Plus—3 Events Driving the Crypto Bull

A decade ago, my son, then in his mid-teens, walked into my office and told me I needed to learn how to buy, trade, and invest in bitcoin.

“It’s going to be huge, Dad.”

He was already trading bitcoin almost every night and on weekends.

At the time, I was a Wall Street Journal financial writer. Stock market through and through.

“Nah—I’ll pass,” I told my son. “But thanks for the input.”

That is, perhaps, the single worst investment decision I’ve ever made.

I look back and I’m filled with regret…

First, I rejected out-of-hand my son’s thoughtful input, which is just bad fathering.

And second, bitcoin at that time was in the $200 range.

Had I pulled $10,000 from stock market profits and funneled that money into bitcoin… that investment would today be worth $3.5 million.

I didn’t listen to someone who knew something, and I missed out on life-changing wealth.

I don’t want you to make the mistake I made a decade ago.

I don’t want you to miss out on the wealth crypto will continue to create.

You see, the “Mother of All Bull Markets” is now here—and we’re still in the early stages of what might be your last, best chance for big crypto wealth…

My journey down the bitcoin and crypto rabbit hole began in 2017. This time, I listened to my son.

I became a crypto expert after first panning the idea of investing in a digital asset…

And I’ve seen my wealth grow to a degree that would not have happened in traditional financial markets.

One example: Shadow Token, a smaller crypto project that has built a very real product that strengthens the Solana blockchain. I spent just under $1,700 to buy into this project in November 2021. Today, my stake is worth more than $100,000—a more than 50-fold increase in just under two-and-a-half years.

You see, a once-in-humanity paradigm shift is underway.

As a species, we’re transitioning from physical money held in our wallet as coins and paper bills to digital money held on the blockchain.

This new form of money will be the fastest and most efficient form of money history has ever seen, and that has society-changing implications—and big opportunities to grow wealth.

But 2024’s crypto boom is also tied to three specific trends…

First, you need to understand that we’re just weeks away from one of the most anticipated events in crypto… which will push the whole market higher…

This event is the bitcoin halving, which is slated to land on April 20.

This is a technical event that, every four years or so, doubles the difficulty of mining bitcoin and decreases by half the amount of bitcoin mined per day.

Another event that has pushed bitcoin’s price rise—and the rise of the whole crypto market with it—is the SEC ruling in January that allowed US financial institutions to begin marketing a bitcoin ETF that tracks bitcoin’s ever-changing “spot” price.

That ruling opened a floodgate…

Money has poured into the various bitcoin ETFs that have launched. One in particular, BlackRock’s iShares Bitcoin ETF, surpassed $15 billion in assets under management in just two months.

That’s the fastest move to $15 billion ever seen by any ETF in any sector of the market!

Now, pair that demand with the fact that the amount of bitcoin mined on a daily basis is about to halve.

No doubt you see the implication there.

Literally hundreds of billons of dollars will be flooding into an asset where the supply of new bitcoins is about to cut in half.

That means all those billions will be gobbling up increasing amounts of existing bitcoin supply.

And that drives prices higher.

That’s happening even as mainstream investors are just now coming back into the crypto market after suffering deep losses during the “crypto winter” over the last two years.

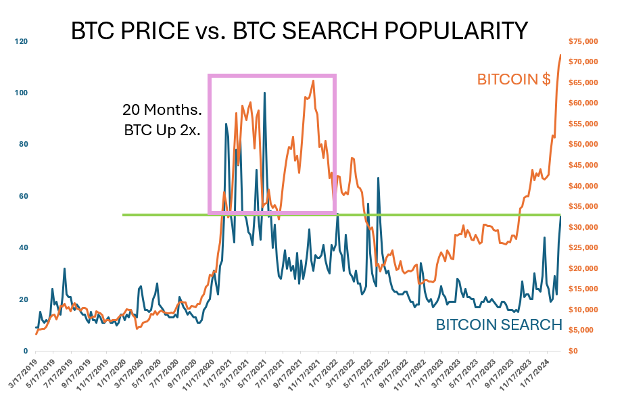

Consider this chart… which shows a third event driving bitcoin’s price—the rise in searches for “bitcoin.”

Bitcoin searches are spiking alongside bitcoin’s price. That says that as bitcoin’s price takes off again, interest in crypto rises, meaning the masses are once again searching for information on how to buy bitcoin. More people getting in is also pushing up the price.

Last time this happened during the previous bull market, bitcoin’s price, then at an all-time high, doubled from there.

And some smaller coins went up (percentage-wise) much, much higher than bitcoin…

In mid-March 2024 bitcoin just set a new all-time high north of $73,000.

Question is: Will we double from here and see bitcoin touch $140,000?

No.

We’ll go higher.

How high exactly?

And what will bitcoin’s rise do for other cryptos?

Buckle up.

Not signed up to Jeff’s Field Notes?

Sign up for FREE by entering your email in the box below and you’ll get his latest insights and analysis delivered direct to your inbox every day (you can unsubscribe at any time). Plus, when you sign up now, you’ll receive a FREE report and bonus video on how to get a second passport. Simply enter your email below to get started.