Surprising News From Europe…

Remember the PIIGS?

In the early days of the global financial crisis, Portugal, Italy, Ireland, Greece, and Spain—collectively referred to as Europe’s PIIGS—suffered financial shock. Their governments and the private sector had borrowed way too much and they were now unable to repay, their economies in chaos.

They had to go begging cap in hand to the European Central Bank, dominated by Germany, for a bailout. Some clever editor came up with the idea of “PIIGS” to describe these financially slovenly nations.

What a difference a few years can make…

A recent article in Fortune explained that Southern Europe is experiencing a burst of economic growth that’s leaving the rest of the continent behind. The immediate cause is post-pandemic tourism. But more fundamentally, all these countries have adopted sound policies that encourage investment and growth.

Greece, for example, saw its gross domestic product (GDP) fall by 25% in the decade to 2018. Its debt-to-GDP ratio soared. But today, Greek government bonds are considered investment grade, and its debt-to-GDP ratio is one of the best in Europe. Portugal has seen a similar burst of growth and reduction of debt.

This growth isn’t just about policy, however. These countries on the edges of Europe are encouraging innovative industries like biotech and communications. Portugal has become a world leader in programming, particularly for video games. Ireland continues to attract top tech companies like Facebook and Zoom. Italy and Spain are building high-tech manufacturing sectors.

The contrast with Germany—whose politicians and citizens protested helping their fellow Europeans in the 2010s—is striking. The German economy was built on cheap energy imports from Russia and big exports to China. The war in Ukraine ended major Russian energy imports to Europe. And as China’s power has grown, it has less need for European imports and Europe is more wary of doing business with China. The German strategy is outdated.

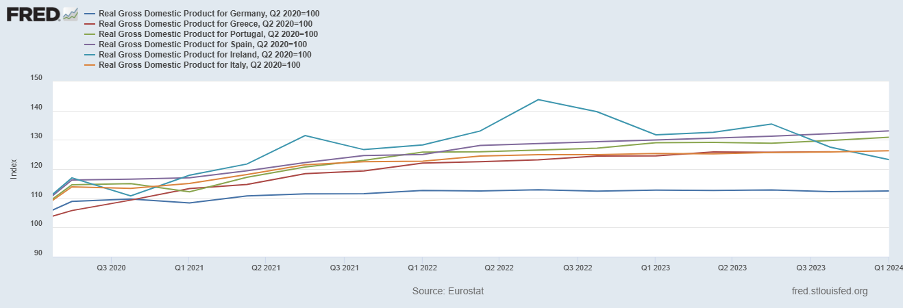

The graph below shows GDP for the PIIGS vs. Germany. Since COVID, the PIIGS economies have left the Germans in the dust:

For anyone considering a move to Europe, this is big news.

There’s newfound political stability and stronger growth in corners of Europe once seen as foot-draggers…

And of course, all these countries (other than Ireland) continue to offer Golden Visas through various types of investment, as well as excellent independent means and digital nomad visas. Greece is the only country that still grants residency based on housing investment. But Portugal and Spain (and Greece) offer attractive visa opportunities through investment funds, banking, and other profitable avenues.

That’s the key point here. Getting a residency visa through investment is a wonderful thing—but it’s even more wonderful if you can make a decent profit out of the deal.

Given the growth we’re seeing in southern Europe—that makes it today’s number-one place to go looking for residency through investment.

(Join me on the ground in Portugal next April for the Fast Track Europe Conference—and we’ll explore your options together. Or, you can book a consultation right now.)

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.