Which Currencies Should You Buy as the Dollar Declines?

Is bigger better?

That’s the fundamental question behind an Ask El Jefe that T.S. recently deposited in my inbox.

A slightly edited version of the missive:

You wrote about opening a bank account in Ireland for non-residents, for your euros. I believe you’ve written about opening accounts in other countries as well. I researched the strongest currencies and have a list of the top 10, with the Kuwait dinar (KWD) being #1.

I guess I’m trying to figure out if it’s smart to buy and hold other currencies, even though you can’t bank in their countries. Would I hold these currencies in a safe deposit box and then how would I spend them?

British pound, Gibraltar pound, Swiss franc, Kuwaiti dinar, and euro are stronger than USD, but [strong] enough to make them worth owning?

Is it possible to open non-resident bank accounts in these countries?

What do you have to do to maintain the accounts?

We’ve got several topics to address here, the primary one being the idea that those named currencies are stronger than the dollar.

T.S. passed along a chart sourced online to show me what she meant:

So let’s start there.

Just because an exchange rate is higher than the dollar does not necessarily imply a stronger currency. Those are just nominal numbers, not fundamental indicators of one currency’s strength vs. another.

Currency strength is a function of a domestic economy and how the world perceives that economy, and currency exchange rates do not always follow because of other factors.

The Bahraini dinar is a great example. Bahrain’s government has kept the local currency pegged to the US dollar at 1 dinar = $2.65 since 1980. So the exchange rate doesn’t necessarily mean that the dinar is stronger than the dollar. It just means that’s the exchange the country set 40-plus years ago and hasn’t changed.

So don’t look at exchange rates as a signal of strength.

For that, you really need to compare one economy against the other.

I’ll use the eurozone and the US as my example (since I’m familiar with both, since I operate my life in both currencies).

The US economy is downshifting because of tariff impacts; plus, the loss of more than a million immigrant workers whose absence is affecting agriculture, construction, healthcare, and the service industry among others. Inflation is pushing higher again. Consumer sentiment is sinking.

And fear about America’s extreme debt levels is spreading globally.

Conversely, Europe is looking up economically.

Inflation in the eurozone is roughly one percentage point lower than the US. Donald Trump has accidentally inspired European economic growth by threatening to stop defending Europe. As a result of that, Europe, led by Germany, is ramping up defense spending, which is what America has historically done to goose economic growth.

And Europe has a trade surplus with the world, meaning the world is buying more from Europe than Europe is buying from the world. A trade surplus effectively means demand for the euro increases since the rest of the world has to buy euros to trade with Europe.

Because of all of that… the euro has been rising against the dollar. Or from the American perspective, the dollar has been losing ground to the euro this year. Since early January, the euro has gained nearly 17% on the dollar, meaning it takes more and more dollars now to buy the same amount of European goods.

That’s what currency strength looks like.

So I would tell you to avoid internet charts that claim the strongest currencies in the world are those that have exchange rates greater than 1:1 with the dollar. That really doesn’t define useful, other than how many units of currency X a greenback will buy.

The Kuwaiti dinar is pegged to an undisclosed basket of currencies that is heavily weighted to the dollar. So if you went off and bought a bunch of dinars hoping they’d rise in value and buy back more USD one day… well, that’s not going to happen. You’ll end up with basically the same amount of dollars you started with.

What currencies are worth owning?

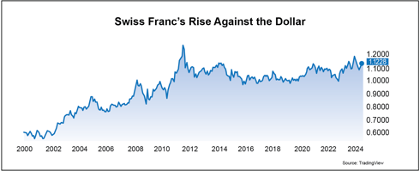

Well, I will say that the Swiss franc is the #1 currency I’d want to own going forward. As I’ve noted many times, the Swissy (as currency traders call it) is more than 20% of my entire portfolio.

You can own Swiss francs by owning an ETF like the Invesco CurrencyShares Swiss Franc Trust or through a Moneycorp account. (Sign up with IL’s affiliate link here: https://register.moneycorp.com/?rp=0021702385)

As to T.S.’s other questions:

- Is it possible to open non-resident bank accounts in these countries?

Yes, but it depends on the country.

T.S. noted my Irish bank account. That’s one country where you can typically find banks that will open an account for you.

In many countries you will face varying degrees of difficulty, with many of them stuck on, “Scram, kid—you bother me!” because they don’t want the hassle of American clients who don’t live locally.

That said, you will find some banks in some countries that might be willing to open an online savings account for you. But you will have to contact local banks in whatever country you’re interested in and inquire.

I would tell you to look at Hong Kong, Singapore, Malaysia… possibly Uruguay. Ireland would cover all the eurozone for you, so no need to venture any farther afield. But outside of the eurozone, the Norwegian krone, Swedish krona, and Danish krone are all good currencies. (The Danish currency is pegged to the euro, so as the euro rises against the dollar, the Danish krone rises too.)

- What do you have to do to maintain the accounts?

You’ll have to ask each bank separately. There’s no single answer here. Sometimes, there could be account minimums, or you could be required to make regular transactions to keep an account active.

Unless you are determined to own other currencies, I’d tell you to focus the bulk of your efforts on the Swiss franc. It remains one of the single best currencies in the world, managed by one of the most respected central banks in the world, and it has served as a global safe haven since World War I.

With that resume, you’re good to go.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.