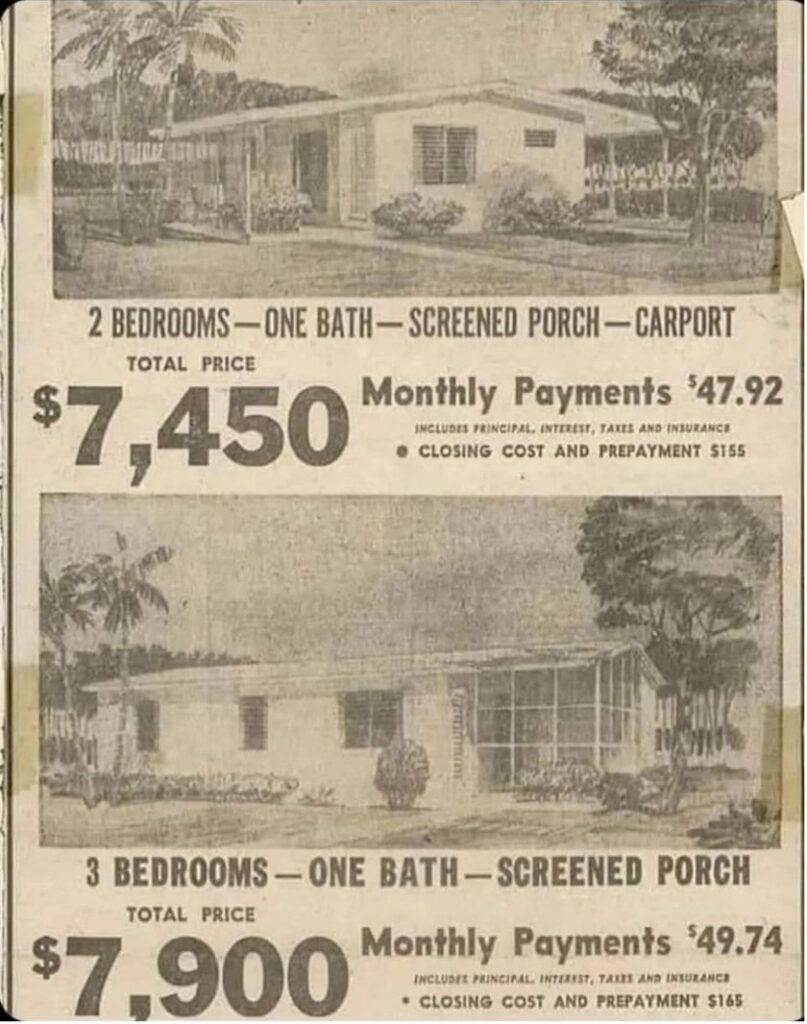

Today, we begin with a newspaper ad from 1955. This ad, specifically:

This popped up on my Twitter/X feed over the weekend, and it so fascinated me that I hopped onto Excel to do some mathing…

A three-bedroom home for $7,900, or $49.74 per month…

It almost seems like those numbers just can’t be real. Surely it’s impossible that America was so affordable at one point.

But that’s what got me to mathing: “Was America really that affordable back in 1955?” Or is it just that our financial reality today has warped our perceptions of expensive and affordable?

I didn’t invade the world until 1966, so I really have no reference for price and affordability until the late ‘70s and early ‘80s.

What were incomes like in 1955? How did a $49.74 monthly mortgage payment stack up against income?

I wanted to know…

So here’s the answer:

Average income in 1955 was $3,400 per year, according to US census data. That’s $283 per month, meaning the note on that house in the ad would’ve represented about 17.6% of gross monthly pay.

I’m not going to try to figure out after-tax comparisons…

From the look of the pictures in that ad, I’m feeling confident those houses were in Florida, based on the palm trees and screened-in porch. And Florida has no state income tax, which makes this a much easier a comparison…

The Census Bureau’s online inflation calculator says that $3,400 in 1955 is the equivalent of $38,655 in pre-tax income today. The $7,900 cost of that three-bedroom house would be just over $89,800 in inflation-adjusted dollars.

Clearly, we’re already in trouble…

The average American house is not $89,800 today.

And you’re certainly not likely to find such a home price in any desirable corner of the Sunshine State now.

But no worries… we keep mathing for a moment, because average incomes in America are not $38,655 today.

The average US salary in 2023 was $59,428.

Based on the home-price-to-income ratio in 1955, a typical home in America today should cost in the range of $140,000. That would keep home prices on par with income growth. But it turns out that $7,900 was a bargain price actually. The average home in America in 1955 was about $18,400, or about 5.4x the average income.

Alas, we’re really in deep dookey at this point…

Because the average home price in America last year was $431,000. And the average mortgage payment was about $2,082.

Meaning that the average American earning the average American salary, and who has purchased the average American home, is spending about 42% of her income on a mortgage payment. And the average home is 7.25x the average salary.

So, no matter how you skin the skin in 2023, you’re still losing out to your American forebears from the mid-‘50s.

Pray tell, Jeffrey, why do you tell me this depressing news so early in my week?

Because price inflation in America that runs well hotter than reported inflation is a feature of the American economy—not a bug. It’s not something that will ever be fixed. It will only worsen as the years stack up for way too many reasons to explain in such a short dispatch.

It deals with real inflation vs reported inflation…

It deals with Uncle Sam’s monolithic debts and the inflationary pressures pumped into the economy through the backdoor by way of interest payments that run from $700 billion to nearly $1 trillion per year (that’s as much as 15% of the US budget)…

It deals with our flat world and the fact that Vietnam and Pakistan and Colombia can produce goods far cheaper than American workers and, thus, that keeps worker income from rising to the degree it should…

And it deals with politicians and business lobbyists who angle successfully for a host of employment and taxation laws that benefit the C-suite and corporate entities over the line workers who do the real work in any company.

None of that is changing any time soon, for sure.

So, here we are…

The expenses of life are going to grow progressively more problematic for Americans because incomes have no hope of keeping pace.

Which is why the bug I want to plant in your brain here at the bottom of today’s dispatch is this: Look abroad.

I am not telling you to abandon America. I love my country, without question.

But there is only one person in the world looking out for your best interests, and that is not Uncle Sam.

You have to do what’s right by you and your family.

If you can live a more affordable (and safer) life outside America, then it’s certainly a consideration to explore.

I’m not saying you have to move. But I am suggesting that if you want to build greater financial security into the later part of your life, the only way to do that—aside from lottery winnings and bank robbings—is to look abroad.

You’re not going to find a three-bedroom house in most places abroad for $7,900. Then again, you’re not going to have to pay $431,000 for an average house, either. At that price point, there are places around the world where you’re living like a minor celebrity…

Just think about it.

The way I see it, there’s absolutely zero reason to go through retirement living a downscaled life because you’re worried about running out of money before you run out of oxygen.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.